10 Innovative Bond Trading Platforms Transforming the Market

10 Innovative Bond Trading Platforms Transforming the Market

Introduction

As the financial landscape evolves, the bond trading market is experiencing a significant transformation. This change is driven by innovative platforms and advanced technologies that streamline trading processes. These platforms offer critical datasets and insights that can shape investment strategies for investors.

However, amidst these advancements, questions arise about how these changes will impact traditional trading practices and market dynamics. What are the key platforms leading this revolution? How can investors leverage these innovations to enhance their trading outcomes?

Understanding these platforms is crucial. They not only provide features that simplify trading but also present advantages such as real-time data access and analytical tools. The benefits are clear: investors can make informed decisions, optimize their strategies, and potentially improve their trading results.

As we delve deeper into this topic, consider how these datasets can apply to your work. By exploring examples and case studies, we can illustrate the practical implications of these innovations in the bond trading market.

Initial Data Offering: A Hub for Innovative Bond Trading Datasets

The Initial Data Offering (IDO) plays a pivotal role in securities exchange by streamlining the discovery and introduction of specialized datasets.

What makes IDO essential for investors?

By focusing on premium offerings, IDO equips participants with critical information that can significantly influence their trading strategies. The bond trading platforms showcase a diverse range of datasets, including alternative data, fundamentals data, and ESG data, all of which are crucial for informed decision-making in the fixed income market.

With a commitment to daily updates, IDO ensures users are kept abreast of the latest trends and insights, fostering a vibrant community of knowledgeable traders and investors.

How does this impact your investment approach?

Leveraging SavvyIQ's AI-powered Recursive Data Engine, IDO enhances its dataset offerings, facilitating real-time decision-making and automating workflows. This accessibility to high-quality information not only refines investment strategies but also positions IDO as a leader in the evolving analytics landscape.

Tradeweb: Leading the Digital Transformation in Bond Trading

Tradeweb is at the forefront of digital transformation in bond transactions, providing bond trading platforms that create an advanced electronic marketplace to simplify exchanges across various bond categories. One of its notable features is the recent launch of dealer algorithmic execution capabilities for U.S. Treasuries. This advancement in trading technology not only enhances the platform's functionality but also provides traders with automated dealer selection and real-time analytics. As a result, transactions can be executed with greater speed and precision, significantly benefiting users.

Moreover, Tradeweb's collaboration with Chainlink further enhances automation and real-time data accessibility. This partnership improves market transparency and liquidity, which are crucial for investors navigating the complexities of securities. By streamlining these processes, Tradeweb empowers institutional investors and assists retail traders in refining their strategies, ultimately promoting efficiency in the fixed income sector.

However, it is essential to acknowledge the ongoing reliance on voice negotiations for complex transactions, especially during volatile periods. This dependence poses a notable risk that investors must consider. In summary, Tradeweb's innovative advancements position it as a vital resource in the bond market by utilizing bond trading platforms to facilitate smoother transactions and foster a more efficient trading environment.

ICMA: Enhancing Bond Market Transparency and Practices

The International Capital Market Association (ICMA) plays a crucial role in enhancing transparency and establishing best practices within the debt securities sector. By implementing various initiatives, ICMA promotes standards that simplify transaction processes and bolster financial integrity. This commitment to openness in pricing and trade reporting cultivates trust among participants, which is essential for the efficient operation of the fixed-income sector. Ultimately, this dedication not only fosters a more knowledgeable investor base but also leads to improved pricing and liquidity in fixed-income securities.

Recent statistics underscore the significance of these efforts. For instance, 60% of issuers have been found to provide accessible and easily locatable reports, reflecting a growing commitment to transparency. Additionally, 91% of issuers surveyed published dedicated GSS reports, showcasing the industry's dedication to best practices. ICMA's introduction of a new tag for transition securities aims to encourage issuance for projects that support decarbonization, addressing the rising demand for sustainable finance, particularly in developing regions. This initiative exemplifies ICMA's proactive approach to enhancing financial practices and ensuring that transactions align with evolving investor expectations.

