Master Live Market Data: Key Practices for Analysts

Master Live Market Data: Key Practices for Analysts

Overview

The article emphasizes essential practices for analysts to effectively master live market data. Key features include:

- Categorizing data types

- Sourcing from reliable platforms

- Integrating live data into research methodologies

- Regularly evaluating research strategies

These practices provide significant advantages, particularly in the context of the growing importance of alternative data and the established value of platforms like Bloomberg and Refinitiv. By adopting adaptive methodologies, analysts can navigate a rapidly evolving market landscape. Ultimately, these strategies enhance decision-making and strategic planning, allowing analysts to respond effectively to market changes.

How can these practices be integrated into your current research methodologies to improve outcomes?

Introduction

Navigating the complex landscape of financial analysis requires a keen understanding of various market data types. Each type offers unique insights that can significantly shape investment strategies. By mastering the categorization of alternative, fundamental, and ESG data, analysts can enhance their research and decision-making processes.

However, as reliance on live market data grows, professionals must consider: how can they select the most effective platforms and methodologies to harness this information?

This article explores key practices that empower analysts to optimize their research efforts and adapt to the ever-evolving market dynamics.

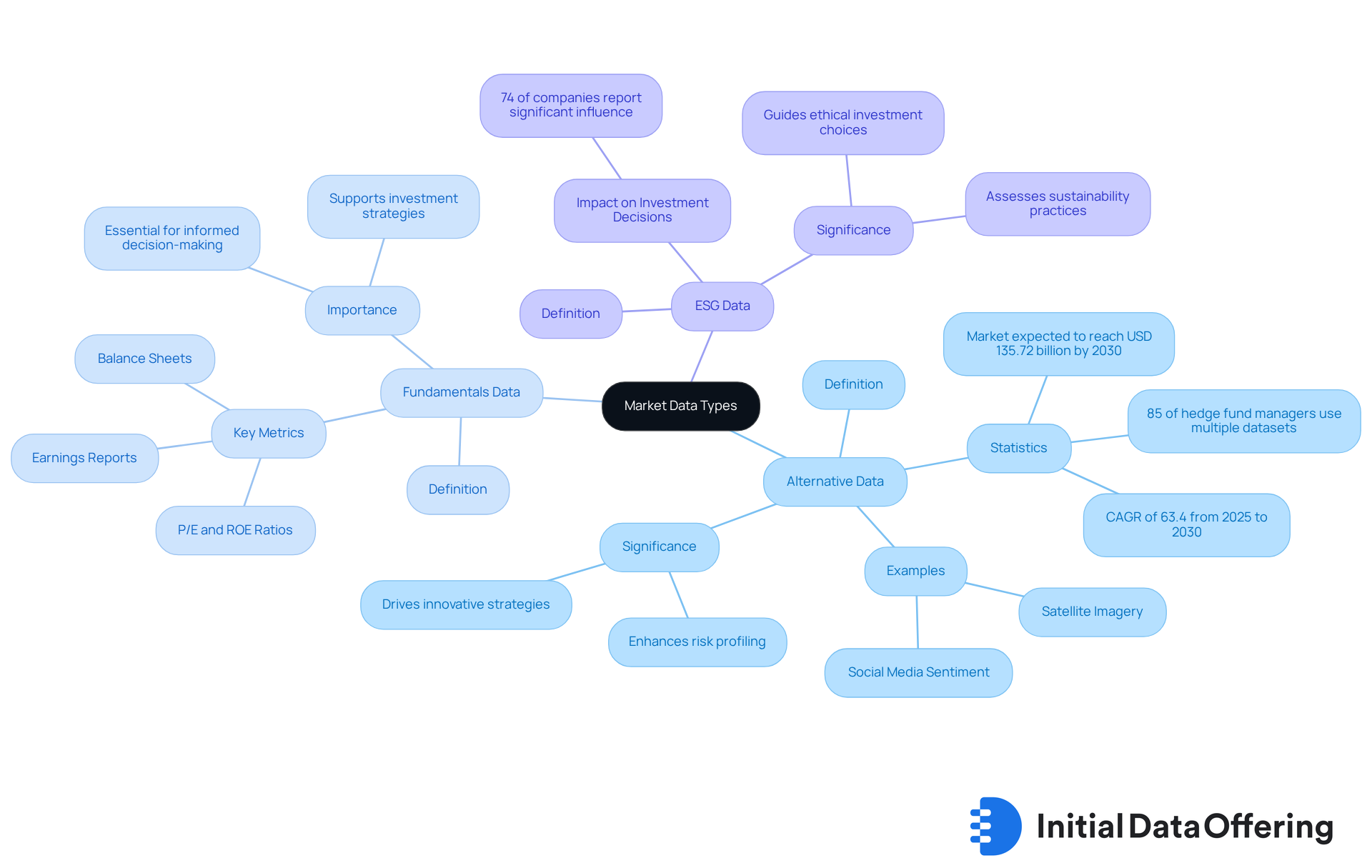

Identify Relevant Market Data Types

Analysts should categorize market data into distinct types to optimize their research efforts, including:

