7 Key Insights on Transaction Data for Market Analysts

7 Key Insights on Transaction Data for Market Analysts

Overview

The article titled "7 Key Insights on Transaction Data for Market Analysts" emphasizes the critical role of transaction data in enhancing market analysis and strategic decision-making. Transaction data serves as a vital feature, offering insights into consumer behavior, market trends, and operational efficiency. This advantage allows businesses to refine their strategies effectively. Ultimately, the benefit of leveraging transaction data is the ability to foster better customer relationships, which is essential for sustained success in today's competitive market.

How can your organization utilize these insights to improve its strategic initiatives?

Introduction

Transaction data has emerged as a cornerstone for market analysts, offering a wealth of insights that can drive strategic decision-making across various industries. By tapping into unique datasets, such as those provided through Initial Data Offerings, professionals can unlock critical information about consumer behavior, market trends, and operational efficiencies. However, as organizations strive to leverage this data, they often encounter challenges that can hinder effective analysis.

How can analysts navigate these complexities to harness the full potential of transaction data and enhance their market strategies? This article explores seven key insights that illuminate the path forward for market analysts in an increasingly data-driven landscape.

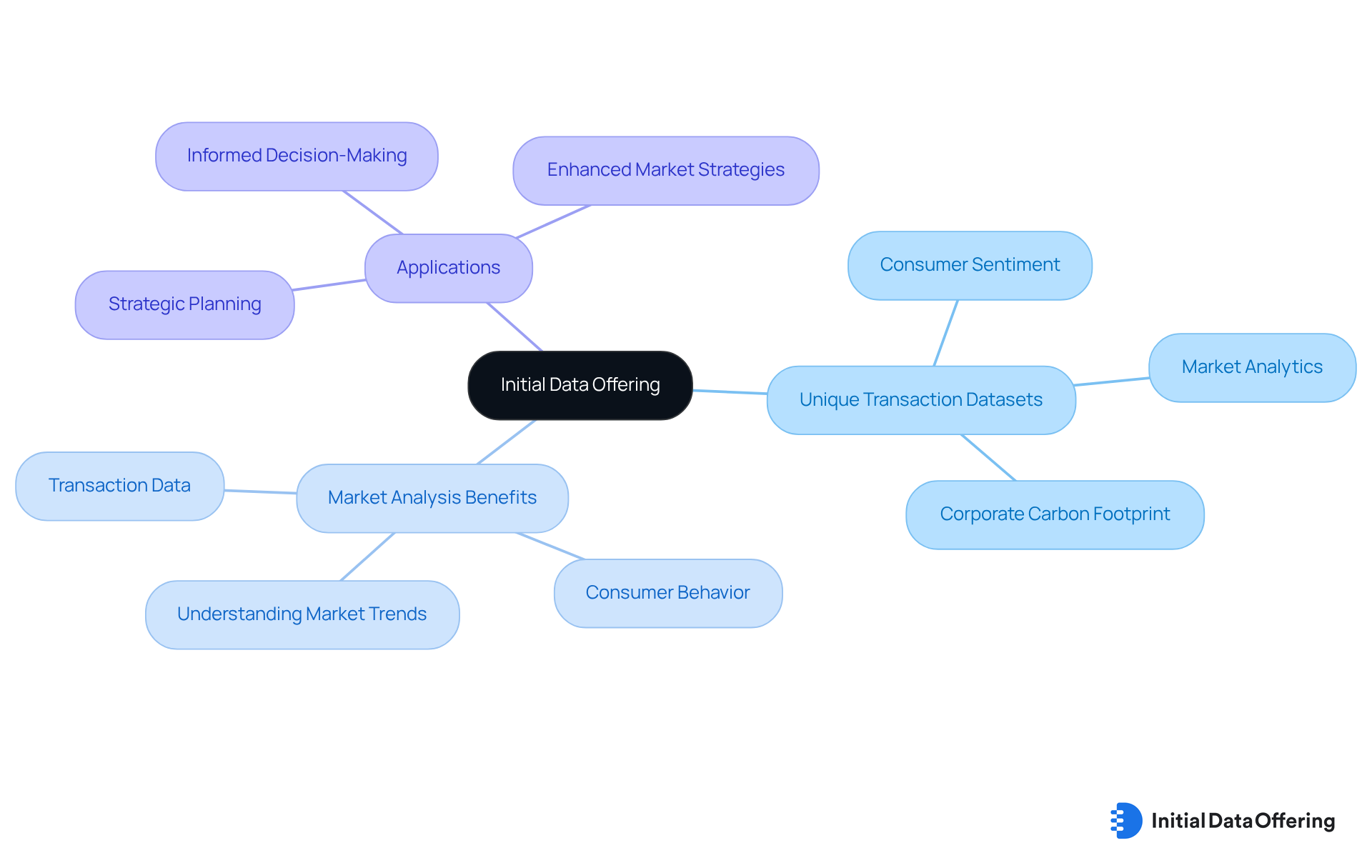

Initial Data Offering: Access Unique Transaction Datasets

The Initial Data Offering (IDO) serves as a centralized platform, enabling market analysts to access unique transaction data. These datasets feature:

- Consumer sentiment information

- Market analytics

- Corporate carbon footprint metrics, among others

By leveraging these comprehensive datasets, analysts gain significant advantages in understanding:

- Market trends

- Consumer behavior

- Transaction data

This understanding is essential for informed strategic planning and decision-making across various industries. How can these insights shape your approach to market analysis? By utilizing the data provided, professionals can enhance their strategies and drive impactful results.

