Navigate the Panama Company Registry: A Step-by-Step Guide

Navigate the Panama Company Registry: A Step-by-Step Guide

Introduction

Navigating the Panama Company Registry can be a daunting task for entrepreneurs and investors alike. Its intricate structure and the wealth of information it holds present both challenges and opportunities. Understanding this registry is not just about compliance; it’s a chance to leverage vital corporate data that enhances decision-making and governance.

What if you could turn these challenges into advantages? By familiarizing yourself with the registry, you can unlock insights that inform your business strategies. However, obstacles such as language barriers and bureaucratic delays can complicate the registration process. So, how can you ensure a smooth experience and select the right business entity?

This guide offers a comprehensive roadmap to successfully maneuver through the Panama Company Registry. It empowers stakeholders to establish their ventures with confidence, providing actionable insights that can lead to informed decisions. With the right knowledge, you can navigate this complex landscape effectively.

Understand the Panama Company Registry Structure

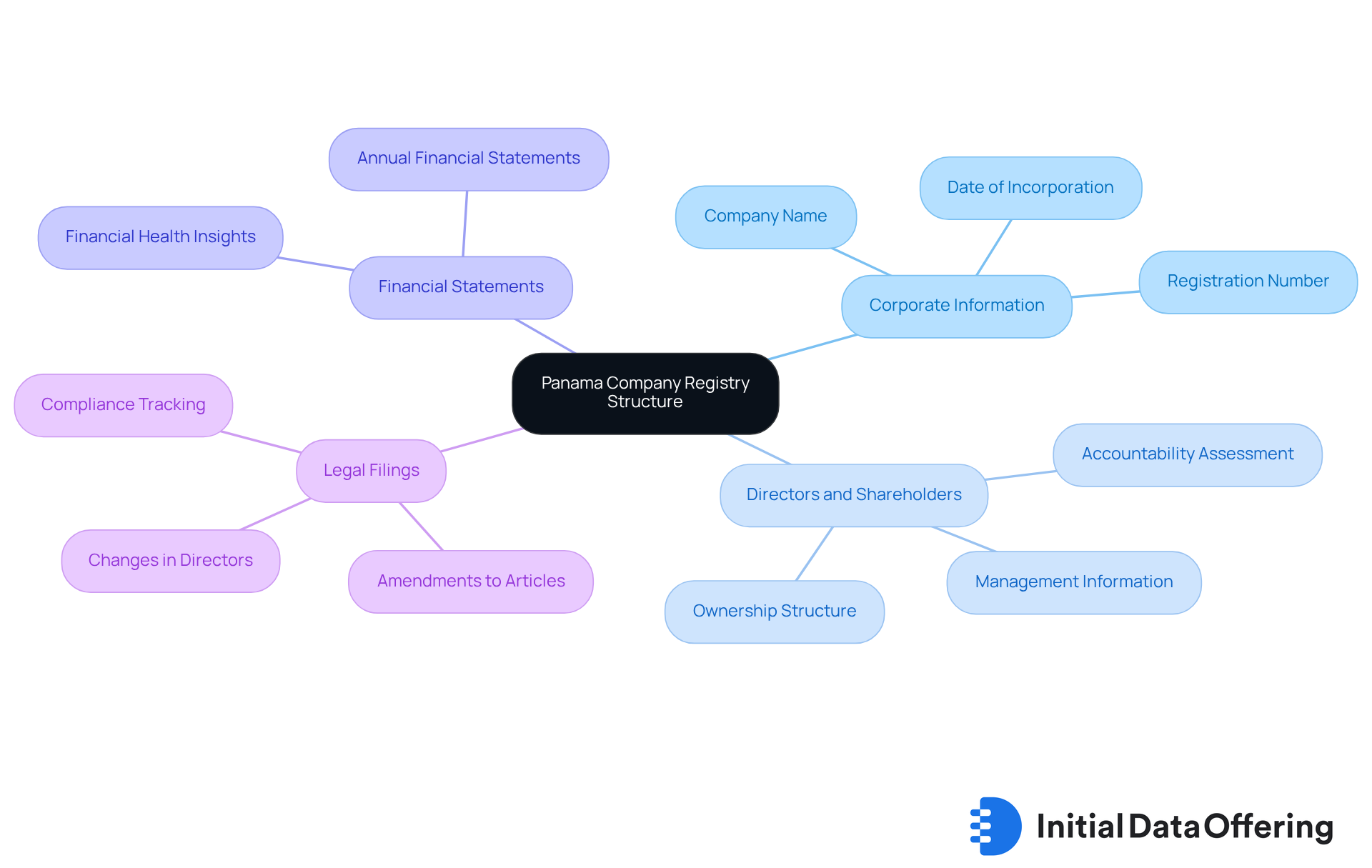

The Panama company registry acts as a centralized database for all registered entities in the country, providing vital information for market research and corporate governance. Understanding its structure is crucial for effective corporate information management, enabling stakeholders to navigate the registration process efficiently.

Corporate Information: This section provides essential details such as the company name, registration number, and date of incorporation. These features lay the groundwork for understanding the entity's legal status, which is fundamental for any business interaction.

Directors and Shareholders: Here, you can find information about the individuals managing and owning the organization. This data is crucial for assessing governance and accountability, allowing stakeholders to evaluate the leadership structure effectively.

Financial Statements: Certain organizations are mandated to file annual financial statements. These documents offer insights into their financial health and operational performance, which can be pivotal for investors and partners.

Legal Filings: This section includes any legal documents submitted by the organization, such as changes in directors or amendments to the articles of incorporation. Tracking these corporate changes is essential for maintaining transparency and compliance.

As of 2025, the Panama company registry boasts a robust number of registered companies, reflecting its favorable business environment. This information not only highlights the registry's importance but also encourages stakeholders to leverage it for informed decision-making. For more details, visit the official website of the Public Registry of the Republic at www.rp.gob.pa.

