15 Hedge Funds to Watch: A Comprehensive Hedge Fund List

15 Hedge Funds to Watch: A Comprehensive Hedge Fund List

Overview

The article titled "15 Hedge Funds to Watch: A Comprehensive Hedge Fund List" serves to identify and analyze key hedge funds that stand out in the investment landscape. Each fund highlighted, including Citadel, Bridgewater Associates, and Renaissance Technologies, is scrutinized for its unique strategies, performance metrics, and innovative approaches. This examination provides valuable insights into why these funds are significant players in the hedge fund sector.

What makes these hedge funds noteworthy? By exploring their distinctive features, we can understand the advantages they offer to investors. For instance, Citadel is renowned for its quantitative strategies, which have consistently delivered strong returns. Similarly, Bridgewater Associates employs a macroeconomic perspective, allowing it to navigate various market conditions effectively. These advantages translate into benefits for investors, highlighting why these funds merit attention.

In conclusion, the insights gained from analyzing these hedge funds can inform investment decisions. By understanding their strategies and performance, investors can better position themselves in the competitive hedge fund arena. This comprehensive overview not only sheds light on individual funds but also encourages readers to reflect on how such information can apply to their investment strategies.

Introduction

The hedge fund landscape is evolving rapidly, characterized by innovative strategies and data-driven approaches that are reshaping the investment arena. As investors strive to navigate this complex environment, it becomes essential to understand which hedge funds are poised for success.

This article presents a curated list of 15 hedge funds to watch in 2025, highlighting their unique strategies, performance metrics, and the key trends that define their operations.

How can these insights inform investment decisions and enhance portfolio performance in a competitive market? By exploring these hedge funds, investors can uncover valuable lessons that are beneficial for both seasoned professionals and those new to the field.

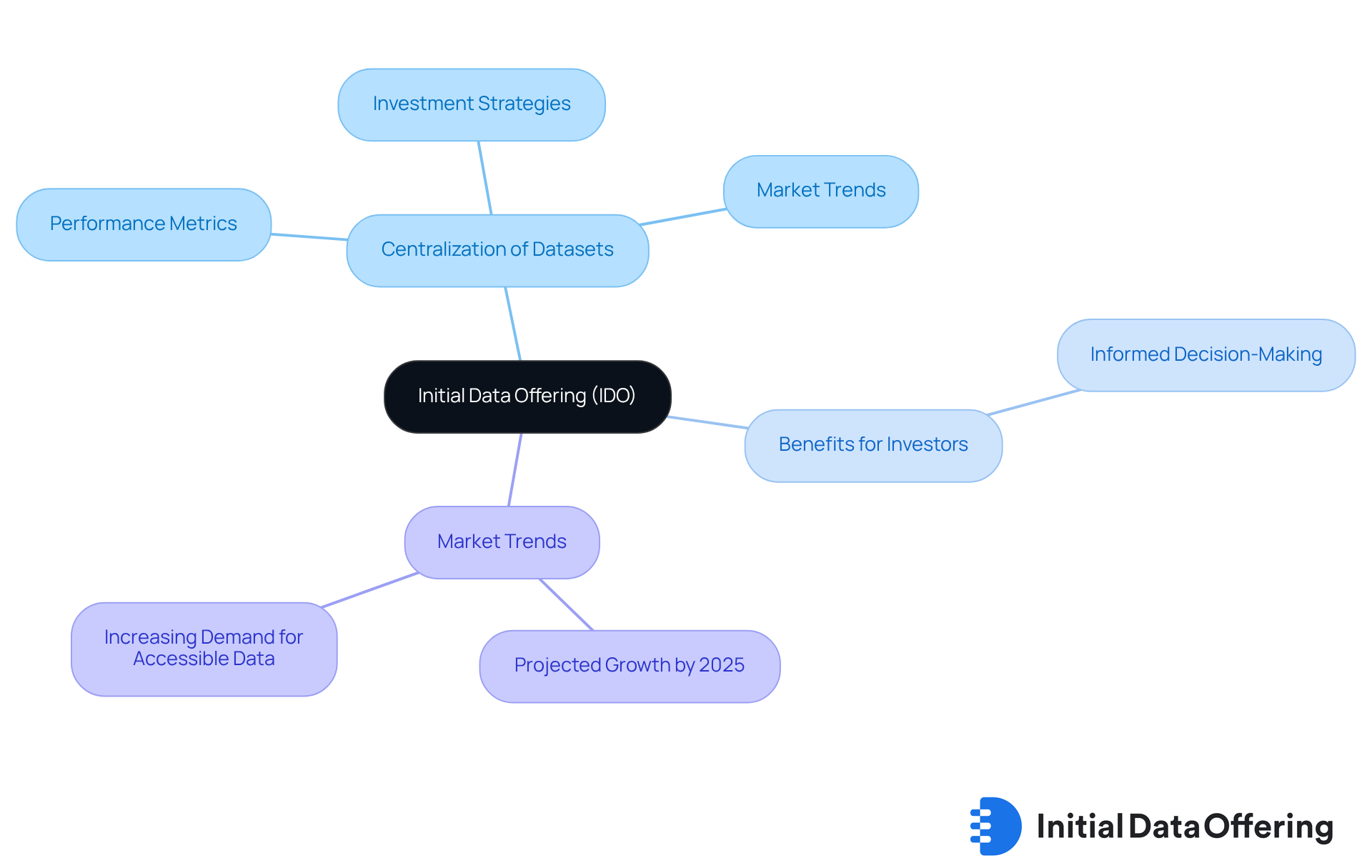

Initial Data Offering: Discover Unique Hedge Fund Datasets

The Initial Data Offering (IDO) serves as a vital platform for accessing unique [investment datasets](https://initialdataoffering.com/datasets). It streamlines the process of discovering high-quality information essential for informed investment approaches. By centralizing various datasets, the IDO enables users to explore performance metrics, investment strategies, and market trends, which are crucial for navigating the intricate investment landscape.

The significance of investment vehicle data cannot be overstated; it plays a pivotal role in shaping investment choices and strategies. With the investment vehicle data market projected to experience substantial growth by 2025, platforms like IDO are poised to meet the increasing demand for .

Industry leaders acknowledge the transformative impact of centralized platforms on data accessibility. They underscore that such resources not only enhance the visibility of valuable datasets but also cultivate a more informed investment community. By providing straightforward access to extensive investment data, the IDO assists investors in making strategic decisions that can lead to improved financial outcomes.

