Understanding Fund of Funds in Private Equity: Structure and Benefits

Understanding Fund of Funds in Private Equity: Structure and Benefits

Introduction

Understanding the world of private equity can often feel daunting, especially when navigating the various investment vehicles available. One such vehicle is the fund of funds (FoF), which allows investors to diversify their portfolios by pooling capital across multiple funds. This approach not only mitigates risks but also opens doors to elite investment opportunities typically reserved for larger players.

However, as the allure of enhanced returns beckons, potential investors must grapple with the complexities of fees and performance dependencies. What key considerations could determine the success of incorporating a fund of funds into an investment strategy? By examining these factors, investors can make informed decisions that align with their financial goals.

Define Fund of Funds in Private Equity

A pool of capital in private equity, known as a fund of funds (FoF), serves as a financial vehicle that aggregates resources from various investors to create a diversified portfolio of other private equity vehicles. This approach stands out from traditional funds that invest directly in companies. Instead, the fund of funds private equity allocates capital across multiple funds, effectively spreading risk and enhancing potential returns.

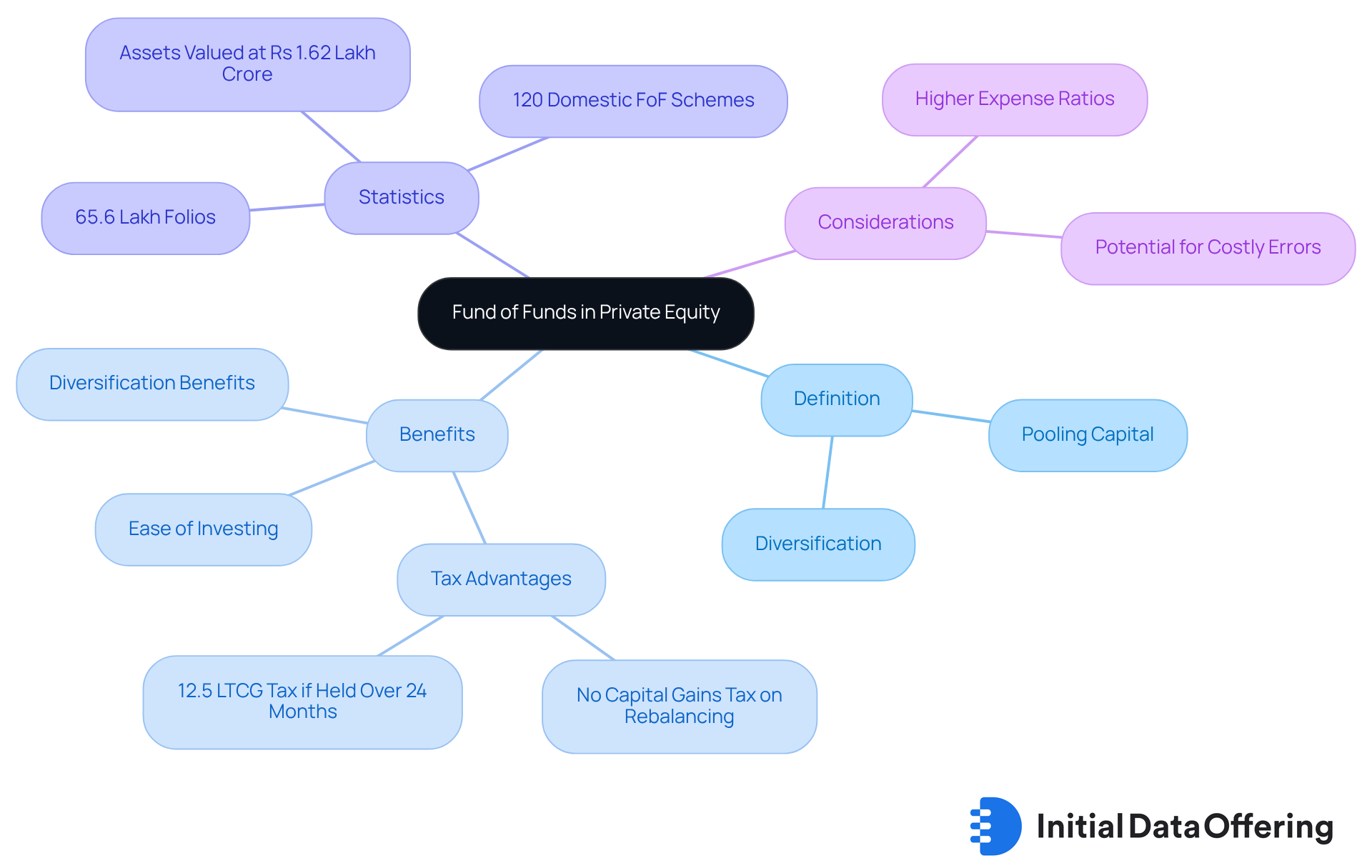

What does this mean for investors? By diversifying their investments, they gain access to a broader range of financial strategies and managers, which is particularly advantageous in the complex realm of fund of funds private equity. As of October 2025, there are 120 domestic fund of funds private equity schemes managing assets valued at Rs 1.62 lakh crore and 65.6 lakh folios, reflecting a growing interest in this financial model.

The latest trends indicate that FoFs are increasingly popular among DIY investors. Their appeal lies in ease of investing, diversification benefits, and favorable tax treatment, such as the absence of capital gains tax during portfolio rebalancing. However, it’s crucial to consider that FoFs often carry higher expense ratios, as investors pay for both the underlying investments and the FoF itself.

This structure not only streamlines portfolio oversight but also enables investors to leverage professional expertise. In today’s financial landscape, fund of funds private equity presents an attractive option for those looking to enhance their investment strategies. How might you incorporate this model into your own investment approach?

