10 Key Strategies for Effective Equity Asset Management

10 Key Strategies for Effective Equity Asset Management

Overview

The article outlines ten key strategies for effective equity asset management, emphasizing the integration of unique datasets, market trend analysis, ESG data incorporation, alternative data utilization, and the critical importance of data accuracy and experienced teams. Each of these strategies presents distinct features that collectively enhance decision-making and enable proactive responses to market dynamics. Furthermore, they foster sustainable growth, positioning investment managers to achieve superior outcomes in a competitive landscape.

How can these strategies be leveraged in your own practice? By utilizing unique datasets, investment managers can gain insights that are not readily available through traditional means. This not only provides a competitive edge but also allows for more informed decision-making. Moreover, the incorporation of ESG data reflects a growing trend towards sustainability, which is increasingly important to investors today.

In conclusion, the integration of these strategies not only enhances the accuracy of data but also ensures that teams are equipped to navigate the complexities of the market. This holistic approach ultimately leads to improved performance and better investment outcomes.

Introduction

In the fast-paced world of equity asset management, staying ahead of the curve is not merely advantageous—it is essential. As investment strategies evolve, the integration of unique datasets, market trend analysis, and ESG factors has emerged as a cornerstone for informed decision-making. This article explores ten key strategies that empower asset managers to navigate the complexities of the market, enhance their investment approaches, and ultimately drive better financial outcomes.

What challenges might arise when implementing these strategies, and how can firms effectively address them to ensure long-term success? By examining these questions, we can better understand the practical implications of these strategies in the realm of equity asset management.

Initial Data Offering: Access Unique Datasets for Informed Equity Decisions

The Initial Data Offering (IDO) serves as a pivotal resource for equity asset management by providing access to a diverse array of distinctive datasets. These include alternative information, fundamental data, and ESG metrics. In 2024, a notable 67% of investment firms reported using alternative data, reflecting a significant increase from prior years and highlighting its growing relevance in equity asset management. By leveraging these datasets, investors can uncover deeper insights into industry trends and company performance. This facilitates informed decision-making, ultimately aiding in the identification of opportunities and the mitigation of risks.

The platform's unwavering commitment to quality ensures that users can depend on the accuracy and timeliness of the information. This reliability is crucial in the dynamic landscape of equity trading. As the demand for unique datasets continues to rise, IDO positions itself as an essential tool for equity asset management, enabling investment managers to refine their strategies and achieve superior outcomes. How might these datasets transform your investment approach? By integrating such insights, investment professionals can enhance their decision-making processes and drive better results.

Market Trends Analysis: Key to Successful Equity Asset Management

Examining financial trends is a crucial element of effective equity management. By monitoring economic indicators, sector performance, and investor sentiment, equity asset management enables asset managers to make proactive decisions that align with economic dynamics.

For instance, the S&P 500 yielded an average of 11.97% annually from 2010 to 2022, which underscores the significance of strategic allocation in a changing environment. Utilizing tools and methodologies to track these trends enables firms to identify emerging opportunities and potential risks.

How can understanding these trends inform your investment strategies? Importantly, Warren Buffett emphasizes that a downturn should be regarded as a chance to purchase shares in high-quality firms at advantageous prices. Comprehending changes in consumer preferences can inform financial strategies in sectors poised for expansion, ensuring that portfolios remain robust and lucrative.

This proactive approach not only enhances decision-making but also positions firms to capitalize on market dynamics effectively.

ESG Data Integration: Enhancing Equity Investment Strategies

Incorporating Environmental, Social, and Governance (ESG) data into equity asset management strategies is essential for aligning with contemporary investor values. Financial analysts emphasize that assessing companies based on their ESG performance allows equity asset management investment managers to identify firms that not only offer potential financial returns but also contribute positively to societal and environmental goals. This dual focus enhances portfolio resilience and attracts a growing demographic of socially conscious investors.

For example, companies like Patagonia, which donates a portion of sales to environmental causes, have effectively engaged consumers who prioritize sustainability, resulting in increased brand loyalty. Notably, 88% of consumers desire businesses to help them make a difference, highlighting the significance of ESG practices in drawing customers.

