Master Historical Options Prices: Tools, Analysis, and Solutions

Master Historical Options Prices: Tools, Analysis, and Solutions

Overview

This article highlights the significance of historical options prices and the various tools and methodologies available for their analysis. Understanding past trading rates is crucial, as it aids traders in recognizing market trends and associated risks. By utilizing specialized platforms like OptionMetrics and Cboe, traders can enhance their analysis through accurate data and diverse analytical techniques. Ultimately, this leads to improved trading strategies that are informed by historical insights.

What if you could leverage historical data to make more informed trading decisions? The advantages of analyzing options prices are clear: they provide a foundation for recognizing patterns and predicting future market movements. By employing these methodologies, traders can navigate the complexities of the market with greater confidence.

In conclusion, the integration of historical options prices into trading strategies not only enhances decision-making but also empowers traders to adapt to market dynamics effectively. The use of precise data and sophisticated analytical tools can significantly improve trading outcomes. As you consider your trading approach, how might these insights transform your strategies?

Introduction

Understanding historical options prices is crucial for traders aiming to navigate the complexities of the financial markets. These prices not only reveal past market behaviors but also serve as a foundation for developing effective trading strategies. By delving into the nuances of historical data, traders can uncover valuable insights that enhance their decision-making processes. However, the journey to mastering this data is fraught with challenges, from information quality to evolving market dynamics. How can traders effectively leverage historical options prices to optimize their strategies while overcoming these obstacles?