Explain the Structure and Functionality of Fund of Funds

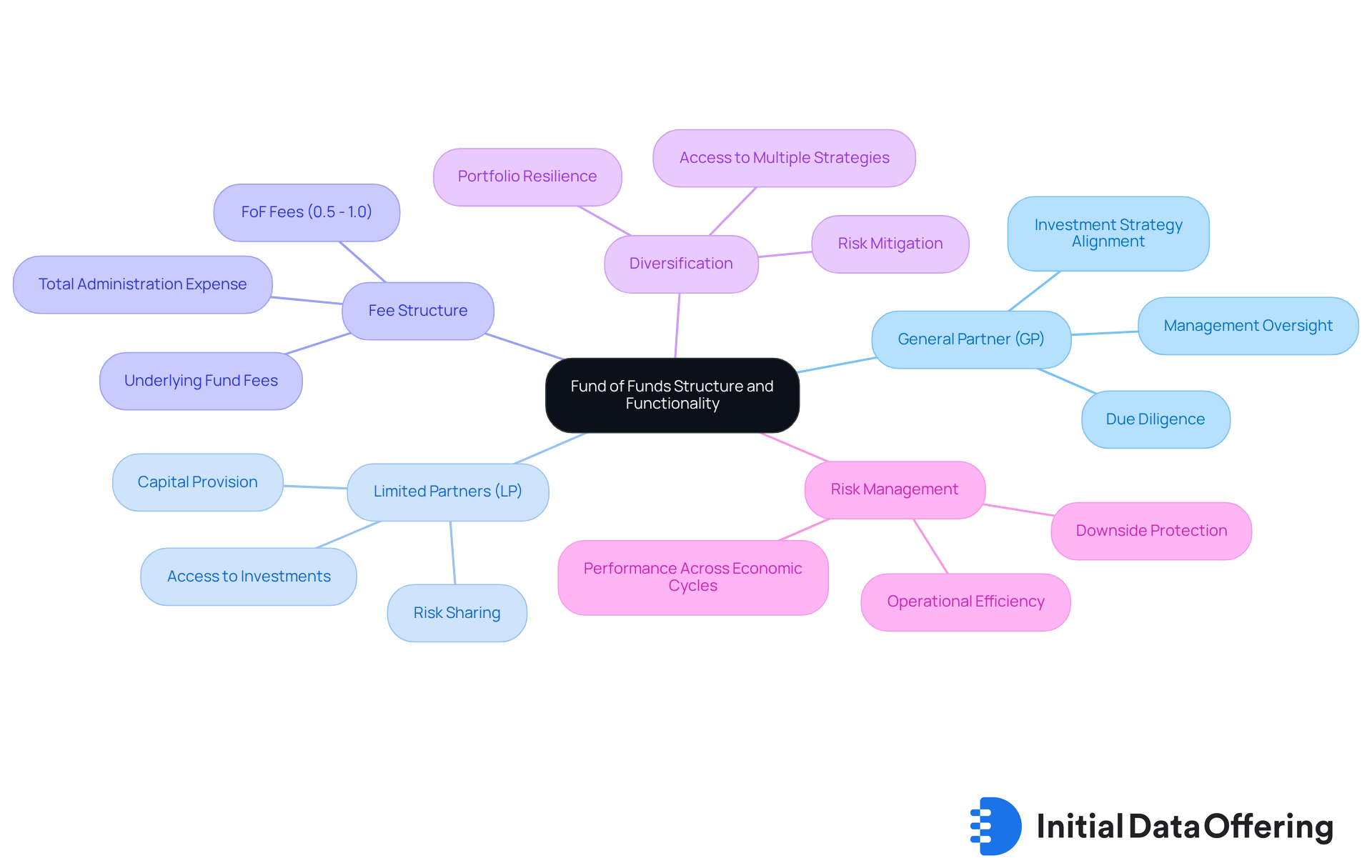

A fund of funds private equity operates within a structured hierarchy, where a general partner (GP) oversees management and allocation decisions, while limited partners (LPs) provide the necessary capital. The GP is responsible for conducting thorough due diligence on potential underlying financial vehicles, ensuring that selected investments align with the FoF's strategic objectives. This multi-layered structure facilitates diversification across various portfolios, sectors, and regions, effectively mitigating risks associated with the performance of individual portfolios.

FoFs typically impose fees at both the portfolio and underlying investment levels, ranging from 0.5% to 1.0% for the FoF itself. This dual fee structure can significantly impact overall returns, as investors must consider both sets of fees. For instance, if a FoF charges a 1% administration fee and the underlying assets add another 1%, the total administration expense could reach 2% annually. This can greatly influence net returns over time. However, the advantages of diversification and professional management often outweigh these costs, granting investors access to premier private equity opportunities through a fund of funds private equity that might otherwise be out of reach due to high capital requirements.

For example, a diversified FoF generally consists of 20 to 30 investments, striking a balance between risk and return potential while bolstering portfolio resilience. This approach allows investors to replicate large-scale private equity initiatives without direct financial commitments, thereby lowering barriers to entry. Moreover, case studies indicate that the fund of funds private equity enhances risk-adjusted returns by distributing capital across various portfolios and strategies, ultimately providing superior downside protection compared to individual assets. By pooling resources, FoFs not only streamline capital deployment but also improve operational efficiency, enabling investors to concentrate on maximizing returns.

