Understanding Financial Planning for Business Owners: Key Insights

Understanding Financial Planning for Business Owners: Key Insights

Overview

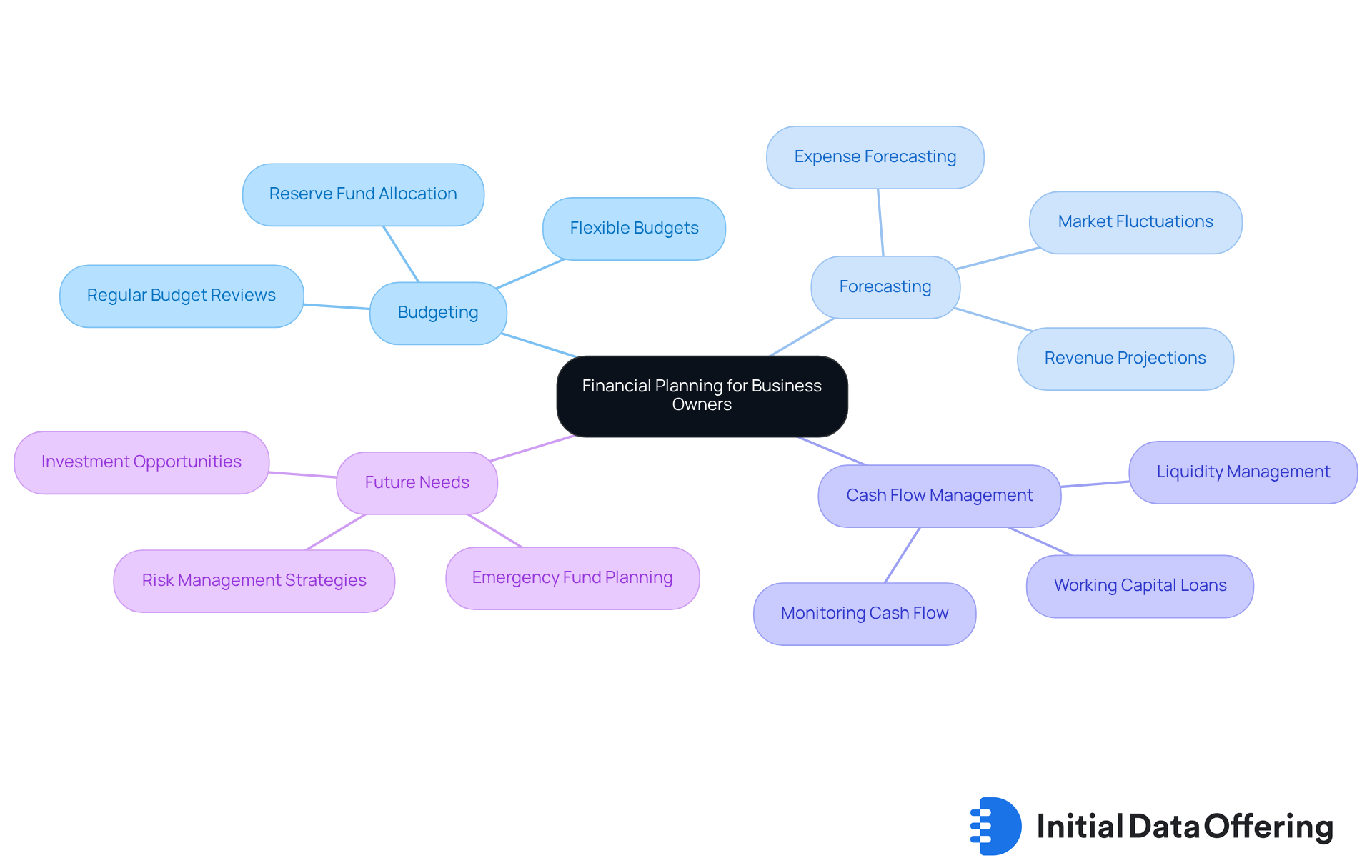

Financial planning for business owners is a strategic process that encompasses budgeting, cash flow management, forecasting, and risk assessment. These features are essential for achieving long-term organizational goals. Effective financial planning is not merely a task; it is a crucial component for navigating economic uncertainties and enhancing decision-making.

