Comparing Financial Firms in Chicago: Key Insights for Analysts

Comparing Financial Firms in Chicago: Key Insights for Analysts

Overview

This article offers essential insights for analysts tasked with comparing financial firms in Chicago. It underscores the significance of assessing various criteria, including:

- Service offerings

- Customer base

- Performance metrics

- Reputation

- Technological capabilities

Evaluating these factors is crucial, as they directly impact a firm's capacity to meet client needs and sustain competitiveness in an ever-evolving financial landscape. How do these criteria influence your decision-making process? Understanding their implications can lead to more informed choices, ultimately benefiting both analysts and their clients.

Introduction

Chicago's financial sector serves as a significant pillar of the U.S. economy, characterized by a diverse array of firms that influence both local and national landscapes. Analysts examining this dynamic market will find a wealth of insights, ranging from the innovative practices of established giants like JPMorgan Chase and Northern Trust to the emerging fintech scene that is transforming traditional finance.

As competition intensifies and technological advancements accelerate, how can one effectively navigate the complexities of selecting the right financial firm? This article delves into the key criteria for comparison, providing valuable guidance for analysts aiming to make informed decisions in this ever-evolving environment.

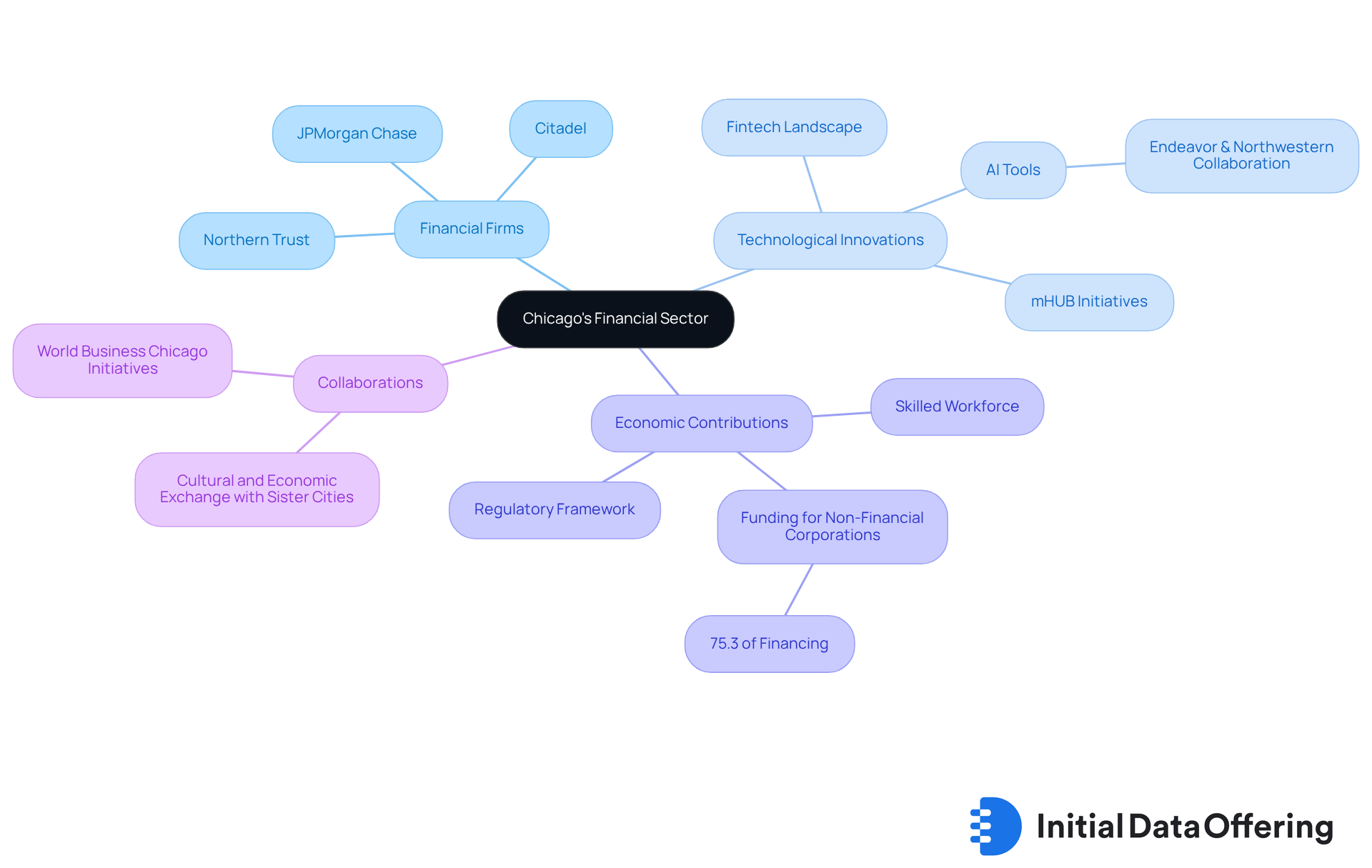

Overview of Chicago's Financial Sector

Chicago's economic sector ranks among the largest and most varied in the United States, including a broad range of financial firms in Chicago such as banks, investment companies, and insurance providers. This city is recognized as a center for economic innovation, hosting both established financial firms in Chicago and a burgeoning fintech landscape. Key participants such as JPMorgan Chase, Northern Trust, and Citadel significantly impact the local economy. Notably, financial firms in Chicago supply 75.3% of funding for non-financial corporations through equity and debt securities issuance, underscoring their essential role in fostering business growth and stability.