Analyze Benefits and Risks of Fund of Funds Investments

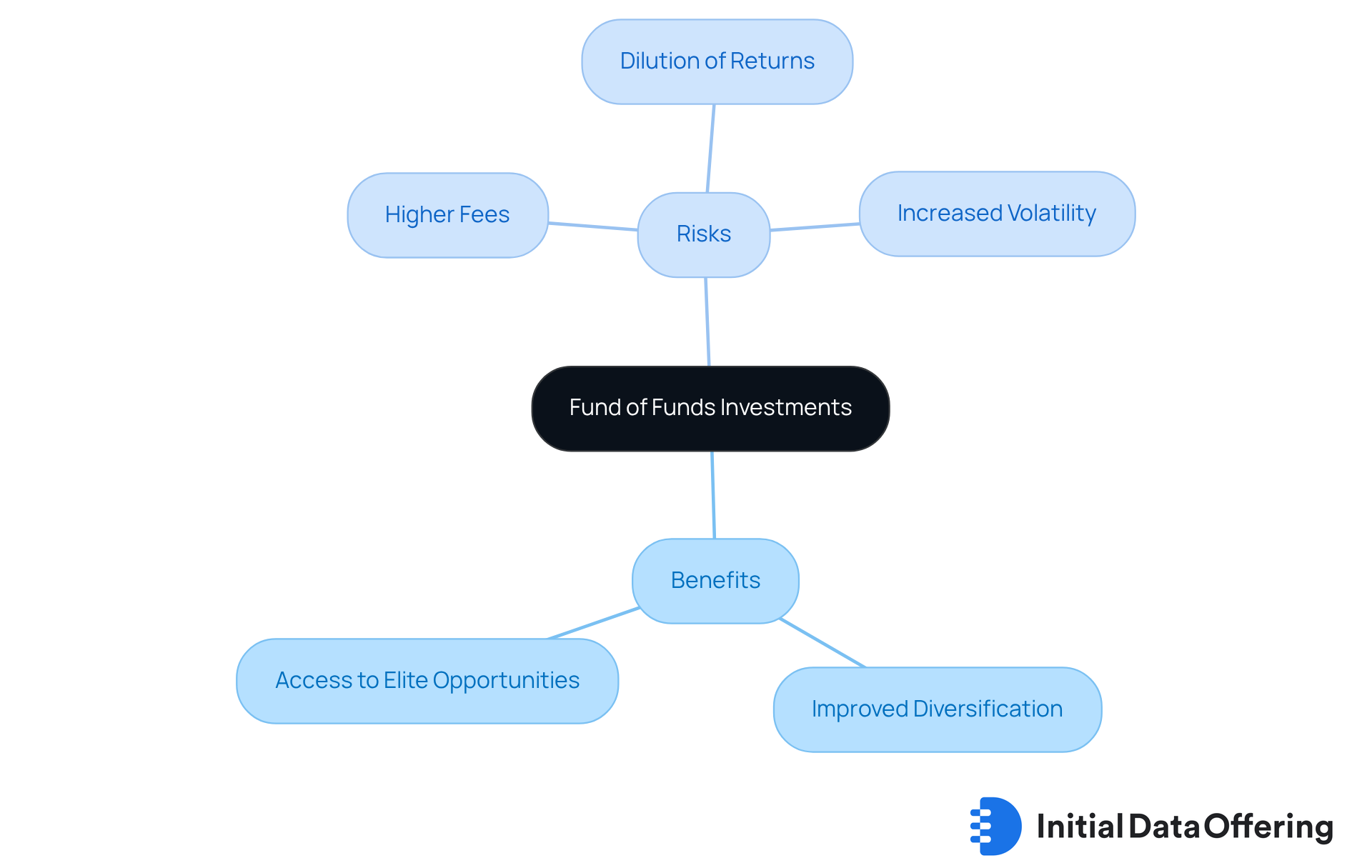

Investing in a fund of funds private equity offers several key features that can significantly enhance an investor's strategy.

- It provides improved diversification, allowing access to a wider range of investment options that might be out of reach for individual investors.

- This approach grants access to elite investment opportunities managed by experts, which can lead to better overall performance.

However, while there are notable advantages, it’s essential to consider the potential risks involved.

- For instance, the layered structure may result in higher fees, which can eat into returns.

- Additionally, there’s a risk of dilution of returns, as the performance of a fund of funds (FoF) is heavily reliant on the success of its underlying investments.

- This dependency can introduce extra volatility, making it crucial for investors to assess their risk tolerance.