Consider the advantages of disciplined monetary practices. Case studies reveal that businesses that implement these practices tend to maintain stability and profitability, even in the face of challenges. This demonstrates the tangible benefits of having a robust financial strategy.

How can these insights apply to your own business? By prioritizing financial planning, you position your organization to respond effectively to economic fluctuations, ensuring sustained growth and resilience. In conclusion, adopting a disciplined approach to financial planning can significantly impact your business's long-term success.

Introduction

Financial planning serves as the backbone of successful entrepreneurship, providing a structured approach to managing resources and navigating the complexities of the business landscape. This process not only helps business owners anticipate future challenges but also allows them to seize growth opportunities that arise in an ever-evolving market. However, with rising costs and economic uncertainties looming, how can entrepreneurs ensure their financial strategies remain resilient and adaptable to change?

By engaging in effective financial planning, entrepreneurs can build a robust framework that supports their decision-making processes. This framework offers several advantages:

- It enhances resource allocation

- It minimizes risks

- It fosters sustainable growth

Ultimately, the benefit lies in a well-prepared business that can thrive amid uncertainties, positioning itself for long-term success.

Define Financial Planning for Business Owners

Financial planning for business owners acts as a strategic procedure, creating an extensive guide for managing funds to achieve organizational goals. This process is an essential aspect of financial planning for business owners, encompassing budgeting, forecasting revenues and expenses, managing cash flow, and preparing for future monetary needs. Unlike personal finance, which centers on individual objectives, corporate fiscal strategy must consider operational expenses, market fluctuations, and investment opportunities that directly influence sustainability and growth.