Furthermore, platforms such as IDO, which provide extensive ESG datasets, empower investors in equity asset management to make informed choices, ensuring their allocations reflect both ethical considerations and financial objectives. Projections indicate that ESG-focused institutional funding is expected to surge 84%, reaching US$33.9 trillion by 2026, with ESG-mandated assets potentially comprising half of all professionally managed funds. Additionally, 80% of investors now incorporate ESG factors into their decision-making, underscoring the growing trend of ESG integration in financial strategies.

As the landscape of ESG investing evolves, the importance of integrating ESG factors into equity asset management strategies cannot be overstated. However, challenges such as the lack of uniform reporting standards and issues related to information quality remain critical concerns that warrant attention.

Alternative Data Utilization: Gaining Competitive Edge in Equity Management

Integrating alternative information into equity asset management is revolutionizing capital placement strategies. This information includes diverse sources such as social media sentiment, satellite imagery, and web traffic analytics, which can reveal insights often overlooked by traditional financial metrics.

For example, by monitoring social media trends, asset managers can anticipate shifts in consumer behavior, allowing for timely adjustments to investment strategies.

The alternative information sector was valued at approximately USD 11.65 billion in 2024 and is projected to grow significantly, reaching USD 135.72 billion by 2030, with a compound annual growth rate of 63.4% from 2025 to 2030.

Companies that leverage these insights can gain a competitive edge, as evidenced by hedge fund operators who commanded a 68.0% revenue share in 2024. Notably, 67% of financial advisers surveyed are currently utilizing alternative information, reflecting broader industry acceptance.

Platforms like IDO are essential in providing access to these valuable datasets, empowering firms to remain competitive in a rapidly evolving market landscape.

Nevertheless, investment companies must also address challenges related to information quality and privacy issues to fully capitalize on the potential of alternative information.

Data Accuracy: Overcoming Challenges in Equity Asset Management

In equity asset management, data accuracy is paramount. Decisions based on flawed information can have dire consequences. Therefore, asset managers must implement strong information governance practices to ensure the integrity of their datasets. This includes:

- Regular audits

- Validation procedures

- The use of trustworthy information sources

By prioritizing information accuracy, firms engaged in equity asset management can enhance their decision-making processes and build trust with their stakeholders.

One effective solution is the Initial Data Offering, which provides a comprehensive dataset of long and short equity positioning and crowding information. This dataset is sourced from over 600 funds representing $700bn in GMV, significantly reducing the risks associated with inaccuracies. The dataset is refreshed daily and provided T+1, capturing information across 15,000 equities and offering historical insights dating back to February 2017. This makes it an invaluable resource for equity asset management, enabling managers to make informed decisions based on reliable data.

How can such a resource transform your investment strategies? By leveraging this exclusive dataset, portfolio managers can not only mitigate risks but also gain a competitive edge in the market. The insights derived from this information can lead to better investment outcomes and foster stronger relationships with stakeholders.

