7 Sources for Historical Intraday Futures Data You Need

7 Sources for Historical Intraday Futures Data You Need

Overview

The article highlights seven key sources for accessing historical intraday futures data, which are crucial for traders and analysts aiming to make informed decisions. Each source, including platforms such as CME Group, CQG, and EODData, presents unique datasets and tools that enhance detailed market analysis. This reflects the increasing demand for high-quality, accessible historical data in trading strategies.

What features do these platforms offer? For instance, CME Group provides comprehensive market data that allows traders to analyze past trends effectively. CQG, on the other hand, offers advanced charting tools that facilitate real-time analysis. EODData supplies extensive historical data, enabling users to backtest their strategies thoroughly.

The advantages of utilizing these sources are significant. By leveraging the unique datasets available, traders can gain insights that inform their decision-making processes. This not only enhances their trading strategies but also improves their overall market understanding.

In conclusion, accessing these seven sources can empower traders and analysts to refine their strategies and make data-driven decisions. As the market continues to evolve, the importance of high-quality historical data cannot be overstated.

Introduction

The world of trading increasingly relies on historical data, particularly intraday futures data, to inform strategic decisions and enhance market understanding. As the demand for precise and comprehensive datasets grows, traders and analysts face a unique opportunity to leverage various sources tailored to their specific needs. However, with so many options available, the challenge persists: how can one effectively navigate this landscape to find the most reliable and insightful data? This article explores seven essential sources for historical intraday futures data, highlighting their unique offerings and the potential benefits they bring to traders aiming to refine their strategies and boost performance.

