10 ETF Examples for Smart Investment Decisions

10 ETF Examples for Smart Investment Decisions

Overview

The article titled "10 ETF Examples for Smart Investment Decisions" serves as a resource for investors seeking to make informed choices regarding exchange-traded funds (ETFs). It highlights notable ETFs, including the Vanguard Total Stock Market ETF and the iShares Core S&P 500 ETF. Each example is presented with a focus on its features, expense ratios, and performance metrics. By detailing these aspects, the article illustrates how these funds can enhance investment strategies and promote portfolio diversification.

Investors may wonder how these ETFs can specifically benefit their investment approach. The Vanguard Total Stock Market ETF, for instance, offers broad exposure to the entire U.S. stock market, which can be advantageous for those looking to capture overall market growth. Meanwhile, the iShares Core S&P 500 ETF provides targeted exposure to large-cap U.S. companies, potentially leading to more stable returns.

By understanding the unique characteristics of these ETFs, investors can make strategic decisions that align with their financial goals. The article ultimately encourages readers to consider how these funds can fit into their investment portfolios, fostering a more diversified and effective investment strategy.

Introduction

In a world where investment options abound, exchange-traded funds (ETFs) emerge as a flexible and efficient means to diversify portfolios. With a plethora of ETFs available, understanding which ones align with specific financial goals can be both daunting and rewarding. This article explores ten exemplary ETFs that not only showcase diverse investment strategies but also highlight the potential for substantial returns.

What factors should investors consider when selecting the right ETFs? How can these choices influence long-term financial success? Delving into these questions will provide valuable insights for informed investment decisions.

Initial Data Offering: Access Comprehensive ETF Data for Informed Decisions

(IDO) serves as a vital resource for individuals seeking . By curating and listing new ones daily, IDO simplifies the process of accessing that can inform . Subscribers gain premium access to , ensuring they stay updated with the latest insights. This enables users, whether experienced participants or newcomers, to utilize data effectively in their financial strategies.

Have you considered how the right data can enhance your ? By subscribing now, you can access the and enhance your . Discover new datasets daily with the Initial Data Offering, and elevate your decision-making process with informed insights.

Vanguard Total Stock Market ETF: A Low-Cost Option for Broad Market Exposure

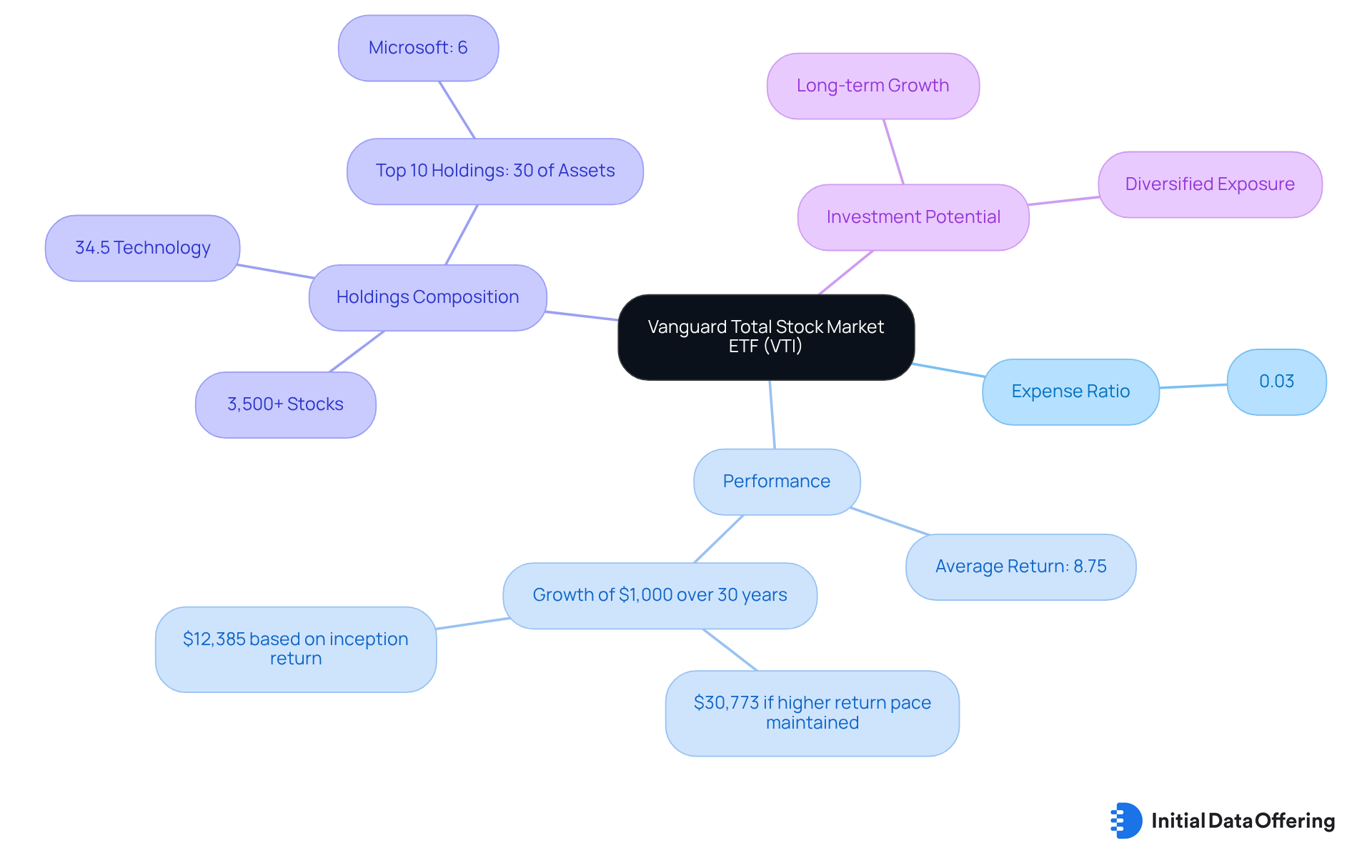

The Vanguard Total Stock Market ETF (VTI) presents a seeking to tap into the entirety of the U.S. equity landscape. Notably, VTI boasts an impressively low expense ratio of 0.03%, which facilitates broad diversification across multiple sectors and market capitalizations. This feature makes it an appealing choice for those looking to capture the overall performance of the U.S. economy without incurring substantial fees.