-

Alternative Data: These non-traditional datasets, such as social media sentiment and satellite imagery, offer unique insights that can drive innovative strategies. With 85% of market-leading hedge fund managers utilizing multiple alternative information sets, and almost half (46%) of all hedge fund teams spending 20% or more of their time working on alternative resources, the significance of these assets is clear. The alternative information sector is expected to attain USD 135.72 billion by 2030, expanding at a CAGR of 63.4% from 2025 to 2030. This emphasizes the growing dependence on these datasets and their potential to transform investment strategies.

-

Fundamentals Data: This category encompasses essential financial metrics and indicators that reflect a company's performance, including earnings reports, balance sheets, and key financial ratios like Price-to-Earnings (P/E) and Return on Equity (ROE). The effective use of fundamental information is essential for informed decision-making, particularly as the alternative information sector continues to grow. How can analysts leverage these metrics to enhance their investment strategies?

-

ESG Data: Environmental, Social, and Governance metrics assess a company's sustainability practices and ethical impact. Importantly, 74% of companies indicate that ESG information greatly impacts their investment choices, highlighting its significance in the current business environment. As sustainability becomes a priority, how can ESG data influence long-term investment decisions?

By distinctly recognizing these categories, researchers can align their research goals with the suitable information sources, ultimately improving the quality and relevance of their insights.