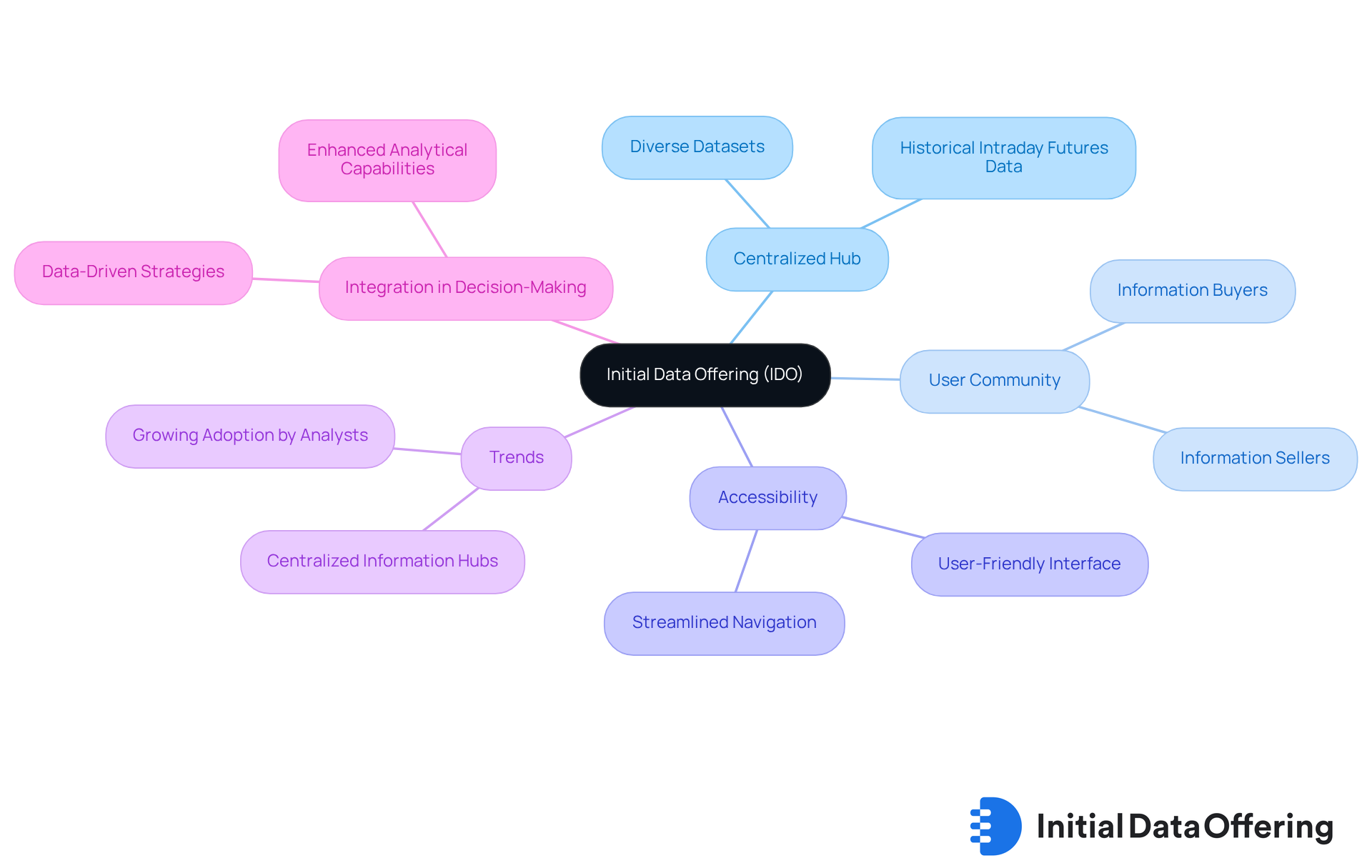

Initial Data Offering: Centralized Hub for Historical Intraday Futures Data

The Initial Data Offering (IDO) serves as a pivotal centralized hub for accessing historical intraday futures data, streamlining access to a diverse range of datasets. By fostering a vibrant community of information buyers and sellers, IDO empowers users to uncover unique, high-quality datasets tailored to their specific requirements. The platform's user-friendly interface facilitates smooth navigation, making it an indispensable tool for companies and scholars aiming to leverage historical information for strategic decision-making.

As we look toward 2025, the trend of centralized information hubs is gaining significant traction, with a notable percentage of research analysts embracing these platforms to enhance their analytical capabilities. Analysts have noted that utilizing platforms like IDO not only simplifies access to historical intraday futures data but also fosters a more efficient information discovery process. This transition is vital as organizations endeavor to make data-driven decisions in an ever-evolving market landscape.

Examples of platforms that streamline access to historical information underscore the importance of such centralized hubs. By delivering a cohesive experience, IDO allows users to focus on extracting actionable insights from data, ultimately driving improved outcomes across various sectors. How can these datasets be integrated into your analytical processes to enhance decision-making? The potential for leveraging IDO's offerings is vast, paving the way for more informed strategies in today's data-centric world.

