Master Consumer Credit Data: Key Insights for Analysts

Master Consumer Credit Data: Key Insights for Analysts

Overview

The article emphasizes the key insights analysts can gain from consumer credit data, underscoring its significance in understanding borrowing behavior, creditworthiness, and economic trends. By examining various types of consumer credit data—such as revolving and installment credit, payment history, and utilization rates—analysts can make informed decisions that influence lending practices and market strategies. This analysis not only drives economic stability but also enhances customer engagement within the financial sector.

How can understanding these datasets transform lending practices? By leveraging consumer credit data, analysts can identify patterns that inform risk assessment and credit decisions. This, in turn, allows financial institutions to tailor their offerings, ultimately benefiting both lenders and consumers.

In conclusion, the insights derived from consumer credit data are invaluable. They not only facilitate informed decision-making but also contribute to a more stable economic environment. As analysts continue to explore these datasets, the implications for lending practices and market strategies will become increasingly significant.

Introduction

Understanding consumer credit data is essential for navigating the complexities of today’s financial landscape. This data reveals an individual’s borrowing and repayment habits, serving as a critical tool for analysts, lenders, and policymakers in assessing creditworthiness and economic health. The advantages of leveraging this information are significant: it allows for informed decision-making that can enhance lending practices and marketing strategies.

As trends such as rising subprime borrowing and stable delinquency rates emerge, the challenge lies in effectively interpreting this information to inform strategic decisions.

How can analysts leverage these insights to enhance lending practices and marketing strategies in an ever-evolving market? This question invites further exploration into the actionable implications of understanding consumer credit data.