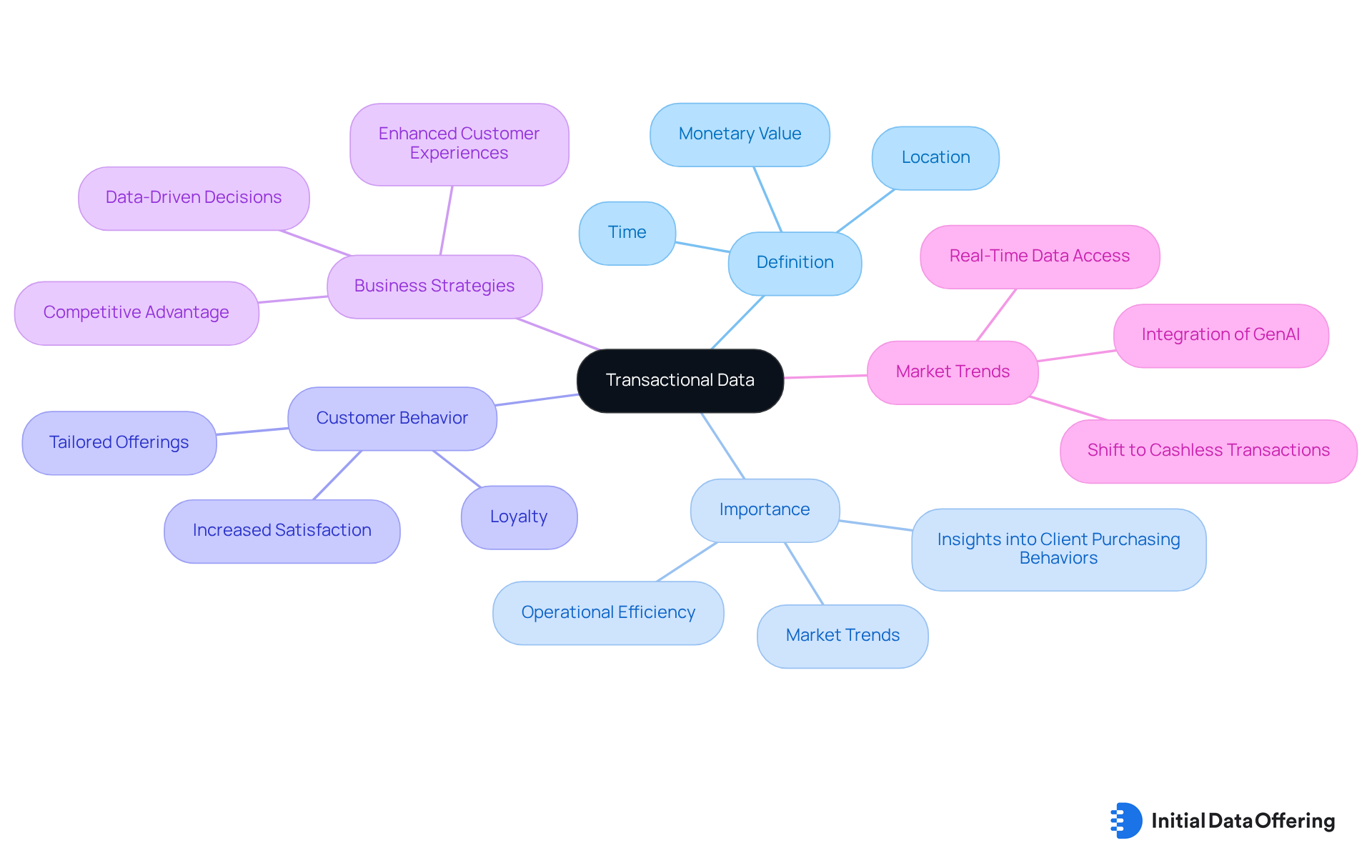

Transactional Data: Definition and Importance

The details generated from transactions, including aspects such as time, location, and monetary value, are referred to as transaction data. This information serves as a vital resource for enterprises, offering insights into client purchasing behaviors, operational efficiency, and market trends. By understanding transactional information, analysts can make informed decisions that enhance business strategies and improve customer experiences.

What if you could predict customer behavior based on their purchasing history? This is where the power of transaction data comes into play. It not only helps businesses identify patterns but also allows them to tailor their offerings to meet customer needs more effectively. In turn, this leads to increased customer satisfaction and loyalty, which are crucial for long-term success.

In summary, grasping the nuances of transaction data empowers businesses to refine their strategies and foster better customer relationships. By leveraging this data, organizations can stay competitive in an ever-evolving market landscape.

