Master Trade Data Analysis: Techniques for Market Insights

Master Trade Data Analysis: Techniques for Market Insights

Overview

The article emphasizes the techniques for analyzing trade data, which are crucial for gaining market insights. Understanding these techniques is vital for comprehending consumer behavior and industry dynamics. It details various analytical methods, including:

- Descriptive analysis

- Predictive analytics

- The utilization of high-quality data sources

Each method serves distinct features that provide significant advantages, enabling businesses to make informed decisions. This ultimately allows them to adapt effectively to evolving market trends, enhancing their competitive edge in the industry.

Introduction

Understanding trade data is crucial for businesses aiming to navigate the complexities of today’s market landscape. This wealth of information reveals not only consumer behaviors and industry trends but also uncovers opportunities for strategic growth. The advantages of effectively analyzing trade data are significant; organizations can identify market shifts, optimize their offerings, and enhance decision-making processes. However, challenges such as information overload and data quality issues can hinder this analysis.

How can organizations leverage trade data analysis to gain a competitive edge while overcoming these inherent challenges? Addressing these questions is essential for harnessing the full potential of trade data.

Define Trade Data and Its Importance for Market Analysis

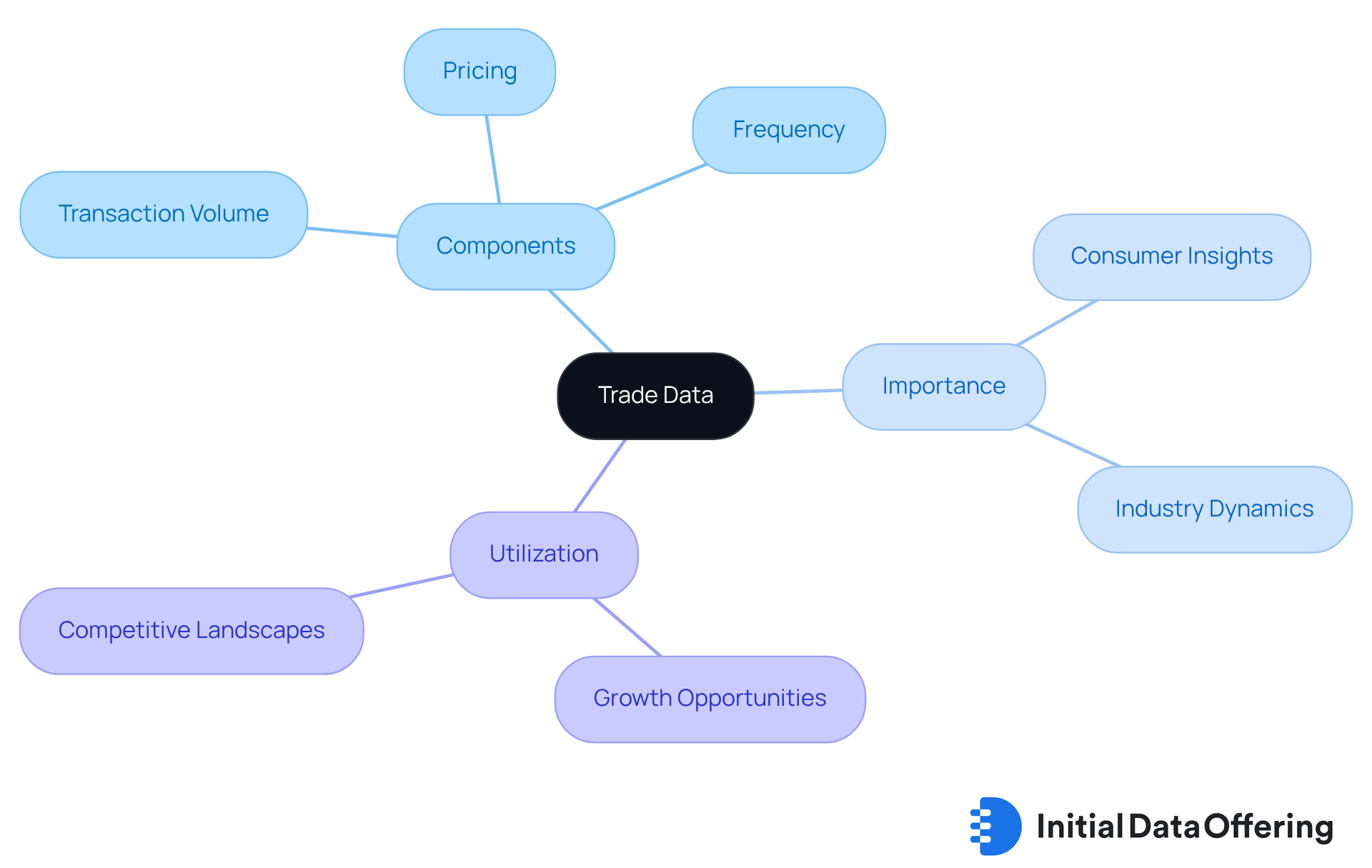

Trade data includes both numerical and descriptive details related to the purchasing and selling of goods and services across various sectors. This trade data includes vital metrics such as transaction volume, pricing, and frequency, which are essential for a comprehensive industry analysis. By delving into trade data, companies gain significant insights into consumer behavior, industry dynamics, and broader economic conditions. For instance, a notable increase in trade data for a specific product category can signify a surge in consumer interest, prompting companies to adapt their strategies to meet evolving industry demands.

Moreover, trade data is instrumental in identifying growth opportunities. Organizations that effectively analyze trade data can assess competitive landscapes and make informed decisions that resonate with industry trends. For example, businesses that track trade data can uncover shifts in consumer preferences, enabling them to tailor their products and marketing strategies accordingly. This proactive approach not only boosts customer engagement but also positions companies to leverage emerging market trends, ultimately driving sustainable growth.

Utilizing high-quality datasets and AI-driven business intelligence solutions, such as those offered by Initial Data Offering, can significantly enhance the analysis of market information. The proprietary AI-driven Recursive Information Engine from SavvyIQ continuously refines a dynamic graph of 265 million global entities, equipping businesses with tools to make more accurate predictions and strategic decisions based on real-time insights.

