Create Your Equity Research Report Template in 4 Simple Steps

Create Your Equity Research Report Template in 4 Simple Steps

Introduction

Creating an equity research report is no small feat. It requires a careful blend of analysis, structure, and presentation to effectively communicate insights to investors. This guide simplifies the process into four straightforward steps, ensuring that both novice and seasoned analysts can craft reports that resonate with their audience.

But what are the essential components that can elevate a report from merely informative to truly impactful? By exploring the intricacies of report creation, readers will discover not only the fundamental elements to include but also strategies for presenting their findings in a compelling manner. This exploration will not only enhance the quality of the reports but also engage the audience more effectively.

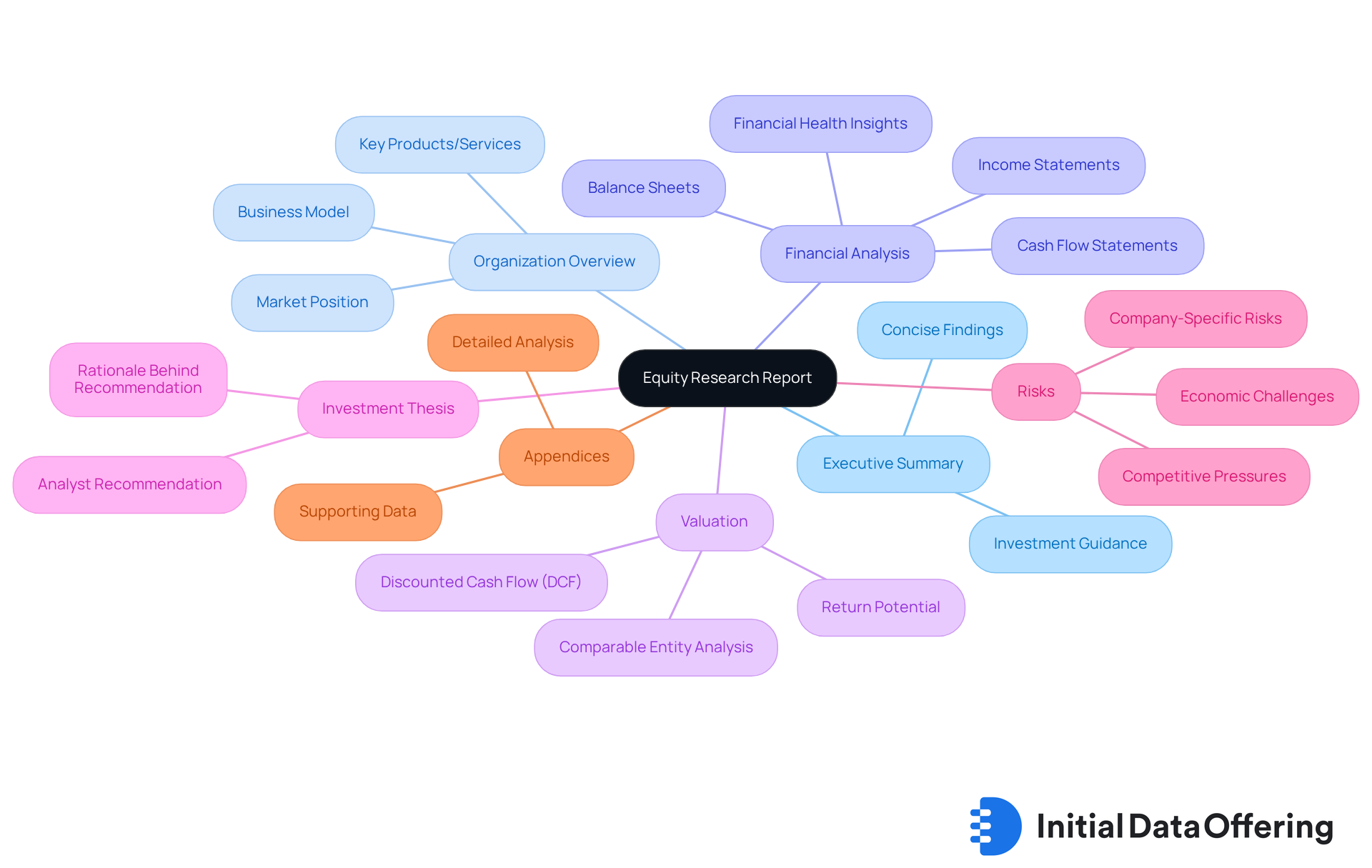

Identify Key Components of an Equity Research Report

Creating an effective equity research report involves several key components that are essential for delivering valuable insights to investors:

-

Executive Summary: This section provides a concise outline of the findings and suggestions. It captures the essence of the document, enabling investors to make informed decisions swiftly. A well-structured report enhances clarity and effectiveness, ultimately guiding investment strategies.

-

Organization Overview: Here, you’ll find background information about the business, including its business model, market position, and key products or services. This context is crucial for understanding the organization’s landscape.

-

Financial Analysis: This involves a detailed examination of the organization's financial statements, such as income statements, balance sheets, and cash flow statements. Equity research documents can be extensive, often ranging from 50 to over 100 pages, providing a thorough analysis of financial health and performance. How does this depth of analysis benefit investors? It equips them with the necessary insights to assess the organization's viability.

-

Valuation: This section assesses the entity's worth using various valuation methods, including Discounted Cash Flow (DCF) analysis or Comparable Entity Analysis. Understanding these methods helps investors gauge the potential return on their investment.

-

Investment Thesis: A clear statement of the analyst's recommendation—whether to buy, sell, or hold—along with the rationale behind it, is crucial. For instance, in a recent analysis of Microsoft, Argus analyst Joseph Bonner presented a comprehensive investment thesis that justified a Buy rating, illustrating how a well-articulated thesis can guide investor decisions.

-

Risks: Identifying potential hazards that could affect the organization's performance and the investment recommendation is vital. This balanced perspective is essential, as equity analysis documents often include a segment on risks that both the organization and investors might encounter. What risks should investors be aware of?

-

Appendices: This section contains extra data or information that supports the analysis but is too detailed for the main body of the document. Including appendices allows for a deeper dive into specific areas without overwhelming the primary narrative.

Successful equity analyses, such as those found in an equity research report template for major companies like Microsoft, demonstrate how these components work together to provide valuable insights and suggestions. Additionally, incorporating figures—like the average expense of independent analyses being below $100—offers context for investors navigating the equity evaluation landscape.