VTI encompasses a , including large, mid, and small-cap stocks, positioning it as a versatile option for . As of July 3, 2025, VTI is priced at $308.03 and manages over $483 billion in assets, underscoring its popularity and credibility within the market. Since its inception in mid-2001, VTI has delivered an , illustrating its potential for wealth accumulation over time. For instance, a could grow to approximately $30,773 in 30 years if it maintains a consistent return pace, as noted by financial analysts.

Additionally, VTI tracks the CRSP U.S. Total Market Index, which includes over 3,500 stocks, with technology stocks constituting 34.5% of its holdings. The top 10 holdings represent nearly 30% of the fund's assets, further emphasizing its diversified asset composition. This compelling performance underscores the role of ETF examples as foundational elements in a . How might incorporating VTI into your investment strategy enhance your overall financial growth?

iShares Core S&P 500 ETF: Invest in America's Largest Companies

The iShares Core S&P 500 ETF (IVV) is one of the that is strategically designed to mirror the performance of the S&P 500 Index, which encompasses 500 of the largest U.S. companies. One of its standout features is its impressively of just 0.03%. This allows investors to gain exposure to without incurring high fees. In comparison, the SPDR S&P 500 ETF has a higher expense ratio of 0.0945%, further emphasizing IVV's cost-effectiveness. The ETF's across multiple sectors make it a cornerstone for many investment portfolios.

As of June 30, 2025, IVV has received a , highlighting its strong performance and dependability in the industry. This is particularly relevant as the S&P 500 is presently up 7.00% year to date, indicating a positive economic environment for this ETF. Not only does IVV provide a solid foundation for long-term , but it is also considered one of the key ETF examples that align with . This makes it an attractive option for both seasoned and novice investors. As Selena Maranjian noted, "The smartest way to invest in the S&P 500 index in July (or in any month) is just to buy into a low-fee S&P 500 index fund."

Furthermore, IVV's news sentiment score of 0.47 suggests mildly positive media coverage, which may further attract research analysts. How might this influence your investment decisions? With its combination of low fees and , IVV stands out as a in the current market landscape.