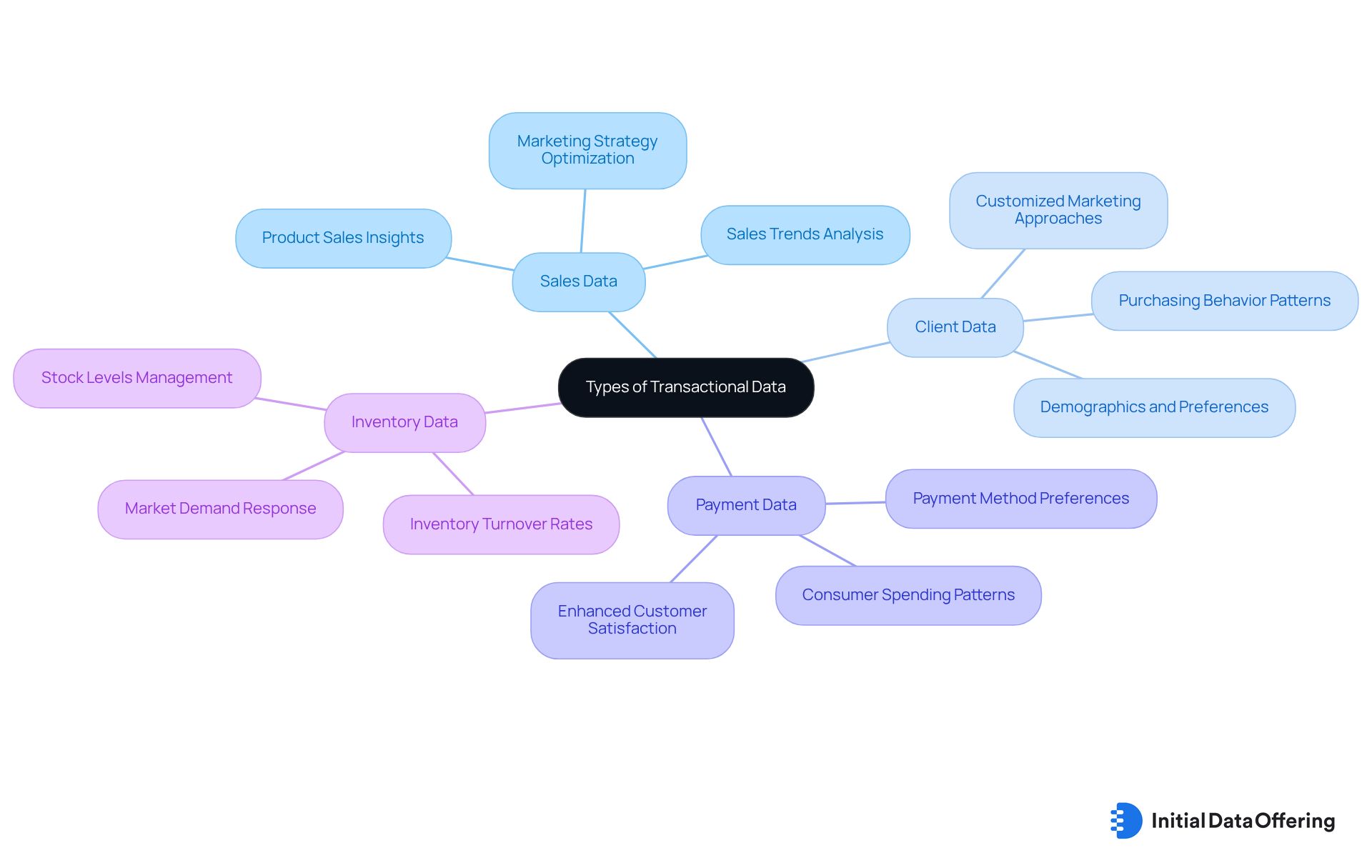

Types of Transactional Data: Key Categories Explained

Transaction data encompasses several essential categories, each offering distinct insights valuable for market analysis and strategic decision-making.

-

Sales Data: This category includes comprehensive information on product sales, detailing quantities sold, pricing structures, and sales trends. Examining sales information can uncover trends that inform marketing strategies. For instance, by pinpointing peak sales times or favored products, companies can direct their promotional efforts more effectively. Understanding peak transaction data volumes is crucial for optimizing marketing campaigns and inventory management, ultimately leading to improved sales performance.

-

Client Data: This category captures vital details about client demographics, preferences, and purchasing behaviors. Grasping client information allows companies to customize their marketing approaches for particular segments, which improves engagement and conversion rates. Insights drawn from client data can assist in recognizing patterns in consumer behavior, enabling more focused and effective marketing efforts that resonate with target audiences.

-

Payment Data: Records of payment methods and transaction amounts fall under this category. Payment information offers insights into consumer spending patterns and preferences, which enables companies to enhance payment choices and boost customer satisfaction. By examining payment data, organizations can uncover trends in favored payment methods, guiding future payment strategy choices to better meet customer needs.

-

Inventory Data: This includes information on stock levels, turnover rates, and inventory management practices. Efficient evaluation of inventory data assists companies in maintaining optimal stock levels and lowering holding expenses while reacting quickly to market demand. Comprehending inventory turnover rates in relation to sales information is crucial for effective inventory management, ensuring product availability and minimizing lost sales opportunities.

