Master Real-Time Stock Data: Best Practices for Analysts

Master Real-Time Stock Data: Best Practices for Analysts

Overview

The article centers on best practices for analysts aiming to master real-time stock data. It underscores the significance of:

- Reliable data sources

- Effective data collection methodologies

- Advanced analysis techniques

- The necessity for adaptability to market fluctuations

By detailing various reputable platforms, such as Bloomberg Terminal and Alpha Vantage, it outlines effective methods for data collection and verification. Furthermore, the article highlights the incorporation of machine learning and visualization tools, which enhance decision-making and improve forecasting accuracy in stock analysis.

How can these practices elevate your analytical capabilities? By leveraging these tools and methodologies, analysts can significantly improve their performance and insight in the ever-evolving stock market.

Introduction

In the fast-paced world of stock trading, accessing and analyzing real-time data is crucial for distinguishing between profit and loss. Analysts are in constant pursuit of reliable sources and effective methodologies that enhance their market insights and decision-making capabilities. This article explores best practices for mastering real-time stock data, examining trusted platforms, advanced analytical techniques, and adaptive strategies essential for navigating the complexities of the stock market.

How can analysts leverage these insights to stay ahead of market trends and make informed investment decisions? By understanding the features of these data sources, analysts can gain significant advantages that translate into tangible benefits for their investment strategies.