Identify Key Sources of Trade Data for Analysts

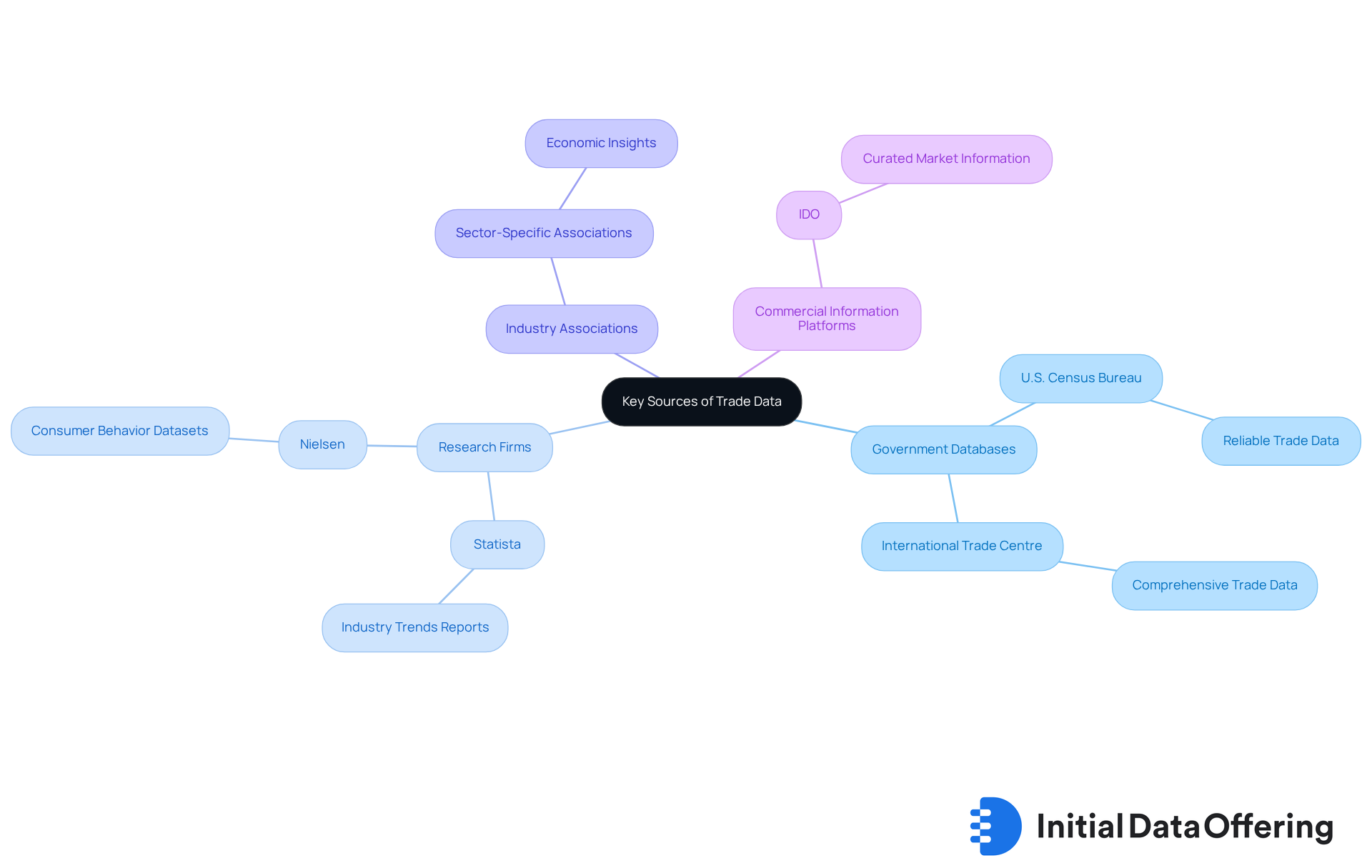

Analysts can source market data from a variety of platforms, including government databases, industry reports, and commercial data providers. Each of these sources offers unique features that enhance research capabilities.

Government trade agencies, such as the U.S. Census Bureau and the International Trade Centre, provide reliable and comprehensive trade data. These trade data are crucial for understanding market dynamics and can serve as a foundation for more detailed analysis.

-

Research Firms: Companies like Statista and Nielsen offer extensive reports and datasets that examine industry trends and consumer behavior. By leveraging these insights, researchers can gain a competitive edge in their analyses, allowing for more informed decision-making.

-

Industry Associations: Numerous sectors possess associations that release industry information pertinent to their fields, offering insights into economic dynamics. This information is invaluable for staying current with market developments and understanding sector-specific challenges.

-

Commercial Information Platforms: Services such as IDO provide a marketplace for datasets, enabling researchers to access exclusive and curated market information tailored to specific requirements. This access not only saves time but also ensures that researchers are working with the most relevant data available.

By utilizing these resources, researchers can compile a robust dataset that significantly enhances their analytical capabilities. How might these datasets inform your next project?