Every type of transaction data plays an essential role in influencing marketing strategies and operational enhancements, ultimately leading to improved business results. The time-critical aspect of financial data highlights the significance of prompt analysis for sustaining a competitive advantage. How can your organization leverage these insights to enhance decision-making and drive success?

Challenges in Using Transactional Data: Common Issues

While transaction data is invaluable for market analysts, several challenges can hinder effective analysis.

-

Data Quality Issues: Inaccurate or incomplete data can lead to misleading insights, significantly impacting decision-making. For instance, TD Bank encountered over $3 billion in penalties due to failures in information integrity, which emphasizes the essential requirement for strong information management practices. The case study 'Real-World Impact of Poor Information Quality' illustrates that neglecting integrity can lead to serious financial consequences.

-

Integration Difficulties: Merging information from various sources often proves complex and time-consuming. Companies must navigate different formats and standards, which can result in inconsistencies and errors. As organizations increasingly adopt AI-driven solutions, the challenge of integrating these systems with current information sources becomes paramount. Michael Malyuk from HumanSignal, Inc. highlights that scaling AI while maintaining quality and compliance will be a significant challenge in 2025, underscoring the importance of effective integration strategies.

-

Privacy Concerns: Adhering to data protection regulations is crucial when managing consumer records. The Electronic Transactions Association (ETA) stresses the need for harmonized privacy laws to protect consumer trust while fostering innovation in the payments industry. This regulatory landscape complicates information management practices, making it essential for analysts to stay informed about evolving compliance requirements.

-

Volume Management: The sheer volume of transaction data can overwhelm analysts, complicating the extraction of actionable insights. With the payments ecosystem handling over $47 trillion each year, managing this information effectively is vital for sustaining operational efficiency and compliance. Analysts must devise strategies to manage this influx of information to derive meaningful insights without feeling overwhelmed.

-

Expert Insights: Industry leaders stress the importance of addressing these challenges. For example, Michael Malyuk notes that scaling AI while maintaining quality and compliance will be a significant challenge in 2025. Furthermore, the ETA emphasizes the pressing requirement for responsible AI implementation to improve information quality and consumer protection.

By comprehending and tackling these challenges, analysts can utilize operational information more effectively to promote informed decision-making and strategic planning. To address these issues, analysts should consider adopting best practices for information management, such as regular audits of quality, investing in robust integration tools, and staying informed on regulatory changes.

Best Practices for Leveraging Transactional Data

To effectively leverage transactional data, analysts should adopt the following best practices:

-

Ensure Data Quality: Regularly cleaning and validating data is essential to maintain accuracy and reliability. Subpar information quality can lead to considerable operational inefficiencies, with companies potentially losing 15-25% in efficiency due to inaccuracies. For instance, a company with a revenue of $10 million might face losses of up to $2.5 million each year if information quality is overlooked. Moreover, confirming trustworthy information sources is crucial for ensuring accuracy and integrity.

-

Utilize Advanced Analytics Tools: Employing advanced analytics software can streamline information processing and enhance analytical capabilities. Tools like AI-driven platforms enable analysts to handle large volumes of information effectively, recognizing patterns and anomalies that guide strategic decisions. Examples of such tools include machine learning algorithms and visualization software that facilitate deeper insights into transaction data.

-

Segment Information: Dividing information into meaningful segments allows analysts to uncover specific insights tailored to various consumer behaviors or market trends. This targeted approach enhances the relevance of the analysis and supports more effective decision-making.

-

Stay Compliant: Adhering to privacy regulations is essential for safeguarding consumer information. Compliance not only protects information integrity but also establishes trust with stakeholders, which is crucial in today’s information-driven environment.

-

Implement Continuous Monitoring: Establishing a system for ongoing information quality checks ensures that any issues are promptly identified and addressed. This proactive method aids in preserving the precision and significance of transaction data over time. Regular audits and monitoring are essential components of this process.

As highlighted by industry specialists, "Ensuring high information quality isn’t a luxury; it’s a necessity." By concentrating on these best practices, market analysts can leverage the full potential of transaction data, driving better outcomes and informed decision-making.

Enhancing Customer Service with Transactional Data

Transaction data plays a pivotal role in enhancing customer service by enabling businesses to personalize interactions, identify pain points, enhance response times, utilize predictive analytics, and improve client engagement.

-

Personalize Interactions: Analyzing purchase history allows companies to tailor recommendations and offers to individual customers, creating a more engaging shopping experience. For instance, Grubhub examines data from over 4,000 meals across 80,000 eateries to recommend dishes based on past orders, significantly boosting client satisfaction.

-

Identify Pain Points: Understanding transaction patterns helps businesses pinpoint areas where clients may encounter challenges. Notably, 25% of clients report that slow payment processes are a major pain point. By addressing these issues proactively, companies can improve the overall client experience.

-

Enhance Response Times: Immediate access to transaction details enables service representatives to address inquiries more effectively. With 74% of clients prioritizing faster checkouts, having prompt insights into transaction details can optimize service interactions and reduce wait times.

-

Utilize Predictive Analytics: Examining past transaction information allows businesses to predict upcoming sales patterns. This foresight enables companies to anticipate client needs and adjust their strategies accordingly. Such proactive methods not only enhance client satisfaction but also stimulate long-term revenue growth.