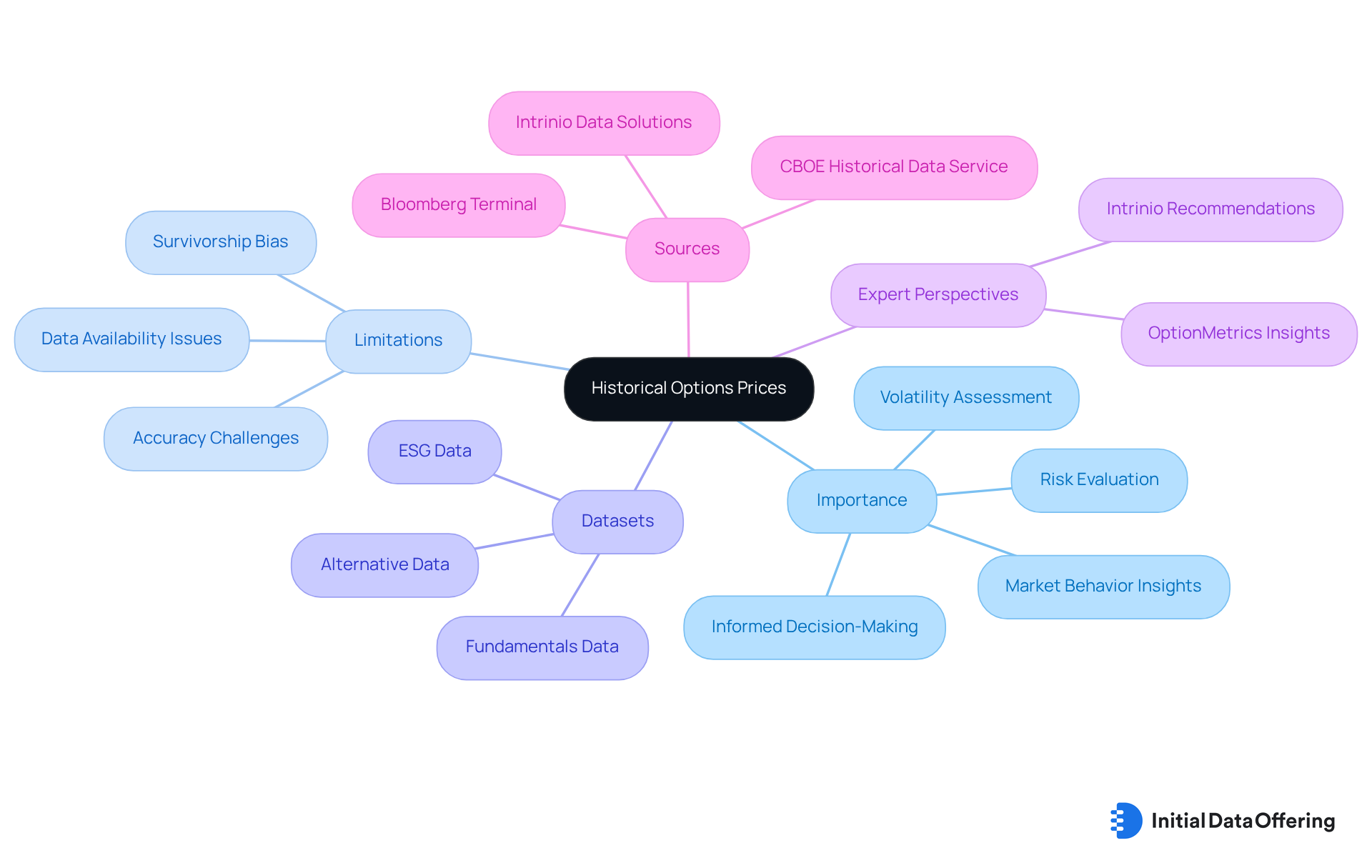

Define Historical Options Prices and Their Importance

Historical options prices represent the documented trading rates of options contracts over time. These costs are essential for traders and analysts as they provide insights into market behavior, volatility, and potential future value movements. By analyzing past information, traders can identify trends, assess risks, and make informed decisions regarding their trading strategies. Understanding the significance of these values is crucial for evaluating market trends and developing predictive models that can enhance trading performance.

However, it is important to recognize the limitations of historical options costs, such as challenges related to information availability and accuracy, which can impact the reliability of analyses. Additionally, the concept of survivorship bias may influence the interpretation of past data, potentially leading to a skewed view of market behavior.

For instance, reviewing how the costs of options have fluctuated in the past can help traders evaluate the potential risks associated with their positions, allowing them to adjust their strategies accordingly. This contextual understanding is invaluable for both novice and experienced traders, as it establishes a foundation for more sophisticated analyses and decision-making processes.

Moreover, traders can leverage various datasets, including:

- Alternative Data

- Fundamentals Data

- ESG Data

to enrich their analyses along with historical options prices. This aligns with the mission of Initial Data Offering (IDO) to curate high-quality datasets that empower users in their trading strategies.

Incorporating expert perspectives, such as those from OptionMetrics—a renowned source of extensive historical derivatives information—can further enhance the credibility of analyses. For example, OptionMetrics underscores the importance of accurate historical options prices in assessing volatility and determining risk, which are vital for making well-informed trading decisions.

Finally, traders should be aware that they can access historical options prices from platforms like CBOE, which provide valuable resources for those looking to integrate this information into their trading strategies. By synthesizing these elements, traders can create more robust strategies that adapt to evolving market dynamics, ultimately leading to improved trading outcomes.

