Master Forex Historical Data: Best Practices for Analysts

Master Forex Historical Data: Best Practices for Analysts

Overview

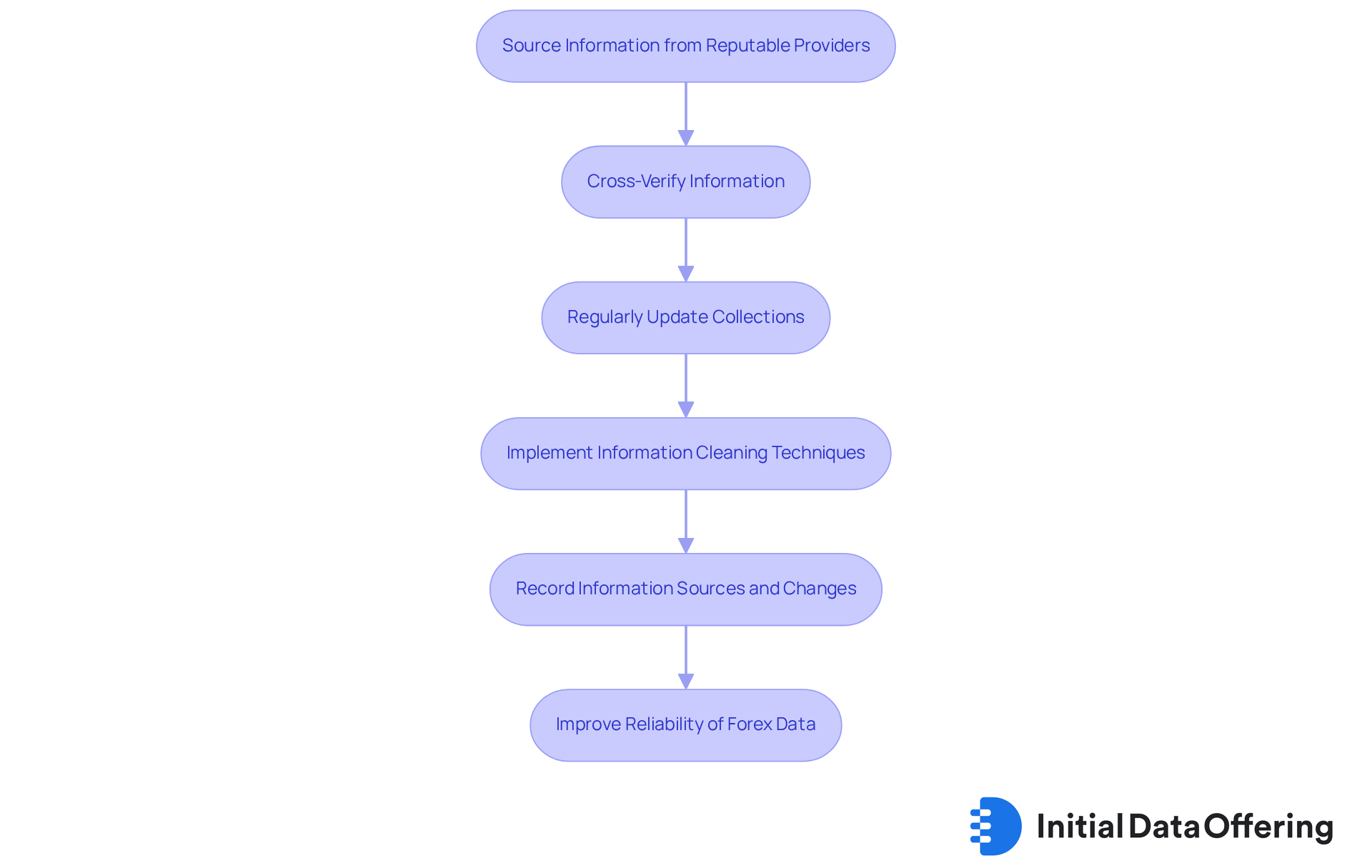

This article highlights best practices for analysts aiming to master forex historical data, underscoring the critical importance of data accuracy and reliability. Key features of effective data management include:

- Sourcing information from reputable providers

- Cross-verifying data

- Regularly updating datasets

These practices not only enhance the integrity of analyses but also support more informed trading strategies. By implementing these strategies, analysts can significantly improve their decision-making processes. How can these practices be integrated into your current analysis methods to enhance your trading outcomes?