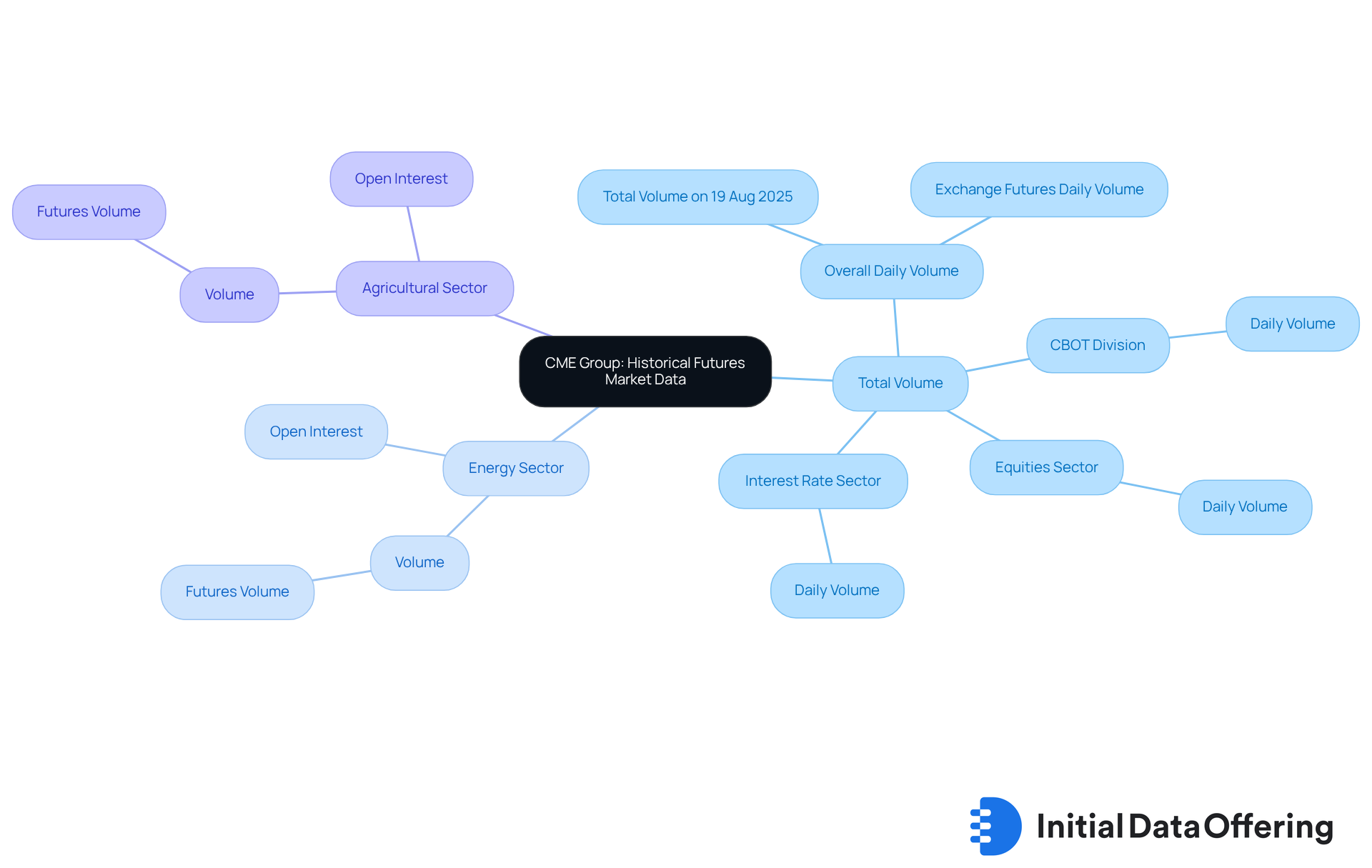

CME Group: Comprehensive Historical Futures Market Data

CME Group provides a comprehensive range of historical intraday futures data, which includes information on prices, volume, and open interest. These datasets are essential for traders and analysts aiming to grasp market dynamics and make informed trading decisions. With a robust information infrastructure, CME Group ensures that users have access to accurate and timely data, which is crucial for effective sector analysis.

For instance, on August 19, 2025, the total daily volume across various divisions reached an impressive 19,677,853. This figure included significant contributions from the CBOT Division at 7,864,010 and the Equities sector at 6,154,679. Furthermore, the interest rate sector recorded a substantial volume of 8,660,769, underscoring the diverse applications of historical data across different sectors. Such information not only reflects economic behavior but also aids investors in identifying patterns and making knowledgeable decisions.

The practical applications of CME Group's historical data are evident in sectors such as energy and agriculture. In the energy sector, for example, futures volume surged to 2,193,878, resulting in a notable increase in open interest. Similarly, the agricultural industry experienced a futures volume of 1,641,078, illustrating how participants leverage historical data to anticipate changes and adjust their strategies accordingly.

The impact of historical intraday futures data on trading decisions is significant. By analyzing historical intraday futures data, as well as past price movements and volume trends, investors can derive insights that inform their trading strategies, ultimately enhancing their chances of success in a competitive market landscape. Additionally, resources like the Daily Bulletin and Open Interest Profile Tool provided by CME Group empower investors to utilize historical data effectively, further refining their trading methodologies.