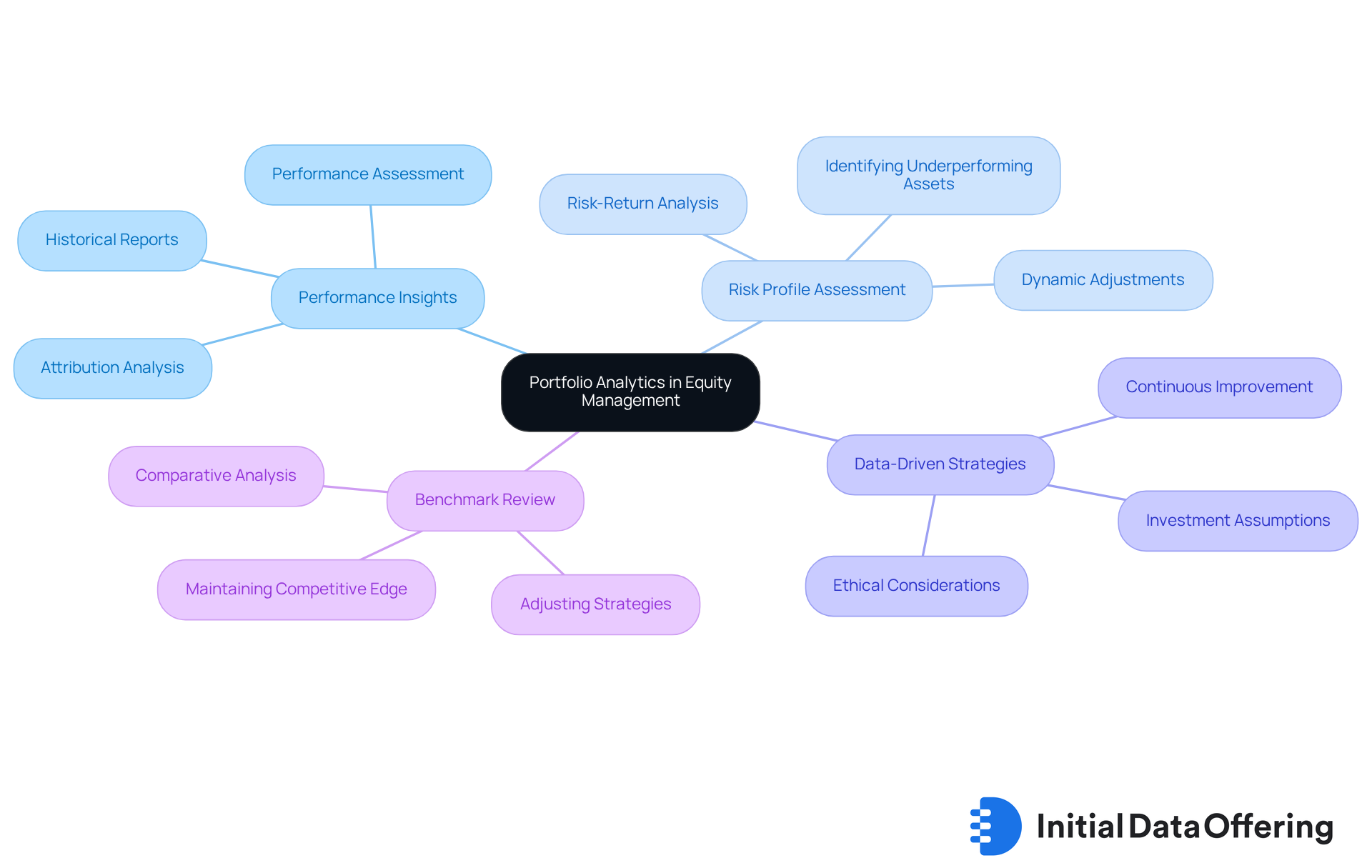

Portfolio Analytics: Essential for Effective Equity Management

Portfolio analytics serve as a fundamental feature for effective equity management, offering insights into the performance and risk profile of investments. By utilizing advanced analytics tools, portfolio managers can assess their holdings' exposure to various economic factors. This evaluation not only identifies areas for enhancement but also provides a significant advantage in making informed decisions.

The benefit of this analytical approach lies in its ability to facilitate data-driven strategies that enhance returns while effectively managing risk. Regularly reviewing portfolio performance against established benchmarks and adjusting strategies accordingly is essential for maintaining a competitive edge in the equity market.

