Master Forex Data: Essential Types, Sources, and Analysis Techniques

Master Forex Data: Essential Types, Sources, and Analysis Techniques

Overview

The article emphasizes the essential types, sources, and analysis techniques of forex data, underscoring its critical role in market analysis and trading decisions. Understanding various data types—such as historical, real-time, and economic information—provides traders with a comprehensive view of the market landscape. By employing analysis techniques like technical and fundamental analysis, traders can make informed decisions that optimize their strategies in the dynamic forex market.

What are the specific advantages of utilizing these data types?

- Historical data allows for trend identification.

- Real-time data supports timely decision-making.

- Economic information provides context for market movements, enabling traders to anticipate shifts and adjust their strategies accordingly.

This multifaceted approach not only enhances decision-making but also increases the potential for successful trades.

In conclusion, a thorough understanding of forex data types and analysis techniques equips traders with the tools necessary to navigate the complexities of the forex market effectively. By integrating these insights into their trading strategies, they can improve their overall performance and achieve better outcomes.

Introduction

The foreign exchange market represents a dynamic and complex environment where a deep understanding of forex data can significantly impact the difference between profit and loss. This article explores the essential types of forex data, their sources, and the analysis techniques that empower traders to navigate the market effectively.

As the landscape increasingly shifts towards data-driven decision-making, the challenge arises: how can traders leverage this wealth of information to enhance their strategies and stay ahead in a rapidly evolving market?

By analyzing the features of various datasets, traders can gain insights into market trends, make informed decisions, and ultimately improve their trading outcomes.

