7 Top Private Credit Funds to Watch for Investment Insights

7 Top Private Credit Funds to Watch for Investment Insights

Introduction

The landscape of private credit investment is evolving rapidly, driven by innovative strategies and emerging opportunities that are reshaping traditional financing methods. As institutional investors increasingly turn to private credit funds for attractive returns, navigating this complex market becomes paramount. This article explores seven top private credit funds to watch, highlighting their unique approaches and the potential benefits they offer.

What insights can these funds provide to investors looking to capitalize on the shifting dynamics of the financial landscape? Each fund presents distinct features that cater to various investment strategies. For instance, some funds focus on niche markets, while others leverage established relationships to secure favorable terms.

The advantages of these approaches include enhanced risk management and the potential for higher yields. By understanding these features and advantages, investors can make informed decisions that align with their financial goals. Ultimately, the benefits of engaging with these private credit funds extend beyond mere returns; they offer a pathway to diversify portfolios and access unique investment opportunities.

Initial Data Offering: Access Unique Private Credit Datasets

The Initial Data Offering (IDO) serves as a centralized hub for accessing unique, confidential datasets, all powered by advanced AI technology. One of its standout features is the proprietary Recursive Data Engine, which continuously expands and enriches a dynamic graph of 265 million global entities. This capability not only curates high-quality data but also enables investors to uncover actionable insights that can significantly inform their investment strategies.

What makes IDO particularly advantageous is its comprehensive datasets that cover various aspects of personal lending. These include:

- Trends

- Borrower characteristics

- Performance indicators

Such detailed information renders IDO an essential resource for both seasoned investors and newcomers to the personal lending sector. By leveraging these datasets, users can make informed decisions that enhance their investment outcomes.

In conclusion, IDO empowers investors by providing them with the tools necessary to navigate the complexities of personal lending. How might these insights shape your investment approach? With the right data at your fingertips, the potential for success in this sector is within reach.

Mackenzie Northleaf Private Credit Fund: Explore Investment Opportunities

The Mackenzie Northleaf Private Loan Fund offers investors access to a diverse range of non-public lending assets, which are part of the top private credit funds. What does this mean for you? With a strategic focus on mid-market lending, this fund stands out among the top private credit funds designed to deliver attractive risk-adjusted returns.

Key Features:

- The fund is backed by a strong management team that leverages extensive industry insights.

- This expertise allows them to identify promising opportunities across various sectors.

Advantages:

- By concentrating on mid-market lending, the fund positions itself to capitalize on unique investment opportunities that may not be available in the top private credit funds compared to more traditional markets.

- This strategic approach can lead to enhanced returns for investors.

Benefits:

- Investors can benefit from the fund's ability to navigate complex lending landscapes, potentially leading to more stable and lucrative investment outcomes.

In conclusion, the Mackenzie Northleaf Private Loan Fund not only provides access to unique lending assets but also offers a well-rounded investment strategy that could align with your financial goals. How might this fund fit into your overall investment portfolio?

HarbourVest: Innovative Strategies in Private Credit Investment

HarbourVest distinguishes itself among the top private credit funds in the financing landscape through innovative strategies, particularly in direct lending and credit secondaries. This firm has adeptly navigated a changing environment where bank lending to middle-market businesses has dropped to just 12%, down from over 75% before the Global Financial Crisis. This significant shift has created opportunities for alternative financing solutions, allowing HarbourVest to seize unique funding prospects that may be overlooked by less experienced investors.

Looking ahead to 2025, the direct lending sector is expected to continue its robust growth, driven by top private credit funds with private financing estimated at around $1.6 trillion. HarbourVest's strategic approach leverages its extensive network and deep industry knowledge to identify unique products tailored for various risk tolerances and financial goals. The company's commitment to innovation is evident in its establishment of a specialized secondary finance team, aimed at addressing the increasing demand for liquidity solutions within the financial sector.

