7 Essential Alternative Data Sets for Market Research Analysts

7 Essential Alternative Data Sets for Market Research Analysts

Overview

The article identifies seven essential alternative data sets for market research analysts, including:

- Social media sentiment

- Satellite imagery

- Transaction information

These datasets significantly enhance predictive capabilities and decision-making processes. The growing market for alternative data is projected to expand rapidly due to increasing demand from various sectors. This trend is evidenced by financial institutions increasingly adopting these datasets to improve risk profiling and credit decisions.

How can these datasets transform your analytical approach? Consider the implications of integrating such data into your strategies for more informed decision-making.

Introduction

The landscape of market research is rapidly evolving, and alternative data sets have emerged as vital tools for analysts seeking deeper insights. These datasets, which include features such as social media sentiment and satellite imagery, provide significant advantages over traditional data sources that may no longer suffice. By integrating diverse datasets, researchers can enhance predictive accuracy and inform strategic decisions, ultimately benefiting their organizations by uncovering actionable insights.

However, as the demand for these innovative data solutions grows, a pressing question arises: how can researchers effectively navigate the complexities of alternative data to drive success? This exploration is essential for leveraging the full potential of these emerging tools.

Initial Data Offering: Access Diverse Alternative Data Sets for Market Insights

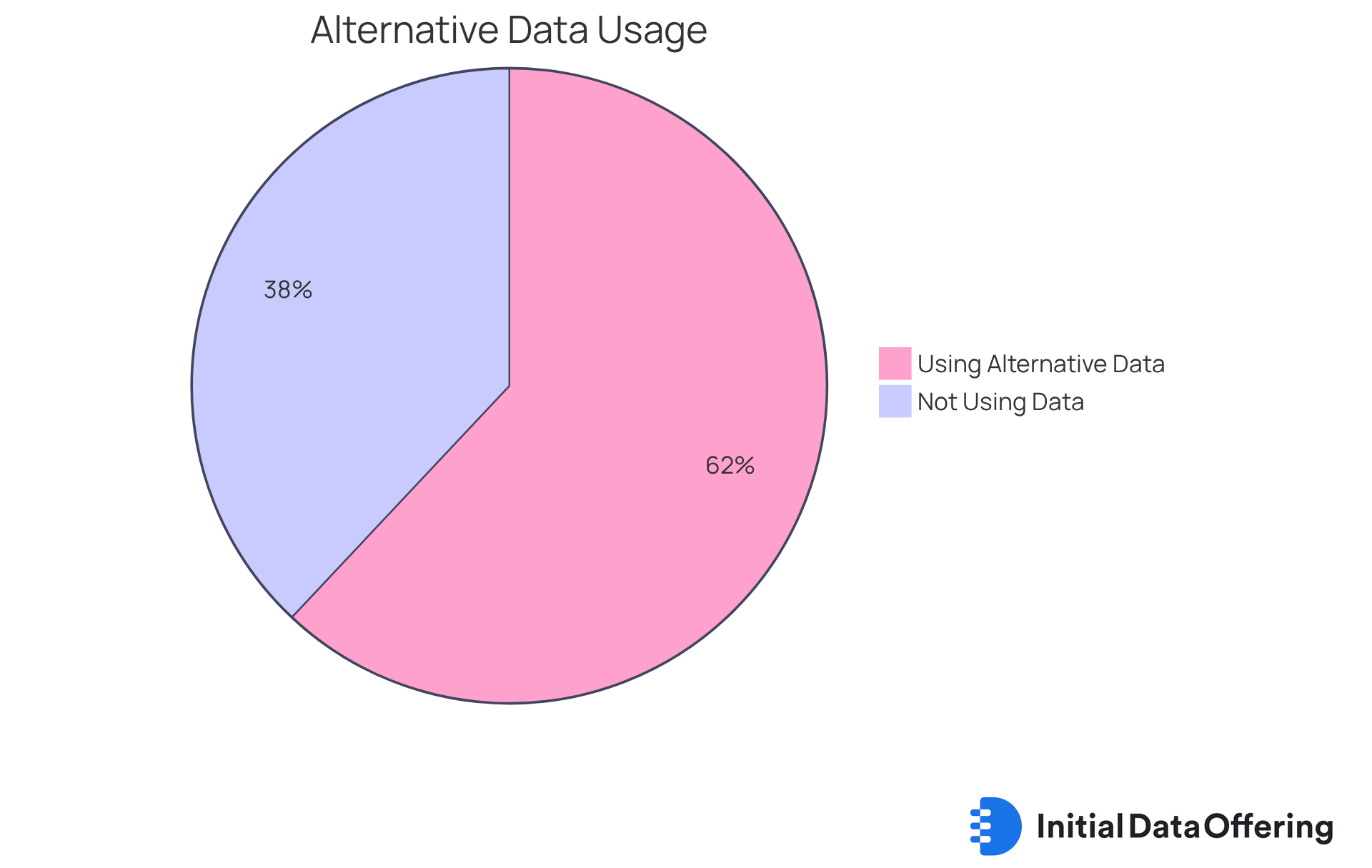

Initial Data Offering (IDO) serves as a crucial platform for market research professionals seeking diverse datasets. With access to a wide range of information across finance, social media, and environmental studies, analysts can uncover unique collections that yield actionable insights. Notably, 62% of financial institutions are now employing alternative data sets to enhance risk profiling and improve credit decision-making processes. This trend highlights the growing importance of alternative data sets in the industry. Furthermore, the substitute information sector is anticipated to expand from USD 11.65 billion in 2024 to roughly USD 135.72 billion by 2030, driven by the rising demand for innovative information sources.

Successful executions of various data exchanges, such as those by Dataminr and YipitData, illustrate the effectiveness of these resources in delivering real-time insights and improving analytical capabilities. Experts emphasize that integrating alternative data sets into research methodologies not only enhances prediction accuracy but also streamlines the analysis process. By leveraging IDO, research professionals can stay ahead of trends and make informed decisions. This ultimately drives better outcomes in their respective areas. Are you ready to explore how these datasets can transform your approach to market research?

SafeGraph: Explore Comprehensive Alternative Data Types for Enhanced Analysis

SavvyIQ excels in providing AI-powered APIs that deliver business identity and intelligence through advanced entity resolution. The features of these APIs allow research professionals to enhance their assessments of location data by utilizing alternative data sets, leading to significant advantages in obtaining essential insights into consumer behavior and industry trends.

