10 Hedge Fund Jobs to Explore for Market Insights

10 Hedge Fund Jobs to Explore for Market Insights

Overview

The article explores various hedge fund jobs available to professionals seeking to gain market insights. It underscores the significance of data-driven decision-making in these roles. One notable feature is the Initial Data Offering (IDO), which provides unique datasets that empower hedge fund analysts, portfolio managers, traders, and other professionals. The advantage of utilizing such tools is their ability to enhance analytical capabilities, ultimately leading to improved investment strategies and outcomes.

How can these datasets transform your approach to investment? By leveraging the insights derived from IDOs, professionals can make more informed decisions and potentially increase their success in the market.

Introduction

In the fast-paced world of finance, hedge funds emerge as powerful players, leveraging data to drive investment success. The market's continual evolution presents professionals in hedge fund jobs with the challenge of navigating complex information landscapes to uncover actionable insights. This article delves into ten intriguing roles within hedge funds, emphasizing the unique datasets and analytical strategies that enhance decision-making and foster competitive advantages.

What challenges do these professionals encounter in effectively harnessing data, and how can they transform insights into impactful investment strategies?

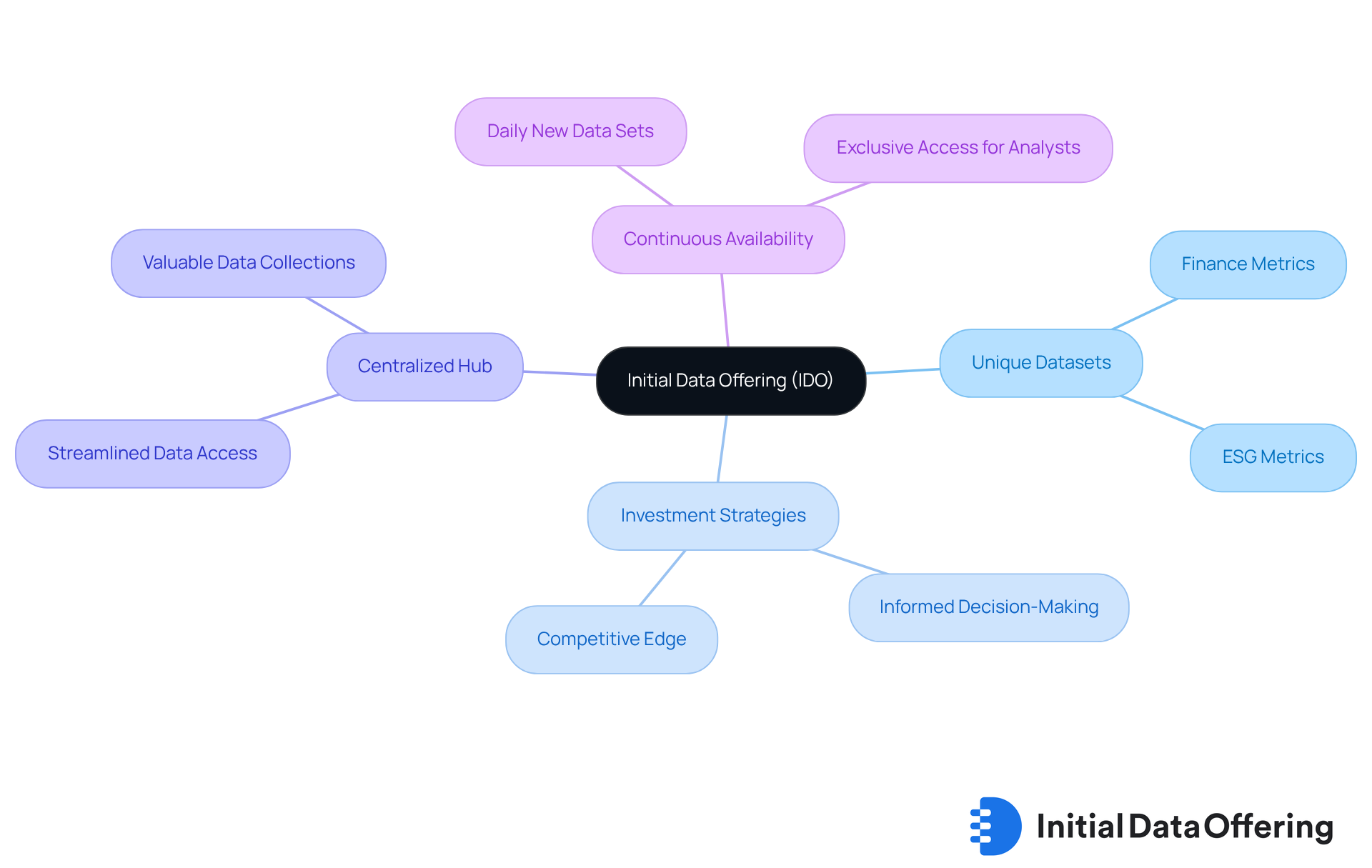

Initial Data Offering: Access Unique Datasets for Hedge Fund Insights

Initial Data Offering (IDO) serves as a vital asset for those seeking hedge fund jobs by providing access to unique data collections that can inform investment strategies and offer insights into the economy. One of the key features of IDO is its ability to organize high-quality information across various sectors, including finance and ESG metrics. This not only enhances the hedge portfolios' capacity to utilize actionable insights but also facilitates informed decision-making. By acting as a centralized hub, IDO streamlines the process of locating valuable data collections, thereby enabling hedge organizations to stay ahead of trends and seize new opportunities.

Moreover, the advantage of enrolling in Initial Data Offering is the continuous availability of new data sets published each day. This ensures that research analysts have exclusive access to the most recent and relevant data collections, significantly improving their ability to make informed choices. How can your organization leverage these insights to enhance its investment strategies? By incorporating IDO into their operations, firms involved in hedge fund jobs can gain a competitive edge in the market, ultimately leading to better investment outcomes.

In conclusion, IDO not only provides essential data but also empowers hedge organizations to navigate the complexities of the financial landscape effectively. With its focus on delivering , IDO enhances decision-making processes and supports the pursuit of new opportunities.