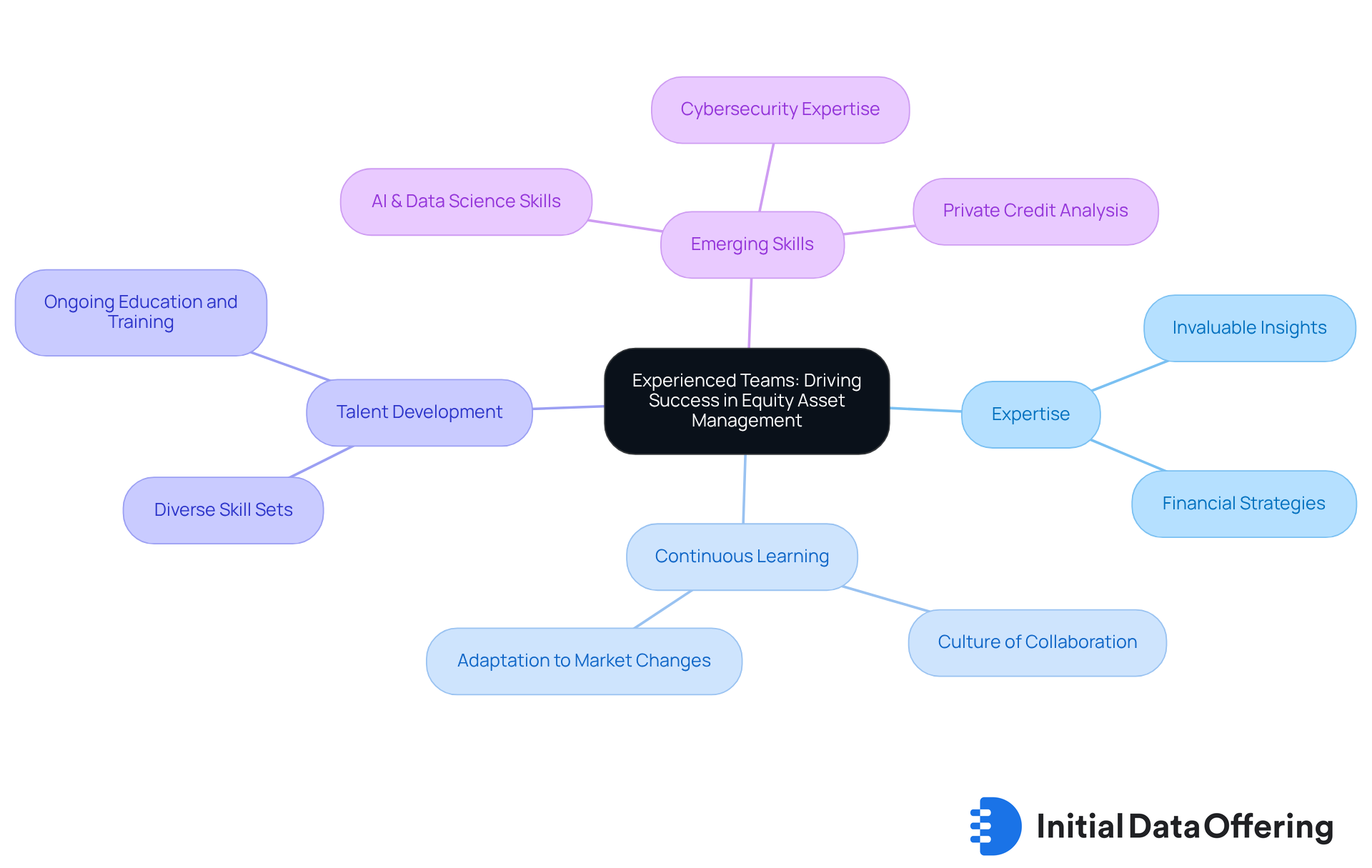

Experienced Teams: Driving Success in Equity Asset Management

The effectiveness of equity asset management is fundamentally connected to the expertise of the teams involved. Seasoned experts provide invaluable insights that influence financial strategies and enhance decision-making processes. To maintain a competitive edge, firms must cultivate a culture of continuous learning and collaboration. This ensures that teams are well-versed in the latest industry trends and best practices.

Investing in talent development not only enhances individual capabilities but also fosters diverse skill sets within teams, leading to innovative and effective investment strategies. For instance, firms that prioritize ongoing education and training create environments where professionals can thrive, adapt to market changes, and leverage emerging technologies.

How can your organization create such an environment? This commitment to continuous learning transforms potential into performance, ultimately driving success in the field of equity asset management. Furthermore, the increasing demand for skills in AI, machine learning, and data science underscores the necessity for finance professionals to remain at the forefront of technological progress.

As Peter Schutz wisely stated, "Hire character. Train skill," emphasizing the importance of character in talent acquisition. Additionally, the evolving landscape necessitates professionals experienced in private credit analysis and cybersecurity, ensuring firms are equipped to navigate the complexities of modern investment management.