Moreover, ICMA's collaboration with regulatory authorities, such as the FCA, to improve post-trade transparency frameworks is a vital step towards strengthening the integrity of debt securities. The FCA’s Policy Statement released on 6 November 2024 highlights the framework's importance for the UK’s market infrastructure, which is crucial for the anticipated consolidated tape. Through these initiatives, ICMA not only sets the standard for securities trading practices but also ensures that the industry adapts to the changing landscape of investor needs and regulatory requirements. However, challenges remain, such as the controversy surrounding the second transition note issued by Marfrig, which has raised concerns about greenwashing. Addressing these challenges is essential for maintaining investor trust and ensuring the long-term success of the transition financing sector.

AllianceBernstein: Insights on Future Bond Trading Dynamics

AllianceBernstein leads the way in analyzing the evolving landscape of debt trading, offering essential insights for investors navigating a challenging market. Their research identifies key trends, particularly how interest rate changes and geopolitical events influence yield rates. For instance, when interest rates rise, fixed-income yields typically increase, reflecting the market's response to economic conditions. Recently, the Federal Open Market Committee (FOMC) lowered the federal funds target rate by 0.25%, bringing it to a range of 3.75% to 4.00% in October 2025. This decision illustrates the direct impact such actions have on yield rates.

Moreover, geopolitical tensions can create uncertainty, which in turn affects trading strategies and the performance of fixed-income securities. By providing forward-looking analysis, AllianceBernstein equips traders on bond trading platforms with the insights needed to make informed decisions in these complex situations. Their expertise in fixed-income investments reinforces their reputation as a trusted source for understanding the intricate dynamics of the debt market.

Additionally, the volatile nature of the municipal debt market and the risks associated with lower-rated securities are critical considerations for investors. This underscores the importance of a comprehensive strategy for fixed-income investments.

How can investors leverage this knowledge to enhance their portfolios? By staying informed and adapting to these trends, they can better navigate the complexities of bond trading platforms.