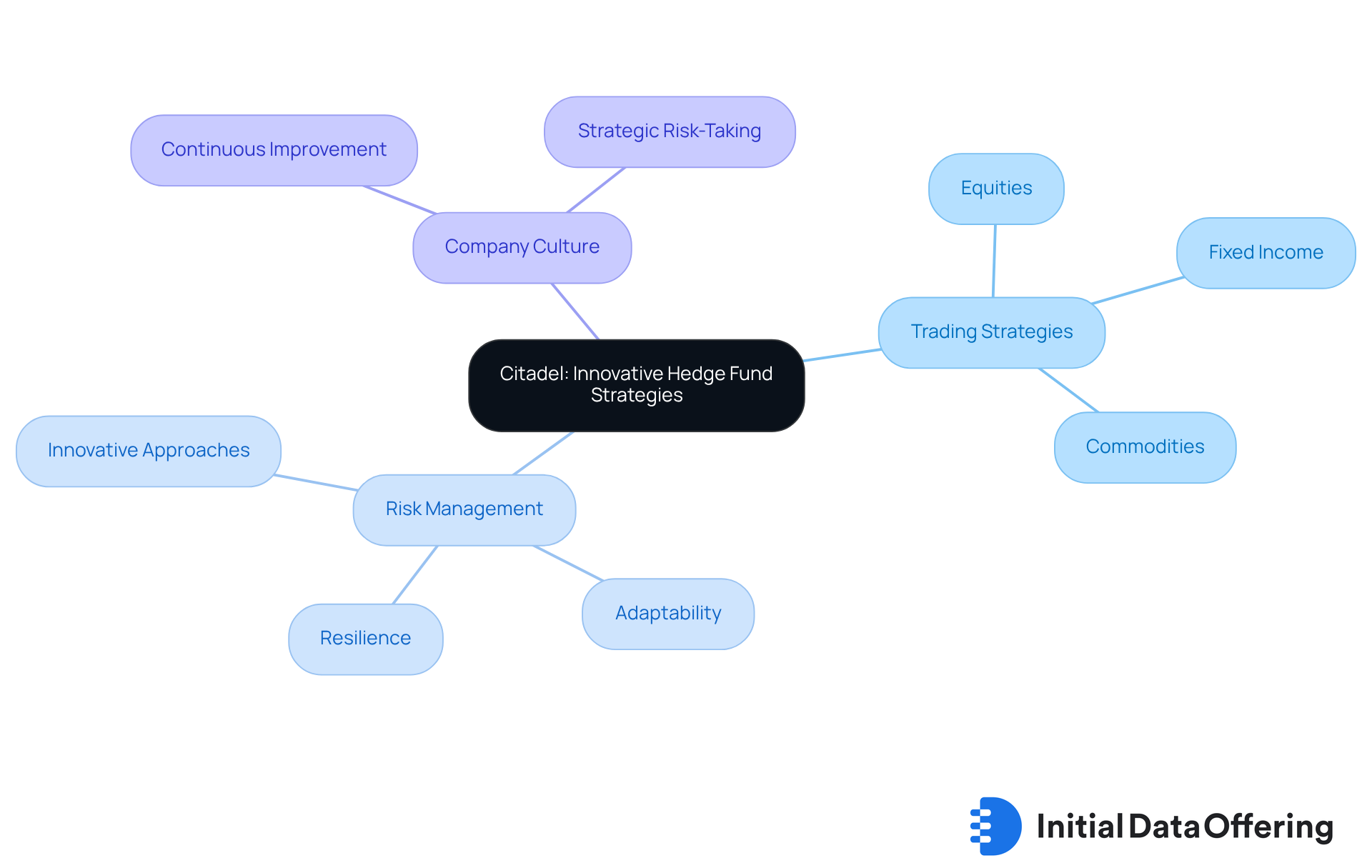

Citadel: Leading Hedge Fund with Innovative Strategies

Citadel is renowned for its innovative trading strategies and robust risk management practices. Established by Ken Griffin, this investment firm utilizes a multi-strategy method that encompasses equities, fixed income, and commodities. Citadel's ability to adapt to changing market conditions and leverage technology for trading efficiency sets it apart as a leader in the hedge fund space. Recent performance metrics indicate that Citadel is one of the largest market makers globally, reflecting its significant influence in the financial markets.

The company's risk management practices are particularly noteworthy; they emphasize resilience and adaptability, which are crucial for sustaining long-term success in a volatile environment. Case studies reveal that Citadel's approach to risk involves not only traditional methods but also innovative strategies that anticipate market shifts. This ensures that the company can capitalize on emerging opportunities. For instance, Ken Griffin emphasizes the importance of selling, stating, "You're always selling. And if you don't like to sell, here's my advice: Get over it." This insight underscores the culture of excellence at Citadel.

By fostering a mindset that prioritizes substantial victories over mere wins, Citadel cultivates an environment where continuous improvement and strategic risk-taking are paramount. This philosophy not only propels the company's success but also acts as a seeking to improve their performance and resilience in the competitive financial environment. How can other firms adopt similar practices to enhance their own strategies? Citadel's model serves as a compelling example of effective risk management and strategic adaptability.

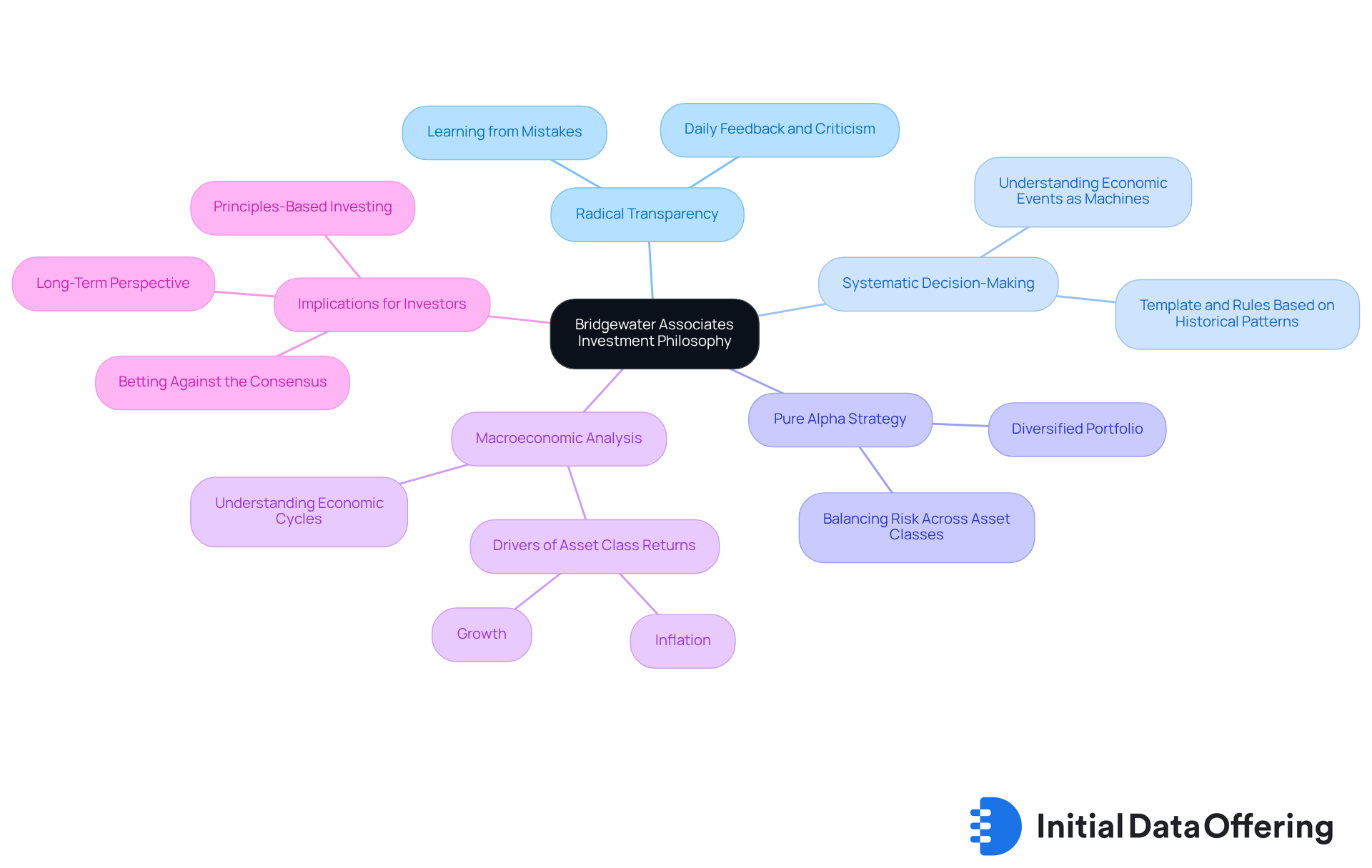

Bridgewater Associates: Pioneering Hedge Fund Philosophy

Bridgewater Associates, founded by Ray Dalio, exemplifies a pioneering investment philosophy that emphasizes radical transparency and systematic decision-making. This approach is a key feature of the firm, allowing it to navigate complex financial landscapes effectively. The firm's flagship investment, Pure Alpha, is designed to generate returns through a diversified portfolio that balances risk across various asset classes. This strategy not only mitigates potential losses but also enhances the potential for sustainable growth.