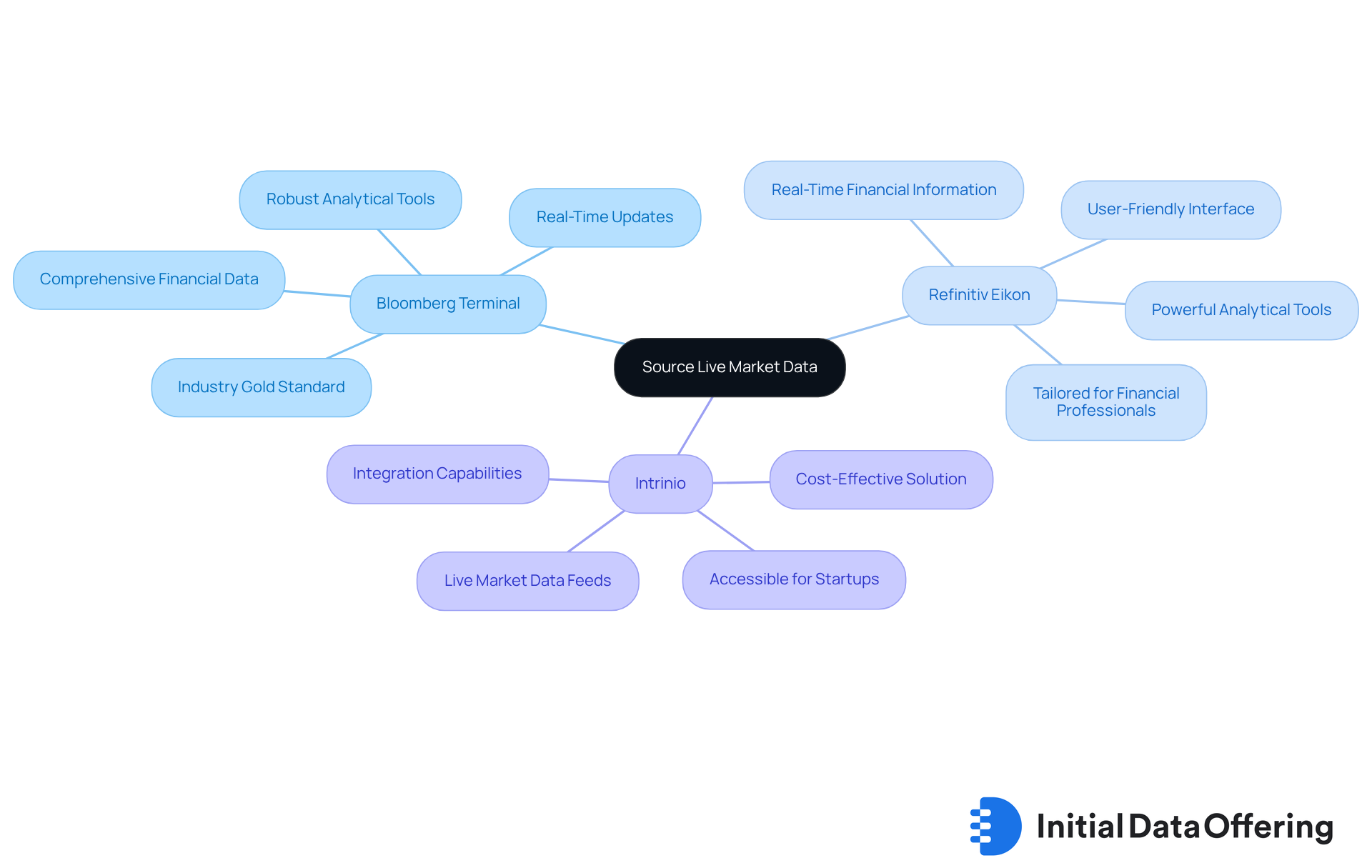

Source Live Market Data from Reliable Platforms

To effectively source live market data, analysts should consider several key platforms that offer valuable insights for their analysis.

-

Bloomberg Terminal is a leading platform that offers comprehensive financial data, analytics, and news. Widely regarded as a gold standard in the industry, it provides users with a robust set of tools to make informed decisions. The advantage of using Bloomberg lies in its extensive coverage and real-time updates, which are critical for financial professionals seeking accurate and timely information.

-

Refinitiv Eikon is another prominent option, delivering real-time financial information and analytics tailored for financial professionals. Its user-friendly interface and powerful analytical tools make it an attractive choice for those looking to enhance their market insights. By leveraging Eikon, analysts can access a wealth of information that supports better decision-making processes.

-

For those seeking a more economical solution, Intrinio offers live market data feeds, which are particularly beneficial for startups and smaller companies. This platform provides an accessible entry point for those looking to integrate live market data without significant financial investment. The benefit of choosing Intrinio is its cost-effectiveness, allowing smaller firms to compete in a data-driven environment.

When selecting a platform, analysts should assess crucial factors such as information coverage, update frequency, and integration capabilities. By doing so, they can ensure they are obtaining the most relevant and timely insights necessary for their analyses. How will these platforms enhance your data sourcing strategies?

