Explore Alternative Funding Solutions for Market Research Analysts

Explore Alternative Funding Solutions for Market Research Analysts

Introduction

The landscape of market research is evolving. Analysts are increasingly turning to non-traditional financing methods to overcome budget constraints and enhance project outcomes. Alternative funding solutions - like crowdfunding, peer-to-peer lending, venture capital, and corporate sponsorships - offer unique advantages that empower analysts to secure necessary resources.

Each of these options presents its own set of challenges and considerations. For instance:

- Crowdfunding can provide immediate access to funds, but it requires effective marketing to attract backers.

- Peer-to-peer lending offers lower interest rates compared to traditional loans, yet it may involve lengthy approval processes.

- Venture capital can lead to significant financial backing, but it often comes with expectations for rapid growth and returns.

- Corporate sponsorships can enhance credibility, but they may limit the scope of research due to sponsor influence.

How can market research professionals navigate this complex funding terrain? By understanding the features, advantages, and benefits of each funding option, analysts can make informed decisions that ensure their analyses remain robust and insightful. This approach not only enhances project outcomes but also fosters a deeper understanding of the funding landscape.

Understanding Alternative Funding Solutions for Market Research

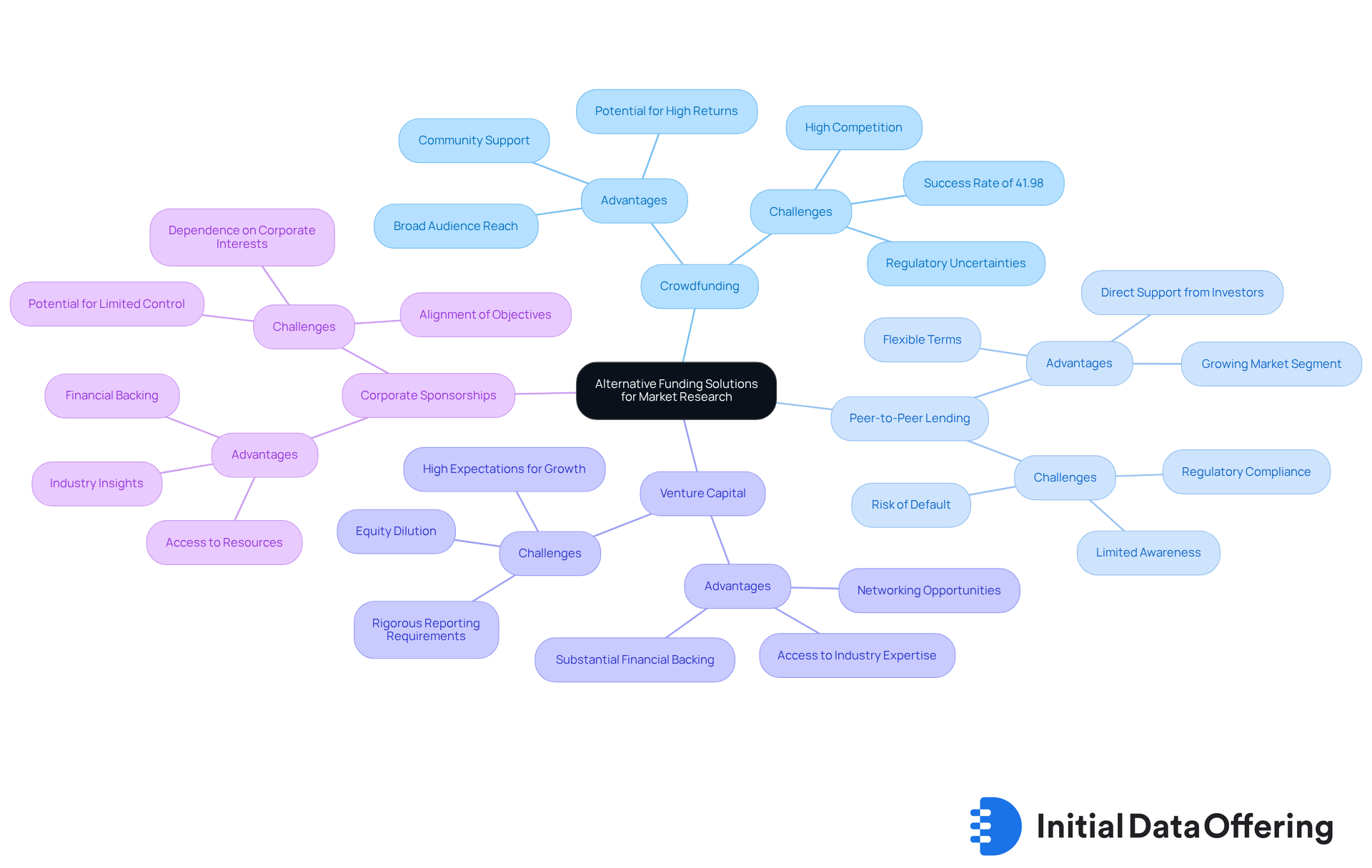

A variety of non-traditional financing techniques that industry evaluators can utilize to support their projects are encompassed within alternative funding solutions. These methods include:

- Crowdfunding

- Peer-to-peer lending

- Venture capital

- Corporate sponsorships