The sector thrives due to a skilled workforce and a robust regulatory framework, with financial firms in Chicago benefiting from the city's strategic location, which facilitates access to major markets. Importantly, the focus on technology and data analytics is transforming conventional practices, enhancing delivery, and increasing efficiency. The integration of innovative economic classification systems, like those offered by DCSC.ai, enables dynamic relevance scoring that connects companies to multiple sectors. This functionality provides market research analysts with actionable insights for investment ideation, allowing them to classify portfolios by sectors and make informed decisions based on emerging trends.

For example, the collaboration between Endeavor and Northwestern University has resulted in the development of an AI tool for diagnosing critical lung conditions. This showcases the intersection of finance and technology in healthcare, demonstrating how technological advancements can enhance delivery across various sectors, including finance.

Furthermore, the region's commitment to innovation is evident in initiatives like mHUB, which has emerged as a national leader in hardware innovation. This initiative not only promotes technological progress but also has the potential to influence the monetary sector by offering innovative solutions that enhance operational efficiency. As the economic landscape continues to evolve, the integration of advanced real-time media monitoring and sentiment analysis tools, such as Media Radar, remains crucial for maintaining Chicago's competitive advantage in the industry. Statements from industry leaders emphasize the significance of this technological advancement, reinforcing the idea that innovation is essential for the future of Chicago's economy.