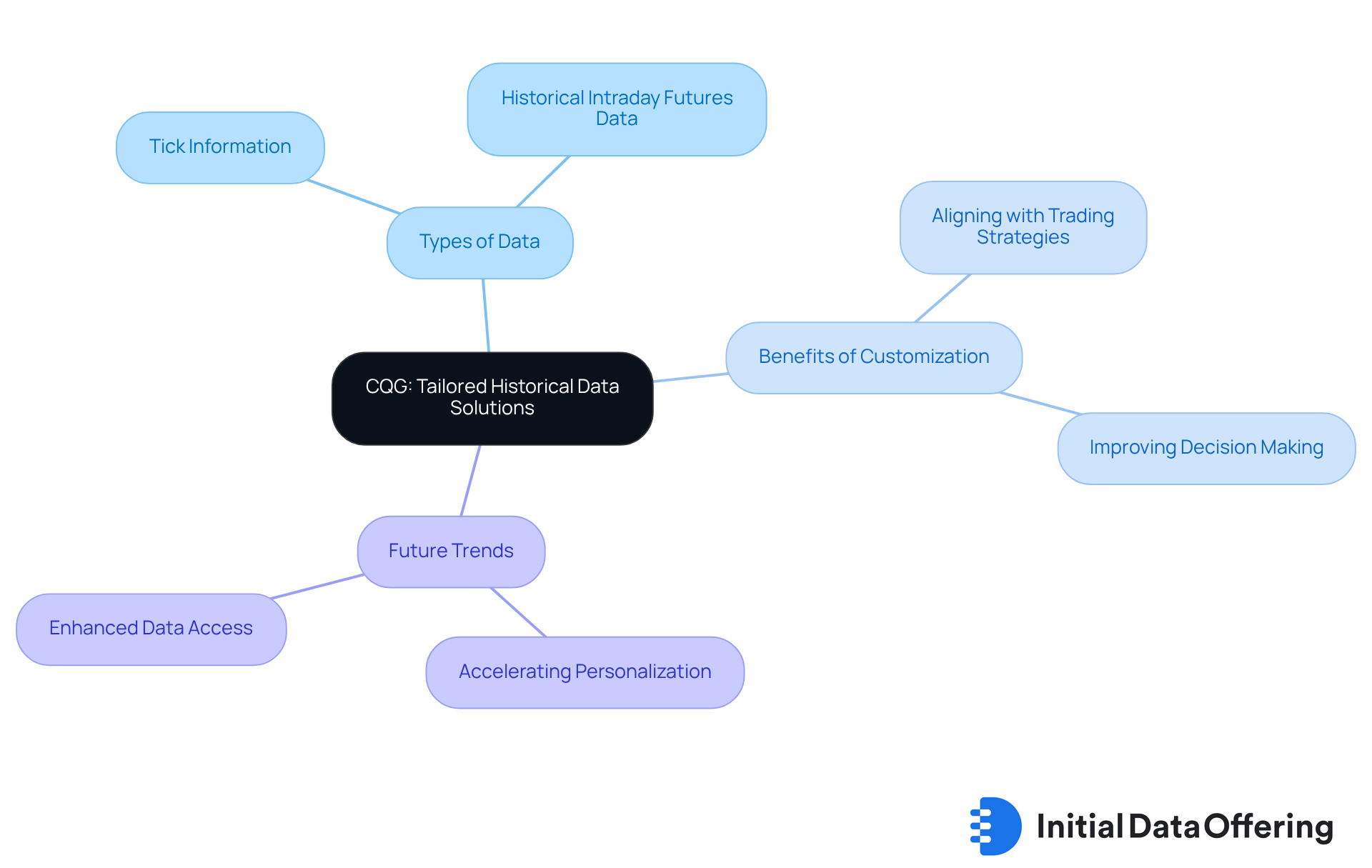

CQG: Tailored Historical Data Solutions for Futures Trading

CQG provides personalized past information solutions tailored for futures trading, featuring a diverse range of data types, including tick information and historical intraday futures data. This flexibility allows traders to customize their information sources to align with specific trading strategies, a critical factor for making informed decisions. For instance, those utilizing CQG's extensive historical intraday futures data can effectively analyze economic trends and refine their approaches. As one trading strategist noted, 'The capability to tailor information feeds is essential; it enables us to adjust our strategies to the constantly evolving business environment.'

In 2025, the trend toward personalization in the provision of historical intraday futures data continues to accelerate, with investors increasingly seeking customized solutions that address their unique trading needs. CQG's platform not only fulfills this demand but also enhances users' abilities to implement complex strategies, ensuring they remain competitive in the dynamic futures landscape. By providing the essential tools for accurate data manipulation, CQG empowers traders to harness the full potential of historical records, ultimately leading to improved trading outcomes. Furthermore, the Initial Data Offering grants premium access to distinctive, high-quality datasets, enabling research analysts to discover new datasets daily and stay ahead with the latest insights.