Each option presents unique advantages and challenges. For instance, crowdfunding allows analysts to tap into a broad audience for small donations, fostering community support for project initiatives. As of early 2025, the U.S. crowdfunding sector is projected to grow significantly, reaching approximately USD 2.05 billion by the end of the year, with a compound annual growth rate (CAGR) of 12.2% anticipated through 2034. This growth highlights the increasing popularity of crowdfunding as a viable financial resource for various initiatives, including research, with forecasts suggesting it could reach as much as USD 6.9 billion by 2034. Notable success stories, such as the Pebble Watch and Oculus Rift, underscore crowdfunding's potential to transform innovative ideas into reality, boasting an overall success rate of 41.98% for projects on platforms like Kickstarter.

Peer-to-peer lending has emerged as a leading segment in the alternative financing landscape, fueled by growing investments and partnerships. This approach enables analysts to secure support directly from individual investors, often with more flexible terms than traditional loans. In 2024, the individual segment captured the largest share in peer-to-peer lending, showcasing its appeal to those seeking accessible financial solutions.

Venture capital, while offering substantial financial backing, typically necessitates equity stakes and compliance with rigorous reporting requirements. This option is particularly advantageous for larger-scale projects that can demonstrate significant growth potential. Analysts must carefully consider the benefits of considerable financial support against the implications of equity dilution and investor oversight.

Corporate sponsorships also present a valuable avenue for financing promotional studies. By partnering with companies that align with their objectives, professionals can secure financial backing while gaining access to industry insights and resources.

In conclusion, understanding these alternative funding solutions is crucial for market study professionals aiming to secure the necessary resources for their projects. Each method presents distinct opportunities and challenges, making it essential for evaluators to assess their specific needs and project goals when selecting a funding strategy.

