Comparing Alternative Data Providers: Features and Pricing Insights

Comparing Alternative Data Providers: Features and Pricing Insights

Overview

The article provides a comprehensive comparison of alternative data providers by examining their features, pricing, and suitability for various organizational needs. It underscores the significance of criteria such as:

- Information quality

- Coverage

- Pricing models

- Integration capabilities

- Customer support

- Specific use cases

These elements are essential for organizations aiming to make informed decisions when selecting a provider that aligns with their strategic objectives. How can these criteria impact your choice of provider? Understanding these factors can enhance your decision-making process, ensuring that the selected provider meets your unique requirements. Ultimately, this analysis serves as a guide to help organizations navigate the complexities of alternative data sourcing.

Introduction

Alternative data has emerged as a transformative force in the realm of business intelligence, providing insights that go beyond traditional datasets. As organizations increasingly aim to leverage the power of social media interactions, satellite imagery, and transaction records, it becomes crucial to understand the features and pricing of alternative data providers.

However, with a plethora of options available, how can businesses effectively navigate this evolving market to identify the right provider that aligns with their specific needs?

This article explores the essential criteria for evaluating alternative data providers, offering a comparative analysis that equips decision-makers to make informed choices in a rapidly changing environment.

Understanding Alternative Data: Definition and Importance

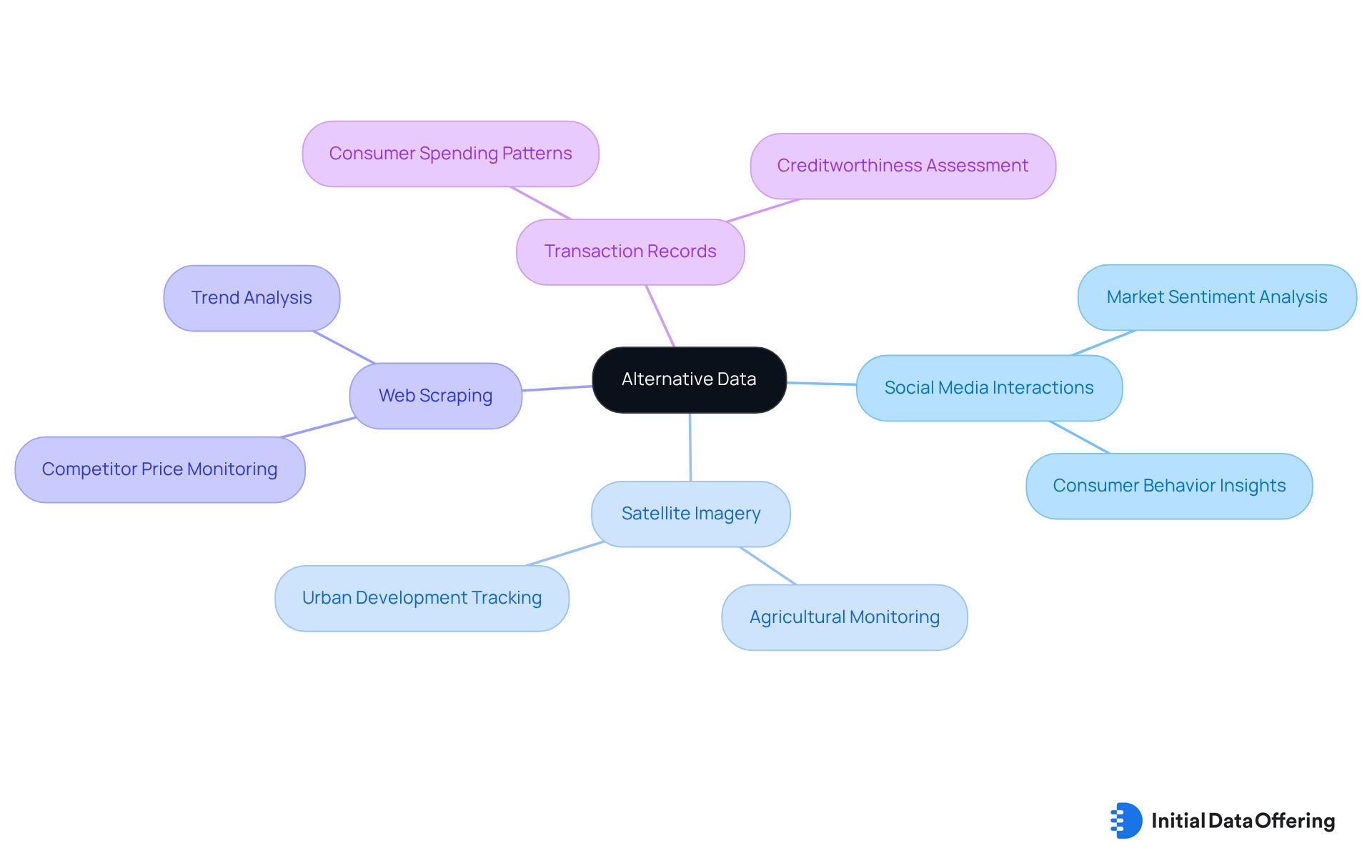

Alternative data providers encompass non-traditional sources that offer insights extending beyond conventional datasets. These sources include:

- Social media interactions

- Satellite imagery

- Web scraping

- Transaction records

The significance of alternative data providers lies in the unique perspectives they offer on market trends, consumer behavior, and economic indicators, greatly enhancing decision-making for businesses and investors. In 2025, the demand for prompt and practical insights has surged, rendering supplemental information a vital asset across sectors such as finance, marketing, and research.

For instance, lenders are increasingly utilizing diverse information to approve a greater number of clients without incurring excessive risk. This approach not only promotes business expansion but also upholds portfolio quality. Companies like New Constructs have developed indices to track the performance of leading firms, consistently outperforming traditional benchmarks. As organizations strive for a competitive advantage, incorporating insights from alternative data providers into their analytical frameworks is proving crucial for informed decision-making and strategic planning.

How can your organization leverage alternative information to enhance its decision-making processes? The integration of such insights could be the key to unlocking new opportunities and driving growth.