Understanding is another advantage of Bridgewater's methodology. By analyzing global economic indicators, the firm positions itself as a vital player in the hedge fund list. This insight enables Bridgewater to make informed investment decisions that align with market dynamics, ultimately benefiting its clients through more strategic asset management.

How can other investors apply similar principles to improve their investment strategies? The implications of Bridgewater's practices extend beyond its operations, offering valuable lessons for professionals seeking to refine their investment approaches.

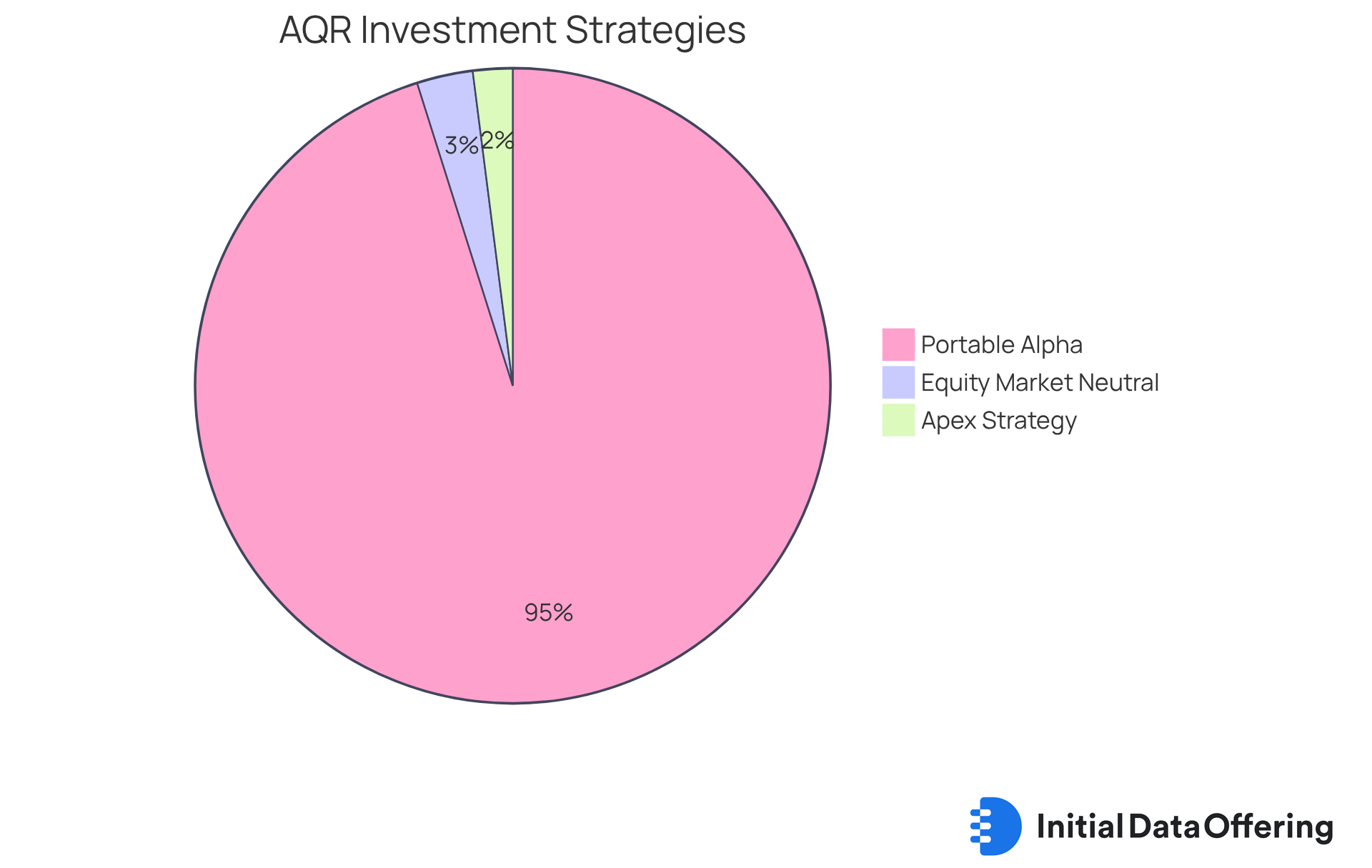

AQR Capital Management: Quantitative Investment Leader

AQR Capital Management stands as a pioneer in quantitative investment approaches, employing advanced mathematical models and data analysis to inform its investment decisions. This company focuses on systematic trading across diverse asset classes, including equities, fixed income, and alternatives. AQR's research-driven methodology enables it to pinpoint market inefficiencies and capitalize on them effectively.

Notably, AQR manages approximately $500 million in portable alpha strategies, reflecting a strategic pivot toward diversification while still maintaining exposure to stock rallies. The company's flagship Apex Strategy has achieved a , showcasing the effectiveness of its approach in the current market landscape. Furthermore, AQR's Equity Market Neutral Fund has returned around 15% year-to-date, indicating a resurgence of disciplined factor investing.

Data scientists at AQR emphasize that thorough data analysis is crucial for guiding informed investment choices, reinforcing the organization's commitment to rational investing in an increasingly complex market landscape. As co-founder Cliff Asness remarked, "It’s been a tremendous return for basic rational investing," highlighting the company's focus on data-driven strategies.