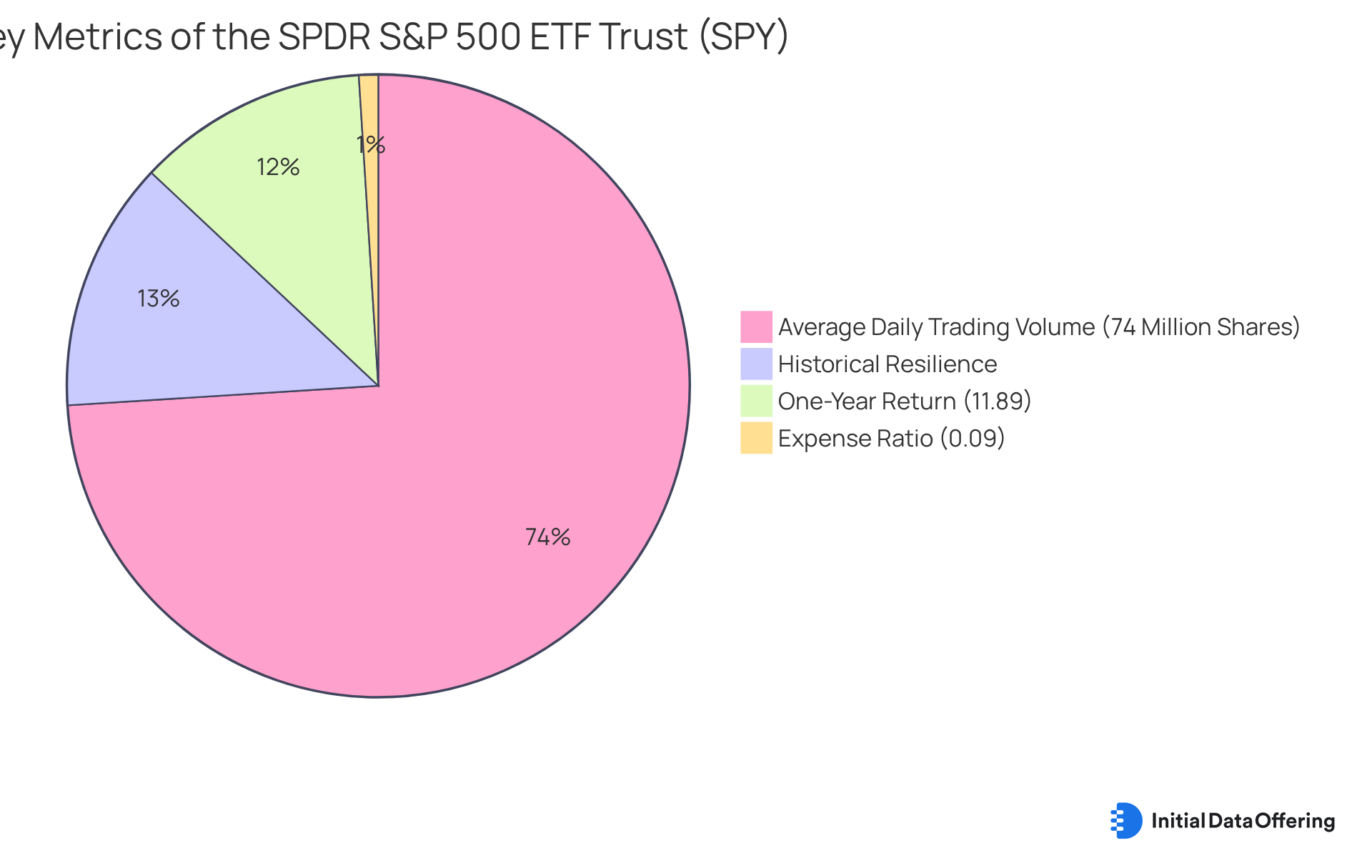

SPDR S&P 500 ETF Trust: A Pioneer in the ETF Market

The SPDR S&P 500 ETF Trust (SPY) serves as one of the pioneering in the ETF landscape, recognized as one of the first ETFs introduced to the market. Its primary feature is designed to mimic the performance of the S&P 500 Index, offering a of just 0.09%. This aspect renders SPY an appealing choice for both budget-minded individuals and traders alike.

Additionally, its exceptional liquidity, with exceeding 74 million shares, positions SPY as a favored option for short-term while also catering to . Historically, SPY has demonstrated , including the 2008 financial crisis and the 2020 pandemic crash.

As of May 2025, SPY's one-year return was an impressive 11.89%, showcasing its capacity to benefit from and technological advancements. This performance reinforces SPY's status as a , establishing it as a staple in various and highlighting its significance among ETF examples in the ongoing development of exchange-traded funds.

How might SPY's features and performance influence your investment strategy?

Invesco QQQ Trust: Focus on Technology and Growth Stocks

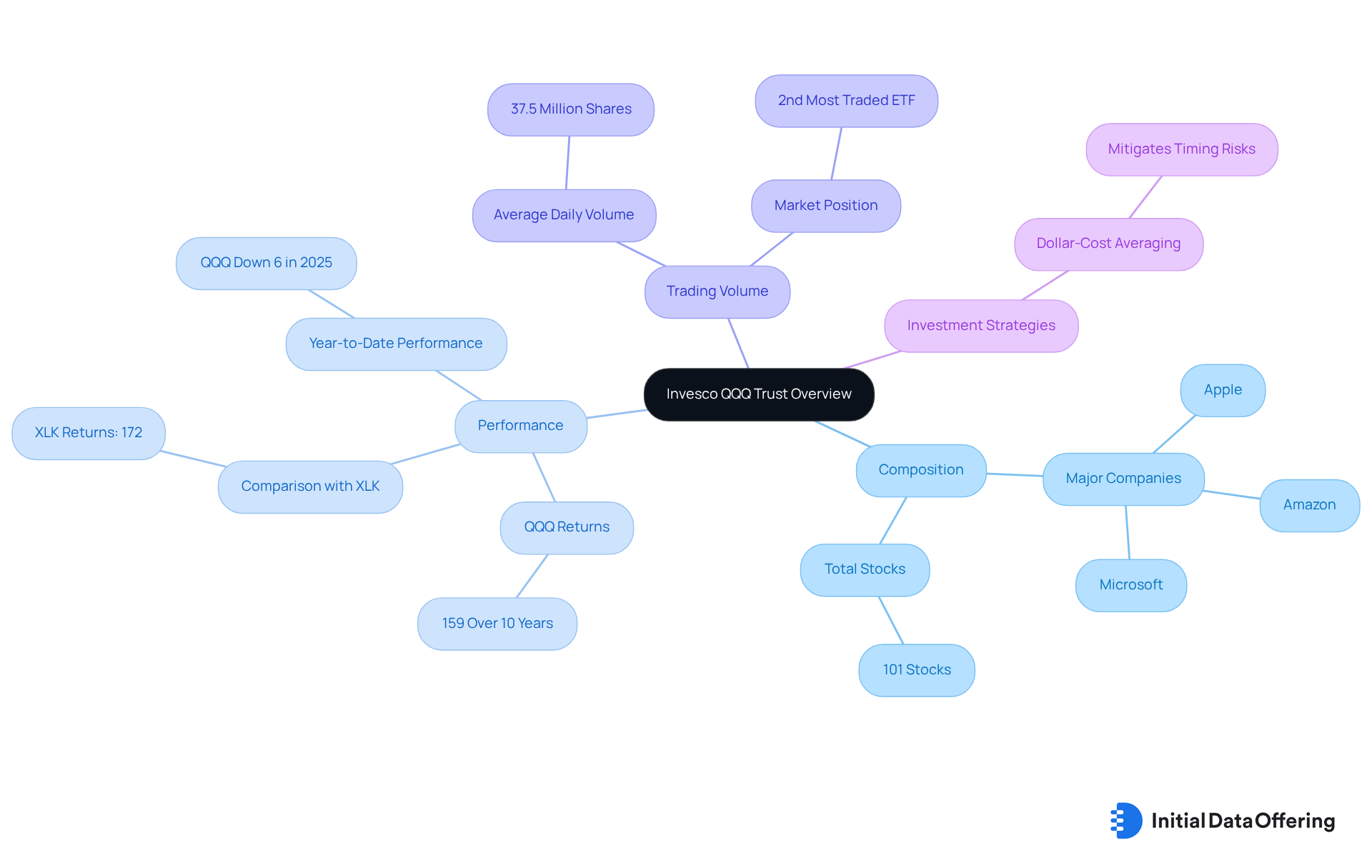

The Invesco QQQ Trust (QQQ) is designed to track the Nasdaq-100 Index, which comprises 101 of the largest non-financial companies listed on the Nasdaq Stock Market. This exchange-traded fund (ETF) serves as one of the ETF examples that are particularly appealing to individuals focused on technology and growth stocks, as it includes major players like Apple, Amazon, and Microsoft. With an , QQQ offers a to gain exposure to the tech sector's growth potential.