Criteria for Comparing Alternative Data Providers: Features, Pricing, and Suitability

When evaluating alternative data providers, several key criteria should be prioritized:

-

Information Quality: The precision, dependability, and promptness of the information are crucial. High-quality information is essential for informed decision-making, as it directly impacts the validity of analyses and insights derived from it. Providers must implement rigorous quality control measures to ensure their information is free from errors and inconsistencies. This commitment to quality not only enhances the reliability of the data but also supports more accurate business strategies.

-

Coverage: The range of information sources and the diversity of datasets available are crucial. A provider with extensive coverage can address diverse analytical requirements, enabling organizations to align their information with specific investment or business goals. This involves taking into account geographic coverage, industry focus, and information granularity. How well does your provider’s coverage meet your specific needs?

-

Pricing Models: Understanding the pricing structure—whether subscription-based, pay-per-use, or tiered pricing—enables organizations to budget effectively. Clear pricing assists in assessing the cost-effectiveness of the solutions provided. This transparency allows for better financial planning and resource allocation.

-

Integration Capabilities: The ease of incorporating information into existing systems and workflows is vital. Providers that offer seamless API integration and cloud-based access can significantly reduce the time and effort needed for information utilization. This integration capability can streamline operations and enhance productivity.

-

Customer Support: The quality of assistance offered to clients, encompassing training and troubleshooting help, is crucial for enhancing the value of the information. A dedicated support team can enhance user experience and facilitate smoother workflows. Consider how effective support can influence your organization’s use of data.

-

Use Cases: Comprehending the particular applications for which the information can be employed—such as industry analysis, risk evaluation, or consumer insights—assists organizations in determining the significance of the information to their strategic objectives. Identifying relevant use cases can help maximize the value derived from the data.

These criteria are essential for organizations to evaluate which alternative data providers offer the supplementary information source that aligns best with their specific needs and objectives, ensuring they utilize high-quality information for optimal decision-making. Furthermore, subscribing to Initial Data Offering enables research analysts to uncover new datasets each day, offering exclusive access and insights that can improve their analytical skills. The worldwide substitute information market is expected to expand from USD 11.65 billion in 2024 to USD 18.74 billion in 2025, emphasizing the rising significance of assessing these suppliers efficiently.

