7 Strategies for Effective ESG Data Analytics in 2025

7 Strategies for Effective ESG Data Analytics in 2025

Overview

The article focuses on effective strategies for ESG (Environmental, Social, and Governance) data analytics in 2025. It emphasizes the importance of robust information management and stakeholder engagement. Various tools and platforms, such as the Initial Data Offering and Brightest.io, are highlighted for their ability to streamline ESG data discovery. These tools enhance reporting, ultimately helping organizations align their strategies with regulatory demands and investor expectations.

How can these advancements in ESG data analytics benefit your organization? By understanding the features and advantages of these tools, organizations can leverage them to improve their data management practices and meet evolving expectations.

Introduction

The growing emphasis on environmental, social, and governance (ESG) factors in business strategy signals a pivotal shift in how organizations approach sustainability. Companies are increasingly striving to enhance their ESG reporting and performance, making the integration of effective data analytics crucial. This article explores seven innovative strategies that organizations can adopt in 2025 to leverage ESG data analytics. It addresses pressing questions about navigating complex regulatory landscapes and meeting investor expectations.

How can businesses not only comply with evolving standards but also gain a competitive edge through insightful data management?

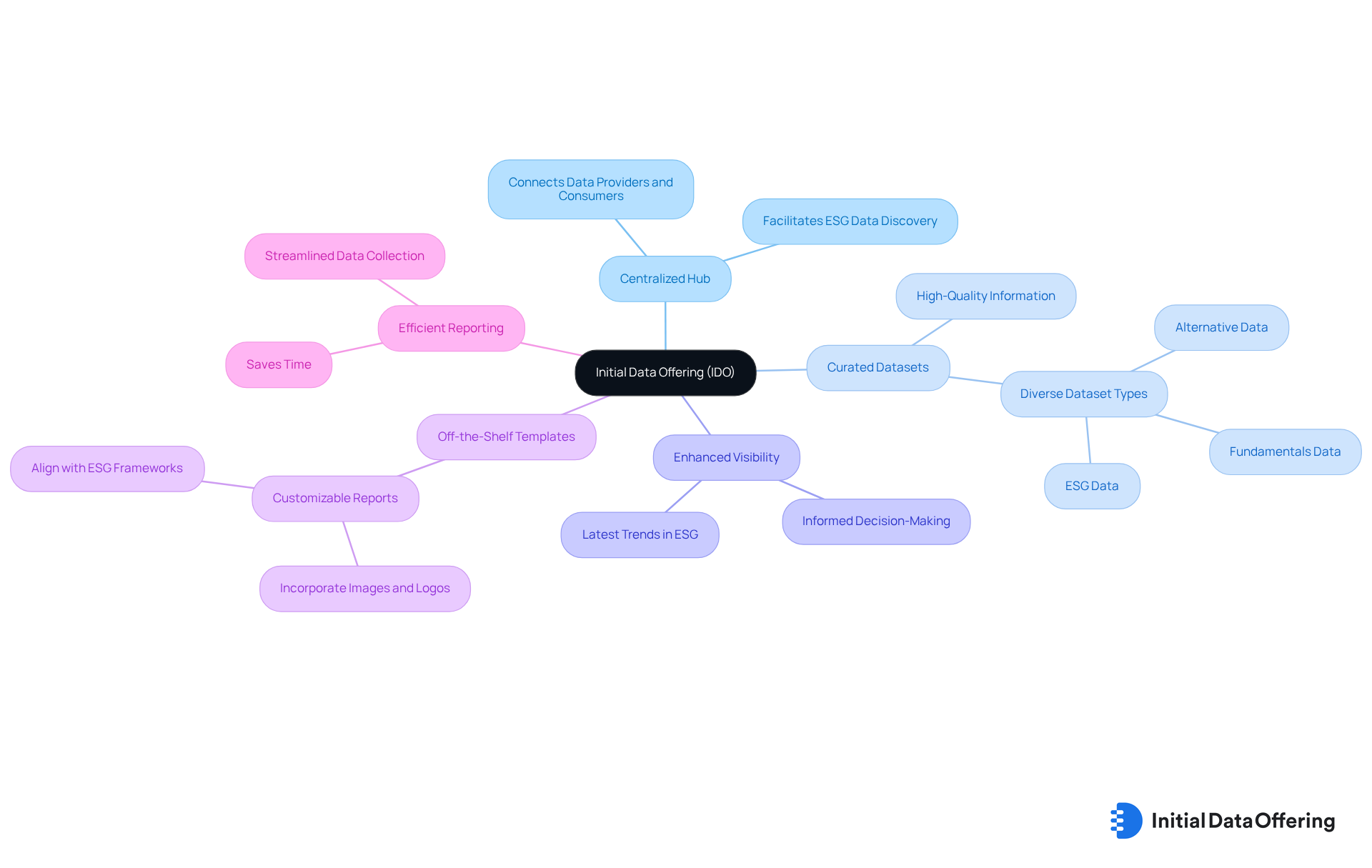

Initial Data Offering: Streamline Your ESG Data Discovery

The Initial Data Offering (IDO) serves as a centralized hub for discovering ESG data analytics, effectively facilitating access to high-quality information for businesses and researchers. By curating unique datasets, IDO enhances the visibility of valuable resources, allowing users to make informed decisions based on the latest trends in ESG data analytics and environmental, social, and governance metrics. Additionally, IDO provides off-the-shelf ESG reporting templates that incorporate ESG data analytics, enabling users to create customized reports that effectively communicate ESG performance to stakeholders. This efficient method not only conserves time but also ensures that organizations can focus on their ecological objectives without becoming overwhelmed in the disjointed information marketplace.

As Vanessa Zerbib, Head of Quality and Sustainability, noted, 'KEY ESG provides the flexibility we need and caters to our very specific reporting requirements.'

