Understanding Fundamental Data: Definition, Importance, and Key Traits

Understanding Fundamental Data: Definition, Importance, and Key Traits

Overview

The article defines fundamental data as both quantitative and qualitative insights that reflect a company's financial health and market position. This data encompasses key metrics such as earnings, revenue, and expenses. Understanding these core elements is crucial for strategic decision-making in businesses and investments.

How can this data influence your choices? By grasping the significance of fundamental data, companies can make informed decisions that enhance their competitive positioning and adapt to market dynamics. Ultimately, leveraging these insights allows businesses to navigate complexities in the market effectively.

Introduction

Understanding the nuances of fundamental data is essential for navigating the complex world of market research. This critical information encompasses both quantitative and qualitative elements, serving as a cornerstone for evaluating a company's financial health and strategic positioning. By effectively utilizing fundamental data, organizations can enhance their decision-making processes, which is pivotal for achieving a competitive advantage. As businesses strive to stay ahead, a pressing question arises: how can they ensure they are leveraging this data effectively amidst a rapidly evolving market landscape?

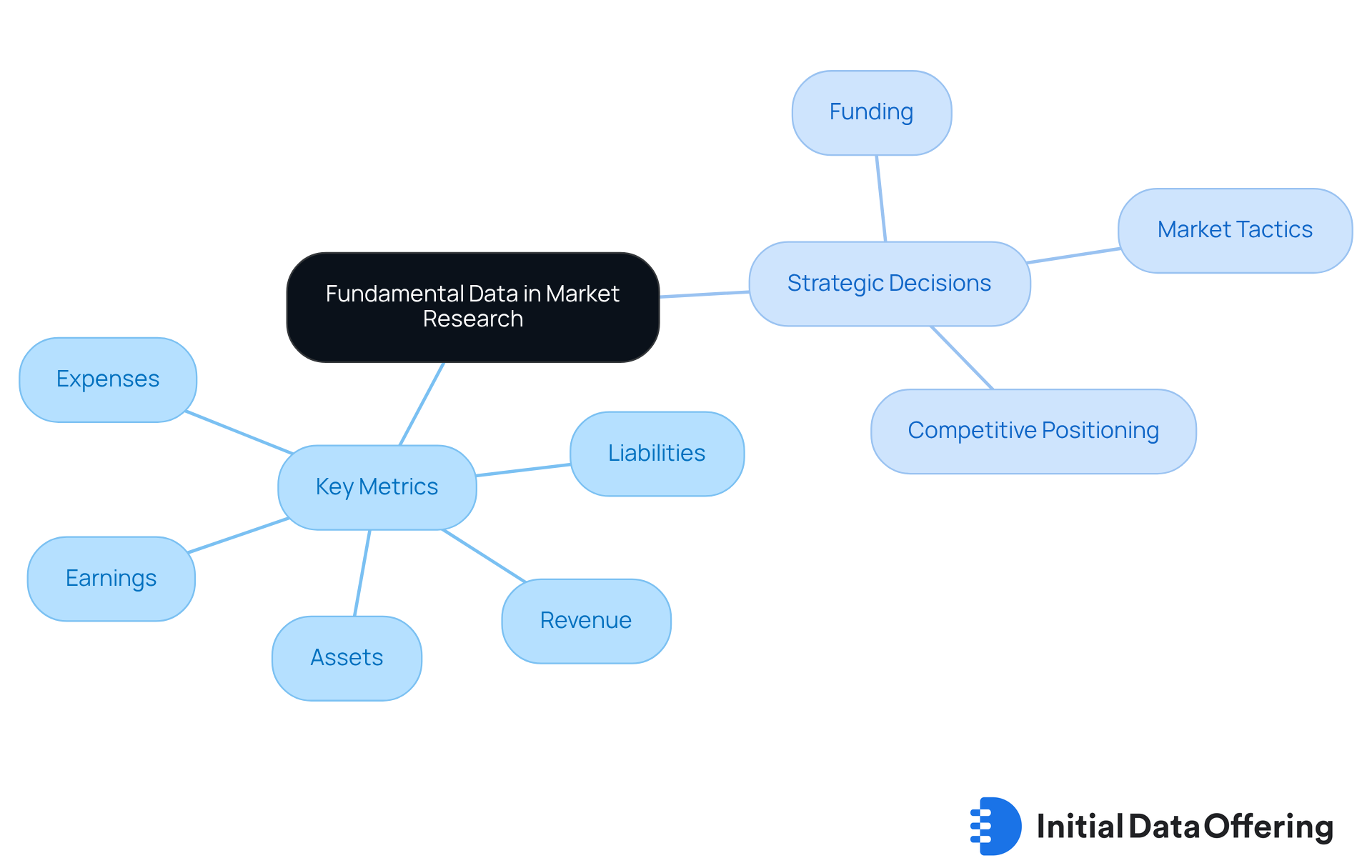

Define Fundamental Data in Market Research

Fundamental data in market research includes both quantitative and qualitative insights that illuminate a company's financial health and market position. This information consists of fundamental data, including essential metrics such as:

- Earnings

- Revenue

- Expenses

- Assets

- Liabilities

All of which are crucial for evaluating a company's performance. By understanding these core elements, companies can leverage analytical techniques, including basic analysis, to assess the intrinsic worth of a security through its underlying financials and economic indicators.

How can companies utilize this essential information to enhance their strategic decisions? By comprehending these insights, organizations can make informed choices regarding:

- Funding

- Market tactics

- Competitive positioning

Ultimately leading to improved outcomes.