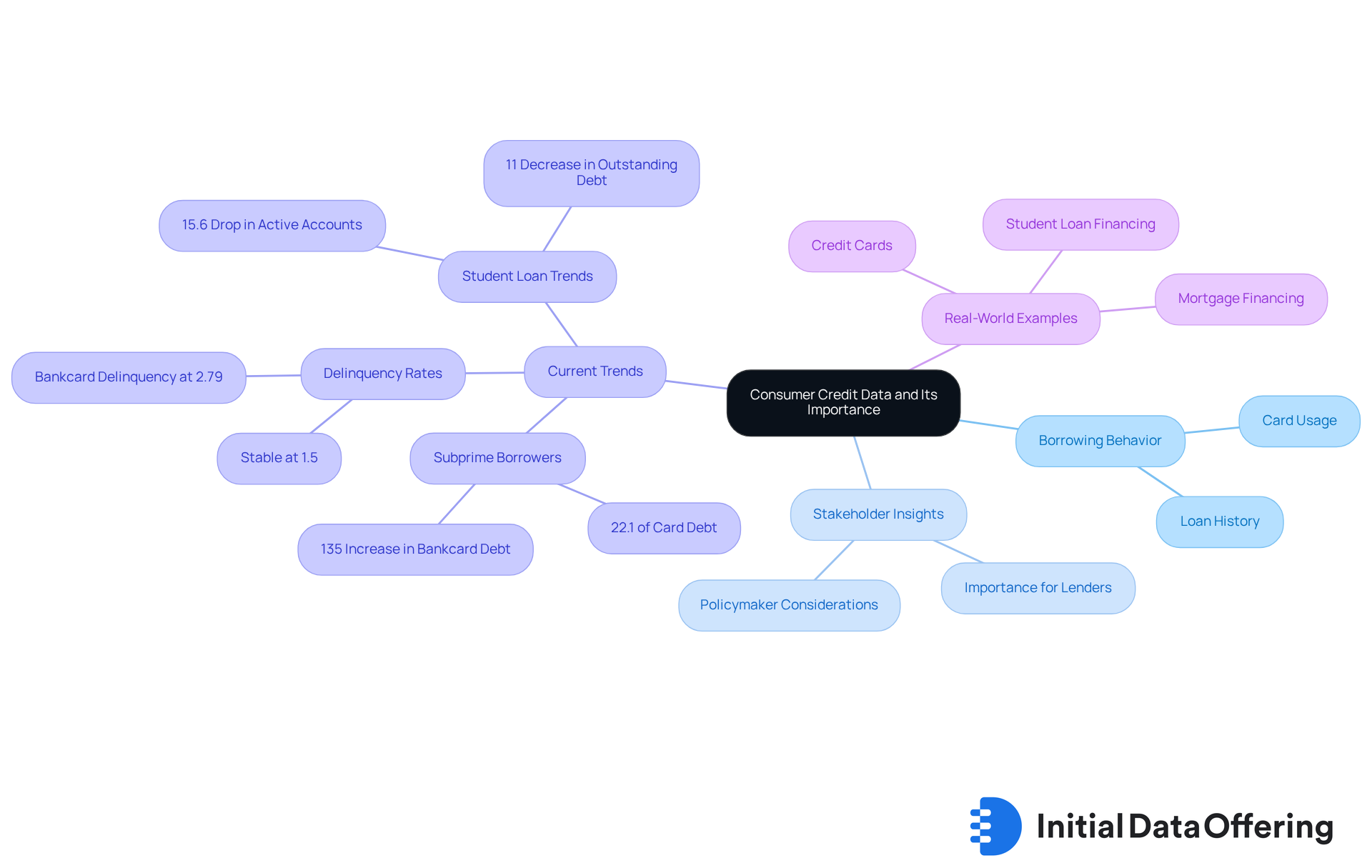

Define Consumer Credit Data and Its Importance

Consumer credit data includes details about an individual's borrowing and repayment behavior, such as card usage, loan history, and payment patterns. This information is crucial for various stakeholders such as lenders, companies, and policymakers. It provides insights into buyer behavior, creditworthiness, and overall economic health. By analyzing consumer credit data, analysts can identify trends, assess risks, and make informed decisions that shape lending practices and market strategies. Understanding this data is vital for crafting effective marketing strategies and enhancing customer engagement in the financial sector.

As of May 2025, the share of card debt held by subprime borrowers increased to 22.1%, reflecting a 3.5% rise from May 2024. This trend suggests a growing segment of the population facing financial challenges. Moreover, delinquency rates on total U.S. personal debt remained stable at 1.5%, consistent with figures from May and April, highlighting the reliability of this metric over time.

Real-world examples illustrate the impact of consumer credit data on economic health. For instance, monitoring mortgage data helps identify trends in housing finance, while insights into student financing reveal the financial struggles faced by students, particularly as delinquency rates have risen significantly. Notably, outstanding student loan debt decreased by 11% year-over-year to $1.33 trillion in June 2025, offering a clearer understanding of the student loan landscape. Grasping these dynamics is essential for developing effective marketing strategies and improving customer engagement within the financial sector. Ultimately, this knowledge drives informed decision-making and supports economic stability.