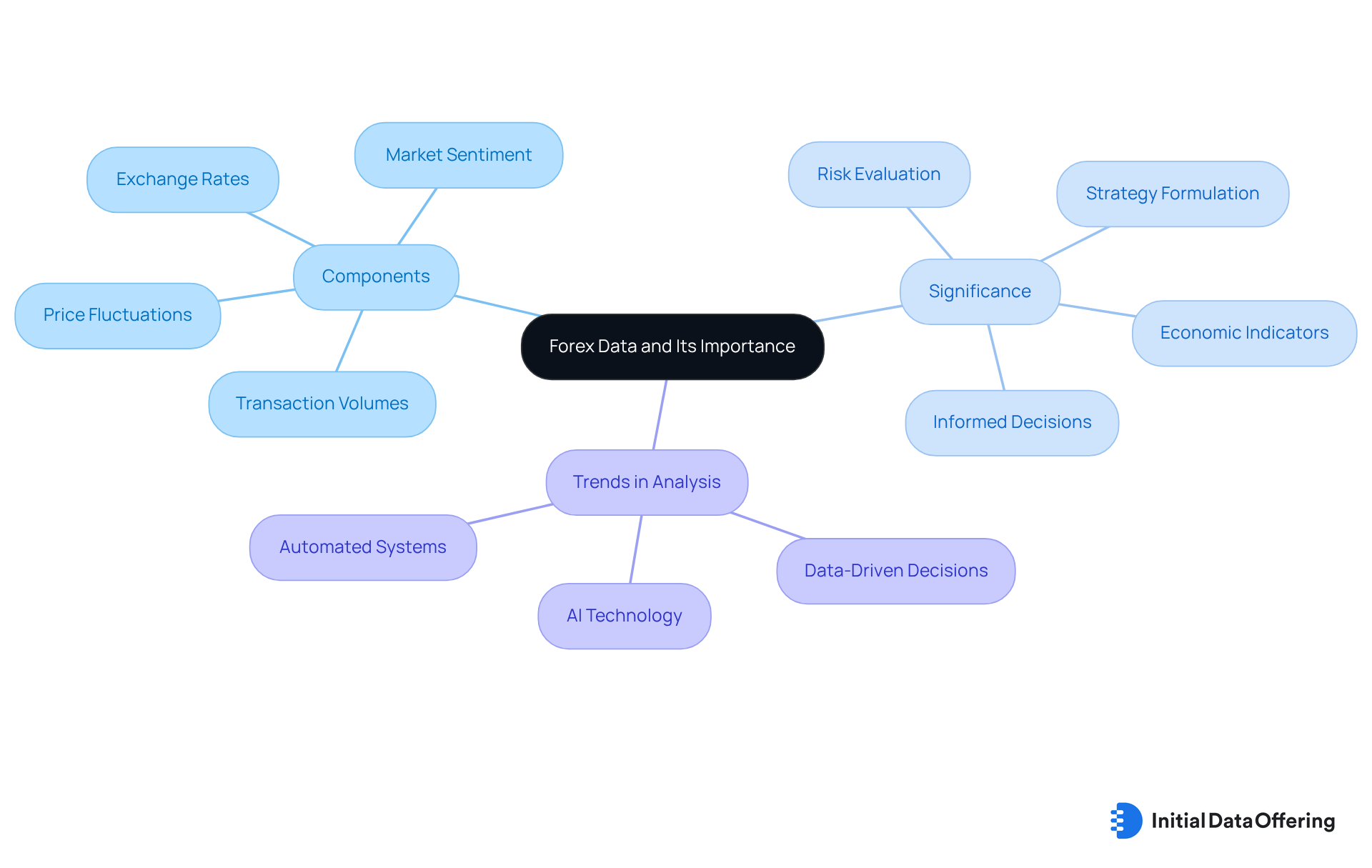

Define Forex Data and Its Importance in Market Analysis

Foreign exchange information encompasses a wide array of details sourced from the global currency market, where active money exchanges occur. This information includes currency exchange rates, historical price fluctuations, transaction volumes, and market sentiment indicators. For investors, a solid understanding of currency market information is vital, as it empowers them to make informed decisions based on prevailing market trends and price changes. By meticulously analyzing this data, investors can identify potential market opportunities, evaluate associated risks, and formulate strategies that adapt to current market conditions.

The significance of forex data in market analysis is substantial, as it underpins all market activities. Consider the U.S. Non-Farm Payrolls (NFP) report, which gauges job creation in non-agricultural sectors. This report often triggers sharp price movements of 50-100 pips within minutes of its release. Such volatility underscores the necessity for market participants to stay informed about economic indicators that can influence currency valuations. Moreover, the average daily exchange volume in the foreign exchange market surpasses USD 6 trillion, highlighting the scale and importance of this marketplace.

Recent trends in currency market data analysis reveal an increasing reliance on advanced technologies, such as AI algorithms, which assess participants' past performance and preferences to provide tailored investment recommendations. Approximately 49% of market participants believe that advanced AI technology will enhance the financial sector, indicating a shift toward data-driven decision-making. This trend is evident, as around 90% of successful currency market practitioners have adopted automated systems to refine their strategies.

In conclusion, forex data is not merely supplementary; it is essential for effective market analysis. It guides traders in identifying optimal entry and exit points while informing their risk management strategies. As Jesse Maida noted, 'The market is projected to expand at a CAGR of 10.6% throughout the forecast period,' emphasizing the ongoing development and significance of foreign exchange information in commerce.

Explore Types of Forex Data: Historical, Real-Time, and More

The categorization of forex data can be done into several types, with each serving distinct purposes.

-

Historical Data: This includes previous price movements and transaction volumes, allowing individuals to analyze trends and patterns over time. The advantages of historical forex data lie in its essential role for back-testing trading methods and acquiring insights into market behavior. This enables individuals to enhance their techniques based on past performance. Notably, around 70% of market participants utilize historical information for strategy formulation, underscoring its significance in informed decision-making.

-

Live Information: Live information provides instant updates on forex data and currency prices, empowering investors to make prompt decisions based on prevailing market conditions. This type of information is vital for day traders and those employing short-term tactics, as it allows them to respond swiftly to market changes. For instance, during significant economic announcements, investors frequently rely on real-time information to capitalize on immediate price fluctuations.