Identifying Market Research Analysts' Needs and Challenges

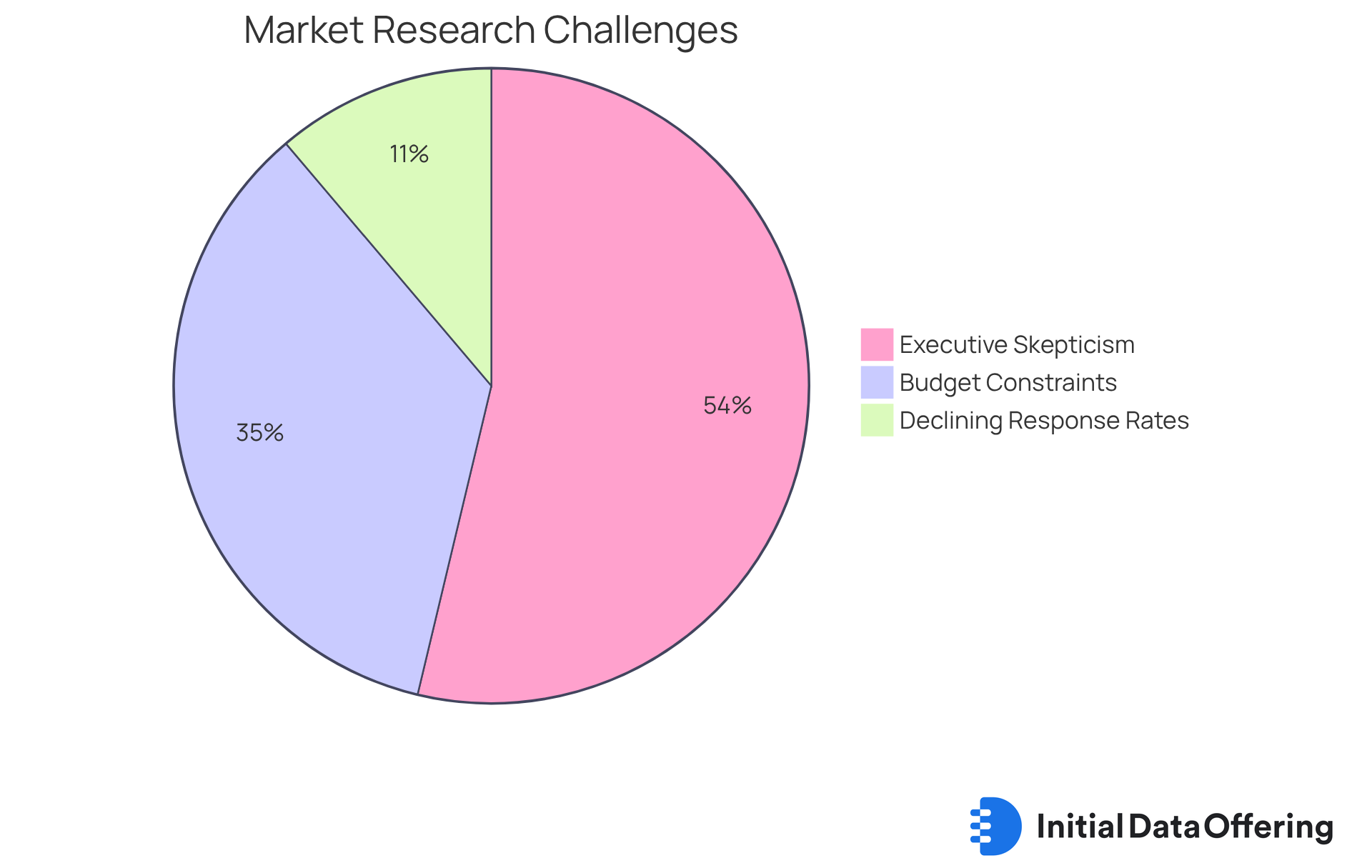

Market assessment professionals frequently encounter significant challenges, primarily due to budget constraints, tight deadlines, and the need for high-quality data. Notably, 47% of industry analysts cite budget limitations as their main obstacle, which can severely restrict their capacity to conduct thorough analyses and derive actionable insights. As the market landscape continues to evolve, analysts must stay agile and responsive, further complicating their funding needs.

Agile methodologies are becoming increasingly popular as a strategy to cut costs while preserving quality. This approach offers a potential solution to the challenges analysts face. However, with participant engagement on the decline - evidenced by a 10-20% drop in survey response rates over the past five years - ensuring data quality is more critical than ever. Additionally, 72% of executives are questioning the value of spending on studies during uncertain times, underscoring the urgency of addressing budget constraints.

As organizations navigate these hurdles, exploring alternative funding solutions emerges as a vital strategy. This investigation can empower analysts to overcome obstacles and enhance the integrity of their research outcomes. How can your organization adapt to these challenges? By considering alternative funding solutions, you can ensure that your market assessments remain robust and insightful.