Follow the Step-by-Step Registration Process

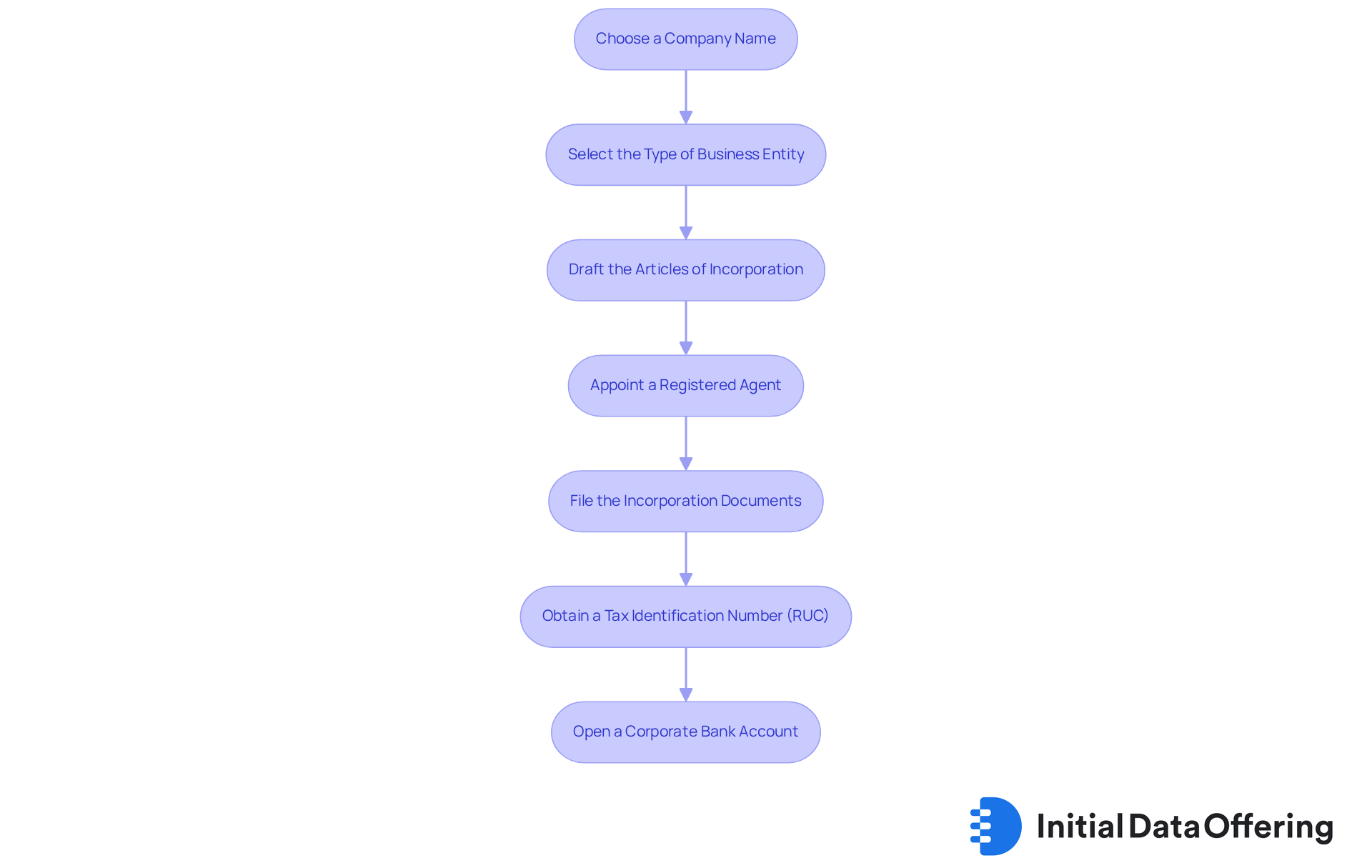

To register a company in Panama, follow these essential steps:

-

Choose a Company Name: Ensure the name is unique and complies with Panama's naming regulations. You can verify name availability on the Panama company registry website. This step is crucial as a distinctive name sets your business apart and ensures compliance with local laws.

-

Select the Type of Business Entity: Decide whether to register as a Corporation (S.A.), Limited Liability Company (S.R.L.), or another entity type. The S.A. structure is popular for its limited liability benefits, protecting personal assets from business debts.

-

Draft the Articles of Incorporation: Prepare essential documents, including the articles of incorporation, which detail the organization's purpose and governance structure. This document must be written in Spanish and notarized before submission. Having a well-drafted article ensures clarity in your business's objectives and operations.

-

Appoint a Registered Agent: A registered agent, who must be a licensed attorney or law firm in the country, is required to manage legal documents on behalf of the company. This ensures that your business remains compliant with legal obligations and can receive important notifications.

-

File the Incorporation Documents: Submit the articles of incorporation and other necessary documents to the Public Registry, which can often be done online. The incorporation process usually takes 3 to 7 working days. Timely filing is essential to avoid delays in starting your business operations.

-

Obtain a Tax Identification Number (RUC): After registration, apply for a RUC from the General Directorate of Revenue, which is essential for tax compliance. This number is vital for conducting business legally and fulfilling tax obligations.

-