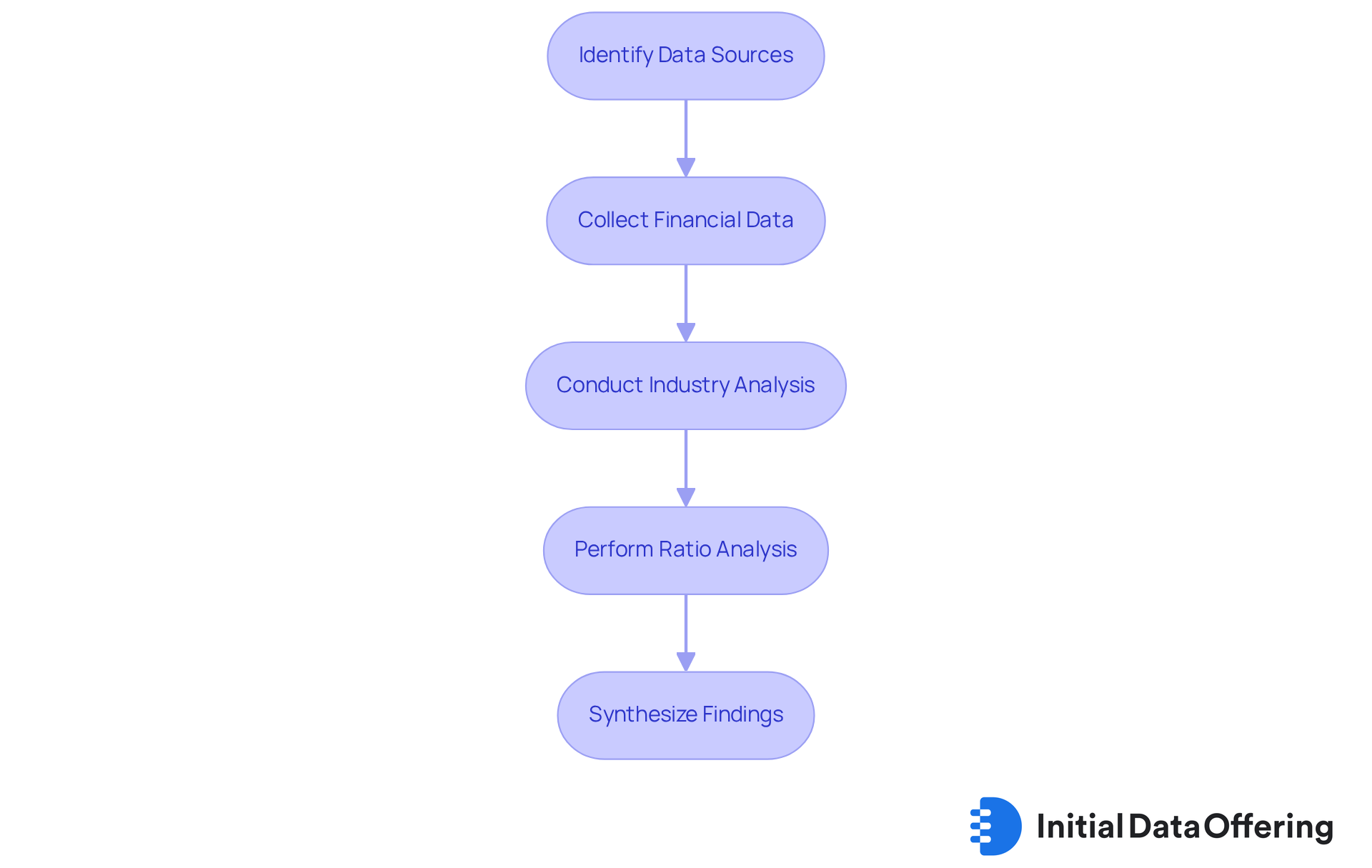

Gather and Analyze Relevant Data for Your Report

To effectively gather and analyze data for your equity research report, follow these essential steps:

-

Identify Data Sources: Start by utilizing reputable sources such as financial statements, industry reports, and market analysis databases. Key platforms include the SEC, Bloomberg, and investor relations pages, which provide reliable and comprehensive information. As Nitin Kumar, Partner and Co-Founder at Magistral Consulting, points out, an equity research report template has become a strategic necessity in the $125 trillion global equity sector. This underscores the importance of employing trustworthy information sources within the equity research report template.

-

Collect Financial Data: Focus on crucial financial metrics like revenue, earnings per share (EPS), and profit margins. Collect data over various periods to identify trends and evaluate average revenue growth rates, which are vital for assessing an organization's performance. For instance, understanding average revenue growth rates can help identify firms that are consistently expanding—an important factor in a market that saw net inflows of $340 billion into global equity funds in 2024.

-

Conduct Industry Analysis: Analyze the industry landscape in which the business operates. Look into market trends, the competitive environment, and regulatory factors that may impact the organization's performance. This context is essential for recognizing potential risks and opportunities. Tools like Koyfin and YCharts offer advanced data analytics to support this analysis.

-

Perform Ratio Analysis: Leverage financial ratios, such as the price-to-earnings (P/E) ratio and debt-to-equity ratio, to assess the organization's financial health relative to its competitors. This comparative analysis can provide insights into the company's operational efficiency and risk profile.

-

In your equity research report template, synthesize findings by summarizing the information gathered and highlighting key insights that bolster your investment thesis. This synthesis should be clear and concise, ensuring that readers can easily grasp the implications of the data and make informed decisions based on your analysis.