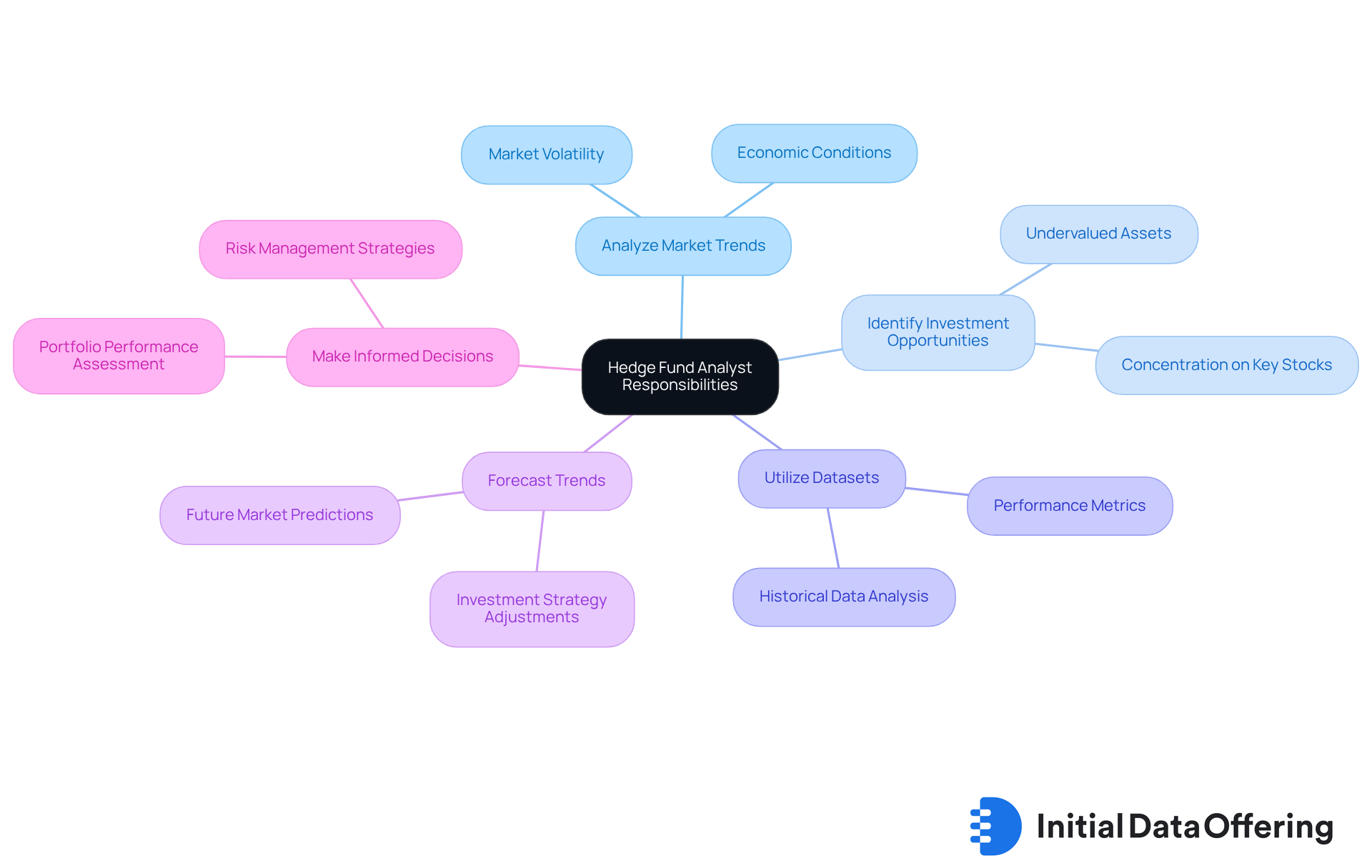

Hedge Fund Analyst: Analyze Market Trends and Investment Opportunities

Hedge fund jobs for analysts are crucial in navigating the complexities of financial systems by meticulously examining trends and identifying profitable investment opportunities. They utilize a range of datasets to analyze economic conditions, assess asset performance, and forecast future trends. By combining information from platforms like IDO, analysts can derive actionable insights that significantly inform investment strategies and enhance overall portfolio performance. This data-focused method not only assists in but also contributes to comprehending market volatility. Consequently, this enables analysts to make informed choices that align with the hedge organization's goals.

As Warren Buffett wisely remarks, 'Risk comes from not knowing what you're doing,' highlighting the importance of comprehensive information analysis in investment choices. Furthermore, the average annual return of the S&P 500 was 11.97% between 2010 and 2022, underscoring the potential benefits of informed investment strategies. A case analysis on 'The Value of Concentration in Investing' demonstrates how concentrating on a small number of thoroughly examined stocks can result in improved investment results. This emphasizes the significance of information in hedge fund jobs operations. As the investment environment continues to evolve, the capacity to combine and analyze information efficiently remains a fundamental aspect of successful hedge fund jobs.