Greg Ciesielski, a managing director at HarbourVest, emphasizes the firm's unique position: "Our close knowledge of leaders in the private lending sector, combined with our underwriting discipline, enables us to engage in the complete range of the secondary finance arena." This perspective underscores HarbourVest's proactive approach to identifying and executing transactions that enhance returns while managing risks effectively.

Successful instances of direct lending and secondary financing highlight HarbourVest's expertise in this domain. The firm has allocated approximately $1.2 billion of LP capital across 19 transactions in debt secondaries, showcasing its ability to navigate complex economic dynamics and deliver value to its investors. With the secondaries sector projected to reach transaction volumes of $40 billion by 2027, and GP-led secondary deals anticipated to account for 60% of transaction volume in 2025, HarbourVest is strategically positioned to leverage its expertise and capitalize on this growth, further reinforcing its reputation as a leader in top private credit funds and private debt investments.

CVC: Pioneering Global Credit Secondaries Strategy

CVC Capital Partners stands out as a leader in the global financing secondaries sector. This firm focuses on acquiring existing financial positions, which presents a unique opportunity for investors. By investing through CVC, you gain exposure to high-quality assets while enjoying enhanced liquidity.

This strategy not only diversifies your investment portfolio but also allows for more flexible responses to changing economic conditions. Consider this: in a volatile market, having the ability to adapt quickly can be a significant advantage. CVC’s approach empowers investors to navigate these challenges effectively, ensuring that their investments remain robust and responsive.

In summary, CVC Capital Partners offers a compelling proposition for investors looking to optimize their portfolios. By leveraging their expertise in the secondaries market, you can enhance your investment strategy and position yourself for success.

ICG: Launching Evergreen Private Credit and Secondaries Funds

ICG is set to introduce evergreen non-public financing and secondaries funds, which allow investors to allocate capital over an extended period without a fixed conclusion. This innovative structure offers enhanced flexibility and the potential for continuous capital deployment, making it particularly appealing to investors eager to capitalize on long-term economic trends.

According to With Intelligence, evergreen funds currently boast a total of $503 billion in assets, reflecting a remarkable growth of 27% from previous figures. ICG's expertise in managing diverse credit strategies positions it to effectively navigate the complexities of the top private credit funds landscape. In fact, firms have seen an average of 18.4% of their target sector deal flow in the past twelve months.

However, investors should remain vigilant about potential challenges, such as valuation complexities and the risk of redemption gates during periods of high withdrawal requests. As the demand for flexible capital solutions rises, ICG's strategy aligns seamlessly with the evolving needs of investors seeking stability and growth in top private credit funds in a dynamic environment.

Moreover, insights from ICG executives regarding their long-term capital deployment strategies will further illuminate the benefits of this approach. How might these strategies impact your investment decisions? Understanding these dynamics could be crucial for navigating the current market landscape.

Mitsui Sumitomo: Strategic Acquisition in Private Credit

Mitsui Sumitomo has made notable strides in the private lending sector, primarily through strategic acquisitions designed to enhance its funding capabilities. By acquiring companies with established financing portfolios, Mitsui Sumitomo not only broadens its asset base but also gains access to innovative funding strategies and specialized expertise. This proactive approach enables the firm to better serve its clients and adapt to the rapidly changing business landscape.

A prime example of this strategy is the recent acquisition of an 18% stake in Barings for $1.44 billion. This move allows Mitsui Sumitomo to strengthen its operational collaboration and extend its influence in the U.S. asset management sector. Such strategic actions are expected to significantly impact Mitsui Sumitomo's investment potential, particularly in the non-public lending sector, which is projected to grow from approximately $1.5 trillion at the start of 2024 to an estimated $2.6 trillion by 2029.

These acquisitions not only enhance Mitsui Sumitomo's portfolio but also reflect a broader trend in the independent lending market. Companies are increasingly seeking to diversify and improve their offerings through strategic partnerships. As the demand for personalized financing solutions continues to rise - driven by stricter bank lending practices and the need for flexible funding options - Mitsui Sumitomo's strategic acquisitions position it favorably to capitalize on emerging opportunities and deliver value to its clients.