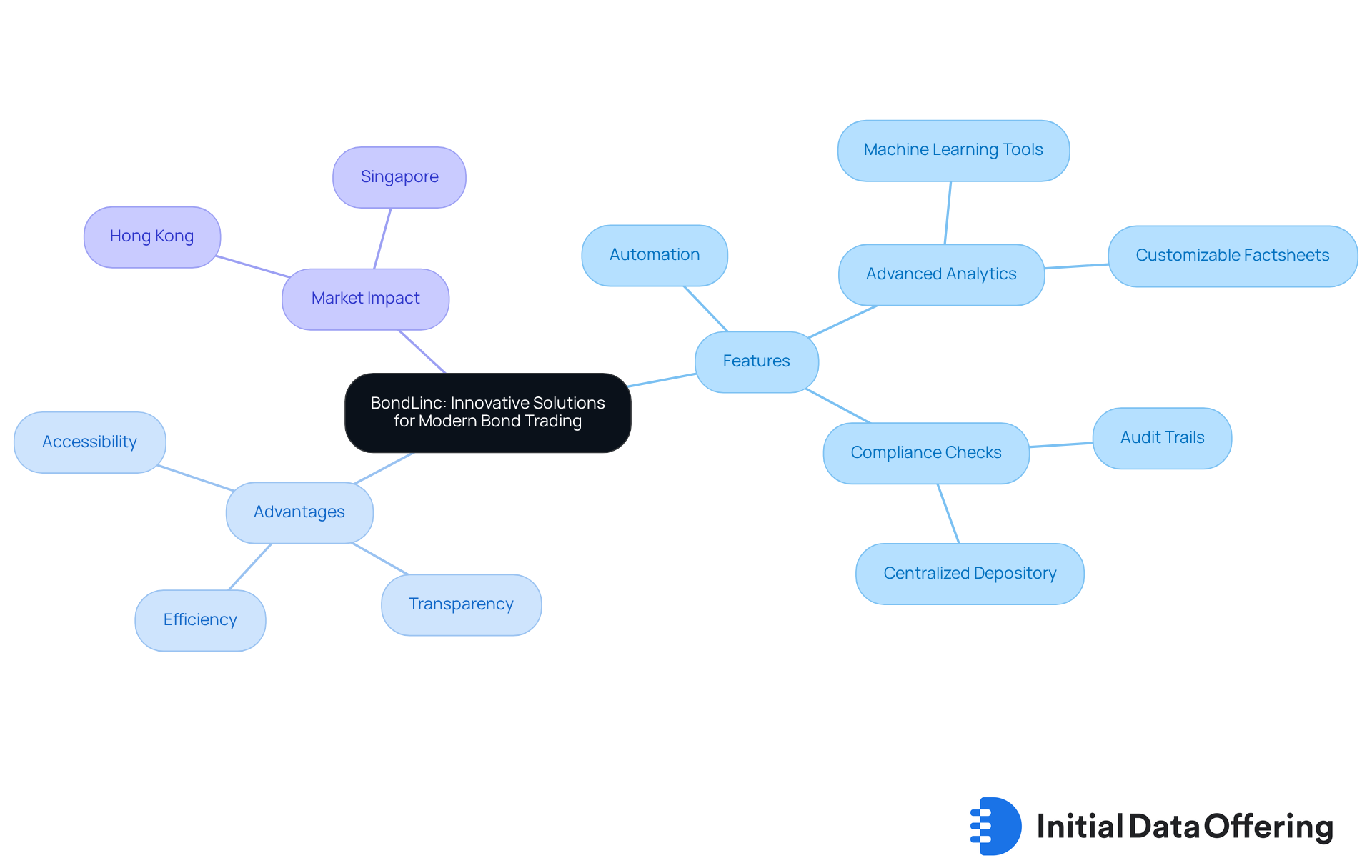

BondLinc: Innovative Solutions for Modern Bond Trading

BondLinc is revolutionizing the market experience with its innovative solutions tailored for private banks and financial organizations. The adaptable electronic platform, which serves as a bond trading platform, includes features such as the automation of securities exchange processes that enhance efficiency and reduce operational risks. By integrating advanced analytics, such as machine learning tools that extract information from legal documents into customizable factsheets, BondLinc empowers traders on bond trading platforms to make informed, data-driven decisions while ensuring compliance with regulatory requirements.

The advantages of this fintech solution are evident in its ability to simplify bond trading platforms, making them more accessible and effective for participants in the financial sector. With features like compliance checks, audit trails, and a centralized depository for product due diligence documents, BondLinc effectively addresses the complexities of pre-trade disclosures on bond trading platforms. This promotes a more organized and transparent marketplace, which is crucial for maintaining trust and efficiency in bond trading platforms.

The benefits of using bond trading platforms, such as BondLinc's, have been proven in markets like Hong Kong and Singapore, where it has significantly improved productivity and information distribution. This ultimately transforms the trading landscape by enabling financial organizations to operate more effectively through bond trading platforms. How might your organization leverage such technology to enhance its trading processes? By considering the implications of these advancements, you can better position your firm for success in an increasingly competitive market.

