10 Essential Hedge Fund Data Insights for Market Analysts

10 Essential Hedge Fund Data Insights for Market Analysts

Introduction

In the fast-paced finance sector, the ability to harness and interpret hedge fund data stands as a pivotal advantage for market analysts. As the landscape evolves, comprehensive datasets and innovative analytical tools emerge, offering professionals a unique opportunity to refine their strategies and enhance decision-making. However, with the increasing volume and complexity of data, how can analysts effectively navigate these challenges to extract actionable insights?

This article delves into ten essential data insights that empower analysts to stay ahead in the competitive hedge fund market. By equipping them with the knowledge needed to thrive in 2025 and beyond, these insights not only highlight the features of the datasets but also underscore their advantages and the benefits they provide.

As we explore these insights, consider how they can apply to your work. What strategies can you implement to leverage these datasets effectively?

Initial Data Offering: Access Comprehensive Hedge Fund Datasets

The Initial Data Offering (IDO) serves as a vital centralized hub for accessing a wide array of hedge fund data, which is crucial for a thorough analysis of the financial landscape. Analysts can delve into categories such as:

- Alternative information

- Fundamentals information

- ESG information

Each category provides unique insights that can significantly inform investment strategies.

The platform boasts a user-friendly interface, allowing analysts to efficiently discover and utilize datasets, which greatly enhances their research capabilities. As the investment sector anticipates a budget surge in alternative information, the importance of having comprehensive access to hedge fund data for 2025 becomes increasingly clear.

By leveraging IDO, analysts can stay ahead of emerging trends and make well-informed decisions. This proactive approach ultimately drives better outcomes in their investment strategies. How might these datasets transform your analytical processes? Consider the potential impact on your investment decisions.

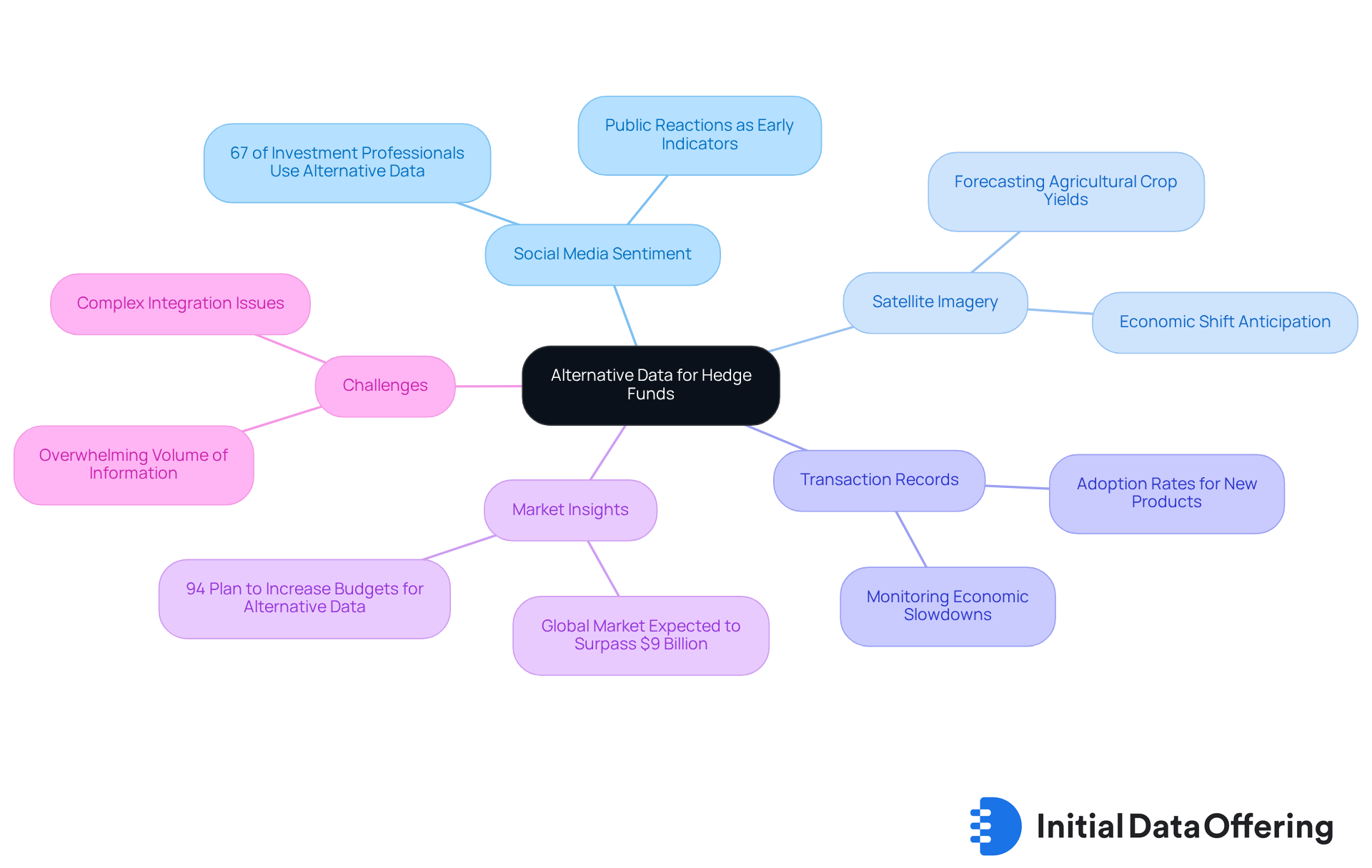

Alternative Data: Unlock Unique Market Insights for Hedge Funds

Alternative information sources, such as social media sentiment, satellite imagery, and transaction records, provide investment firms with unique insights into trend patterns and consumer behavior. For instance, analyzing hedge fund data on social media platforms allows hedge funds to gauge public reactions to significant news events, serving as early indicators of potential financial volatility. This method has proven effective; a notable 67% of investment professionals reported using alternative information in 2025, up from 62% in 2023. The global market for alternative information is expected to surpass $9 billion, underscoring its growing significance in investment strategies.