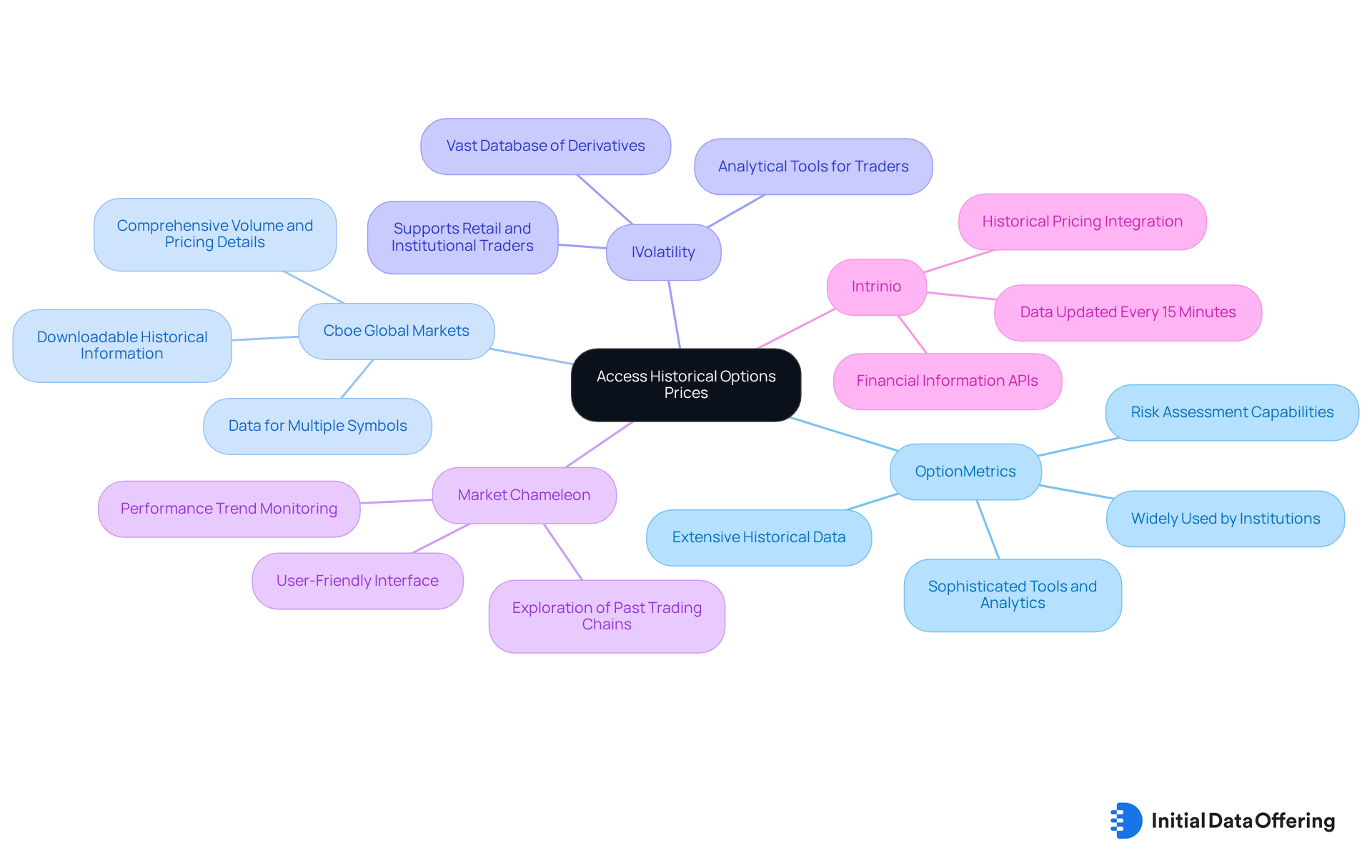

Access Historical Options Prices: Tools and Platforms

Traders seeking historical options prices can take advantage of a variety of specialized tools and platforms that excel in delivering financial information. These resources are essential for making informed decisions in the trading landscape. Notable sources include:

-

OptionMetrics: Renowned for its extensive historical derivatives information, OptionMetrics offers sophisticated tools and analytics crucial for institutional investors and scholars. This platform enables precise risk assessment and strategy evaluation, with leading institutional investment and academic organizations worldwide relying on the accuracy of its information to measure volatility, assess risk, analyze investment strategies, and consider historical options prices.

-

Cboe Global Markets: This platform provides downloadable historical information on contracts, allowing users to access comprehensive volume and pricing details across multiple symbols. Such data, particularly historical options prices, is vital for thorough market analysis, enabling traders to make data-driven decisions.

-

IVolatility: With a vast database of derivatives and futures values, IVolatility equips both retail and institutional traders with analytical tools that enhance decision-making capabilities. This resource is particularly beneficial for those looking to refine their trading strategies based on historical options prices.

-

Market Chameleon: Featuring a user-friendly interface, Market Chameleon allows users to effortlessly explore past trading chain information. This simplification aids in monitoring performance trends over time, making it easier for traders to identify patterns and insights.

-

Intrinio: Offering a suite of financial information APIs, Intrinio provides historical pricing for alternatives that can be seamlessly integrated into customized applications. This enhances analytical insights significantly, with the added advantage of having choices information refreshed every 15 minutes, ensuring timely access to the latest data.

Utilizing these platforms enables traders to effectively gather essential historical options prices for their analyses, ensuring they have access to the most accurate and relevant information for informed decision-making. Historical options prices are essential for backtesting trading strategies, enabling traders to refine their methods based on past performance. How might these tools enhance your trading approach?

Analyze Historical Options Prices: Methodologies and Techniques

Examining historical options prices involves various methodologies and techniques that yield valuable insights. Understanding these approaches is crucial for traders seeking to enhance their decision-making processes.

-

Statistical Analysis is a fundamental method where statistical tools assess value movements, volatility, and correlations with underlying assets. By employing techniques like regression analysis, traders can recognize trends and forecast future value behavior, ultimately improving their predictive accuracy.

-

Technical Analysis employs charting methods to illustrate past movement trends. Indicators such as moving averages, Bollinger Bands, and the Relative Strength Index (RSI) provide insights into market sentiment and potential reversal points, which can be pivotal for strategic trading decisions.

-

Volatility Analysis involves examining past volatility to understand price fluctuations over time. This analysis helps traders assess the risk linked to particular choices, allowing them to modify their strategies accordingly and better navigate market uncertainties.