Apply Analytical Techniques to Interpret Trade Data

To effectively interpret trade data, analysts can utilize various analytical techniques that offer valuable insights into market dynamics.

-

Descriptive Analysis: This technique involves summarizing trade data to reveal patterns and trends. Analysts can utilize statistical measures such as mean, median, and mode to grasp the central tendencies of the information. This allows for a clearer understanding of overall performance. For instance, a strategic approach to consumer trends is crucial for enhancing sales at sell-in and sell-through, as highlighted by the increased visibility into B2B commerce information.

-

Comparative Examination: By scrutinizing trade data across various time frames or market segments, evaluators can recognize changes in consumer behavior and market dynamics. This approach enables the detection of emerging trends and helps in adjusting strategies accordingly. A case study on 'Strategic Sales Planning with B2B Information' illustrates how real-time visibility into B2B sales insights enhances sales monitoring and planning.

-

Predictive Analytics: Utilizing statistical models and machine learning algorithms, experts can anticipate future market trends based on past information. This technique is crucial for preparing strategic responses to market changes, thereby enhancing decision-making capabilities. As Josh Reddin, EVP of Elastic Suite, noted, "The brands that are wildly successful at enhancing their wholesale business are the ones that are best collaborators," emphasizing the role of data-driven decision-making in fostering collaboration.

