Understanding Stock History: Definition, Context, and Key Features

Understanding Stock History: Definition, Context, and Key Features

Overview

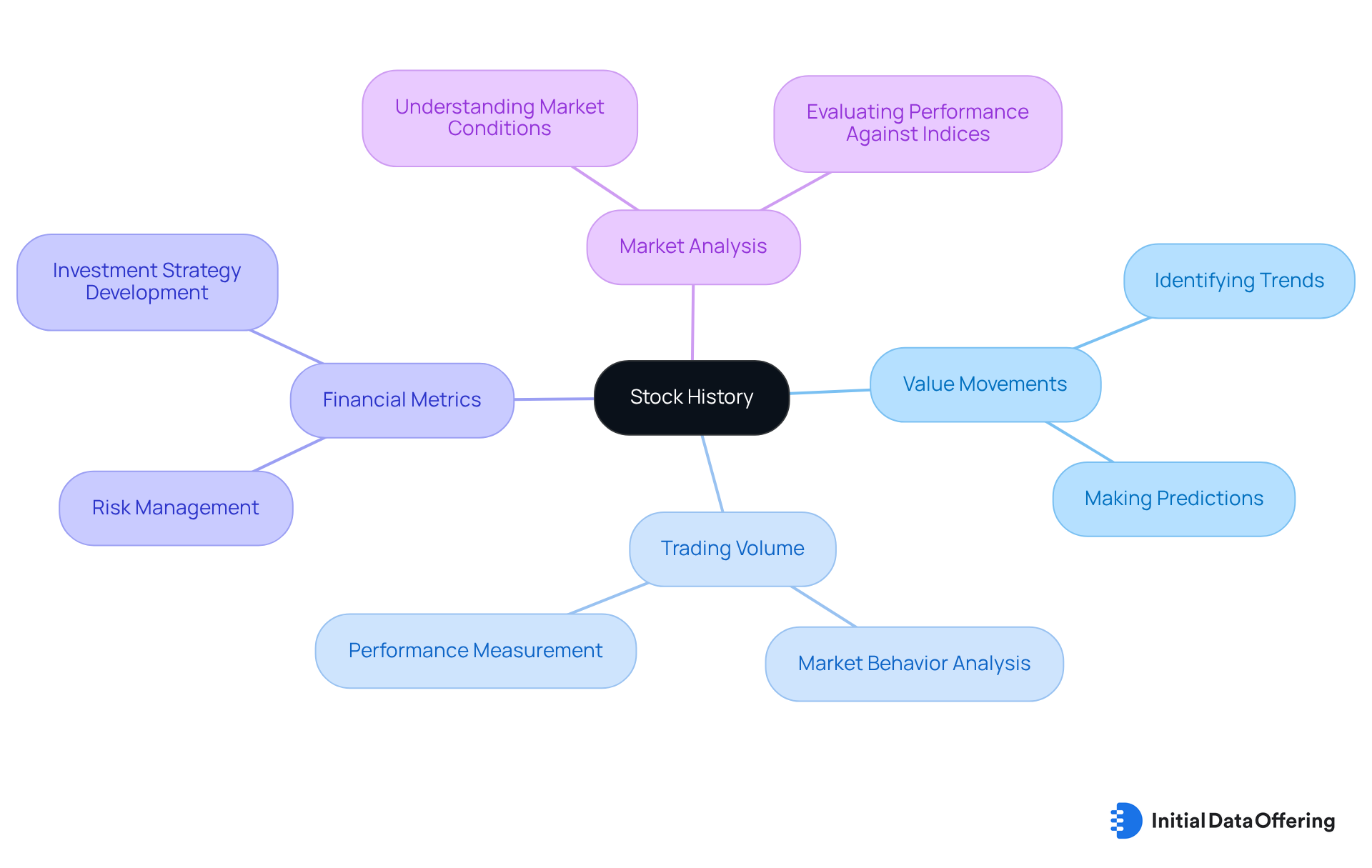

The article defines stock history as the chronological record of an asset's value movements, trading volume, and other financial metrics. These elements serve as essential tools for market analysis and informed investment decisions. By analyzing past data, investors can:

- Identify trends

- Assess performance against market indices

- Develop robust strategies

This underscores the critical role of historical data in navigating complex financial environments.

How might understanding stock history influence your investment choices? By leveraging this knowledge, investors can make more strategic decisions, ultimately enhancing their portfolio performance.