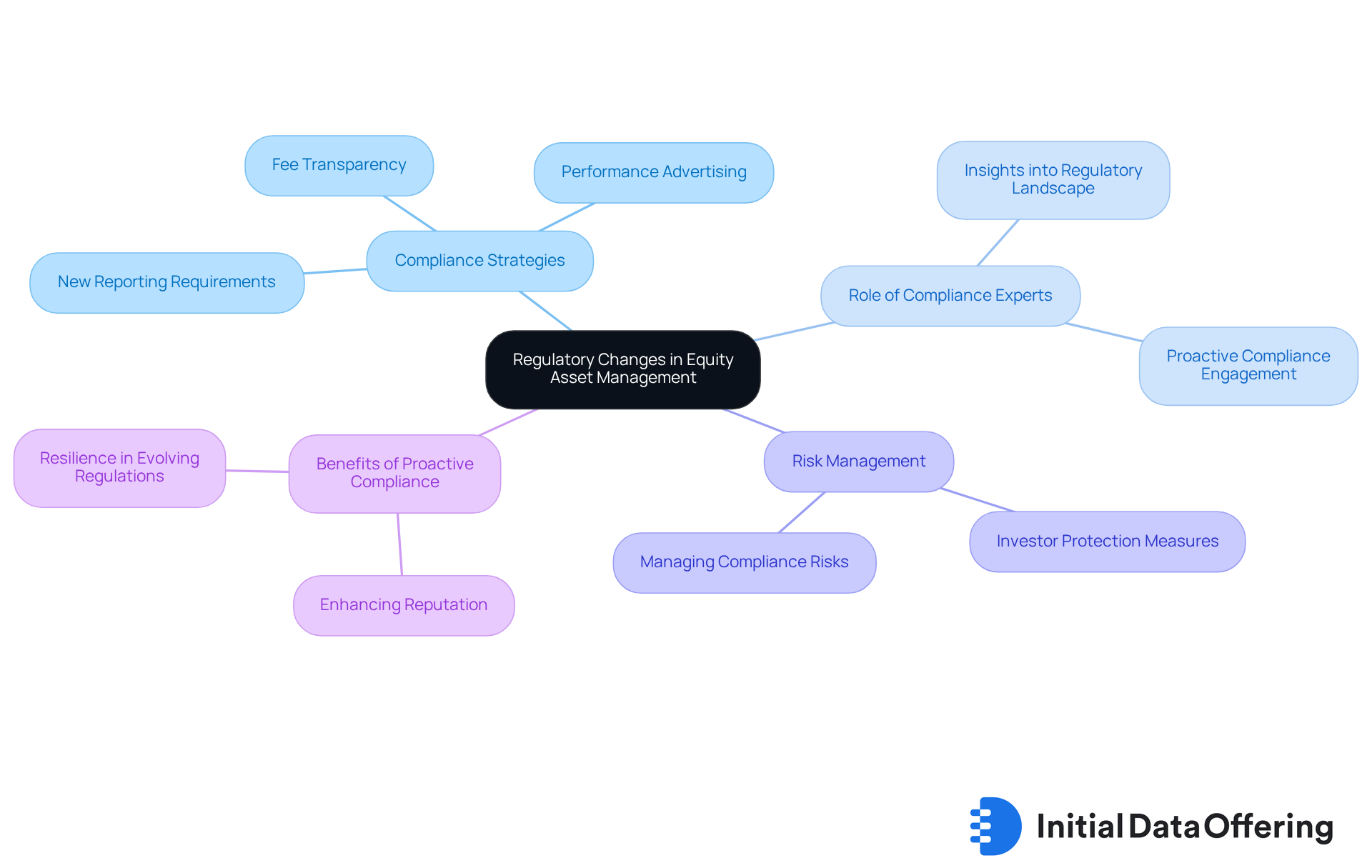

Regulatory Changes: Navigating Compliance in Equity Asset Management

Navigating regulatory changes is essential for effective equity management. As regulations evolve, those involved in equity asset management must remain vigilant and adapt their strategies to ensure compliance with new reporting requirements, risk management protocols, and investor protection measures.

Engaging with compliance experts is crucial, as they provide insights into the complexities of the regulatory landscape. Companies that proactively tackle compliance challenges not only reduce risks but also enhance their reputation in the industry.

For instance, firms that have successfully integrated compliance into their investment strategies demonstrate resilience in the face of evolving regulations. By emphasizing adherence, fund managers can effectively position themselves to capitalize on opportunities while safeguarding investor interests.