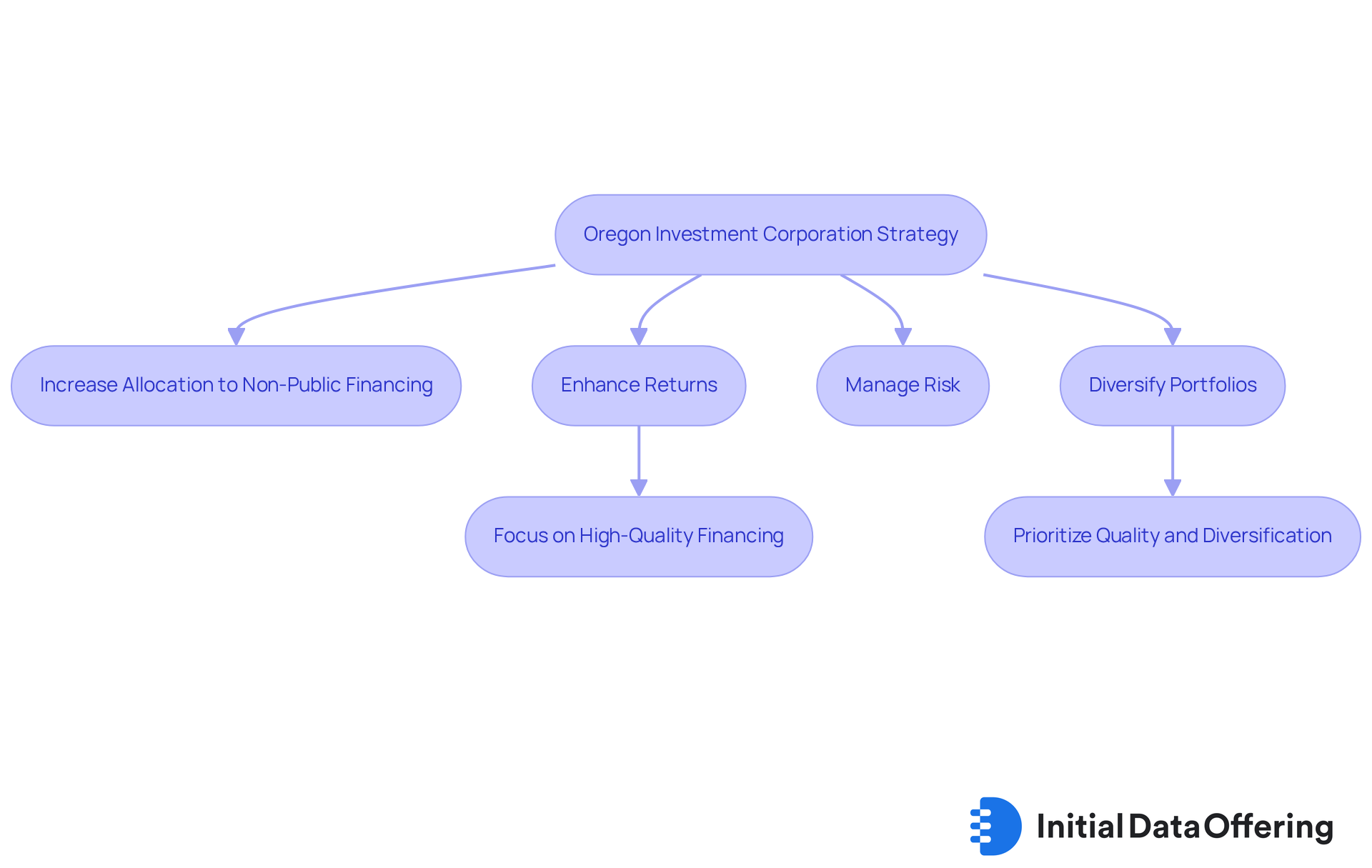

Oregon Investment Corporation: Adapting to Private Credit Markets

The Oregon Investment Corporation is strategically increasing its allocation to non-public financing. This move aims to enhance returns while effectively managing risk, reflecting a broader trend among institutional investors. By diversifying their portfolios, these investors are utilizing alternative financing as a dependable income source.