Introduction

Stock history serves as a vital compass for investors navigating the often-turbulent waters of financial markets. By examining the past movements and trends of stock prices, traders and analysts can uncover insights that inform their future investment strategies. Yet, with the vast amount of historical data available, how can one effectively harness this information to make sound decisions? Understanding the definition, context, and key features of stock history is essential for anyone looking to enhance their market analysis and investment performance.

The features of stock history include detailed records of price movements, trading volumes, and market trends over time. These datasets provide advantages such as identifying patterns that may predict future performance. The benefits are clear: informed decision-making can lead to improved investment outcomes. By leveraging historical data, investors can better understand market dynamics and refine their strategies accordingly.

In conclusion, stock history is not just a record of past events; it is a powerful tool that, when utilized effectively, can significantly enhance one's investment approach. As you consider your own investment strategies, reflect on how the insights derived from stock history can inform your decisions and ultimately lead to greater success in the financial markets.

Define Stock History and Its Role in Market Analysis

Stock history encompasses the chronological record of an asset's value movements, trading volume, and other pertinent financial metrics over time. This dataset is crucial for evaluation, as it enables investors and analysts to effectively assess stock history. By identifying trends, they can make informed predictions about future price movements.

How can analyzing past data benefit your investment decisions? Through this analysis, market participants can gauge the stock history of an equity, understand its behavior in various market conditions, and measure its overall performance against market indices. This historical perspective is essential for developing robust investment strategies and effective risk management practices.