Comparison Criteria for Financial Firms

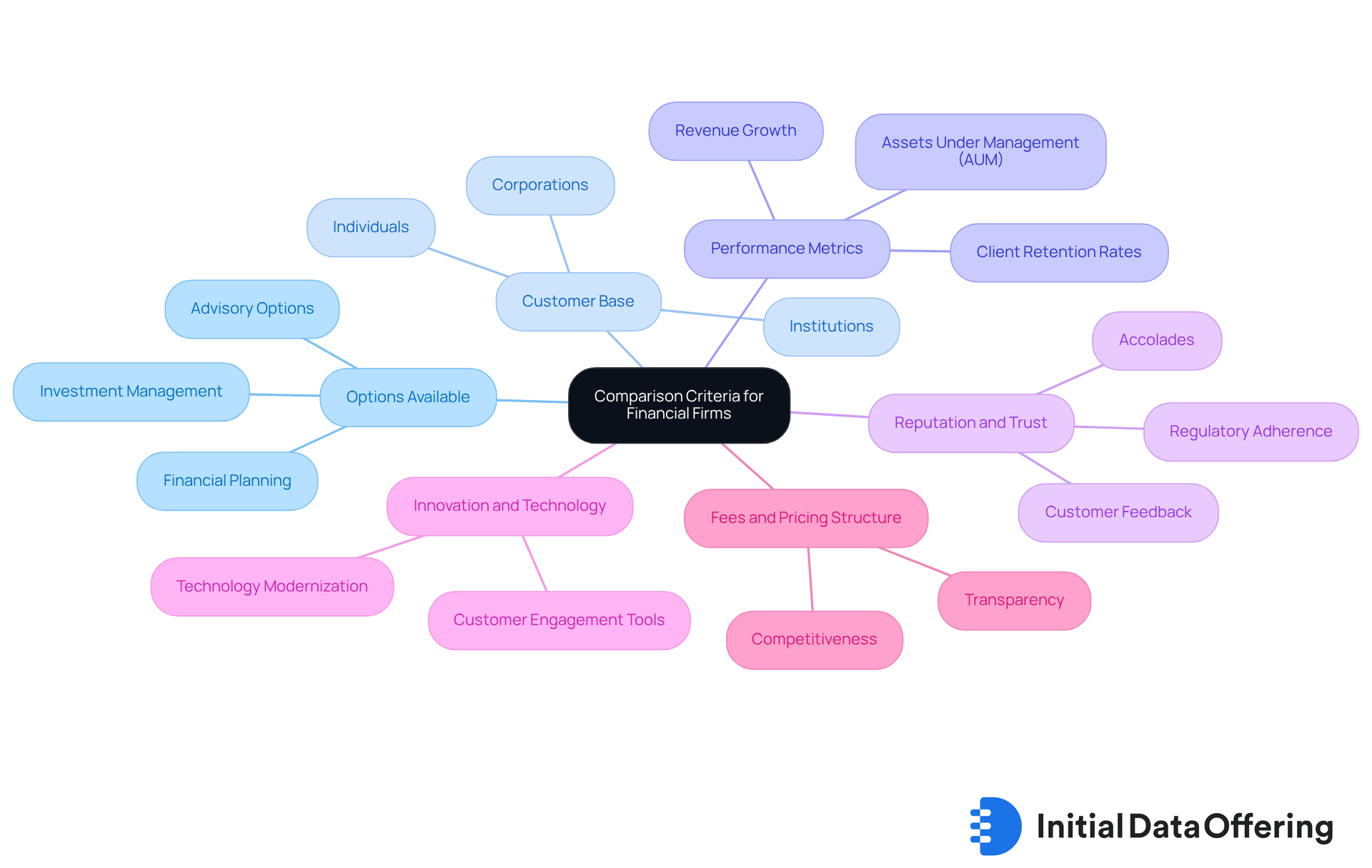

When comparing financial firms in Chicago, analysts should consider several key criteria that can significantly impact their evaluations.

Options Available: Analysts should assess the variety of offerings provided by each firm, including investment management, financial planning, and advisory options. A varied service portfolio not only reflects an organization's capacity to address diverse customer requirements but also enhances its appeal to a broader client base.

Customer Base: It is essential to examine the categories of customers served, such as individuals, corporations, or institutions, to comprehend the firm's market positioning. Financial firms in Chicago that cater to a diverse customer demographic often exhibit versatility and resilience in changing market conditions, which can be advantageous in maintaining a competitive edge.

Performance Metrics: Review economic performance indicators, including assets under management (AUM), revenue growth, and client retention rates. For instance, compensation costs for US banks increased by 4.1% annually in the first half of 2024, emphasizing the economic well-being of companies being assessed. These metrics are crucial for evaluating a company's financial health and operational effectiveness, providing insights into their stability and growth potential.

Reputation and Trust: Evaluating the organization's standing in the industry is vital. This includes customer feedback, regulatory adherence, and accolades. A strong reputation is often crucial for financial firms in Chicago, as it correlates with customer loyalty and long-term success, making it a critical factor for consideration.

Innovation and Technology: Consider the firm's implementation of technology and creative practices that enhance delivery and customer engagement. As noted by Mike Wade, managing director at Deloitte, banks must prioritize technology modernization to remain competitive. Firms leveraging advanced technologies are better positioned to adapt to market changes and improve operational efficiency, which could lead to better customer satisfaction and retention.

Fees and Pricing Structure: Lastly, examine the fee structures to determine competitiveness and transparency in pricing. Understanding the expense of offerings is crucial for clients to make educated choices regarding their economic partnerships, ensuring they receive value for their investments.