Over the past decade, QQQ has demonstrated a , with returns of approximately 159%. In comparison, the Technology Select Sector SPDR Fund (XLK) has delivered returns of around 172% over the same period, which serves as one of the in the competitive landscape of technology-focused investments. Despite a year-to-date drop of almost 6% in 2025, QQQ continues to be a strong choice for those pursuing in a fluctuating market.

Furthermore, QQQ's average daily trading volume of about 37.5 million shares on April 2, 2025, underscores its liquidity, rendering it an appealing option for . As Randi Zuckerberg noted, QQQ is one of the top-notch that is a strong choice for any AI-focused investor. For those contemplating , utilizing can help reduce timing risks and improve long-term returns. How might these insights influence your ?

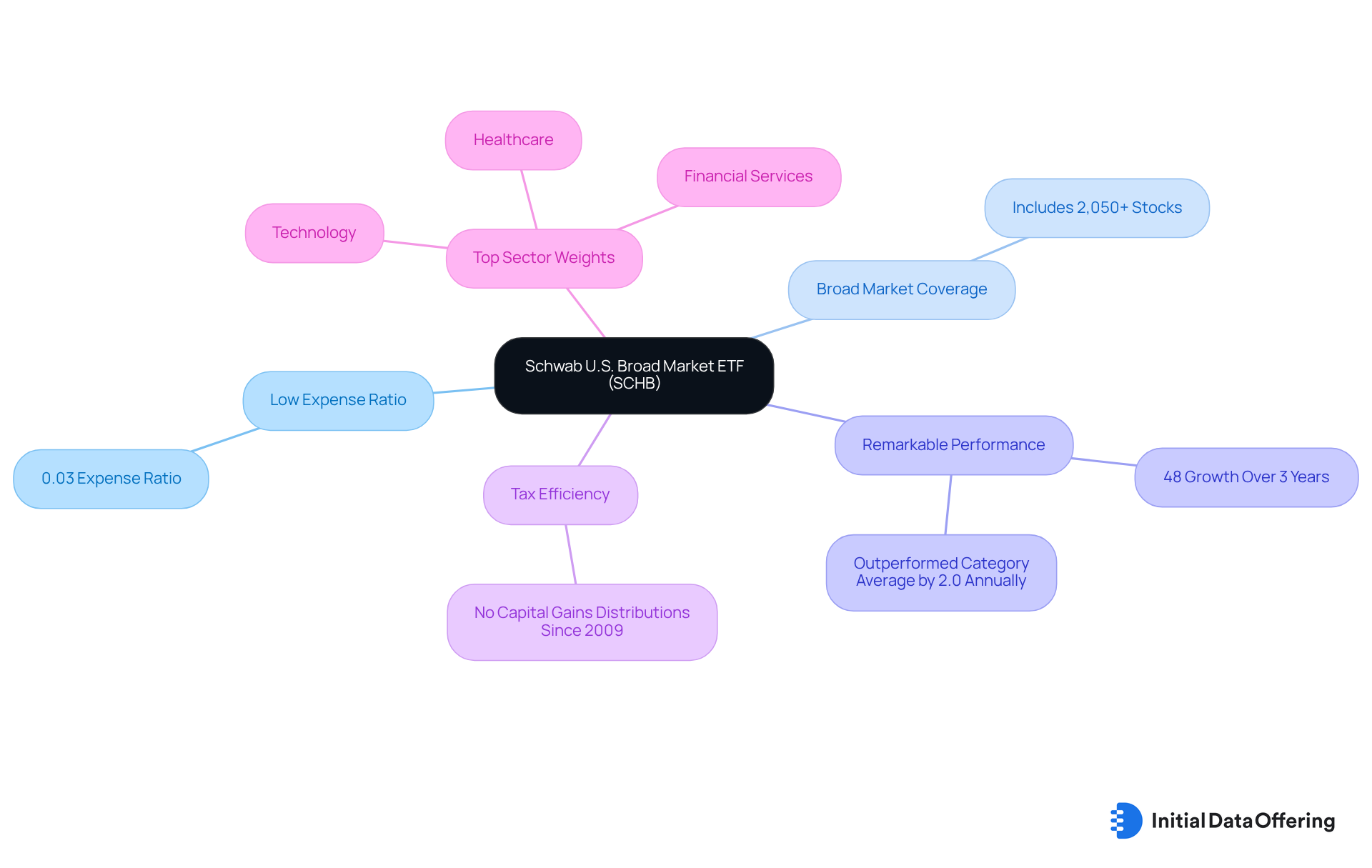

Schwab U.S. Broad Market ETF: Diversify Your Portfolio with One Fund

The Schwab U.S. Broad Market ETF (SCHB) offers extensive exposure to the entire U.S. equity landscape, covering small, mid, and large-cap stocks. One of its key features is an impressively low expense ratio of just 0.03%, making it a for diversifying . By tracking the Dow Jones U.S. Broad Stock Market Index, which includes over 2,050 stocks, SCHB serves as an example of an ETF that provides a straightforward solution for individuals seeking without the complexities of managing multiple funds.

For , SCHB has demonstrated remarkable performance, achieving a 48% growth over the last three years and surpassing the category average return by 2.0% annually since its launch in November 2009. This underscores the importance of diversification in investment portfolios, a principle emphasized by financial advisors. Thus, SCHB emerges as an ideal choice for those aiming for steady growth, as it is one of the ETF examples that maintains a to risk management.

Another significant advantage of SCHB is its ; it has not distributed any capital gains since its inception in 2009. This feature allows investors to manage costs effectively while capturing the broader U.S. equity market. With in technology, healthcare, and financial services, can lead to a more balanced and efficient portfolio. How might this ETF fit into your investment approach?