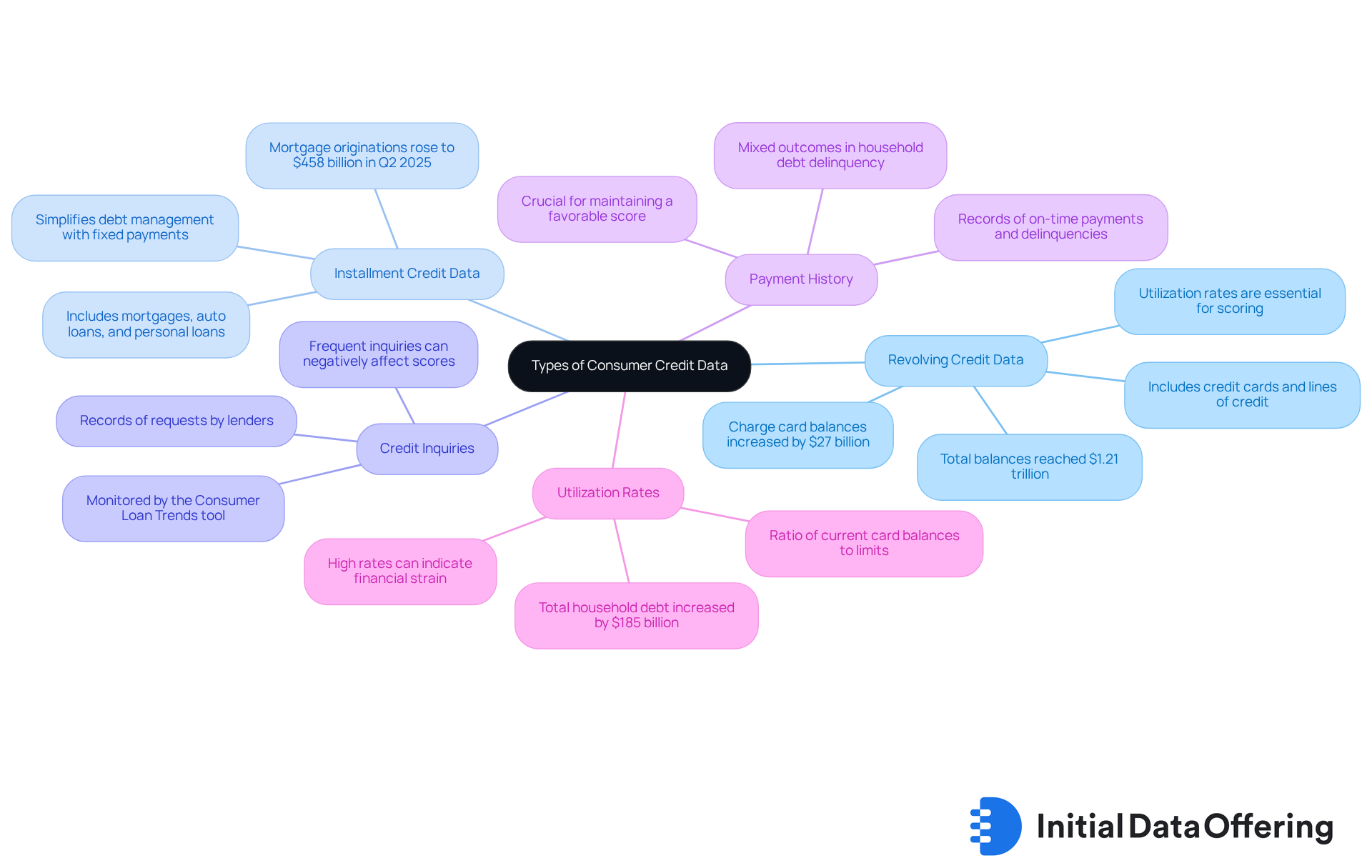

Explore Types of Consumer Credit Data

Consumer credit data can be categorized into several key types, each playing a crucial role in understanding consumer behavior and creditworthiness:

-

Revolving Credit Data: This category includes credit cards and lines of credit, allowing consumers to borrow up to a specified limit and repay over time. The adaptability of revolving financing can result in differing utilization rates, which are essential for scoring. Recent statistics indicate that charge card balances increased by $27 billion from the previous quarter, totaling $1.21 trillion. This growing dependence on revolving loans highlights the importance of monitoring these trends.

-

Installment Credit Data: This encompasses loans with fixed payments over a defined period, such as mortgages, auto loans, and personal loans. Installment financing is characterized by consistent payment plans, simplifying debt management for individuals. Mortgage originations rose modestly, with $458 billion in newly originated loans in Q2 2025, indicating continued public involvement in installment financing. Understanding these trends can help analysts assess long-term financial obligations by analyzing consumer credit data.

-

Credit Inquiries: These are records of requests made by lenders to evaluate an individual's borrowing history. Frequent inquiries can negatively affect scores, indicating potential risk to lenders. The Consumer Loan Trends tool monitors these inquiries, offering valuable insights into consumer credit data and borrowing behavior. How do these inquiries influence your credit score?

-

Payment History: This includes detailed records of an individual's payment behavior, highlighting on-time payments and delinquencies. A robust payment history is crucial for sustaining a favorable score and indicates a consumer's dependability. According to Joelle Scally, Economic Policy Advisor at the New York Fed, the movement of household debt into serious delinquency has displayed varied outcomes across debt categories, with charge card and auto loans remaining stable. This variability underscores the need for continuous monitoring of payment behaviors.

-

Utilization Rates: This metric represents the ratio of current card balances to limits. High utilization rates can indicate financial strain and may negatively impact scores. Understanding these rates is crucial, especially as total household debt increased by $185 billion in Q2 2025, reaching $18.39 trillion. What strategies can consumers employ to manage these rates effectively?

Comprehending consumer credit data allows analysts to customize their research and insights efficiently. For example, examining revolving financing information can uncover trends in public spending and borrowing habits, while installment financing details can offer insights into long-term financial obligations and repayment behaviors. By utilizing these differences, market research analysts can create more refined strategies for evaluating financial risk and individual financial well-being.