Introduction

In the fast-paced world of forex trading, the accuracy and reliability of historical data are crucial for shaping an analyst's strategy. The myriad sources available present a challenge: discerning which practices genuinely enhance data collection and interpretation. This article explores essential methodologies that empower analysts to gather trustworthy forex historical data effectively. By navigating the complexities of the market, analysts can leverage these practices to achieve optimal trading outcomes. How can they ensure they are utilizing the best strategies for their success?

Ensure Data Accuracy and Reliability in Forex Historical Data

To ensure data accuracy and reliability, analysts should adopt several best practices in forex historical data.

-

Source Information from Reputable Providers: Utilizing information from established financial institutions or platforms renowned for their rigorous collection methods is crucial. Platforms like OANDA and Dukascopy are widely acknowledged for providing high-quality information feeds that traders can rely on. A significant percentage of analysts depend on trustworthy information providers to ensure the integrity of their analyses. By sourcing from reputable providers, analysts can enhance the reliability of their data, leading to more informed trading decisions.

-

Cross-Verify Information: Comparing information from multiple sources is essential to identify discrepancies. This practice not only confirms the precision of the information but also boosts confidence in the findings. For instance, experts frequently verify information from sources such as Forex Factory and Investing.com to guarantee consistency. Forex Factory, especially, provides free access with limited features, making it an accessible choice for analysts seeking trustworthy information. Cross-verifying enhances the credibility of the analysis, ultimately resulting in better trading outcomes.

-

Regularly Update Collections: Historical information must be refreshed frequently to reflect current market conditions. This practice is vital for backtesting trading strategies effectively, as outdated information can lead to misleading conclusions. Financial analysts stress that timely updates are essential for maintaining the relevance of information in trading decisions. Regular updates ensure that analysts are working with the most accurate data, thereby improving their strategic planning.

-

Implement Information Cleaning Techniques: Preserving information integrity involves eliminating outliers and rectifying errors within the dataset. Techniques such as z-score analysis can effectively detect anomalies, ensuring that the information utilized for analysis is trustworthy. Analysts suggest routine cleansing of information to maintain the quality of the datasets. By implementing these techniques, analysts can enhance the reliability of their data, thus supporting more accurate analyses.

-

Record Information Sources and Changes: Maintaining a thorough record of information sources and any alterations made is essential for transparency. This documentation assists in future audits and strengthens the reliability of the information used in trading decisions. Comprehensive documentation is a best practice that boosts confidence in the information utilized. By keeping meticulous records, analysts can ensure accountability and enhance the trustworthiness of their analyses.

By following these practices, professionals can significantly improve the reliability of their currency information, ultimately resulting in more informed trading strategies and better market outcomes.