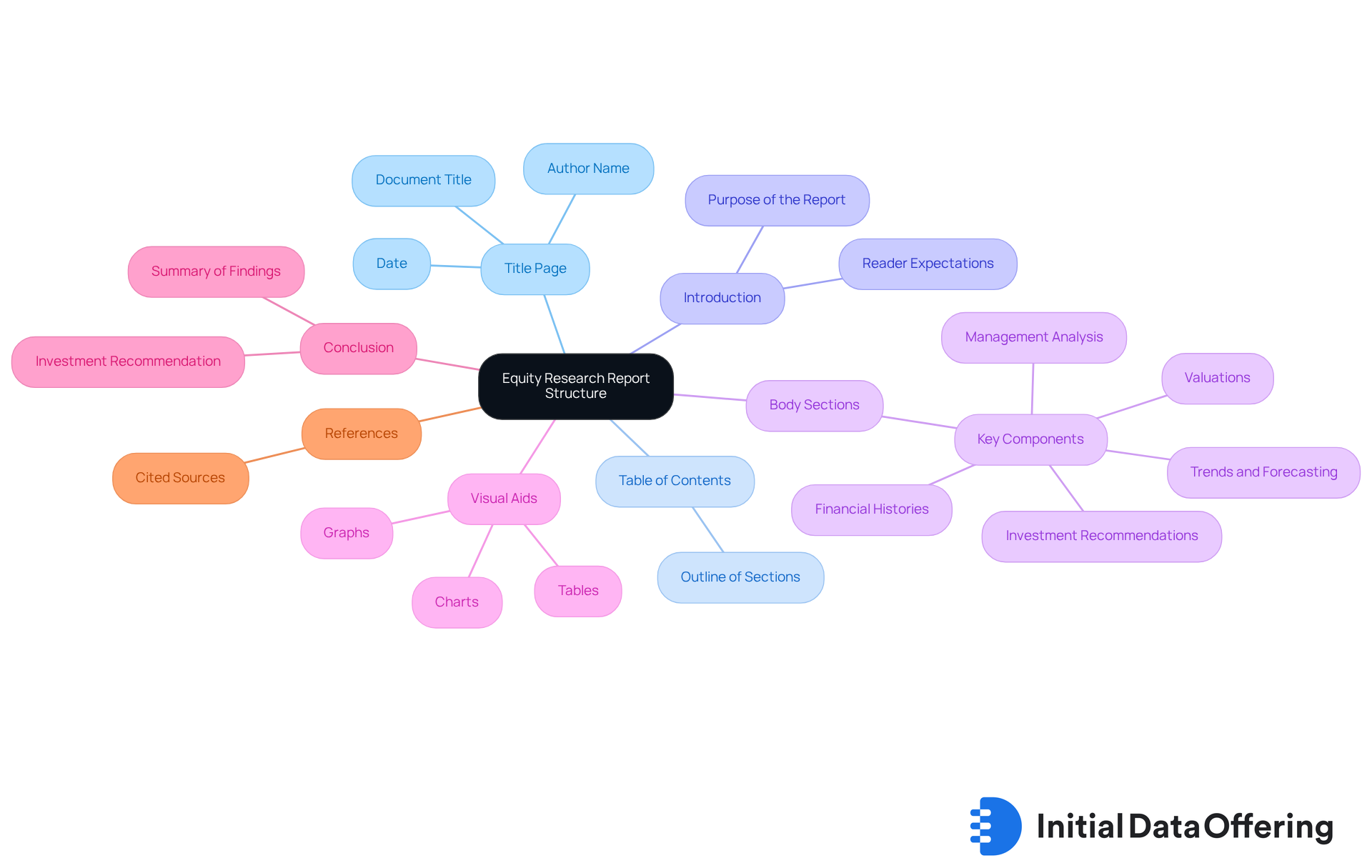

Structure Your Report for Clarity and Impact

To effectively structure your equity research report, consider the following layout:

- Title Page: This should include the document title, your name, and the date.

- Table of Contents: A clear outline of the document sections will facilitate easy navigation.

- Introduction: Briefly introduce the purpose of the report and what the reader can expect.

- Body Sections: Organize the body into clear sections based on the key components identified earlier. Use headings and subheadings to break up text and guide the reader.