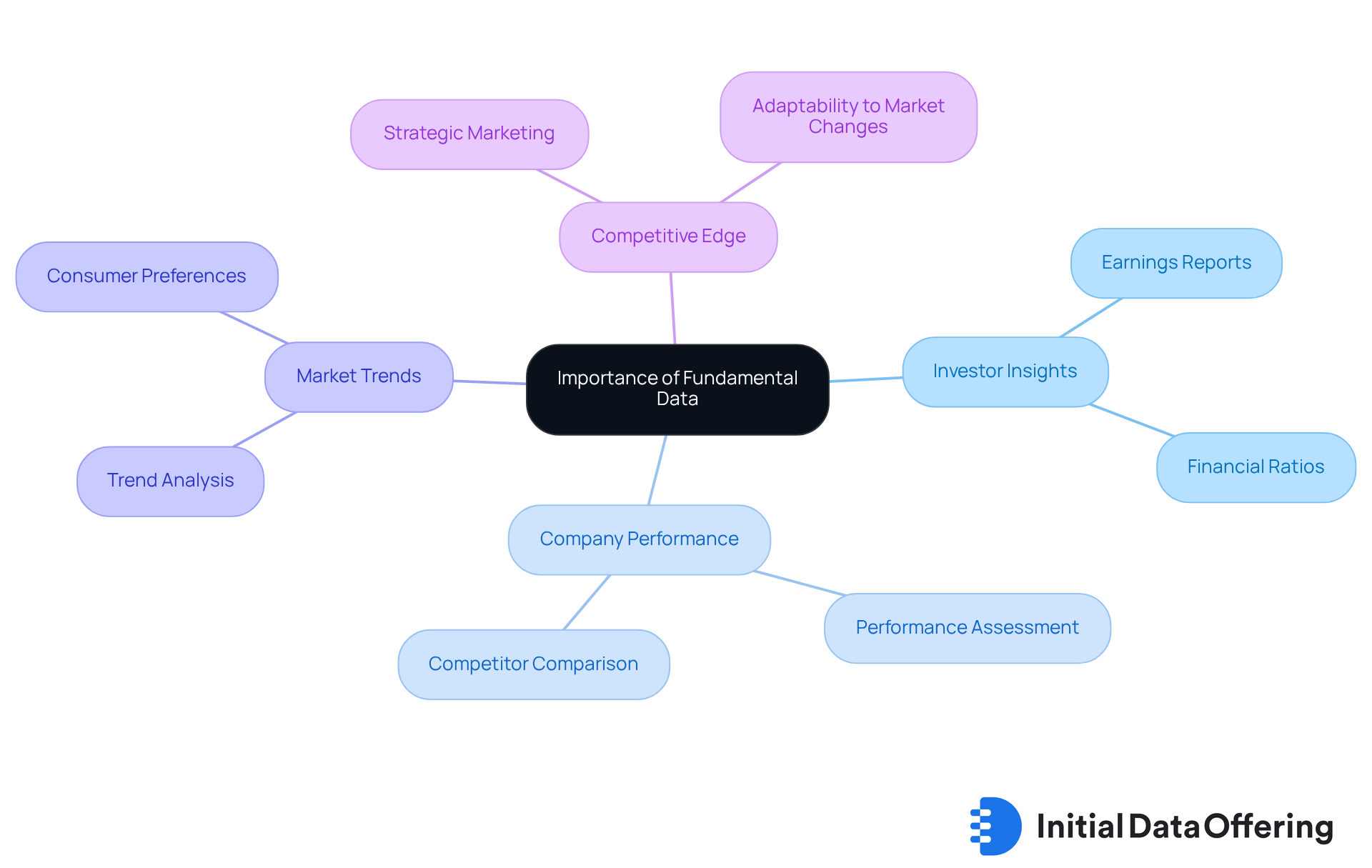

Contextualize the Importance of Fundamental Data

The significance of fundamental data is paramount, as it provides the insights necessary for making strategic business choices. Investors rely on fundamental data to evaluate the potential risks and rewards associated with specific investments. For example, by analyzing earnings reports and financial ratios, investors can ascertain whether a stock is undervalued or overvalued. Moreover, companies leverage fundamental data to assess their performance against competitors, identify market trends, and develop effective marketing strategies. In an increasingly information-driven world, the ability to utilize fundamental data is vital for gaining a competitive edge and fostering growth.

How can essential information influence your investment strategies? By understanding its role, you can make more informed decisions. This capability not only enhances your market position but also contributes to long-term success. The effective use of fundamental data can lead to improved performance, enabling businesses to adapt swiftly to changing market dynamics and consumer preferences.