Moreover, satellite imagery can forecast agricultural crop yields, allowing hedge fund data to enable informed investment decisions by anticipating economic shifts. Transaction data in the tech sector reveals adoption rates for new products, further enhancing decision-making capabilities. As the alternative information market evolves, it's noteworthy that 94% of current users plan to increase their budgets for it, highlighting its critical role in investment strategies.

Hedge fund managers recognize the value of hedge fund data, with many emphasizing its role in improving investment decisions. The use of AI-processed information has also surged, with adoption rates doubling from 14% in 2024 to 31% in 2025. Will Wainewright noted, "Twice as many participants indicated their companies are utilizing AI-processed information to enhance investment/trade strategies," stressing the necessity for investment groups to leverage alternative insights to outpace competitors in 2025 and beyond. However, challenges such as the overwhelming volume of information and complex integration remain, making it essential to partner with reliable providers like PromptCloud to navigate these complexities effectively.

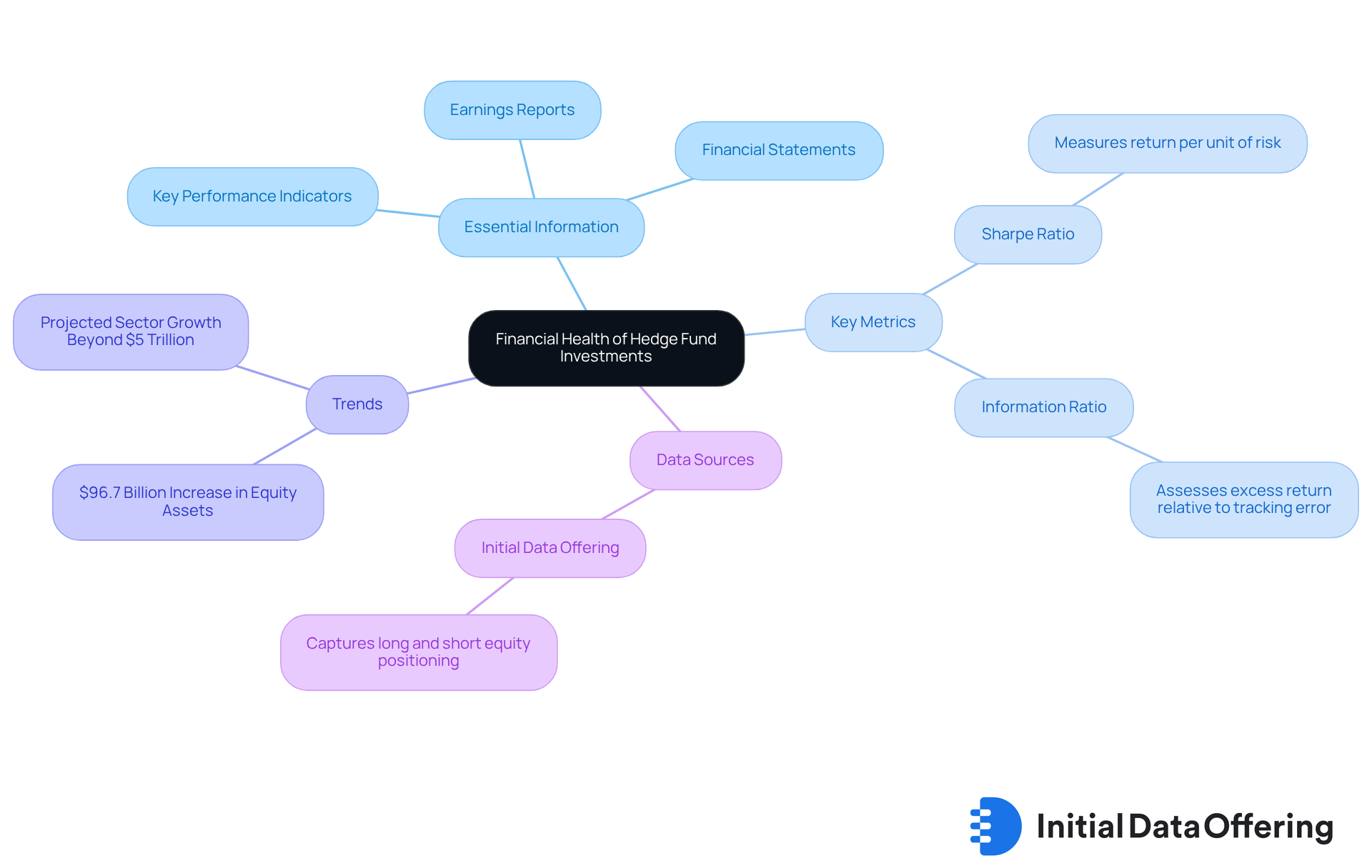

Fundamentals Data: Analyze Financial Health of Hedge Fund Investments

Essential information - like financial statements, earnings reports, and key performance indicators - is crucial for market analysts assessing the financial health of investment portfolios. By carefully analyzing this data, analysts can gauge the effectiveness of investment strategies and identify potential risks. This thorough approach grounds their investment decisions in solid financial analysis.