Comparative Analysis of Leading Alternative Data Providers: Features and Pricing

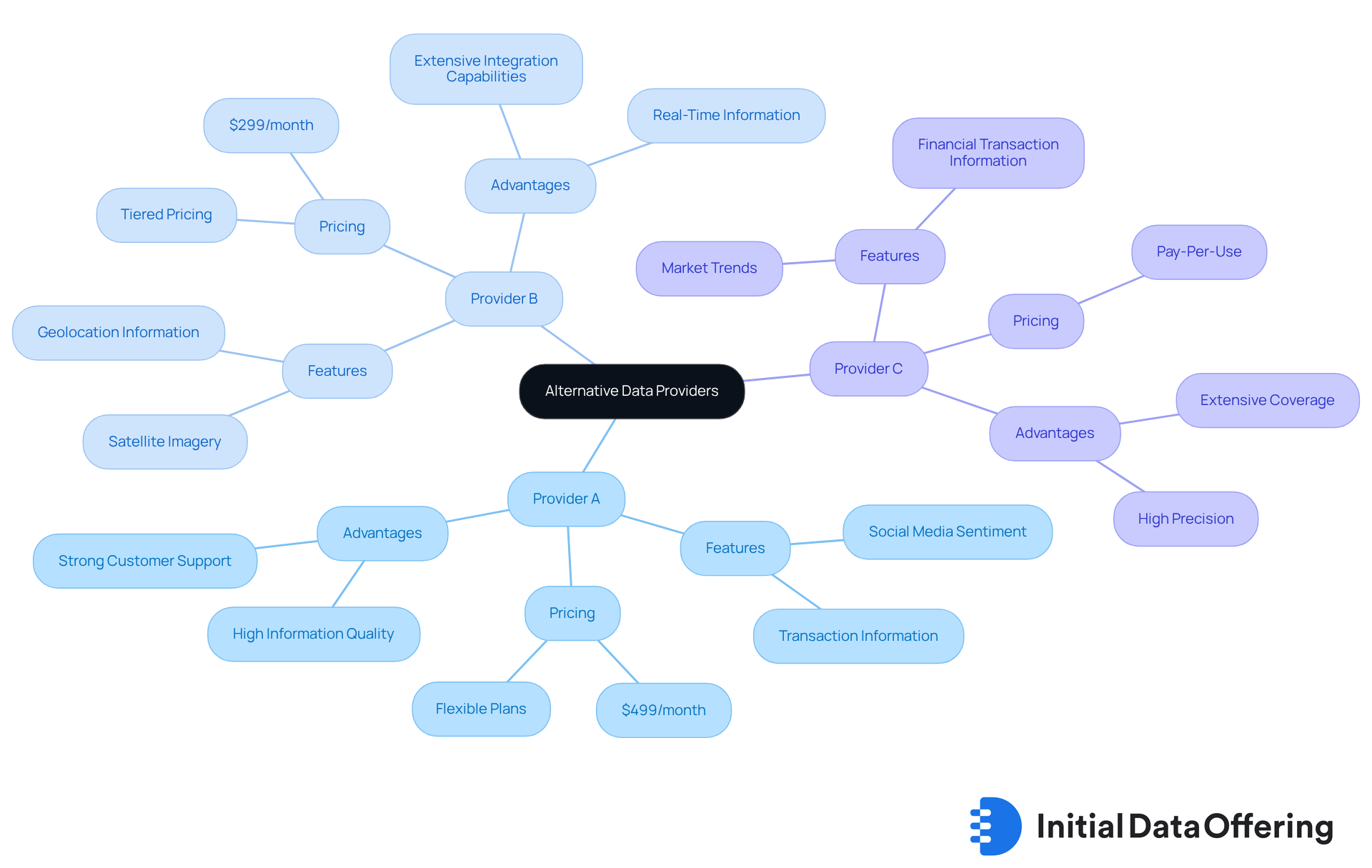

In this comparative analysis, we examine three leading alternative data providers:

-

Provider A: This provider offers a wide variety of datasets, including social media sentiment and transaction information. The pricing starts at $499/month with flexible plans based on usage. The advantages of Provider A, such as high information quality and strong customer support, make it an appealing choice for organizations seeking reliable data from alternative data providers.

-

Provider B: Focused on satellite imagery and geolocation information, Provider B features tiered pricing starting from $299/month. They provide extensive integration capabilities with existing analytics platforms. This provider is especially suited for sectors that require real-time information, enhancing decision-making processes.