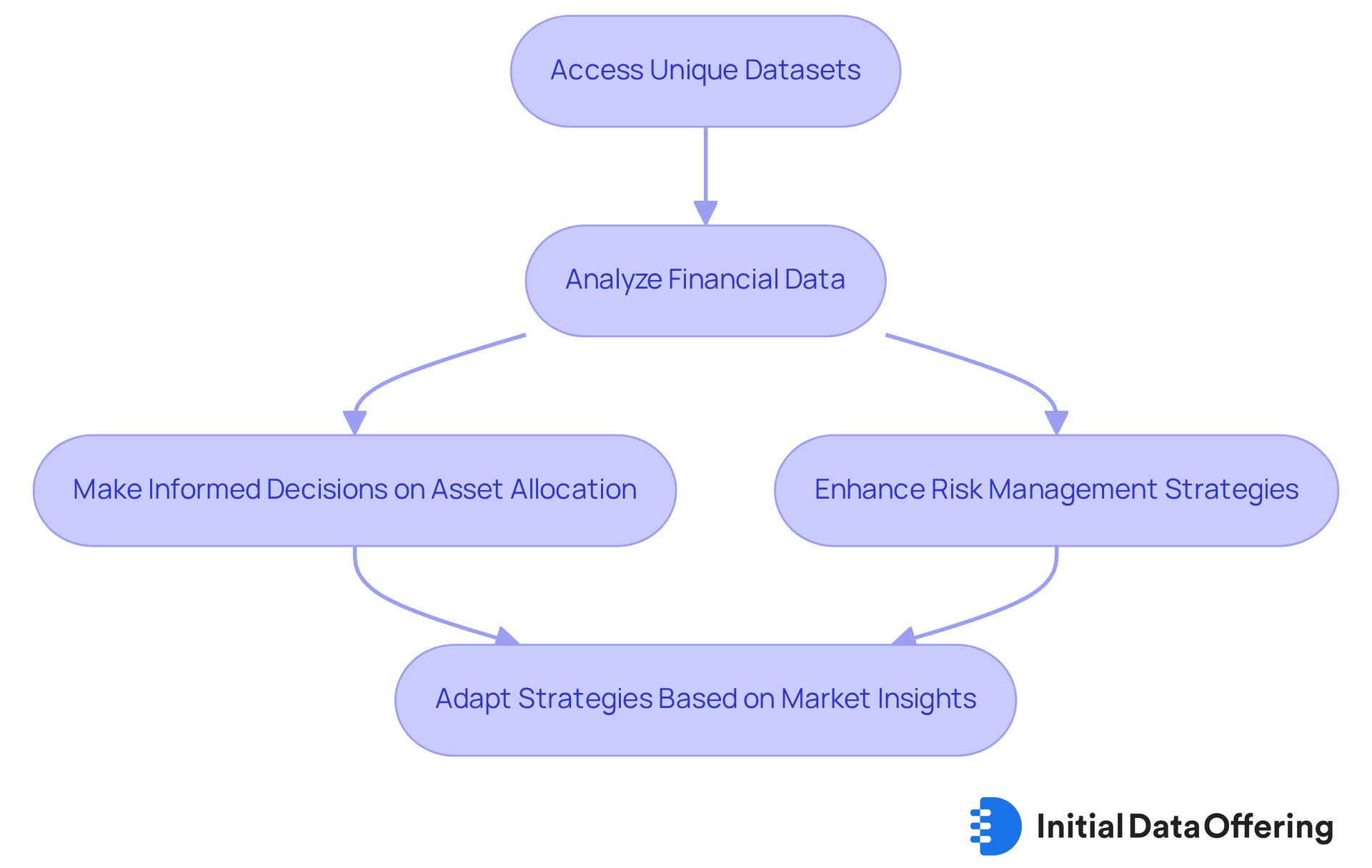

Hedge Fund Portfolio Manager: Manage Investments and Drive Strategy

Hedge fund portfolio managers play a crucial role in managing investment portfolios and shaping overall strategy. They analyze financial data to make informed decisions about asset allocation and risk management. By subscribing to the Initial Data Offering, portfolio managers can access unique datasets that provide daily updates on long and short equity positioning insights. This not only aligns investments with industry trends but also enhances risk management strategies. Consequently, it empowers portfolio managers to make informed decisions that yield a competitive advantage in the market.

What does this mean for portfolio managers? The ability to leverage these datasets allows them to stay ahead of market fluctuations and adapt strategies accordingly. By utilizing the insights gained from these daily updates, managers can effectively navigate the complexities of the financial landscape. This not only fosters more strategic investment choices but also builds a foundation of trust and reliability with stakeholders. In essence, the Initial Data Offering serves as a vital tool for enhancing decision-making processes in hedge fund jobs.