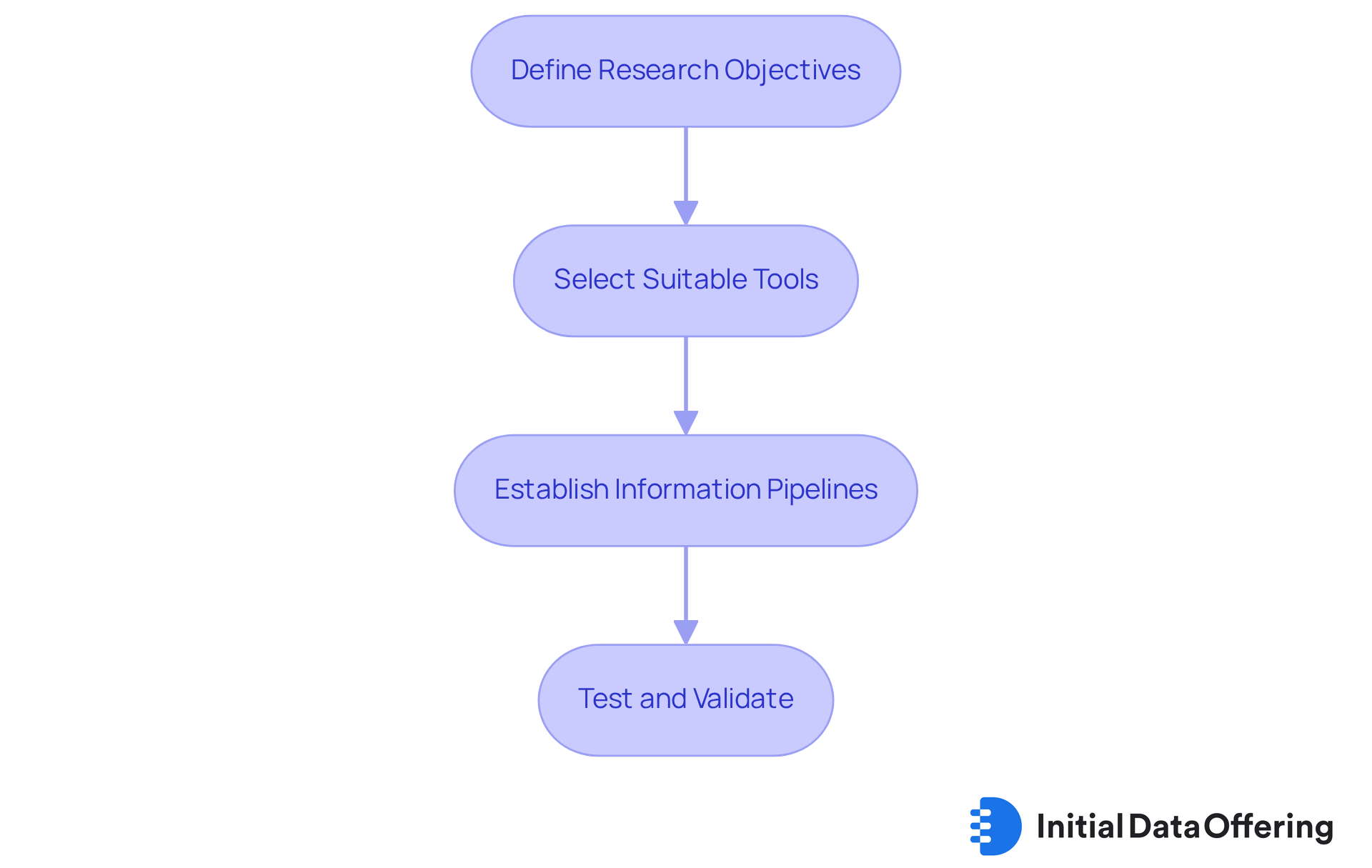

Integrate Live Data into Research Methodologies

Analysts can effectively integrate live market data into their research methodologies by following these essential steps:

-

Define Research Objectives: Clearly outline the insights required and how real-time information can contribute to achieving those goals. As Geoffrey Moore emphasizes, information is crucial for making informed business decisions, making this step foundational. What specific insights are you aiming to gain from the analysis of live market data?

-

Select Suitable Tools: Employ analytical instruments that enable real-time information integration. Python libraries such as Pandas and NumPy stand out as excellent options, along with specialized software like Tableau, which enhances visualization and analysis capabilities. How might these tools transform your data analysis process?

-

Establish Information Pipelines: Create automated information pipelines that continuously supply live information into analytical models. This approach guarantees that insights rely on the most up-to-date information, addressing the reality that analysts spend 60% to 80% of their time searching for information. Imagine the efficiency gained by automating this process.