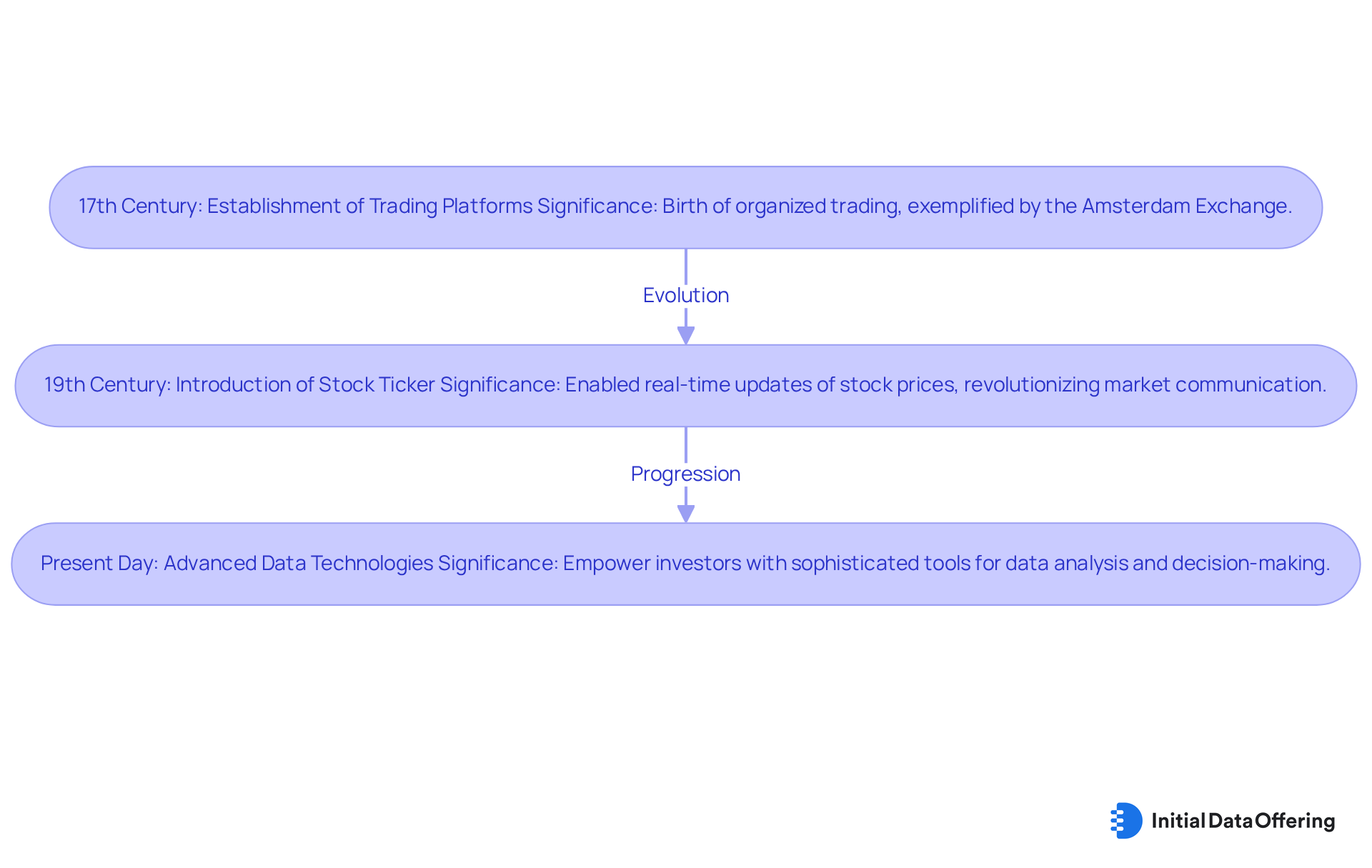

Explore the Historical Context and Evolution of Stock History

The concept of share history has its roots in the establishment of trading platforms during the 17th century, notably exemplified by the Amsterdam Exchange, one of the earliest. Over the centuries, the methods for documenting and evaluating market values have evolved significantly. Initially, equity values were communicated through handwritten records and public announcements. The advent of the stock ticker in the 19th century marked a pivotal change, enabling real-time updates of stock price information. Today, cutting-edge technologies empower the collection and analysis of vast historical data, such as stock history, providing investors with sophisticated tools for analysis. This progression not only underscores the increasing complexity of financial environments but also highlights the essential role of data-driven decision-making in contemporary investing.

