Understanding the Financial Services Marketplace: Key Insights

Understanding the Financial Services Marketplace: Key Insights

Overview

The financial services marketplace is a complex economic sector that includes various entities such as banks, investment firms, and insurance companies. These institutions facilitate capital movement and liquidity, which are essential for economic functioning. The marketplace is evolving rapidly, driven by technological advancements and regulatory changes. These developments enhance accessibility and efficiency, ultimately benefiting consumers and businesses alike. Importantly, these institutions play a crucial role in driving economic stability and growth, underscoring their significance in the broader economic landscape.

Introduction

The financial services marketplace represents a dynamic ecosystem that is integral to the global economy, facilitating essential functions such as capital movement and risk management. This sector's evolution presents stakeholders with numerous opportunities to explore, especially as technological advancements continue to reshape traditional practices.

However, innovation introduces complexity. How can businesses effectively navigate this shifting landscape while maintaining consumer trust and adapting to regulatory changes? Understanding these intricacies is vital for anyone aiming to thrive in this ever-evolving environment.

By grasping the features and advantages of these developments, stakeholders can leverage the benefits they provide, ensuring their strategies align with the demands of the marketplace.

Define the Financial Services Marketplace

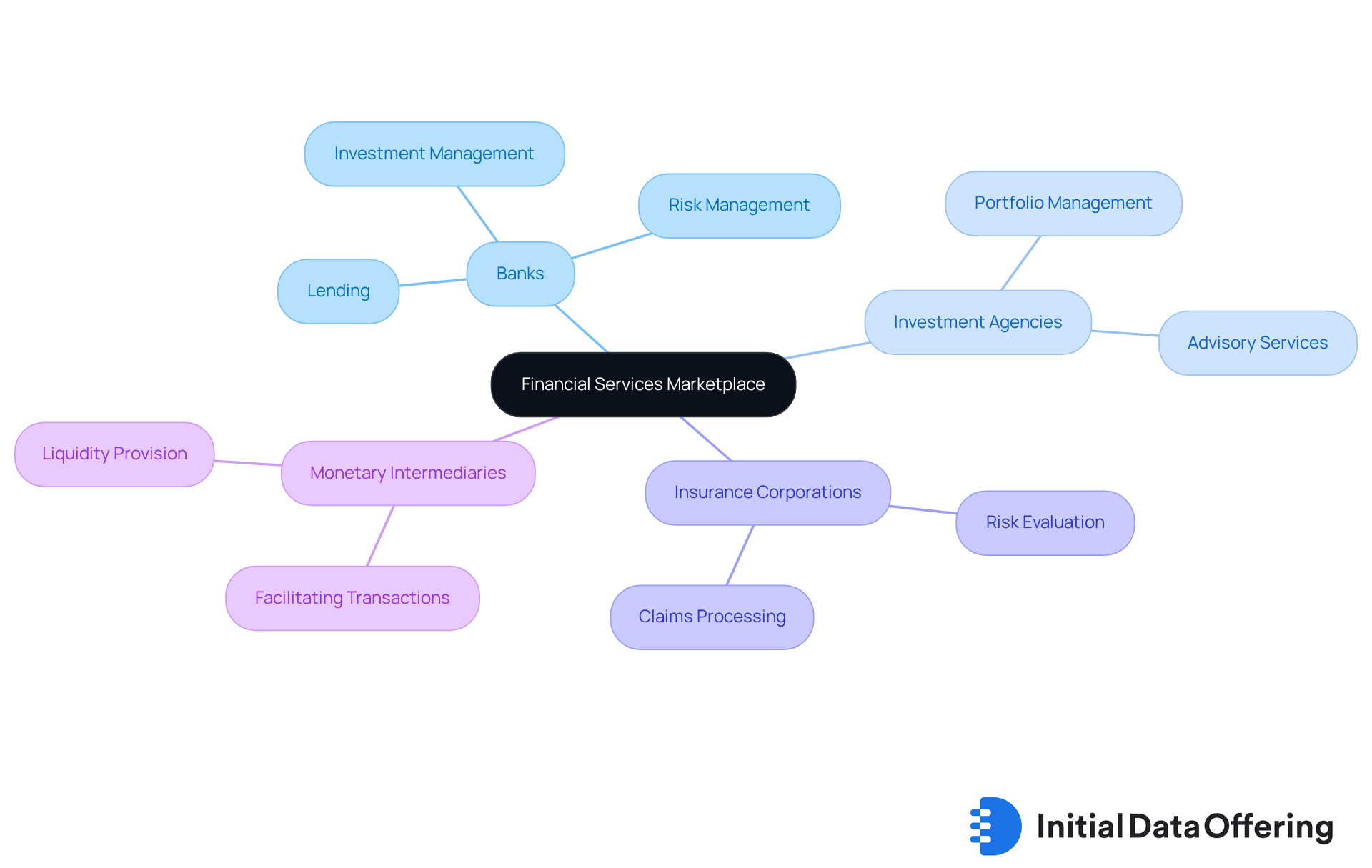

The economic sector represents a complex system comprised of various entities and offerings that facilitate capital movement and liquidity throughout the economy. Key features of this environment include:

- Banks

- Investment agencies

- Insurance corporations

- Monetary intermediaries

These entities provide essential functions such as lending, investment management, and risk evaluation. As we look towards 2025, the market is characterized by a substantial number of banking organizations, each contributing to the diverse options available to consumers and businesses alike.

Operational channels within the financial services marketplace range from traditional physical institutions to innovative online platforms, which have fundamentally transformed how economic offerings are delivered and consumed. These digital platforms enhance accessibility and efficiency in the financial services marketplace, allowing consumers to engage with monetary products and services in real-time. This shift has not only redefined customer expectations but also significantly improved their experiences.

Expert insights highlight the critical role that banks and investment firms play in this ecosystem. They serve not only as custodians of capital but also as key players in driving economic growth through strategic investments and effective risk management. Organizations that thrive in this sector are those that adapt to the evolving landscape, leveraging technology to meet consumer demands while maintaining a focus on value and quality. Understanding the dynamics of this environment is essential for stakeholders aiming to navigate its complexities and capitalize on emerging growth opportunities.