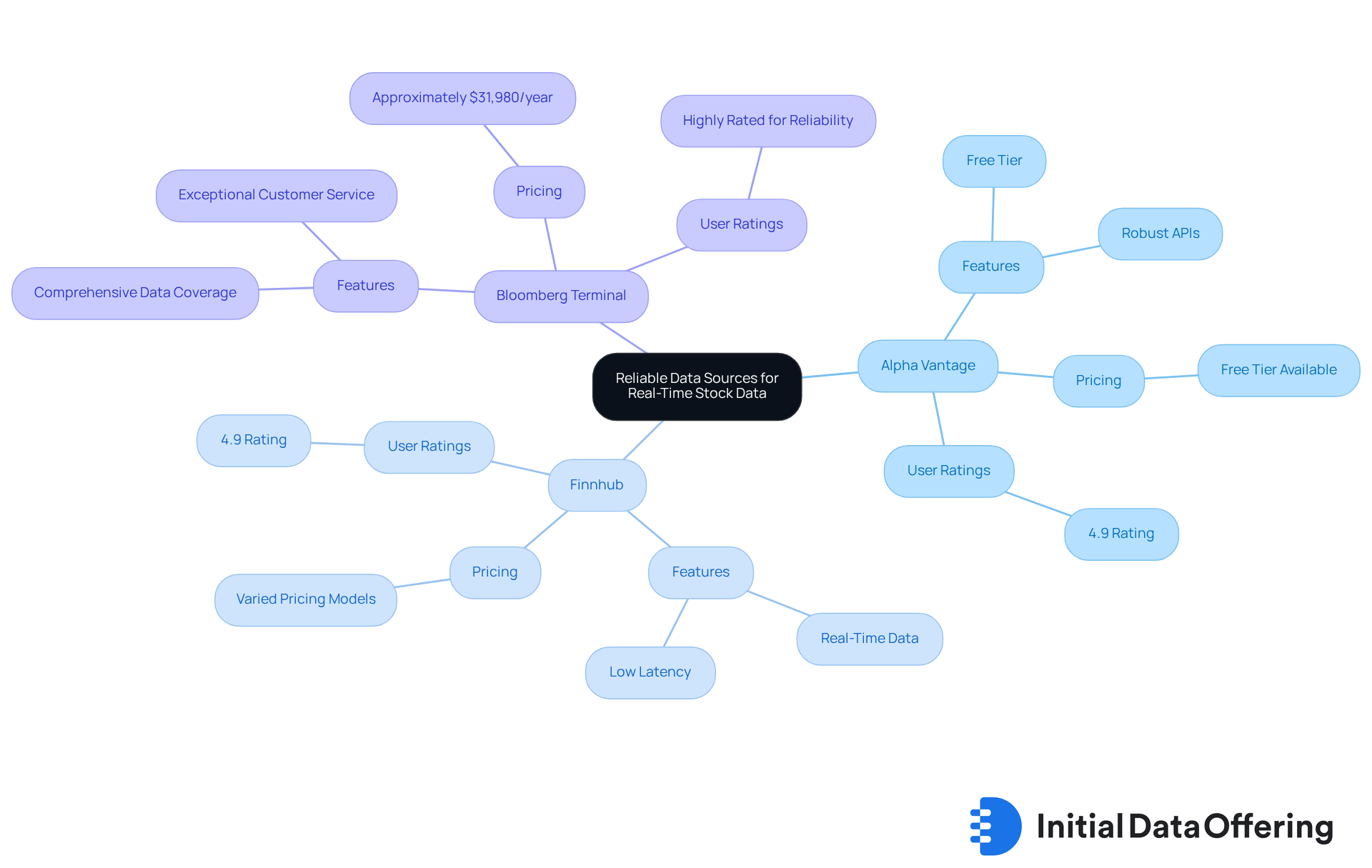

Identify Reliable Data Sources for Real-Time Stock Data

To effectively examine real time stock market information, experts should prioritize trustworthy information sources such as Alpha Vantage, Finnhub, and Bloomberg Terminal. These platforms offer robust APIs that provide both real time stock data and historical data, ensuring researchers have access to the most current market insights. Notably, Bloomberg Terminal, with an annual subscription fee of approximately $31,980, is renowned for its comprehensive data coverage and reliability. In contrast, Alpha Vantage and Finnhub present competitive alternatives with varied pricing models. For example, Alpha Vantage features a free tier, making it a viable option for analysts working within budget constraints.

When selecting an information source, it is essential to consider factors such as accuracy, latency, and the , which includes real time stock prices, trading volumes, and market indices. User reviews indicate that:

- Cbonds boasts a rating of 4.9 for information quality

- ESG Analytics claims an impressive perfect score of 5.0

Moreover, experts emphasize that precise information is vital for informed decision-making in stock evaluation. As S. J. Utradea highlights, "It's not just the quality and affordability that makes FMP outstanding; it's their remarkable customer service and assistance."

By leveraging these trusted APIs, researchers can significantly enhance their research capabilities and make more strategic investment decisions. How can these platforms improve your market analysis? By understanding the strengths of each source, you can tailor your approach to meet your specific needs and objectives.