Identify Key Characteristics and Components of Stock History

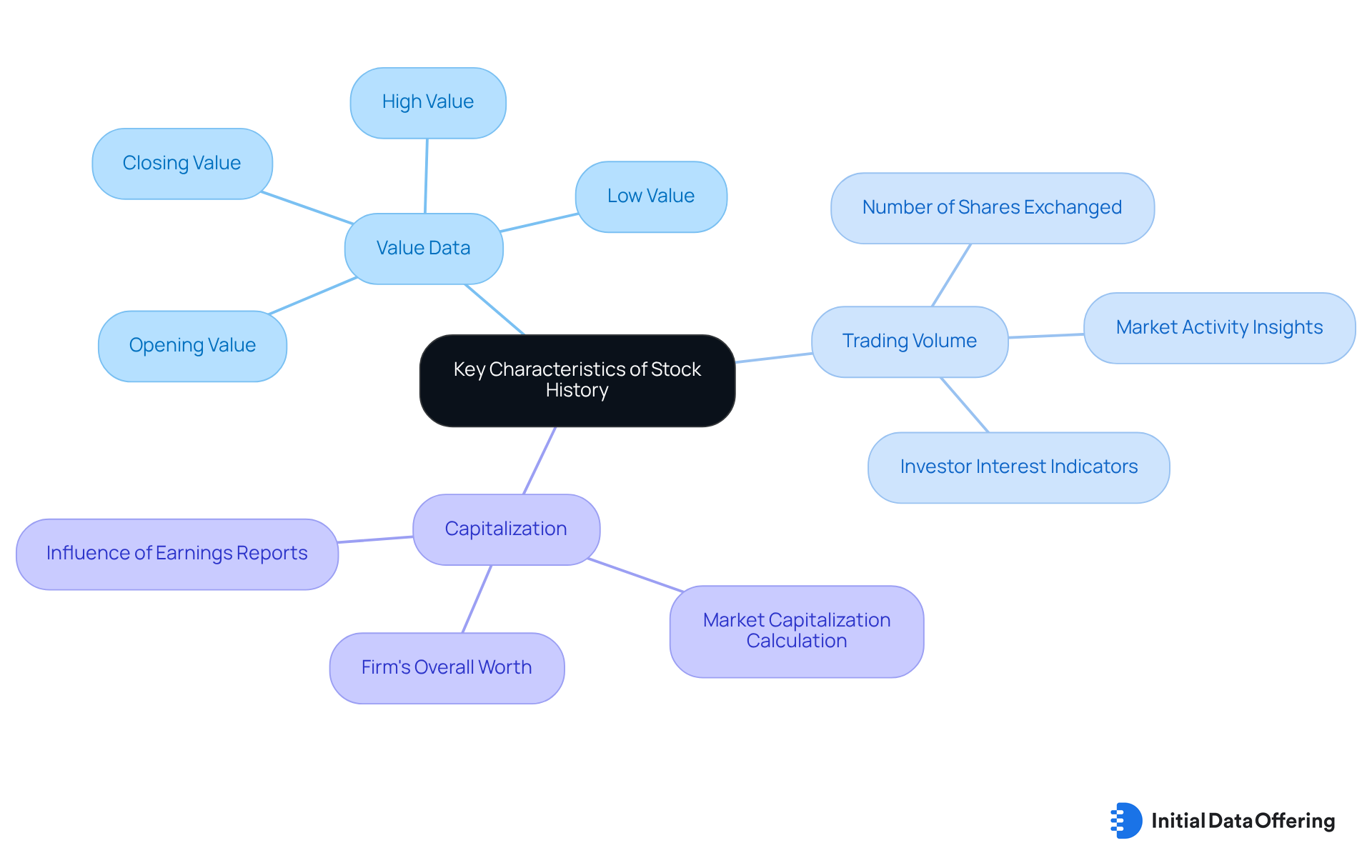

Essential features of share history encompass value data, trading volume, and capitalization. The cost information includes the opening, closing, high, and low values of a share over a specified duration, serving as a foundation for analysis. Trading volume, which indicates the number of shares exchanged, provides insights into market activity and liquidity, revealing investor interest and potential fluctuations. Capitalization, calculated by multiplying the share value by the total number of outstanding shares, reflects the firm's overall worth in the industry and is crucial for evaluating its scale and stability.

Approaching the analysis of stock history through various time frames—daily, weekly, or monthly—enables analysts to identify both short-term trends and long-term patterns. For instance, a notable rise in trading volume often precedes price changes, suggesting heightened investor interest or significant economic events. This relationship highlights the importance of trading volume in making informed investment decisions.

Recent trends demonstrate that leading firms experience variations in capitalization, influenced by factors such as earnings reports and investor sentiment. Analysts emphasize that understanding trading volume and capitalization is essential for assessing security performance. As noted by industry specialists, "Trading volume is a crucial indicator of strength; without it, price movements can be deceptive." Furthermore, studies indicate that the likelihood of incurring losses in investments over a decade is approximately 10%, underscoring the significance of these metrics in financial decision-making. This reinforces the necessity of incorporating these elements into a comprehensive market analysis framework, ultimately guiding investors toward more strategic choices.