Open a Corporate Bank Account: Choose a financial institution in a Central American country to set up a corporate account, essential for carrying out commercial activities. The account opening process may take 4 to 8 weeks, depending on the bank's requirements. Having a corporate account facilitates smooth financial transactions and enhances your business's credibility.

By following these steps, you can navigate the registration process efficiently, ensuring compliance with local regulations and positioning your business for success in the region. Consider this: over 75% of business owners in the country report that federal income tax is a significant challenge. Consulting with legal experts can help mitigate potential issues. As noted by Limitless Legal, 'Establishing a business in the country is a swift and attainable process that can be accomplished in a few days with the appropriate guidance.' Moreover, recent updates, including the removal of the country from the FATF grey list in October 2023, indicate a more favorable regulatory environment for new enterprises.

Address Common Challenges and Considerations

Registering a company in Panama can be straightforward, but several challenges may arise that you should be aware of:

-

Language Barrier: Many official documents are in Spanish. If you’re not fluent, hiring a translator or a local attorney can be beneficial. This ensures that you fully understand the legal requirements and avoid potential pitfalls.

-

Bureaucratic Delays: The registration process can sometimes be slow due to bureaucratic inefficiencies. Being prepared for potential delays allows you to plan accordingly, reducing frustration and keeping your business timeline on track.

-

Compliance Requirements: It’s crucial to understand the ongoing compliance obligations for your selected organization, including tax filings and annual reports. This knowledge helps you avoid penalties and maintain good standing with local authorities.