So, how can investors navigate these complexities? Understanding the balance between the benefits of diversification and the associated risks is vital. By carefully evaluating the underlying strategies and performance metrics of the funds involved, investors can make informed decisions that align with their financial goals.

Detail the Investment Selection and Management Process

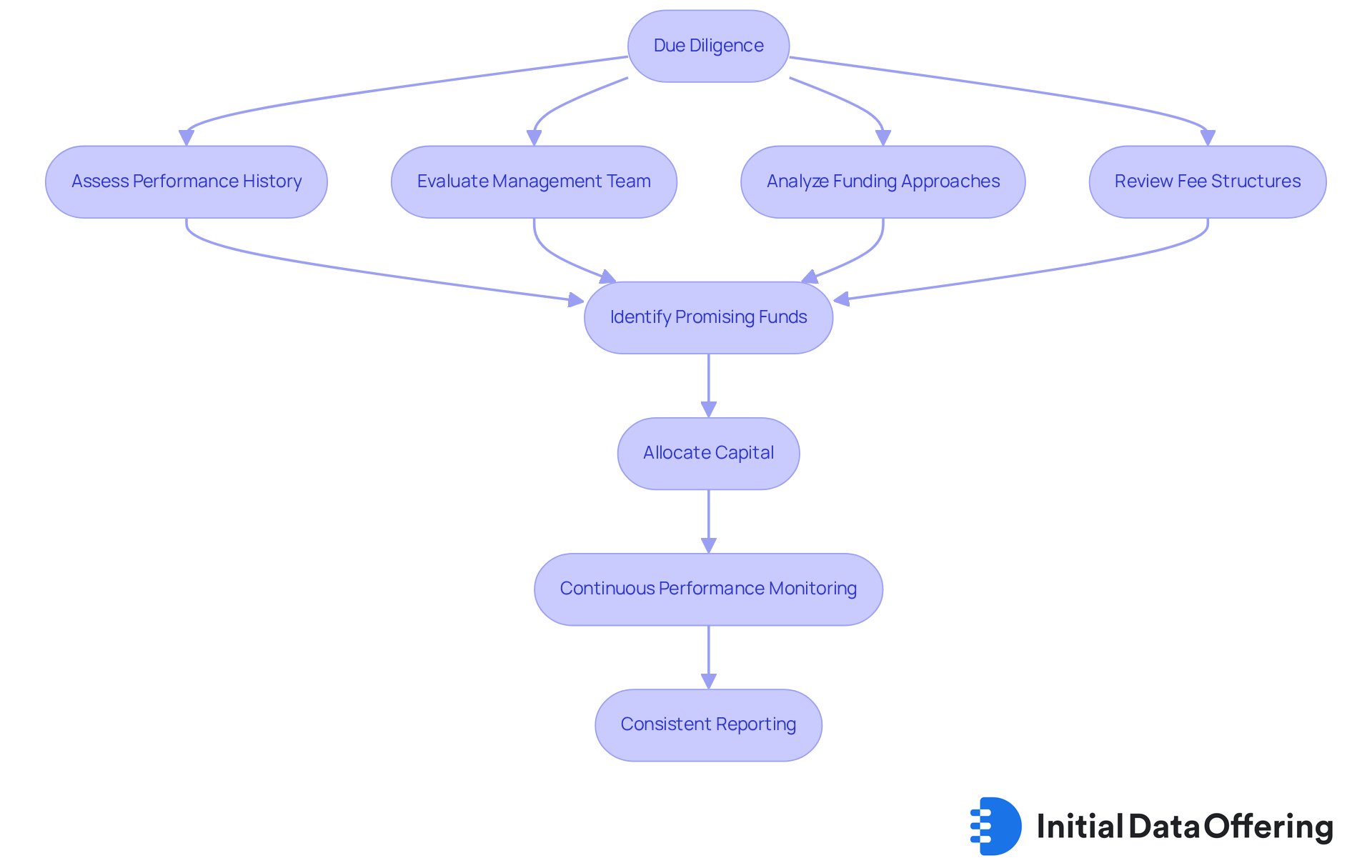

The selection process for a fund of funds private equity is a multifaceted endeavor that begins with thorough due diligence on potential underlying vehicles. General Partners (GPs) meticulously assess various aspects, including:

- Performance history

- Management team dynamics

- Approaches to funding

- Fee structures

This thorough examination encompasses both quantitative metrics-such as historical returns, volatility, and risk-adjusted performance ratios like the Sharpe and Treynor ratios-and qualitative factors, including the manager's reputation and financial philosophy.

Once promising funds are identified, GPs allocate capital in alignment with the fund of funds private equity's strategic objectives. This ensures that each allocation complements the overall portfolio, enhancing the potential for superior investment outcomes. Continuous performance monitoring is essential; it allows GPs to make informed adjustments to optimize returns.

How can this structured approach benefit your investment strategy? Consistent reporting and openness are vital elements of efficient management, keeping Limited Partners (LPs) updated about their assets and promoting trust in the management process.

This structured approach not only enhances the potential for superior investment outcomes but also aligns with best practices in the industry. By adhering to rigorous standards of due diligence and operational excellence, GPs can foster a more reliable investment environment. Consider how implementing these practices could improve your own investment decisions.

Conclusion

A fund of funds in private equity is a sophisticated investment vehicle that aggregates capital from multiple investors, creating a diversified portfolio of underlying funds. This model not only spreads risk but also enhances potential returns by providing access to a wider array of investment strategies and expert management. As the popularity of this approach continues to rise, understanding its structure and benefits becomes increasingly crucial for investors looking to optimize their financial strategies.

Key insights highlighted throughout the article include:

- The multi-layered structure of fund of funds

- The importance of due diligence in investment selection

- The balance between diversification benefits and associated risks

The dual fee structure, while a consideration, is often outweighed by the advantages of professional management and access to premier investment opportunities. Have you considered how continuous performance monitoring can ensure that your investment objectives are met? This emphasis on ongoing evaluation is essential for maximizing the effectiveness of your investment strategy.

Ultimately, the fund of funds model presents a compelling option for investors seeking to navigate the complexities of private equity. By leveraging professional expertise and diversifying investments, individuals can potentially enhance their portfolio's resilience and performance. As the financial landscape evolves, adopting a thoughtful approach to incorporating fund of funds into investment strategies could yield significant benefits. Isn't it worth exploring this avenue to elevate your investment outcomes?

Frequently Asked Questions

What is a fund of funds (FoF) in private equity?

A fund of funds (FoF) in private equity is a pool of capital that aggregates resources from various investors to create a diversified portfolio of other private equity vehicles, rather than investing directly in companies.

How does a fund of funds differ from traditional funds?

Unlike traditional funds that invest directly in companies, a fund of funds allocates capital across multiple funds, which helps to spread risk and enhance potential returns.

What benefits do investors gain from investing in a fund of funds?

Investors gain access to a broader range of financial strategies and managers, which provides diversification and can enhance potential returns in the complex realm of private equity.

How many fund of funds private equity schemes are there as of October 2025, and what is their total asset value?

As of October 2025, there are 120 domestic fund of funds private equity schemes managing assets valued at Rs 1.62 lakh crore and 65.6 lakh folios.

Why are fund of funds becoming popular among DIY investors?

Fund of funds are increasingly popular among DIY investors due to their ease of investing, diversification benefits, and favorable tax treatment, such as the absence of capital gains tax during portfolio rebalancing.

What should investors be cautious about when considering fund of funds?

Investors should be aware that fund of funds often carry higher expense ratios, as they pay for both the underlying investments and the fund of funds itself.

What advantages do fund of funds offer in terms of portfolio management?

Fund of funds streamline portfolio oversight and enable investors to leverage professional expertise, making them an attractive option for enhancing investment strategies.