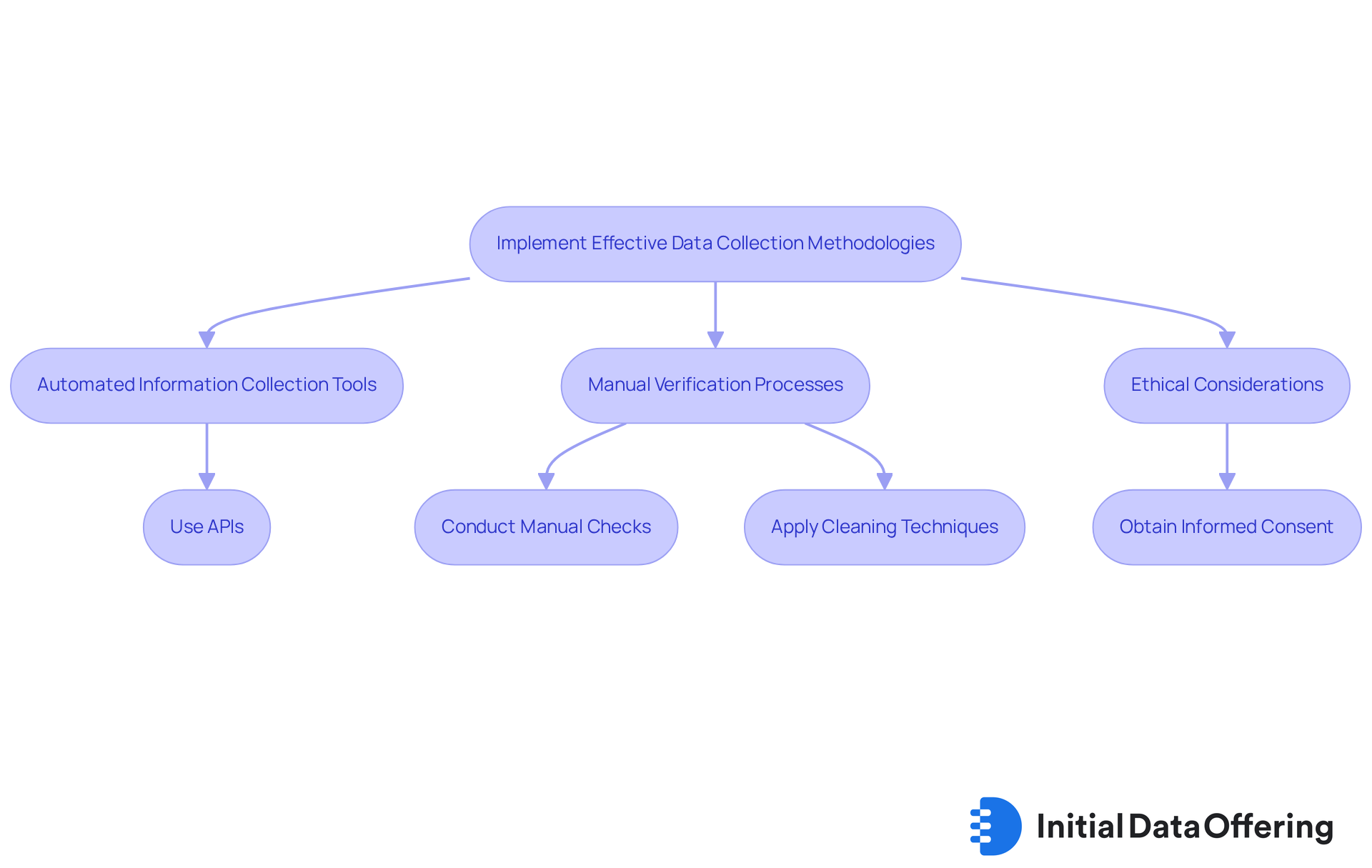

Implement Effective Data Collection Methodologies

To ensure information integrity, analysts should adopt a combination of automated and manual verification processes. The use of APIs from reputable sources facilitates the ingestion of real time stock information, providing a significant advantage in maintaining up-to-date datasets. Regular manual checks are essential, as they help identify and rectify discrepancies, ultimately benefiting the reliability of the information. Furthermore, applying cleaning techniques—such as removing duplicates and standardizing formats—ensures high-quality datasets that analysts can trust.

Analysts can significantly improve their efficiency by utilizing programming languages such as Python and R to automate collection processes. This not only streamlines the gathering of information but also decreases the time invested, allowing analysts to focus on more critical tasks. Moreover, it is crucial to consider the ethical elements of information collection, including acquiring informed consent and safeguarding participant privacy. By integrating qualitative insights, analysts can enhance quantitative information, offering a more thorough understanding of the datasets at hand.

Being aware of common pitfalls in information gathering practices is vital for analysts. How can they avoid misapplication of these principles? By adhering to these guidelines, analysts can fortify the reliability of the information used in financial analysis related to real time stock, ensuring that their findings are both accurate and actionable.