Looking ahead to 2025, the significance of assessing financial health in investment vehicles becomes even clearer, especially with the sector's expected growth, projected to surpass the $5 trillion mark. Analysts should prioritize metrics such as the Sharpe ratio, which measures return per unit of risk, and the information ratio, which helps determine if the risk of outperforming the market is justified. For example, a portfolio boasting a Sharpe ratio of 0.6 indicates a favorable return relative to its risk profile, while a high information ratio suggests that the excess return is worth the associated risk.

Furthermore, evaluating investment vehicle performance through financial statements allows analysts to spot trends and make informed forecasts. For instance, equity investment vehicles saw a notable increase of $96.7 billion in assets during Q3, fueled by positive investor inflows. This hedge fund data not only reflects the financial health of these resources but also highlights the growing investor confidence in hedge strategies.

Additionally, leveraging extensive hedge fund data from Initial Data Offering, which captures long and short equity positioning and crowding information from over 600 portfolios, can yield deeper insights into trends and performance. This exclusive dataset, derived from $700 billion in GMV, offers historical information dating back to February 2017 and can be categorized by various investment types, enhancing the analysis.

Ultimately, a comprehensive evaluation of financial health is essential for analysts navigating the complexities of investment strategies. This ensures their approaches align with current economic dynamics and meet investor expectations. How can these insights shape your investment strategies moving forward?

ESG Data: Evaluate Sustainability Metrics in Hedge Fund Strategies

Environmental, Social, and Governance (ESG) information provides crucial insights into the sustainability practices of investment vehicles. What makes ESG metrics so important? By analyzing these metrics, investment analysts can assess how effectively pooled assets align with sustainable investment principles. This alignment is increasingly vital for attracting socially aware investors.

The advantages of utilizing ESG data are significant. Not only does it help identify investment opportunities that pursue financial returns, but it also highlights those that contribute positively to society and the environment. This dual focus on profit and purpose can enhance an investment portfolio's appeal to a broader range of investors.

In conclusion, understanding ESG information is essential for investment analysts. It allows them to recognize resources that align with both financial goals and ethical considerations. As the demand for sustainable investing grows, leveraging ESG metrics will be key to attracting and retaining socially conscious investors.

Market Trends: Stay Ahead with Real-Time Data Analysis

Immediate data evaluation is essential for investment analysts striving to stay ahead of financial trends and make quick, informed decisions. By utilizing platforms like IDO, analysts gain access to the latest information on trading movements, economic indicators, and sector performance. This capability allows them to proactively adjust their strategies and seize emerging opportunities.

The global investment vehicle size was assessed at USD 5.3 trillion in 2024, with an anticipated compound annual growth rate (CAGR) of 4.1% from 2025 to 2034. Notably, North America is expected to surpass USD 3.3 trillion by 2034. Such hedge fund data underscore the necessity for hedge funds to remain responsive to economic dynamics. How can analysts leverage real-time information to recognize shifts in investor sentiment and economic conditions? By doing so, they can enhance their strategies efficiently.

Firms like Bridgewater Associates and Renaissance Technologies exemplify the effective incorporation of current information into their decision-making processes. Together, they held over 9% market share in 2024, showcasing their ability to navigate complex financial landscapes skillfully. As market analysts emphasize, utilizing real-time information is not merely a benefit; it is crucial for sustaining a competitive advantage in the evolving investment landscape.

In conclusion, the ability to access and analyze immediate data is vital for investment analysts. It empowers them to make informed decisions, adapt strategies, and ultimately thrive in a competitive market.