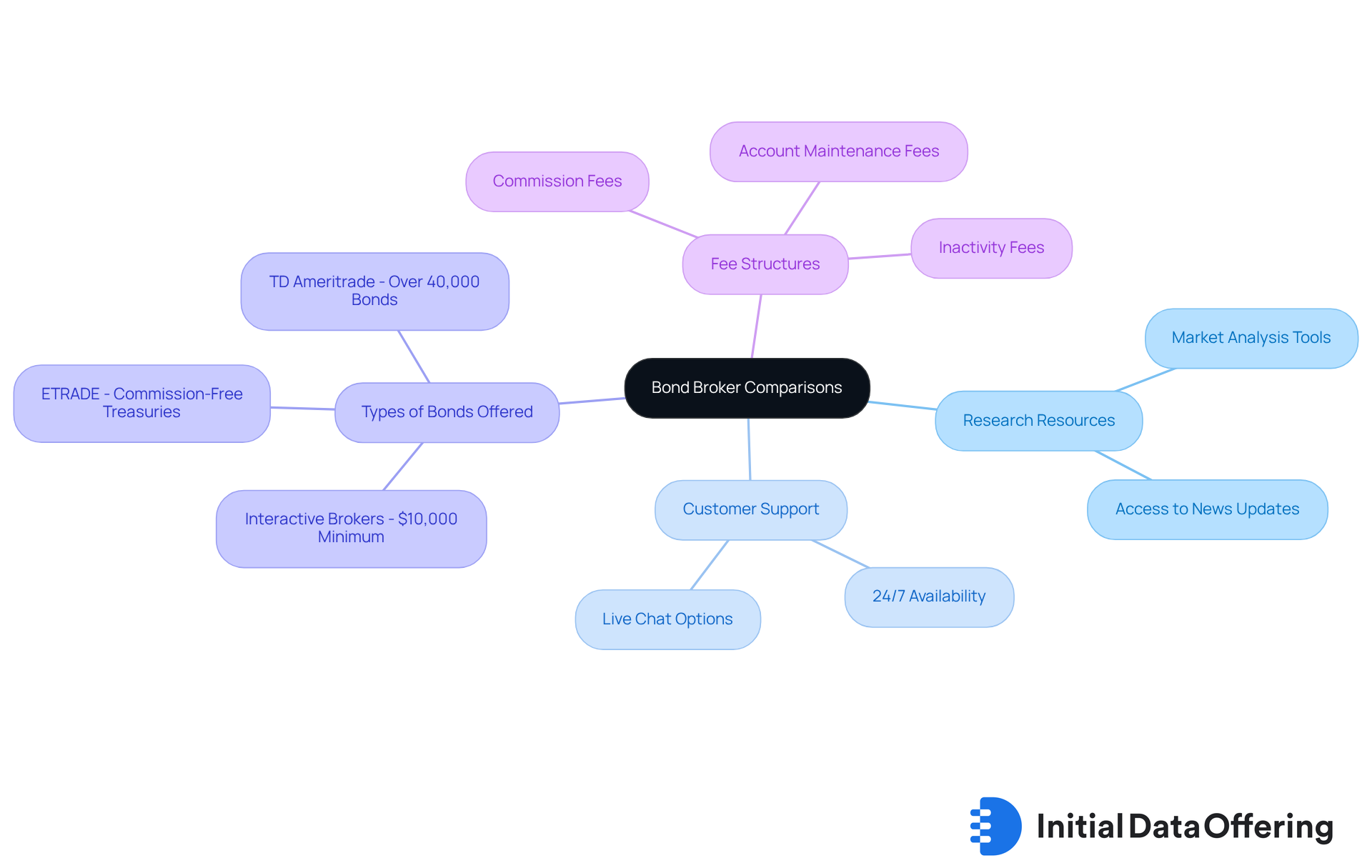

Investing.com: Comprehensive Bond Broker Comparisons

Investing.com serves as a vital resource for investors looking to compare brokers. It provides a comprehensive analysis of various bond trading platforms, focusing on their fees, features, and the range of fixed-income products available. When evaluating bond trading platforms, important factors to consider include:

- Research resources

- Customer support

- The specific types of bonds offered

For instance, did you know that Interactive Brokers requires a $10,000 account minimum, while ETRADE provides commission-free transactions on Treasuries? This comparison is crucial for traders aiming to enhance their experience by selecting brokers and bond trading platforms that align with their investment strategies.

Investing.com employs a rigorous evaluation process to assess broker performance. This ensures that investors receive detailed insights into user experiences, which can significantly influence their decision-making. Financial advisors emphasize the importance of comparing brokers and utilizing bond trading platforms to effectively navigate the complexities of the fixed-income market. By providing extensive information, Investing.com empowers investors to make informed choices, ultimately improving their fixed-income investment outcomes.