- Visual Aids: Incorporate charts, graphs, and tables to illustrate key points and information. Visual aids enhance understanding and retention of information. As W. Edwards Deming noted, "Without data, you're just another person with an opinion," which underscores the necessity of empirical evidence in inquiry. Moreover, 95% of leading consulting firms depend on AlphaSense, highlighting the significance of efficient research tools in generating high-quality documents.

- Conclusion: Summarize the main findings and reiterate the investment recommendation.

- References: List all sources utilized in the document to lend credibility and allow readers to verify information.

Incorporating these elements not only enhances the clarity of your equity research report template but also increases its impact, making it a valuable tool for investment decision-making. Have you considered how neglecting visual aids might lead to misunderstandings and reduced retention of critical information? Thoughtful integration of these elements is essential.

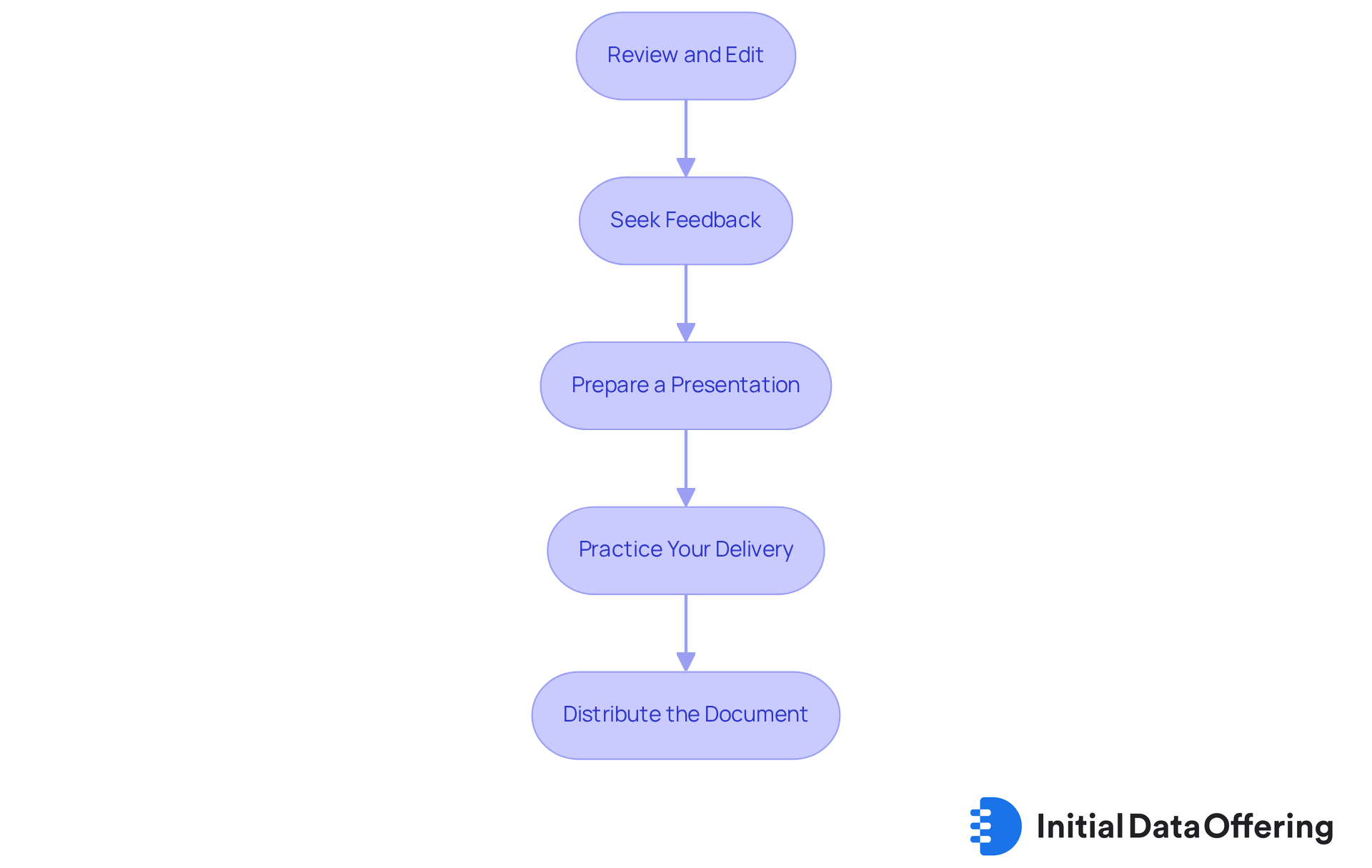

Finalize and Present Your Equity Research Report

To finalize and present your equity research report, follow these essential steps:

-

Review and Edit: Begin by carefully proofreading the document for grammatical errors, typos, and inconsistencies. This step is crucial as it ensures that all data is accurate and properly cited, which enhances the report's credibility.

-

Seek Feedback: If feasible, have a colleague examine the document to offer constructive criticism. Fresh eyes can catch errors you might have missed, ultimately improving the quality of your report.

-

Prepare a Presentation: Create a concise presentation summarizing the key findings and suggestions from the document. Use slides to highlight important data and visuals, making it easier for your audience to grasp the main points.

-

Practice Your Delivery: Rehearse your presentation to ensure you can communicate your findings clearly and confidently. Anticipate questions and prepare responses, which will help you engage effectively with your audience.

-

Distribute the Document: Finally, share the finalized document with stakeholders, ensuring it is accessible in both digital and print formats. Consider using an equity research report template to improve the report's appearance, making it more appealing and easier to navigate.

Conclusion

Creating an equity research report template is essential for empowering investors to make informed decisions. This process establishes a clear structure and incorporates vital components, allowing analysts to present a comprehensive view of an organization's financial health, market position, and potential risks. Such clarity not only enhances understanding but also boosts the report's effectiveness in guiding investment strategies.

The article outlines the critical elements of a robust equity research report, including:

- Executive summary

- Financial analysis

- Valuation methods

- Investment thesis

Gathering relevant data from reputable sources, conducting thorough industry analysis, and utilizing visual aids are emphasized as key practices. Each step in structuring and finalizing the report is crucial for ensuring that findings are communicated clearly and effectively.

Ultimately, the significance of a well-crafted equity research report cannot be overstated. It serves as a powerful tool for investors navigating a complex financial landscape. By following best practices and leveraging the insights provided, analysts can create reports that not only inform but also inspire confident investment decisions. Prioritizing clarity, accuracy, and thoroughness in this process maximizes the impact of the research conducted. How can you apply these insights to enhance your investment strategies?

Frequently Asked Questions

What are the key components of an equity research report?

The key components of an equity research report include the Executive Summary, Organization Overview, Financial Analysis, Valuation, Investment Thesis, Risks, and Appendices.

What is the purpose of the Executive Summary in an equity research report?

The Executive Summary provides a concise outline of the findings and suggestions, enabling investors to make informed decisions quickly.

What information is included in the Organization Overview section?

The Organization Overview includes background information about the business, such as its business model, market position, and key products or services.

What does the Financial Analysis section entail?

The Financial Analysis involves a detailed examination of the organization's financial statements, including income statements, balance sheets, and cash flow statements, to assess financial health and performance.

How does the depth of financial analysis benefit investors?

The depth of financial analysis equips investors with necessary insights to assess the organization's viability.

What is the purpose of the Valuation section in an equity research report?

The Valuation section assesses the entity's worth using various methods, such as Discounted Cash Flow (DCF) analysis or Comparable Entity Analysis, helping investors gauge potential returns.

What should be included in the Investment Thesis?

The Investment Thesis should include a clear recommendation from the analyst—whether to buy, sell, or hold—along with the rationale behind that recommendation.

Why is it important to identify Risks in an equity research report?

Identifying Risks is vital as it highlights potential hazards that could affect the organization's performance and the investment recommendation, providing a balanced perspective for investors.

What is the purpose of the Appendices in an equity research report?

The Appendices contain extra data or information that supports the analysis but is too detailed for the main body of the document, allowing for deeper insight without overwhelming the primary narrative.

How do successful equity analyses demonstrate the importance of these components?

Successful equity analyses, such as those for major companies like Microsoft, illustrate how these components work together to provide valuable insights and suggestions for investors.