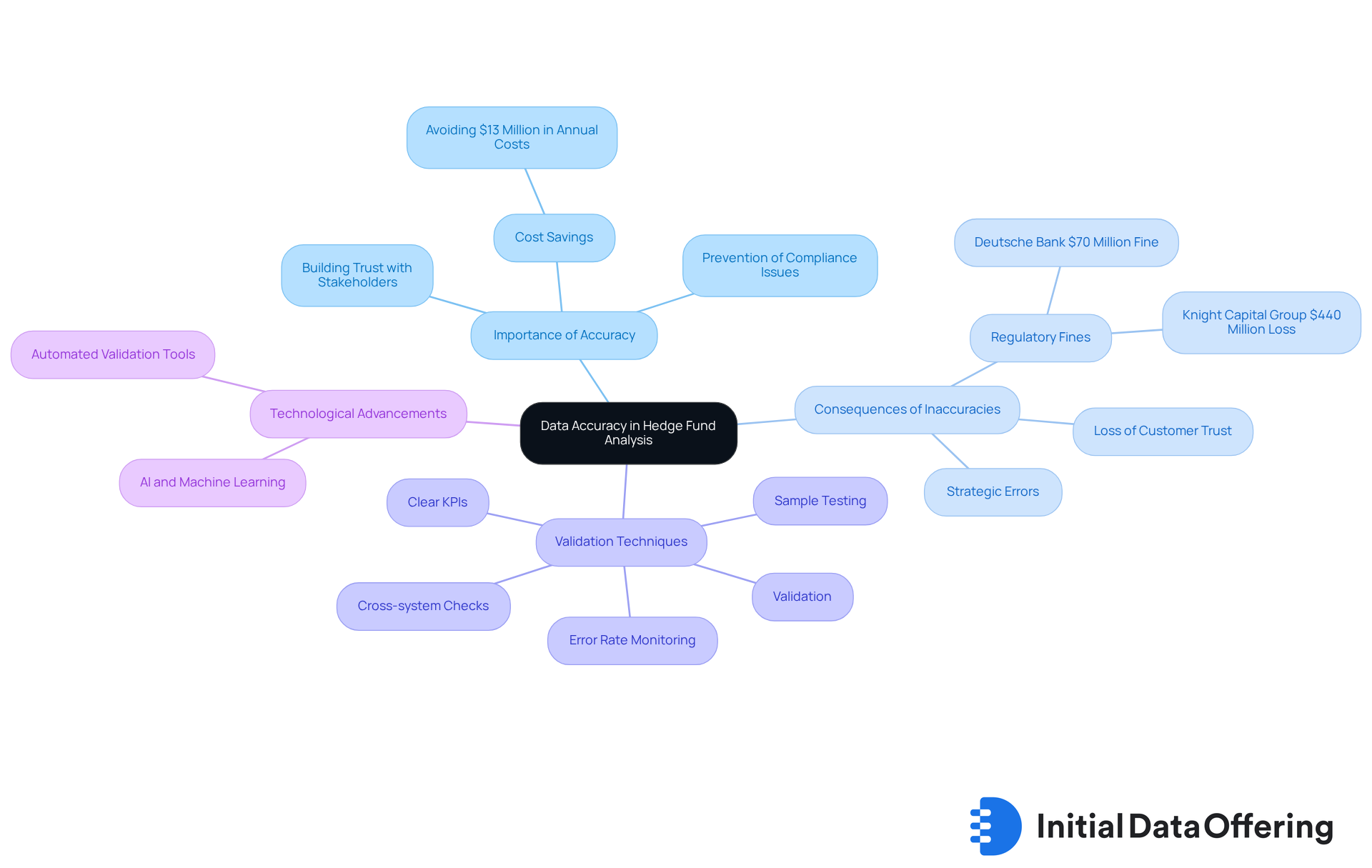

Data Accuracy: Ensure Reliable Insights for Hedge Fund Analysis

Hedge fund data accuracy is crucial for analysts in the industry. Inaccuracies can lead to misguided insights and detrimental investment choices. Establishing strong information validation procedures is vital. For instance, comparing datasets against reliable sources significantly enhances precision. This method not only confirms the accuracy of information but also lays a solid foundation for trustworthy analysis. As industry specialists emphasize, the consequences of weak information integrity can be severe, resulting in strategic errors and regulatory fines. Organizations that prioritize information accuracy can save nearly $13 million each year by avoiding costs linked to poor-quality information.

Recent advancements in information validation techniques, particularly in 2025, underscore the importance of maintaining high standards. Hedge fund data shows that hedge funds are increasingly adopting automated validation tools that provide real-time monitoring and anomaly detection. This ensures discrepancies are identified and addressed promptly. Techniques such as:

- Validation

- Cross-system checks

- Error rate monitoring

- Sample testing

- Clear KPIs

are becoming standard practices in the industry. This proactive approach not only enhances operational efficiency but also builds trust among stakeholders. Did you know that 84% of customers have more confidence in companies that actively oversee quality management? By focusing on information integrity and promoting cross-functional collaboration, analysts can significantly enhance the reliability of their assessments, ultimately leading to improved investment results.

