What is Market Data? Definition, Types, and Importance Explained

What is Market Data? Definition, Types, and Importance Explained

Overview

Market data encompasses essential information about prices, sales volumes, and buyer behavior, all of which are vital for companies aiming to comprehend industry dynamics and make informed decisions. By leveraging diverse types of market data—quantitative, qualitative, alternative, fundamental, and ESG—organizations can identify opportunities, mitigate risks, and enhance their understanding of customers.

This multifaceted approach not only improves their competitive edge in the market but also empowers them to navigate the complexities of their respective industries effectively. How can your organization utilize these insights to drive growth and innovation?

Understanding the nuances of market data is crucial, as it enables businesses to adapt and thrive in an ever-evolving landscape. Ultimately, embracing these data-driven strategies leads to informed decision-making and sustained success.

Introduction

Understanding market data is crucial for businesses navigating the complexities of today’s economy. Informed decision-making can mean the difference between success and failure. This article delves into the definition, types, and significance of market data, offering insights into how organizations can leverage this information to enhance their strategies and adapt to changing market dynamics.

With a vast array of data available, how can businesses ensure they are utilizing the right information effectively to drive growth and mitigate risks? By examining the features, advantages, and benefits of market data, we can uncover its potential to transform strategic decision-making.

Define Market Data: Understanding Its Core Concept

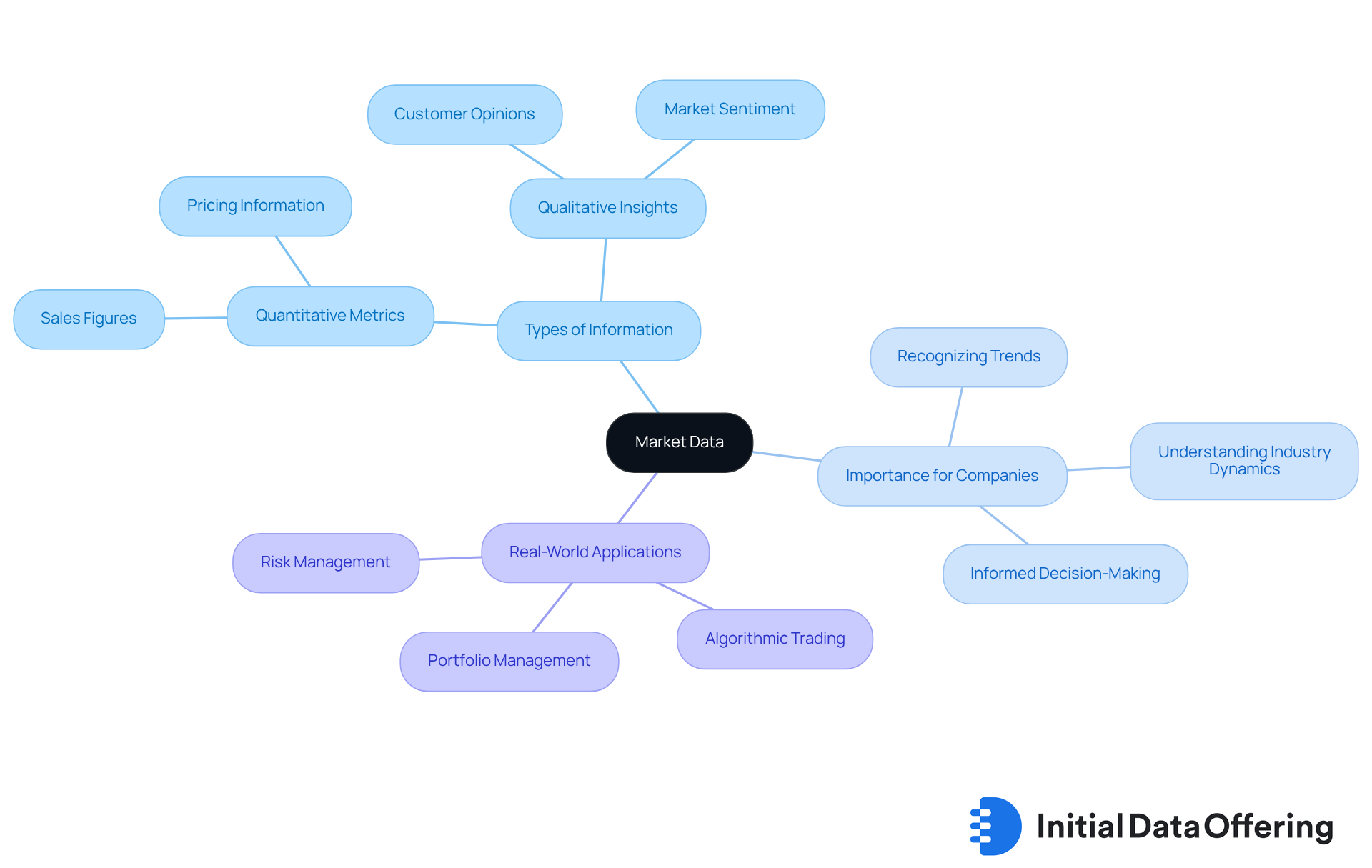