One notable feature of this strategy is the rise of personal lending, which has consistently outperformed high yield investments over the long term. With returns ranging from 8-10%, personal lending presents an appealing choice for organizations like Oregon. As institutional funding in alternative lending continues to grow, organizations are adjusting their strategies to navigate the complexities of this evolving market.

By focusing on high-quality financing opportunities and ensuring diversification across sectors and positions, Oregon is positioning itself to capitalize on the potential for stable returns amidst fluctuating economic conditions. This proactive approach not only demonstrates a commitment to enhancing asset performance but also underscores the increasing recognition of alternative financing's role in achieving long-term financial objectives.

However, caution is advised regarding public business development companies (BDCs) that may have lower quality asset bases compared to non-traded BDCs. This highlights the importance of careful selection in this area.

How can organizations ensure they are making informed decisions in this changing landscape? By prioritizing quality and diversification, they can better navigate the risks and rewards of alternative financing.

New Jersey: Embracing Next Gen Managers in Private Credit

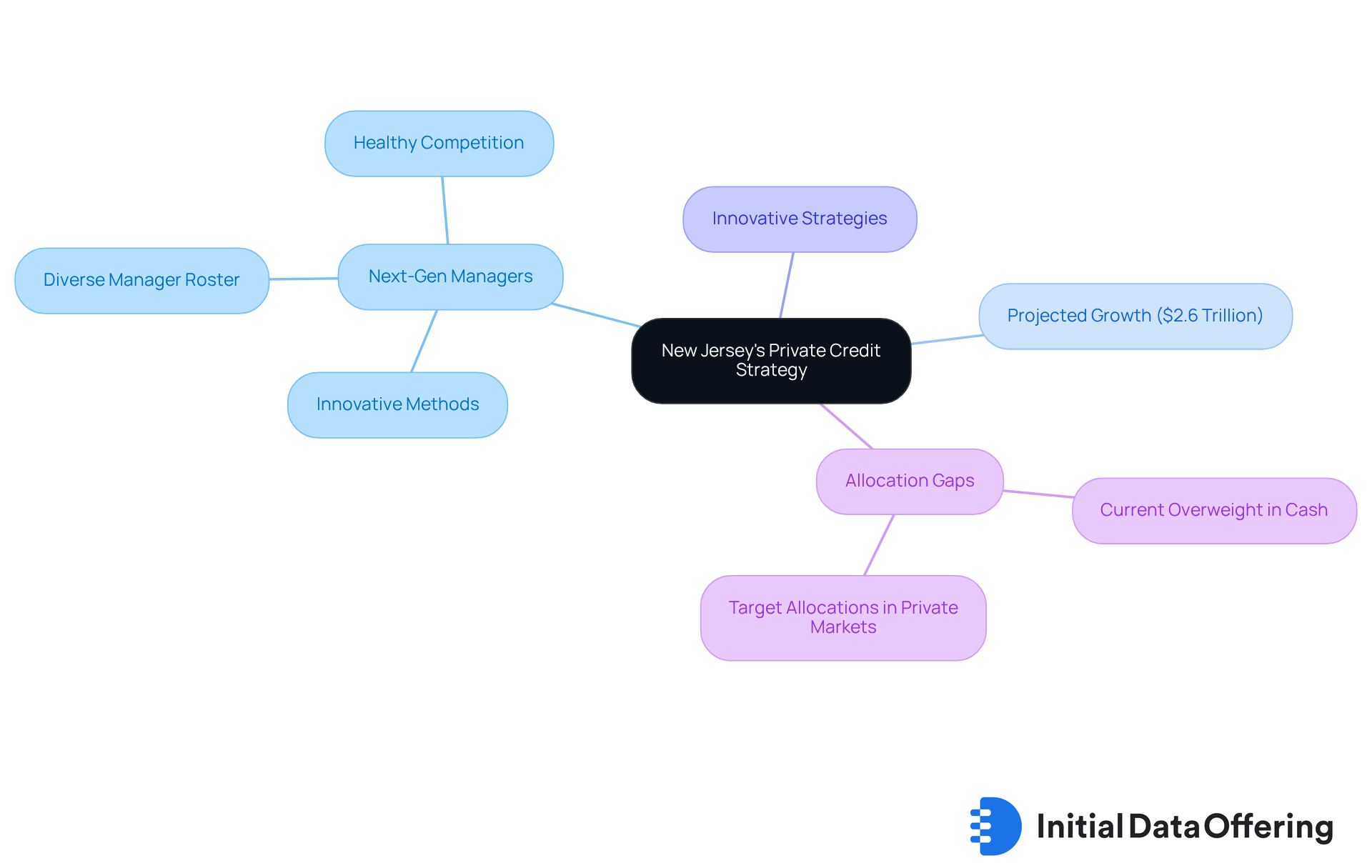

New Jersey is actively incorporating next-generation managers into its strategy for top private credit funds, recognizing their potential to provide innovative methods that can yield appealing returns. This strategic move not only diversifies the manager roster to include emerging firms but also allows the state to capitalize on unique financial opportunities often overlooked by conventional players. By fostering healthy competition, New Jersey supports the creation of innovative funding methodologies that can enhance overall portfolio performance.

In 2025, top private credit funds are projected to reach a staggering $2.6 trillion, underscoring the growing significance of this asset class. New Jersey's commitment to collaborating with next-gen managers highlights a broader trend in the financial landscape, particularly among top private credit funds, where innovative strategies are increasingly valued. Investment officials, including David Miller, have noted that these emerging firms bring fresh perspectives and agility, which are essential for navigating the complexities of today's financial environment.

As New Jersey continues to restructure its portfolio, the emphasis on innovative financial strategies positions the state to seize new opportunities. However, it is important to note that New Jersey continues to fall short of its target allocations in alternative markets. This highlights the urgency of this strategic shift. How can these next-gen managers help bridge that gap? By leveraging their unique insights and approaches, they may provide the solutions needed to enhance New Jersey's investment landscape.