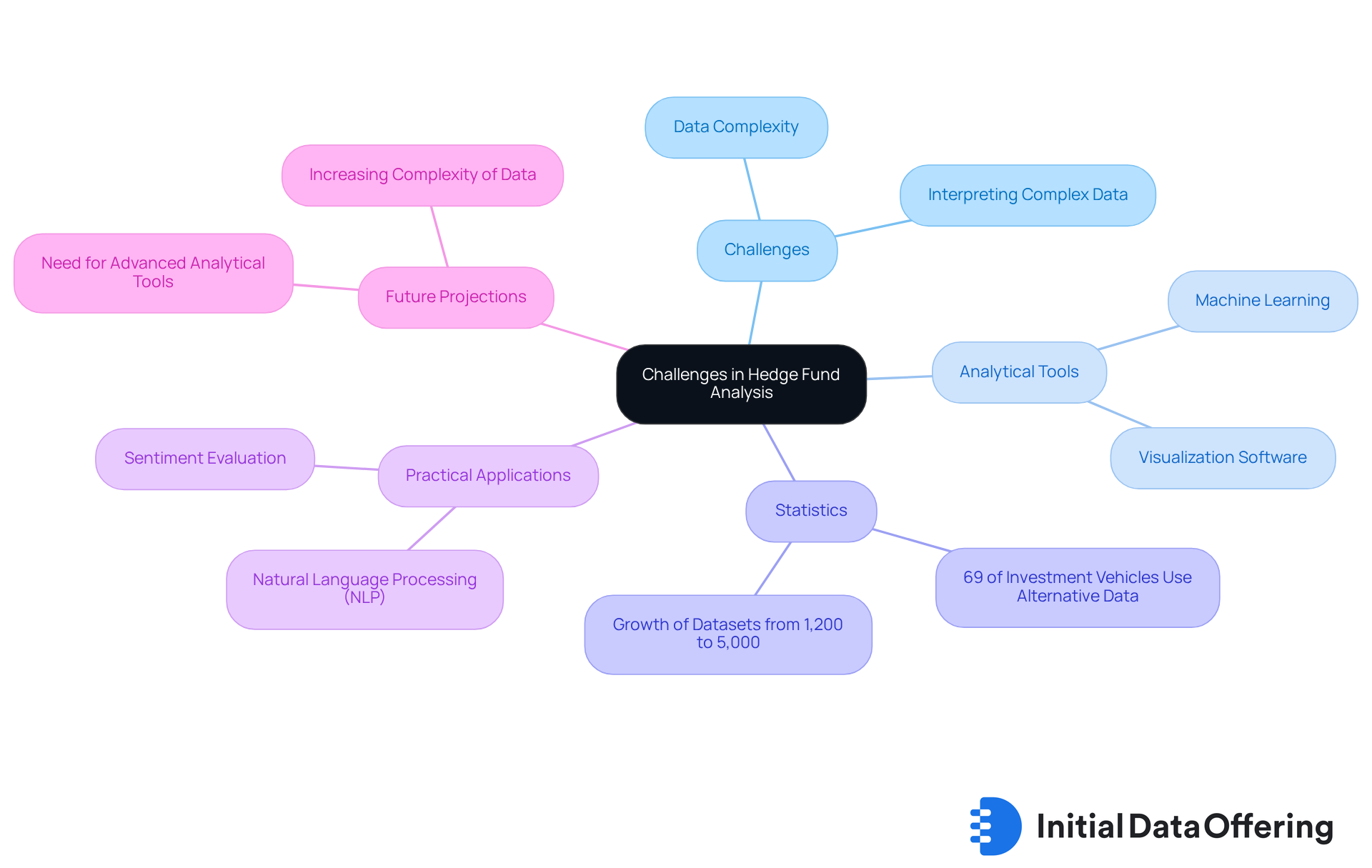

Complex Data Interpretation: Overcome Challenges in Hedge Fund Analysis

Hedge fund analysts often face challenges when interpreting complex hedge fund data, which can hinder their ability to derive actionable insights. Utilizing advanced analytical tools and techniques, particularly machine learning algorithms and visualization software, is essential. These technologies streamline information interpretation and empower analysts to uncover trends and patterns with greater precision.

Statistics reveal that 69% of investment vehicles leverage alternative information to outperform the market, with machine learning playing a pivotal role in this process. For instance, investment pools increasingly employ machine learning models to analyze vast amounts of data, including web-scraped content and consumer spending metrics. This capability enables them to gain a competitive edge.

Practical applications of machine learning in investment analysis include natural language processing (NLP) for sentiment evaluation. Companies like Man GLG effectively use this approach to assess news sentiment in the luxury goods sector. This not only identifies potential investment opportunities but also enhances risk management strategies.

As Andrew Grosser, co-founder and CTO of Sourcetable, notes, "At investment firms, access to information and sophisticated analysis tools determines your advantage." This highlights the necessity for analysts to adopt advanced tools that leverage hedge fund data to facilitate informed decision-making and drive superior investment outcomes. Furthermore, the alternative information sector is projected to grow from 1,200 to around 5,000 datasets by the end of 2024, emphasizing the increasing complexity and need for sophisticated analytical tools in investment analysis.