-

Tick Information: Representing the most granular form of forex data, tick data captures every price change in real-time. The benefits of this level of detail are invaluable for high-frequency strategies that depend on minute price fluctuations, enabling participants to take advantage of rapid market movements. Analysts emphasize that tick information can provide a competitive edge in fast-paced trading environments.

-

Sentiment Information: Reflecting the overall mood of the market, forex data indicates whether participants feel optimistic or pessimistic about a currency pair. Analyzing sentiment can yield insights into potential market movements, as investor psychology often influences price dynamics. Market analysts frequently assert that understanding sentiment can be as crucial as technical analysis in predicting price trends.

-

Economic Information: Forex data includes reports on key economic indicators such as GDP, unemployment rates, and inflation, all of which can significantly impact currency values. A strong grasp of economic information is essential for conducting fundamental analysis in currency exchange, as it helps individuals predict market responses to economic changes. Furthermore, geopolitical events, such as elections or trade negotiations, can also sway these indicators, making it vital for market participants to stay informed.

In conclusion, each category of foreign exchange information plays a crucial role in shaping investment strategies. By understanding the unique objectives of historical, real-time, tick, sentiment, and economic data, traders can refine their decision-making processes and enhance their overall performance in the market.

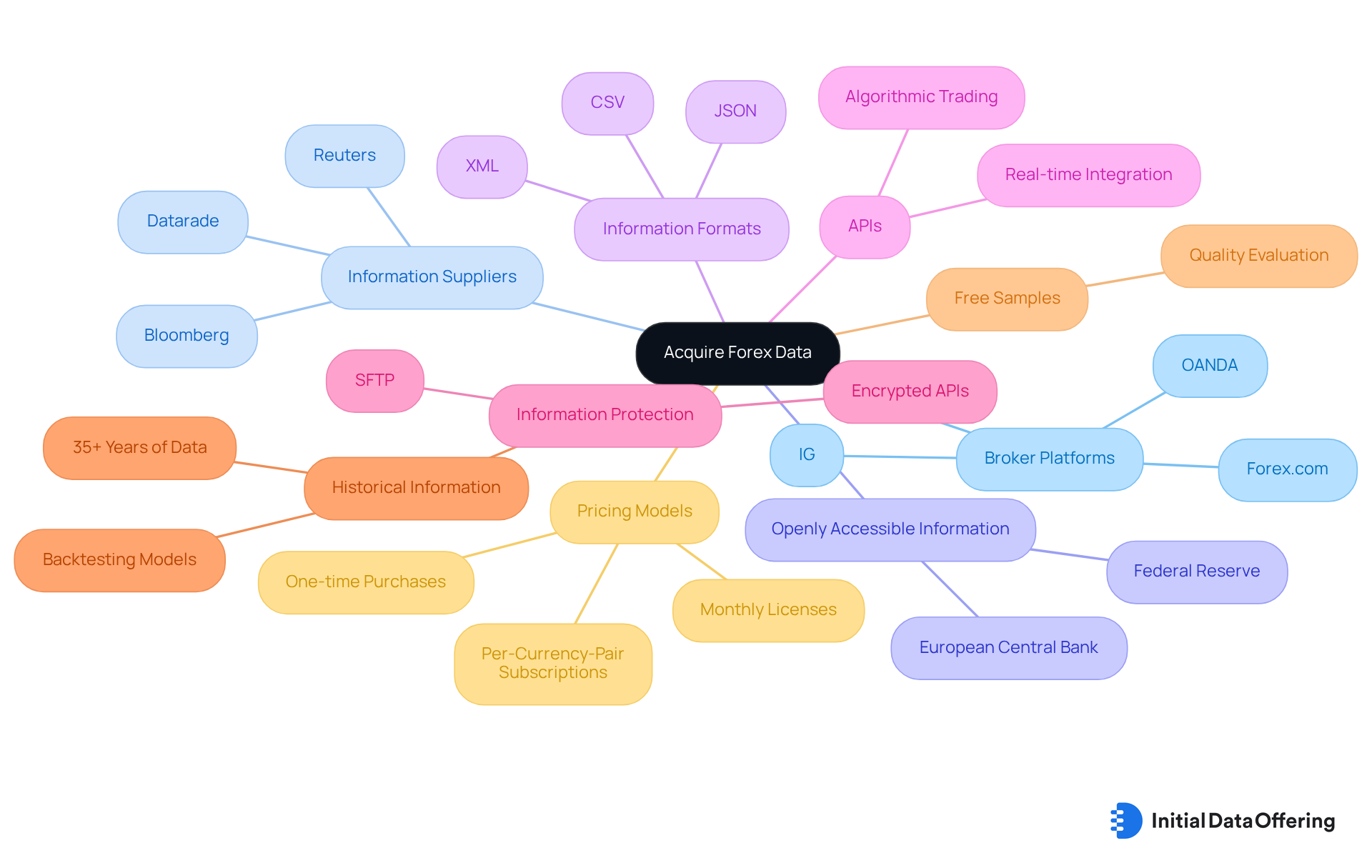

Acquire Forex Data: Sources, Formats, and Access Methods

Obtaining forex data can be achieved through various sources and formats, each offering distinct advantages for traders. Understanding these methods is essential for making informed trading decisions using forex data.

-

Broker Platforms: Many currency exchange brokers, such as OANDA, IG, and Forex.com, provide clients with access to both real-time and historical information via their trading platforms. This option is particularly popular among traders, with a significant percentage relying on broker platforms for their informational needs. By utilizing these platforms, traders can access timely data that can influence their trading strategies.

-

Information Suppliers: Specialized information suppliers like Bloomberg, Reuters, and Datarade offer comprehensive currency exchange services, including APIs for real-time access. Although these services typically require a subscription, they deliver high-quality, reliable information that is crucial for making informed trading choices. The dependability of these sources can significantly enhance a trader's confidence in their decisions.

-