-

Enhance Client Engagement: Businesses that effectively tailor their interactions based on transaction details can cultivate stronger relationships with their clients. Given that 71% of consumers feel frustrated when their shopping experience is impersonal, utilizing information to create personalized communications can significantly boost loyalty and retention.

By harnessing the power of transaction data, companies can transform their customer service approaches, leading to improved decision-making, operational effectiveness, and a competitive edge.

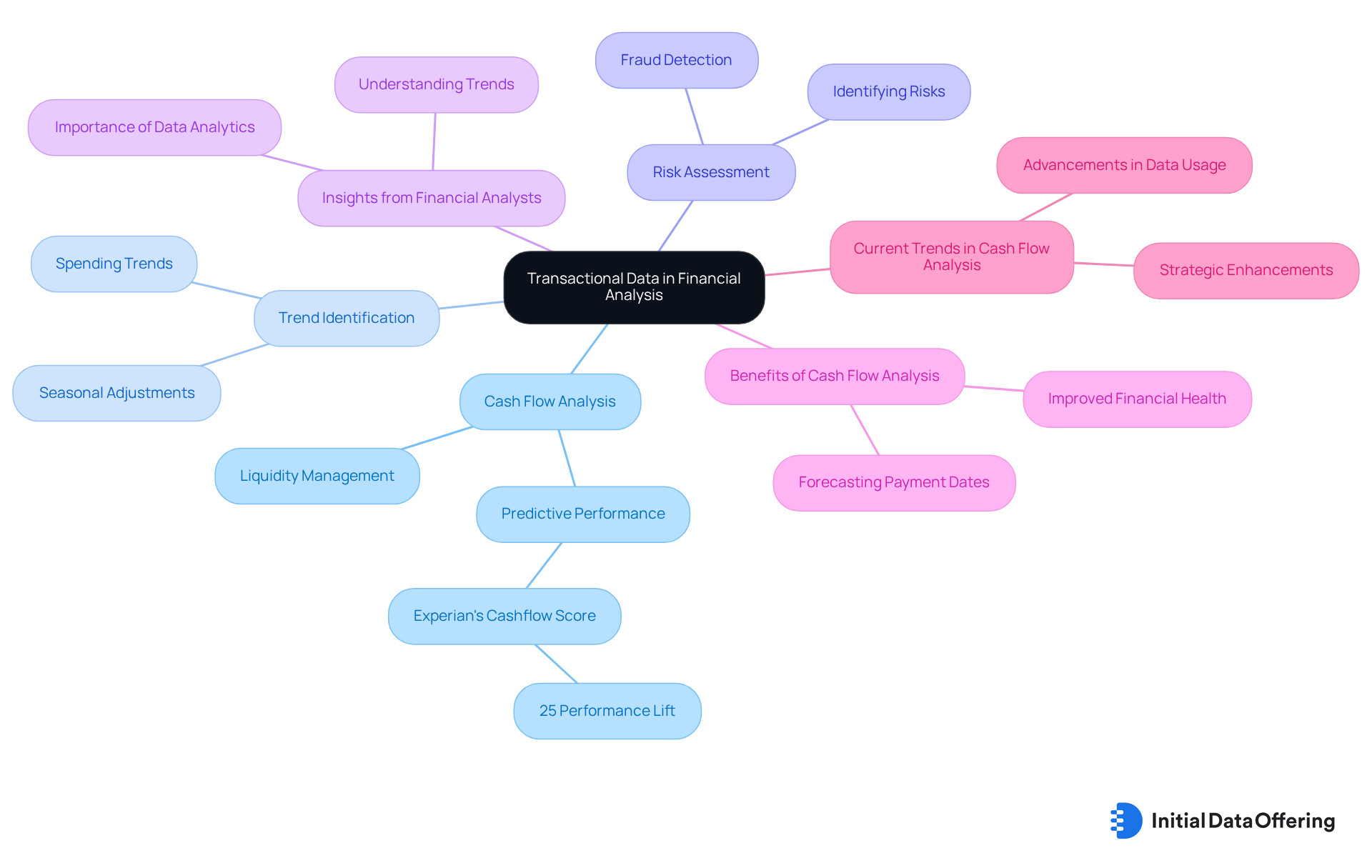

Transactional Data in Financial Analysis: Key Insights

In financial analysis, transaction data provides critical insights that significantly enhance decision-making processes.

-

Cash Flow Analysis: By meticulously tracking inflows and outflows, businesses can effectively manage liquidity. This analysis is crucial for predicting cash flow needs and ensuring that operational expenses are met without disruption. For instance, Experian's Cashflow Score offers up to a 25% lift in predictive performance compared to conventional credit scores, underscoring the significance of accurate cash flow analysis based on transaction data.

-

Trend Identification: Analyzing historical transaction information allows analysts to uncover spending trends, which can be instrumental in forecasting future performance. A recent study emphasized that businesses utilizing transaction data could recognize seasonal spending trends, enabling them to modify inventory and marketing tactics accordingly. This corresponds with insights from Wipfli's Analytics Solutions, which highlight the importance of analytics in recognizing trends and opportunities.