-

Provider C: Concentrating on financial transaction information and market trends, Provider C employs a pay-per-use pricing structure, which is ideal for companies with fluctuating information needs. They offer extensive coverage and are highly regarded for their precision, making them a valuable resource for businesses looking to stay ahead in the market.

This examination emphasizes the advantages and disadvantages of each supplier, assisting organizations in making informed choices based on their specific information requirements, financial constraints, and insights from alternative data providers.

Use Cases and Suitability: Choosing the Right Alternative Data Provider

Choosing the appropriate alternative data providers is vital for organizations seeking to utilize insights efficiently for investment evaluation and strategic decision-making. The choice should be guided by specific use cases and objectives:

-

Market Research: Businesses focused on understanding consumer behavior and market trends can benefit from providers that specialize in social media analytics and transaction data. These datasets unveil insights into customer preferences and industry dynamics, enhancing competitive positioning.

-

Investment Analysis: Companies looking to enhance their investment approaches may gain from alternative data providers that offer financial transaction information and sentiment evaluation. Such information offers near real-time insights, enabling quicker and more informed investment decisions, which is essential for outperforming in today's fast-paced market.

-

Credit Scoring and Risk Evaluation: Organizations in the lending sector can utilize alternative data providers for credit scoring and risk evaluation. Alternative data providers with extensive financial information are especially appropriate, as they can deliver insights that conventional sources may overlook, thereby enhancing risk assessment procedures.

-

Supply Chain Optimization: Companies aiming to enhance operational efficiency can leverage geolocation and satellite imagery information to monitor logistics and inventory levels. This information is critical for optimizing supply chain operations and ensuring timely responses to market changes.

By coordinating the choice of different information providers with particular organizational requirements, companies can enhance the value obtained from these resources. This ultimately fosters improved decision-making and strategic results. As noted by industry experts, organizations that fail to leverage alternative data's full potential risk falling behind their peers in the quest for growth and competitive advantage.

Conclusion

Alternative data providers are increasingly essential for businesses and investors aiming for deeper insights into market dynamics and consumer behavior. By leveraging non-traditional data sources, such as social media, satellite imagery, and transaction records, organizations can enhance their decision-making processes and gain a competitive edge. As the market for alternative data expands, understanding how to evaluate and select the right providers becomes crucial for maximizing the value derived from these resources.

This article outlines key criteria for comparing alternative data providers, including:

- Information quality

- Coverage

- Pricing models

- Integration capabilities

- Customer support

- Specific use cases

Each of these factors plays a vital role in determining which provider aligns best with an organization's unique needs and objectives. The comparative analysis of leading providers emphasizes the diverse offerings available, allowing businesses to make informed choices based on their specific data requirements and budget considerations.

In a landscape where the ability to quickly adapt and make data-driven decisions can significantly impact success, leveraging alternative data is not just beneficial but necessary. Organizations that embrace these insights will enhance their analytical capabilities and position themselves favorably in an increasingly competitive market. As the demand for alternative data continues to grow, companies must prioritize integrating these insights into their strategic frameworks to unlock new opportunities and drive sustainable growth.

Frequently Asked Questions

What is alternative data?

Alternative data refers to non-traditional sources of information that provide insights beyond conventional datasets. Examples include social media interactions, satellite imagery, web scraping, and transaction records.

Why is alternative data important?

Alternative data is important because it offers unique perspectives on market trends, consumer behavior, and economic indicators, which can greatly enhance decision-making for businesses and investors.

How has the demand for alternative data changed by 2025?

By 2025, the demand for prompt and practical insights has surged, making supplemental information a vital asset across various sectors, including finance, marketing, and research.

How are lenders using alternative data?

Lenders are increasingly using diverse information to approve more clients while managing risk, which promotes business expansion and maintains portfolio quality.

What examples exist of companies utilizing alternative data?

Companies like New Constructs have developed indices to track the performance of leading firms, consistently outperforming traditional benchmarks by leveraging alternative data.

How can organizations benefit from alternative data?

Organizations can benefit from alternative data by integrating these insights into their analytical frameworks, which can unlock new opportunities and drive growth in decision-making processes.