In summary, leveraging the insights from Investing.com can lead to better investment decisions. Are you ready to explore how these comparisons can enhance your investment strategy?

BrokerNotes: Essential Resources for Bond Trading Knowledge

BrokerNotes serves as a vital resource for market participants eager to enhance their knowledge and investment skills. The bond trading platforms feature a diverse array of educational materials, such as detailed articles, comprehensive guides, and timely financial analyses focused on fixed income investment. As of 6:56 AM ET, the yield on the 10-year note stands at 4.11%, highlighting the current financial landscape that investors must navigate.

The advantages of using BrokerNotes as one of the bond trading platforms are evident in its ability to provide insights into prevailing market trends, effective investment strategies, and crucial regulatory updates. This empowers traders with the knowledge necessary to maneuver through the complexities of the securities market. Robin Foley, Head of Fixed Income at Fidelity, emphasizes this point by stating, "I believe it to be a good time for fixed income securities." This reinforces the significance of staying informed in today’s market.

- Benefits of this educational focus extend beyond individual knowledge; it fosters a more informed investor community, leading to better investment decisions and an enhanced overall experience.

- Traders are encouraged to leverage BrokerNotes' tools and resources, such as webinars and guides, to deepen their understanding.

- How might diversifying investments across various issuers help mitigate risks? By considering this, investors can make more strategic choices.