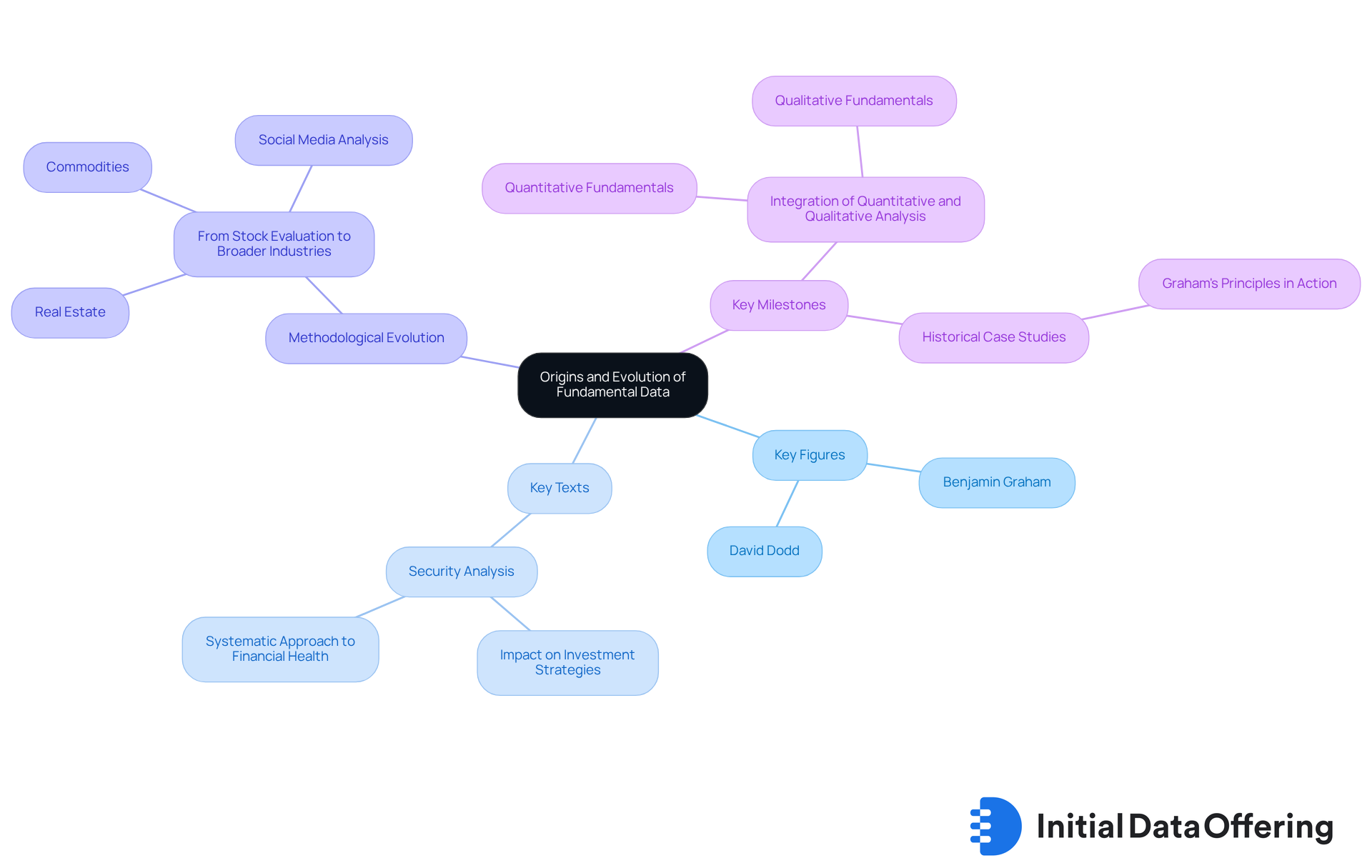

Trace the Origins and Evolution of Fundamental Data

The origins of essential data trace back to the early 20th century, marked by the pioneering efforts of Benjamin Graham and David Dodd. Their influential work, 'Security Analysis,' published in 1934, established the foundation for basic analysis by underscoring the necessity of evaluating a company's financial statements to ascertain its intrinsic value. This seminal text not only shaped investment strategies but also introduced a systematic approach to analyzing financial health, which remains relevant today.

Over the decades, the methodologies surrounding essential information have undergone significant transformation, driven by technological advancements and the increasing availability of information. Originally concentrated on stock exchange evaluation, essential information has broadened its scope into various industries like real estate, commodities, and social media analysis. This evolution demonstrates a wider relevance in comprehending economic fluctuations and financial prospects.

Key milestones in the development of fundamental data methodologies involve integrating quantitative and qualitative analysis, enabling investors to evaluate both numerical metrics and non-numerical factors such as management quality and competitive advantage. Historical case studies, especially those showcasing the effect of Graham's principles, illustrate how these methodologies have shaped financial choices and economic behavior over time. As the landscape of financial analysis continues to change, the principles established by early pioneers remain essential to the practice of assessing assets and understanding trends.