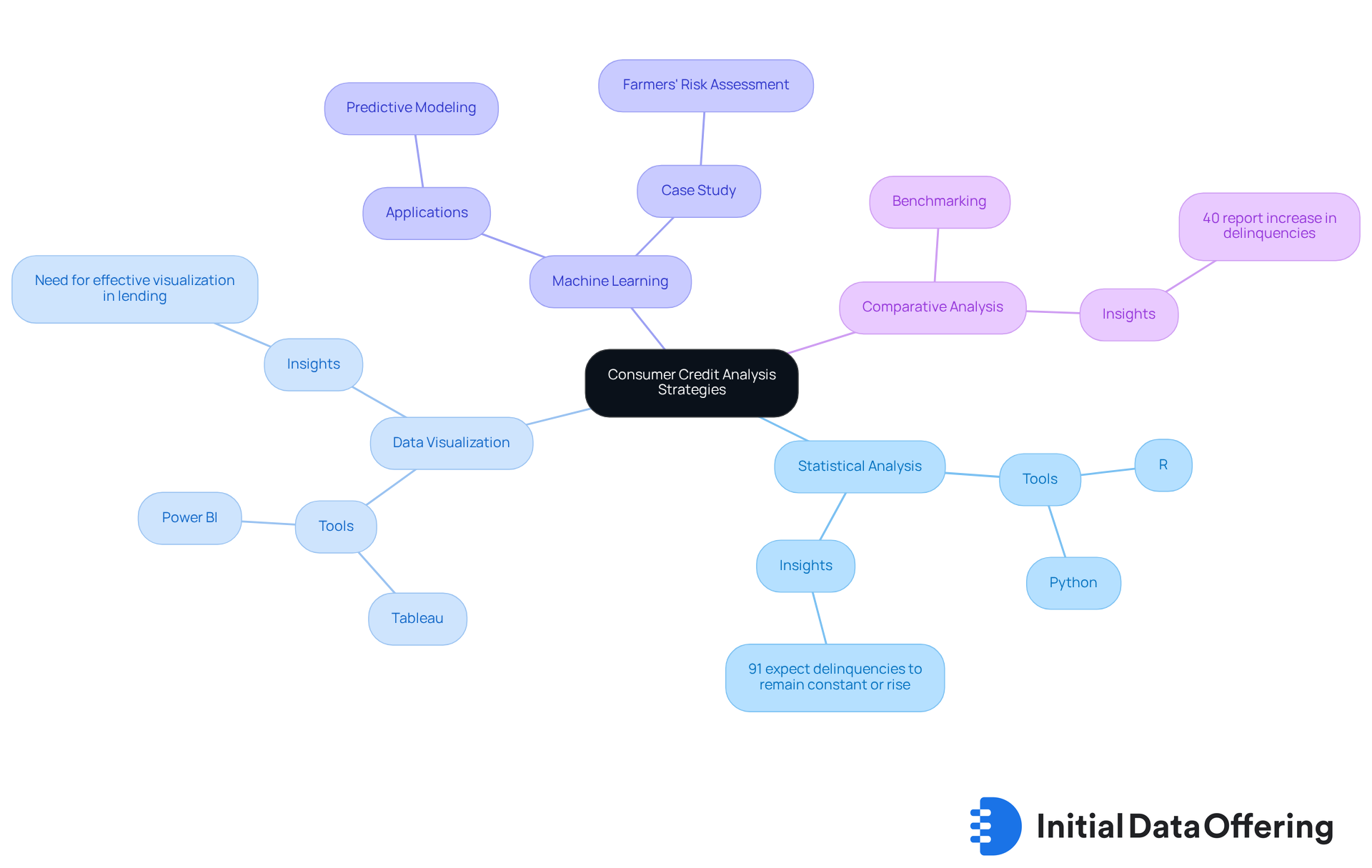

Analyze Consumer Credit Data: Methodologies and Tools

Examining customer financing information necessitates a multifaceted strategy that employs diverse methodologies and instruments to extract actionable insights. The key components of this strategy include:

- Statistical Analysis: Utilizing software such as R and Python is essential for conducting regression analyses. These tools allow analysts to uncover trends and correlations within credit datasets, facilitating a deeper understanding of consumer behavior and creditworthiness. For instance, 91% of worldwide participants anticipate that delinquencies and defaults will remain constant or rise in the coming 12 months. This statistic underscores the significance of robust statistical analysis in comprehending the risks associated with loans.

- Data Visualization: Platforms like Tableau and Power BI are invaluable for transforming complex datasets into intuitive visual formats. By employing these tools, analysts can easily identify patterns, trends, and anomalies, thereby enhancing their ability to communicate insights effectively. Kevin King, a noted expert, emphasizes that financial institutions need to adopt alternative approaches for evaluating creditworthiness, highlighting the critical role of effective visualization in today’s lending environment.

