Compare Leading Insurance Software Development Companies Today

Compare Leading Insurance Software Development Companies Today

Introduction

In the rapidly evolving landscape of insurance technology, a select group of software development companies is redefining how insurers operate and engage with customers. These companies offer robust policy management systems and innovative claims processing solutions.

- The features of these systems enhance operational efficiency, allowing insurers to streamline their processes.

- The advantages are clear: improved workflows lead to faster service delivery and reduced operational costs.

- Ultimately, the benefits are significant, as these advancements drive substantial improvements in customer satisfaction.

However, as competition intensifies, businesses face a critical question: how can they discern which software provider aligns best with their unique needs and future goals? Understanding the specific features and advantages of each option is essential for making informed decisions. By evaluating how these solutions can meet their operational demands, insurers can position themselves for success in a competitive market.

Overview of Leading Insurance Software Development Companies

In 2025, several insurance software development companies are making significant strides in the sector. Notable names include:

-

Guidewire Software: This company is renowned for its comprehensive suite of solutions tailored for property and casualty insurers. Guidewire excels in policy administration and claims management, providing insurers with the tools they need to streamline operations and enhance customer satisfaction.

-

Duck Creek Technologies: Offering a flexible, cloud-based platform, Duck Creek supports rapid product launches and enhances operational efficiency. This adaptability allows insurers to respond quickly to market demands, ultimately improving their competitive edge.

-

Applied Systems: As a leader in agency management systems, Applied Systems focuses on improving customer engagement through innovative technology. Their solutions empower agencies to foster stronger relationships with clients, driving loyalty and retention.

-

Cognizant: Recognized for its consulting and technology services, Cognizant assists insurers in modernizing their operations. By leveraging their expertise, insurers can navigate the complexities of digital transformation more effectively.

-

TechMagic: This company specializes in custom application development, particularly for insurtech startups. TechMagic provides personalized offerings that address unique business needs, enabling startups to innovate and grow in a competitive landscape.

These insurance software development companies represent a blend of established entities and creative newcomers, each contributing uniquely to the evolving technology landscape in the insurance sector. How might these advancements influence your approach to insurance software solutions?