-

Choosing the Right Entity: Selecting the appropriate organizational structure is vital. Each type has different implications for liability, taxation, and operational flexibility. Thorough research or consultation with a legal expert can guide you in making the best choice for your business.

By recognizing these challenges, you can navigate the Panama company registry registration process more effectively and set your business up for success.

Explore Different Types of Business Entities in Panama

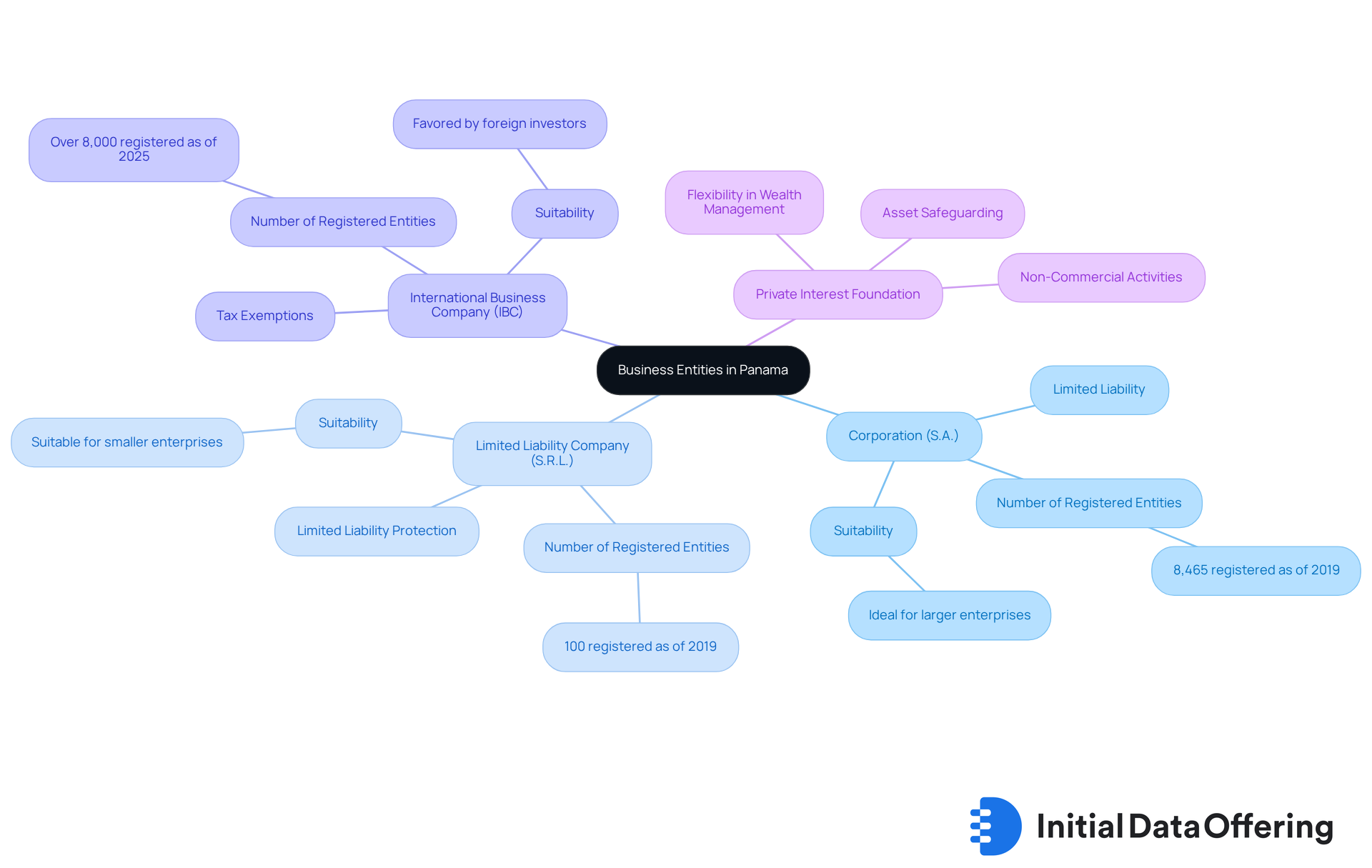

In Panama, a variety of business entities cater to different operational needs and goals, each with its own distinct characteristics:

-

Corporation (S.A.): This is the most prevalent business structure in Panama. It offers limited liability to its shareholders, protecting personal assets from business debts. With a requirement of at least three directors and the ability to accommodate an unlimited number of shareholders, it’s ideal for larger enterprises. As of 2019, there were 8,465 registered corporations in Panama, reflecting its popularity among entrepreneurs.