By employing visualization tools such as Tableau or Power BI, professionals can produce visual representations of trade data. This aids in communicating insights to stakeholders effectively. Effective visual representations can highlight key trends and anomalies that may not be readily apparent in raw information, making complex content more accessible.

By mastering these techniques, experts can derive actionable insights that inform business strategies and enhance decision-making processes. The significance of these analytical methods is underscored by the fact that in the United States, B2B eCommerce surpasses B2C by almost seven times. This statistic demonstrates the essential requirement for efficient trade information analysis.

Overcome Common Challenges in Trade Data Analysis

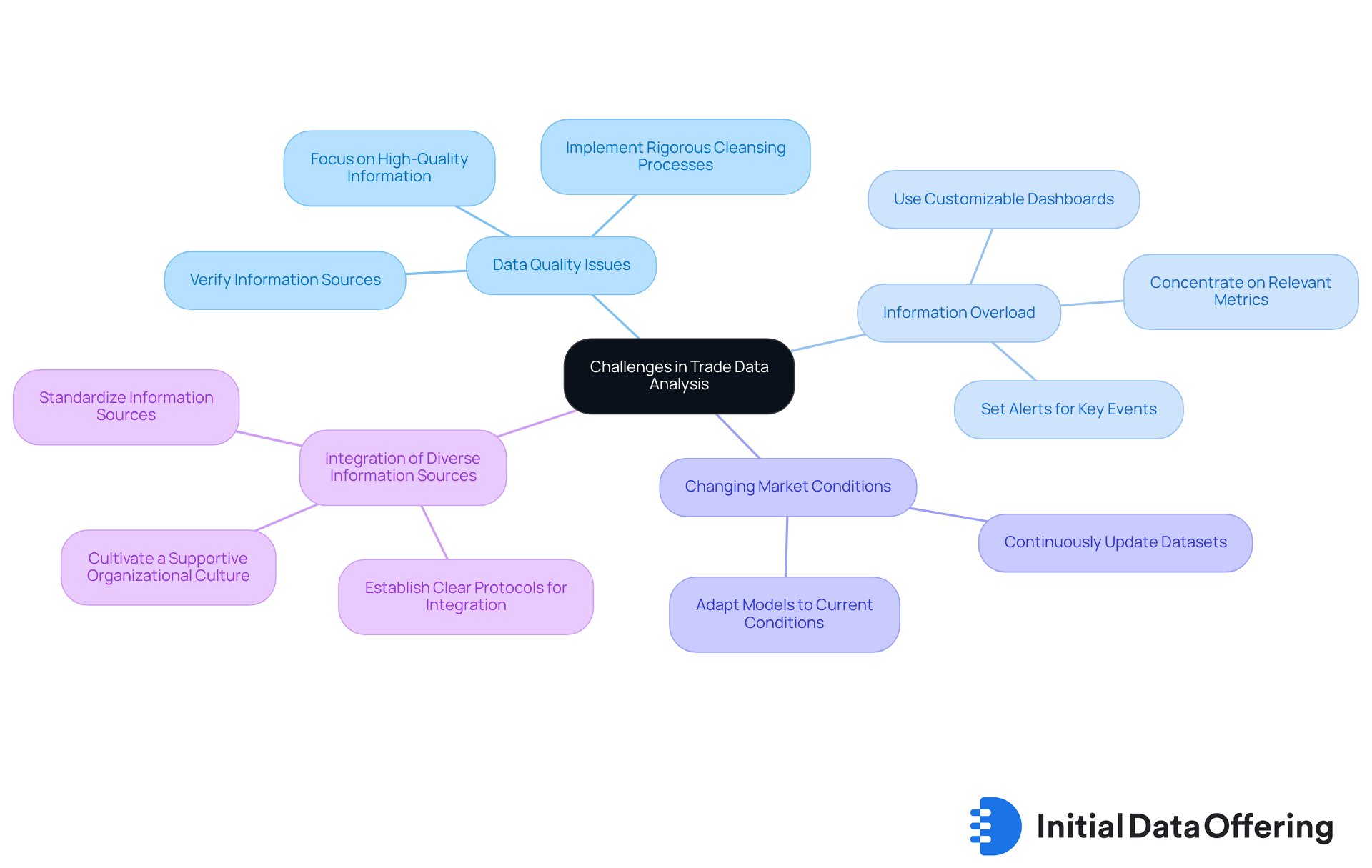

Analyzing trade data presents several significant challenges that analysts must navigate to derive meaningful insights.