Comparative Analysis of Alternative Funding Solutions

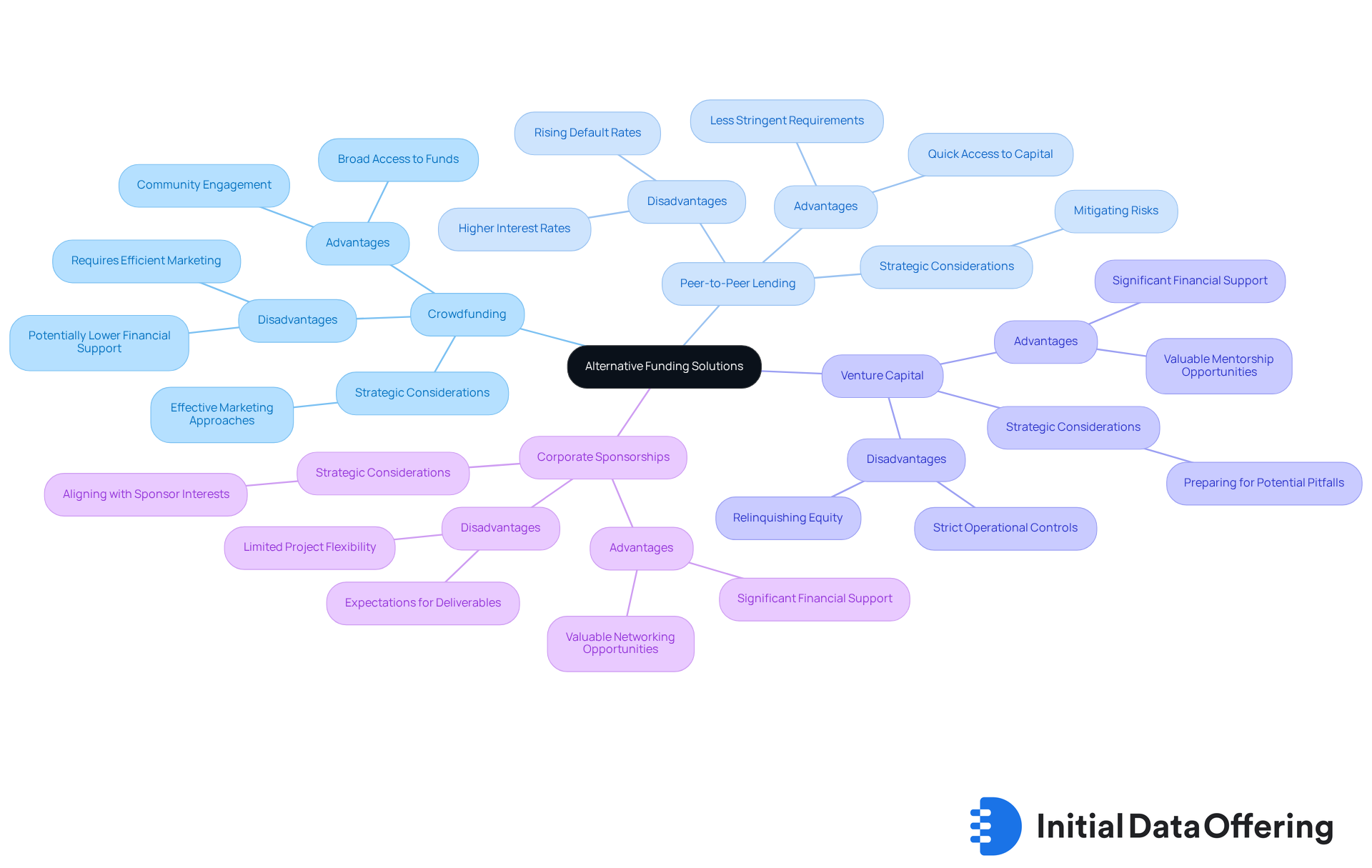

When evaluating alternative funding solutions, several critical factors must be considered:

-

Crowdfunding: This method offers broad access to funds and fosters community engagement. It’s an attractive option for many entrepreneurs. However, it necessitates efficient marketing approaches to attract attention and may lead to reduced financial support than expected. How can entrepreneurs effectively market their crowdfunding campaigns to maximize support?

-

Peer-to-Peer Lending: This approach provides quick access to capital with less stringent requirements compared to traditional banks, appealing to those in need of immediate funds. Nevertheless, borrowers should be aware that interest rates can be higher, impacting overall repayment costs. The global P2P lending market is projected to grow at a compound annual growth rate (CAGR) of 25% from 2024 to 2032, indicating a robust demand for such services. However, the sector faces challenges such as rising default rates, which can erode investor confidence. What strategies can borrowers employ to mitigate these risks?

-

Venture Capital: While venture capital can provide considerable financial support and valuable mentorship opportunities, it often requires relinquishing equity and may impose strict operational controls. Historically, only 10-15% of VC-backed startups generate the majority of a fund's returns, highlighting the risks involved. Furthermore, the excitement of raising large amounts of venture capital can lead to challenges, such as legal issues or running out of funds without a clear return plan. As Andrew Wilkinson aptly puts it, "Venture: Roulette; Private equity: Blackjack; Bootstrapping: Poker," illustrating the varying levels of risk associated with each financing approach. How can startups prepare for the potential pitfalls of venture capital?