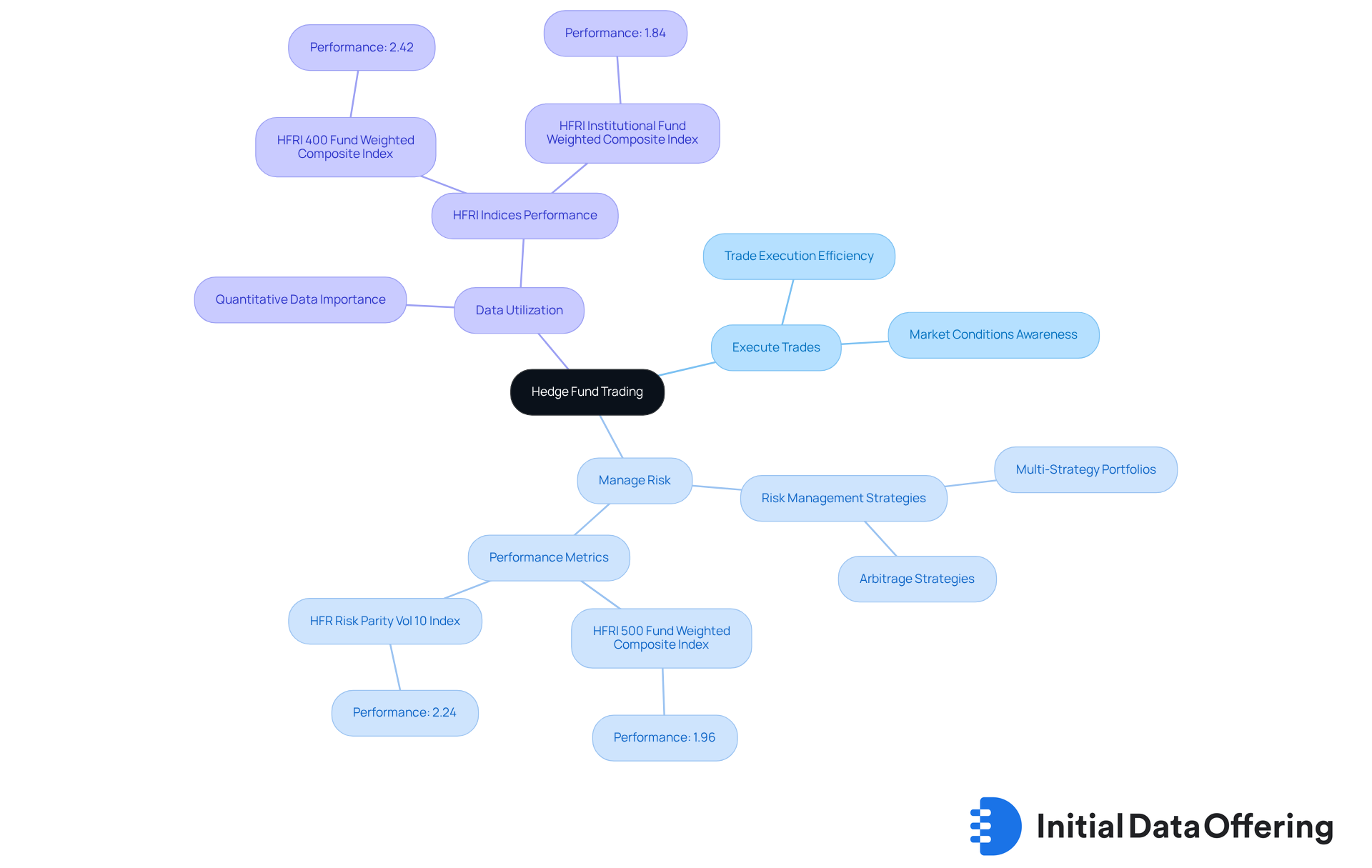

Hedge Fund Trader: Execute Trades and Manage Risk

Hedge fund jobs are crucial for hedge investment traders who execute transactions and manage related risks, necessitating a keen awareness of financial conditions and trends. In 2025, effective risk management strategies have become more essential than ever, particularly given the fluctuations in hedge fund jobs, such as the 2.4% decline in 2022. By leveraging datasets from IDO, traders can significantly enhance their analysis and optimize trade execution. For example, the HFRI 500 Fund Weighted Composite Index reported a performance of 1.96% as of August 2025, illustrating how data-driven insights can lead to improved outcomes in trade execution efficiency.

Traders frequently depend on to guide their decisions, with many underscoring the significance of data in managing risk. As one trader noted, "Data is essential for navigating the complexities of the industry and making informed decisions." Real-world examples further illustrate this point:

- Multi-strategy portfolios have demonstrated resilience, achieving 12 consecutive months of positive returns despite challenges in the financial landscape, as highlighted in the HFR report.

- The HFR Risk Parity Vol 10 Index achieved a performance of 2.24%, showcasing the effectiveness of information in navigating intricate economic dynamics.

As traders harness information to refine their strategies, they not only enhance trade execution efficiency but also bolster the overall profitability of their portfolios. The integration of robust datasets fosters a more nuanced understanding of market trends, ultimately empowering traders to make informed decisions in an increasingly volatile environment.