Korea Investment Corporation: Focusing on Alternative Investments

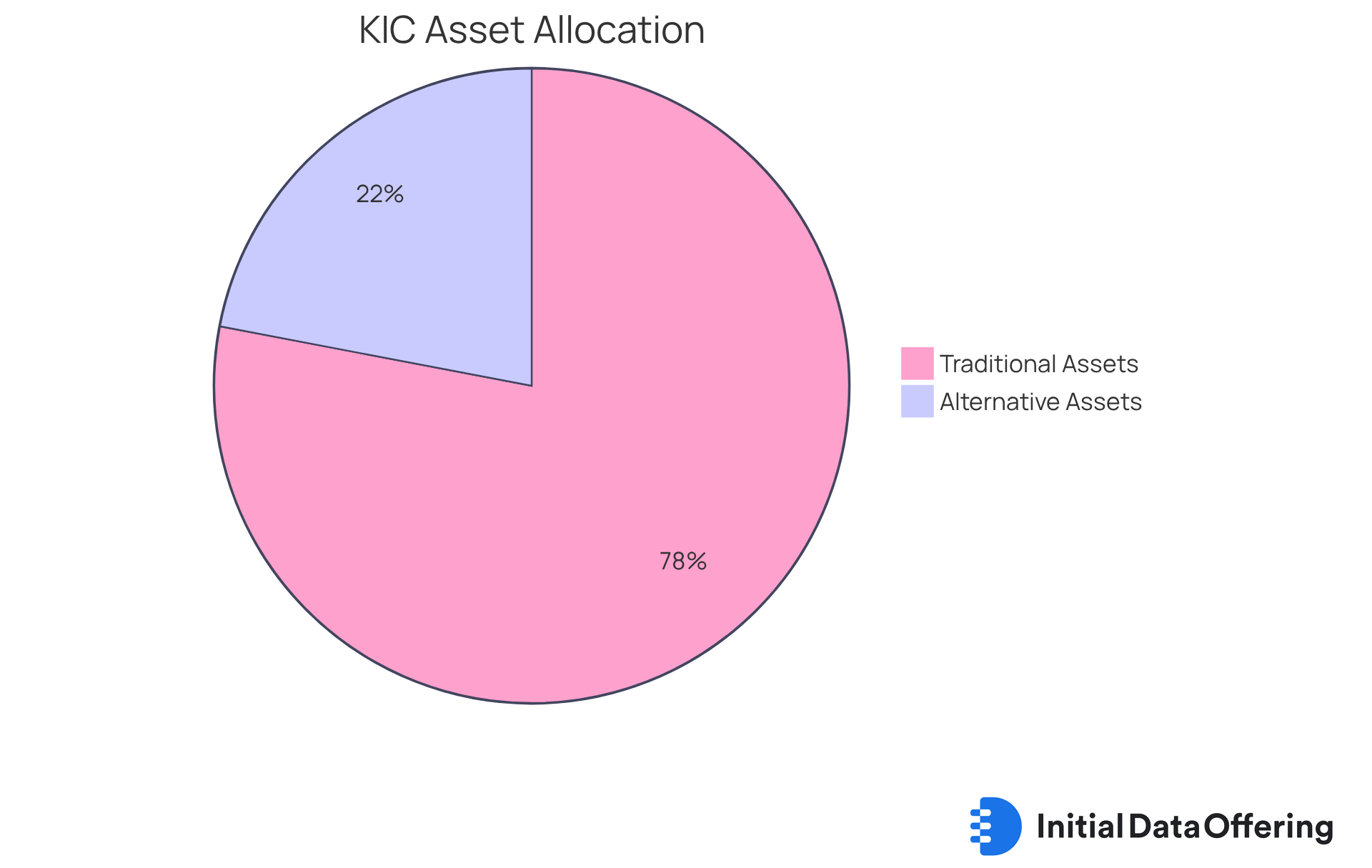

The Korea Investment Corporation (KIC) is strategically enhancing its focus on alternative assets, particularly non-public financing. This shift acknowledges the potential for stable returns in the current low-interest-rate environment. Notably, KIC's funding strategy has undergone a significant transformation, with alternative assets rising from just 2% in 2009 to 22% as of September 2023. By diversifying its portfolio to include alternative financing, KIC aims to improve its overall financial performance while effectively managing risks associated with traditional asset categories.

KIC's commitment to non-public financing is underscored by its recent performance metrics. The corporation reported an impressive annual return of 8.49% last year, driven by strategic allocations across various sectors, including notable gains from equity holdings in AI tech stocks. This performance highlights the effectiveness of diversifying into alternative assets, particularly as KIC adapts its portfolio to navigate the complexities of the current economic landscape. As KIC's President Park Il-young emphasized, the organization is focused on structural growth themes, including personal financing, to ensure stable cash flows and long-term development.

In a landscape marked by geopolitical uncertainties and financial volatility, KIC's emphasis on alternative financing not only enhances its strategic approach but also positions it to capitalize on emerging opportunities within this asset category. This strategy reflects a broader trend among institutional investors, who are increasingly recognizing the value of non-public lending as a reliable source of income and a means to achieve improved risk-adjusted returns.

How can KIC's approach to alternative assets inform your investment strategies? By understanding the features, advantages, and benefits of such a shift, investors can better navigate the evolving financial landscape.

Dutch Insurer NN: Insights on Capital and Lending in Private Credit

NN Group, a prominent Dutch insurer, is strategically engaged in the personal lending sector, focusing on capital distribution and innovative financing strategies that align with its funding objectives. What does this mean for the market? By leveraging its substantial capital base, NN Group aims to provide competitive financing solutions while effectively managing associated risks. This dual strategy not only promotes the growth of personal financing but also solidifies NN Group's position among the top private credit funds in the evolving landscape of alternative investments.