-

Corporate Sponsorships: These can provide significant financial support and valuable networking opportunities. Yet, they often come with expectations for deliverables that align with the sponsor's interests. This can limit the flexibility of the funded projects, as sponsors may impose conditions that restrict the project's scope. What considerations should organizations keep in mind when pursuing corporate sponsorships?

Each funding choice, such as alternative funding solutions, offers distinct advantages and disadvantages. It’s crucial for industry evaluators to thoroughly assess their particular requirements and situations when choosing a funding source. Understanding the landscape of venture capital, including its pros and cons, is essential for making informed decisions in this evolving financial environment.

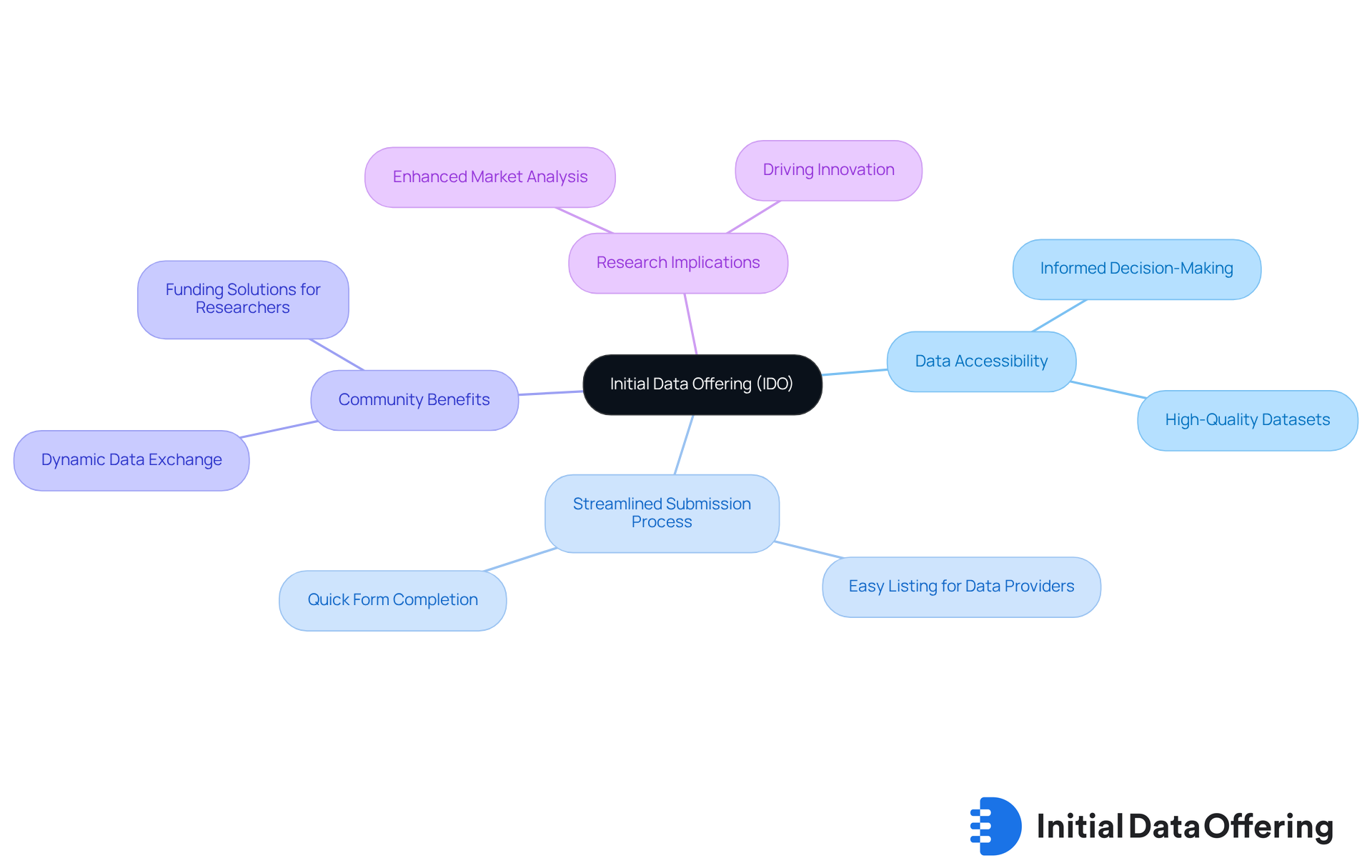

Highlighting the Unique Value of Initial Data Offering

The Initial Data Offering (IDO) serves as a vital resource for market study professionals, offering a centralized platform focused on the discovery and monetization of high-quality datasets. This platform emphasizes data accessibility, which is essential for informed decision-making, particularly in an era where data quality directly impacts study outcomes. By curating unique datasets, IDO equips professionals with the latest trends and insights, significantly enhancing the effectiveness of their investigative efforts.