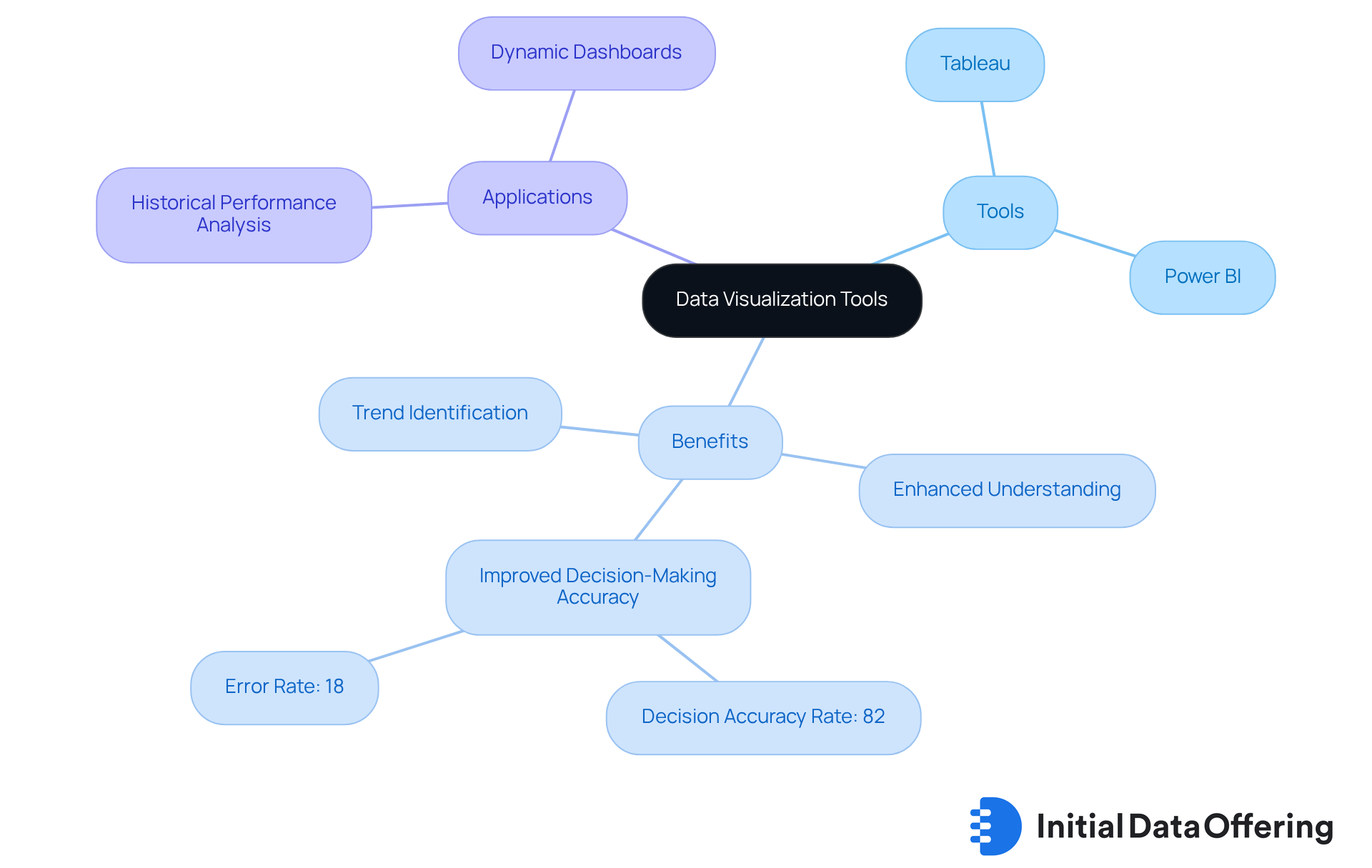

Data Visualization Tools: Enhance Understanding of Hedge Fund Insights

Data visualization tools, such as Tableau and Power BI, play a crucial role in enhancing the understanding of hedge fund data insights. These tools convert complex datasets into accessible visual formats, enabling analysts to communicate their findings more effectively to stakeholders. This capability not only facilitates informed decision-making by utilizing hedge fund data but also illuminates key trends and correlations, revealing anomalies that might otherwise go unnoticed.

Consider this: research indicates that investors who utilize visual representation achieve a decision accuracy rate of 82%, compared to just 65% for those relying solely on traditional methods. This enhanced clarity is vital in the fast-paced financial landscape of 2025, where hedge fund data can significantly influence strategic investment choices. Analysts have observed that presenting data visually fosters a more nuanced discussion of financial insights, bridging the gap between raw numbers and actionable intelligence.

By leveraging tools like Tableau and Power BI, analysts can create dynamic dashboards that showcase historical performance based on hedge fund data while also forecasting future trends. This approach ultimately leads to a more comprehensive analysis of investments. How might these tools transform your own data analysis processes? The ability to visualize data not only enhances understanding but also empowers analysts to make more informed decisions.