For example, SavvyIQ's Recursive Data Engine continuously enriches a dynamic graph of global entities. This capability enables researchers to identify peak shopping times, assess the impact of promotional events, and understand the demographics of customers visiting stores.

As we approach 2025, the implications of the trends derived from SavvyIQ's extensive alternative data sets will continue to influence how businesses adapt to evolving consumer preferences, highlighting the importance of integrating such insights into research.

How might these insights reshape your approach to understanding market dynamics?

Investopedia: Understand the Importance and Examples of Alternative Data

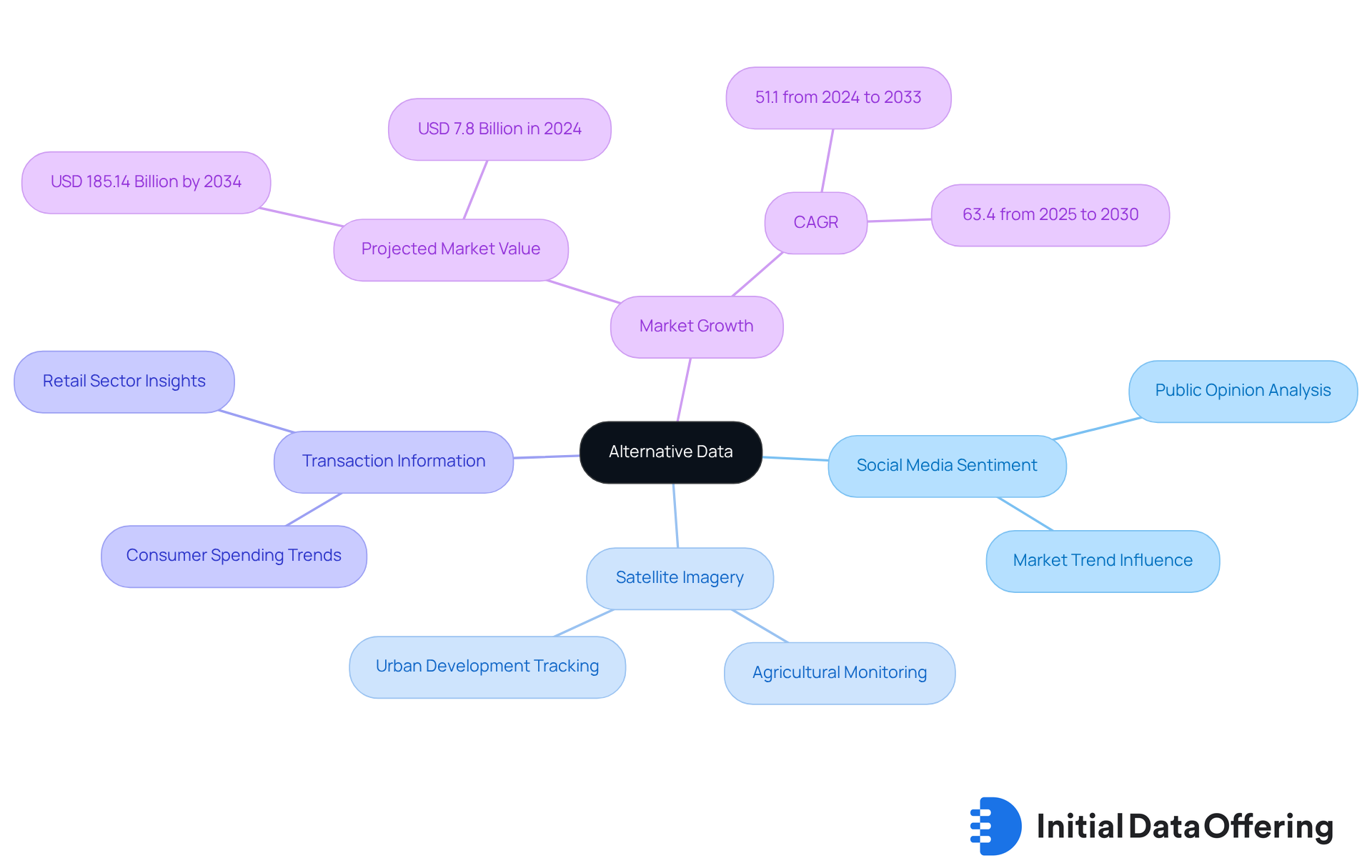

Alternative data sets include non-traditional datasets that provide unique insights into trends, significantly enhancing the predictive capabilities of research analysts. These datasets include:

-

Social Media Sentiment: Analysts employ sentiment analysis from platforms such as Twitter and Facebook to assess public opinion and its potential influence on market trends. This approach can reveal shifts in consumer sentiment that traditional metrics might miss, ultimately affecting investment strategies.

-

Satellite Imagery: The applications of satellite information range from monitoring agricultural yields to tracking shipping activity and evaluating urban development. For instance, experts can analyze changes in crop health or construction progress, yielding actionable insights into supply chain dynamics.

-

Transaction Information: Credit and debit card transactions serve as a vital supplementary source, allowing analysts to observe consumer spending trends in real-time. This data is crucial for understanding trends in commerce, particularly in the retail sector, where it led the non-traditional information domain in 2023.

The growing reliance on alternative data sets is underscored by the projected market expansion, expected to reach USD 185.14 billion by 2034, driven by increasing demand from hedge funds and the rise of fintech firms. This growth indicates a CAGR of 51.1% during the forecast period from 2024 to 2033. By leveraging these diverse information types, analysts can uncover patterns and trends that conventional sources may overlook, ultimately facilitating more informed decision-making. However, it is essential to remain cautious about potential biases in AI algorithms that could affect the interpretation of various information, as highlighted by experts in the field.

Neudata: Discover How Alternative Data is Transforming Market Research

The Initial Information Offering serves as a crucial platform connecting purchasers with providers of alternative data sets, granting access to a vast range of datasets. This connection transforms industry research by enabling analysts to combine diverse information sources into their assessments, leading to more thorough insights. With new collections listed daily, Initial Information Offering becomes the hub for enthusiasts to discover high-quality datasets that can enhance their research capabilities.