One of the standout features of IDO is its streamlined submission process, which allows data providers to easily list their datasets. This fosters a dynamic community of data exchange that benefits both buyers and sellers. In this collaborative environment, researchers can meet their funding needs by exploring alternative funding solutions while simultaneously improving the overall quality of market analysis. As analysts tap into IDO's resources, they gain access to high-quality datasets that drive innovation and strategic planning across various industries. This ultimately leads to more accurate and actionable insights.

How can these datasets transform your research approach? By leveraging IDO, professionals can stay ahead of the curve, ensuring their analyses are grounded in the most relevant and high-quality data available. The implications of utilizing such resources are profound, as they not only enhance individual projects but also contribute to the broader landscape of market research.

Conclusion

Exploring alternative funding solutions is essential for market research analysts navigating the complexities of securing financial support for their projects. These non-traditional financing methods - crowdfunding, peer-to-peer lending, venture capital, and corporate sponsorships - offer diverse avenues to meet funding needs, each presenting unique advantages and challenges.

Understanding the characteristics of each funding option is crucial.

- Crowdfunding fosters community engagement and has experienced substantial growth, making it a popular choice.

- Peer-to-peer lending provides quick access to capital with flexible terms, which can be particularly beneficial for time-sensitive projects.

- Venture capital can offer significant backing, although it often requires equity stakes, which may not align with every analyst's goals.

- Corporate sponsorships can enhance project visibility but may impose certain restrictions.

Each of these strategies must be carefully assessed against the specific objectives and constraints faced by analysts in the ever-evolving market landscape.

As the demand for innovative funding solutions continues to rise, market research professionals are encouraged to embrace these alternatives to enhance their research capabilities. By leveraging platforms like Initial Data Offerings, analysts can secure necessary funding while accessing high-quality datasets that improve the integrity and impact of their studies. How can these funding options empower analysts to overcome financial obstacles? Engaging with these alternatives can drive meaningful insights, ultimately shaping the future of market research.

Frequently Asked Questions

What are alternative funding solutions for market research?

Alternative funding solutions encompass non-traditional financing techniques such as crowdfunding, peer-to-peer lending, venture capital, and corporate sponsorships that industry evaluators can use to support their projects.

What are the advantages of crowdfunding?

Crowdfunding allows analysts to access a broad audience for small donations, fostering community support for project initiatives. It is projected to grow significantly, reaching approximately USD 2.05 billion by the end of 2025, with an anticipated CAGR of 12.2% through 2034.

Can you provide examples of successful crowdfunding projects?

Notable success stories include the Pebble Watch and Oculus Rift, which highlight crowdfunding's potential to turn innovative ideas into reality, with an overall success rate of 41.98% for projects on platforms like Kickstarter.

What is peer-to-peer lending and its benefits?

Peer-to-peer lending enables analysts to secure support directly from individual investors, often with more flexible terms than traditional loans. It has become a leading segment in alternative financing, with the individual segment capturing the largest share in 2024.

What are the considerations when opting for venture capital?

Venture capital offers substantial financial backing but typically requires equity stakes and compliance with rigorous reporting requirements. It is particularly beneficial for larger-scale projects that can demonstrate significant growth potential, though analysts must weigh the benefits against equity dilution and investor oversight.

How do corporate sponsorships work as a funding solution?

Corporate sponsorships involve partnering with companies that align with project objectives, allowing professionals to secure financial backing while gaining access to industry insights and resources.

Why is it important for market study professionals to understand these funding solutions?

Understanding alternative funding solutions is crucial for market study professionals to secure the necessary resources for their projects. Each method presents distinct opportunities and challenges, making it essential to assess specific needs and project goals when selecting a funding strategy.