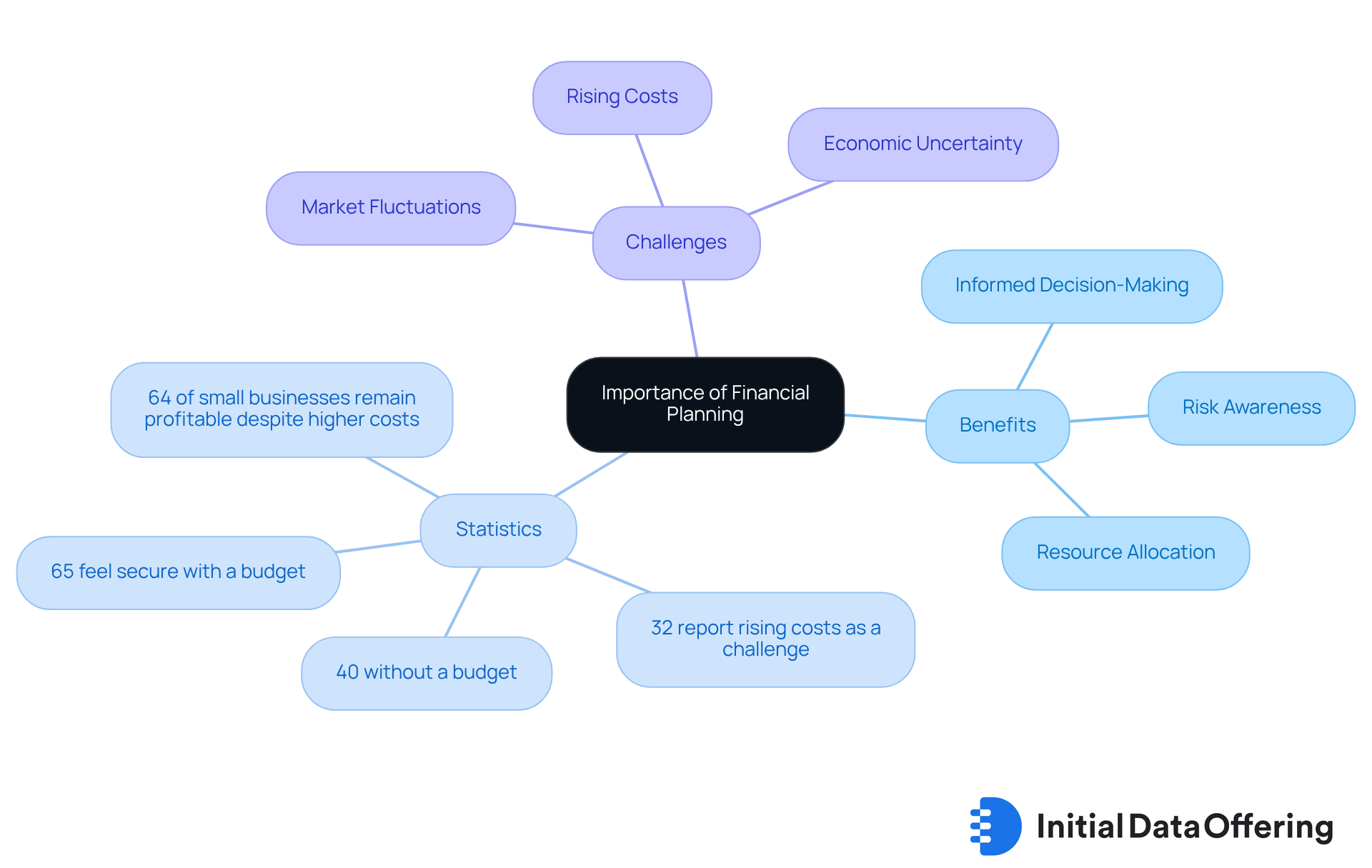

Why is effective monetary planning crucial? It empowers entrepreneurs to make informed decisions that align with long-term goals, ensuring efficient resource allocation and effective risk management. Companies that regularly evaluate and adjust their monetary strategies tend to maintain stability and enhance decision-making. Case studies reveal that proactive monetary management often leads to superior outcomes. In fact, 64% of small enterprises remain profitable despite rising operating expenses, underscoring the resilience of firms that implement effective monetary strategies.

Looking ahead to 2025, the importance of budget planning becomes increasingly evident as businesses navigate potential market shifts and economic uncertainties. Industry specialists emphasize that a well-organized monetary strategy not only fulfills legal obligations but also enhances a company's attractiveness to investors and lenders. By establishing clear and measurable economic goals, business owners can engage in financial planning for business owners to effectively monitor progress and adjust strategies, ultimately fostering resilience and growth in challenging market conditions.

Moreover, it is advisable for companies to allocate at least 10% of projected annual income to a reserve fund to prepare for unforeseen expenses. Additionally, adopting flexible budgets that can be modified monthly, rather than adhering to rigid year-long plans, significantly boosts economic adaptability.

Explain the Importance of Financial Planning

Economic planning, specifically financial planning for business owners, is crucial for entrepreneurs, serving as the foundation for informed monetary decision-making. It enables enterprises to foresee future cash flow needs, allocate resources effectively, and prepare for unexpected challenges. A thorough financial planning for business owners allows them to recognize potential risks and opportunities, aiding in necessary strategic adjustments. Additionally, it promotes responsibility and transparency within the organization, aligning all stakeholders with the entity's economic goals.

In a competitive market, particularly in 2025, enterprises that emphasize financial planning for business owners are not only better equipped to navigate economic uncertainties but also poised to seize growth opportunities. For instance, 65% of individuals with a documented budget report feeling secure economically, compared to just 40% of those without one. This statistic underscores the significance of organized financial planning for business owners. Furthermore, case studies, such as the one titled 'Conclusion on Business Resilience,' indicate that companies employing disciplined monetary practices can effectively manage cash flow and enhance resilience against market fluctuations.

Moreover, with 32% of entrepreneurs identifying rising costs as their primary challenge, financial planning for business owners becomes essential for incorporating budgeting into their operations and making strategic decisions that foster success and sustainability. As noted by a Staff Writer, 'Effective 2025 fiscal strategies for entrepreneurs are vital, particularly given the potential market and economic changes during an election year.' This highlights the need for entrepreneurs to adopt robust economic planning to thrive in an evolving landscape.