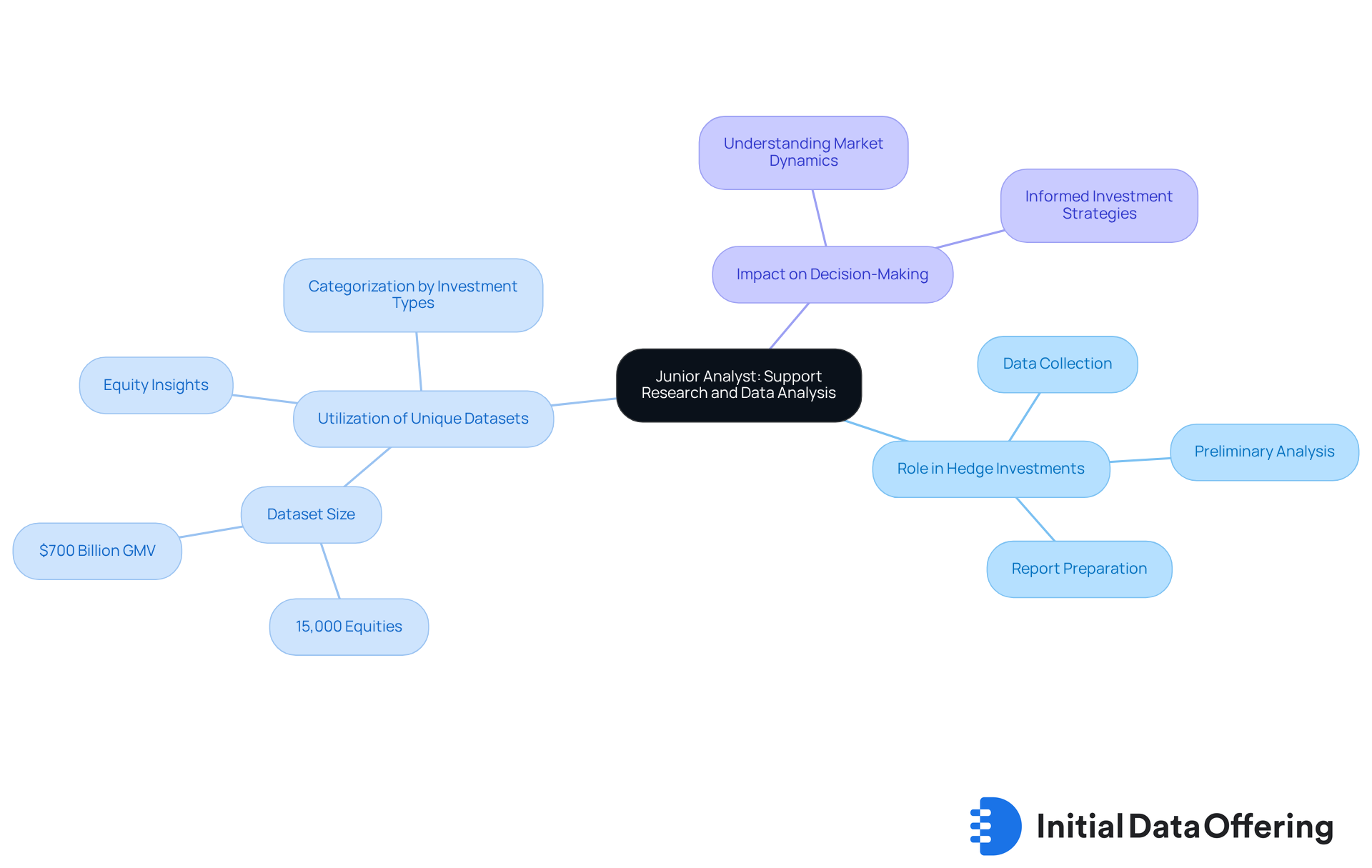

Junior Analyst: Support Research and Data Analysis

Junior analysts play a vital role in research and information analysis within hedge investments. They assist in collecting and processing information, conducting preliminary analyses, and preparing reports for senior analysts. One of the key features of their work is the utilization of unique datasets from Initial Data Offering. This dataset includes comprehensive sourced from over 600 investment vehicles representing $700 billion in GMV. Such extensive data enhances their research capabilities significantly.

The dataset, which encompasses information on 15,000 equities and offers historical insights beginning in February 2017, can be categorized by eight different investment types. This categorization provides valuable insights that contribute to the overall investment strategy.

How can these insights inform your decision-making processes? By leveraging this exclusive dataset, junior analysts not only support their teams but also gain a deeper understanding of market dynamics, ultimately leading to more informed investment strategies.

Hedge Fund Senior Analyst: Conduct In-Depth Analysis and Reporting

Hedge fund senior analysts conduct in-depth analyses and reporting, providing critical insights that guide investment decisions. They utilize various data collections to evaluate market conditions, assess risks, and identify opportunities. One notable resource is the Initial Data Offering, which lists new information daily. By accessing these distinctive datasets, senior analysts can significantly enhance their analyses.

Subscribing to the Initial Data Offering offers several key advantages:

- It ensures that reports are data-driven and actionable.

- It provides exclusive access to high-quality datasets that can greatly inform investment strategies.

How might these data collections influence your decision-making process? With the right information at hand, analysts can make more informed choices, ultimately leading to better investment outcomes.

In conclusion, the integration of comprehensive data sources like the Initial Data Offering not only enriches the analytical process but also empowers hedge fund jobs to navigate the complexities of the market effectively. This resource can be a game-changer in developing .

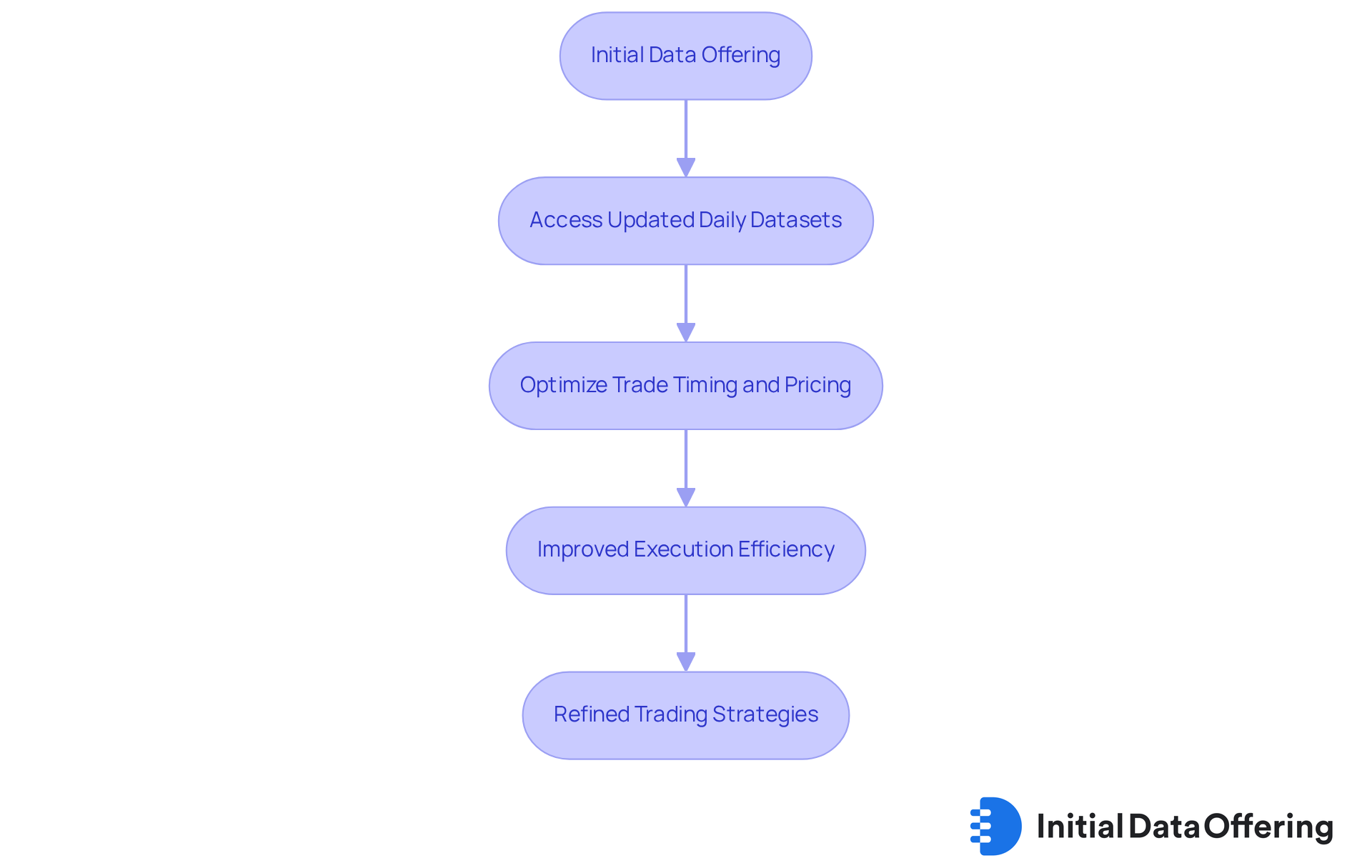

Hedge Fund Execution Trader: Ensure Efficient Trade Execution

Efficient trade execution is critical in today’s dynamic market environment, which is why hedge fund jobs for execution traders prioritize this aspect. They must adeptly navigate fluctuating market conditions and leverage information to optimize trade timing and pricing. The Initial Data Offering provides a valuable resource, featuring comprehensive datasets that include long and short equity positioning insights across 15,000 equities, along with historical data dating back to February 2017. This enhances execution traders' strategies by informing their decisions.