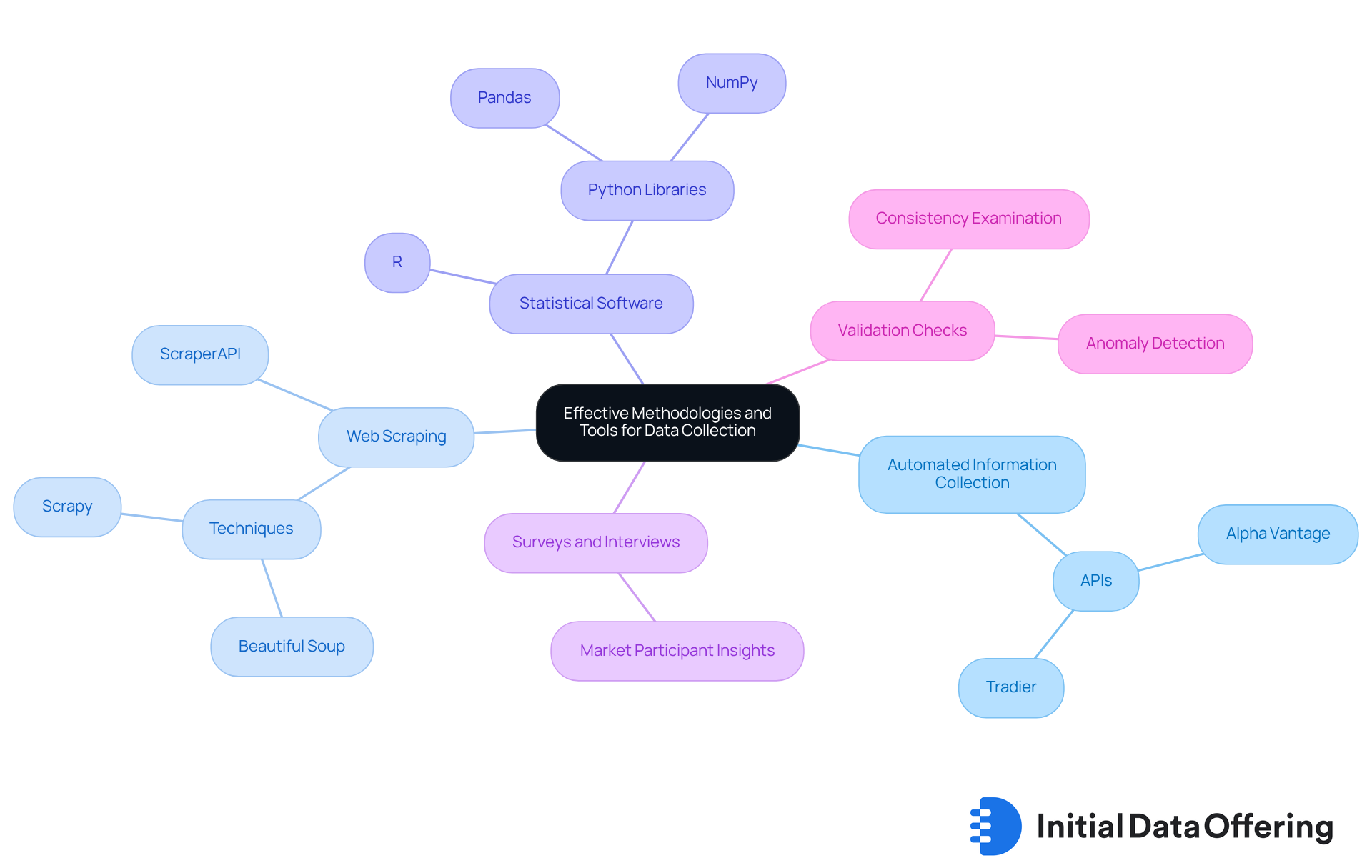

Utilize Effective Methodologies and Tools for Data Collection

To effectively collect forex historical data, analysts should consider several methods that enhance both the accuracy and depth of their findings.

-

Leverage Automated Information Collection Tools: Utilizing APIs from information providers like Alpha Vantage or Tradier allows for the automation of the data collection process. This ensures timely and precise retrieval, making it easier for analysts to focus on interpreting the data rather than gathering it.

-

Utilize Web Scraping Methods: For additional insights, web scraping methods can be employed to extract information from financial news sites and forums. This approach provides valuable context to the raw figures, enriching the analysis with qualitative data that numbers alone may not convey.

-

Use Statistical Software: Tools such as R or Python libraries (e.g., Pandas, NumPy) facilitate manipulation and analysis of the data. These resources enable analysts to handle and visualize complex datasets more effectively, leading to deeper insights.

-

Conduct Surveys and Interviews: Gathering qualitative information through surveys or interviews with market participants can reveal insights that numerical data may overlook. This method adds a layer of understanding, allowing analysts to grasp market sentiment and trends more comprehensively.

-

Implement Validation Checks: Regular examination of the gathered information for consistency and accuracy is crucial. By utilizing validation rules, analysts can identify any anomalies that may arise during the collection process, ensuring the reliability of their data.

Incorporating these strategies not only enhances the quality of forex historical data but also empowers analysts to make more informed decisions based on comprehensive insights.