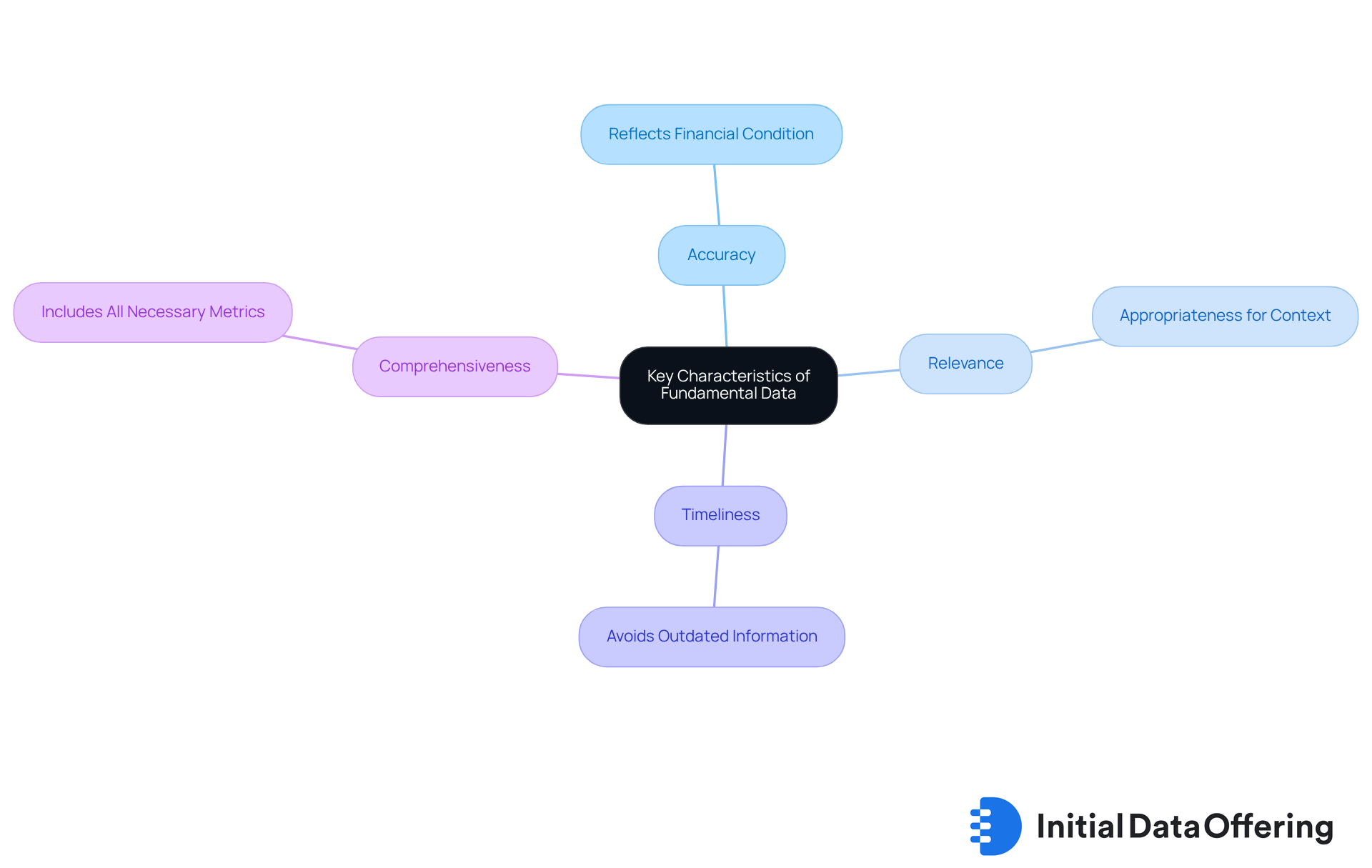

Identify Key Characteristics of Fundamental Data

Key characteristics of fundamental data encompass accuracy, relevance, timeliness, and comprehensiveness.

- Accuracy ensures that the fundamental data accurately reflects a company's financial condition.

- Relevance pertains to the appropriateness of that fundamental data for the specific context or investment decision at hand.

- Timeliness is essential; relying on outdated fundamental data can result in misguided decisions.

- Comprehensiveness guarantees that all necessary fundamental data metrics are included for a thorough analysis.

For instance, evaluating a company's performance requires not just its earnings but also an examination of its market share, competitive landscape, and macroeconomic factors. By understanding these characteristics, analysts and investors can make more informed decisions founded on fundamental data that offers reliable and actionable insights.

Conclusion

Understanding fundamental data is crucial for navigating the complexities of market research and investment strategies. This essential information not only provides a clear picture of a company's financial health but also serves as a vital tool for making informed decisions that can significantly impact business outcomes.

The article highlights the definition of fundamental data, its historical evolution, and its key characteristics such as:

- Accuracy

- Relevance

- Timeliness

- Comprehensiveness

By examining these aspects, it becomes evident how fundamental data empowers investors and companies alike to assess risks, identify market trends, and enhance competitive positioning. The insights derived from fundamental data enable organizations to adapt to changing market dynamics and make strategic choices that lead to long-term success.

In a world where data drives decision-making, leveraging fundamental data effectively can set businesses apart from their competitors. By prioritizing the understanding and application of this information, companies can not only improve their market position but also foster sustainable growth. Embracing the principles of fundamental data analysis is essential for anyone looking to navigate the complexities of the financial landscape and achieve lasting success.

Frequently Asked Questions

What is fundamental data in market research?

Fundamental data in market research includes both quantitative and qualitative insights that provide information about a company's financial health and market position.

What essential metrics are included in fundamental data?

Essential metrics in fundamental data include earnings, revenue, expenses, assets, and liabilities.

Why is fundamental data important for evaluating a company's performance?

Fundamental data is crucial for evaluating a company's performance as it helps assess the intrinsic worth of a security through its underlying financials and economic indicators.

How can companies utilize fundamental data to enhance their strategic decisions?

Companies can use fundamental data to make informed choices regarding funding, market tactics, and competitive positioning, ultimately leading to improved outcomes.