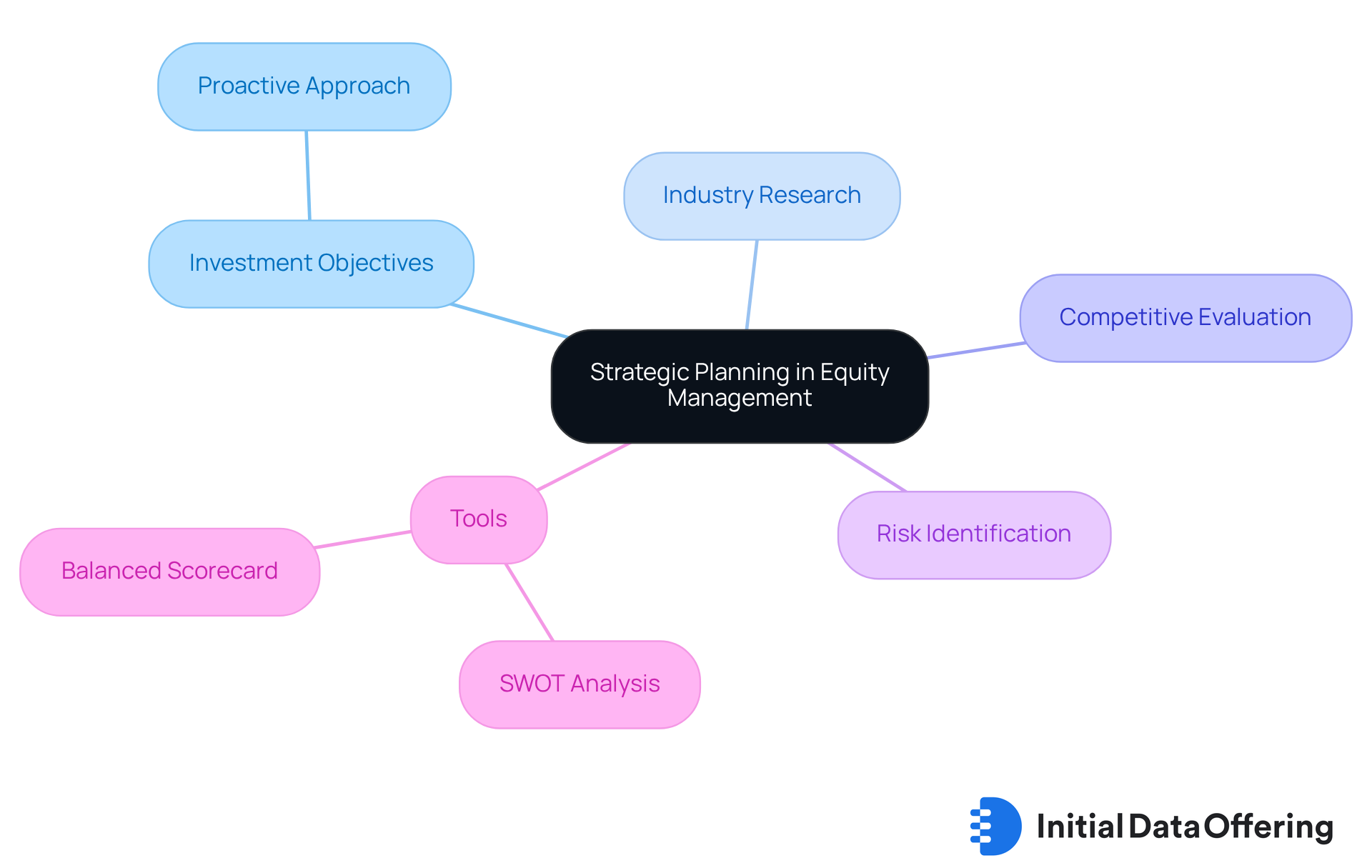

Strategic Planning: Key to Long-Term Success in Equity Management

Strategic planning is essential for achieving long-term success in equity asset management. By establishing clear investment objectives that align with economic opportunities, asset managers can effectively navigate market fluctuations and capitalize on emerging trends. This process begins with comprehensive industry research, an evaluation of the competitive landscape, and the identification of potential risks. For example, organizations that successfully harness the ability to implement new growth strategies can boost their profitability by 77%. This statistic underscores the importance of a proactive approach to strategic planning.

Regularly reviewing and refining strategic plans allows organizations to remain adaptable and responsive to evolving conditions, fostering sustainable growth and enhancing profitability. As the financial landscape becomes increasingly competitive, the ability to adapt and innovate through strategic planning in equity asset management emerges as a vital differentiator for portfolio managers. To further enhance their strategic efforts, firms can utilize tools such as:

- SWOT Analysis

- Balanced Scorecard

These instruments provide actionable insights, enabling companies to align their resources effectively and distinguish themselves in a challenging environment.

How can your organization leverage these strategic planning tools to gain a competitive edge? By integrating these practices, firms not only position themselves for success but also ensure they are prepared to meet future challenges head-on.