How might your organization leverage these resources to enhance its ESG reporting and decision-making processes?

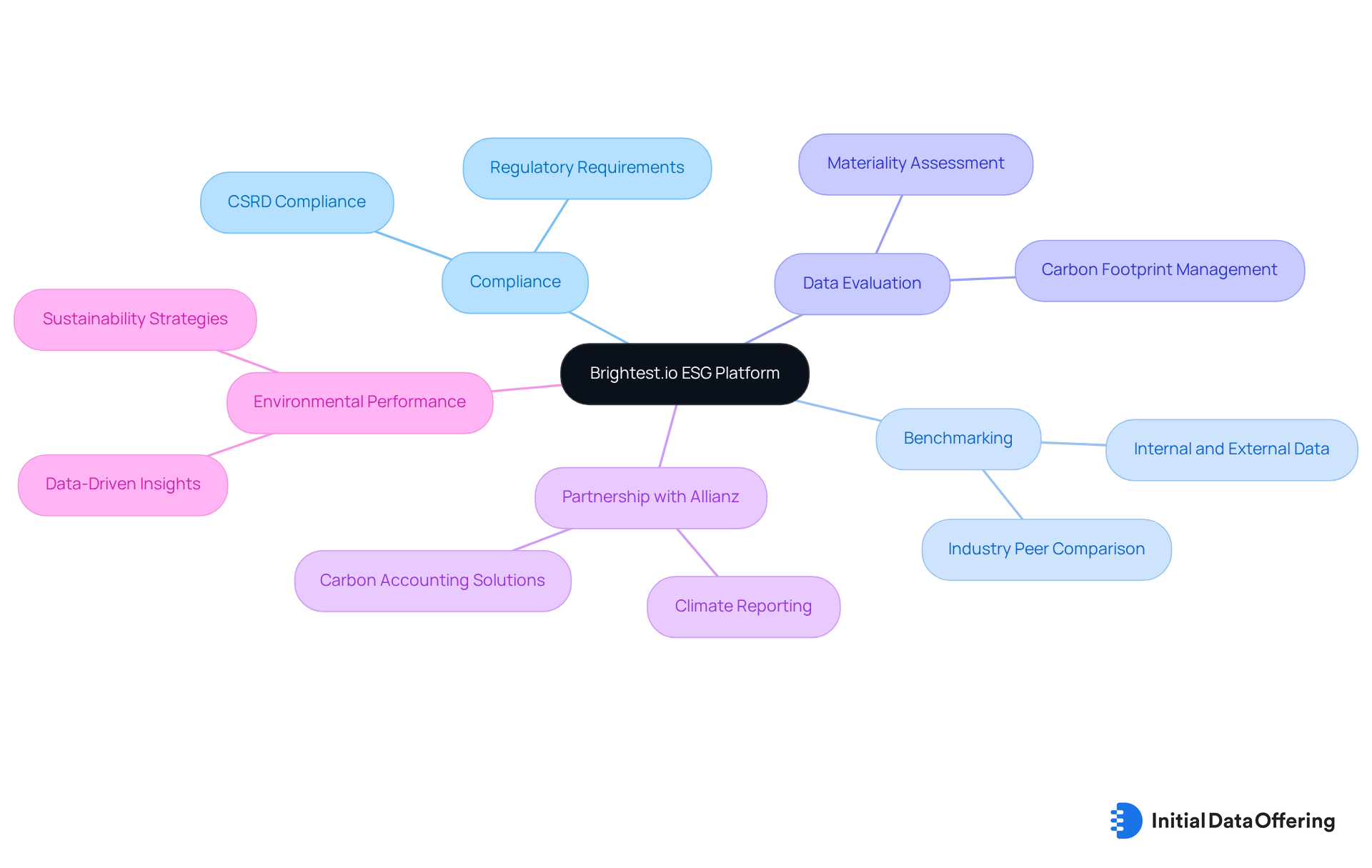

Brightest.io: Comprehensive ESG Data Overview and Utilization

Brightest.io provides a robust platform for managing ESG data analytics, allowing users to gain a comprehensive overview of their environmental metrics. Organizations can effectively monitor their ESG performance against industry benchmarks, which is essential for maintaining compliance with evolving regulatory requirements. By utilizing Brightest.io, businesses can achieve full compliance with the Corporate Sustainability Reporting Directive (CSRD) and other key ESG legislation in just a matter of weeks. This swift adherence is particularly crucial, especially as global greenhouse gas emissions rose by 1.9% from 2022 to 2023, underscoring the urgent need for effective environmental strategies.

Through Brightest.io, companies can conduct thorough evaluations of their data, pinpoint areas for improvement, and enhance their overall eco-friendly strategies. The platform's integrated materiality assessment software allows organizations to benchmark against industry peers and gather both internal and external data, leading to a comprehensive understanding of their ESG impact. This method not only fosters organizational alignment but also empowers businesses to make informed decisions that drive significant environmental progress.

Moreover, Brightest.io's partnership with Allianz Commercial exemplifies how companies can elevate their environmental performance through data-driven insights. This collaboration aims to equip businesses with comprehensive solutions for measuring and managing their carbon footprint, addressing the growing regulatory demands and aiding them in navigating the complexities of sustainability management. As Chris Bolman, Founder and CEO of Brightest, points out, making ESG accessible and affordable is vital for every company. As organizations increasingly seek data-driven approaches for their ESG strategies, Brightest.io becomes an essential tool for achieving effective ESG performance tracking using ESG data analytics.

GEP: Boost Your ESG Performance with Data Analytics

GEP provides advanced ESG data analytics tools that empower organizations to enhance their ESG performance. With a user rating of 4.4 for its ESG tool, GEP showcases its effectiveness in aiding companies to utilize ESG data analytics, uncover critical trends, assess potential risks, and identify opportunities for improvement. As industry leaders emphasize, "GEP GREEN provides the tools and insights you need to take action to improve your ESG performance." This analytical capability, powered by ESG data analytics, enables companies to make informed, data-driven decisions aligned with their environmental goals, thereby enhancing their competitive advantage in the marketplace.