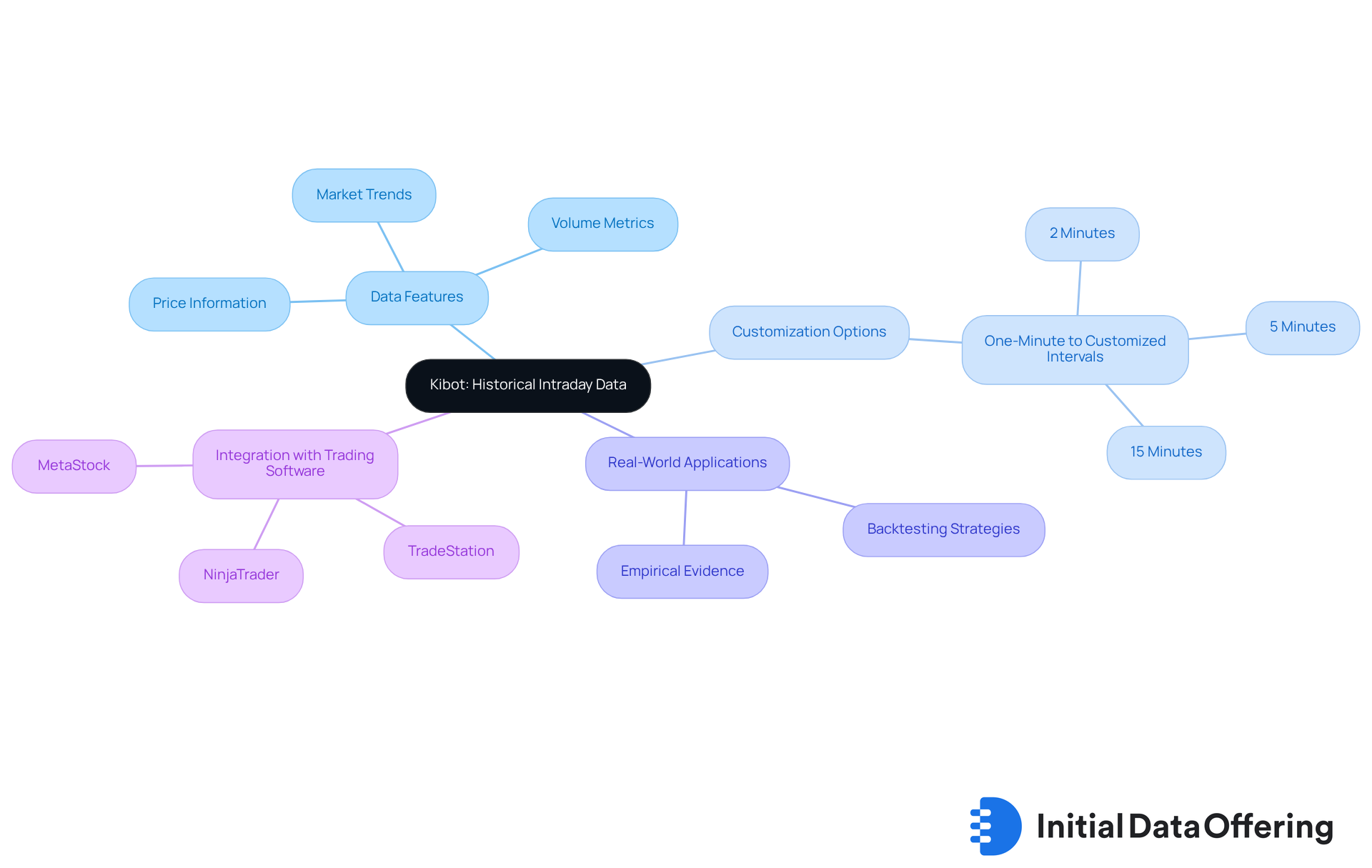

Kibot: Detailed Historical Intraday Data for Market Analysis

Kibot provides a wealth of historical intraday futures data that is crucial for effectively analyzing the financial landscape. Their datasets feature detailed price information, volume metrics, and other key indicators that market participants and analysts rely on to assess market trends. With over 63 years of daily data and 27 years of historical intraday futures data, Kibot ensures users have access to comprehensive insights. This dedication to quality enables thorough analyses, empowering traders to make informed decisions based on accurate historical data.

The importance of historical intraday futures data in industry analysis is paramount. Kibot's datasets allow users to convert one-minute values into customized intervals, such as 2, 5, or 15 minutes, which supports tailored analyses that align with individual trading strategies. Additionally, the automated ordering system ensures that clients can quickly access their information products, enhancing their ability to respond to market changes in real-time.

Real-world applications of Kibot's information are evident across various trading strategies. For instance, investors can utilize historical intraday futures data to backtest their strategies against past economic conditions, ensuring that their methods are grounded in empirical evidence. The compatibility of Kibot's datasets with popular trading software, such as TradeStation and NinjaTrader, further streamlines the analysis process, enabling seamless integration and rapid access to vital trading information. This combination of high-quality data and user-friendly tools positions Kibot as an invaluable resource for individuals looking to enhance their analytical skills.