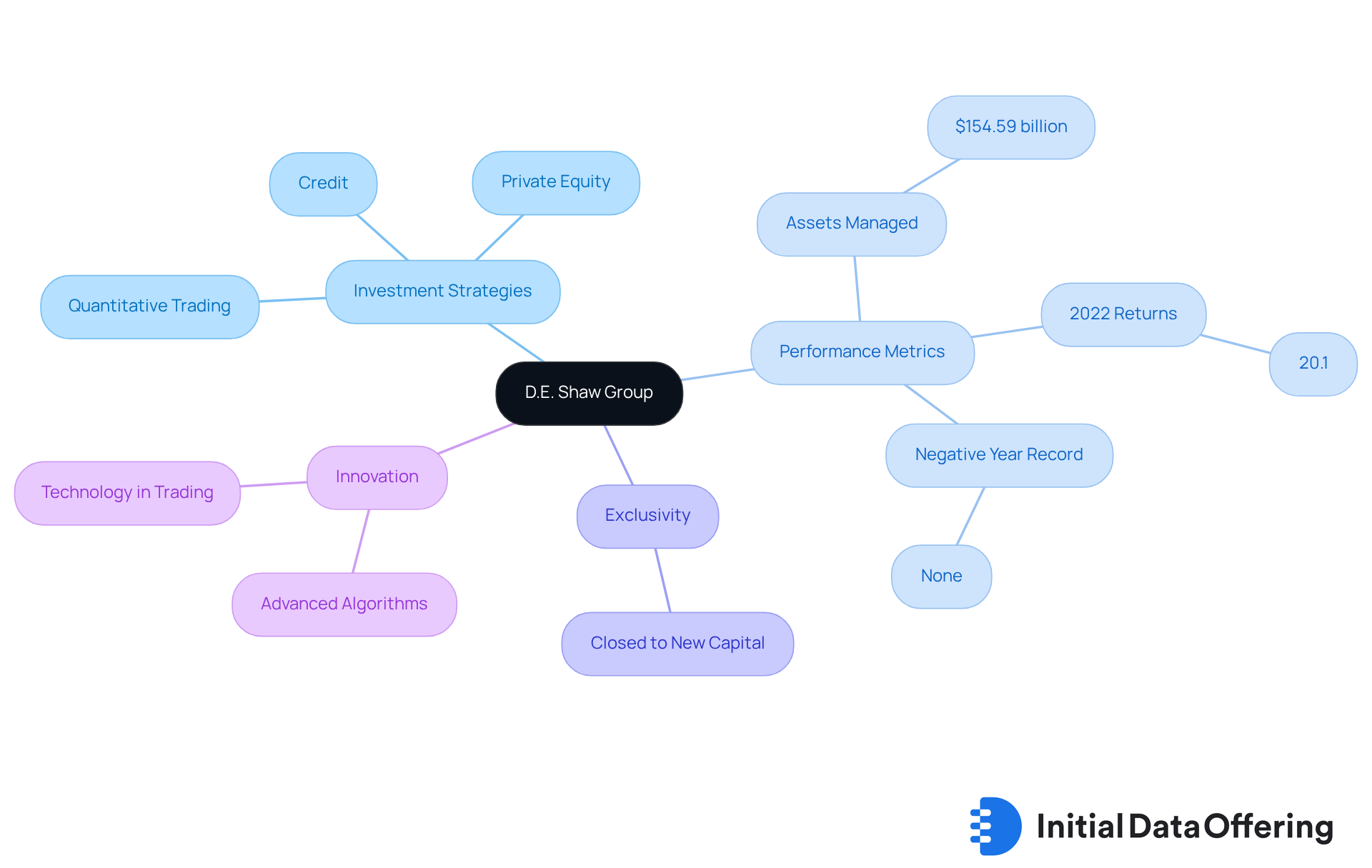

D.E. Shaw: Diverse Strategies and Strong Performance

D.E. Shaw Group is distinguished in the hedge fund landscape due to its multifaceted investment strategies, which include quantitative trading, credit, and private equity. Founded by David E. Shaw in 1988, the firm employs a team of scientists and engineers dedicated to developing advanced algorithms that underpin its trading methodologies. As of June 2025, D.E. Shaw manages an impressive $154.59 billion in assets, showcasing its robust performance and strategic acumen. This substantial figure reflects the firm's consistent ability to deliver , including a remarkable 20.1 percent in 2022, and highlights that it has not experienced a negative year since its inception.

Additionally, D.E. Shaw's two investment vehicles are currently closed to new capital, underscoring the company's exclusivity and appeal to high-net-worth individuals and organizations. The firm has recorded gains across systematic, hybrid, and discretionary methods, further exemplifying its diverse investment approach. This commitment to innovation and performance reinforces D.E. Shaw's status as a formidable player in the hedge fund arena, particularly as algorithmic trading continues to transform the industry landscape. As David E. Shaw aptly stated, 'Innovation is central to our trading approaches,' emphasizing the critical role of technology in their operations.

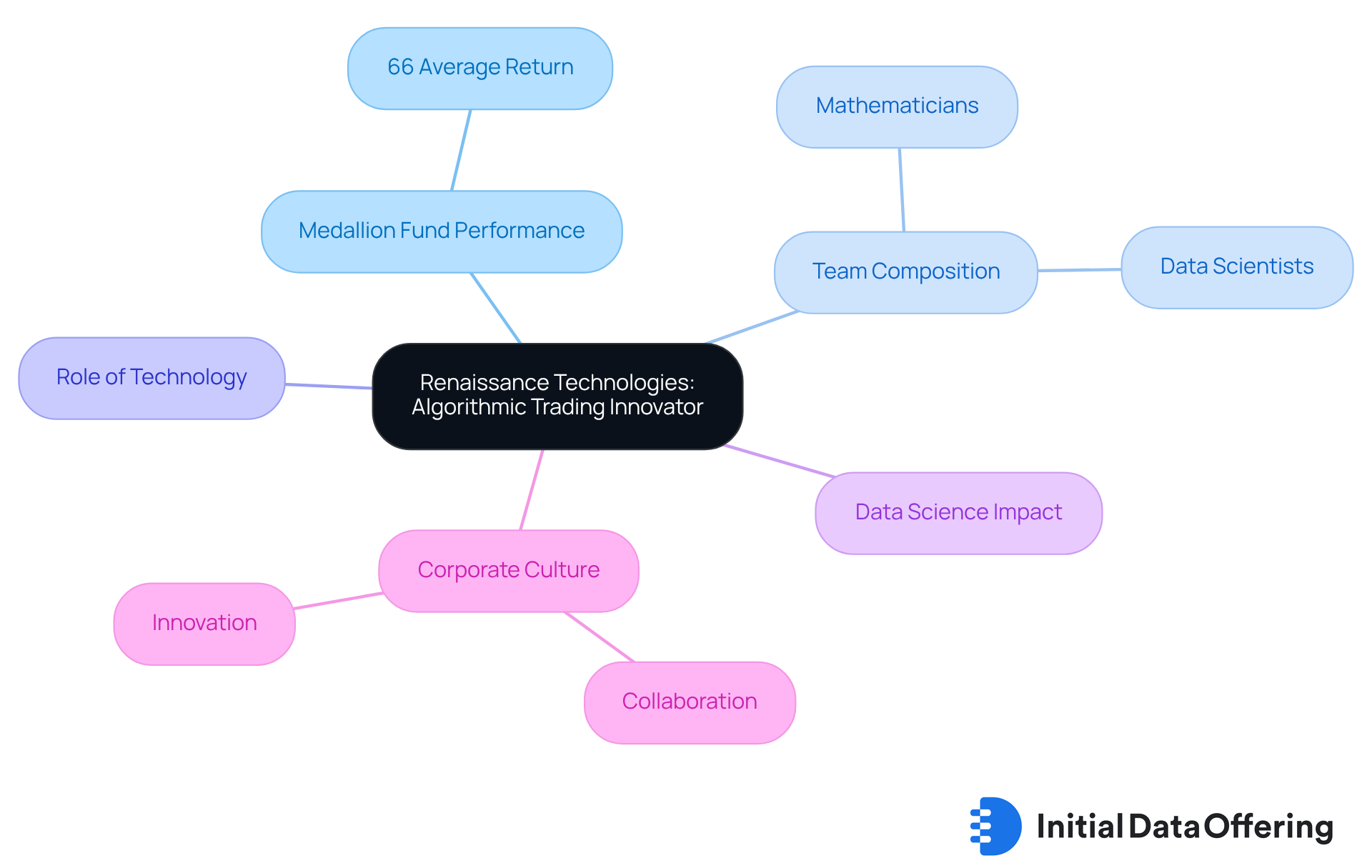

Renaissance Technologies: Algorithmic Trading Innovator

Renaissance Technologies emerges as a leader in algorithmic trading, particularly through its Medallion Fund, which boasts an impressive average gross annual return of 66% over three decades. Founded by Jim Simons, the firm employs a diverse team of mathematicians and data scientists who develop sophisticated models to analyze market trends and patterns. This approach underscores the critical role of in investment strategies.

Furthermore, it illustrates how extensive datasets and data science significantly enhance the performance of investment firms. In 2025, the Medallion Fund continues to outperform the S&P 500, demonstrating the efficacy of its algorithmic trading systems. Financial analysts attribute this success to Renaissance's distinctive corporate culture, which promotes collaboration and innovation among its elite talent.