Furthermore, GEP GREEN connects with the Carbon Disclosure Project (CDP), allowing entities to measure ESG performance across various metrics. To maximize the effectiveness of GEP's analytics tools, organizations should consider implementing predictive models using ESG data analytics to anticipate potential ESG risks, ensuring proactive management of their environmental strategies. How can your organization leverage these insights to bolster its ESG initiatives?

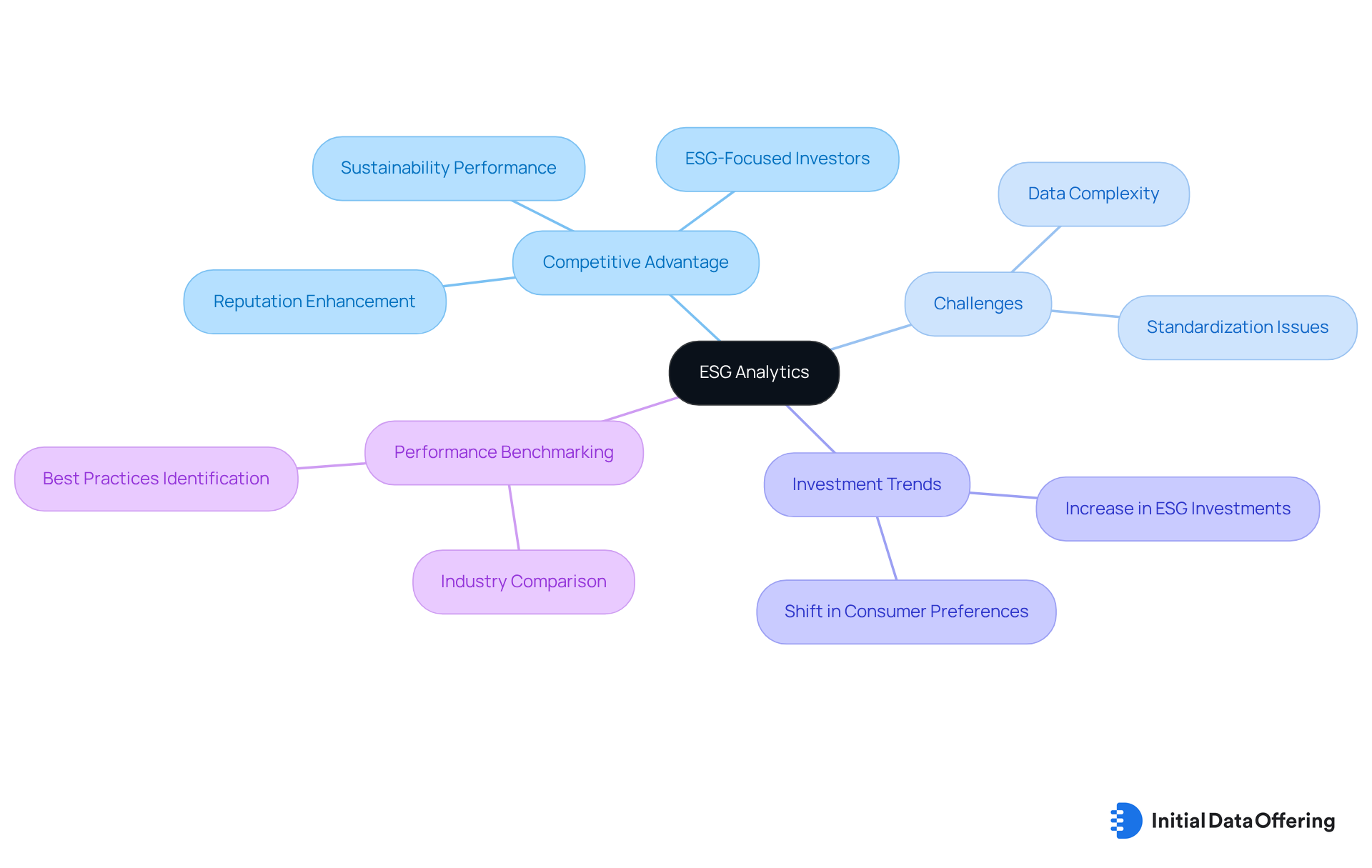

ESG Analytics: Gain Competitive Advantage Through ESG Data

Utilizing ESG data analytics offers entities a significant competitive advantage by providing essential insights into their sustainability performance. This systematic analysis of ESG data analytics allows companies to effectively benchmark their performance against industry peers, uncover best practices, and enhance their reputation among stakeholders. By adopting this strategic methodology, organizations not only improve compliance with evolving regulations but also attract ESG-focused investors, ultimately fostering long-term value creation.

However, the complexity and lack of standardization in ESG data analytics present notable challenges. It becomes crucial for organizations to depend on reliable data sources. As of 2024, worldwide ESG assets have surpassed $40 trillion, underscoring the growing importance of eco-friendliness in investment decisions. Furthermore, 62% of directors and VPs recognize that supply chain resilience directly contributes to growth and competitiveness, illustrating the tangible benefits of integrating ESG factors into corporate strategies.

With 87% of executives planning to maintain or increase their investments in business eco-friendliness by 2025, corporate America is poised to lead green initiatives. This proactive approach prepares companies for success in a rapidly evolving market. How can your organization leverage these insights to enhance its sustainability efforts and drive growth?