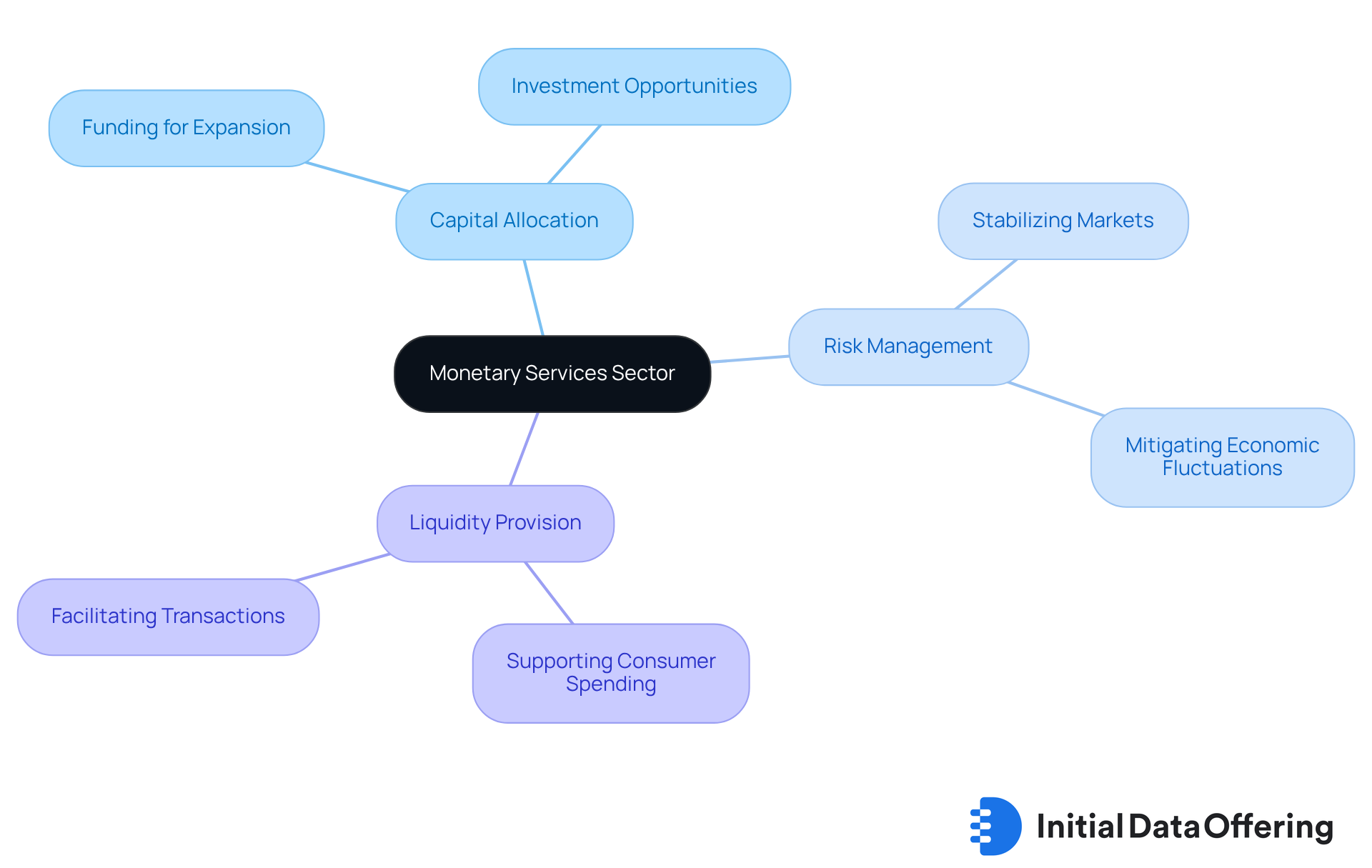

Contextualize Its Role in the Economy

The monetary services sector is pivotal in the economy, facilitating essential functions such as capital allocation, risk management, and liquidity provision. These features enable businesses to secure funding for expansion and support consumer spending through credit, while also offering investment opportunities for individuals and institutions. The advantages of a robust monetary marketplace are evident, particularly in sustaining economic stability by managing risks associated with monetary transactions and investments.

For instance, during economic recessions, strong monetary institutions provide critical assistance to stabilize markets and restore trust among investors and consumers. As Hendrith Vanlon Smith Jr. aptly states, 'Capital allocation is what makes all business processes possible,' underscoring the indispensable role of monetary systems in driving economic activity.

Furthermore, the case study titled 'Economic Well-Being and Control' illustrates how effective risk management by monetary institutions can mitigate the impacts of economic fluctuations. With consumer prices rising by 0.2% in 2023, the function of these institutions in stabilizing markets becomes increasingly vital, emphasizing their significance in navigating both prosperous and challenging periods.