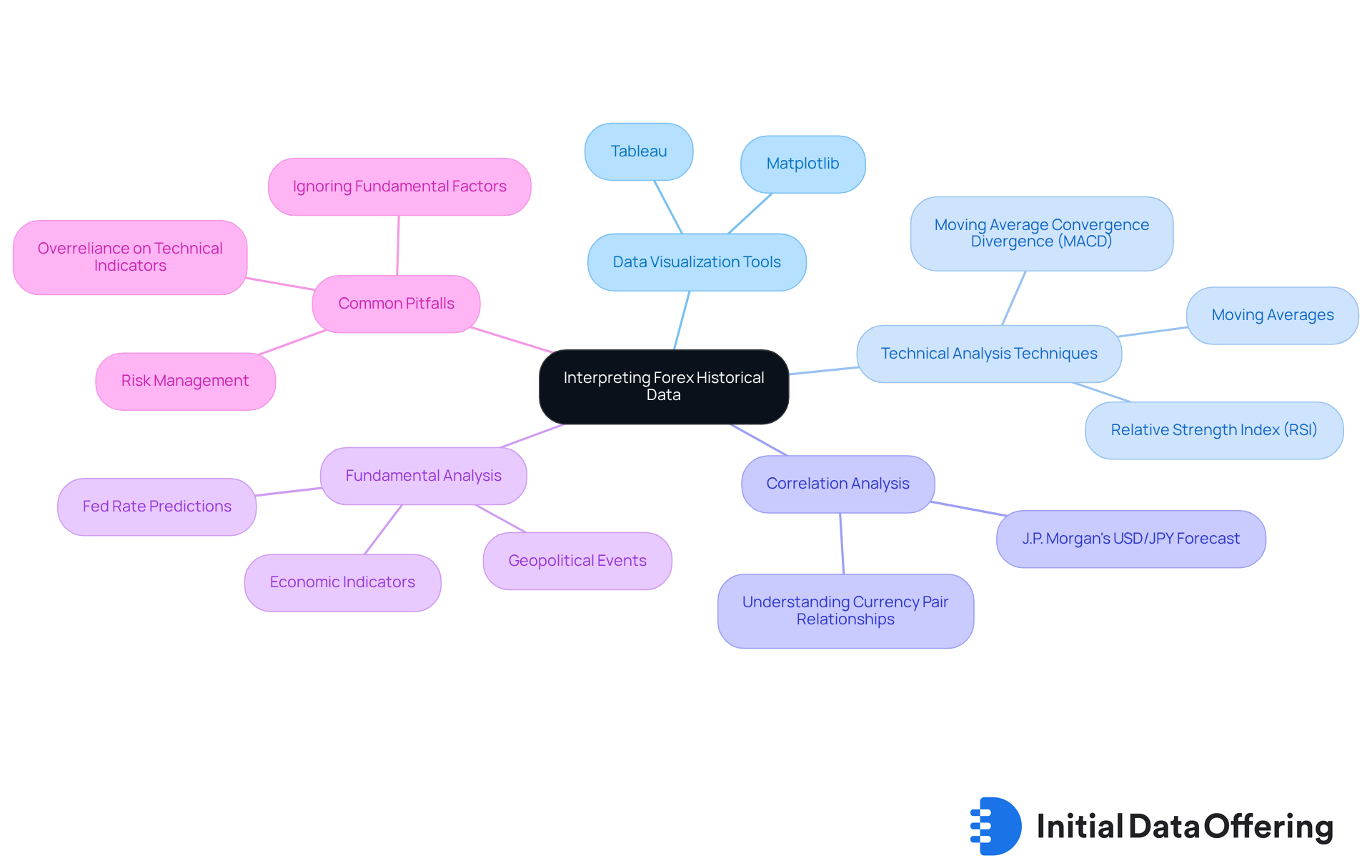

Interpret Complex Data Sets to Identify Market Trends

To effectively interpret complex forex historical data, analysts should adopt a multifaceted approach that includes several key techniques.

-

Utilize Data Visualization Tools: Employing tools like Tableau or Matplotlib enhances the ability to visualize data trends. This facilitates the identification of patterns and anomalies that may not be immediately apparent, ultimately leading to more informed decisions.

-

Apply Technical Analysis Techniques: Analysts should leverage indicators such as moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) to analyze price movements. These tools help pinpoint potential entry and exit points, guiding trading decisions. As Eamonn Sheridan pointed out, comprehending these indicators is essential for navigating economic dynamics effectively.

-

Conduct Correlation Analysis: Understanding the relationships between different currency pairs is crucial. By examining how these pairs move in relation to each other, analysts can gain insights into economic dynamics. This understanding assists in making informed trading decisions. For instance, J.P. Morgan's forecast of USD/JPY reaching 146 in Q3 emphasizes the significance of correlation analysis in current economic conditions.

Analyzing forex historical data across various time frames—daily, weekly, and monthly—reveals different trends. This segmentation aids in differentiating between short-term fluctuations and long-term trends, enabling more strategic planning.