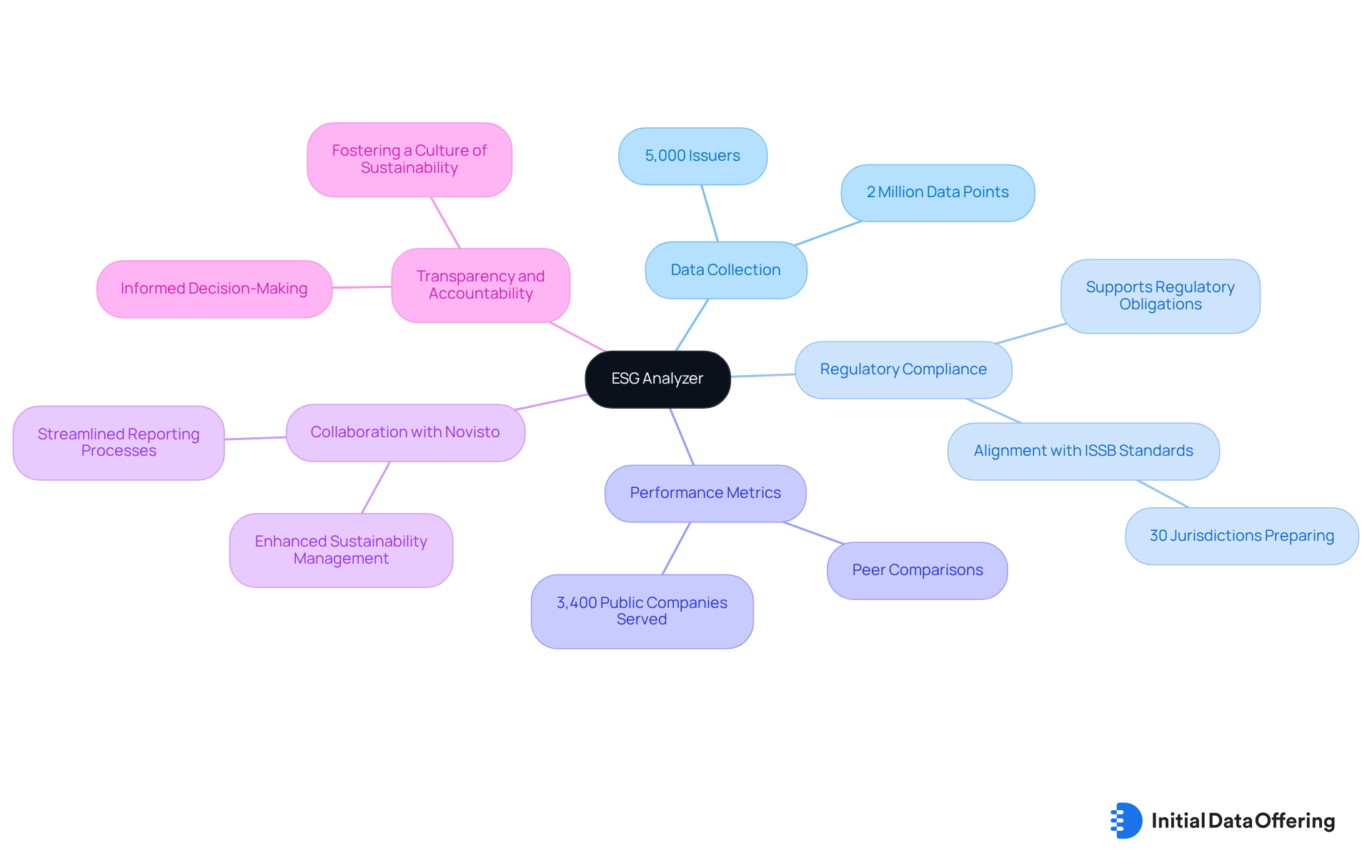

Broadridge: Simplify ESG Disclosure with ESG Analyzer

Broadridge's ESG Analyzer simplifies the ESG disclosure process through ESG data analytics, enabling entities to efficiently compare their ESG performance against peers. This tool assists companies in fulfilling regulatory obligations while improving transparency in their environmental initiatives. By simplifying complex reporting requirements, Broadridge empowers entities to concentrate on their sustainability efforts through ESG data analytics, fostering a culture of accountability and informed decision-making.

The ESG Analyzer features the gathering of public ESG disclosures and metrics from over 5,000 issuers, offering access to more than 2 million information points. This comprehensive approach enables entities to utilize ESG data analytics to visualize their ESG metrics on a single dashboard, facilitating peer comparisons and alignment with leading ESG frameworks. With Broadridge serving over 3,400 public companies in the U.S., the tool demonstrates widespread applicability and credibility in the market.

Furthermore, the collaboration with Novisto enhances Broadridge's sustainability information management capabilities. As Joseph Vicari from Broadridge notes, how essential is this tool for management to identify strengths and weaknesses in their ESG practices? Ultimately, it aids in the development of strategies to enhance performance and disclosures.