Discuss the Implications of Stock History for Market Research Analysts

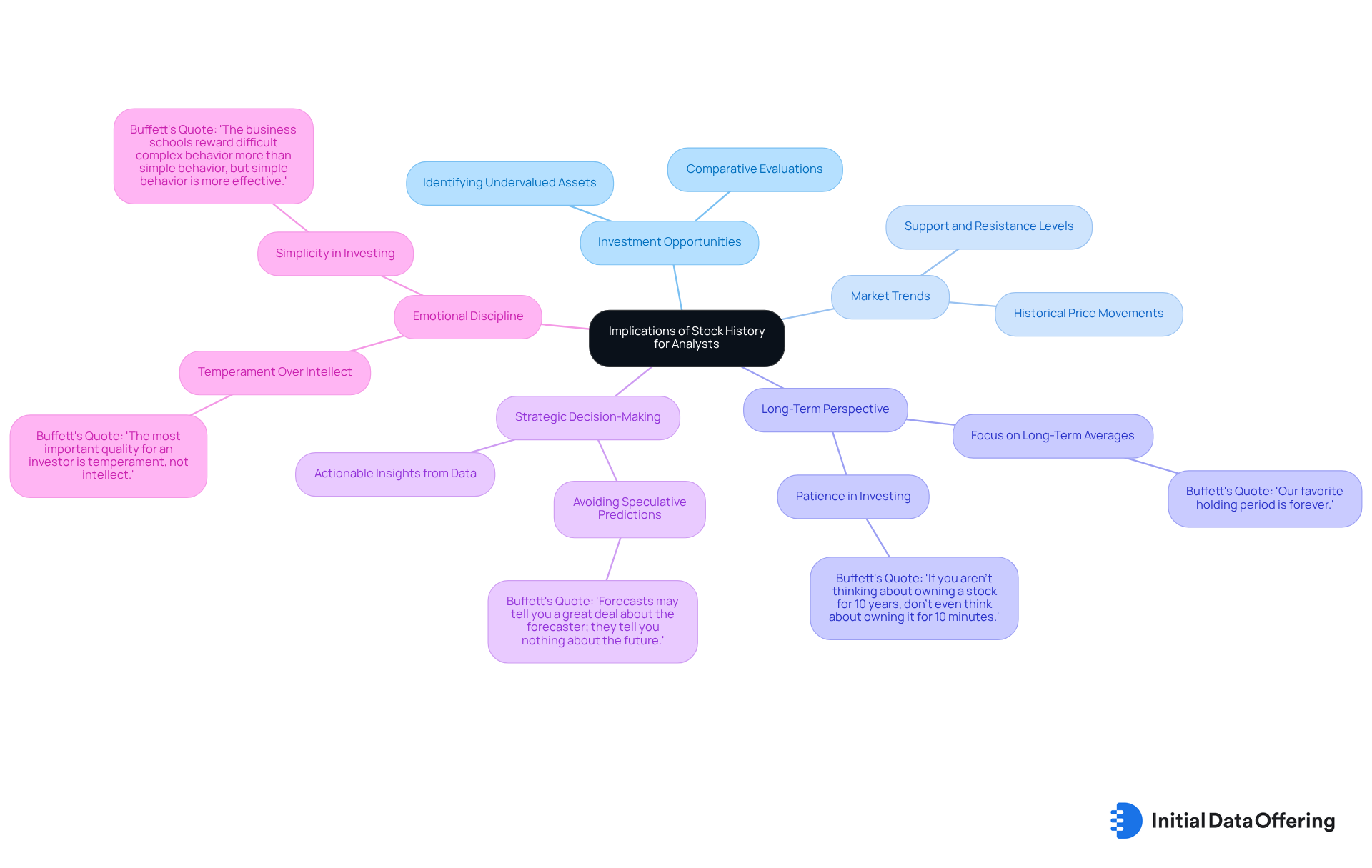

For market research analysts, stock history serves as an invaluable resource for assessing investment opportunities and identifying market trends. By scrutinizing past price movements, analysts can uncover patterns that may signal future performance, including critical support and resistance levels. This historical perspective, particularly stock history, enables comparative evaluations across different equities or sectors, aiding in the recognition of undervalued or overvalued assets.

The implications of stock history extend beyond individual shares; it plays a crucial role in broader evaluations, allowing analysts to assess macroeconomic trends and shifts in investor sentiment. Warren Buffett emphasizes the importance of focusing on long-term averages rather than short-term fluctuations, suggesting that a patient investment approach can yield significant insights. He additionally observes that "the equity market is intended to shift funds from the active to the patient," underscoring the importance of patience in investment strategies informed by past data.

Moreover, leveraging stock history empowers analysts to provide actionable insights that inform strategic decision-making for both companies and investors. Buffett's viewpoint that 'forecasts may reveal much about the forecaster; they provide no insight into the future' highlights the significance of relying on historical data rather than speculative predictions. By understanding how stock history correlates with current economic conditions, analysts can better anticipate potential outcomes and effectively direct investment strategies. Ultimately, the thoughtful application of stock history not only enhances investment performance metrics but also fosters a deeper understanding of market dynamics, aligning with Buffett's belief that investing is more about emotional discipline than raw intelligence.

Conclusion

Understanding the intricacies of stock history is essential for both investors and analysts alike, as it provides a comprehensive view of an asset's past performance. By examining historical data, market participants can glean insights that inform their investment strategies, enabling them to anticipate future price movements and navigate the complexities of the financial landscape. What if you could leverage the lessons of the past to enhance your investment decisions?

Throughout this article, key aspects of stock history have been explored, including its definition, historical evolution, and critical components. From the foundational role of price movements and trading volume to the implications for market research, stock history serves as a vital tool for making informed investment decisions. The evolution of trading practices, highlighted by advancements in technology, underscores the importance of data-driven analysis in modern investing. Therefore, understanding these elements is not just beneficial; it is imperative for success in today’s market.

Ultimately, embracing the lessons of stock history can significantly enhance investment performance and market understanding. By applying historical insights to current market conditions, investors can cultivate a disciplined approach that prioritizes long-term value over short-term speculation. Engaging with stock history not only empowers individuals to make strategic decisions but also fosters a deeper appreciation for the dynamics that shape financial markets. Are you ready to incorporate these insights into your investment strategy?

Frequently Asked Questions

What is stock history?

Stock history is the chronological record of an asset's value movements, trading volume, and other relevant financial metrics over time.

Why is stock history important for market analysis?

Stock history is crucial for evaluation as it allows investors and analysts to assess trends, make informed predictions about future price movements, and understand the behavior of a stock in various market conditions.

How can analyzing past data benefit investment decisions?

Analyzing past data helps market participants gauge a stock's history, measure its performance against market indices, and develop robust investment strategies and effective risk management practices.