Profile of Leading Financial Firms in Chicago

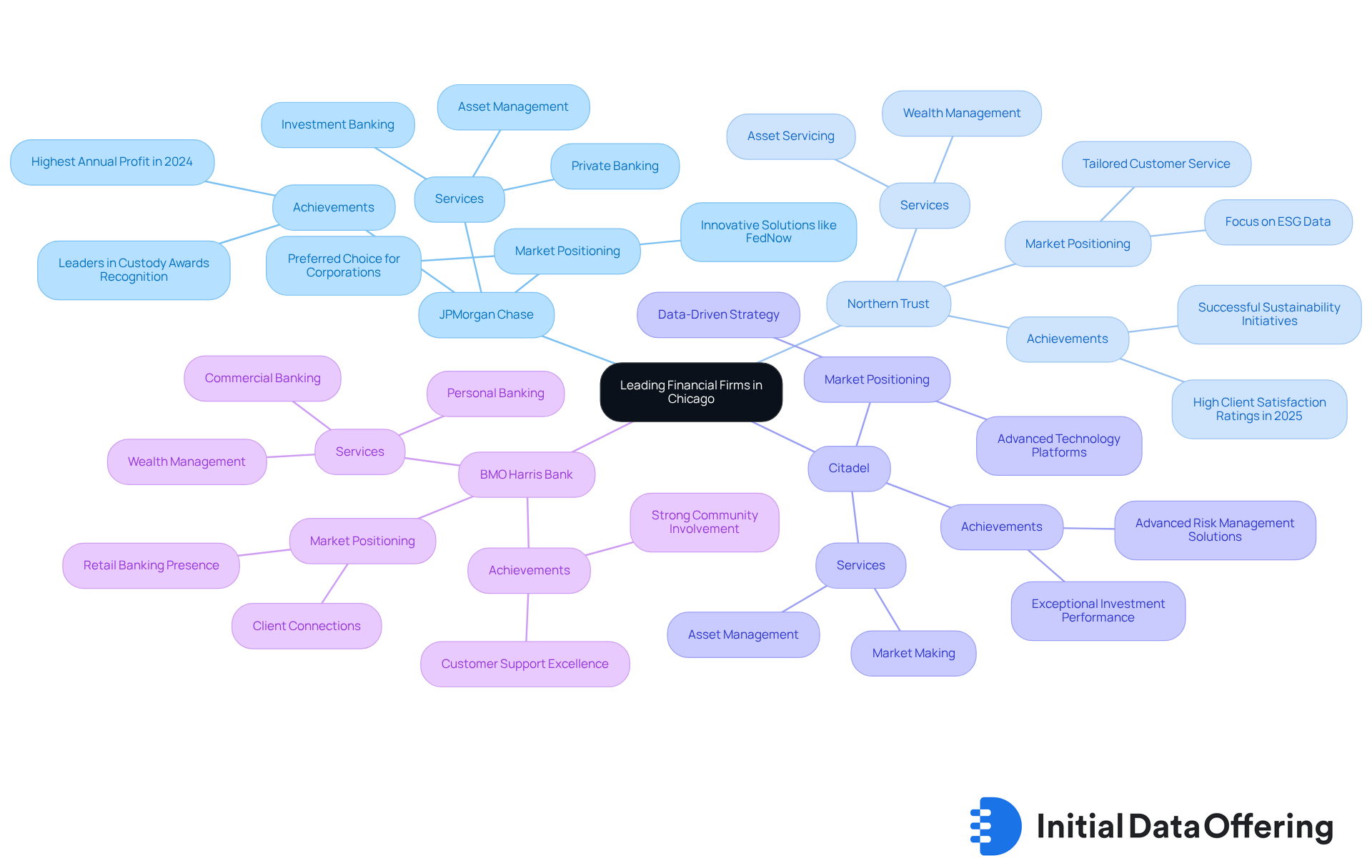

-

JPMorgan Chase: As one of the largest financial institutions worldwide, JPMorgan Chase offers an extensive range of services, including investment banking, asset management, and private banking. Its strong reputation and vast resources position it as a preferred choice for large corporations and high-net-worth individuals. In 2024, the company achieved its highest-ever annual profit, reflecting a robust operational environment and strategic market positioning. Additionally, JPMorgan Chase's Commercial & Investment Bank received recognition at the Leaders in Custody Awards in June 2025, underscoring its excellence in the securities sector. The company also supports innovative solutions such as FedNow integrated payables and prepaid card offerings, enhancing its competitive advantage in the market.

-

Northern Trust: Specializing in wealth management and asset servicing, Northern Trust is recognized for its tailored customer service and innovative investment solutions. The company has made significant strides in sustainability, launching initiatives focused on responsible investing and environmental stewardship. In 2025, Northern Trust's client satisfaction ratings reflect a commitment to excellence, with clients valuing the personalized approach to wealth management. Case studies illustrate successful sustainability initiatives, such as their emphasis on ESG data, reinforcing the firm's appeal to socially conscious investors.

-

Citadel: A prominent global economic institution, Citadel operates within asset management and market making. Its data-driven strategy and advanced technology platforms enable exceptional investment performance and risk management solutions, establishing it as a formidable contender in the economic landscape.

-

BMO Harris Bank: With a strong retail banking presence, BMO Harris Bank offers a variety of products, including personal banking, commercial banking, and wealth management options. Its commitment to community involvement and customer support distinguishes it in a competitive market, fostering strong connections with clients.

Key Takeaways: Choosing the Right Financial Firm

Selecting the right financial firm in Chicago involves a thorough evaluation of several key factors:

-

Aligning Services with Monetary Goals: It is essential to ensure that the company's offerings are tailored to your specific monetary objectives, whether they pertain to investment management, comprehensive planning, or specialized advisory services. A study by Morningstar indicates that individuals prioritize achieving their financial goals above all else when hiring advisors, underscoring the need for alignment. This alignment not only fosters a productive relationship but also enhances the likelihood of achieving desired financial outcomes.