Information about the environment reveals what is market data, including prices, sales volumes, and buyer behavior. This information includes a broad variety of types, comprising quantitative metrics like sales figures and qualitative insights such as customer opinions. Understanding what is market data is essential for companies, as it helps them comprehend industry dynamics, recognize trends, and make informed choices. By examining this information, companies can customize their strategies to satisfy consumer needs, ultimately improving their competitive standing.

Statistics show that worldwide expenditure on financial information exceeded $30 billion in 2018, emphasizing its vital role in the financial sector. Moreover, information has undergone a compound annual growth rate (CAGR) of 9.5% during the last five years. This suggests an increasing dependence on analytics-based decision-making, which is crucial for organizations striving to stay ahead in a competitive landscape.

Real-world examples demonstrate how companies effectively use information to navigate economic dynamics. For instance, companies employing algorithmic trading techniques depend on real-time information to execute trades according to established rules, thereby enhancing their investment approaches. Furthermore, organizations that analyze past price information can establish alerts for notable price fluctuations. This proactive strategy enables them to manage portfolios effectively and protect investments against volatility.

Understanding what is market data is not only advantageous; it is essential for companies striving to succeed in today's information-driven environment. As highlighted by industry leaders, "The high quality and reliability of these insights are particularly important for customers," underscoring the significance of information quality in decision-making. How can your organization leverage this information to enhance its strategies and decision-making processes?