Outline Key Components of Financial Planning

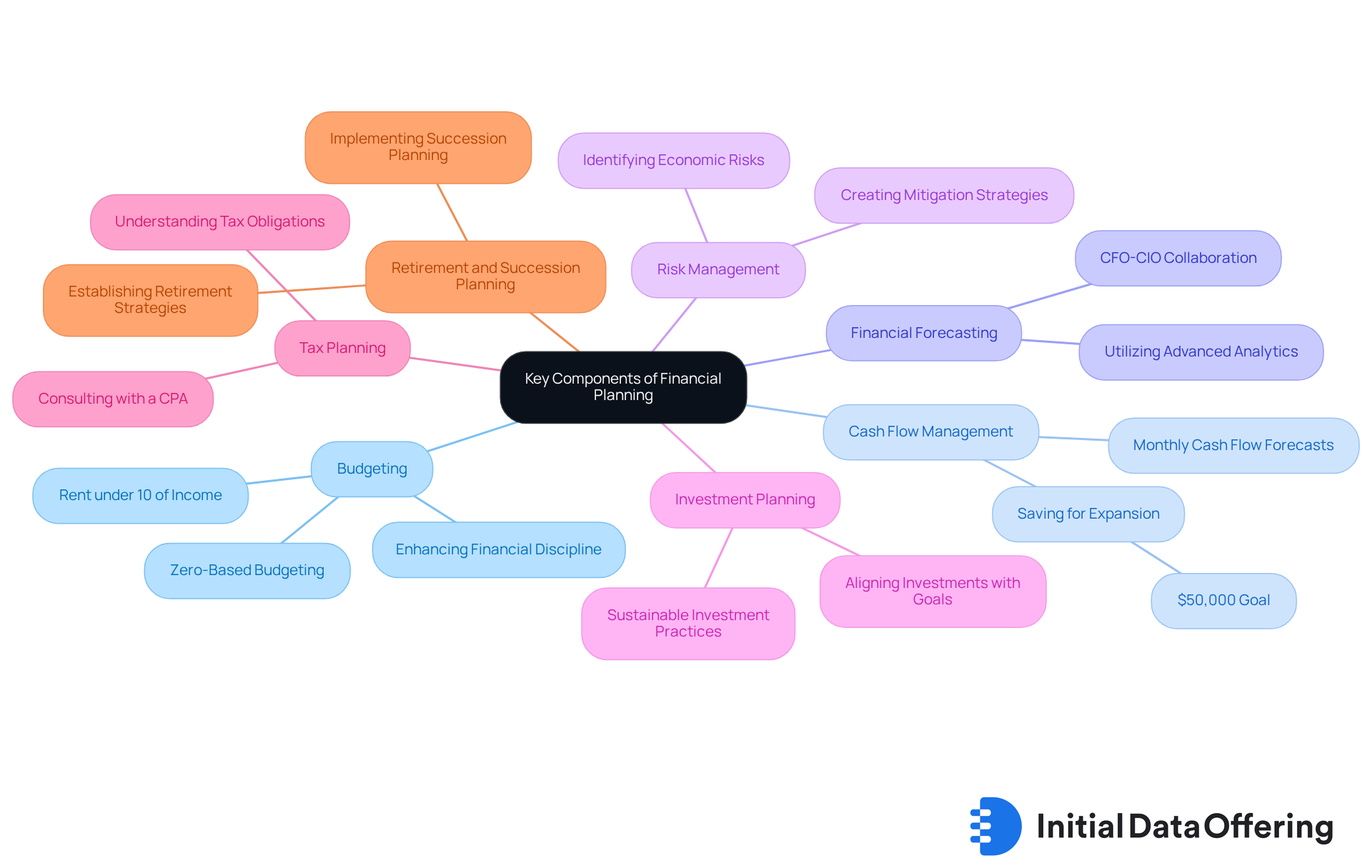

Key components of financial planning for business owners include:

-

Budgeting: Creating a budget is crucial for monitoring income and expenses, ensuring that the organization functions within its means. In 2025, adopting zero-based budgeting, which requires justification for each expense, can optimize costs without sacrificing performance. Furthermore, it is advisable that rent should generally be under 10% of income for retail enterprises, offering a useful standard for budgeting methods. This approach not only enhances financial discipline but also supports sustainable growth.

-

Cash Flow Management: Monitoring cash flow is vital for understanding liquidity and making timely decisions regarding expenditures and investments. Companies ought to develop monthly cash flow forecasts for a minimum of 12 months to improve economic stability. This proactive approach can also support goals such as saving $50,000 for expansion by the end of the fiscal year, ultimately enhancing financial resilience.