Looking ahead to 2025, the company is expected to refine its lending strategies, particularly as the demand for flexible financing solutions rises among middle-market companies. With personal financing projected to reach $2.8 trillion by 2028, NN Group's proactive capital allocation strategies are designed to capitalize on emerging opportunities in this dynamic market. How can businesses benefit from this trend? The firm’s commitment to quality and customer satisfaction, highlighted by its top ranking in Dutch broker satisfaction, further emphasizes its dedication to nurturing strong relationships within the top private credit funds sector.

Conclusion

The exploration of top private credit funds reveals a dynamic landscape filled with investment opportunities. Understanding the unique strategies and innovations each fund offers can provide investors with valuable insights that enhance their portfolios. The focus on alternative financing solutions, such as those from Mackenzie Northleaf and HarbourVest, underscores a shift towards more flexible and diverse investment strategies that meet evolving market demands.

Various funds have been examined throughout this article, showcasing their strengths in mid-market lending, innovative secondary financing, and strategic acquisitions. For instance, insights from firms like CVC and ICG highlight the importance of adaptability in an ever-changing financial environment. Additionally, organizations such as the Oregon Investment Corporation and Korea Investment Corporation emphasize the growing recognition of alternative assets as reliable income sources.

Investors should consider how these emerging trends and strategies can inform their decision-making processes. The potential for enhanced returns and effective risk management in the private credit sector is significant. Staying informed and proactive is essential. By leveraging the insights shared, both individuals and institutions can position themselves to capitalize on the opportunities that lie ahead in the evolving world of private credit funds.

Frequently Asked Questions

What is the Initial Data Offering (IDO)?

The Initial Data Offering (IDO) is a centralized hub that provides access to unique, confidential datasets powered by advanced AI technology. It features the proprietary Recursive Data Engine, which enriches a dynamic graph of 265 million global entities to curate high-quality data and actionable insights for investors.

What types of datasets does IDO provide?

IDO offers comprehensive datasets covering various aspects of personal lending, including trends, borrower characteristics, and performance indicators.

Who can benefit from the IDO?

Both seasoned investors and newcomers to the personal lending sector can benefit from IDO, as it provides detailed information that allows users to make informed investment decisions.

What is the Mackenzie Northleaf Private Loan Fund?

The Mackenzie Northleaf Private Loan Fund is an investment fund that provides access to a diverse range of non-public lending assets, focusing on mid-market lending to deliver attractive risk-adjusted returns.

What are the key features of the Mackenzie Northleaf Private Loan Fund?

The fund is backed by a strong management team with extensive industry insights, allowing them to identify promising opportunities across various sectors.

What advantages does the Mackenzie Northleaf Private Loan Fund offer?

By concentrating on mid-market lending, the fund can capitalize on unique investment opportunities that may not be available in more traditional markets, potentially leading to enhanced returns for investors.

How does HarbourVest differentiate itself in private credit investment?

HarbourVest stands out through innovative strategies in direct lending and credit secondaries, successfully navigating a changing environment where traditional bank lending has decreased significantly.

What is the expected growth of the direct lending sector by 2025?

The direct lending sector is expected to continue robust growth, with private financing estimated at around $1.6 trillion by 2025.

How does HarbourVest leverage its expertise in private credit investments?

HarbourVest utilizes its extensive network and deep industry knowledge to identify unique products tailored for various risk tolerances and financial goals, enhancing returns while managing risks effectively.

What is the significance of HarbourVest's secondary finance team?

The establishment of a specialized secondary finance team at HarbourVest addresses the increasing demand for liquidity solutions within the financial sector, showcasing the firm's commitment to innovation.

What is the projected transaction volume for the secondaries sector by 2027?

The secondaries sector is projected to reach transaction volumes of $40 billion by 2027, with GP-led secondary deals anticipated to account for 60% of transaction volume in 2025.