Continuous Learning: Adapting to Changes in Equity Asset Management

In the dynamic realm of equity asset management, continuous learning is crucial for adapting to market shifts and maintaining a competitive advantage. Asset managers must remain vigilant about industry trends, technological advancements, and changing investor preferences. This can be achieved through various avenues, such as:

- Ongoing education

- Participation in industry conferences

- Collaboration with thought leaders

By fostering a culture of education within their organizations, firms empower their teams to effectively utilize new insights and technologies, thereby enhancing their financial strategies and improving overall performance.

Organizations that prioritize continuous learning not only enhance employee engagement but also drive innovation, leading to better investment outcomes. As the equity asset management landscape evolves, those who embrace lifelong learning will be better positioned to navigate challenges and seize opportunities. However, implementing continuous learning can encounter challenges, such as resistance to change, which organizations must address to cultivate a truly effective learning environment.

Furthermore, leadership involvement in learning initiatives is crucial, as it fosters a culture of continuous improvement and ensures that employees feel supported in their development. Statistics show that 94% of employees indicated they would stay at a company longer if it invested in their career development. This underscores the importance of continuous learning for retention and engagement.

How can your organization leverage continuous learning to enhance both employee satisfaction and investment success?

Conclusion

Effective equity asset management relies on a multifaceted approach that integrates innovative strategies, robust data utilization, and a commitment to continuous improvement. By embracing key strategies such as leveraging unique datasets, analyzing market trends, and integrating ESG considerations, investment managers can enhance their decision-making processes and ultimately drive superior investment outcomes. The emphasis on data accuracy and the expertise of teams further solidifies the foundation for success in this competitive landscape.

Throughout the article, critical insights have been shared. These include:

- The transformative power of alternative data

- The necessity for strategic planning

- The importance of regulatory compliance

Collectively, these elements contribute to a comprehensive framework that empowers equity asset managers to navigate complexities, identify opportunities, and effectively mitigate risks. The growing significance of ESG factors and continuous learning reflects a shift in investor priorities and market dynamics, underscoring the need for adaptability in investment strategies.

In conclusion, the evolving landscape of equity asset management calls for a proactive mindset and a willingness to embrace change. Firms that prioritize these key strategies will not only position themselves for success but also enhance their resilience in the face of future challenges. By fostering a culture of continuous learning and leveraging advanced analytics, organizations can ensure they remain at the forefront of the industry, ready to seize emerging opportunities and drive sustainable growth.

Frequently Asked Questions

What is the Initial Data Offering (IDO)?

The Initial Data Offering (IDO) is a resource for equity asset management that provides access to a diverse range of unique datasets, including alternative information, fundamental data, and ESG metrics.

How prevalent is the use of alternative data among investment firms?

In 2024, 67% of investment firms reported using alternative data, indicating a significant increase from previous years and highlighting its growing importance in equity asset management.

How do the datasets provided by IDO benefit investors?

By leveraging these datasets, investors can gain deeper insights into industry trends and company performance, facilitating informed decision-making and helping to identify opportunities while mitigating risks.

What is the significance of market trends analysis in equity asset management?

Examining financial trends is crucial for effective equity management, allowing asset managers to make proactive decisions based on economic indicators, sector performance, and investor sentiment.

Can you provide an example of the S&P 500's performance?

The S&P 500 yielded an average of 11.97% annually from 2010 to 2022, highlighting the importance of strategic allocation in a changing market environment.

How does understanding market trends influence investment strategies?

Understanding market trends enables investment professionals to identify emerging opportunities and potential risks, allowing them to adjust their strategies accordingly.

Why is ESG data integration important in equity asset management?

Incorporating ESG data helps align investment strategies with contemporary investor values, allowing managers to identify companies that offer potential financial returns while also contributing positively to societal and environmental goals.

What are some examples of companies that effectively engage consumers through ESG practices?

Companies like Patagonia, which donates a portion of sales to environmental causes, have successfully engaged consumers who prioritize sustainability, resulting in increased brand loyalty.

What are the projections for ESG-focused institutional funding by 2026?

ESG-focused institutional funding is projected to surge 84%, reaching US$33.9 trillion by 2026, with ESG-mandated assets potentially comprising half of all professionally managed funds.

What challenges exist in integrating ESG factors into investment strategies?

Challenges include the lack of uniform reporting standards and issues related to information quality, which remain critical concerns in the evolving landscape of ESG investing.