-

Include Fundamental Analysis: A thorough perspective of economic conditions necessitates merging technical information with fundamental analysis. Economic indicators and geopolitical events play a significant role in shaping trends. Understanding these factors can enhance decision-making. As emphasized by experts, the consequences of possible Fed rate reductions by Morgan Stanley should be taken into account when evaluating currency market data.

-

Address Common Pitfalls: Analysts should be mindful of frequent traps in currency analysis, such as excessive dependence on technical indicators without considering fundamental factors. Trading is inherently risky, and decisions should be made based on advice from qualified financial professionals to mitigate potential losses.

By combining these methods and knowledge, currency specialists can navigate the intricacies of the environment more efficiently. This results in more informed trading strategies.

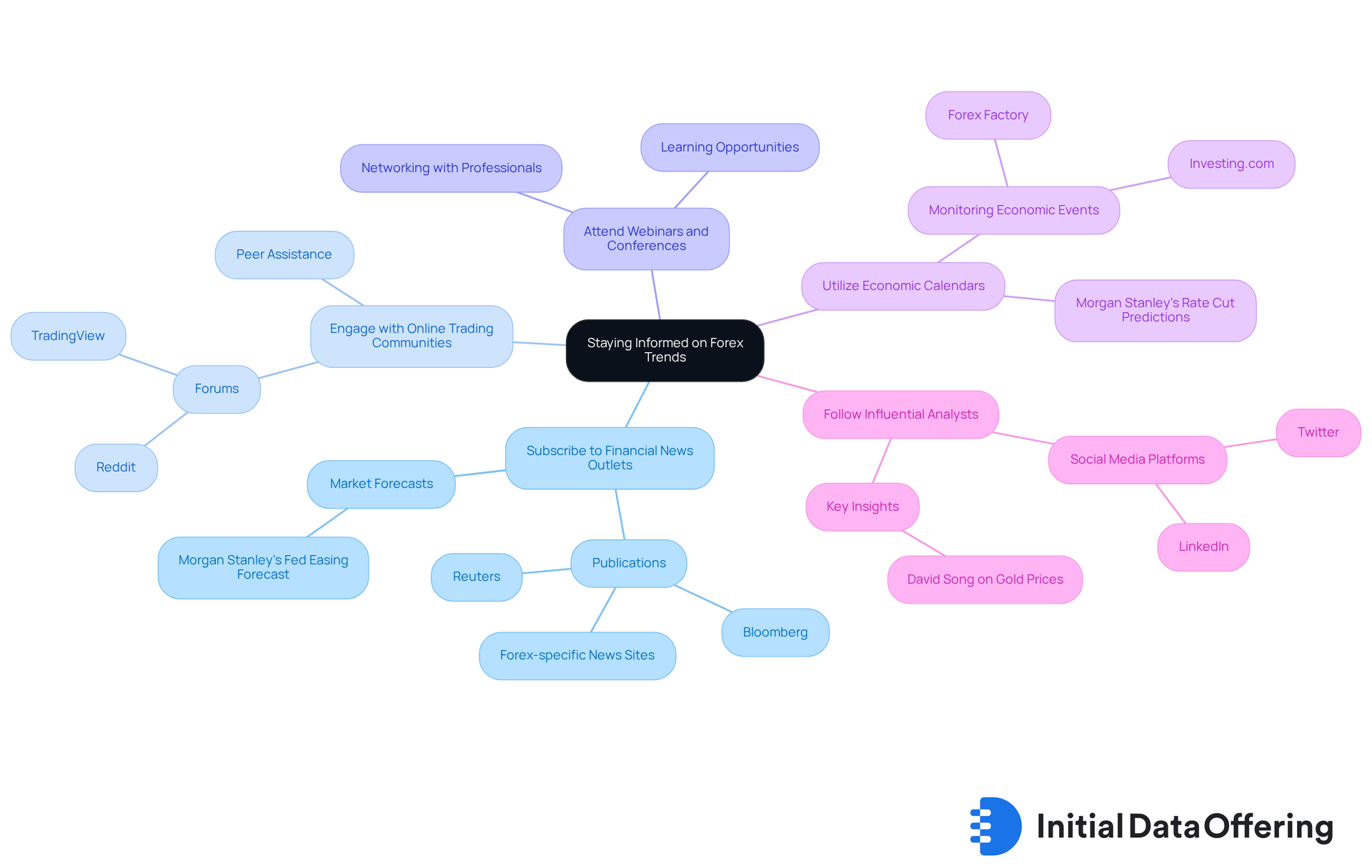

Stay Informed on Latest Data Trends and Insights

To stay informed on the latest trends and insights in forex historical data, analysts should adopt a multifaceted approach.