As industry specialists note, "The combined knowledge of Renaissance's staff is a crucial element in the portfolio's enduring success," reinforcing its position as a trailblazer in the investment sector.

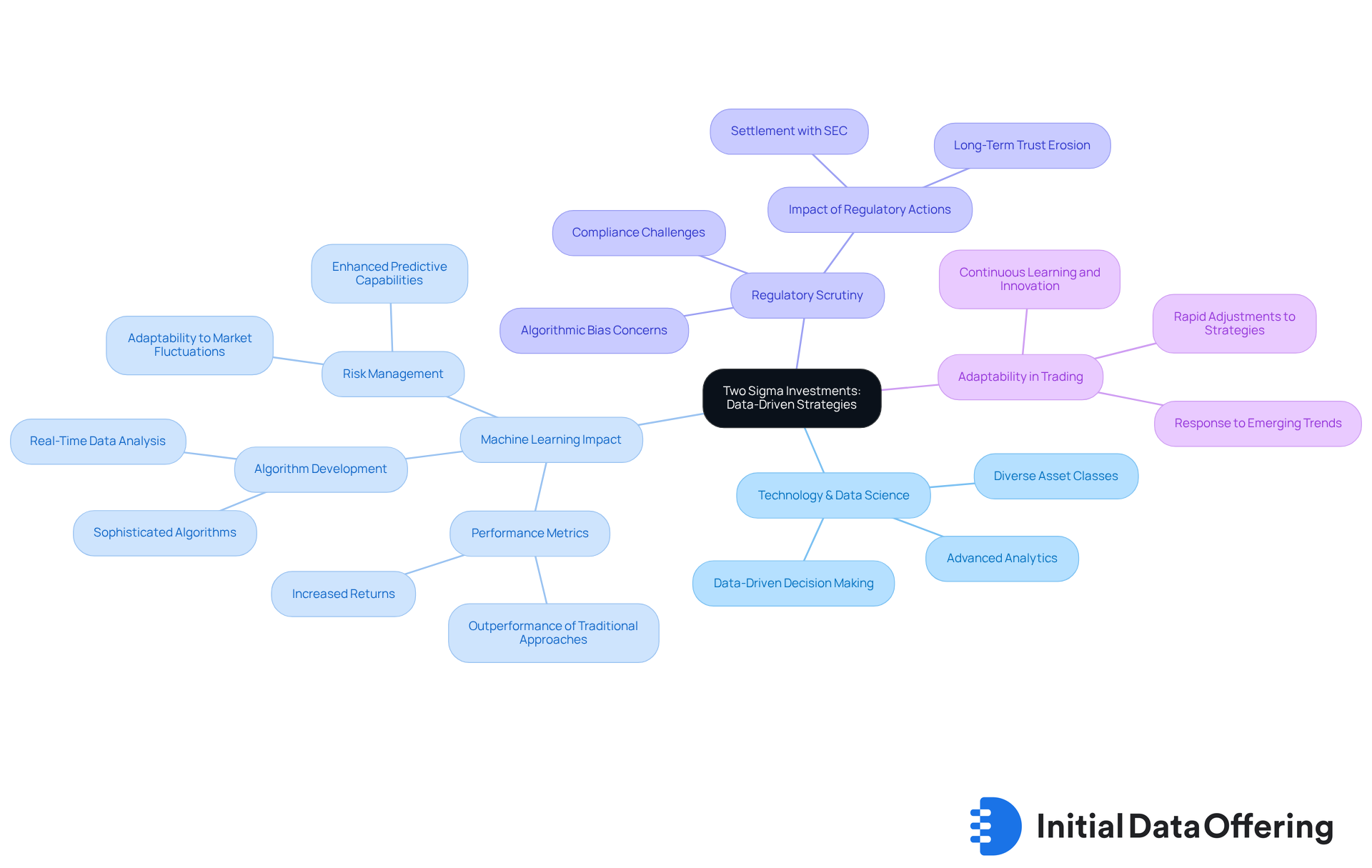

Two Sigma Investments: Data-Driven Investment Strategies

Two Sigma Investments stands at the forefront of the investment sector, leveraging technology and data science to enhance its investment strategies. By employing advanced analytics and machine learning, the firm systematically trades across diverse asset classes, pinpointing lucrative investment opportunities with precision. This data-focused strategy not only enhances decision-making but also highlights a significant trend within the investment sector: the growing reliance on .

In 2025, statistics indicate that investment pools utilizing machine learning have outperformed traditional approaches, demonstrating a notable increase in returns linked to algorithmic trading. Industry leaders emphasize that machine learning applications are revolutionizing investment performance, enabling firms to analyze vast datasets and uncover insights previously deemed unreachable. For example, Two Sigma's integration of machine learning into its trading models has resulted in improved risk management and enhanced predictive capabilities, establishing a benchmark for innovation in the field.

Nevertheless, Two Sigma has encountered regulatory scrutiny, underscoring the need to balance innovation with accountability. As industry experts have noted, "Firms that fail to balance innovation with accountability risk not only regulatory penalties but also long-term erosion of trust." Recent advancements at Two Sigma include the development of sophisticated algorithms that incorporate real-time data analysis, facilitating rapid adjustments to trading strategies in response to market fluctuations. This adaptability is essential in today's fast-paced financial environment, where the capacity to react to emerging trends can significantly influence profitability.

As the investment landscape evolves, Two Sigma's commitment to harnessing the power of machine learning positions it as a leader in advancing the future of data-driven investing, while also addressing the challenges posed by algorithmic bias and regulatory compliance.