- Machine Learning: The application of machine learning algorithms enables predictive modeling based on historical financial data. This approach significantly enhances risk assessment capabilities, allowing institutions to anticipate consumer behavior and potential defaults with greater accuracy. A case study titled 'Farmers' Risk Assessment with an Explainable Hybrid Ensemble Approach' illustrates how machine learning can improve risk evaluation.

- Comparative Analysis: Benchmarking against industry standards or historical performance is crucial for evaluating financial insights. This method aids in identifying areas for improvement and informs strategic decision-making. For example, 40% of financial institutions reported an increase in delinquencies over the past 12 months, which emphasizes the need for ongoing comparative analysis to adapt to changing market conditions.

By utilizing these approaches, analysts can derive significant insights from consumer credit data, ultimately promoting informed decision-making and enhancing risk management strategies.

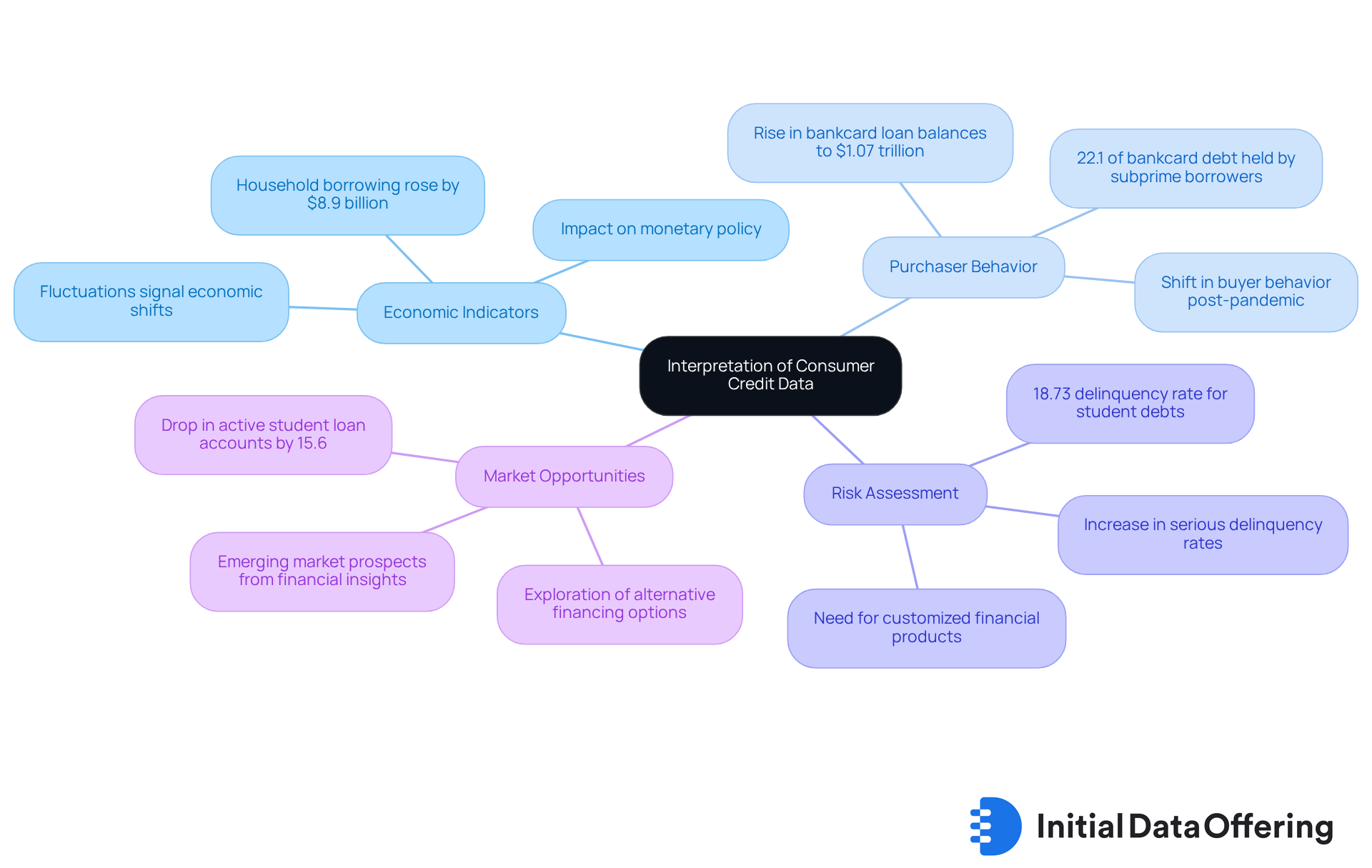

Interpret Consumer Credit Data: Implications for Market Trends

Interpreting consumer credit data is crucial for understanding its implications on market trends, which include several key areas:

-

Economic Indicators: Fluctuations in consumer credit levels often signal shifts in economic health, which can impact monetary policy and lending practices. For instance, as of June 2025, household borrowing rose by $8.9 billion, suggesting a careful optimism in expenditure despite ongoing economic uncertainties. This trend highlights the importance of monitoring credit levels as a barometer for economic conditions.