Tick Data: Research-Quality Historical Market Data Solutions

Initial Data Offering specializes in providing research-quality solutions for historical intraday futures data, including market information. Their datasets are meticulously organized, ensuring precision and dependability. This organization makes them ideal for investors and researchers who require high-quality information for their analyses.

With new collections listed daily, Initial Data Offering serves as a central hub for discovering unique data sets. By subscribing to their platform, users gain premium access to exclusive insights, allowing them to trust the information they utilize for critical trading decisions.

How might these datasets enhance your trading strategies? Consider the implications of having reliable data at your fingertips.

EODData: Comprehensive Historical Data Services for Traders

EODData distinguishes itself as a leading supplier of extensive past information services tailored for investors, particularly in the realm of historical intraday futures data. Their platform features a comprehensive array of datasets, empowering traders to access critical information essential for informed decision-making. This commitment to providing thorough historical information coverage enables users to analyze trends over time, significantly enhancing their trading strategies and overall decision-making processes.

Market analysts highlight the crucial role that extensive historical intraday futures data plays in the development of effective trading strategies. By leveraging EODData's vast datasets, investors can identify patterns and trends that inform their predictions. For instance, individuals utilizing EODData for trend analysis have reported increased accuracy in forecasting price changes, ultimately leading to more successful transactions.

As the demand for extensive historical intraday futures data continues to rise, EODData remains at the forefront, providing market participants with the necessary tools to navigate the complexities of the market. Their unwavering dedication to quality and accessibility ensures that users can harness the potential of information to achieve enhanced trading results. Furthermore, as industry specialists emphasize, selecting the right API for specific use cases is vital for those engaged in trading. EODData's services position it strongly against competitors such as Tiingo and Financial Modeling Prep (FMP), which also provide valuable historical information services. By choosing EODData, investors can benefit from a robust platform that not only meets their information needs but also supports their strategic trading decisions.