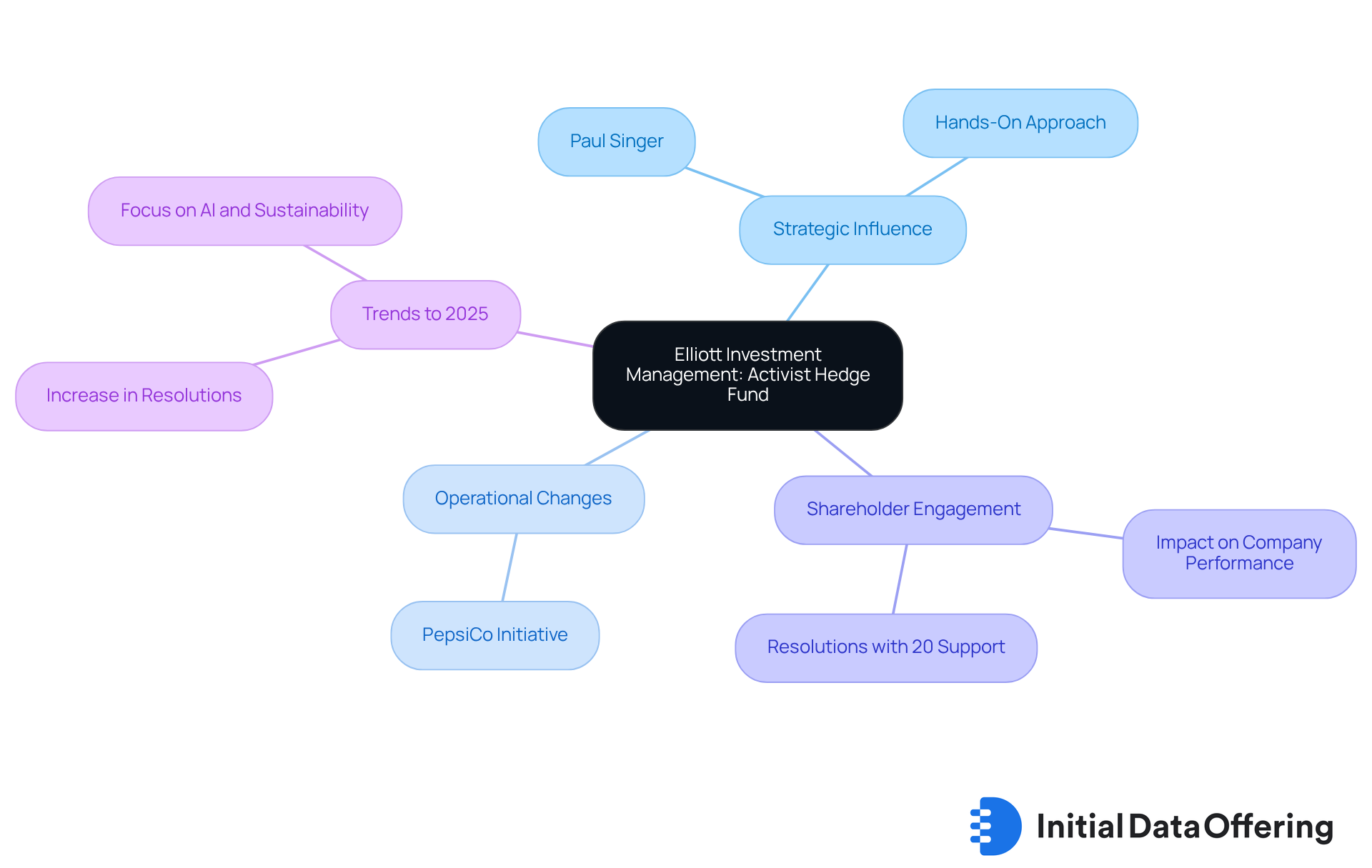

Elliott Investment Management: Activist Hedge Fund

Elliott Investment Management stands out as a prominent activist investment group, recognized for its strategic influence on the management and direction of its portfolio companies. Founded by Paul Singer, Elliott employs a hands-on approach, actively engaging with management teams to advocate for significant changes aimed at enhancing shareholder value. This proactive involvement has solidified Elliott's reputation as a formidable player in the investment landscape, where its ability to is widely acknowledged.

Looking ahead to 2025, the trend of shareholder involvement by investment firms is expected to continue its upward trajectory, with a notable increase in the number of resolutions submitted. Elliott's influence is highlighted by its recent initiatives, such as advocating for operational changes at PepsiCo, where it holds a substantial stake. This action exemplifies a broader strategy among investment groups to leverage their positions for substantial change within companies.

Financial analysts emphasize that effective engagement with management teams can lead to improved company performance and enhanced shareholder returns. Data reveals that shareholder resolutions receiving over 20% support often prompt formal company actions, underscoring the significance of active participation in governance. As hedge funds like Elliott persist in asserting their influence, the hedge fund list of key players in corporate management is poised for transformation, accentuating the critical role of shareholder engagement in driving company success.

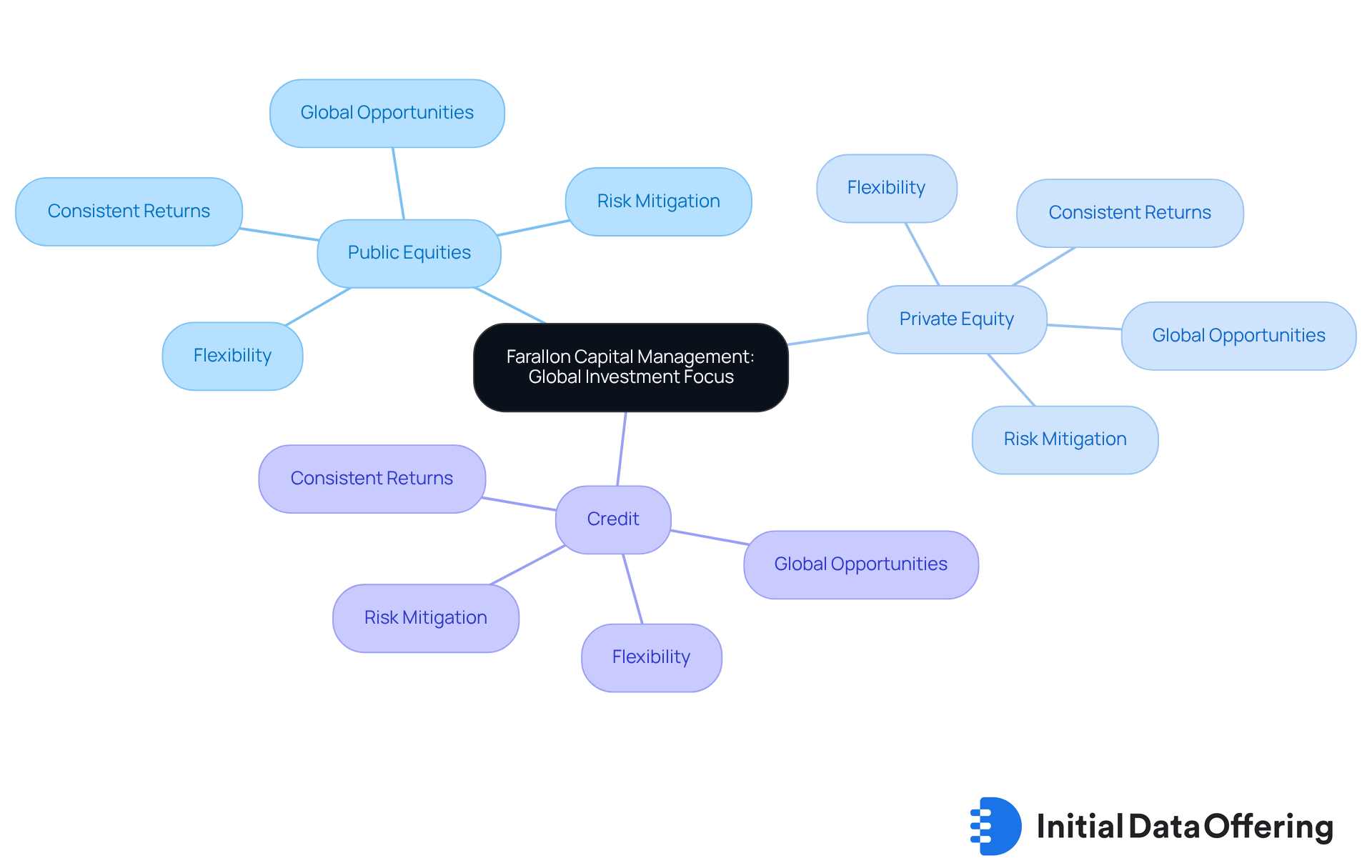

Farallon Capital Management: Global Investment Focus

Farallon Capital Management is a global investment company that specializes in a diverse array of asset classes, including public equities, private equity, and credit. This broad focus allows the company to adapt its flexibly, responding effectively to changing market conditions. By seizing opportunities around the world, Farallon enhances its potential for returns. Furthermore, the company's commitment to global diversification not only mitigates risk but also amplifies its ability to generate consistent returns.

How does this approach to diversification impact your investment strategies? Consider the implications of such a flexible investment model in your own portfolio management.