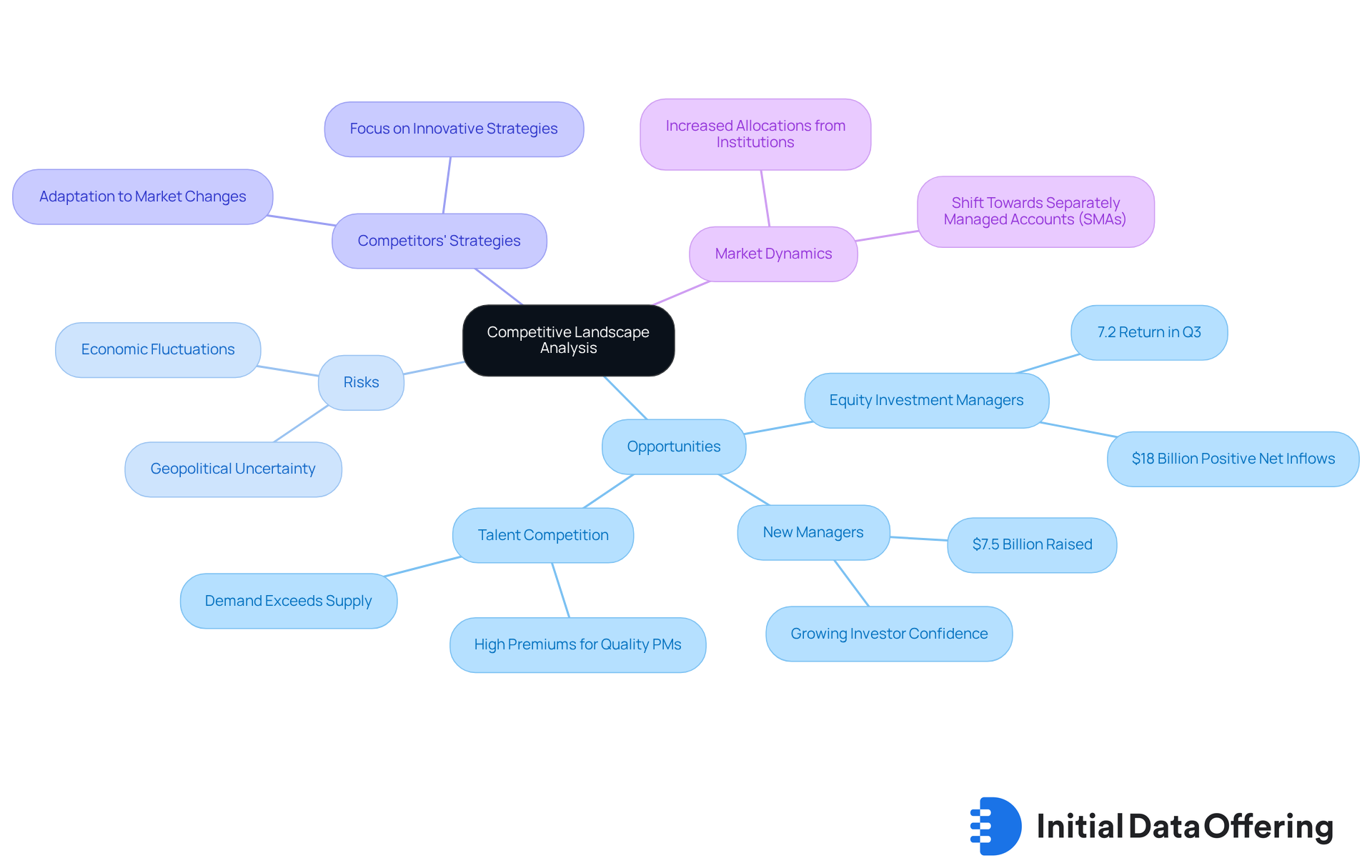

Competitive Landscape Analysis: Identify Opportunities in Hedge Fund Markets

Performing a competitive landscape assessment is crucial for investment analysts aiming to pinpoint opportunities and risks within the sector. By examining competitors' strategies, performance metrics, and positioning, analysts can uncover gaps that may present potential investment opportunities. For instance, recent data reveals that equity investment managers achieved a 7.2% return in Q3, accompanied by a notable $18 billion in positive net inflows. This indicates a robust demand for well-placed investments, underscoring the necessity of understanding competitors' performance to guide strategic decisions.

Moreover, the investment landscape is evolving, with new managers attracting $7.5 billion despite economic challenges. This shift suggests a growing investor confidence in innovative strategies. How can analysts leverage this information to assess which portfolios are gaining traction? By doing so, they can adjust their investment strategies accordingly, ensuring they remain competitive in a dynamic market.

The current economic fluctuations are expected to create further opportunities for investment managers to generate excess returns through careful asset selection. As noted by Agecroft Partners, discussions with over 2,000 institutional investors indicate that the demand for top talent continues to outstrip supply. Major firms are willing to pay high premiums to attract quality portfolio managers. This intense competition for talent highlights the need for firms to adapt their strategies to attract and retain the best professionals in the field.

In conclusion, a thorough competitive evaluation not only aids in identifying opportunities within the sector but also equips analysts with the insights necessary to navigate the complexities of the investment industry effectively. Additionally, understanding the evolving nature of investment strategies-particularly those that are scale-enabled, cross-asset, and risk-engineered-is vital for grasping current economic dynamics.