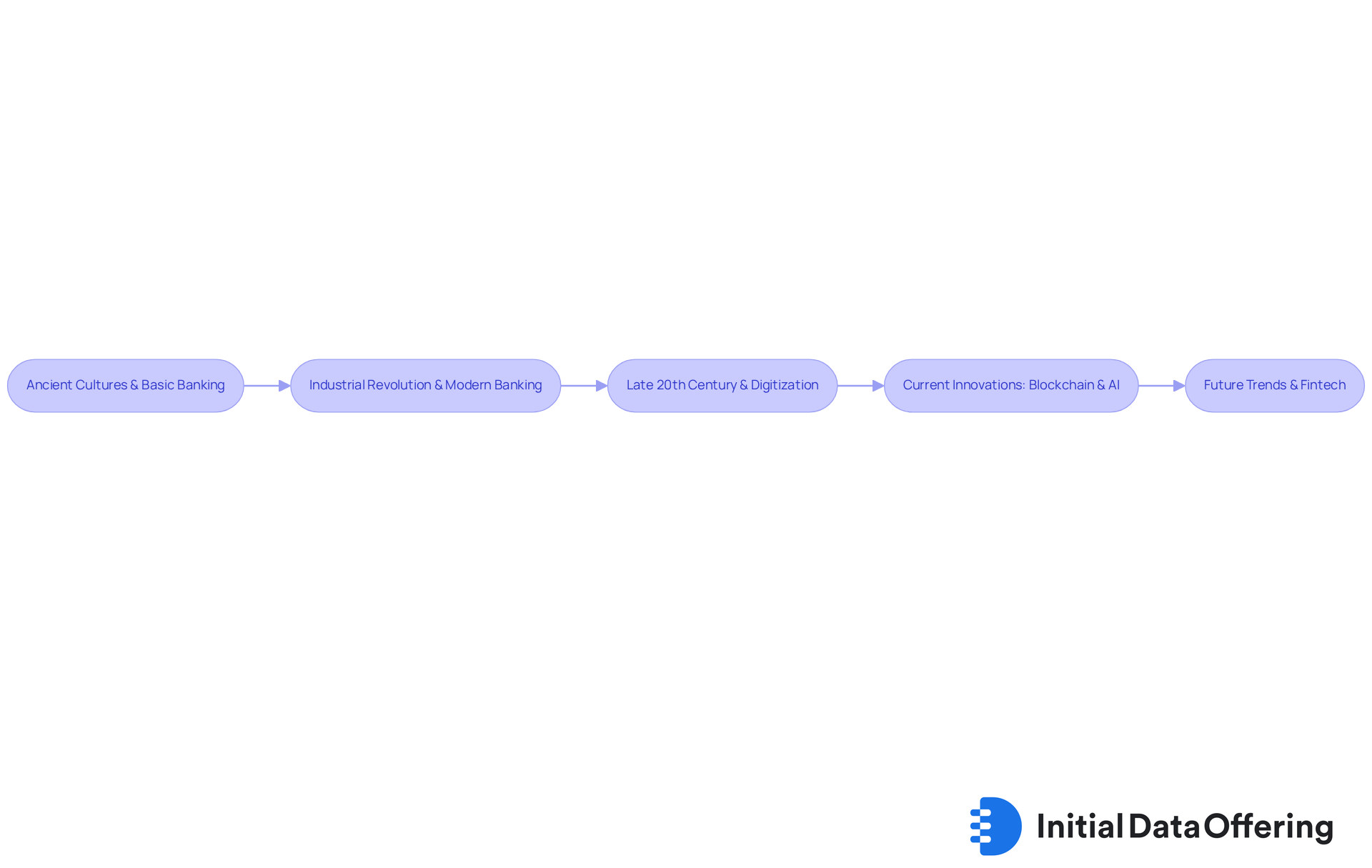

Trace the Evolution of the Marketplace

The development of the monetary marketplace can be traced back to ancient cultures, where basic forms of banking and lending emerged. Over centuries, this sector has undergone significant transformations, especially during the Industrial Revolution, which saw the rise of modern banking institutions. The late 20th century introduced technological progress, leading to the digitization of monetary systems and the emergence of fintech firms.

Today, the marketplace is characterized by rapid innovation, with trends such as blockchain technology, artificial intelligence, and regulatory changes continuously reshaping its landscape. For instance, the digital payments market is projected to reach $196.3 billion by 2029, growing at a CAGR of 9.4%. This statistic highlights the increasing reliance on digital transactions. Furthermore, the artificial intelligence solutions market is anticipated to expand to $184.34 billion by 2029, emphasizing the pivotal role of AI in transforming economic services.

The rise of peer-to-peer lending platforms has also opened new sources of capital for small businesses and individuals, illustrating fintech's transformative effects on traditional banking practices. As JP Nicols cautions, banks must enhance their offerings to contemporary techniques or risk becoming outdated. Moreover, the obstacles presented by regulatory adherence in the fintech environment are considerable, necessitating a robust strategy from institutions.