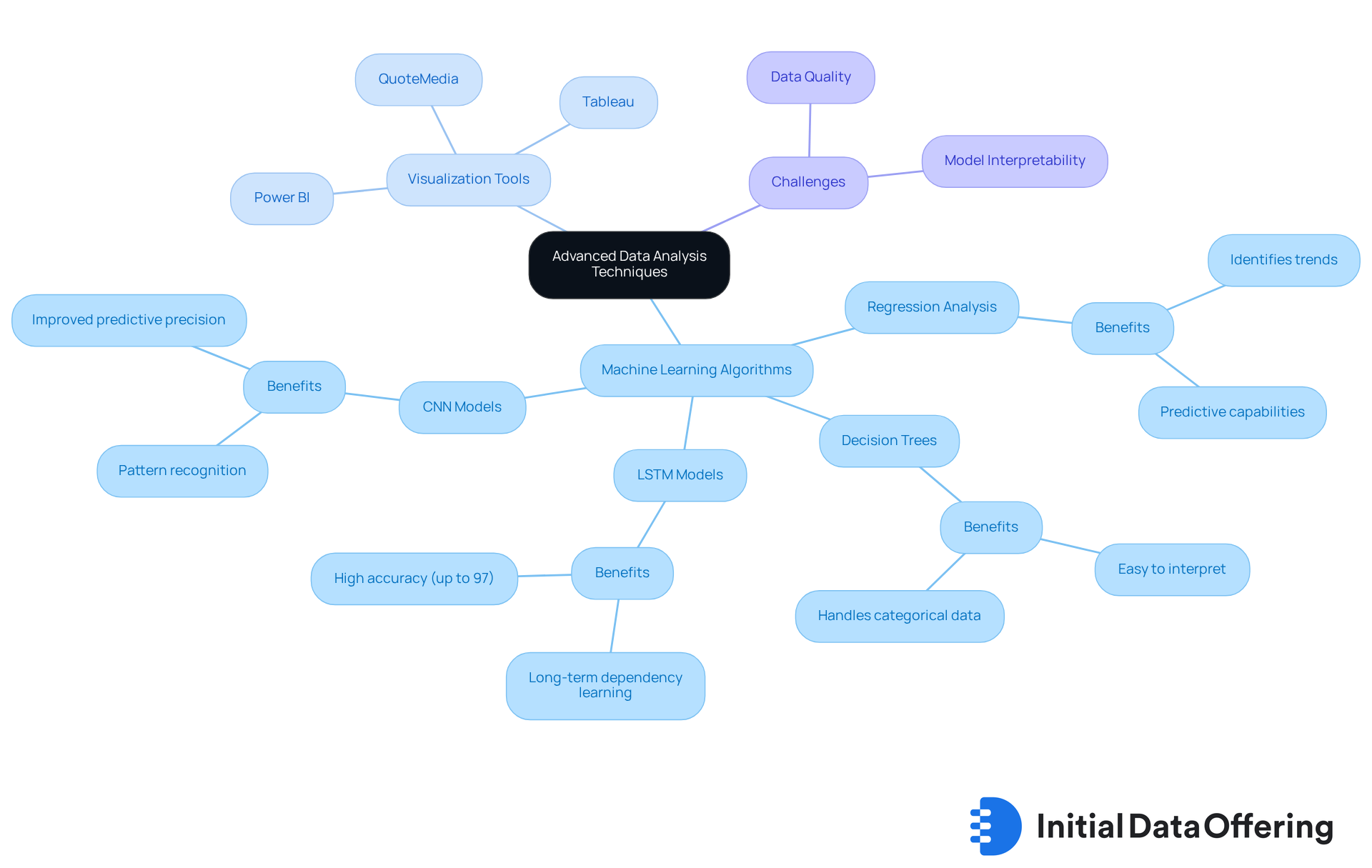

Utilize Advanced Data Analysis Techniques

Analysts should utilize machine learning algorithms, such as regression analysis and decision trees, to effectively identify patterns within market data. These algorithms provide the advantage of uncovering insights that may not be immediately apparent, benefiting stakeholders by enhancing decision-making processes. Time series analysis, in particular, is invaluable for and can provide real time stock insights based on historical trends. For instance, LSTM models can achieve an accuracy of up to 97% in forecasts, while sophisticated models like CNN can significantly improve predictive precision by capturing intricate dynamics.

Moreover, visualization tools like QuoteMedia's advanced charting instruments, Tableau, and Power BI are crucial for showcasing complex information in a user-friendly manner. These tools allow stakeholders to swiftly comprehend key insights, facilitating informed decisions. Consistently refreshing analytical models with new information is essential for maintaining the relevance and applicability of insights. This practice ensures that decision-making is guided by the most current industry conditions.