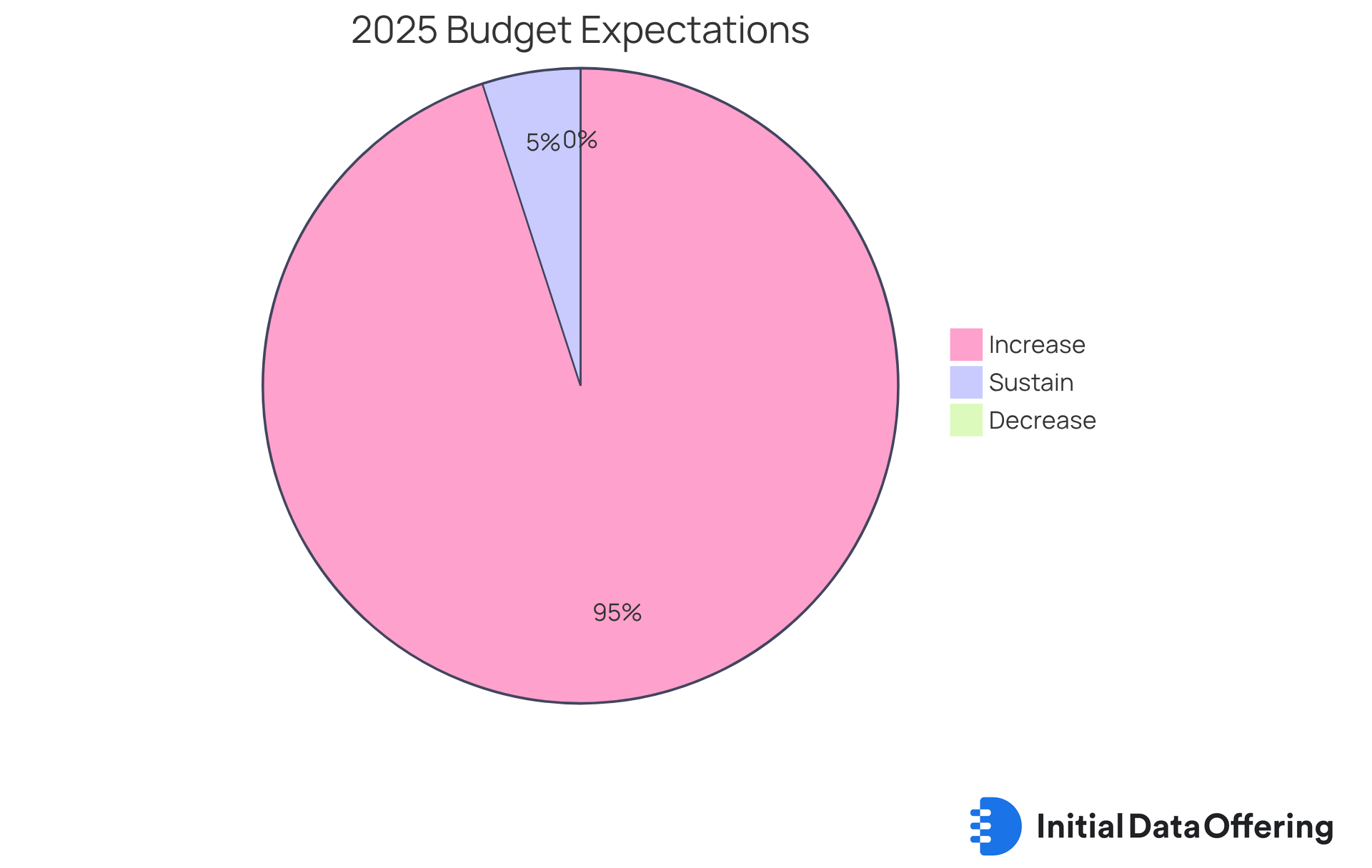

In 2024, the substitute information sector for investment management reached a minimum of $2.5 billion in yearly expenditure, indicating an increasing acknowledgment of the worth of these datasets. Furthermore, 95% of alternative information purchasers expect to sustain or boost their budget allocations in 2025, highlighting the growing significance of alternative information in research. With more than 4,046 information providers and over 70% of vendors indicating a rise in subscriptions, researchers utilizing Initial Information Offering can effectively stay ahead of market trends.

This strategic access enhances decision-making processes and empowers analysts to uncover unique opportunities, driving innovation in their respective fields. As Rado Lipuš, CEO of Neudata, pointed out, "It’s no surprise to observe the strong demand for non-traditional information expanding across sectors." As we approach 2025, the influence of substitute information on market analysis is anticipated to intensify, further changing how insights are created and applied.

Are you ready to gain exclusive access to these valuable datasets? Subscribe today to unlock the potential of alternative information in your research.

LSEG: Leverage Advanced Analytics and Alternative Data for Investment Decisions

LSEG provides a comprehensive suite of sophisticated analytics tools designed to integrate alternative data sets, which significantly enhances investment decision-making processes. These tools enable analysts to uncover hidden patterns and insights that traditional information sources often overlook. This integration not only supports more accurate forecasting but also strengthens risk assessment, ultimately resulting in improved investment outcomes.