Risk assessment utilizes transaction data as a valuable tool for identifying potential risks. By analyzing spending habits, companies can create informed risk management approaches that reduce financial exposure. For example, companies can pinpoint unusual spending spikes that may indicate fraud or financial distress.

-

Insights from Financial Analysts: Experts emphasize the importance of cash flow analysis in understanding business health. As Kate E. Brown, Partner in Data and Analytics, noted, "Data analytics offer the opportunity to not only identify trends and opportunities with existing policies and practices but also open the door to a deeper understanding of important trends with customers, suppliers and more."

-

Benefits of Cash Flow Analysis: Utilizing financial information improves cash flow analysis by providing a clearer view of financial health. This information allows companies to forecast payment dates for receivables, enhancing the precision of cash flow reports and facilitating prompt decision-making.

-

Current Trends in Cash Flow Analysis: Recent advancements in the field emphasize the increasing dependence on transaction details for cash flow analysis. A forthcoming article named 'The essentials of building a strategy' will explore how organizations can utilize this information to enhance their financial operations, reflecting the changing environment of financial analysis.

By harnessing the strength of transaction information, enterprises can not only enhance their cash flow control but also gain a competitive advantage through informed decision-making and strategic planning.

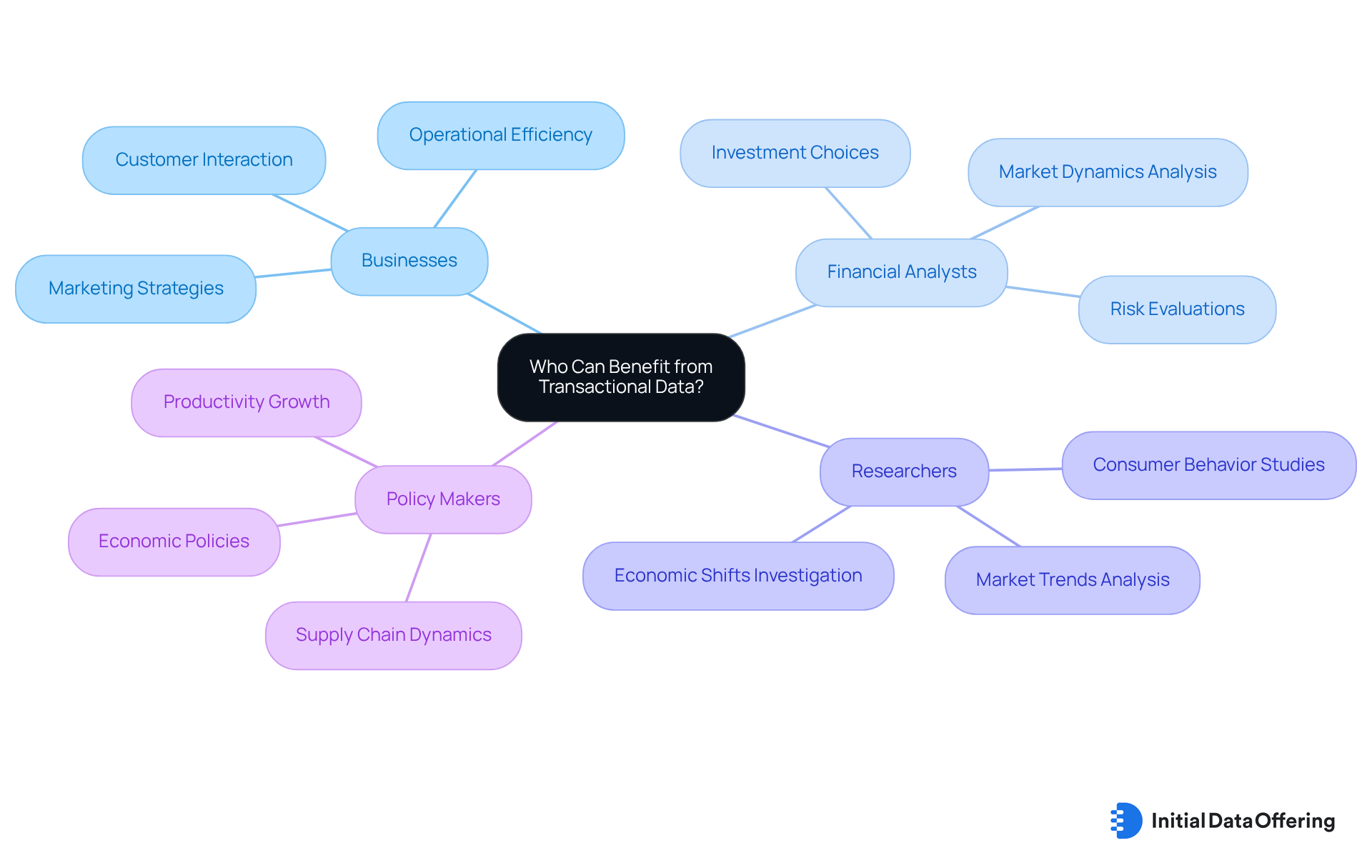

Who Can Benefit from Transactional Data? Target Audiences

Transaction data serves as a valuable resource for a diverse range of stakeholders, each harnessing its insights to drive informed decision-making and strategic initiatives.