-

Backtesting Strategies are essential for evaluating the efficiency of trading strategies using historical financial data. By simulating trades based on past data, traders can assess potential profitability and risk, informing their future strategies.

-

Comparative Analysis evaluates past asset values across various periods or against comparable assets. This method helps determine relative performance and identify market irregularities, providing a broader context for making informed decisions.

By employing these methodologies, traders can derive actionable insights from historical options prices, enabling them to make knowledgeable choices and refine their trading tactics effectively.

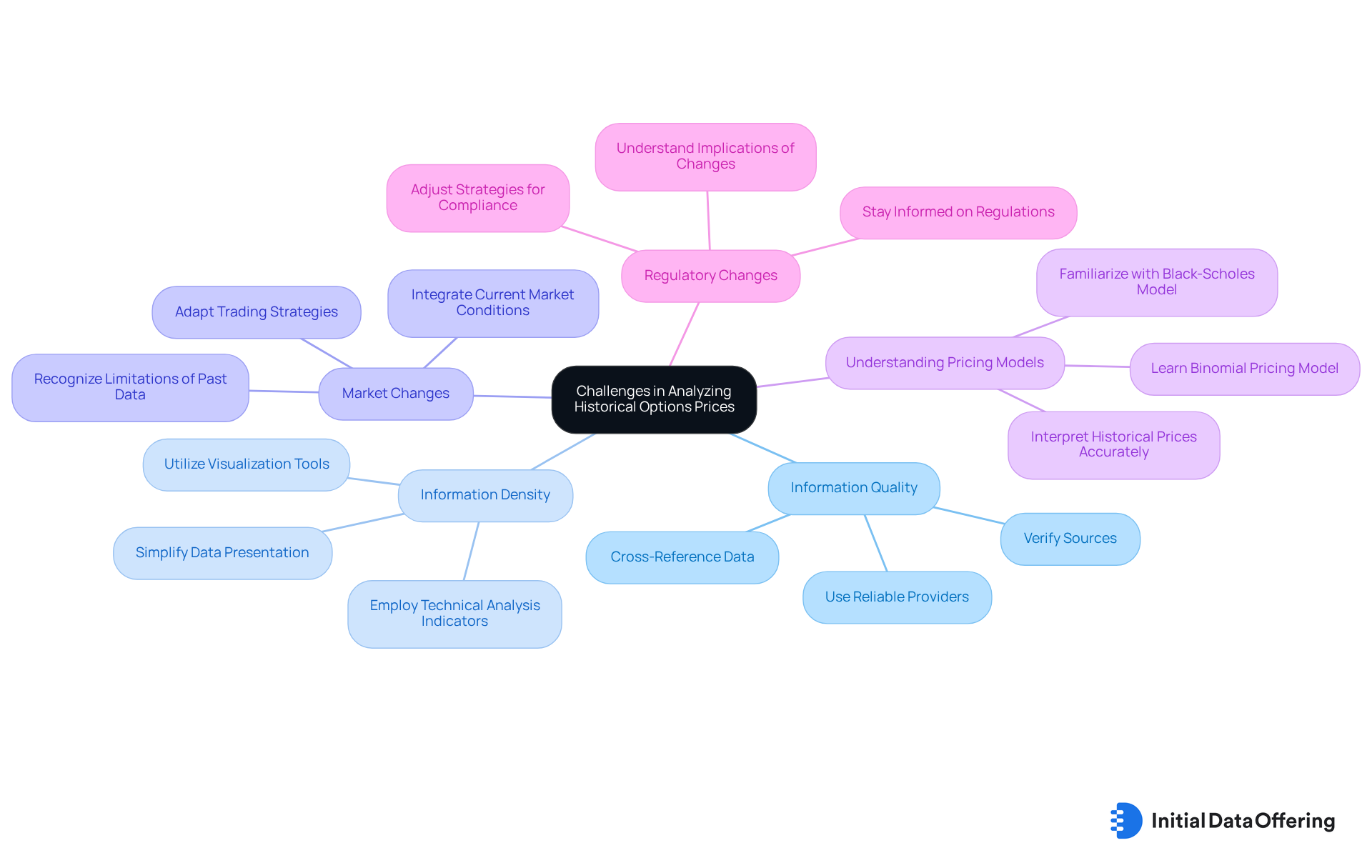

Overcome Challenges in Working with Historical Options Prices

Navigating the complexities of analyzing historical options prices presents several key challenges that traders must address effectively. Understanding these challenges is crucial for enhancing decision-making and trading outcomes.