-

Subscribe to Financial News Outlets: Regularly reading publications like Bloomberg, Reuters, and Forex-specific news sites is essential for staying updated on economic developments. As Eamonn Sheridan noted, "Morgan Stanley’s forecast adds weight to expectations of imminent Fed easing, reinforcing dollar downside risks and supporting equities." This strategy not only keeps analysts informed but also helps them anticipate market movements.

-

Engage with Online Trading Communities: Participation in forums and social media groups, such as Reddit or TradingView, allows traders to share insights and discuss trends. Interacting with these communities provides up-to-date information and peer assistance, which is crucial in a swiftly evolving environment. How can these shared experiences enhance your understanding of market dynamics?

-

Attend Webinars and Conferences: Engaging in industry webinars and conferences offers opportunities to learn from experts and network with other professionals. These events often showcase emerging trends and provide deeper insights into economic dynamics, equipping analysts with knowledge from forex historical data that can inform their trading strategies.

-

Utilize Economic Calendars: Monitoring forthcoming economic events and reports that could influence currency exchange is vital. Tools like Forex Factory or Investing.com can be invaluable in this regard. For instance, Morgan Stanley forecasts two 25-basis-point rate cuts in 2025, which could significantly influence trading strategies. How might these anticipated changes affect your trading decisions?

-

Follow Influential Analysts and Economists: Identifying and following key figures in currency exchange on platforms like Twitter or LinkedIn allows analysts to gain insights from their analyses and predictions. As David Song noted, "Gold price displays a rebound prior to the August low," emphasizing the importance of staying informed about financial trends.

By leveraging these strategies, analysts can effectively navigate the complexities of the Forex market and make informed trading decisions.

Conclusion

Mastering forex historical data is essential for analysts aiming to enhance their trading strategies and market insights. By implementing best practices—such as sourcing information from reputable providers, cross-verifying data, and maintaining updated collections—analysts can significantly improve the reliability and accuracy of their analyses. Furthermore, utilizing effective methodologies and tools, including automated information collection and data visualization, allows for a deeper understanding of market trends and dynamics.

The article underscores the importance of a multifaceted approach in interpreting complex data sets. By combining:

- Technical and fundamental analysis

- Conducting correlation analysis

- Addressing common pitfalls

Analysts can navigate the intricacies of the forex market more effectively. Staying informed through financial news, engaging with trading communities, and following influential analysts further equips professionals with the knowledge needed to make informed trading decisions.

Ultimately, the significance of accurate and reliable forex historical data cannot be overstated. Analysts are encouraged to adopt these best practices and methodologies not only to enhance their trading outcomes but also to contribute to a more informed and efficient market. Embracing these strategies will empower analysts to leverage data-driven insights, fostering confidence in their trading decisions and ultimately leading to greater success in the forex arena.

Frequently Asked Questions

Why is it important to ensure data accuracy and reliability in forex historical data?

Ensuring data accuracy and reliability is crucial for making informed trading decisions and improving the credibility of analyses in the forex market.

What sources are recommended for obtaining reliable forex historical data?

Analysts should source information from reputable providers like OANDA and Dukascopy, which are known for their rigorous collection methods and high-quality information feeds.

How can analysts cross-verify information in forex data?

Analysts can compare information from multiple sources, such as Forex Factory and Investing.com, to identify discrepancies and confirm the precision of the data, enhancing the credibility of their analyses.

Why is it necessary to regularly update historical data collections?

Regular updates are vital to reflect current market conditions and are essential for effectively backtesting trading strategies. Outdated information can lead to misleading conclusions.

What techniques can be used to clean forex data and maintain its integrity?

Information cleaning techniques, such as z-score analysis, can be employed to detect anomalies, eliminate outliers, and rectify errors within the dataset, ensuring the data used for analysis is trustworthy.

Why is it important to record information sources and changes made to the data?

Maintaining thorough records of information sources and any alterations enhances transparency, assists in future audits, and strengthens the reliability of the information used in trading decisions.

How do these best practices improve trading strategies and market outcomes?

By following these best practices, analysts can significantly enhance the reliability of their currency information, leading to more informed trading strategies and better market outcomes.