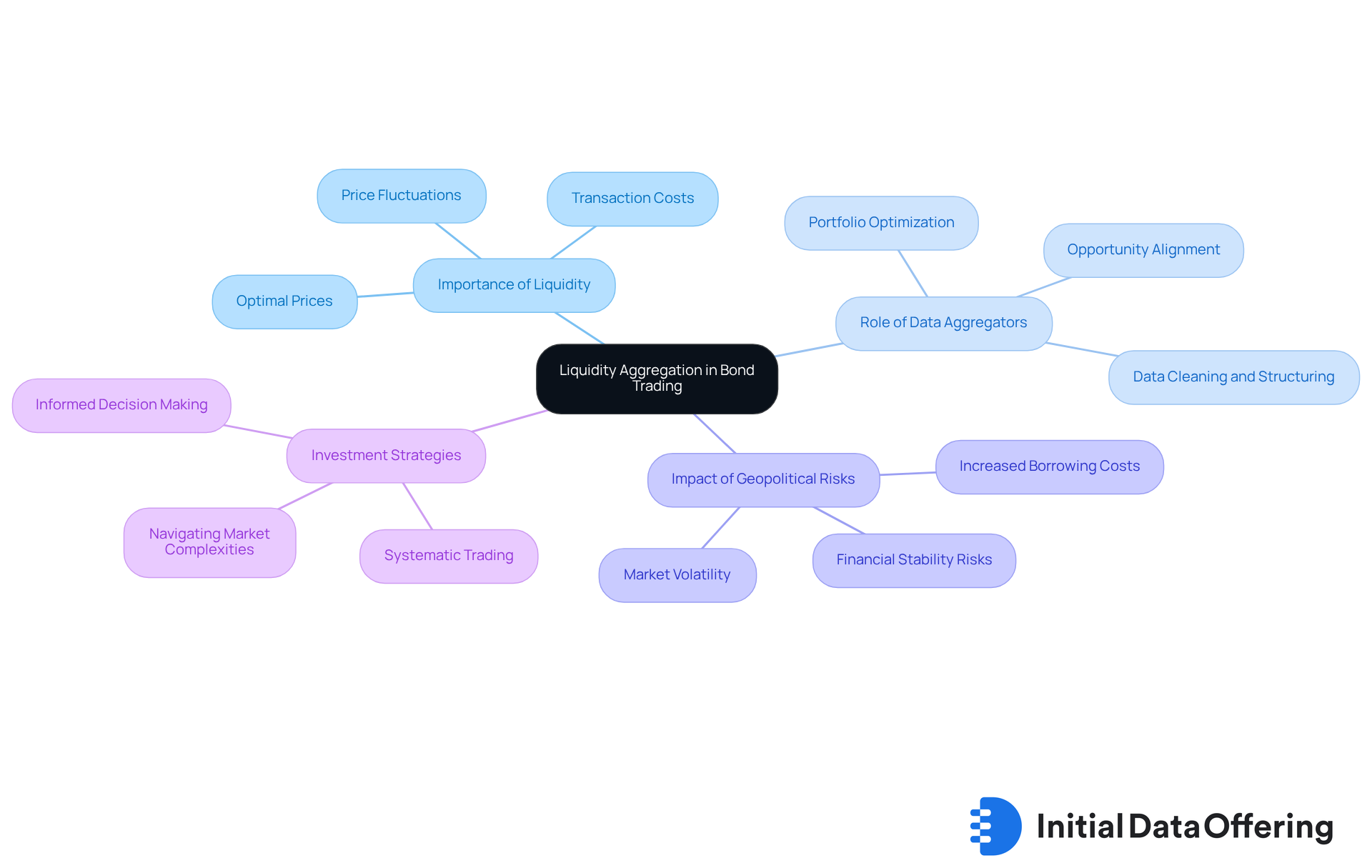

FI Desk: Insights on Liquidity Aggregation in Bond Trading

FI Desk provides comprehensive insights into liquidity aggregation within the securities exchange environment. Why is liquidity so crucial? It plays a vital role in executing trades at optimal prices, which is essential for fixed-income investors. For instance, the government bond sector, valued at around $80 trillion, demonstrates that liquidity directly impacts price levels. Tighter liquidity often leads to higher transaction costs and price fluctuations, which can significantly affect investment outcomes.

Analysts like Susan Joyce emphasize the importance of a data aggregator in developing systematic strategies. This tool facilitates improved portfolio optimization and opportunity alignment, allowing investors to navigate the complexities of the market more effectively. Furthermore, heightened geopolitical risks can increase government borrowing costs, complicating liquidity dynamics even further. Understanding these industry dynamics, including pricing models and transaction expenses, is crucial for crafting effective investment strategies.

As industry specialists point out, a robust liquidity plan can greatly enhance performance. It enables investors to seize opportunities as they arise. By leveraging FI Desk's insights, traders can refine their approaches, ensuring they remain competitive in a rapidly evolving market. How can you apply these insights to your investment strategy? By considering the implications of liquidity on your trades, you can make more informed decisions that align with market conditions.