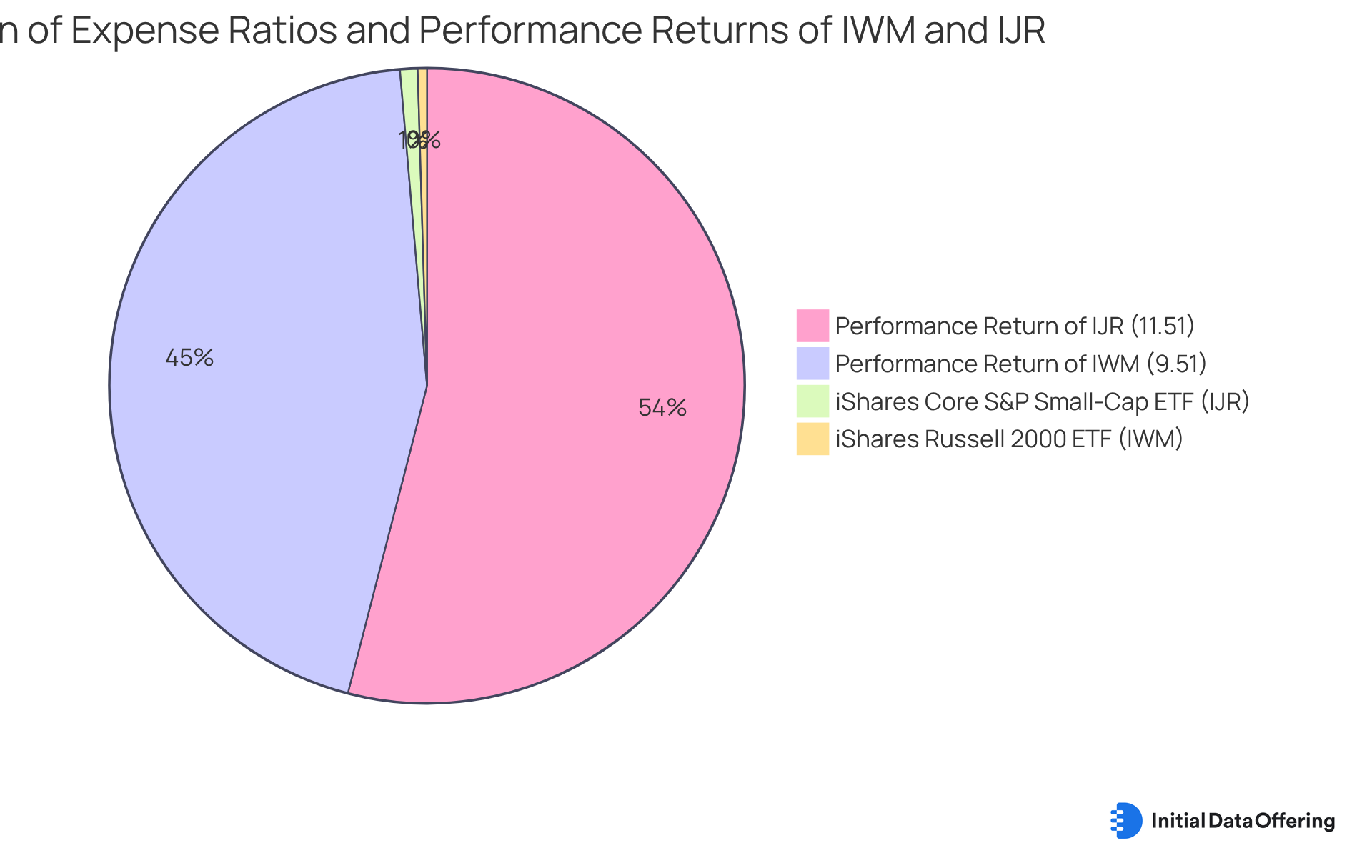

iShares Russell 2000 ETF: Targeting Small-Cap Growth Opportunities

The iShares Russell 2000 ETF (IWM) is one of the that focuses on , which are frequently overlooked yet can offer significant growth opportunities. This ETF, which is one of the , offers a competitive and allows investors to tap into the potential of smaller companies that may be poised for rapid growth. In contrast, the iShares Core S&P Small-Cap ETF (IJR), which is one of the ETF examples, has an expense ratio of 0.19%, positioning IWM as a more cost-effective option for investors.

Historically, [small-cap stocks](https://money.usnews.com/investing/articles/best-russell-2000-etfs-to-buy-now) have delivered better performance than their larger counterparts over the long term, as seen in several ETF examples; for instance, IJR's five-year total annual return of 11.51% has outpaced IWM by 200 basis points. This trend highlights the potential for , particularly for those who are prepared to navigate the volatility that often accompanies smaller companies, as demonstrated by .

However, it is essential to recognize that small-cap companies, highlighted in several ETF examples, can be more susceptible to economic downturns, a factor that market participants should weigh carefully. Starting in 2025, the , driven by improving sentiment and positive economic indicators, making it one of the compelling ETF examples for those looking to capitalize on these trends. Kent Thune points out that focused investment in fundamentally robust small-cap companies, as shown in various ETF examples, may yield the best opportunities in this evolving landscape.