However, experts must also be cognizant of challenges in predictive analytics, such as data quality and model interpretability. Addressing these challenges is vital to avoid common pitfalls and enhance the reliability of analytics. How can your organization leverage these insights to improve its predictive capabilities? By understanding the features and benefits of these tools, analysts can better navigate the complexities of real time stock market data.

Monitor and Adapt to Market Changes

Analysts should establish a consistent routine for monitoring essential indicators, such as economic reports, industry news, and competitor activities. Utilizing tools like Google Alerts and social media monitoring offers on consumer sentiment, enabling researchers to stay ahead of trends. For instance, platforms like LevelFields provide insights into significant financial events by analyzing millions of occurrences that impact real time stock prices. This capability not only enhances the accuracy of forecasts but also empowers analysts to capitalize on emerging opportunities.

Moreover, adaptability is crucial for analysts. They must modify their strategies in response to economic changes, employing versatile modeling methods that incorporate new information. Regularly reviewing and refining analytical frameworks ensures alignment with current market conditions, facilitating timely and informed decision-making. Consider this: according to historical data, the average return for the S&P 500 twelve months after a decline of more than 10% is 13.3%. This statistic underscores the importance of proactive analysis in navigating market fluctuations.

In conclusion, a proactive approach not only enhances forecasting accuracy but also positions analysts to seize opportunities as they arise. How can you integrate these insights into your analytical practices to improve outcomes? By leveraging these tools and strategies, analysts can effectively navigate the complexities of the market landscape.

Conclusion

Mastering real-time stock data is essential for analysts aiming to navigate the complexities of the financial markets effectively. By prioritizing reliable data sources and implementing robust data collection methodologies, analysts can significantly enhance their decision-making capabilities. Utilizing advanced analysis techniques and adapting to market changes further improves forecasting accuracy, ultimately benefiting their strategic insights.

Key insights from this article emphasize the importance of selecting trustworthy platforms like:

- Alpha Vantage

- Finnhub

- Bloomberg Terminal

These platforms offer comprehensive data coverage, which is crucial for informed analysis. Additionally, employing automated tools alongside manual verification helps maintain data integrity. Advanced analytical methods, such as machine learning and visualization techniques, provide deeper insights into market trends. Regular monitoring of market indicators ensures that analysts remain agile and well-informed, enabling them to respond promptly to economic shifts.

Ultimately, the ability to leverage these best practices empowers analysts to make informed decisions and capitalize on emerging opportunities within the stock market. Embracing these strategies enhances analytical capabilities and positions analysts for success in an ever-evolving financial landscape. By integrating these insights into daily practices, analysts can significantly improve their outcomes and contribute to more strategic investment decisions.

Frequently Asked Questions

What are some reliable data sources for real-time stock data?

Reliable data sources for real-time stock data include Alpha Vantage, Finnhub, and Bloomberg Terminal.

What type of data do these platforms provide?

These platforms provide both real-time stock data and historical data, including real-time stock prices, trading volumes, and market indices.

How much does a Bloomberg Terminal subscription cost?

A Bloomberg Terminal subscription costs approximately $31,980 per year.

Are there any budget-friendly alternatives to Bloomberg Terminal?

Yes, Alpha Vantage offers a free tier, making it a viable option for analysts working within budget constraints.

What factors should be considered when selecting a data source?

When selecting a data source, it is essential to consider accuracy, latency, and the breadth of data available.

How do user reviews reflect the quality of these data sources?

User reviews indicate that Cbonds has a rating of 4.9 for information quality, while ESG Analytics has a perfect score of 5.0.

Why is precise information important in stock evaluation?

Precise information is vital for informed decision-making in stock evaluation, as highlighted by experts in the field.

How can leveraging trusted APIs enhance research capabilities?

By leveraging trusted APIs, researchers can enhance their research capabilities and make more strategic investment decisions tailored to their specific needs and objectives.