Businesses can utilize transaction data to refine their marketing strategies, tailoring campaigns to consumer preferences and behaviors. For instance, Trust Bank, initiated by Standard Chartered, attracted nearly 1 million clients in just 2 years, demonstrating how efficient utilization of transaction details can enhance customer interaction and facilitate business expansion. This information, particularly transaction data, also aids in improving operational efficiency by recognizing trends and patterns that inform inventory management and resource allocation.

Financial Analysts leverage transaction data to make informed investment choices and conduct comprehensive risk evaluations. By analyzing spending patterns and market dynamics, they can identify lucrative opportunities and potential pitfalls, thereby enhancing their forecasting accuracy.

-

Researchers: Scholars and market analysts utilize sales records to investigate consumer behavior and market trends. This information provides a rich foundation for studies aimed at understanding purchasing habits, economic shifts, and the impact of external factors on consumer spending.

-

Policy Makers: Government officials and regulators examine transaction details to influence economic policies and regulations. The LIFT Network's case study on unlocking firm-to-firm transaction data illustrates how such data informs policymaking, enhancing understanding of supply chain dynamics and productivity growth. By comprehending spending behaviors and market fluctuations, they can craft policies that promote economic stability and growth, ensuring that regulations are responsive to real-world dynamics.

The diverse applications of transaction data underscore its significance across industries, fostering innovation and strategic planning in an increasingly information-driven environment. As market research analysts, consider exploring specific datasets available on platforms such as Initial Data Offering (IDO) to effectively utilize transaction data in your own work.

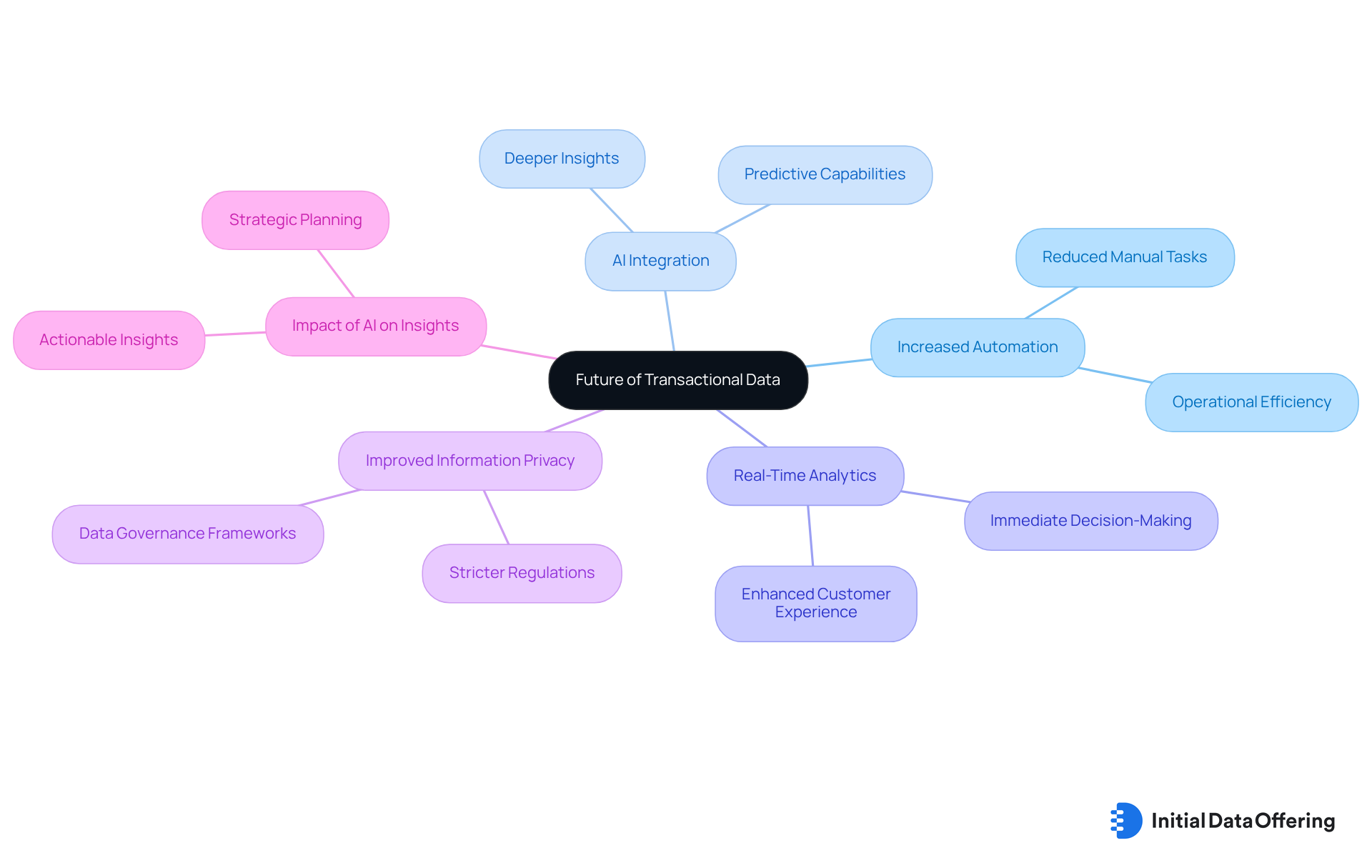

The Future of Transactional Data: Trends and Predictions

The future of transaction data is being shaped by several pivotal trends that organizations must understand to maintain a competitive edge.