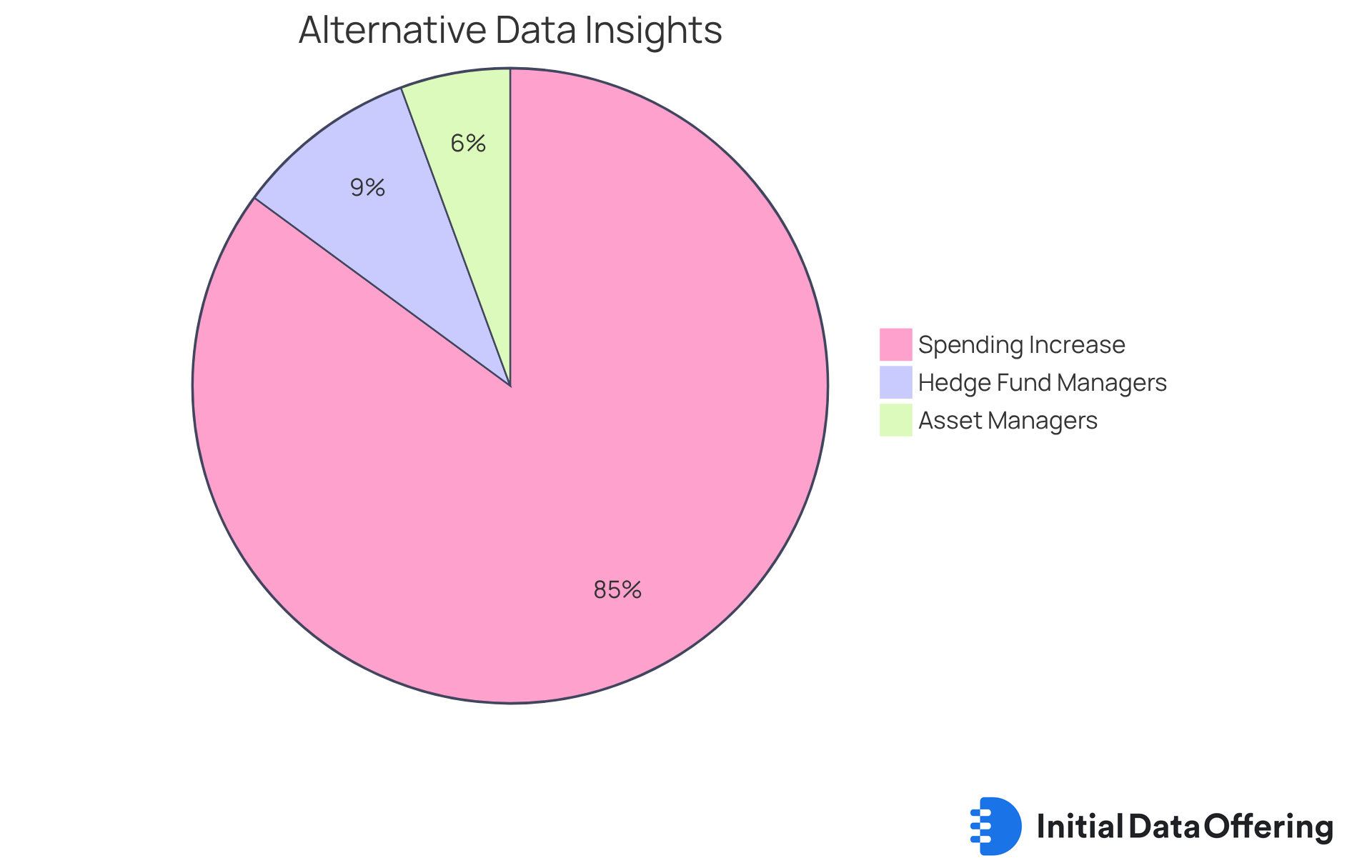

Notably, 70% of hedge fund managers currently incorporate non-traditional information into their strategies, with many attributing a substantial portion of their alpha to these insights. Additionally, 42% of all asset managers believe that the alpha advantage derived from non-traditional information persists for at least four years, underscoring its long-term value. The total buy-side spending on unconventional information surged from USD 232 million in 2016 to approximately USD 1.7 billion in 2020, reflecting a remarkable 639% increase in reliance on alternative data sets.

As the alternative data sets sector continues to expand, driven by technological advancements, the ability to identify these concealed trends becomes increasingly vital for informed investment decisions. To effectively integrate diverse information into forecasting processes, evaluators should consider leveraging alternative data sets. Currently, 54% of hedge fund managers utilize seven or more distinct information sets, thereby enhancing their analytical depth.

Moreover, participation in Initial Data Offering allows research professionals to discover new datasets daily, including detailed insights into long and short equity positioning that are essential for hedge fund evaluation and understanding trends in the financial sector.