Explore Types of Market Data: Categories and Their Uses

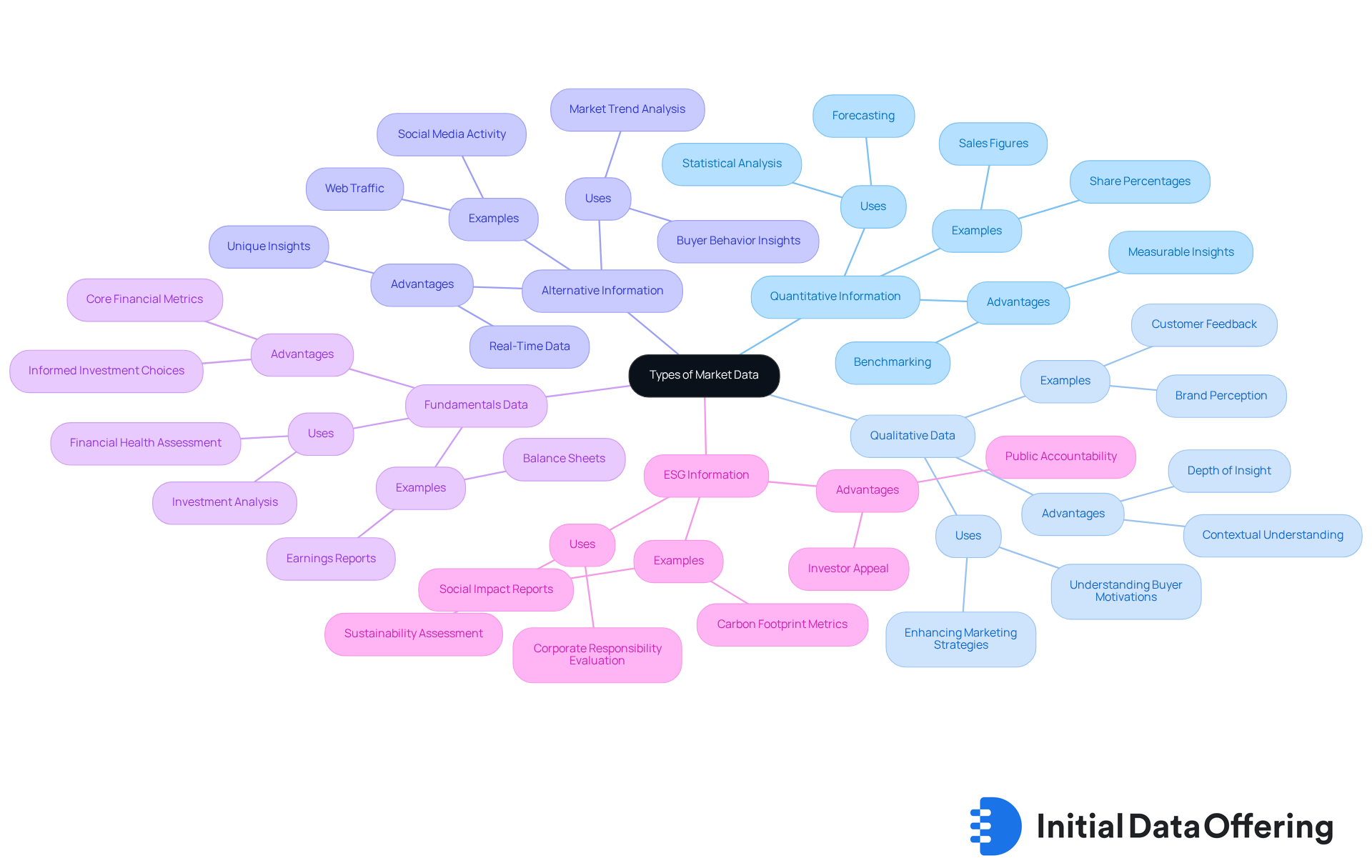

Market data can be categorized into several types, each serving distinct purposes:

-

Quantitative Information: This encompasses numerical details such as sales figures, share percentages, and pricing specifics. It is often employed for statistical analysis and forecasting, allowing businesses to identify trends and make data-driven decisions. The advantages of quantitative research techniques, such as surveys and experiments, lie in their ability to provide measurable insights that can be easily compared and benchmarked against industry standards. This enables companies to make informed choices based on solid data.

-

Qualitative Data: This type encompasses non-numerical insights, such as customer feedback, brand perception, and market sentiment. The value of qualitative information is its ability to provide depth regarding buyer motivations and preferences, offering insights that numerical data alone cannot deliver. Businesses are progressively utilizing qualitative research techniques, such as interviews and focus groups, to uncover the underlying motives behind buyer behavior, which enhances their marketing strategies and product development. It is often recommended to use qualitative research in the exploratory phase to develop hypotheses, followed by quantitative methods to test these hypotheses, thus creating a comprehensive understanding of the market.

-

Alternative Information: This encompasses non-traditional information sources, such as social media activity, web traffic, and satellite imagery. Companies utilize alternative information to gain unique insights into market trends and buyer behavior, frequently uncovering patterns that conventional information may overlook. For instance, assessing social media sentiment can provide real-time insights into brand perception and buyer preferences, which can be pivotal for timely decision-making.

-

Fundamentals Data: This refers to core financial metrics of companies, such as earnings reports and balance sheets, which are essential for investment analysis. Investors depend on fundamental information to evaluate a company's financial condition and make informed investment choices. Understanding these metrics can significantly impact investment strategies and outcomes.

-

ESG Information: Environmental, Social, and Governance (ESG) metrics assess a company's sustainability practices and ethical influence, becoming increasingly significant for investors and the public alike. As economic dynamics change, comprehending ESG factors can affect investment approaches and consumer decisions, highlighting the growing importance of corporate responsibility.

Every kind of commercial information plays an essential role in influencing business strategies and improving decision-making processes. Understanding what is market data through the combination of both numerical and descriptive information enables companies to create a comprehensive perspective of their industry environment, fostering innovation and strategic planning. Moreover, qualitative information offers context and sentiment that enhance quantitative metrics, emphasizing the significance of a hybrid approach in analysis. Companies such as [Example Company] have effectively utilized qualitative insights to enhance their marketing strategies, showcasing the practical applications of this information type. However, it is essential to acknowledge that qualitative research can be labor-intensive and challenging to analyze due to subjective interpretations, which highlights the need for a balanced approach.