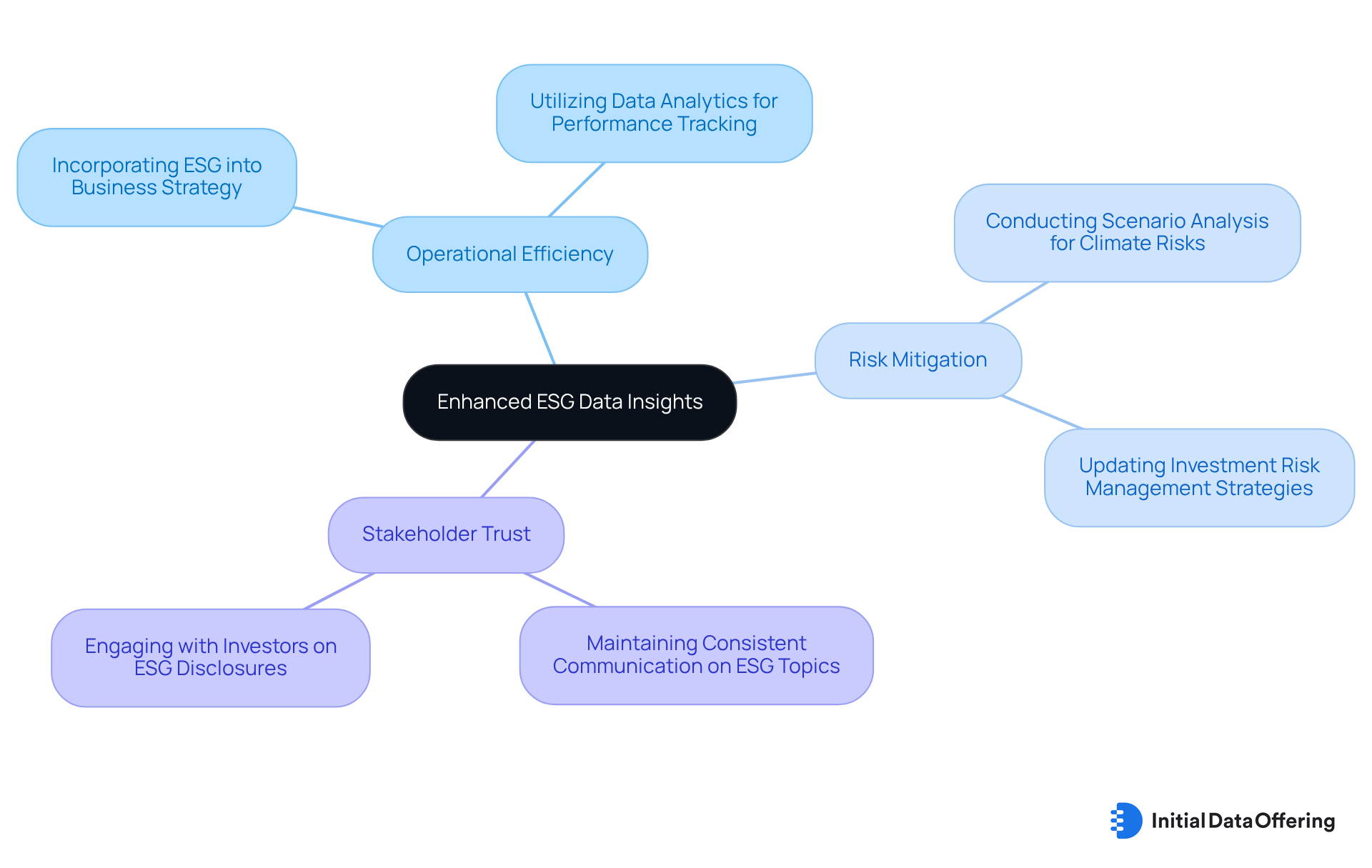

EY: Unlock Long-Term Value with Enhanced ESG Data Insights

EY emphasizes the importance of enhanced insights from ESG data analytics in driving long-term value for organizations. By incorporating ESG considerations into their business strategies, companies can achieve improved operational efficiency, mitigate risks, and foster greater stakeholder trust. EY's approach to ESG information management enables entities to pinpoint key performance indicators that not only support sustainable growth but also align with investor expectations.

How can your organization leverage these insights to enhance its ESG strategy? By recognizing the value of ESG data analytics, companies can position themselves favorably in the eyes of investors and stakeholders alike, ensuring a more sustainable future.