FactSet: Utilize Alternative Data Solutions for Enhanced Market Analysis

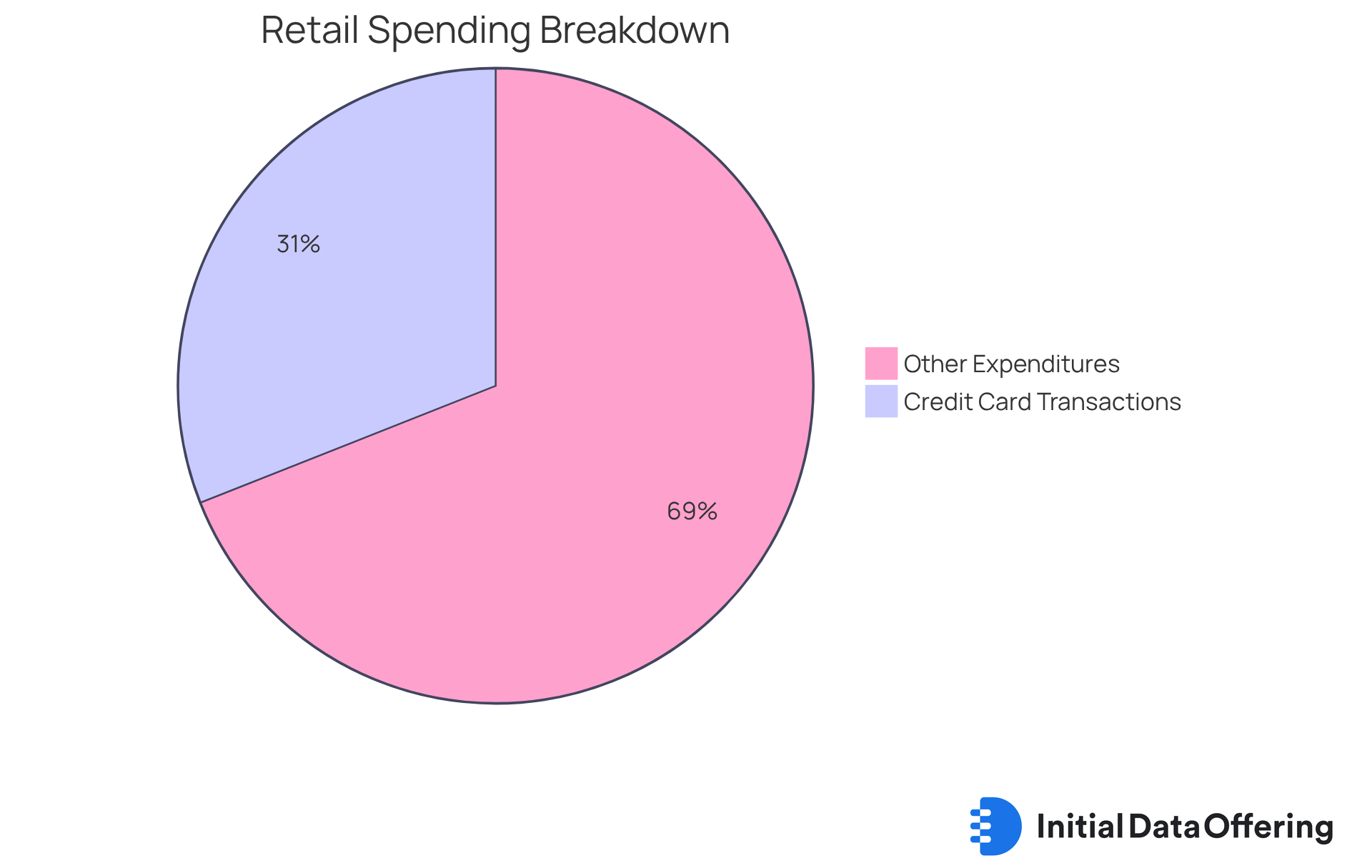

FactSet offers a robust collection of alternative data sets, such as credit card transactions and web traffic metrics, which are essential for research professionals seeking to interpret consumer behavior and industry dynamics. The feature of credit card transaction data allows researchers to uncover spending patterns that reveal consumer preferences and trends. Notably, credit card transactions account for approximately 31% of total retail expenditure in the United States, underscoring their importance in understanding economic shifts.

The advantage of web traffic data lies in its ability to provide insights into online consumer engagement. This enables evaluators to assess interest levels and predict purchasing behaviors. By merging these alternative data sets, analysts can conduct a more comprehensive analysis, leading to informed, data-driven decisions that align with evolving industry circumstances.

The benefit for analysts utilizing FactSet's solutions is a significant enhancement in market analysis. For instance, insights derived from credit card transaction data can inform promotional strategies and product recommendations, ultimately driving engagement and conversion rates. As Daniel Vidal, a noted expert, states, "Every swipe, tap, or click of a credit card tells a story about our economy, consumer behavior, and technological evolution."

Moreover, the typical credit card debt of an American rose to $6,580 in Q4 2024, reflecting consumer financial behavior that evaluators must consider in their strategies. Additionally, credit card payment volume increased by 8.2% year-over-year in 2022, indicating a growing reliance on credit cards that highlights their significance in research. By integrating credit card transaction information with web traffic insights, research professionals can cultivate a comprehensive understanding of consumer behavior, ultimately resulting in more effective marketing strategies and improved business outcomes.

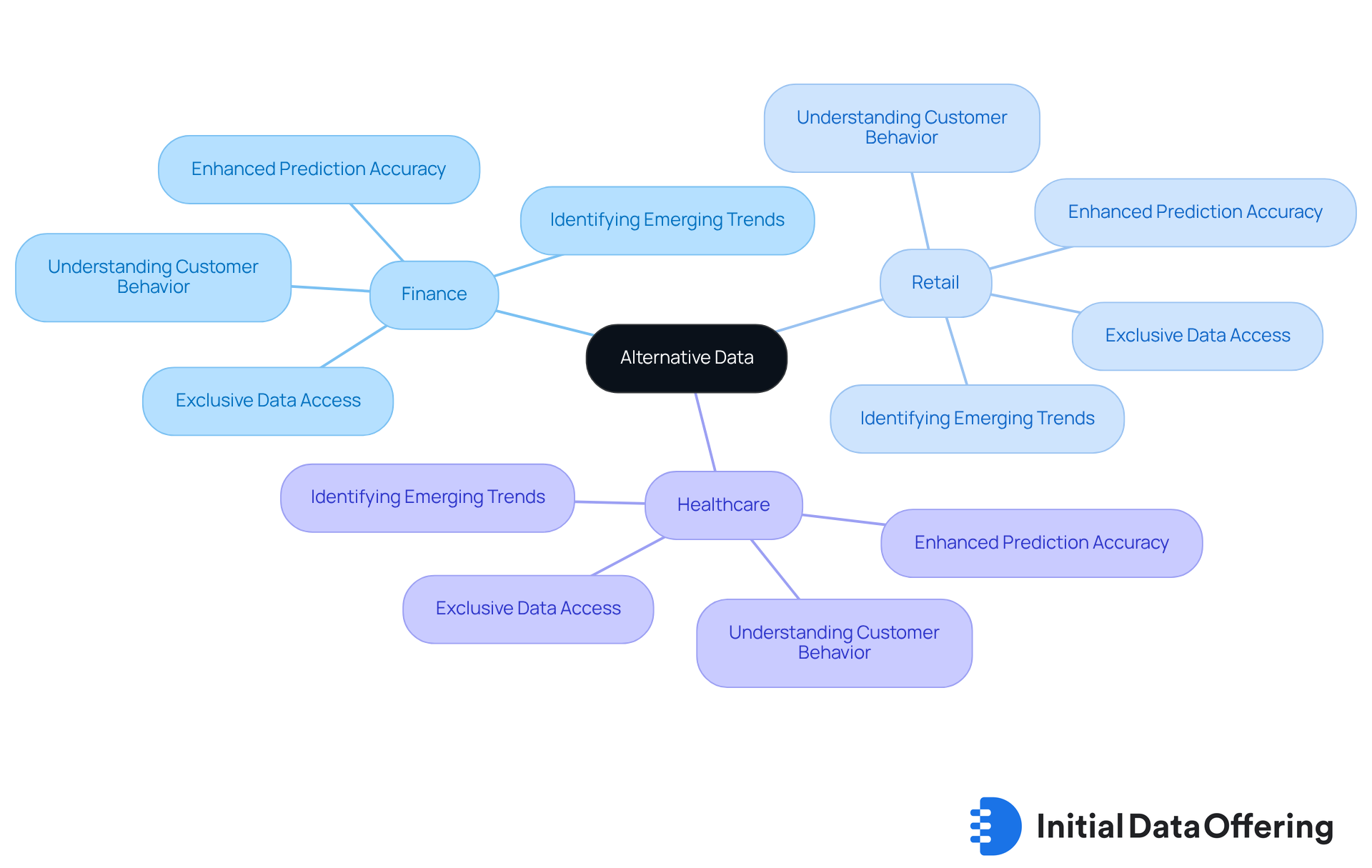

PredikData: Understand the Role and Benefits of Alternative Data Across Industries

PredikData specializes in delivering unique information solutions tailored for various sectors, including finance, retail, and healthcare. Understanding the role of diverse information and alternative data sets within these sectors enables market research professionals to leverage insights that drive strategic initiatives. The features of these information solutions include:

- Enhanced prediction accuracy

- A deeper understanding of customer behavior

The advantages of utilizing alternative data sets are significant, as they empower researchers to identify emerging trends effectively. Moreover, by subscribing to the Initial Data Offering, researchers gain access to exclusive, high-quality alternative data sets that can substantially enhance their research capabilities. This premium access not only enriches their insights but also opens up new avenues for analysis and exploration.