Understanding this evolution is crucial for stakeholders aiming to navigate future developments effectively. How can cultural reconciliation between fintech and traditional banks be achieved? This understanding becomes increasingly important as the landscape continues to evolve.

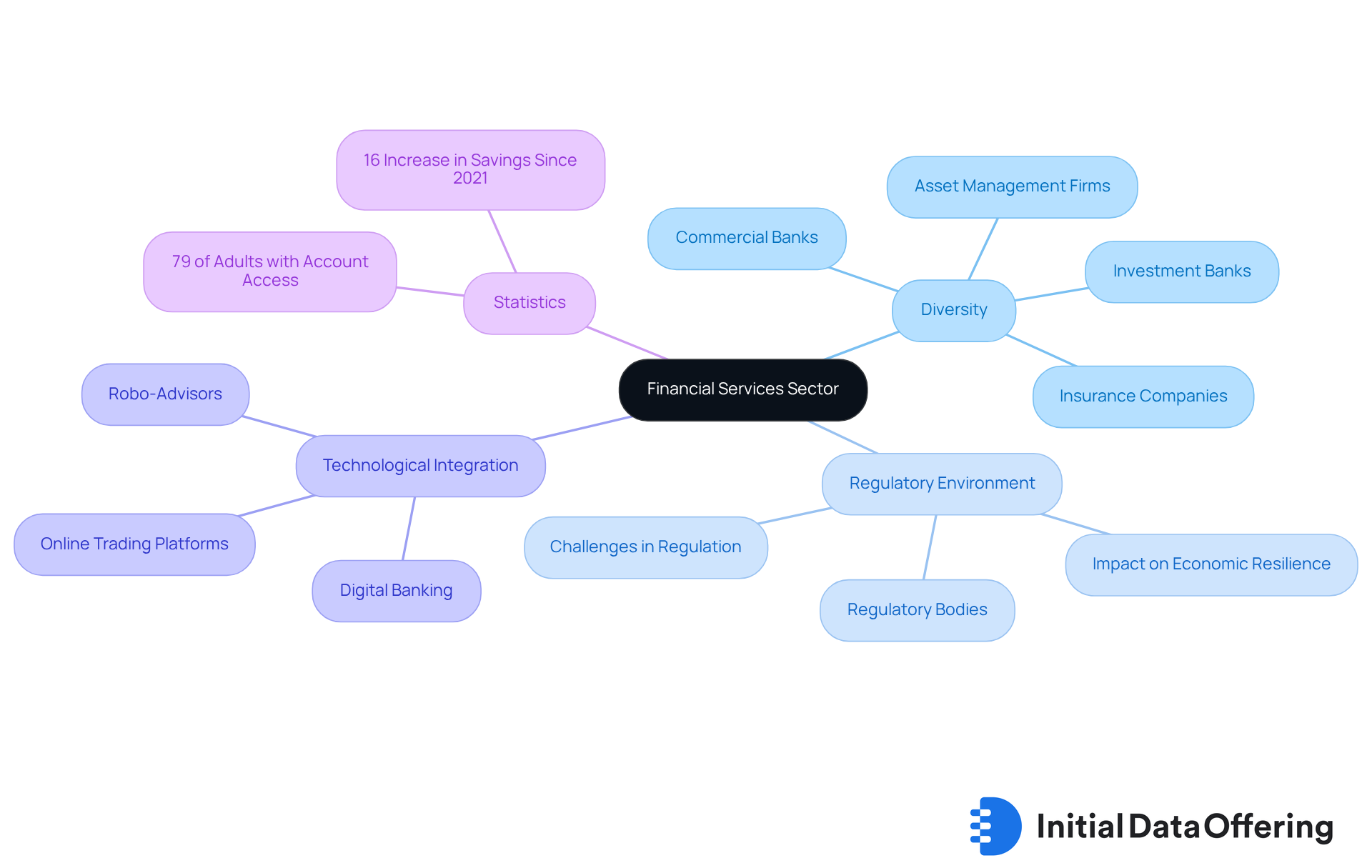

Identify Key Characteristics and Components

Key characteristics of the financial services sector encompass its diversity, regulatory environment, and technological integration. This marketplace comprises various components, including commercial banks, investment banks, insurance companies, and asset management firms, each serving distinct functions. Regulatory bodies play a crucial role in overseeing these institutions, ensuring stability and protecting consumers. Furthermore, the integration of technology has led to the emergence of digital banking, robo-advisors, and online trading platforms, significantly enhancing accessibility and efficiency.