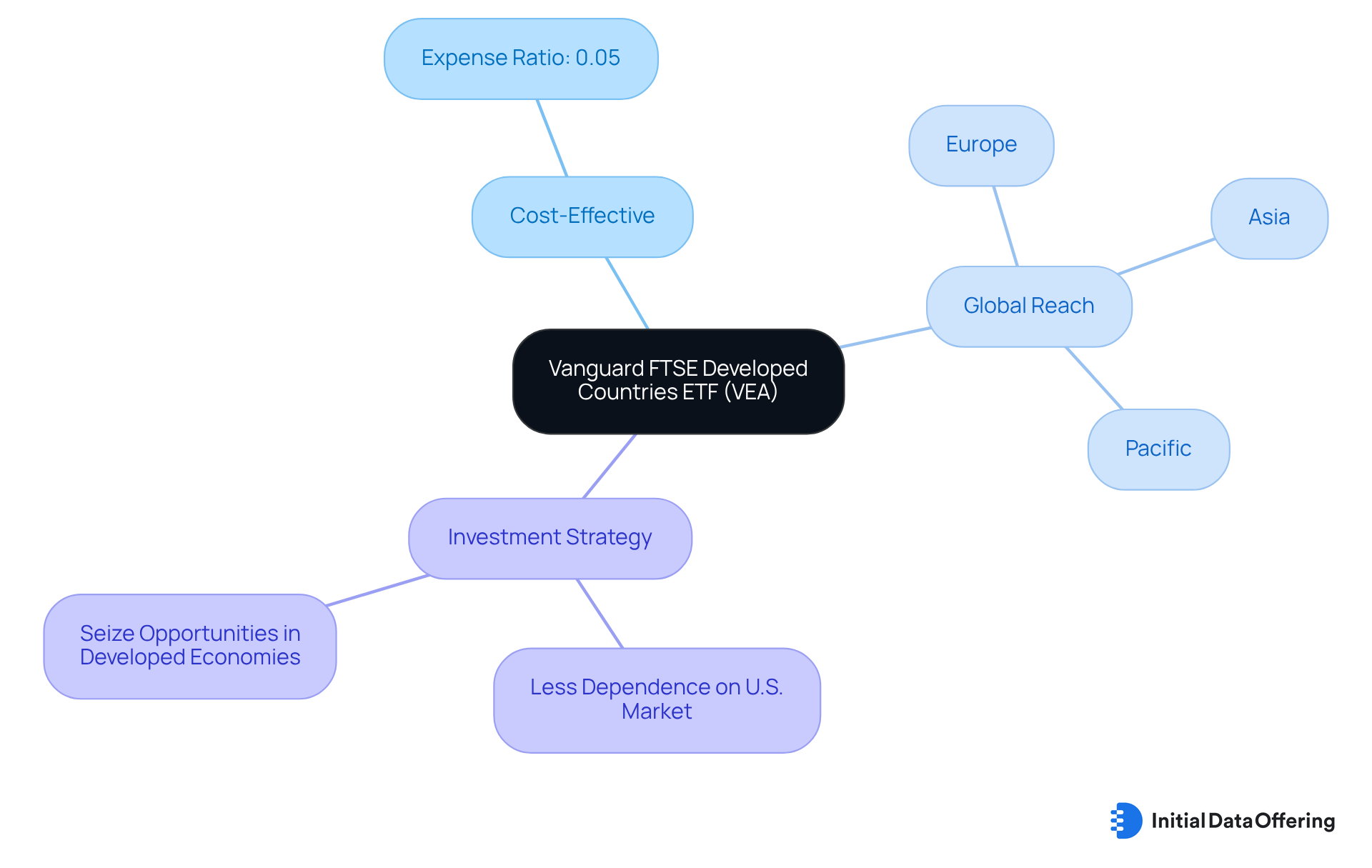

Vanguard FTSE Developed Markets ETF: Expand Your Global Reach

The Vanguard FTSE Developed Countries ETF (VEA) is an example of an ETF that offers participants access to shares in advanced economies beyond the U.S. and Canada. With an expense ratio of just 0.05%, this ETF serves as one of the notable for providing a cost-effective means of diversifying internationally. VEA includes firms from Europe, Asia, and the Pacific, allowing participants to benefit from global economic growth. This ETF is particularly suitable for those looking for ETF examples that can help lessen their dependence on the U.S. market and seize opportunities in other developed economies.

How might with VEA enhance your ?