By enrolling in the Initial Data Offering, traders gain access to new datasets that are updated daily. This ensures that trades can be executed at optimal prices, ultimately maximizing returns on investments. How can these insights transform your trading strategies? The integration of such data not only improves execution efficiency but also positions traders for hedge fund jobs by allowing them to capitalize on market opportunities more effectively.

In summary, the combination of timely information and extensive historical data equips execution traders with the tools necessary to refine their strategies and achieve better outcomes in their trading activities.

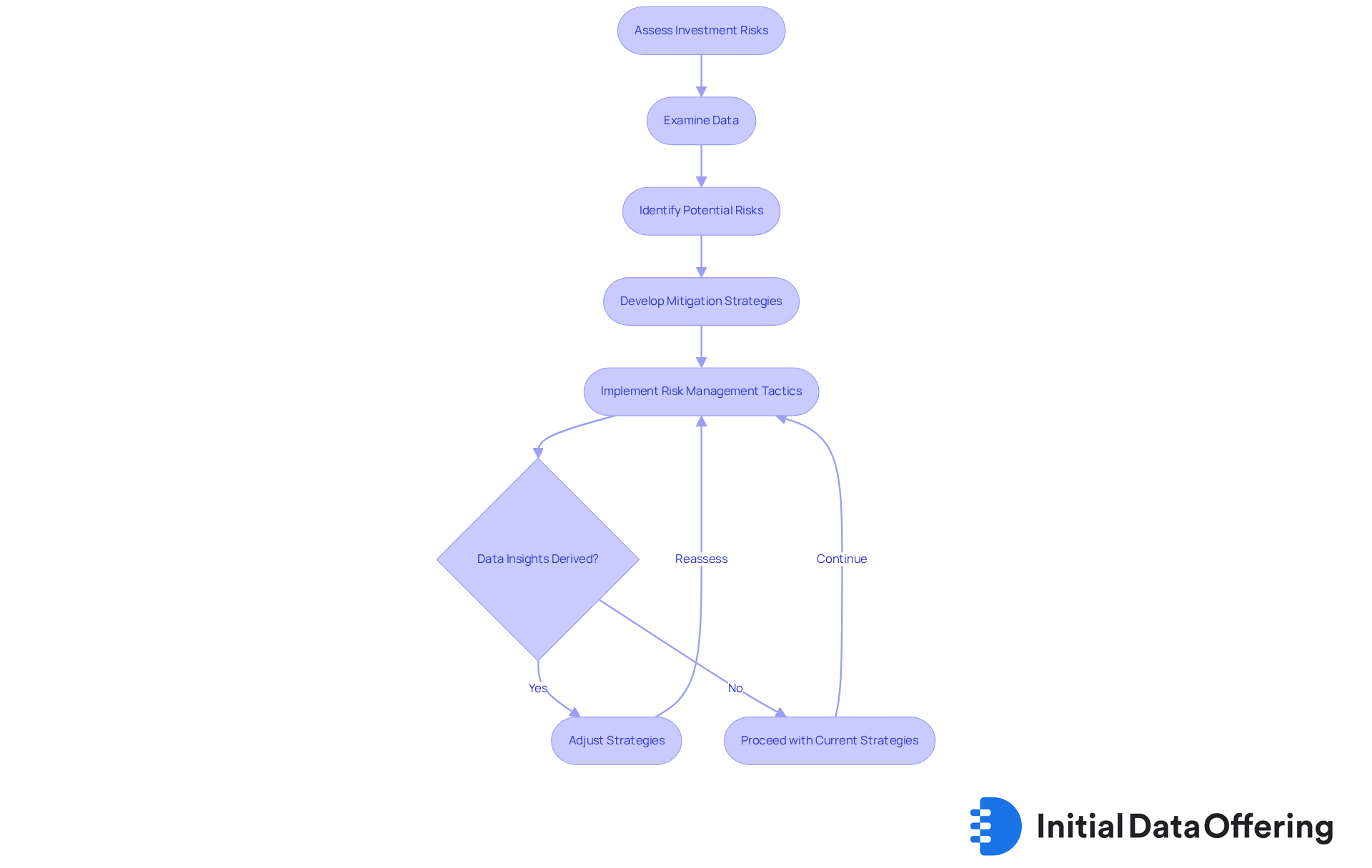

Hedge Fund Risk Manager: Assess and Mitigate Investment Risks

Hedge fund jobs for risk managers play a crucial role in assessing and mitigating investment risks by leveraging data-driven insights. They carefully examine information to identify potential risks and develop strategies to reduce exposure. By utilizing unique datasets from Initial Data Offerings (IDOs), these professionals significantly enhance their risk assessment processes. For instance, incorporating diverse information and ESG metrics allows risk managers to achieve a more refined understanding of economic dynamics and recognize emerging threats.

Real-world examples illustrate the effectiveness of information in risk mitigation strategies. One hedge investment group effectively utilized advanced analytics on historical market data to foresee downturns, enabling proactive portfolio adjustments. This data-driven approach not only safeguarded their investments but also improved overall fund performance.

Statements from industry specialists emphasize the significance of information in reducing investment risks. A prominent risk manager noted, "Access to high-quality datasets enables us to make informed decisions that protect our investments from unforeseen market shifts." This sentiment resonates throughout the industry, where 90% of executives acknowledge as a long-term risk, underscoring the necessity for robust analytics in risk management.