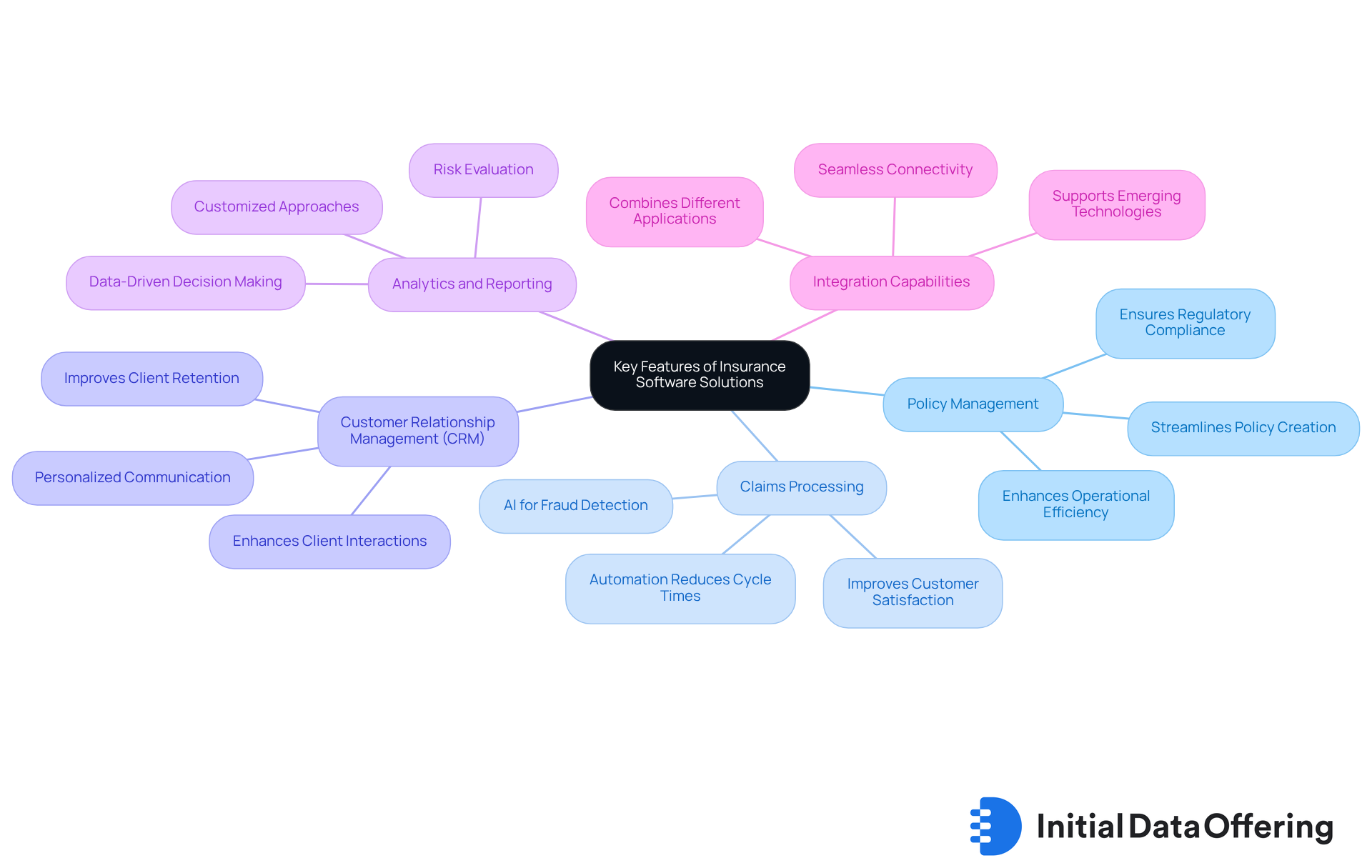

Key Features of Insurance Software Solutions

Leading insurance software solutions are characterized by several essential features that drive operational efficiency and enhance customer experiences:

-

Policy Management: This feature is crucial for streamlining the creation, modification, and management of insurance policies. It ensures compliance with regulatory standards and enhances operational efficiency, which is increasingly important as the industry evolves in 2025. The Digital Operational Resilience Act and the EU's AI Act are essential regulations that insurance providers must navigate. How robust is your policy management system in adapting to these changes?

-

Claims Processing: Automation in claims handling significantly reduces cycle times, leading to faster resolutions and improved customer satisfaction. For instance, Zurich's implementation of AI technologies for claims fraud detection is projected to save P&C insurers up to $160 billion by 2032. This showcases the potential of advanced claims processing systems. With almost 70 percent of policyholders anticipating immediate quotes, digital documents, and real-time assistance, how prepared is your organization to meet these expectations?

-

Customer Relationship Management (CRM): Effective CRM tools enhance client interactions and retention through personalized communication and service. Insurance software development companies are increasingly focusing on customer-centric strategies, with 90% of executives acknowledging the need for improved human-machine collaboration to elevate service quality. As noted by J.D. Power, enhancing customer experience is vital for retention and growth in the insurance industry. What steps are you taking to improve your CRM strategies?

-

Analytics and Reporting: Strong analytical features offer insights into performance metrics, allowing providers to make informed, data-driven decisions. The incorporation of AI in analytics is changing how insurance software development companies evaluate risk and customer behavior, enabling more customized approaches. Industry experts emphasize that leveraging data analytics is essential for adapting to the evolving demands of customers. Are you utilizing analytics effectively to inform your strategies?

-

Integration Capabilities: Seamless connectivity with other systems, such as accounting and regulatory compliance tools, is vital for operational coherence. As the coverage environment grows more intricate, the capacity to combine different applications will be a crucial distinguishing factor for successful providers. Emerging technologies such as Hyper-X, Ensureverse, and AI-ssurance are anticipated to have major impacts on the future of coverage solutions. How well does your system integrate with other essential tools?

These features are not only essential for enhancing operational efficiency but also for adapting to the latest trends in the insurance industry, such as hyper-personalization and intelligent automation, which are expected to dominate in 2025.