Openly Accessible Information: Numerous financial organizations and governmental bodies publish currency exchange information free of charge. Websites such as the Federal Reserve and the European Central Bank provide historical exchange rates and economic indicators, making them invaluable resources for traders seeking essential forex data. This accessibility enables traders to conduct thorough analyses without incurring additional costs.

-

Information Formats: Currency exchange information is generally available in various formats, including CSV, JSON, and XML. Merchants should select a format that aligns with their analytical tools or market platforms to ensure seamless integration. This choice can enhance the efficiency of data processing and analysis.

-

APIs: Many information providers offer APIs, allowing traders to integrate foreign exchange information into their applications or systems for commerce. This method is particularly advantageous for algorithmic strategies that depend on real-time information streams, enabling rapid responses to market fluctuations. Leveraging APIs can provide traders with a competitive edge in fast-paced markets.

-

Information Protection: Currency exchange information is transmitted through secure channels, such as encrypted APIs and SFTP, ensuring data integrity and adherence to regulatory standards. This security is vital in high-stakes financial environments, fostering trust in the information being utilized.

-

Historical Information: Some datasets offer extensive historical information, dating back over 35 years, which is invaluable for backtesting trading models and conducting econometric research. Accessing such historical data can provide insights into market trends and inform future trading strategies.

-

Free Samples: Traders can often obtain complimentary samples of currency exchange information to evaluate quality before making a purchase. This practice allows traders to assess the value of the information without financial commitment, ensuring they make informed decisions.

-

Pricing Models: Pricing options for foreign exchange information vary widely, including one-time purchases, monthly or yearly licenses, and per-currency-pair subscriptions. This variety allows users to select options that best suit their budget and requirements, making it easier to access the information they need.

Analyze Forex Data: Techniques and Tools for Market Insights

Examining forex data involves various techniques and tools that assist traders in gaining market insights. Understanding these methods is crucial for making informed trading decisions. Here are some effective approaches:

-

Technical Analysis: This approach utilizes historical price information and chart patterns to predict future price movements. Common tools include moving averages, Bollinger Bands, and Fibonacci retracement levels. By employing charting software like TradingView or MetaTrader, traders can visualize forex data effectively, enhancing their decision-making process.