The impact of data on risk assessment processes cannot be overstated. By employing advanced risk assessment techniques and consistently overseeing datasets, those in hedge fund jobs can swiftly adapt to evolving market conditions. This proactive stance not only enhances risk management but also positions resources to capitalize on new opportunities as they arise.

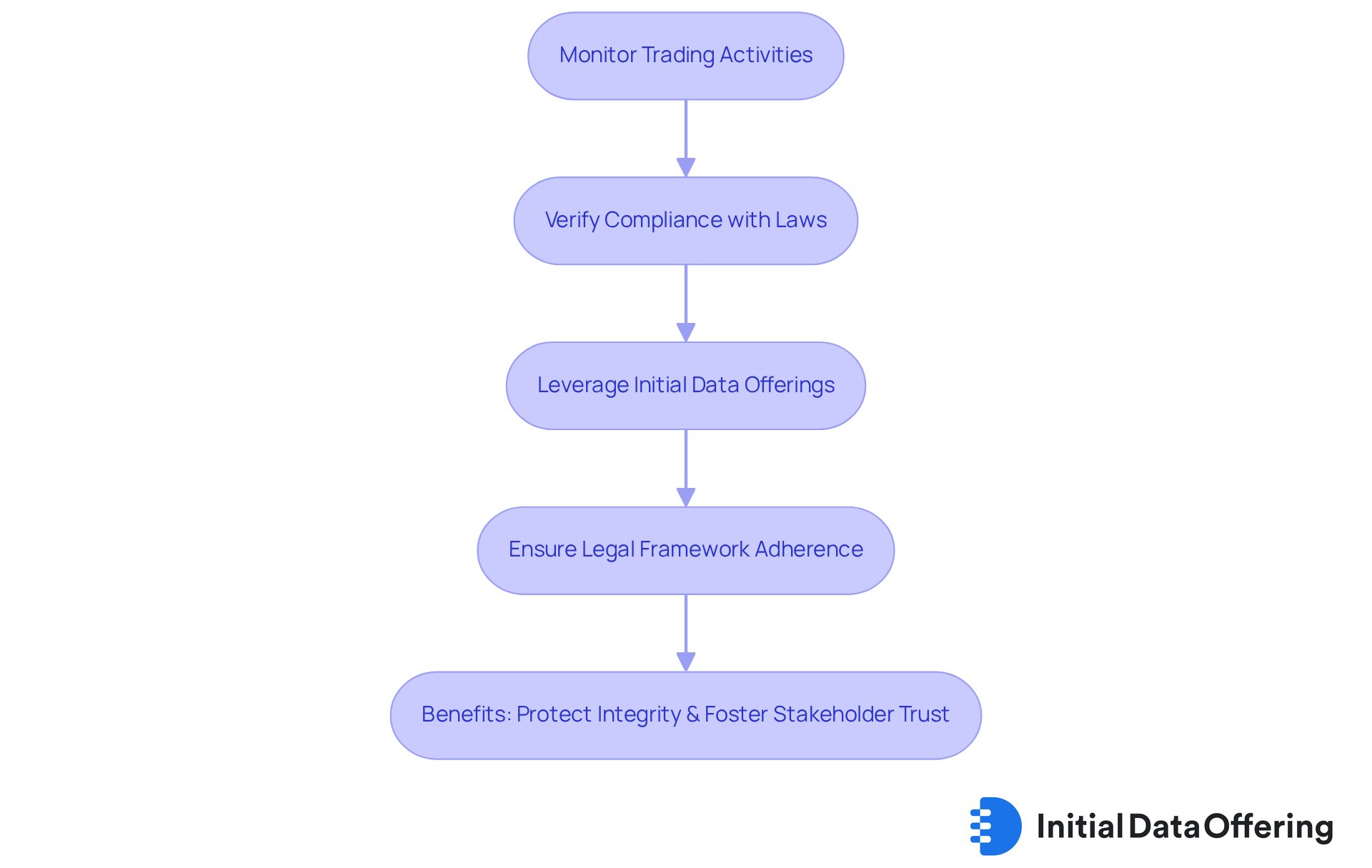

Hedge Fund Compliance Officer: Ensure Regulatory Adherence

Hedge fund compliance officers play a crucial role in ensuring that portfolios adhere to regulatory requirements. They monitor trading activities and verify that all operations comply with relevant laws and regulations. By leveraging information from Initial Data Offerings, compliance officers enhance their monitoring processes. This ensures that investments operate within legal frameworks and uphold their reputations.

How can these practices be applied to improve your own compliance strategies? The benefits of such not only protect the integrity of the investment but also foster trust among stakeholders.