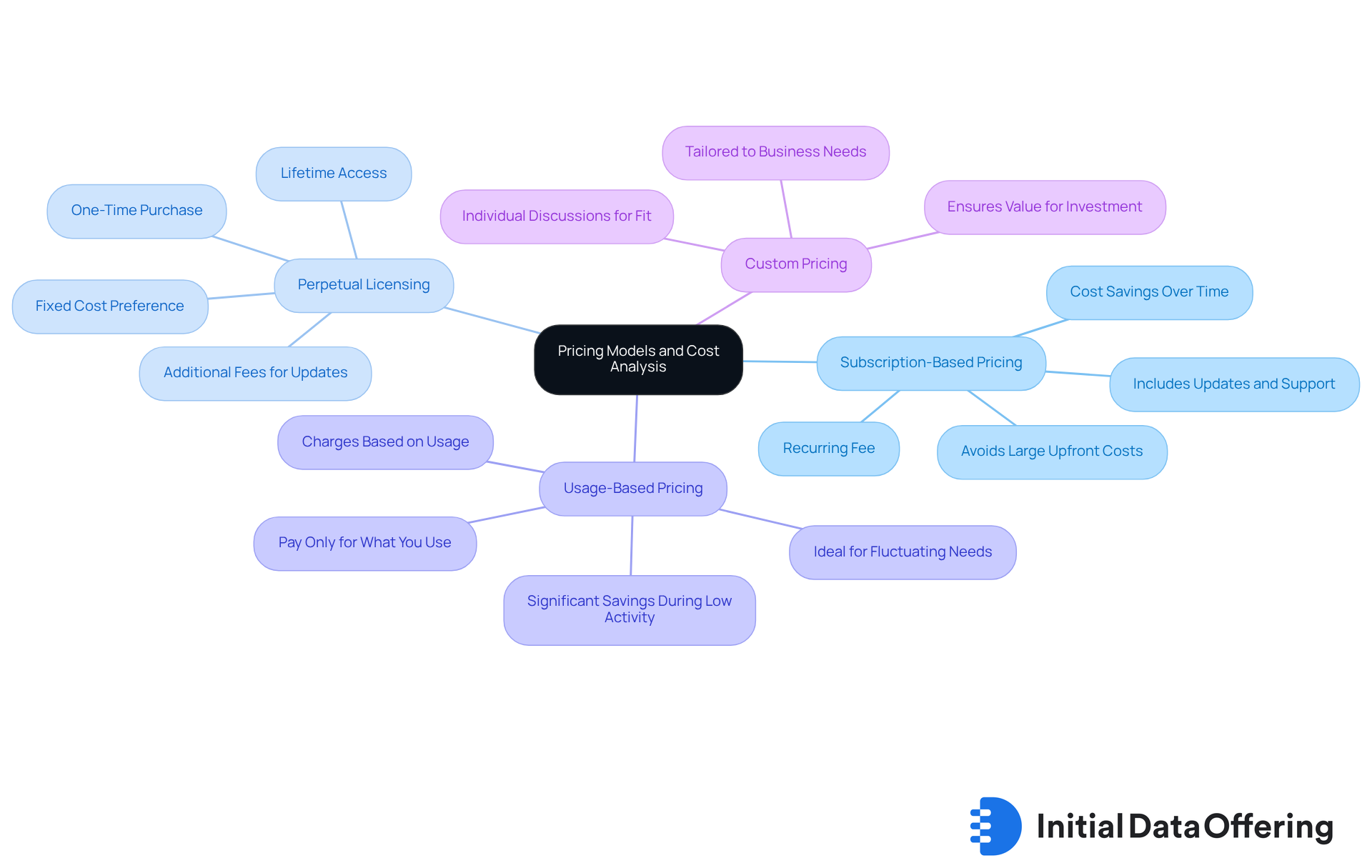

Pricing Models and Cost Analysis

Various pricing models offered by insurance software development companies can significantly impact a business's financial strategy. Understanding these models is crucial for evaluating budgets and selecting the most suitable option. Here are some common pricing models:

-

Subscription-Based Pricing: This model is prevalent in SaaS offerings, allowing businesses to pay a recurring fee for software access. The advantage? It often includes updates and support, ensuring that users always have the latest features. This can lead to cost savings over time, as businesses avoid large upfront costs.