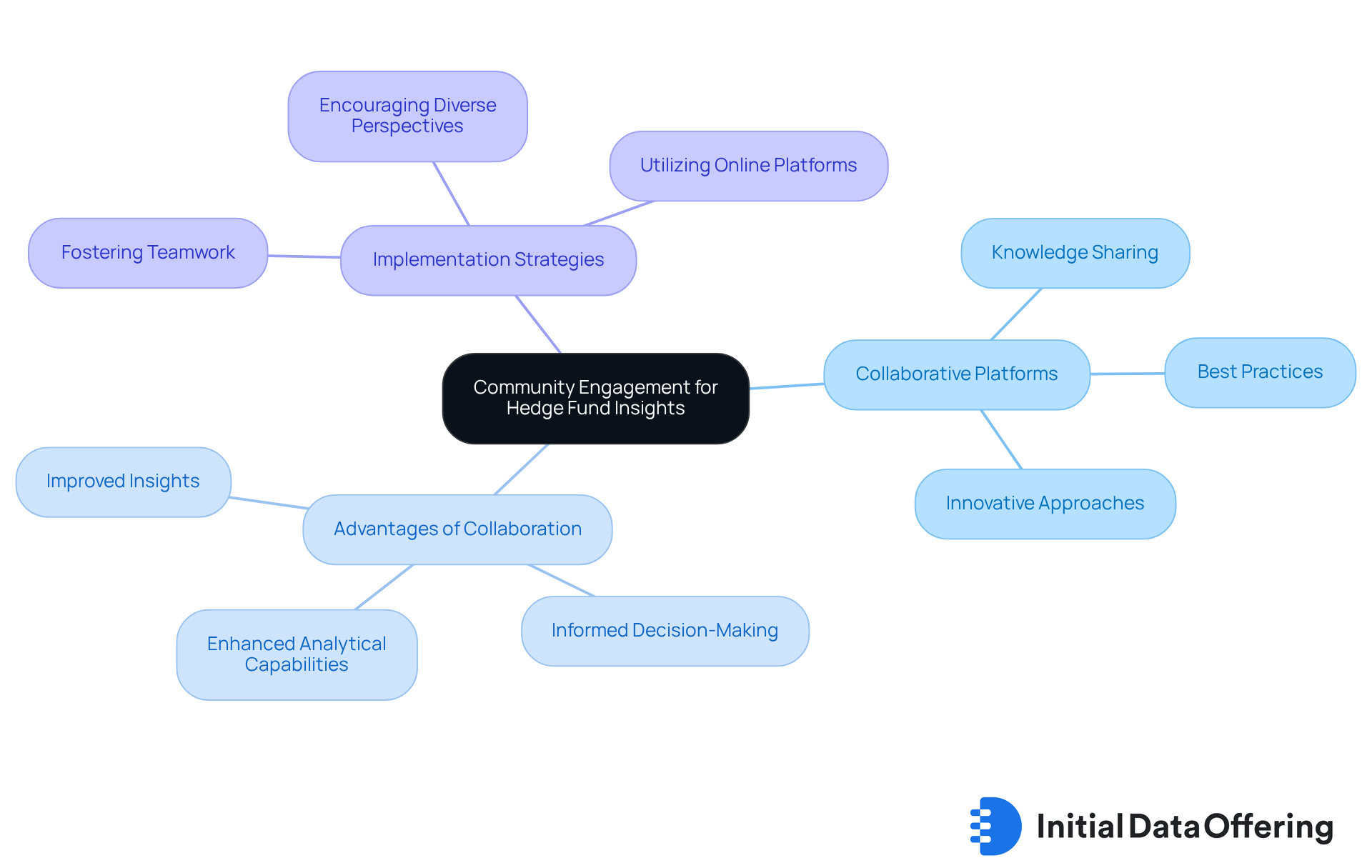

Community Engagement: Foster Collaboration for Enhanced Hedge Fund Data Insights

Interacting with a group of analysts and market researchers significantly enhances the quality of insights derived from hedge fund data. Collaborative platforms serve as a vital feature, enabling analysts to share knowledge, best practices, and innovative approaches to data analysis. This collaboration not only fosters a culture of teamwork but also enhances analytical capabilities.

What advantages does this collaboration bring? By pooling their expertise, analysts can drive better investment outcomes. The benefits are clear: improved insights lead to more informed decision-making, ultimately benefiting the entire organization.

In conclusion, fostering a collaborative environment among analysts is essential. It encourages the sharing of diverse perspectives and innovative ideas, which can lead to superior analytical results. How can you implement such collaborative practices in your own work? Consider the potential impact on your investment strategies.

Conclusion

The exploration of hedge fund data insights reveals a significant landscape for market analysts, highlighting the necessity of comprehensive and varied datasets. Features such as alternative data, fundamentals data, and ESG metrics empower analysts to refine their investment strategies and make informed decisions. The advantage of having access to essential information is clear: as the financial sector anticipates substantial growth, particularly in 2025, leveraging these insights becomes crucial for maintaining a competitive edge.

Key arguments emphasize the importance of:

- Utilizing advanced analytical tools

- Ensuring data accuracy

- Fostering community engagement among analysts

The rise of alternative data sources and the integration of real-time data analysis have reshaped investment strategies. This enables analysts to stay ahead of market trends and identify emerging opportunities. Moreover, the growing emphasis on ESG metrics underscores the demand for sustainable investment practices, aligning financial returns with ethical considerations.

In light of these insights, how can analysts adopt a proactive approach in harnessing hedge fund data? By embracing collaboration, leveraging technology, and prioritizing data integrity, investment professionals can enhance their analytical capabilities and drive superior outcomes. The future of hedge fund analysis will hinge on the ability to navigate the complexities of data, ensuring that informed decisions lead to sustainable growth and success in an ever-evolving market landscape.

Frequently Asked Questions

What is the Initial Data Offering (IDO)?

The Initial Data Offering (IDO) is a centralized hub that provides access to a wide range of hedge fund data, essential for thorough financial analysis.

What categories of data can analysts access through the IDO?

Analysts can access three main categories of data: alternative information, fundamentals information, and ESG (Environmental, Social, and Governance) information.

How does alternative data benefit hedge funds?

Alternative data sources, such as social media sentiment and satellite imagery, offer unique insights into market trends and consumer behavior, enabling hedge funds to make informed investment decisions.

What is the significance of alternative information in investment strategies?

The global market for alternative information is projected to exceed $9 billion, and 94% of current users plan to increase their budgets for it, highlighting its critical role in enhancing investment strategies.

What types of fundamental data are important for analyzing hedge fund investments?

Key fundamental data includes financial statements, earnings reports, and performance indicators, which help analysts assess the financial health of investment portfolios.

What metrics should analysts prioritize when evaluating financial health?

Analysts should focus on metrics like the Sharpe ratio, which measures return per unit of risk, and the information ratio, which assesses whether the risk of outperforming the market is justified.

How can the IDO enhance research capabilities for analysts?

The IDO features a user-friendly interface that allows analysts to efficiently discover and utilize datasets, significantly improving their research capabilities and decision-making processes.

What challenges do analysts face when using alternative data?

Analysts may encounter challenges such as the overwhelming volume of information and complex integration, making it essential to work with reliable data providers to navigate these issues effectively.

How has the use of AI-processed information changed in investment strategies?

The adoption rate of AI-processed information has doubled from 14% in 2024 to 31% in 2025, indicating its growing importance in enhancing investment and trading strategies.

Why is evaluating the financial health of investment vehicles critical for analysts?

A comprehensive evaluation of financial health helps analysts align their investment strategies with current economic dynamics and meet investor expectations, ensuring better outcomes.