-

Limited Liability Company (S.R.L.): This structure is particularly suitable for smaller enterprises, requiring at least two partners. It provides limited liability protection while imposing restrictions on the transfer of shares, which can be beneficial for family-owned or closely-held businesses. In 2019, there were 100 registered limited liability companies in the Central American nation.

-

International Business Company (IBC): Tailored for international trade and investment, IBCs enjoy significant tax exemptions and confidentiality. This makes them a favored choice among foreign investors. As of 2025, Panama has registered over 8,000 IBCs, showcasing their popularity in the global market.

-

Private Interest Foundation: Mainly utilized for asset safeguarding and estate strategy, this organization does not engage in commercial activities. Instead, it serves to hold assets for specified beneficiaries, providing a flexible structure for wealth management.

Choosing the right organization depends on your specific goals, preferred level of liability protection, and operational inclinations. Have you considered how each entity type aligns with your business strategy? Engaging with a legal consultant can provide valuable insights, ensuring you select the most suitable structure for your needs. Understanding the subtleties of each organization type is essential for enhancing your business strategy according to the Panama company registry. Additionally, the Friendly Nations program allows for residency through ownership of a corporate vehicle, which can be registered with the Panama company registry, making it an attractive option for foreign investors. It’s also crucial to consider the tax implications associated with each entity type, as well as the operational requirements and timelines for establishing these entities.

Conclusion

Navigating the Panama Company Registry is a crucial step for anyone aiming to establish a business in this vibrant environment. Understanding the registry's structure and the registration process is essential for ensuring compliance and positioning your venture for success. By familiarizing yourself with the necessary steps and the various types of business entities available, you can streamline your journey and make informed decisions that align with your business goals.

Key aspects highlighted throughout this guide include:

- The importance of understanding corporate information

- The roles of directors and shareholders

- The necessity of financial transparency

The step-by-step registration process-from selecting a unique company name to obtaining a tax identification number-provides a clear roadmap for prospective business owners. Moreover, being aware of common challenges, such as language barriers and compliance requirements, can help mitigate potential pitfalls during the registration process.

Ultimately, the Panama Company Registry serves as a vital resource for entrepreneurs seeking to establish a foothold in the region. By leveraging this comprehensive guide, you can effectively navigate the complexities of registration and ensure your business operates within the legal framework. Have you considered consulting with legal experts? Understanding the implications of different business structures can significantly enhance your likelihood of success in Panama's dynamic market. Taking these steps not only fosters compliance but also paves the way for sustainable growth and prosperity in the long run.

Frequently Asked Questions

What is the purpose of the Panama company registry?

The Panama company registry serves as a centralized database for all registered entities in the country, providing vital information for market research and corporate governance.

What information can be found in the corporate information section of the registry?

The corporate information section provides essential details such as the company name, registration number, and date of incorporation, which are fundamental for understanding the entity's legal status.

Why is information about directors and shareholders important?

Information about directors and shareholders is crucial for assessing governance and accountability, allowing stakeholders to evaluate the leadership structure of the organization effectively.

Are companies required to file financial statements?

Yes, certain organizations are mandated to file annual financial statements, which offer insights into their financial health and operational performance.

What types of legal filings are included in the registry?

The registry includes legal documents submitted by organizations, such as changes in directors or amendments to the articles of incorporation, which are essential for maintaining transparency and compliance.

What does the number of registered companies in the Panama company registry indicate?

As of 2025, the robust number of registered companies reflects Panama's favorable business environment, highlighting the registry's importance for stakeholders.

Where can I find more information about the Panama company registry?

For more details, you can visit the official website of the Public Registry of the Republic at www.rp.gob.pa.