-

Perpetual Licensing: With this one-time purchase model, companies gain lifetime access to the application. However, it may require additional fees for updates and support. This model can be beneficial for businesses that prefer a fixed cost and want to avoid ongoing payments.

-

Usage-Based Pricing: This approach charges based on actual software usage, making it ideal for companies with fluctuating needs. It allows businesses to pay only for what they use, which can lead to significant savings during periods of low activity.

-

Custom Pricing: Tailored to the specific needs and size of a business, this model often involves individual discussions to determine the best fit. This personalized approach can ensure that companies receive the most value for their investment.

By comprehending these pricing models, insurance software development companies can make informed decisions that align with their financial strategies. Which model do you think would best suit your business needs? Consider how each option could impact your budget and operational efficiency.

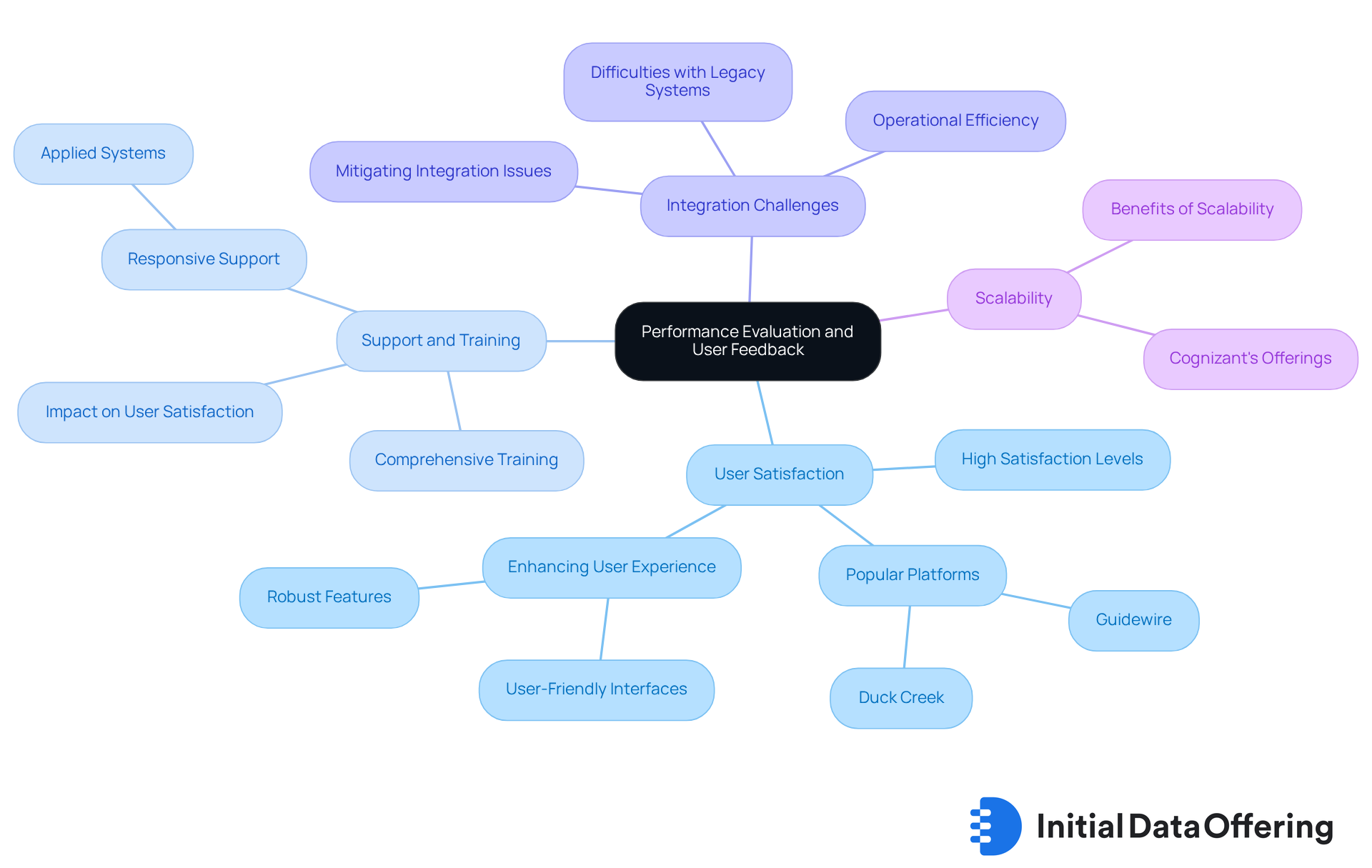

Performance Evaluation and User Feedback

The performance evaluation of insurance applications created by insurance software development companies is crucial for understanding their effectiveness in the market. User feedback and industry reviews play a significant role in this assessment.

-

User Satisfaction: Many users express high satisfaction levels with platforms like Guidewire and Duck Creek. Their robust features and user-friendly interfaces contribute to positive experiences, making them popular choices in the industry. How do these platforms enhance user experience?

-

Support and Training: Companies that provide comprehensive training and responsive support, such as Applied Systems, often receive better reviews. This support not only helps users navigate the software but also maximizes its potential, leading to improved operational outcomes. What impact does effective training have on user satisfaction?

-

Integration Challenges: Some users have reported difficulties in integrating certain applications with legacy systems. These challenges can hinder operational efficiency, highlighting the importance of seamless integration in software selection. How can businesses mitigate these integration issues?

-

Scalability: Solutions like Cognizant's offerings are recognized for their scalability. This feature allows businesses to grow without the need to switch platforms, ensuring long-term viability and adaptability. What benefits does scalability bring to a growing business?

User feedback is invaluable for prospective buyers, offering insights into the practical implications of software choices, particularly from insurance software development companies. By considering these evaluations, businesses can make informed decisions that align with their operational needs.

Conclusion