Veriforce: Align Business Strategy with Investor Expectations Using ESG Data

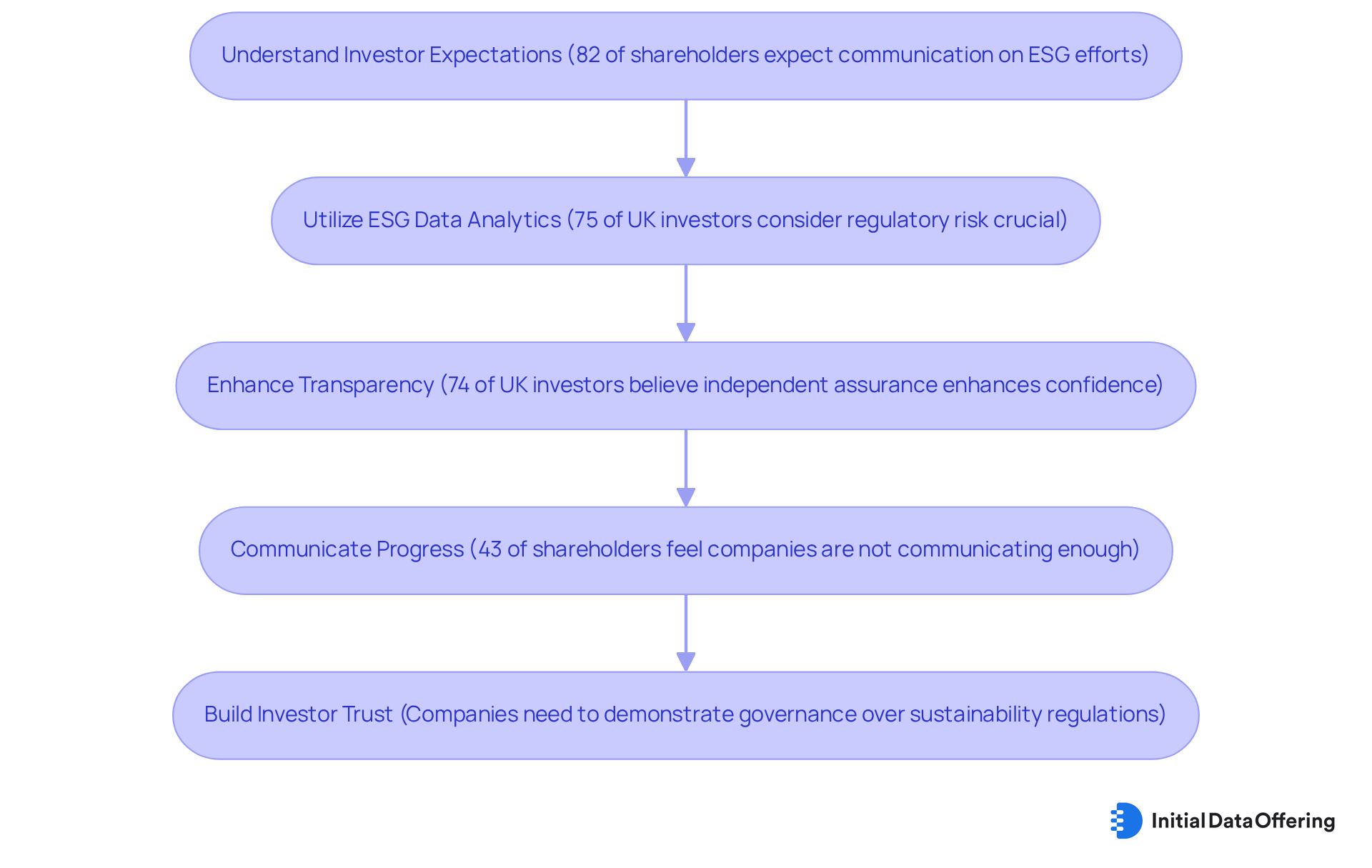

Veriforce equips companies with the essential tools to align their business strategies with investor expectations through the effective utilization of ESG data analytics. By leveraging ESG insights, organizations can demonstrate their commitment to ecological balance and social responsibility—factors that are increasingly significant to investors. Veriforce's solutions facilitate the tracking of ESG performance and the communication of progress to stakeholders, thereby fostering trust and transparency.

Investor expectations are evolving. In fact, 82% of shareholders in the US and UK believe that companies are responsible for communicating their ESG efforts. This demand for clarity highlights the urgent need for businesses to refine their ESG strategies and reporting practices. As emphasized by industry leaders, effective communication regarding ESG initiatives can significantly enhance investor relations, ensuring stakeholders are well-informed about a company's environmental commitments and progress. Tom Rayner, Founder of ESG Consultancy Sillion, notes that "ultimately, boards need to understand that ESG reporting is about openness and clearly defining the firm’s objectives and progress."

The impact of ESG data analytics on aligning business strategies cannot be overstated. Companies that incorporate ESG data analytics into their core strategies are better positioned to navigate regulatory risks and address the increasing scrutiny from investors. For instance, more than 75% of UK investors consider regulatory risk a crucial element in their investment decisions, underscoring the necessity for companies to keep pace with evolving environmental regulations. Additionally, 90% of executives anticipate that backlash against ESG initiatives will continue or escalate over the next two years, highlighting the challenges organizations face in their ESG strategies.

In this context, the significance of high-quality ESG insights is evident. As entities strive to meet investor expectations, prioritizing transparency and accountability in environmental reporting becomes imperative. Notably, 74% of UK investors believe that independent assurance enhances their confidence in the accuracy of sustainability reporting. By adopting such measures, companies not only bolster their credibility but also affirm their commitment to driving positive change within their industries.

Lythouse: Develop a Future-Proof ESG Data Management Strategy

Lythouse emphasizes the critical need for organizations to establish a future-proof strategy for ESG data analytics information management. This strategy involves developing a comprehensive framework that not only addresses current regulations but also anticipates emerging ones, ensuring both information quality and accessibility.

By investing in robust information management practices, companies can significantly enhance their capabilities in ESG data analytics for reporting.

How can your organization adapt to the evolving landscape of sustainability expectations? Improved practices not only streamline reporting but also leverage ESG data analytics to align with stakeholder demands for transparency and accountability.

In conclusion, prioritizing effective information management is essential for navigating the complexities of today's sustainability environment.