Highlight Importance of Market Data: Driving Informed Decisions

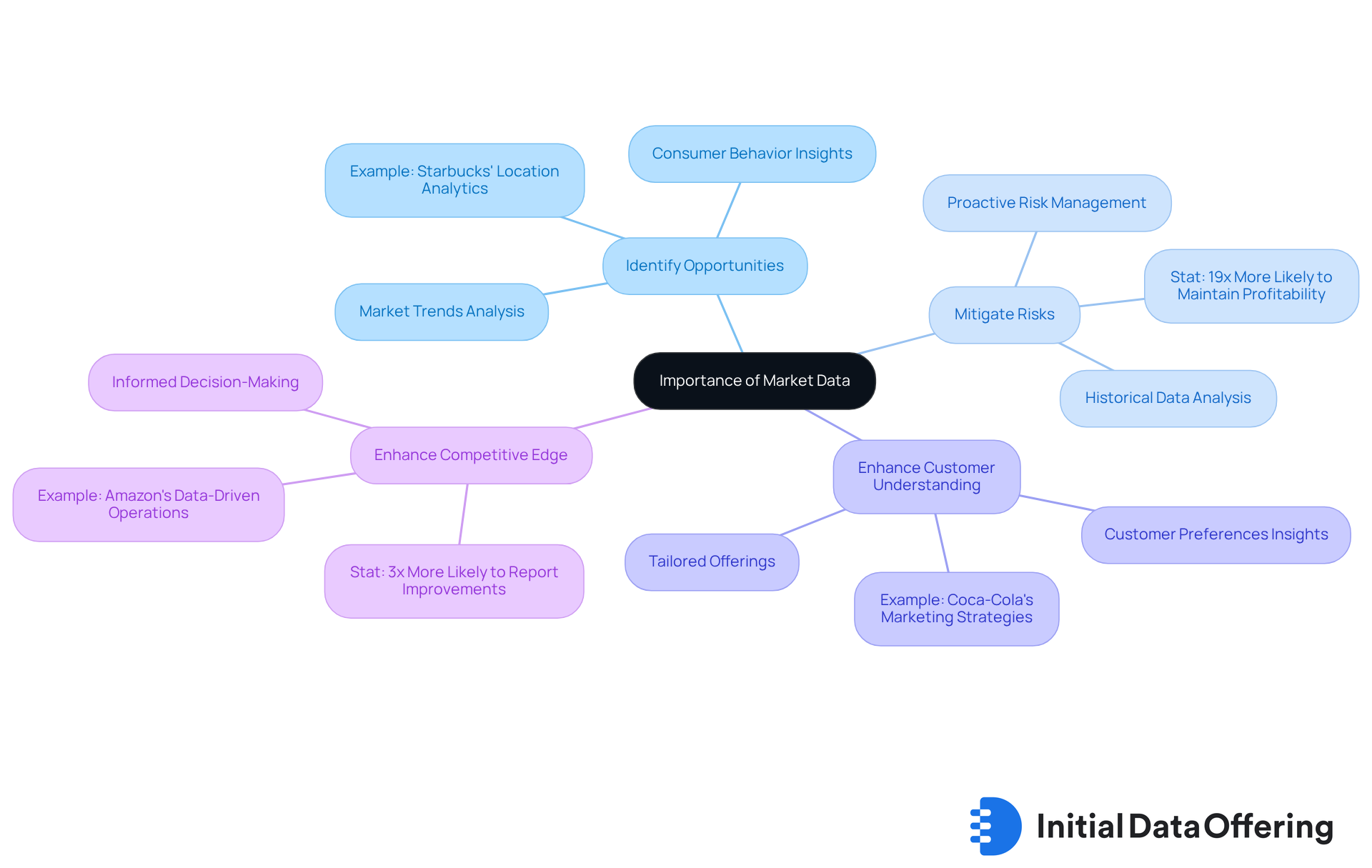

The significance of industry information is paramount in today's business landscape, serving as the foundation for strategic decision-making. By leveraging market data, businesses can:

-

Identify Opportunities: Analyzing market trends and consumer behavior allows companies to discover new growth areas and market opportunities. For example, a retail firm that examines sales data might find a rising demand for eco-friendly products, prompting adjustments in inventory and promotional strategies to capitalize on this trend. Starbucks exemplifies this approach by using data analytics to pinpoint optimal store locations based on demographics and traffic patterns, ensuring a successful market entry.

-

Mitigate Risks: A thorough understanding of industry dynamics equips organizations to anticipate challenges and adapt their strategies, effectively reducing potential risks. Companies that embrace data-driven strategies are approximately 19 times more likely to maintain profitability, underscoring the importance of proactive risk management in navigating economic uncertainties.

-

Enhance Customer Understanding: Market data provides valuable insights into customer preferences and behaviors, enabling businesses to tailor their offerings to effectively meet consumer needs. This customer-centric focus not only cultivates loyalty but also propels sales growth.