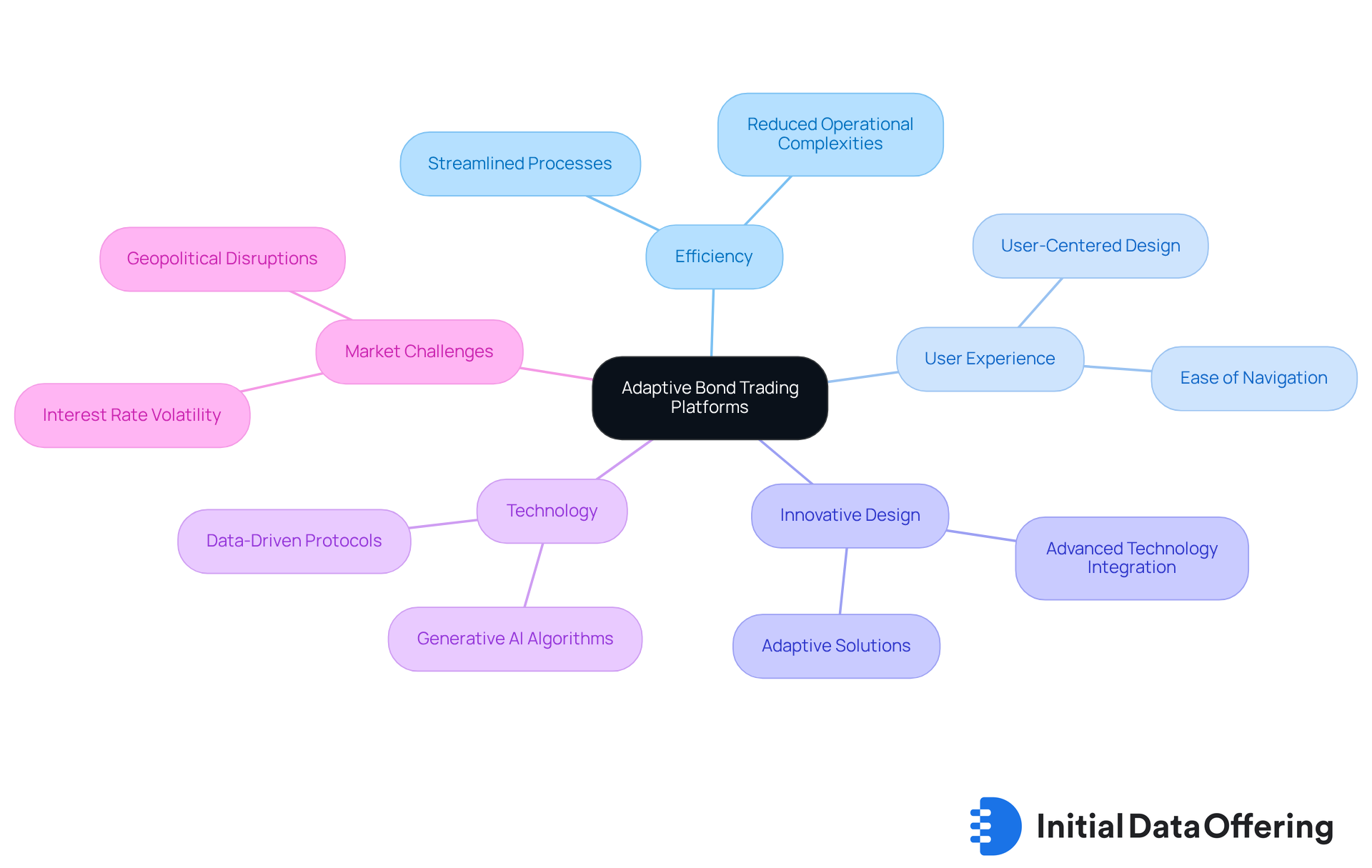

We Are Adaptive: Re-engineering Bond Trading Platforms for Efficiency

We Are Adaptive focuses on re-engineering bond trading platforms, aiming to enhance both efficiency and user experience. By leveraging innovative design principles and advanced technology, they create platforms that simplify workflows and reduce operational complexities. This user-centered design approach ensures that participants can navigate the platform with ease, leading to quicker execution and improved outcomes.

As Bailey aptly notes, "Different market regimes require different tools," highlighting the importance of adaptive solutions in today’s dynamic market landscape. This commitment to efficiency positions We Are Adaptive as a key player in advancing securities exchange technology. Market participants face challenges such as interest rate volatility and geopolitical disruptions, making adaptive solutions more crucial than ever.

How can these advancements in bond trading platforms impact your operations? By embracing these innovative tools, organizations can not only streamline their processes but also respond more effectively to market changes. The emphasis on user experience and operational efficiency ultimately translates to better results in a complex trading environment.

Investopedia: Foundational Knowledge for Bond Traders

Investopedia serves as a vital resource for fixed-income investors, offering a wealth of educational material that covers the essentials of investing in bond trading platforms. What makes this platform stand out? It provides detailed insights into various bond types and pricing strategies, empowering individuals to navigate the bond market with confidence through bond trading platforms.

The comprehensive guides and articles demystify complex concepts, making them accessible for both novice and experienced traders. Why is this important? By enhancing their understanding, investors can refine their trading strategies, ultimately leading to better investment decisions.