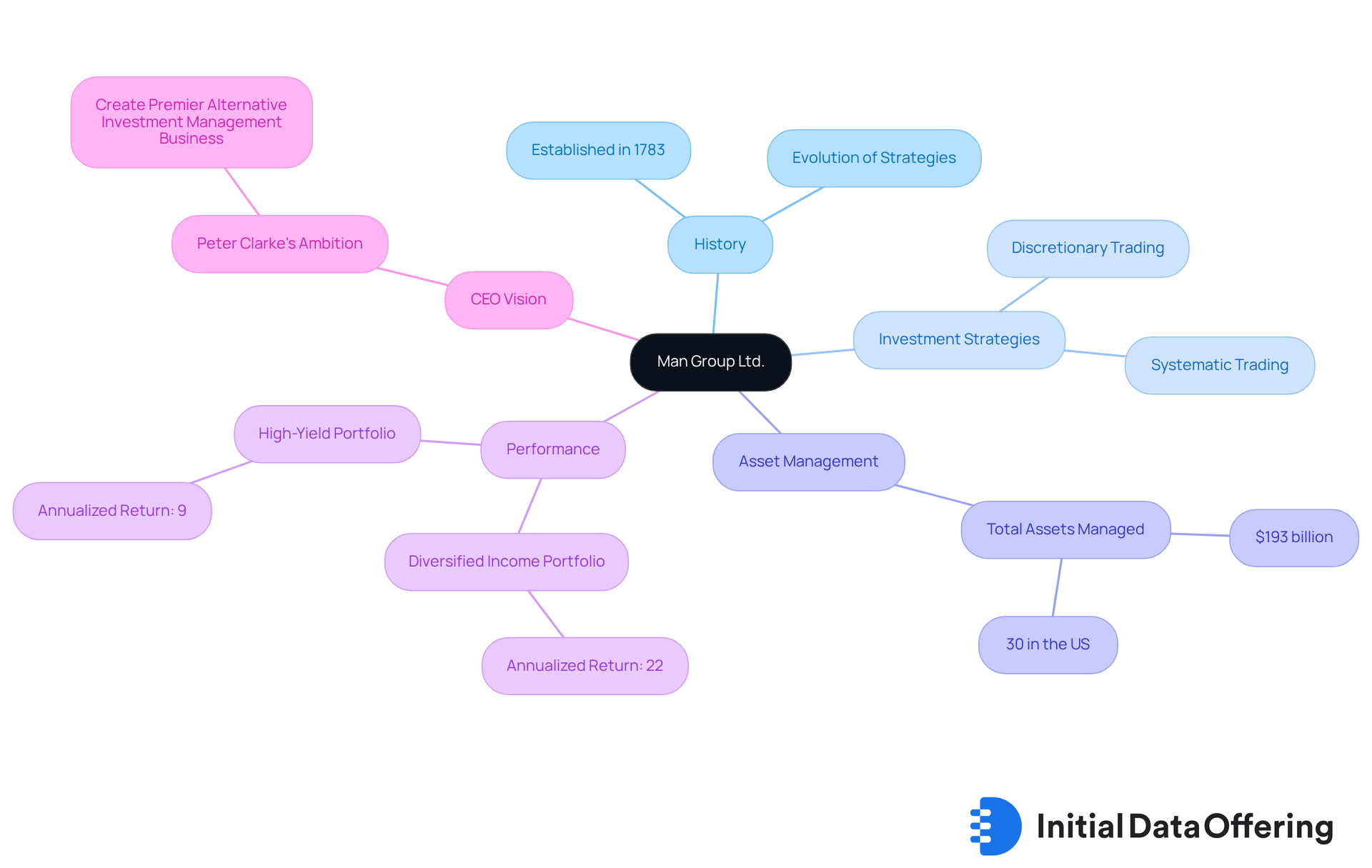

Man Group Ltd.: Established Hedge Fund with Diverse Strategies

Man Group Ltd., established in 1783, is a distinguished investment firm recognized for its diverse strategies, which encompass both discretionary and systematic trading. This firm has successfully adapted over the centuries, now utilizing advanced technology and data analytics to enhance its investment processes. Notably, the launch of actively-managed bond ETFs exemplifies this integration of technology, which not only improves decision-making but also enables Man Group to adeptly navigate various market conditions.

As of mid-2025, Man Group oversees approximately $193 billion in assets, with around 30% of these assets located in the US. This substantial presence underscores its significant role in the hedge fund list. The annualized returns for its diversified income portfolio and high-yield portfolio are approximately 22% and 9%, respectively. These figures align with the company's historical performance, showcasing the effectiveness of its multifaceted investment approach.

Peter Clarke, the CEO of Man Group, states, 'My overall ambition is to create the premier alternative investment management business.' This vision reflects the company's and commitment to excellence in the investment management sector. How might these insights into Man Group's operations inform your understanding of investment strategies in today's market?

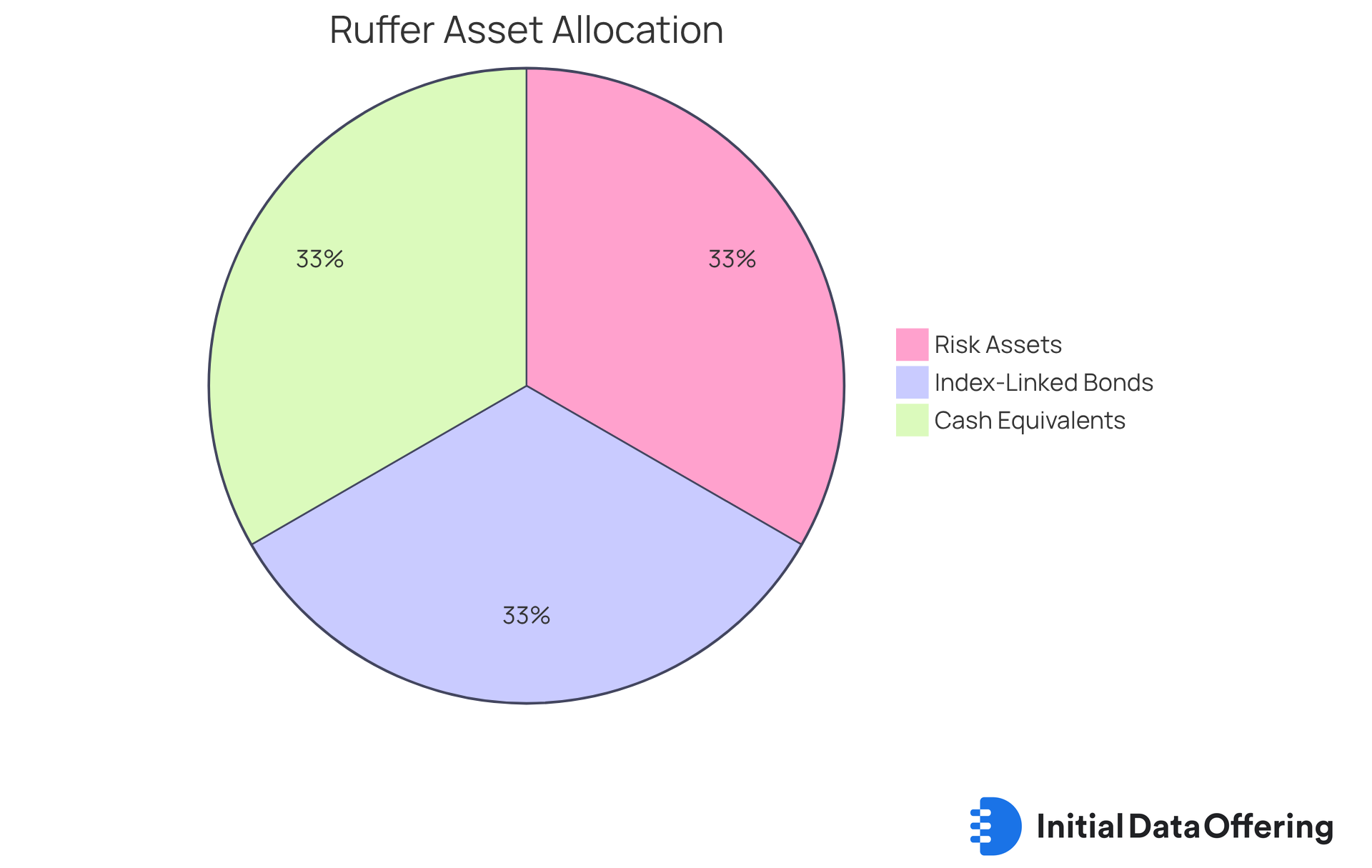

Ruffer Investment Co.: Capital Preservation Focus

Ruffer Investment Co. distinguishes itself in the hedge fund list by emphasizing capital preservation while actively pursuing returns. This firm implements a that is specifically designed to protect clients' assets during market downturns, a vital approach given the volatility observed in recent months. For example, during the market turbulence in March, Ruffer succeeded in delivering positive returns, sharply contrasting with the broader market, where the S&P 500 experienced a decline of 9.9% over the same period.