-

Enhance Competitive Edge: Organizations that harness industry information can make informed decisions that bolster their positioning within the sector. Companies employing data-driven decision-making are three times more likely to report significant improvements in their strategic outcomes. As Randy Bean, CEO of NewVantage Partners, notes, "The ability to make informed decisions based on the very latest up-to-the-moment information is rapidly becoming the mainstream norm."

By prioritizing information insights and fostering a culture centered on analysis, organizations can drive innovation, adapt to changing conditions, and achieve outstanding results, ultimately positioning themselves for long-term success.

Challenges in Accessing and Utilizing Market Data

Accessing and utilizing information from the marketplace effectively presents numerous challenges that can impede decision-making processes. Key issues include:

-

Data Fragmentation: The market data landscape is notoriously fragmented, complicating the search for relevant datasets. A considerable share of companies, particularly larger entities, struggle with managing their financial expenditures, usage, and compliance due to this fragmentation. Platforms like Initial Information Offering (IDO) have been developed to alleviate these challenges by providing a centralized hub for exchange, thus enhancing the accessibility and visibility of valuable datasets.

-

Quality and Reliability: The integrity of market information is paramount. Companies must ensure that the information they utilize is accurate, current, and sourced from reputable providers. This is especially vital given that unorganized information constitutes 80-90% of current records, complicating analysis and heightening the risk of reliance on outdated or inaccurate details.

-

Integration with Existing Systems: Organizations often face difficulties in integrating new information sources with their current systems, which can hinder their ability to leverage insights effectively. This challenge is exacerbated by the complexity of information architecture in larger firms, leading to inefficiencies and potential overspending.

Identifying these challenges empowers organizations to develop targeted strategies to address them, ensuring they maximize the value of information in their decision-making processes by understanding what is market data. By tackling data fragmentation and prioritizing quality and integration, firms can enhance their market analysis capabilities and drive improved outcomes. For effective utilization of datasets like Hazeltree's Long and Short Equity Positioning Insights, consulting the user manual can provide additional guidance on leveraging these insights effectively.

Conclusion

Understanding market data is essential for businesses striving to excel in a competitive landscape. It encompasses various information types, including quantitative metrics like sales figures and qualitative insights such as customer feedback. By effectively leveraging these insights, organizations can tailor their strategies to meet consumer needs, recognize emerging trends, and make informed decisions that enhance their competitive advantage.

The article highlights the different categories of market data:

- Quantitative

- Qualitative

- Alternative

- Fundamental

- ESG information

Each category serves distinct purposes in business strategy. Quality data is paramount in driving informed decisions, identifying opportunities, mitigating risks, and enhancing customer understanding. However, challenges such as data fragmentation and integration difficulties must be addressed, underscoring the necessity for companies to prioritize data quality and accessibility.

In conclusion, the significance of market data is profound; it serves as the backbone of strategic decision-making in today’s information-driven environment. Companies that adopt a data-centric approach are better positioned to innovate, adapt to market changes, and achieve sustained success. Organizations are encouraged to leverage these insights effectively, ensuring they harness the full potential of market data to drive growth and enhance their strategic outcomes.

Frequently Asked Questions

What is market data?

Market data refers to information about the environment that includes prices, sales volumes, and buyer behavior. It encompasses both quantitative metrics like sales figures and qualitative insights such as customer opinions.

Why is understanding market data important for companies?

Understanding market data is essential for companies as it helps them comprehend industry dynamics, recognize trends, and make informed choices. This knowledge allows companies to customize their strategies to better satisfy consumer needs, improving their competitive standing.

What was the global expenditure on financial information in 2018?

Worldwide expenditure on financial information exceeded $30 billion in 2018, highlighting its vital role in the financial sector.

What is the compound annual growth rate (CAGR) of market data in recent years?

The information sector has experienced a compound annual growth rate (CAGR) of 9.5% over the last five years, indicating an increasing reliance on analytics-based decision-making.

How do companies use market data in real-world scenarios?

Companies use market data in various ways, such as employing algorithmic trading techniques that rely on real-time information to execute trades based on established rules. Additionally, organizations analyze past price information to set alerts for significant price fluctuations, enabling effective portfolio management.

What is the significance of the quality and reliability of market data?

High quality and reliability of market data are crucial for customers, as emphasized by industry leaders. This quality significantly impacts decision-making processes for organizations.

How can organizations leverage market data to enhance their strategies?

Organizations can leverage market data to enhance their strategies by analyzing the information to make informed decisions, recognize trends, and adapt their approaches to meet consumer needs effectively.