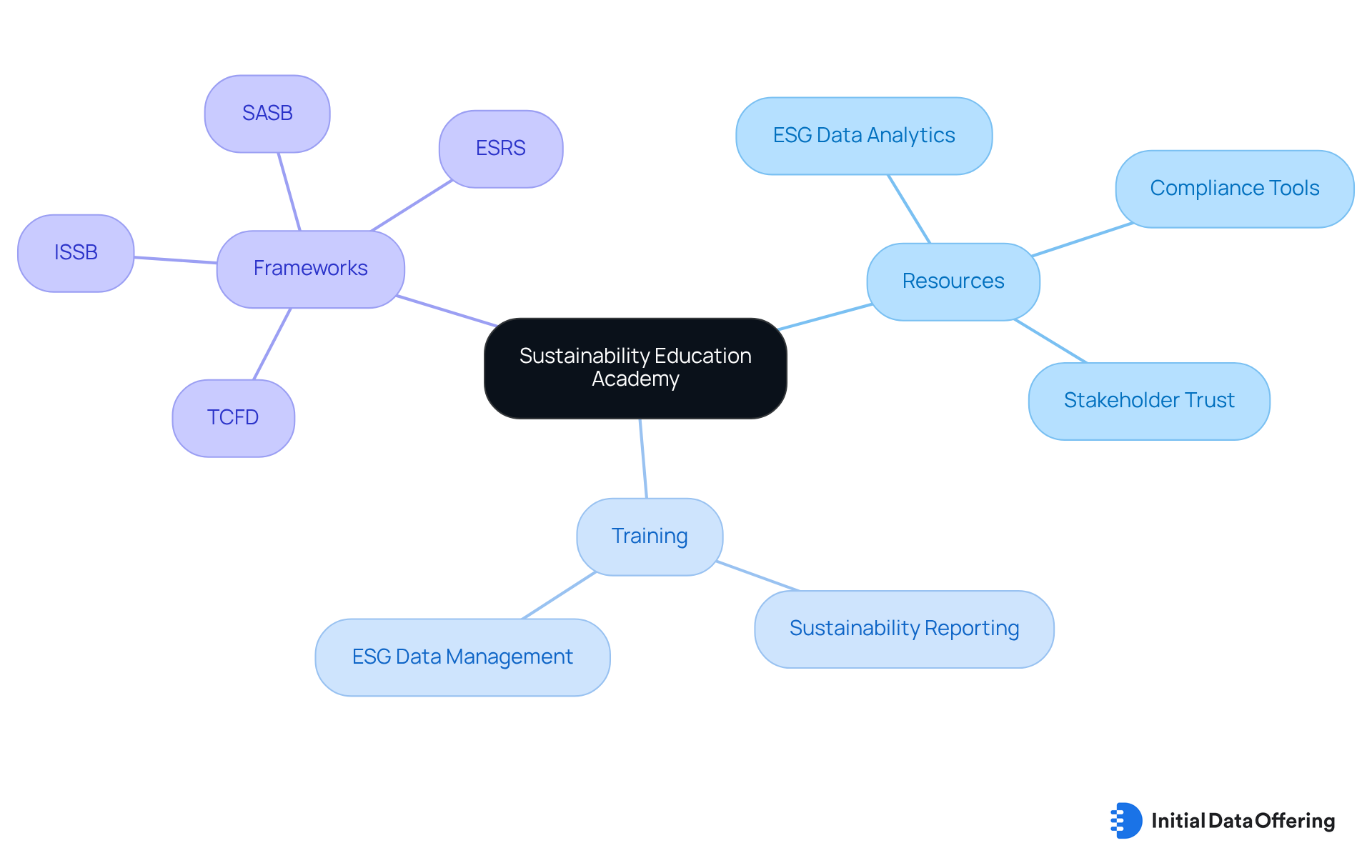

Sustainability Education Academy: Overcome ESG Data Management Challenges

The Sustainability Education Academy equips entities with essential resources and training to effectively tackle challenges in managing ESG data analytics. By focusing on optimal methods for information gathering, analysis, and reporting, organizations can significantly enhance their ESG performance using ESG data analytics and ensure compliance with evolving regulatory requirements. This proactive educational approach not only promotes greater transparency through ESG data analytics but also fosters trust among stakeholders, ultimately leading to improved decision-making and sustainable growth.

The eight-week Sustainability Reporting and ESG Data Analytics Programme, launched by Oxford University in collaboration with AICPA & CIMA, emphasizes the use of frameworks such as TCFD, ISSB, SASB, and ESRS. This structured approach to ESG education incorporates ESG data analytics, providing participants with the knowledge necessary to navigate the complexities of sustainability reporting. As the global head of ESG matters for AICPA & CIMA states, "Accounting and finance professionals who complete this program will have the necessary tools, including ESG data analytics, to guide their entities in sustainability reporting, employing best practices in meeting compliance with evolving regulations."

How can these frameworks enhance your organization's ESG strategy? By engaging with these resources, professionals can better position their entities for success in sustainability reporting through the use of ESG data analytics, ensuring they meet regulatory demands while driving sustainable growth.