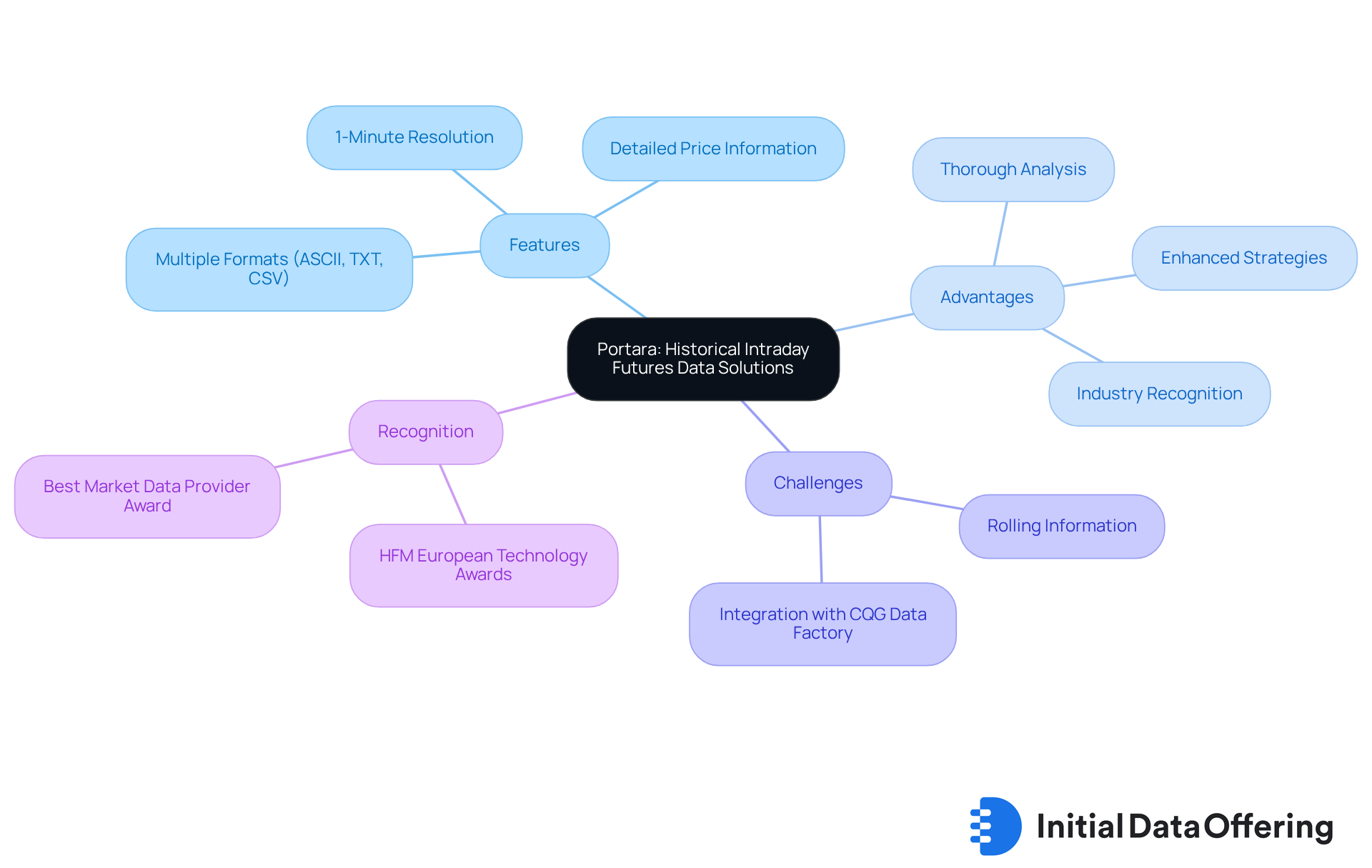

Portara: Specialized Historical Intraday Futures Data Solutions

Portara offers specialized solutions for investors that provide historical intraday futures data. These solutions feature detailed price information and trading volumes, enabling users to conduct extensive analyses of trading behavior. A significant advantage of Portara's datasets is their ability to generate historical intraday futures data down to a 1-minute resolution, ensuring that traders have access to crucial insights necessary for refining their trading strategies. With 123 years of historical intraday futures data starting in 1899, Portara showcases a depth of resources that is essential for thorough analysis.

As noted by industry experts, detailed price information is vital for understanding market dynamics and developing effective trading approaches. One specialist emphasizes that possessing comprehensive historical intraday futures data allows investors to backfill years of price history, which is essential for precise modeling and strategy formulation. Moreover, Portara's recognition as the TOP SUBSTITUTE MARKET INFORMATION PROVIDER at the HFM European Technology Awards 2019 highlights the quality of their solutions. By utilizing Portara's customized information solutions, investors can significantly enhance their strategies, leveraging accurate insights to make informed choices in a competitive market environment.

Furthermore, it is crucial to consider the challenges that market participants face when rolling intraday futures information, along with the integration with CQG Data Factory, which facilitates the development of continuous past intraday information. Portara's capability to retrieve information in multiple formats, including ASCII, TXT, and CSV, further enhances its compatibility with users' systems. Ultimately, focusing on quality rather than quantity in historical intraday futures data is essential, as investing in high-quality information is key to developing effective trading strategies.

DataShop by CBOE: Access to Diverse Historical Futures Data

DataShop by CBOE provides individuals with access to a diverse collection of historical intraday futures data, which includes prices and trading volumes. This platform features a wide array of datasets that empower users to explore specific information crucial for their analyses. By emphasizing the diversity of information solutions, DataShop presents a significant advantage: it enables investors to make well-informed decisions grounded in thorough insights into the industry. The availability of varied datasets not only enhances the ability to recognize trends but also aids in evaluating economic conditions and refining trading strategies. Ultimately, this leads to more efficient risk management and improved investment outcomes.

How might these datasets influence your investment strategies? Consider the insights they can provide for informed decision-making in your trading activities.

Nord Pool Group: Essential Historical Data for Energy Traders

Nord Pool Group serves as a vital resource for energy professionals, providing extensive historical intraday futures data that encompasses prices and trading volumes. This wealth of information, particularly the historical intraday futures data, is essential for analyzing industry trends within the energy sector, enabling investors to make informed decisions based on accurate historical insights. As noted by energy sector analyst Kee H. Chung, "Uncertainty in the industry exerts a large broad effect on liquidity, which leads to co-movements in individual asset liquidity." By emphasizing sector-specific data, Nord Pool Group equips energy professionals with the necessary tools to navigate the complexities of the industry effectively.

The significance of historical intraday futures data is paramount, as it plays a crucial role in shaping trading strategies and optimizing market participation. Additionally, the upcoming transition of open interest on Nasdaq’s Nordic Power Futures exchange to Euronext Clearing represents a key update that participants should integrate into their strategies. Traders leveraging Nord Pool Group's information can discern patterns and trends that inform their trading decisions, ultimately enhancing their competitive advantage in the ever-evolving energy landscape.