In summary, Investopedia not only equips investors with essential knowledge but also fosters a deeper comprehension of the bond market, which is crucial for informed practices on bond trading platforms. How can you leverage this information in your investment journey?

Conclusion

The landscape of bond trading is undergoing a significant transformation, driven by innovative platforms and advanced technologies that are reshaping how transactions are executed and analyzed. This evolution is marked by ten key players, each offering unique solutions that enhance transparency, efficiency, and accessibility in the bond market. By leveraging cutting-edge tools and data-driven insights, these platforms empower investors to make informed decisions, ultimately fostering a more dynamic trading environment.

Key insights from the discussion highlight the critical role of data offerings in optimizing trading strategies. Transparency and best practices, championed by organizations like ICMA, are essential in this context. Moreover, adapting to market fluctuations through innovative solutions is necessary for success. Platforms such as Tradeweb and BondLinc illustrate how technology can streamline processes and improve user experiences. Additionally, resources like Investing.com and BrokerNotes provide essential comparisons and educational materials that enhance investor knowledge and confidence.

As the bond trading market continues to evolve, embracing these innovations is essential for traders and investors alike. How can market participants stay informed and adapt to the latest trends and technologies? Engaging with these platforms not only enhances individual investment strategies but also contributes to a more efficient and transparent bond market. This ultimately benefits all stakeholders involved, allowing them to navigate the complexities of fixed-income investments more effectively.

Frequently Asked Questions

What is the Initial Data Offering (IDO) and its significance in bond trading?

The Initial Data Offering (IDO) streamlines the discovery and introduction of specialized datasets in securities exchange, equipping investors with critical information that influences their trading strategies.

What types of datasets does IDO provide?

IDO offers a diverse range of datasets, including alternative data, fundamentals data, and ESG data, which are crucial for informed decision-making in the fixed income market.

How does IDO keep users updated?

IDO is committed to daily updates, ensuring users are informed about the latest trends and insights, fostering a knowledgeable trading community.

How does SavvyIQ's technology enhance IDO's offerings?

SavvyIQ's AI-powered Recursive Data Engine enhances IDO's dataset offerings, facilitating real-time decision-making and automating workflows, thereby refining investment strategies.

What role does Tradeweb play in bond trading?

Tradeweb is leading the digital transformation in bond transactions by providing advanced electronic marketplaces that simplify exchanges across various bond categories.

What recent advancements has Tradeweb made?

Tradeweb recently launched dealer algorithmic execution capabilities for U.S. Treasuries, enhancing platform functionality and providing traders with automated dealer selection and real-time analytics.

How does Tradeweb improve market transparency and liquidity?

Tradeweb's collaboration with Chainlink enhances automation and real-time data accessibility, improving market transparency and liquidity for investors navigating securities complexities.

What challenges does Tradeweb face in bond trading?

Tradeweb continues to rely on voice negotiations for complex transactions, especially during volatile periods, which poses risks that investors must consider.

What is the role of the International Capital Market Association (ICMA) in the bond market?

ICMA enhances transparency and establishes best practices within the debt securities sector, promoting standards that simplify transaction processes and bolster financial integrity.

What recent statistics highlight ICMA's impact on transparency?

Recent statistics show that 60% of issuers provide accessible reports, and 91% publish dedicated GSS reports, reflecting a growing commitment to transparency in the market.

How is ICMA addressing sustainable finance?

ICMA introduced a new tag for transition securities to encourage issuance for projects that support decarbonization, responding to the rising demand for sustainable finance.

What collaboration has ICMA undertaken to improve market integrity?

ICMA collaborates with regulatory authorities like the FCA to enhance post-trade transparency frameworks, which are crucial for the integrity of debt securities.

What challenges does ICMA face in maintaining investor trust?

ICMA must address challenges such as concerns about greenwashing, exemplified by issues surrounding the second transition note issued by Marfrig, to maintain investor trust in the transition financing sector.