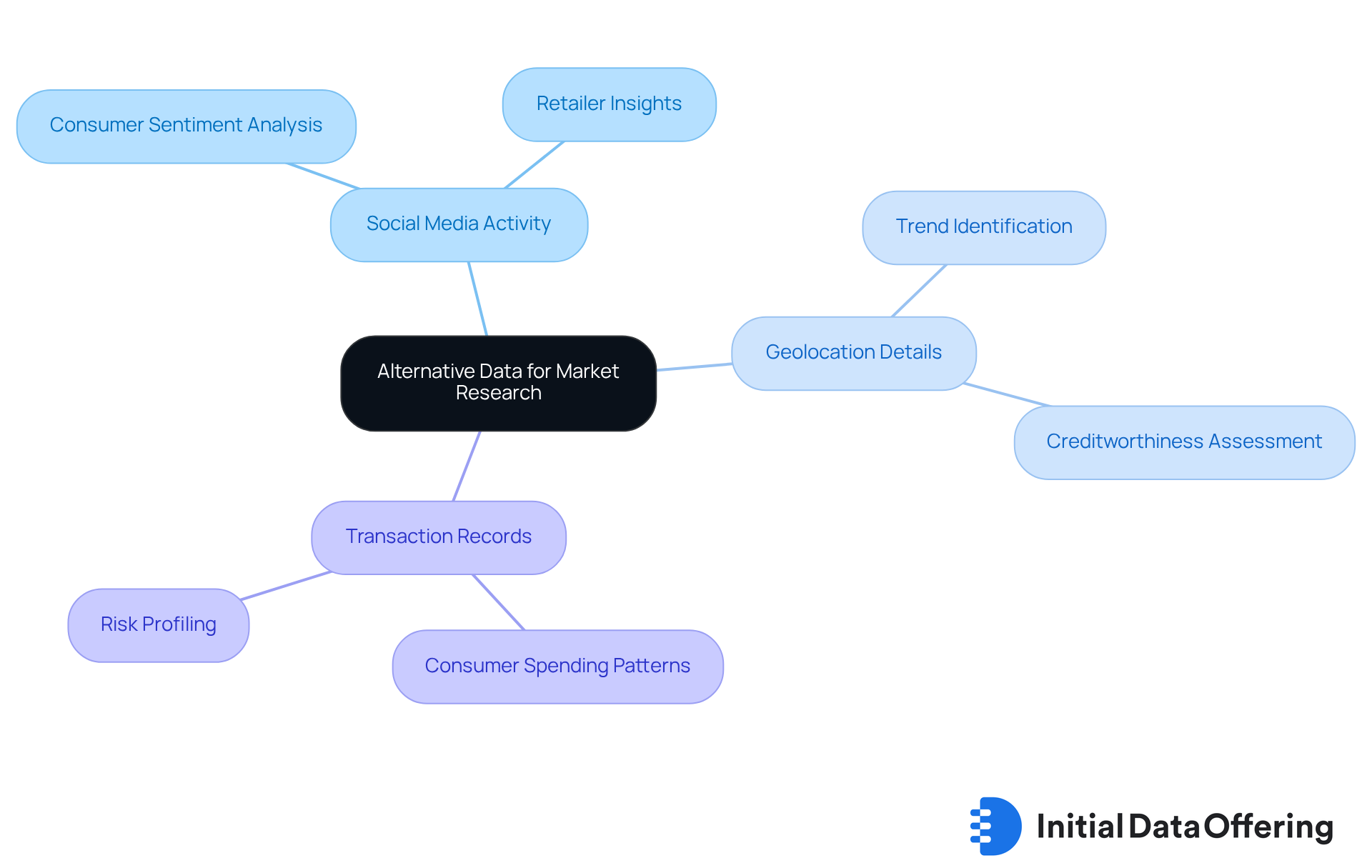

Builtin.com: Identify Key Types of Alternative Data for Market Research

Key types of alternative data sets consist of:

- Social media activity

- Geolocation details

- Transaction records

Understanding these classifications enables research specialists to select the most relevant datasets for their evaluations. By incorporating alternative data sets along with various types of information, analysts can enhance their research methodologies and uncover valuable insights that inform strategic decisions. The alternative information market, which includes alternative data sets, is projected to expand at a compound annual growth rate of 63.4% from 2025 to 2030, surpassing $135 billion. This underscores the increasing significance of these information types.

Social media insights are pivotal in understanding consumer sentiment, with retailers leveraging this information to analyze customer behavior and preferences. Notably, 78% of hedge funds utilize or plan to utilize non-traditional information, indicating its widespread acceptance in the sector. Geolocation information, in particular, supports strategic decision-making by utilizing alternative data sets to identify emerging trends and consumer preferences. For instance, financial organizations utilize geolocation data to assess potential borrowers' creditworthiness more accurately, with 62% of these organizations improving their risk profiling methods through diverse sources. By integrating these insights, research professionals can make informed decisions that drive business success.

SafeGraph: Learn How Alternative Data is Generated for Reliable Insights

SafeGraph employs a variety of techniques to generate alternative data sets, prominently including foot traffic tracking and the analysis of consumer behavior patterns. Understanding these generation processes is vital for research analysts, as it allows them to assess the reliability of the information they utilize. For instance, foot traffic data, which reveals consumer trends and behaviors, is increasingly recognized for its accuracy in research. Studies show that businesses leveraging foot traffic insights can significantly enhance their operational strategies and decision-making processes. Trustworthy alternative data sets are not just beneficial; they are essential for making informed choices and improving the accuracy of market evaluations. As the landscape of information generation evolves, analysts must remain diligent in evaluating the sources and methodologies behind the information to ensure their strategies are rooted in reliable insights.