For instance, energy professionals have successfully utilized Nord Pool Group's data to track trends and adjust their strategies accordingly. This illustrates the practical application of this invaluable resource, prompting the question: how can you incorporate such insights into your trading approach to stay ahead in the market?

Tiingo: Access to Diverse Historical Market Datasets

Initial Data Offering provides access to a range of historical intraday futures data as well as other trading datasets. This platform enables traders to explore diverse datasets, allowing them to pinpoint the specific information necessary for their analyses. With new datasets listed daily, Initial Data Offering serves as a central hub for high-quality datasets and AI-powered business intelligence solutions. By subscribing, users enjoy premium access to insights that inform trading decisions, grounded in comprehensive market data.

What advantages do these datasets offer? The ability to access a wealth of historical intraday futures data empowers traders to make informed decisions based on past trends and market behaviors. This not only enhances their analytical capabilities but also provides a competitive edge in the trading landscape. The continuous addition of datasets ensures that users have the most up-to-date information at their fingertips, fostering a proactive approach to trading strategies.

In summary, Initial Data Offering equips traders with the tools they need to navigate the complexities of the market effectively. By leveraging these datasets, users can enhance their trading strategies, ultimately leading to more informed and successful trading outcomes.

Conclusion

Accessing historical intraday futures data is crucial for traders and analysts aiming to make informed decisions in a rapidly evolving market. This article highlights several key sources, including:

- Initial Data Offering

- CME Group

- CQG

- Kibot

- Others

Each source offers unique datasets and tools that cater to the diverse needs of market participants. By utilizing these platforms, users can streamline their data access and enhance their analytical capabilities, ultimately leading to more strategic decision-making.

The discussion emphasizes the importance of centralized hubs like IDO and specialized services such as those provided by CME Group and CQG, which facilitate tailored data solutions. Additionally, platforms like Kibot and EODData offer extensive historical datasets that empower traders to backtest strategies and identify market trends. Each source presents distinct advantages, enabling users to refine their trading approaches based on comprehensive and reliable data.

In conclusion, the ability to leverage high-quality historical intraday futures data is paramount for traders seeking to gain a competitive edge. As the demand for accurate and actionable insights continues to grow, exploring these data sources can significantly enhance trading strategies and outcomes. Embracing the right tools and datasets not only aids in navigating the complexities of the market but also fosters a proactive approach to informed decision-making.

Frequently Asked Questions

What is the Initial Data Offering (IDO)?

The Initial Data Offering (IDO) is a centralized hub for accessing historical intraday futures data, designed to streamline access to various datasets and foster a community of information buyers and sellers.

How does the IDO benefit users?

IDO empowers users to uncover unique, high-quality datasets tailored to their specific needs, facilitating smooth navigation and enabling strategic decision-making for companies and scholars.

What trends are emerging regarding centralized information hubs by 2025?

By 2025, there is a growing trend of research analysts embracing centralized information hubs like IDO to enhance their analytical capabilities and simplify access to historical data.

What types of data does CME Group provide?

CME Group provides a comprehensive range of historical intraday futures data, including prices, volume, and open interest, which are essential for traders and analysts to understand market dynamics.

Can you provide an example of CME Group's data usage?

On August 19, 2025, CME Group reported a total daily volume of 19,677,853 across various divisions, with significant contributions from the CBOT Division and the Equities sector, showcasing the diverse applications of historical data.

How does historical intraday futures data impact trading decisions?

Analyzing historical intraday futures data allows investors to derive insights from past price movements and volume trends, enhancing their chances of making informed trading decisions in a competitive market.

What resources does CME Group offer to help investors utilize historical data?

CME Group provides resources such as the Daily Bulletin and Open Interest Profile Tool to help investors effectively use historical data and refine their trading methodologies.

What tailored solutions does CQG offer for futures trading?

CQG offers personalized historical data solutions, including tick information and historical intraday futures data, allowing traders to customize their information sources according to their specific trading strategies.

How is the trend toward personalization in historical data solutions evolving?

In 2025, there is an increasing demand for personalized historical intraday futures data solutions, as investors seek customized options that cater to their unique trading needs.

What advantage does the Initial Data Offering provide to research analysts?

The Initial Data Offering grants premium access to distinctive, high-quality datasets, enabling research analysts to discover new datasets daily and stay ahead with the latest insights.