-

Test and Validate: Regularly assess the integration process to ensure information accuracy and reliability. Modify approaches as needed to incorporate new information sources, emphasizing the necessity for high-quality information, as noted by Veda Bawo. How often do you review your data sources for accuracy?

By adhering to these steps, professionals can leverage live market data to significantly enhance their findings, ultimately fostering better decision-making and strategic planning.

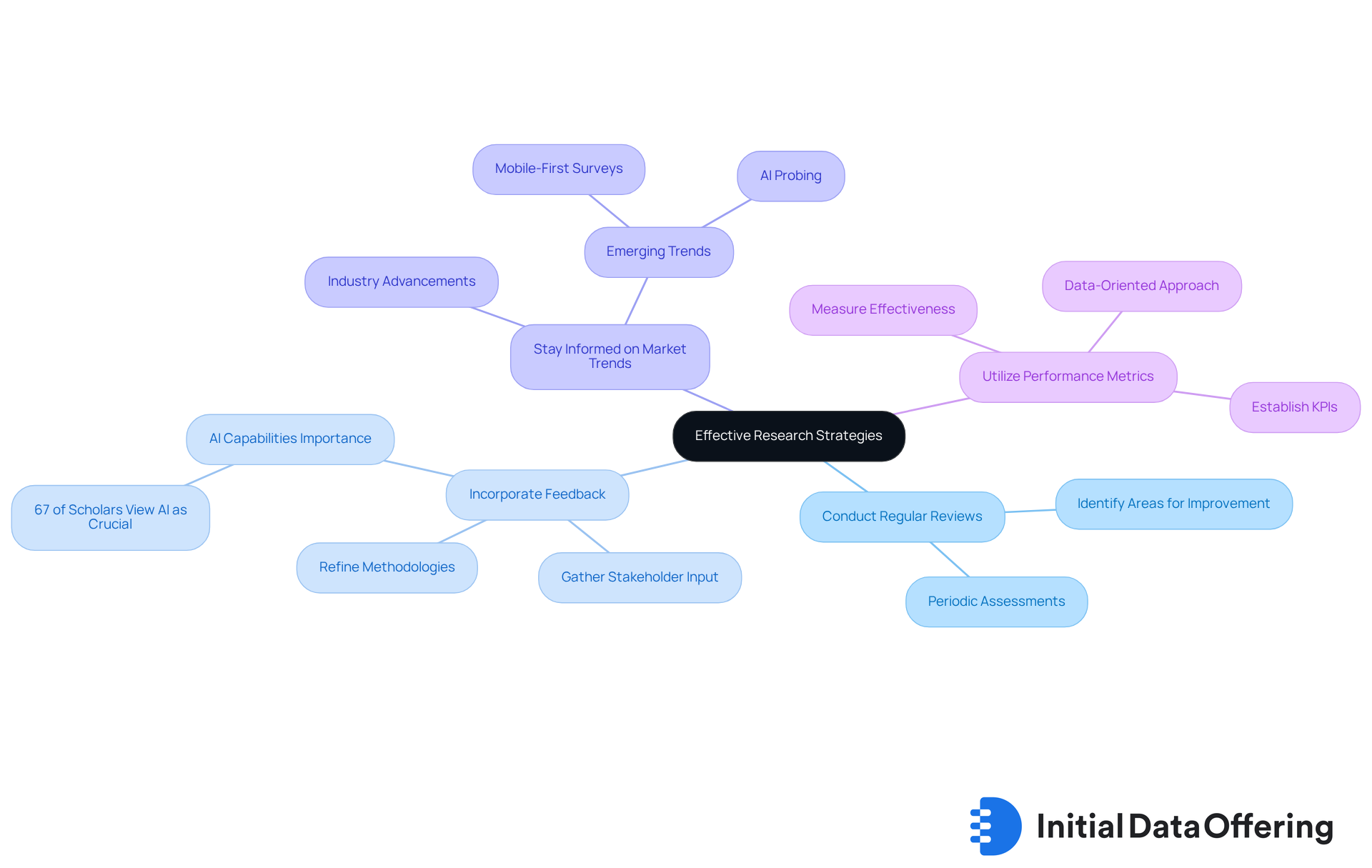

Evaluate and Adapt Research Strategies Regularly

To maintain effective research strategies, analysts should:

-

Conduct Regular Reviews: Schedule periodic assessments of research methodologies. This practice helps identify areas for improvement and adapt to changing market conditions, ensuring that strategies remain effective.