-

Increased Automation: Automation tools are set to revolutionize data collection and analysis, significantly enhancing operational efficiency. By reducing manual involvement, organizations can guarantee reliable information delivery. This not only enhances the precision of insights obtained from operational records but also allows teams to focus on strategic initiatives rather than routine tasks.

-

AI Integration: Artificial intelligence is becoming essential to the analysis of transaction data, enabling companies to uncover deeper insights and predictive capabilities. As AI technologies evolve, they empower analysts to identify patterns and trends that were previously undetectable. This evolution drives more informed decision-making. Ariel Katz notes, "In 2025, traditional BI tools will become obsolete, as API-first architectures and GenAI seamlessly embed real-time analytics into every application."

-

Real-Time Analytics: The demand for real-time information analysis is increasing, allowing businesses to react quickly to market shifts and consumer behavior. Organizations that leverage real-time analytics will gain a competitive edge by making immediate, data-driven decisions. These decisions enhance customer experiences and operational efficiency. The increasing significance of real-time analytics is underscored by the anticipation that the Big Information Growth market will probably reach $103 billion by 2027.

-

Improved Information Privacy: With stricter regulations concerning information privacy, companies must prioritize security in their business practices. Establishing strong information governance frameworks is crucial for ensuring compliance and upholding client trust. This is particularly important as the volume of information produced continues to rise.

-

Impact of AI on Insights: AI's role in transforming operational information insights cannot be overstated. As organizations increasingly adopt AI-driven analytics, they will generate actionable insights that inform strategic planning and operational improvements. This shift towards AI integration is anticipated to redefine how businesses approach information analysis, making it a cornerstone of their decision-making processes.

In 2025, the landscape of transaction data analysis will be characterized by these trends, fundamentally altering how organizations harness data for competitive advantage. How will your organization adapt to these changes to maximize the benefits of transaction data?

Conclusion

Understanding and leveraging transaction data is essential for market analysts aiming to enhance their strategic decision-making capabilities. By accessing unique datasets through platforms like the Initial Data Offering, analysts gain insights into consumer behavior, market trends, and operational efficiencies. This comprehensive understanding not only aids in tailoring marketing strategies but also fosters improved customer relations and business growth.

Throughout the article, key insights were presented, highlighting the importance of transaction data across various categories, including:

- Sales

- Client

- Payment

- Inventory data

Each category plays a critical role in informing marketing strategies and operational improvements. Furthermore, the challenges associated with transaction data, such as data quality issues and integration difficulties, were examined, alongside best practices for effective utilization. These practices, including ensuring data quality and utilizing advanced analytics tools, are pivotal for maximizing the potential of transaction data.

As the landscape of transaction data continues to evolve, organizations must stay ahead of emerging trends, such as increased automation and AI integration. By embracing these advancements, businesses can enhance their analytical capabilities and make informed decisions that drive competitive advantage. The future of transaction data is bright, and its effective use will be a cornerstone for success in an increasingly data-driven world.

Frequently Asked Questions

What is an Initial Data Offering (IDO)?

An Initial Data Offering (IDO) is a centralized platform that allows market analysts to access unique transaction datasets, which include consumer sentiment information, market analytics, and corporate carbon footprint metrics.

What advantages do analysts gain from using the datasets provided by the IDO?

Analysts gain significant advantages in understanding market trends, consumer behavior, and transaction data, which are essential for informed strategic planning and decision-making across various industries.

What is transactional data, and why is it important?

Transactional data refers to the details generated from transactions, such as time, location, and monetary value. It serves as a vital resource for enterprises, offering insights into client purchasing behaviors, operational efficiency, and market trends, which help enhance business strategies and improve customer experiences.

What are the key categories of transactional data?

The key categories of transactional data include: - Sales Data: Information on product sales, including quantities sold, pricing structures, and sales trends. - Client Data: Details about client demographics, preferences, and purchasing behaviors. - Payment Data: Records of payment methods and transaction amounts. - Inventory Data: Information on stock levels, turnover rates, and inventory management practices.

How can sales data inform marketing strategies?

Sales data can uncover trends that inform marketing strategies by identifying peak sales times or favored products, enabling companies to direct their promotional efforts more effectively.

How does client data enhance marketing approaches?

Client data allows companies to customize their marketing approaches for specific segments, improving engagement and conversion rates by recognizing patterns in consumer behavior.

What insights can payment data provide?

Payment data offers insights into consumer spending patterns and preferences, which enable companies to enhance payment choices and boost customer satisfaction by examining favored payment methods.

Why is inventory data crucial for businesses?

Inventory data helps companies maintain optimal stock levels, lower holding expenses, and respond quickly to market demand, ensuring product availability and minimizing lost sales opportunities.

How does understanding transactional data contribute to business success?

Grasping the nuances of transactional data empowers businesses to refine their strategies, foster better customer relationships, and stay competitive in an ever-evolving market landscape.