-

Financial Forecasting: Predicting future revenues and expenses allows businesses to plan for growth and prepare for potential downturns. Utilizing advanced analytics and AI-powered economic platforms can significantly enhance the precision of these forecasts. Organizations with strong CFO-CIO alignment are further along in their digital finance transformation, highlighting the significance of collaboration in budgeting. This collaborative effort can lead to more informed decision-making and strategic planning.

-

Risk Management: Identifying and mitigating economic risks, such as market volatility or unexpected expenses, is crucial for maintaining stability. Companies should regularly assess economic risks, including market, financing, and operational risks, and create strategies to tackle them proactively. By doing so, they can safeguard their assets and ensure long-term sustainability.

-

Investment Planning: Allocating resources to investments that align with business goals can drive growth and enhance profitability. Sustainable investment practices are increasingly important, as companies investing in renewable energy and carbon-neutral initiatives may find themselves positioned for growth, meeting stakeholder expectations and reducing long-term risks. This strategic alignment not only benefits the business but also contributes to broader societal goals.

-

Tax Planning: Understanding tax obligations and opportunities for deductions can significantly impact the bottom line. A well-designed tax plan can enhance liquidity and cash flow, making it a critical component of financial strategy. This highlights the importance of consulting with a CPA to ensure compliance and optimize tax benefits, ultimately improving financial health.

-

Retirement and Succession Planning: Preparing for the future by establishing retirement strategies for proprietors and implementing succession planning for leadership transitions ensures long-term sustainability. This proactive strategy assists companies in managing leadership transitions smoothly, securing their legacy and operational continuity.

By addressing these components, business owners can implement financial planning that creates a robust plan supporting their strategic objectives and enhances their ability to respond to changing market conditions.

Conclusion

Financial planning for business owners is a pivotal strategy that equips entrepreneurs with essential tools to manage their finances effectively and achieve organizational objectives. This comprehensive approach not only facilitates informed decision-making but also ensures that businesses can adapt and thrive in an ever-changing economic landscape.

Key insights into the importance of financial planning have been explored throughout this article. The necessity of budgeting and cash flow management, alongside the significance of forecasting and risk mitigation, highlights how each component plays a crucial role in fostering business resilience. The correlation between documented budgets and economic security underscores the tangible benefits that structured financial strategies can provide.

Ultimately, the message is clear: embracing financial planning is essential for any business owner aiming for long-term success. As the market continues to evolve, proactive financial strategies will safeguard against uncertainties and unlock new growth opportunities. Entrepreneurs are encouraged to prioritize financial planning as a fundamental element of their business strategy, ensuring they are well-prepared to navigate the challenges and opportunities that lie ahead.

Frequently Asked Questions

What is financial planning for business owners?

Financial planning for business owners is a strategic process that creates a comprehensive guide for managing funds to achieve organizational goals. It includes budgeting, forecasting revenues and expenses, managing cash flow, and preparing for future monetary needs.

How does financial planning for businesses differ from personal finance?

Unlike personal finance, which focuses on individual objectives, corporate fiscal strategy must consider operational expenses, market fluctuations, and investment opportunities that directly impact sustainability and growth.

Why is effective monetary planning crucial for business owners?

Effective monetary planning empowers entrepreneurs to make informed decisions that align with long-term goals, ensuring efficient resource allocation and effective risk management. It helps maintain stability and enhances decision-making.

What are the benefits of proactive monetary management for businesses?

Proactive monetary management often leads to superior outcomes, with case studies showing that 64% of small enterprises remain profitable despite rising operating expenses.

What should business owners focus on regarding budget planning for the future?

Business owners should focus on creating a well-organized monetary strategy that fulfills legal obligations and enhances attractiveness to investors and lenders, especially as they navigate potential market shifts and economic uncertainties.

How can business owners prepare for unforeseen expenses?

It is advisable for companies to allocate at least 10% of projected annual income to a reserve fund to prepare for unforeseen expenses.

What is the advantage of adopting flexible budgets?

Adopting flexible budgets that can be modified monthly, rather than adhering to rigid year-long plans, significantly boosts economic adaptability.