-

Incorporate Feedback: Actively gather input from stakeholders and team members. By refining investigation approaches based on practical experiences and insights, analysts can enhance their methodologies. Notably, 67% of scholars view AI capabilities as crucial when choosing service providers, underscoring the need for adaptive methodologies. Additionally, companies focusing on analysis are 2X as likely to achieve double-digit growth, highlighting the significant impact of effective analytical strategies on business success.

-

Stay Informed on Market Trends: Keeping up with industry advancements and new information sources is essential for improving investigative efforts. The insights industry is evolving, emphasizing participant engagement and data integrity. Emerging trends such as mobile-first surveys and AI probing are transforming feedback collection, enabling more agile and responsive methodologies.

-

Utilize Performance Metrics: Establishing key performance indicators (KPIs) is vital for measuring the effectiveness of investigation strategies. This data-oriented approach allows for prompt modifications, ensuring that studies remain relevant and influential.

By adopting these practices, professionals can ensure their strategies are not only effective but also aligned with the dynamic landscape of market analysis, which incorporates live market data, in 2025. In this environment, stakeholder feedback plays a pivotal role in shaping methodologies. However, analysts should remain vigilant about common pitfalls, such as survey fatigue and the necessity of human oversight in AI-driven processes, to maintain the integrity and quality of their research.

Conclusion

Mastering live market data is essential for analysts aiming to enhance their investment strategies and decision-making processes. By effectively categorizing market data into alternative, fundamental, and ESG types, analysts can align their research with relevant information sources. This alignment ultimately leads to more informed insights and strategic planning.

The article emphasizes the importance of sourcing live market data from reliable platforms such as:

- Bloomberg Terminal

- Refinitiv Eikon

- Intrinio

Each platform offers distinct advantages that cater to different needs and budgets. Furthermore, integrating live data into research methodologies through defined objectives, suitable tools, and automated information pipelines ensures that analysts can leverage the most current information available. Regular evaluation of research strategies, incorporating feedback, and staying informed about market trends are all critical components for maintaining effective methodologies.

In the rapidly evolving landscape of financial analysis, the significance of live market data cannot be overstated. Analysts are encouraged to adopt these best practices not only to enhance their research capabilities but also to remain competitive in a data-driven environment. Embracing these strategies will empower analysts to navigate market complexities more effectively and drive impactful investment decisions.

Frequently Asked Questions

What are the main types of market data analysts should focus on?

Analysts should categorize market data into three main types: Alternative Data, Fundamentals Data, and ESG Data.

What is Alternative Data and why is it significant?

Alternative Data includes non-traditional datasets, such as social media sentiment and satellite imagery, that provide unique insights for investment strategies. Its significance is underscored by 85% of market-leading hedge fund managers using multiple alternative datasets, and the sector is projected to reach USD 135.72 billion by 2030, growing at a CAGR of 63.4% from 2025 to 2030.

What does Fundamentals Data encompass?

Fundamentals Data includes essential financial metrics and indicators that reflect a company's performance, such as earnings reports, balance sheets, and key financial ratios like Price-to-Earnings (P/E) and Return on Equity (ROE). This data is crucial for informed decision-making in investment strategies.

How does ESG Data impact investment decisions?

ESG Data assesses a company's sustainability practices and ethical impact. It is significant because 74% of companies report that ESG information greatly influences their investment choices, making it a key factor as sustainability becomes a priority in business.

How can recognizing these market data categories help researchers?

By distinctly identifying these categories, researchers can better align their research goals with appropriate information sources, thereby enhancing the quality and relevance of their insights.