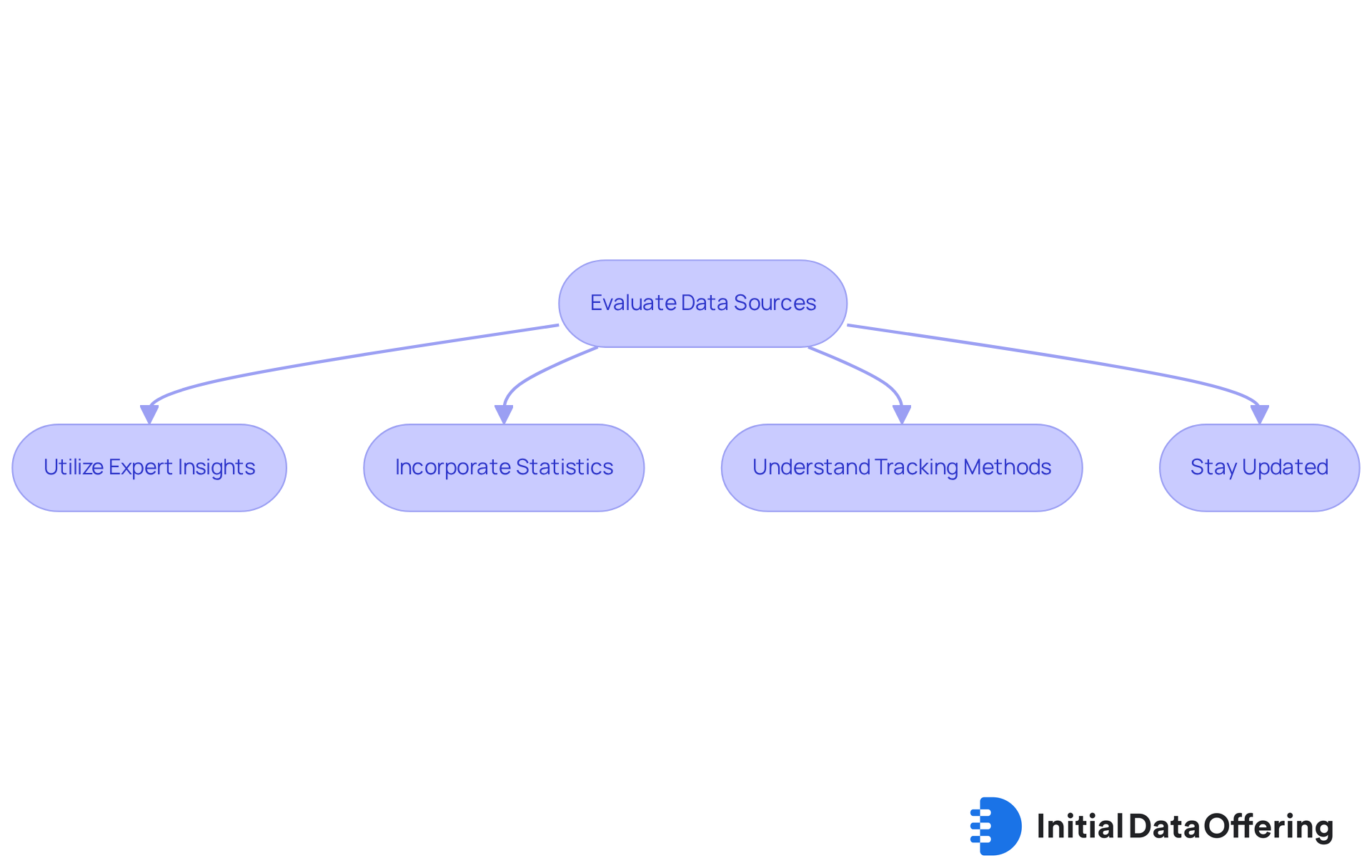

Key Considerations for Market Research Analysts:

- Evaluate Data Sources: Always assess the credibility of the data sources you are using.

- Utilize Expert Insights: Incorporate expert quotes, such as "Foot traffic information can reveal early signs of product interest before sales figures are available," to support your analysis.

- Incorporate Statistics: Use statistics on the reliability of foot traffic information to strengthen your arguments. For example, businesses that leverage foot traffic insights can improve their operational strategies by up to 30%.

- Understand Tracking Methods: Familiarize yourself with various methods of tracking consumer behavior, including mobility information collection through mobile devices, WiFi, and sensors.

- Stay Updated: Keep informed about evolving information generation techniques to ensure your analyses remain relevant and precise.