-

Information Quality is paramount. Incomplete or erroneous information can significantly distort analysis. To ensure accuracy, it is essential to verify the source of your information and cross-reference it with multiple platforms. Research indicates that the precision of past options data can vary widely, with some sources highlighting inconsistencies that may lead to erroneous decision-making. As Intrinio emphasizes, "You can rely on the past pricing data you receive from us to be of the utmost quality, allowing you to make knowledgeable choices with assurance."

-

Information Density also complicates analysis. The multi-dimensional nature of historical options information can be overwhelming. Utilizing visualization tools, such as charting instruments and technical analysis indicators, can distill complex datasets into clear, actionable insights. This approach enables traders to identify key trends and patterns more easily, thereby enhancing their analytical capabilities.

-

Market Changes further complicate the landscape. Market dynamics are not static; they evolve over time, potentially diminishing the relevance of previous information. To maintain the applicability of trading strategies, it is vital to integrate current market conditions into analyses, ensuring they reflect the latest trends and sentiments. Recognizing the limitations of past data is crucial, as it serves merely as a reference for traders.

-

Understanding Pricing Models is essential for accurate analysis. Familiarity with various pricing models, such as Black-Scholes and binomial, can yield varied assessments of contracts. Comprehending these models allows traders to interpret past prices accurately and make informed choices. For instance, pricing models rely on historical data to assess fair market values, influencing decisions regarding purchases or sales.

-

Regulatory Changes should not be overlooked. Staying informed about modifications in regulations that may impact trading strategies and data reporting is critical. Being aware of these shifts enables traders to proactively adjust their strategies, ensuring compliance and relevance in their analyses. As the industry evolves, understanding the implications of these changes is vital for maintaining effective trading strategies.

By addressing these challenges directly, traders can enhance their analysis of historical options prices, which leads to more informed decision-making and improved trading outcomes.

Conclusion

Understanding historical options prices is essential for traders aiming to enhance their strategies and make informed decisions. These prices provide a window into market behavior, allowing for the analysis of trends, volatility, and risk assessment. By leveraging this data, traders can better navigate the complexities of the financial landscape and adapt their approaches to changing market conditions.

The article discusses various tools and platforms available for accessing historical options prices, such as:

- OptionMetrics

- Cboe Global Markets

- IVolatility

Each of these platforms offers unique features that cater to different trading needs, providing traders with valuable resources. Additionally, the methodologies employed in analyzing this data include:

- Statistical analysis

- Technical analysis

- Backtesting strategies

These methodologies enhance the accuracy of trading decisions. However, it is crucial to recognize the challenges traders face when working with historical options prices, such as ensuring data quality, adapting to market changes, and navigating regulatory considerations.

In conclusion, the significance of historical options prices cannot be overstated. They serve as a critical foundation for developing robust trading strategies and improving decision-making processes. Traders are encouraged to utilize the available tools and methodologies to effectively analyze past data, recognize patterns, and refine their approaches. By doing so, they can enhance their trading outcomes and adapt to the ever-evolving financial markets.

Frequently Asked Questions

What are historical options prices?

Historical options prices represent the documented trading rates of options contracts over time, providing insights into market behavior, volatility, and potential future value movements.

Why are historical options prices important for traders?

They are essential for traders and analysts as they help identify trends, assess risks, and make informed decisions regarding trading strategies, ultimately enhancing trading performance.

What limitations should traders be aware of when using historical options prices?

Traders should recognize challenges related to information availability and accuracy, which can affect the reliability of analyses. Additionally, survivorship bias may skew the interpretation of past data.

How can analyzing historical options prices benefit traders?

By reviewing past fluctuations in options prices, traders can evaluate potential risks associated with their positions and adjust their strategies accordingly, providing a contextual understanding that is valuable for both novice and experienced traders.

What types of datasets can traders use alongside historical options prices?

Traders can leverage various datasets, including alternative data, fundamentals data, and ESG data, to enrich their analyses and improve their trading strategies.

How does OptionMetrics contribute to the analysis of historical options prices?

OptionMetrics provides extensive historical derivatives information and underscores the importance of accurate historical options prices in assessing volatility and determining risk, which are vital for making well-informed trading decisions.

Where can traders access historical options prices?

Traders can access historical options prices from platforms like CBOE, which offer valuable resources for integrating this information into their trading strategies.