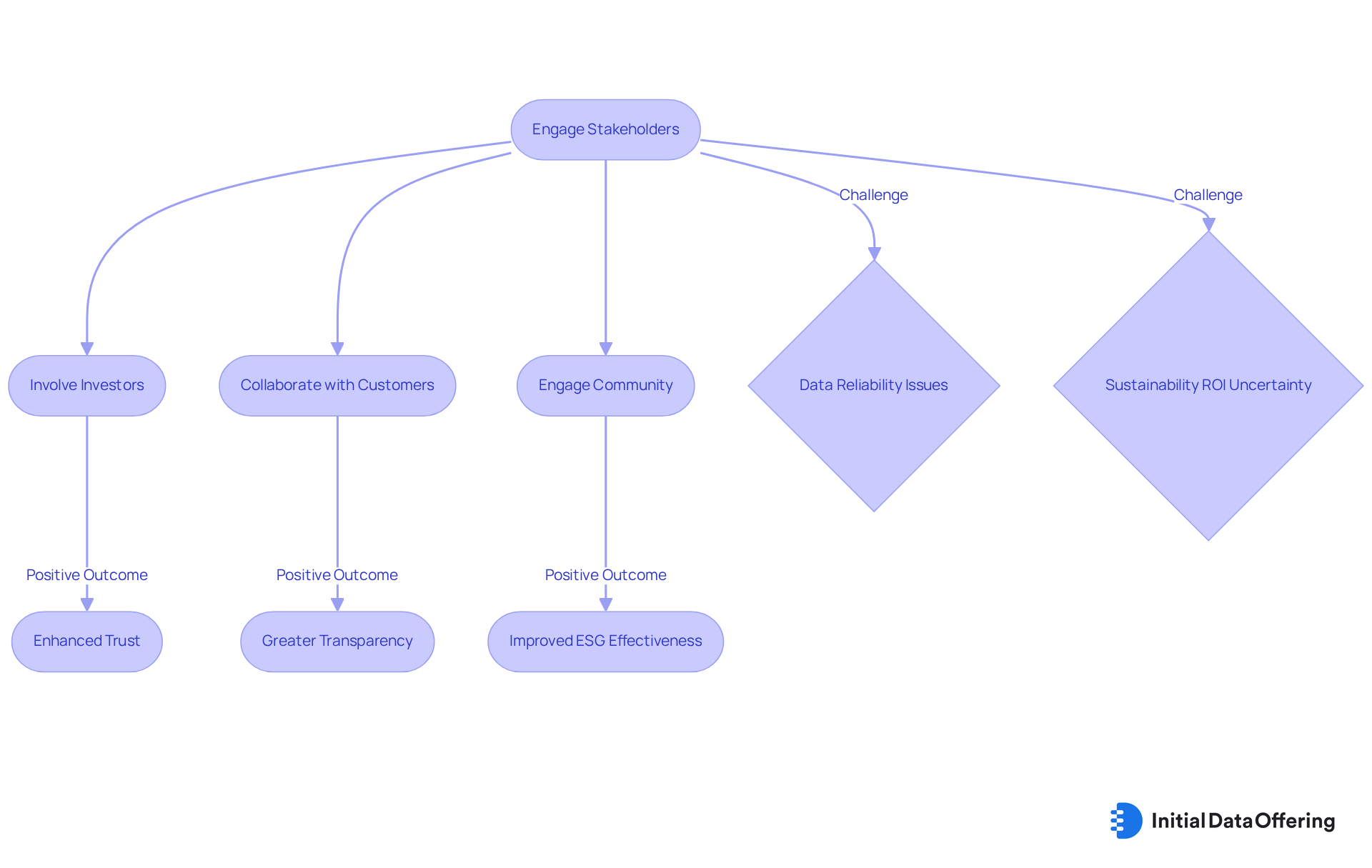

Thomson Reuters: Engage Stakeholders for Effective ESG Data Strategies

Thomson Reuters emphasizes the critical role of engaging stakeholders in the development of effective ESG data analytics strategies. Engaging stakeholders in the decision-making process ensures that ESG initiatives resonate with the expectations and needs of investors, customers, and the community. This collaborative approach not only fosters transparency and accountability but also enhances the overall effectiveness of ESG strategies.

Industry leaders assert that aligning ESG initiatives with investor expectations is essential, as it cultivates trust and credibility. As Camille Fordy, Vice President and ESG Practice Lead at Summit Strategy Group, articulates, 'Sustainability is no longer a peripheral concern, but rather a central filter through which every decision must pass.'

Furthermore, organizations that prioritize stakeholder involvement often observe a significant positive impact on the success of their ESG initiatives, leading to more sustainable and resilient business practices. However, they must also navigate challenges such as data reliability from supply chains, with 41% of companies expressing uncertainty or underperformance in assessing sustainability ROI through ESG data analytics. This scenario underscores the necessity for immediate actions over long-term ambitions to ensure effective ESG strategies.

Conclusion

The exploration of effective ESG data analytics strategies for 2025 reveals a transformative landscape in which organizations can leverage innovative tools and methodologies to enhance their sustainability initiatives. Central to this evolution is the emphasis on streamlined access to high-quality ESG data, enabling businesses to make informed decisions that align with both regulatory expectations and stakeholder demands.

Key strategies include:

- The Initial Data Offering (IDO) for efficient data discovery

- Comprehensive platforms like Brightest.io for performance monitoring

- Advanced analytics tools from GEP that drive competitive advantage

These features not only facilitate better data management but also provide organizations with the advantage of making data-driven decisions that enhance their overall performance. Furthermore, the importance of stakeholder engagement, as highlighted by Thomson Reuters, underscores the need for transparency and collaboration in developing effective ESG strategies.

As organizations increasingly recognize the value of ESG data analytics, integrating these insights into core business practices becomes crucial for long-term success and accountability. This proactive adoption positions companies favorably in the eyes of investors and fosters a culture of sustainability that is essential in today's market. By prioritizing effective ESG data management and embracing innovative solutions, organizations can navigate the complexities of environmental responsibility and drive meaningful change within their industries.

Engaging with these insights and tools will enhance compliance and performance while contributing to a more sustainable future for all stakeholders involved. How can your organization leverage these strategies to improve its ESG initiatives? The adoption of these practices not only fulfills regulatory requirements but also demonstrates a commitment to sustainability that resonates with both investors and consumers alike.

Frequently Asked Questions

What is the Initial Data Offering (IDO)?

The Initial Data Offering (IDO) is a centralized hub for discovering ESG data analytics, providing access to high-quality information for businesses and researchers. It curates unique datasets to enhance the visibility of valuable resources for informed decision-making regarding ESG metrics.

How does IDO assist in ESG reporting?

IDO provides off-the-shelf ESG reporting templates that incorporate ESG data analytics, allowing users to create customized reports that effectively communicate ESG performance to stakeholders, saving time and focusing on ecological objectives.

What platform does Brightest.io offer for ESG data management?

Brightest.io offers a robust platform for managing ESG data analytics, enabling organizations to monitor their ESG performance against industry benchmarks and maintain compliance with regulatory requirements, including the Corporate Sustainability Reporting Directive (CSRD).

How quickly can organizations achieve compliance using Brightest.io?

Organizations can achieve full compliance with key ESG legislation, such as the CSRD, in just a matter of weeks using Brightest.io.

What features does Brightest.io provide for evaluating ESG data?

Brightest.io allows companies to conduct thorough evaluations of their data, identify areas for improvement, and utilize integrated materiality assessment software to benchmark against industry peers.

How does GEP support organizations in enhancing their ESG performance?

GEP provides advanced ESG data analytics tools that help organizations uncover critical trends, assess risks, and identify opportunities for improvement, thus enhancing their ESG performance.

What is the user rating for GEP's ESG tool?

GEP's ESG tool has a user rating of 4.4, indicating its effectiveness in aiding companies with ESG data analytics.

How does GEP GREEN connect with the Carbon Disclosure Project (CDP)?

GEP GREEN connects with the Carbon Disclosure Project (CDP) to measure ESG performance across various metrics, facilitating better management of environmental strategies.

What should organizations consider to maximize the effectiveness of GEP's analytics tools?

Organizations should consider implementing predictive models using ESG data analytics to anticipate potential ESG risks and ensure proactive management of their environmental strategies.