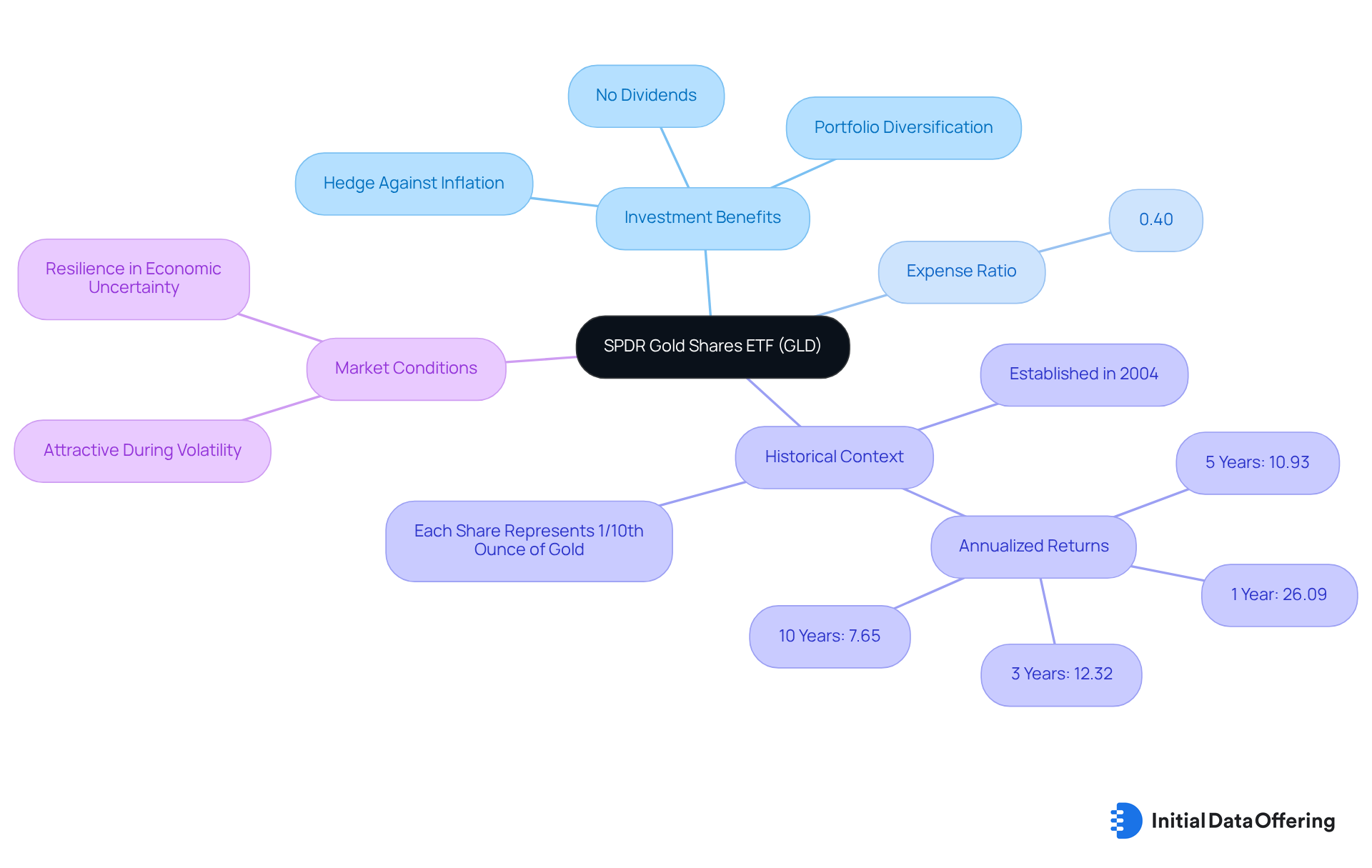

SPDR Gold Shares ETF: Invest in Gold Easily and Effectively

The (GLD) provides a straightforward way for individuals to without the complications associated with physical ownership. Fully backed by gold, this ETF tracks the price of gold bullion and features an expense ratio of just 0.40%. This makes it an and economic uncertainty. However, it is important to note that GLD does not pay dividends, which may be a consideration for investors seeking income from their investments.

As inflationary pressures persist into 2025, GLD remains particularly attractive, especially during periods of volatility when while other assets may falter. Investors have reported that during turbulent times, such as the COVID-19 downturn, ETF examples like gold ETFs such as GLD have served as a stabilizing force in their portfolios. Initially, each share of GLD represented 1/10th of an ounce of gold, providing valuable historical context for its value over time.

Financial experts consistently recommend gold as a strategic asset, underscoring its . Joe Cavatoni, Principal Executive Officer, emphasizes that SPDR Gold Shares aim to eliminate barriers for participants, making gold more accessible. By integrating GLD and various ETF examples into their investment strategies, individuals can with a robust alternative asset that has shown resilience in fluctuating market conditions.