In 2025, the regulatory environment is evolving, with an emphasis on improving economic resilience and addressing emerging risks. Recent statistics reveal that 79% of adults worldwide now have access to an account, reflecting the positive impact of regulatory efforts on economic inclusion. Additionally, there has been a notable 16-percentage-point increase in savings in accounts since 2021, illustrating encouraging trends in consumer behavior within the financial services sector.

Understanding these characteristics is vital for stakeholders seeking effective engagement within the marketplace. As regulatory bodies adapt to new challenges and technological advancements continue to reshape the landscape, staying informed about these dynamics will be essential for effective participation. The potential negative effects of regulatory changes on lending practices, as highlighted in the case study on capital requirements, underscore the necessity of a balanced regulatory approach. Moreover, the focus on non-financial risks, such as operational resilience and cybersecurity, will be crucial as the industry navigates the complexities of the evolving financial environment.

Conclusion

The financial services marketplace represents a dynamic and intricate system that plays a crucial role in the economy. It encompasses a variety of entities, including banks, investment firms, and insurance companies, all of which facilitate the movement of capital and liquidity. As the landscape evolves towards 2025, the integration of technology and the emergence of innovative platforms are redefining how financial products and services are accessed and utilized, enhancing overall consumer experience and expectations.

Key insights reveal the importance of this sector in:

- Capital allocation

- Risk management

- Liquidity provision

The historical evolution from ancient banking practices to the current digital age underscores the significance of adaptability in this marketplace. With rapid technological advancements, such as the rise of fintech and digital payments, stakeholders must remain vigilant and responsive to these changes to leverage emerging growth opportunities effectively. The regulatory environment is also pivotal, ensuring stability and consumer protection while fostering economic resilience.

Ultimately, understanding the complexities of the financial services marketplace is essential for all stakeholders. As this sector continues to transform, staying informed about trends and innovations will be vital for navigating its future. Engaging with these developments not only aids in effective participation but also highlights the marketplace's significant impact on economic growth and stability. Embracing these insights can empower individuals and organizations to make informed decisions that contribute to a more robust financial ecosystem.

Frequently Asked Questions

What is the financial services marketplace?

The financial services marketplace is an economic sector that includes various entities and offerings that facilitate capital movement and liquidity throughout the economy. Key players include banks, investment agencies, insurance corporations, and monetary intermediaries.

What functions do entities in the financial services marketplace provide?

Entities in this marketplace provide essential functions such as lending, investment management, and risk evaluation.

How is the financial services market expected to change by 2025?

By 2025, the financial services market is characterized by a substantial number of banking organizations, offering diverse options to consumers and businesses.

What are the operational channels in the financial services marketplace?

Operational channels range from traditional physical institutions to innovative online platforms, which have transformed how economic offerings are delivered and consumed.

How have digital platforms impacted the financial services marketplace?

Digital platforms enhance accessibility and efficiency, allowing consumers to engage with monetary products and services in real-time, thereby redefining customer expectations and improving their experiences.

What role do banks and investment firms play in the financial services ecosystem?

Banks and investment firms serve as custodians of capital and are key players in driving economic growth through strategic investments and effective risk management.

What characteristics do successful organizations in the financial services sector share?

Successful organizations adapt to the evolving landscape, leverage technology to meet consumer demands, and maintain a focus on value and quality.

Why is it important to understand the dynamics of the financial services marketplace?

Understanding the dynamics is essential for stakeholders aiming to navigate its complexities and capitalize on emerging growth opportunities.