-

Data Quality Issues: Inaccurate or incomplete data can lead to misleading conclusions. Analysts should prioritize verifying information sources and implementing rigorous cleansing processes to ensure reliability. High-quality information is crucial; organizations with information-literate employees are more likely to thrive in their analytical pursuits. Significantly, merely 20% of analytics insights are anticipated to produce business results, highlighting the necessity of concentrating on high-quality information and actionable insights.

-

Information Overload: The overwhelming volume of available trade information can lead to analysis paralysis. As noted by AdroFx, information overload takes a heavy psychological toll on traders. To combat this, analysts should concentrate on relevant metrics that align with their specific objectives. Strategies such as utilizing customizable dashboards and economic calendars can help filter out unnecessary information, allowing for a more focused analysis.

-

Changing Market Conditions: Rapid shifts in market dynamics can render historical information less relevant. Analysts must continuously update their datasets and adapt their models to reflect current conditions. This flexibility is essential; traders exposed to excessive information miss opportunities 30% more frequently than their counterparts.

-

Integration of Diverse Information Sources: Combining information from multiple origins can lead to inconsistencies and confusion. Establishing clear protocols for information integration and standardization is vital to maintain coherence. Furthermore, 67% of analytics leaders identify organizational culture as the biggest barrier to becoming a data-oriented company, highlighting the need for a supportive culture in overcoming these challenges. Organizations should concentrate on a clearly outlined information gathering strategy that aligns with specific objectives, minimizing unnecessary information accumulation.

By recognizing these challenges and implementing proactive strategies, analysts can significantly enhance the accuracy and effectiveness of their analysis of trade data, ultimately leading to better-informed trading decisions.

Conclusion

Understanding and effectively analyzing trade data is pivotal for gaining valuable market insights. The ability to interpret trade data not only enhances decision-making but also positions businesses to respond adeptly to shifting consumer behaviors and market dynamics. By leveraging high-quality datasets and advanced analytical techniques, organizations can unlock opportunities for growth and innovation.

Throughout this article, key points have been highlighted, including:

- The definition and importance of trade data

- Various reliable sources for obtaining this data

- The analytical techniques that can be employed to derive meaningful insights

Additionally, common challenges in trade data analysis have been discussed, along with strategies to overcome these obstacles. Utilizing descriptive analysis, comparative examination, and predictive analytics can empower analysts to make informed decisions that drive success.

In conclusion, mastering trade data analysis is essential for any organization aiming to thrive in a competitive landscape. By prioritizing high-quality data, employing robust analytical methods, and addressing the challenges faced in data interpretation, businesses can enhance their strategic initiatives and better align with market demands. Embracing these practices not only fosters a data-driven culture but also equips companies with the insights necessary to navigate the complexities of the market effectively.

Frequently Asked Questions

What is trade data?

Trade data includes both numerical and descriptive details related to the purchasing and selling of goods and services across various sectors. It encompasses vital metrics such as transaction volume, pricing, and frequency.

Why is trade data important for market analysis?

Trade data is essential for comprehensive industry analysis as it provides insights into consumer behavior, industry dynamics, and broader economic conditions. An increase in trade data for a specific product category can indicate a surge in consumer interest, prompting companies to adapt their strategies.

How can organizations benefit from analyzing trade data?

Organizations that effectively analyze trade data can identify growth opportunities, assess competitive landscapes, and make informed decisions aligned with industry trends. This helps them uncover shifts in consumer preferences and tailor their products and marketing strategies accordingly.

What tools can enhance the analysis of market information?

Utilizing high-quality datasets and AI-driven business intelligence solutions can significantly enhance market information analysis. For instance, the proprietary AI-driven Recursive Information Engine from SavvyIQ refines a dynamic graph of 265 million global entities to aid businesses in making accurate predictions and strategic decisions based on real-time insights.