-

Purchaser Behavior: Examining financial data uncovers unique spending trends that are essential for guiding marketing tactics and product innovation. The recent rise in bankcard loan balances to $1.07 trillion, coupled with a notable increase in subprime borrowers holding 22.1% of all bankcard debt, underscores the necessity for targeted marketing approaches. Furthermore, the portion of charge card liability owned by non-prime borrowers has exceeded pre-pandemic heights, indicating a significant shift in buyer behavior that businesses must adapt to.

-

Risk Assessment: Understanding borrowing trends is vital for evaluating lending risks across different consumer segments. The increase in serious delinquency rates, particularly in student debts reaching 18.73% in May 2025, emphasizes the need for customizing financial products to mitigate risk. How can lenders adjust their offerings to better serve these borrowers and reduce delinquency rates?

-

Market Opportunities: Insights from financial information can reveal emerging market prospects, assisting businesses in strategic planning. For example, the drop in active student loan accounts by 15.6% signals a change in the education financing environment, prompting lenders to explore alternative financing options. What new opportunities might arise from this shift?

By effectively interpreting consumer credit data, analysts can provide insights that not only drive business decisions but also influence broader market strategies. This approach allows businesses to stay ahead of trends and better meet the needs of their customers.

Conclusion

Understanding and mastering consumer credit data is essential for analysts navigating the complexities of today's financial landscape. This data not only reflects individual borrowing and repayment behaviors but also serves as a critical indicator of broader economic trends. Consequently, it influences lending practices and strategic decision-making across various sectors.

The article elucidates several key aspects of consumer credit data:

- Definition

- Importance

- Types

- Methodologies for analysis

- Implications for market trends

It highlights the growing significance of revolving and installment credit, the role of payment history in credit scoring, and the necessity of employing advanced analytical tools such as statistical analysis and machine learning. Furthermore, interpreting this data can reveal valuable insights into consumer behavior, economic health, and emerging market opportunities.

Ultimately, effective analysis and interpretation of consumer credit data empower analysts to make informed decisions, enhancing risk management and driving strategic marketing efforts. As consumer credit landscapes continue to evolve, staying abreast of these trends and utilizing robust methodologies will be crucial for analysts and businesses alike. Engaging proactively with this data can lead to better outcomes for consumers and financial institutions, fostering a more resilient economic environment.

Frequently Asked Questions

What is consumer credit data?

Consumer credit data includes details about an individual's borrowing and repayment behavior, such as card usage, loan history, and payment patterns.

Why is consumer credit data important?

It is crucial for stakeholders like lenders, companies, and policymakers as it provides insights into buyer behavior, creditworthiness, and overall economic health. Analyzing this data helps identify trends, assess risks, and make informed decisions that shape lending practices and market strategies.

How does consumer credit data impact marketing strategies in the financial sector?

Understanding consumer credit data is vital for crafting effective marketing strategies and enhancing customer engagement, as it allows businesses to tailor their approaches based on consumer behavior and financial needs.

What trend was observed in subprime borrowers' credit card debt as of May 2025?

The share of card debt held by subprime borrowers increased to 22.1%, reflecting a 3.5% rise from May 2024, indicating a growing segment of the population facing financial challenges.

What do the delinquency rates on U.S. personal debt indicate?

Delinquency rates on total U.S. personal debt remained stable at 1.5%, consistent with figures from May and April, highlighting the reliability of this metric over time.

Can you provide examples of how consumer credit data affects economic health?

Monitoring mortgage data helps identify trends in housing finance, while insights into student financing reveal financial struggles faced by students, particularly as delinquency rates have risen significantly.

What was the status of outstanding student loan debt as of June 2025?

Outstanding student loan debt decreased by 11% year-over-year to $1.33 trillion, providing a clearer understanding of the student loan landscape.

How does understanding consumer credit data contribute to economic stability?

Grasping the dynamics of consumer credit data supports informed decision-making, which ultimately drives economic stability by enabling stakeholders to respond effectively to credit trends and borrower behavior.