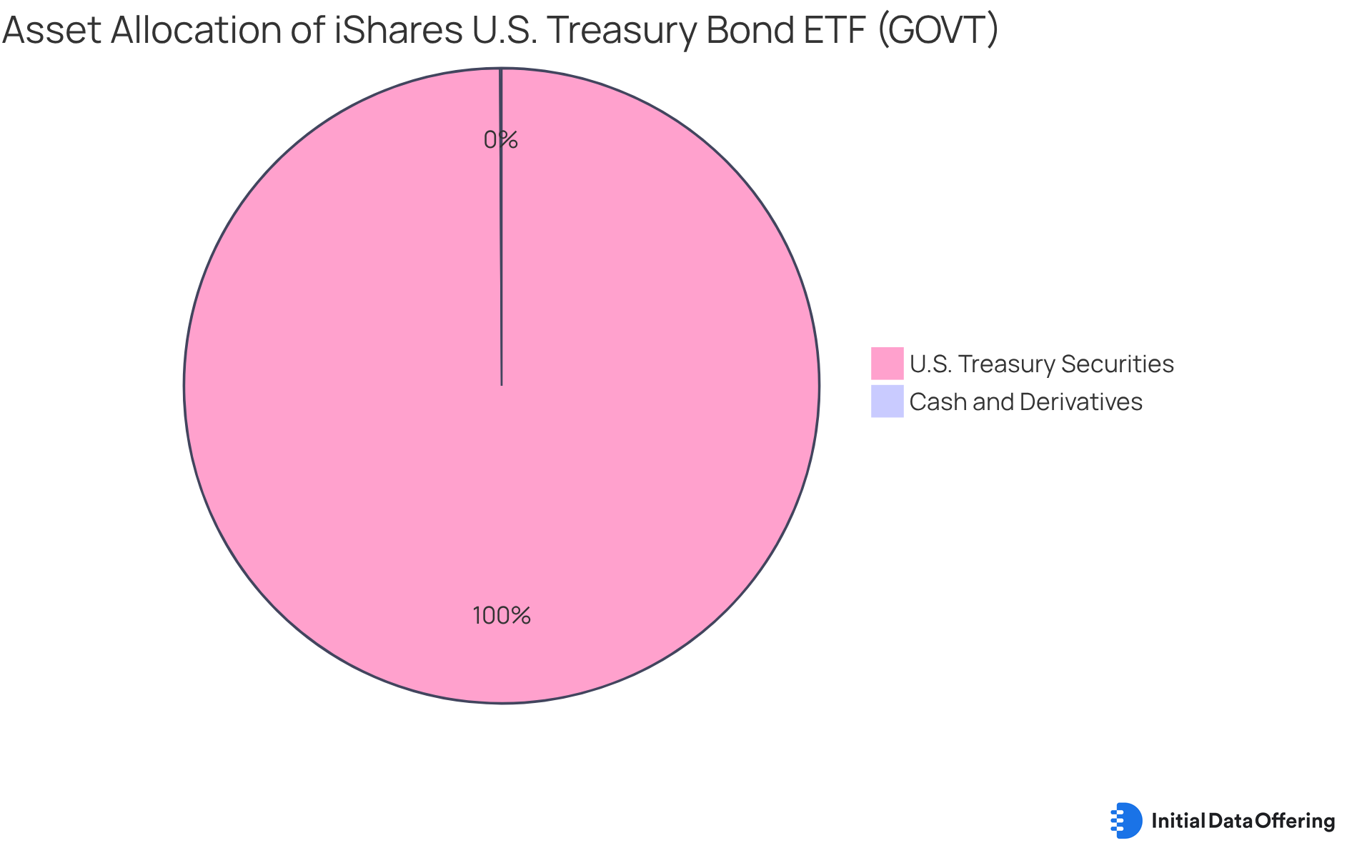

iShares U.S. Treasury Bond ETF: Secure Your Investments with Government Bonds

The iShares U.S. Treasury Bond ETF (GOVT) is an appealing example of an ETF for investors seeking stability through U.S. government bonds. With an of just 0.15%, this ETF includes a diverse range of maturities, enabling a well-rounded approach to . As of July 3, 2025, the fund's composition is predominantly weighted towards at 99.91%, with negligible exposure to cash and derivatives at 0.09%. This structure makes GOVT particularly suitable for conservative investors aiming to reduce risk and secure income, especially during periods of .

The ETF examples serve as a safe haven, effectively balancing risk within a . Financial advisors frequently highlight the significance of fixed-income assets, such as government bonds, in fostering long-term against market fluctuations. As analyst Zachary Evens notes, 'ETF examples like the iShares U.S. Treasury Bond provide a market-value weighted portfolio of the entire U.S. Treasury yield curve.' Its efficient approach and razor-thin expense ratio make this a compelling option.

As of June 30, 2025, the iShares U.S. Treasury Bond ETF has achieved an Overall Morningstar Rating of 3 stars, indicative of its robust risk-adjusted performance among 216 Intermediate Government Funds. This rating, coupled with a Silver medal awarded by Morningstar effective February 6, 2025, underscores the ETF's reliability as a fundamental component of a comprehensive financial strategy. Furthermore, the hypothetical growth of a $10,000 investment is tracked over 162 data points, offering additional insight into the ETF's performance potential.

The current price of GOVT stands at $22.78, and it boasts an Analyst-Driven percentage of 100.00% as of February 6, 2025, validating its thorough analysis and reliability. How might such an investment align with your financial goals?

Conclusion

Investing in Exchange-Traded Funds (ETFs) can significantly enhance financial portfolios by providing diversified exposure to various asset classes with cost-effective structures. This article highlights ten exemplary ETFs, each showcasing unique benefits tailored to different investment strategies. For instance, the Vanguard Total Stock Market ETF offers broad market exposure, whereas the Invesco QQQ Trust focuses on targeted growth opportunities in technology. Understanding these options empowers investors to make informed decisions that align with their financial goals.

Key insights discussed include the importance of low expense ratios in maximizing returns. The iShares Core S&P 500 ETF and the SPDR S&P 500 ETF Trust both offer competitive costs while tracking the performance of leading U.S. companies. Furthermore, the potential of small-cap stocks is emphasized through the iShares Russell 2000 ETF, alongside the international diversification provided by the Vanguard FTSE Developed Markets ETF. Each ETF serves as a vital tool in constructing a balanced and resilient investment strategy.

Ultimately, the landscape of ETFs presents a wealth of opportunities for savvy investors. By leveraging comprehensive data sources like the Initial Data Offering, individuals can stay informed about market trends and make strategic choices that enhance their portfolios. Embracing these investment vehicles not only facilitates growth but also fosters financial security in an ever-evolving economic environment. Consider exploring these ETFs further; they may serve as pivotal components in achieving long-term financial success.

Frequently Asked Questions

What is the Initial Data Offering (IDO)?

The Initial Data Offering (IDO) is a resource that provides comprehensive examples of ETFs, curating high-quality datasets and listing new ones daily to help individuals make informed financial decisions.

How does IDO benefit subscribers?

Subscribers gain premium access to unique data collections, ensuring they stay updated with the latest insights, which helps them utilize data effectively in their financial strategies.

What is the Vanguard Total Stock Market ETF (VTI)?

The Vanguard Total Stock Market ETF (VTI) is a low-cost investment option that provides broad exposure to the entire U.S. equity market, including large, mid, and small-cap stocks.

What are the key features of VTI?

VTI has an expense ratio of 0.03%, manages over $483 billion in assets, and has delivered an average return of 8.75% since its inception in mid-2001.

What is the potential growth of a $1,000 investment in VTI?

A $1,000 investment in VTI could grow to approximately $30,773 over 30 years if it maintains a consistent return pace of 8.75%.

What index does VTI track?

VTI tracks the CRSP U.S. Total Market Index, which includes over 3,500 stocks, with technology stocks making up 34.5% of its holdings.

What is the iShares Core S&P 500 ETF (IVV)?

The iShares Core S&P 500 ETF (IVV) is designed to mirror the performance of the S&P 500 Index, which includes 500 of the largest U.S. companies.

How does IVV compare to other S&P 500 ETFs in terms of cost?

IVV has a low expense ratio of 0.03%, making it more cost-effective than the SPDR S&P 500 ETF, which has an expense ratio of 0.0945%.

What is the current performance of IVV as of June 30, 2025?

IVV has received a high rating from Morningstar and the S&P 500 is up 7.00% year to date, indicating a positive economic environment for this ETF.

What is the significance of IVV's news sentiment score?

IVV's news sentiment score of 0.47 suggests mildly positive media coverage, which may attract more research analysts and influence investment decisions.