-

Assessing Performance and Reputation: Look for companies with a strong history of performance and favorable client reviews. An organization's reputation can greatly affect the quality of service offered. For instance, case studies indicate that companies emphasizing client-centric objectives tend to attain greater satisfaction and retention rates. This suggests that a firm's reputation is not just a reflection of past successes but a predictor of future service quality.

-

Understanding Fee Structures: Familiarize yourself with the fee structures of potential firms, ensuring they are clear and competitive. Hidden fees can diminish investment returns over time, making it crucial to clarify all costs upfront. In 2025, financial firms in Chicago are anticipated to show an increasing focus on transparency in typical fee arrangements, with numerous organizations adopting flat-rate or performance-based fees to align their interests with those of the individuals they serve. Understanding these structures can significantly impact your financial planning and investment strategy.

-

Evaluating Technological Abilities: Consider companies that leverage technology to improve client experiences and provide innovative solutions. Firms investing in advanced technology are often better equipped to navigate evolving market conditions and provide superior service. The integration of AI and data analytics has become a hallmark of successful companies, enabling them to provide personalized advice and enhance operational efficiency. This technological edge can lead to more informed decision-making and improved financial outcomes.

-

Personal Fit: Finally, evaluate the personal compatibility with the firm's advisors. A solid relationship founded on trust and mutual understanding can result in more advantageous economic outcomes. Advisors who prioritize communication and client engagement are more likely to foster long-term relationships that benefit both parties. This personal connection can be the difference between a transactional relationship and a partnership that drives success.

By focusing on these critical factors, you can make a more informed decision when selecting a financial firm that aligns with your needs and goals.

Conclusion

Chicago's financial sector serves as a dynamic hub of innovation and diversity, playing a crucial role in the broader economic landscape. The analysis of financial firms in Chicago reveals that their contributions extend beyond mere financial services; they are integral to fostering growth and stability across various industries. By leveraging technology, maintaining robust performance metrics, and emphasizing customer satisfaction, these firms position themselves as leaders in a competitive market.

Key insights from this comparative analysis underscore the importance of evaluating financial firms based on their service offerings, customer base, performance metrics, and reputation. What does this mean for the industry? The emphasis on innovation and technology highlights the necessity for firms to adapt and evolve in response to changing market conditions. With organizations like JPMorgan Chase, Northern Trust, and Citadel leading the way, the potential for growth and advancement in Chicago's financial landscape is significant.

In conclusion, the insights gleaned from this exploration serve as a valuable guide for analysts and investors alike. Understanding the criteria for comparing financial firms not only facilitates informed decision-making but also enhances the ability to navigate the complexities of the financial sector. As the industry continues to evolve, prioritizing innovation and aligning services with client goals will be paramount for success in Chicago's vibrant financial ecosystem.

Frequently Asked Questions

What is the significance of Chicago's financial sector?

Chicago's financial sector is one of the largest and most varied in the United States, playing a crucial role in the economy by providing 75.3% of funding for non-financial corporations through equity and debt securities issuance.

What types of financial firms are present in Chicago?

Chicago hosts a broad range of financial firms, including banks, investment companies, and insurance providers, alongside a growing fintech landscape.

Who are some key participants in Chicago's financial sector?

Key participants include major firms like JPMorgan Chase, Northern Trust, and Citadel, which significantly impact the local economy.

How does Chicago's location benefit its financial sector?

The city's strategic location facilitates access to major markets, enhancing the operational capabilities of financial firms.

What role does technology play in Chicago's financial sector?

Technology and data analytics are transforming traditional practices, improving delivery, and increasing efficiency within the financial sector.

Can you provide an example of innovation in Chicago's financial sector?

A notable example is the collaboration between Endeavor and Northwestern University, which developed an AI tool for diagnosing critical lung conditions, showcasing the intersection of finance and technology in healthcare.

What is mHUB and its relevance to Chicago's economy?

mHUB is a national leader in hardware innovation that promotes technological progress, potentially influencing the monetary sector by providing innovative solutions that enhance operational efficiency.

Why is real-time media monitoring and sentiment analysis important for Chicago's financial sector?

The integration of advanced tools like Media Radar is crucial for maintaining Chicago's competitive advantage in the industry as the economic landscape continues to evolve.

How do industry leaders view the importance of innovation in Chicago's economy?

Industry leaders emphasize that innovation is essential for the future of Chicago's economy, highlighting its significance in driving growth and competitiveness.