The landscape of insurance software development is rapidly evolving, with key players making significant contributions to enhance operational efficiency and customer satisfaction. Companies like Guidewire Software, Duck Creek Technologies, Applied Systems, Cognizant, and TechMagic are at the forefront of this innovation, showcasing how tailored software can meet the unique needs of the insurance industry. This adaptability not only shapes the future of operations but also transforms client interactions.

Essential features such as policy management, claims processing, customer relationship management, analytics, and integration capabilities are critical components for success in the insurance software sector. Each feature streamlines processes and improves customer experiences, enabling companies to adapt to regulatory changes and market demands. Understanding various pricing models also provides businesses with strategic insights, aligning software investments with their financial goals.

As the insurance industry embraces digital transformation, organizations must stay informed about the latest trends and advancements in software solutions. How can user feedback and performance evaluations guide your decision-making processes? By ensuring that chosen systems meet current needs and support future growth, businesses can position themselves to thrive in an increasingly competitive landscape. Prioritizing these factors ultimately enhances service delivery and client satisfaction.

Frequently Asked Questions

What are some leading insurance software development companies in 2025?

Notable companies include Guidewire Software, Duck Creek Technologies, Applied Systems, Cognizant, and TechMagic.

What does Guidewire Software specialize in?

Guidewire Software is known for its comprehensive suite of solutions tailored for property and casualty insurers, excelling in policy administration and claims management.

How does Duck Creek Technologies enhance operational efficiency?

Duck Creek Technologies offers a flexible, cloud-based platform that supports rapid product launches and allows insurers to respond quickly to market demands.

What is the focus of Applied Systems in the insurance sector?

Applied Systems specializes in agency management systems and aims to improve customer engagement through innovative technology, fostering stronger relationships between agencies and clients.

What services does Cognizant provide to insurers?

Cognizant offers consulting and technology services to assist insurers in modernizing their operations and navigating digital transformation.

What is the primary focus of TechMagic?

TechMagic specializes in custom application development for insurtech startups, providing personalized solutions that address unique business needs.

How do these companies contribute to the insurance technology landscape?

These companies represent a mix of established entities and innovative newcomers, each playing a unique role in advancing technology within the insurance sector.