Investopedia: Analyze the Growth and Trends in the Alternative Data Market

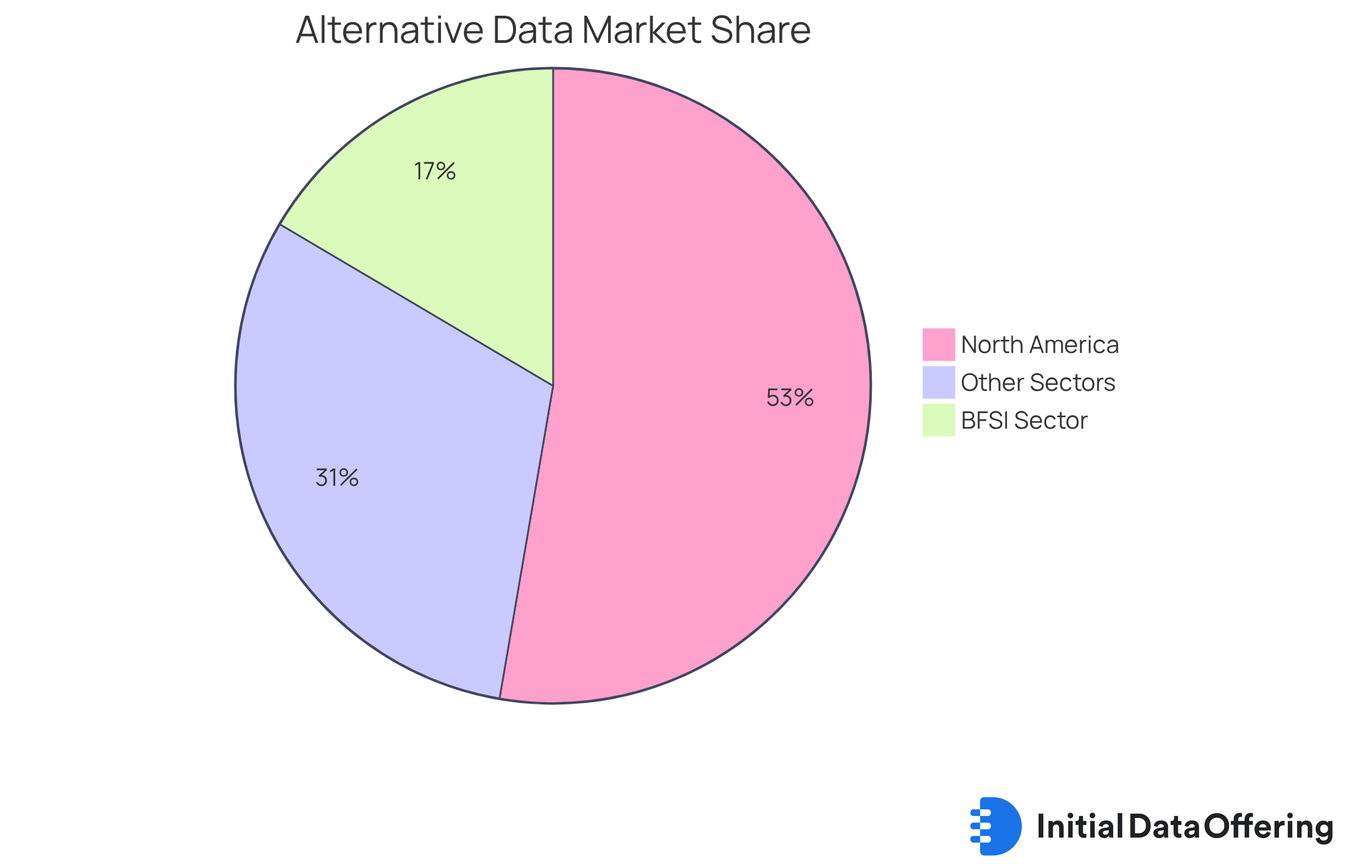

The alternative data sets sector is witnessing remarkable growth, fueled by an escalating demand for unique insights and data-informed decision-making. Valued at USD 6.7 billion in 2023, the sector is projected to leap to USD 426.8 billion by 2033, reflecting a compound annual growth rate (CAGR) of 51.50%. Additionally, the industry is expected to grow from USD 11.65 billion in 2024 to USD 18.74 billion in 2025, underscoring a robust immediate growth trajectory. Notably, North America captured 52.7% of the market share in 2023, generating USD 3.5 billion in revenue. Analysts must remain vigilant about these trends to effectively adapt their strategies.

Companies across various industries are increasingly leveraging supplementary information to refine their market strategies. For instance:

- Financial organizations utilize diverse data for risk assessment and fraud detection.

- Retailers harness it to personalize marketing strategies and improve inventory management.

The BFSI sector alone accounted for a revenue share of 16.5% in 2024, highlighting the critical role of alternative data sets in enhancing operational efficiency.

As industry research experts navigate this evolving landscape, understanding the implications of alternative data sets is vital. The rise of unique insights is reshaping market strategies, prompting analysts to integrate alternative data sets into their methodologies. This transition not only deepens analyses but also positions professionals to seize emerging opportunities in a competitive marketplace. As YipitData notes, alternative data sets are crucial for delivering insights and analytics from many non-traditional data sources, underscoring their growing significance in the industry.

Conclusion

The exploration of alternative data sets unveils their transformative potential in market research, underscoring the necessity for analysts to adapt their methodologies to integrate these innovative resources. By leveraging diverse datasets, professionals can achieve deeper insights, enhance predictive accuracy, and ultimately drive more informed decision-making processes.

Throughout the article, several key points highlight the significance of alternative data. There is a growing reliance on non-traditional datasets across various sectors, including finance, retail, and healthcare. Noteworthy trends indicate that alternative data is not only reshaping investment strategies but also revolutionizing how businesses comprehend consumer behavior and market dynamics. The anticipated market growth further emphasizes the urgency for analysts to embrace these tools to maintain competitiveness and relevance in a rapidly evolving landscape.

As the demand for unique insights continues to rise, it becomes essential for market research professionals to actively engage with alternative data sets. How can they uncover emerging trends and enhance their analytical capabilities? By strategically positioning themselves to seize new opportunities, they can thrive in the future of market research. Embracing this shift is not merely an option; it is a necessity for those aiming to succeed.

Frequently Asked Questions

What is the Initial Data Offering (IDO) and its significance?

The Initial Data Offering (IDO) is a platform that provides market research professionals access to diverse datasets across finance, social media, and environmental studies, enabling them to uncover unique collections that yield actionable insights.

How are financial institutions utilizing alternative data sets?

Approximately 62% of financial institutions are employing alternative data sets to enhance risk profiling and improve credit decision-making processes, highlighting their growing importance in the industry.

What is the projected growth of the alternative data sector?

The alternative data sector is expected to expand from USD 11.65 billion in 2024 to roughly USD 135.72 billion by 2030 due to rising demand for innovative information sources.

Can you provide examples of successful data exchanges?

Successful data exchanges, such as those by Dataminr and YipitData, demonstrate the effectiveness of alternative data resources in delivering real-time insights and improving analytical capabilities.

How can integrating alternative data sets enhance research methodologies?

Integrating alternative data sets into research methodologies enhances prediction accuracy and streamlines the analysis process, helping research professionals stay ahead of trends and make informed decisions.

What capabilities does SavvyIQ provide for market analysis?

SavvyIQ offers AI-powered APIs that enhance assessments of location data through advanced entity resolution, allowing researchers to gain insights into consumer behavior and industry trends.

What insights can be derived from SavvyIQ's Recursive Data Engine?

SavvyIQ's Recursive Data Engine helps researchers identify peak shopping times, assess the impact of promotional events, and understand the demographics of customers visiting stores.

What are some examples of alternative data sets?

Examples of alternative data sets include: - Social Media Sentiment: Analyzing public opinion from platforms like Twitter and Facebook to assess its influence on market trends. - Satellite Imagery: Monitoring agricultural yields, shipping activity, and urban development. - Transaction Information: Observing real-time consumer spending trends through credit and debit card transactions.

What is the expected market growth for alternative data sets by 2034?

The market for alternative data sets is projected to reach USD 185.14 billion by 2034, with a compound annual growth rate (CAGR) of 51.1% from 2024 to 2033, driven by increasing demand from hedge funds and fintech firms.

What caution should analysts take when using alternative data?

Analysts should be cautious about potential biases in AI algorithms that could affect the interpretation of various information, as highlighted by experts in the field.