-

Fundamental Analysis: This technique focuses on economic indicators and news events that can influence currency values. Traders should monitor economic calendars for upcoming reports and assess their potential impacts on the currency market. Recognizing these factors can provide a strategic advantage in trading decisions.

-

Sentiment Analysis: Understanding market sentiment is essential for anticipating potential price movements. Instruments such as the Commitment of Traders (COT) report and sentiment indicators help market participants gauge the mood of the market. How can these insights inform your trading strategy?

-

Statistical Analysis: Traders can employ statistical techniques to uncover correlations and patterns within forex data. Techniques such as regression analysis and time series analysis reveal hidden trends, offering valuable insights for traders looking to optimize their strategies.

-

Automated Trading Systems: Many traders utilize algorithmic systems that analyze forex data and execute transactions based on established criteria. These systems can process vast amounts of data rapidly, resulting in more efficient trading strategies. How might automation enhance your trading performance?

By integrating these methods into your trading approach, you can enhance your market analysis and improve your decision-making capabilities.

Conclusion

Understanding the intricacies of forex data is crucial for anyone looking to navigate the complexities of the currency market effectively. This data not only informs traders about current market conditions but also empowers them to make strategic decisions based on historical trends and real-time information. By leveraging various types of forex data—ranging from historical and real-time to sentiment and economic indicators—traders can refine their strategies and enhance their overall performance in the marketplace.

The article delves into the essential types of forex data, highlighting their unique roles and significance.

- Historical data aids in back-testing strategies.

- Real-time information is vital for day traders looking to capitalize on immediate market changes.

- Understanding sentiment and economic indicators can provide valuable insights into potential market movements, further enriching a trader's analytical toolkit.

- The discussion on sources and access methods underscores the importance of reliable data in making informed trading decisions.

Ultimately, mastering forex data is not just about accumulating information; it is about transforming that information into actionable insights. As the forex market continues to evolve, embracing advanced analysis techniques and leveraging technology will be key to staying ahead. Traders are encouraged to actively seek out diverse data sources and employ various analytical methods to navigate the dynamic landscape of currency trading effectively. By doing so, they can enhance their decision-making capabilities and ultimately achieve greater success in their trading endeavors.

Frequently Asked Questions

What is forex data?

Forex data refers to a wide range of information sourced from the global currency market, including currency exchange rates, historical price fluctuations, transaction volumes, and market sentiment indicators.

Why is forex data important for investors?

Forex data is crucial for investors as it allows them to make informed decisions based on market trends and price changes, identify potential market opportunities, evaluate risks, and formulate adaptive strategies.

How does the U.S. Non-Farm Payrolls (NFP) report impact the forex market?

The NFP report measures job creation in non-agricultural sectors and can trigger significant price movements in the forex market, often ranging from 50 to 100 pips within minutes of its release.

What is the average daily exchange volume in the forex market?

The average daily exchange volume in the foreign exchange market exceeds USD 6 trillion, indicating the scale and importance of this marketplace.

What recent trends are observed in currency market data analysis?

There is an increasing reliance on advanced technologies, such as AI algorithms, which analyze past performance and preferences to provide tailored investment recommendations.

How do market participants view the impact of AI technology in the financial sector?

Approximately 49% of market participants believe that advanced AI technology will enhance the financial sector, signaling a shift toward data-driven decision-making.

What percentage of successful currency market practitioners use automated systems?

Around 90% of successful currency market practitioners have adopted automated systems to refine their trading strategies.

How does forex data assist traders in their strategies?

Forex data helps traders identify optimal entry and exit points and informs their risk management strategies, making it essential for effective market analysis.

What is the projected growth rate of the forex market?

The forex market is projected to expand at a compound annual growth rate (CAGR) of 10.6% throughout the forecast period, highlighting the ongoing significance of forex information in commerce.