Hedge Fund Operations Manager: Oversee Fund Operations and Efficiency

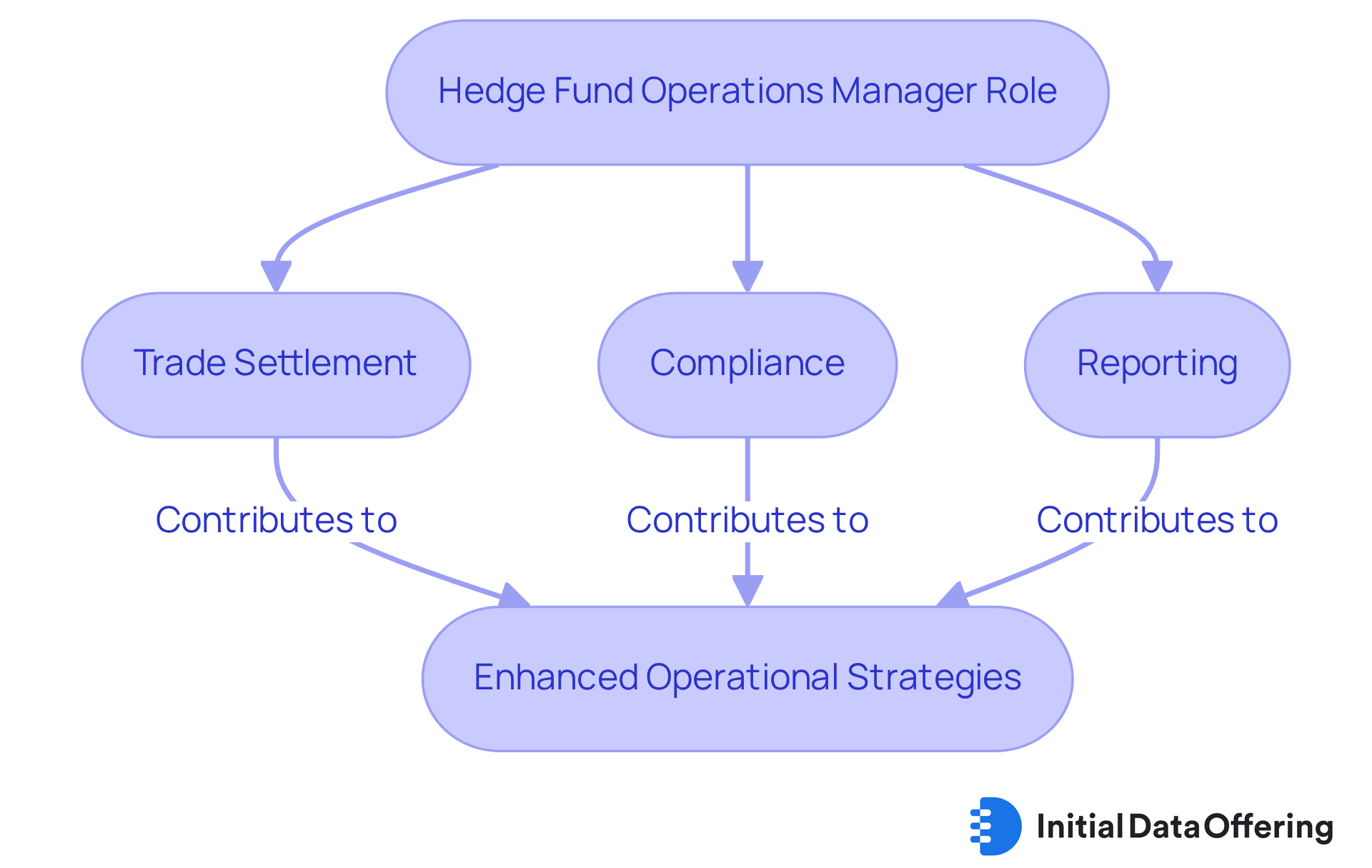

Supervisors in hedge fund jobs play a crucial role in managing the daily activities of the organization, ensuring both efficiency and effectiveness. They coordinate such as trade settlement, compliance, and reporting.

By leveraging distinctive data from Initial Data Offering, which includes daily updates on long and short equity positioning insights, operations managers can significantly enhance their operational strategies. This access to high-quality, comprehensive data not only ensures that hedge fund jobs operate smoothly and efficiently but also contributes to the overall success of the fund.

How might these insights transform your approach to decision-making? Subscribe today to discover new datasets daily and gain premium insights that can drive informed decision-making.

Conclusion

The exploration of hedge fund job opportunities reveals a landscape where data-driven insights are paramount to success. With roles ranging from analysts to portfolio managers, each position underscores the importance of leveraging unique datasets to inform investment strategies and navigate market complexities. The integration of resources like the Initial Data Offering not only enhances decision-making but also equips professionals with the tools necessary to thrive in an increasingly competitive environment.

Throughout the article, key insights have been provided on various hedge fund roles, including:

- The crucial functions of analysts in market trend analysis

- The strategic oversight of portfolio managers

- The risk mitigation efforts of compliance officers

Each role showcases how access to timely and relevant data can lead to improved investment outcomes and operational efficiency. The emphasis on data as a vital asset highlights the evolving nature of hedge fund jobs and the necessity for professionals to adapt to changing market conditions.

Ultimately, the message is clear: embracing data-driven strategies is essential for anyone looking to excel in the hedge fund industry. By prioritizing access to high-quality datasets and continuously honing analytical skills, professionals can not only enhance their individual performance but also contribute to the overall success of their organizations. As the hedge fund landscape continues to evolve, staying informed and agile will be key to seizing new opportunities and achieving sustainable growth.

Frequently Asked Questions

What is the Initial Data Offering (IDO)?

The Initial Data Offering (IDO) is a resource that provides access to unique datasets, helping individuals in hedge fund jobs inform investment strategies and gain insights into the economy.

How does IDO benefit hedge fund organizations?

IDO organizes high-quality information across various sectors, enhancing hedge portfolios' capacity for actionable insights and facilitating informed decision-making. It serves as a centralized hub for locating valuable data collections.

What types of data does IDO include?

IDO includes data collections related to finance and ESG (Environmental, Social, and Governance) metrics, among other sectors.

How often is new data published in IDO?

New datasets are published daily, ensuring that research analysts have access to the most recent and relevant information.

How can hedge fund organizations leverage IDO for investment strategies?

By incorporating IDO into their operations, hedge fund organizations can gain a competitive edge in the market, leading to better investment outcomes.

What role do hedge fund analysts play in investment strategies?

Hedge fund analysts analyze market trends and identify profitable investment opportunities using various datasets to assess economic conditions and forecast future trends.

How do analysts utilize IDO in their work?

Analysts combine information from platforms like IDO to derive actionable insights that inform investment strategies and enhance portfolio performance.

What is the significance of comprehensive information analysis in hedge fund jobs?

Comprehensive information analysis is crucial for making informed investment choices and managing risks, as highlighted by Warren Buffett's quote on risk.

What is the role of hedge fund portfolio managers?

Hedge fund portfolio managers manage investment portfolios and shape overall strategy by analyzing financial data to make informed decisions about asset allocation and risk management.

How does IDO support hedge fund portfolio managers?

By subscribing to IDO, portfolio managers gain access to unique datasets with daily updates, which helps them align investments with industry trends and enhance risk management strategies.

Why is it important for portfolio managers to stay updated with market fluctuations?

Staying updated allows portfolio managers to adapt strategies accordingly, fostering strategic investment choices and building trust with stakeholders.