The risk management techniques employed by Ruffer are central to its investment strategy. The investment pool allocates approximately one-third of its assets to risk assets, another third to index-linked bonds, and the final third to cash or cash equivalents. This balanced approach not only mitigates potential losses but also positions the portfolio to capitalize on opportunities that arise during periods of volatility. Notably, Ruffer's assets increased by 0.6% in the previous month, underscoring the effectiveness of its defensive posture amidst a broader market decline.

Statistics reveal that the performance gap between the top and lowest performing capital preservation investments can exceed 12 percentage points over three months, emphasizing the importance of strategic asset allocation. Ruffer's commitment to maintaining a defensive bias has proven advantageous, particularly during significant market downturns, which is why it remains a top contender on the hedge fund list as it has consistently outperformed many of its peers.

Financial analysts underscore the importance of such risk management practices in unstable markets, noting that Ruffer's approach not only protects investor capital but also provides a pathway for growth. As market conditions continue to fluctuate, Ruffer Investment Co. remains an appealing option for conservative investors seeking stability and resilience in their portfolios.

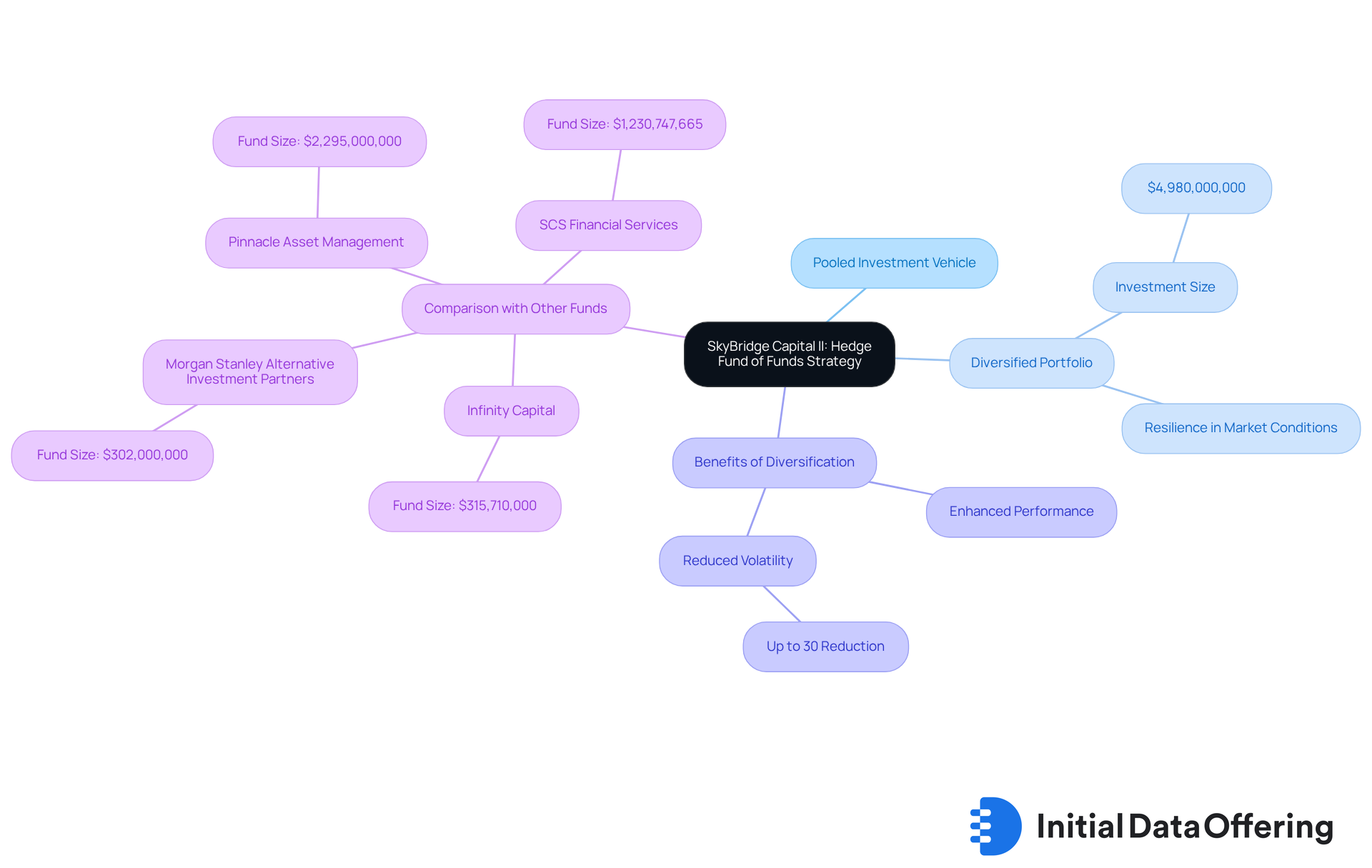

SkyBridge Capital II: Hedge Fund of Funds Strategy

SkyBridge Capital II operates as a pooled investment vehicle, strategically allocating resources across a diversified portfolio that encompasses various investment strategies and asset categories. Founded by Anthony Scaramucci, the firm is dedicated to delivering appealing risk-adjusted returns by leveraging the expertise of multiple investment managers. With a substantial of $4,980,000,000, SkyBridge's diversified portfolio has shown remarkable resilience amidst changing market conditions in 2025.

The benefits of diversification are particularly pronounced in investment portfolios, where exposure to a variety of strategies can lead to enhanced overall performance. Research indicates that diversified investment portfolios can reduce volatility by as much as 30% compared to single-strategy investments. By employing a blend of premier hedge fund strategies from our hedge fund list, SkyBridge Capital II empowers investors to harness the unique advantages of diversification, ultimately resulting in improved investment outcomes.

In contrast, other fund-of-fund approaches, such as those from Infinity Capital and Morgan Stanley Alternative Investment Partners, also prioritize diversification. However, they may adopt different methodologies and performance metrics. How might these varying approaches influence your investment decisions? Understanding these distinctions can help investors navigate the complexities of investment strategies more effectively.

Pinnacle Asset Management: Tailored Investment Solutions

Pinnacle Asset Management offers customized investment solutions tailored to meet the distinct needs of its clients. This allows the company to adeptly adjust its plans in response to evolving market conditions and specific client objectives. Such a commitment to personalization not only enhances the company's ability to deliver value but also aligns with the growing trend towards tailored investment approaches.

In 2025, data indicates that personalized investment strategies have outperformed traditional models, underscoring the effectiveness of customized methods in achieving higher returns. Financial analysts assert that this level of customization is essential for optimizing investment outcomes, as it enables a more precise alignment with individual risk tolerances and financial goals.

Pinnacle's focus on adaptability ensures that its investment strategies remain relevant and effective, positioning the company as a leader in the dynamic field of asset management.

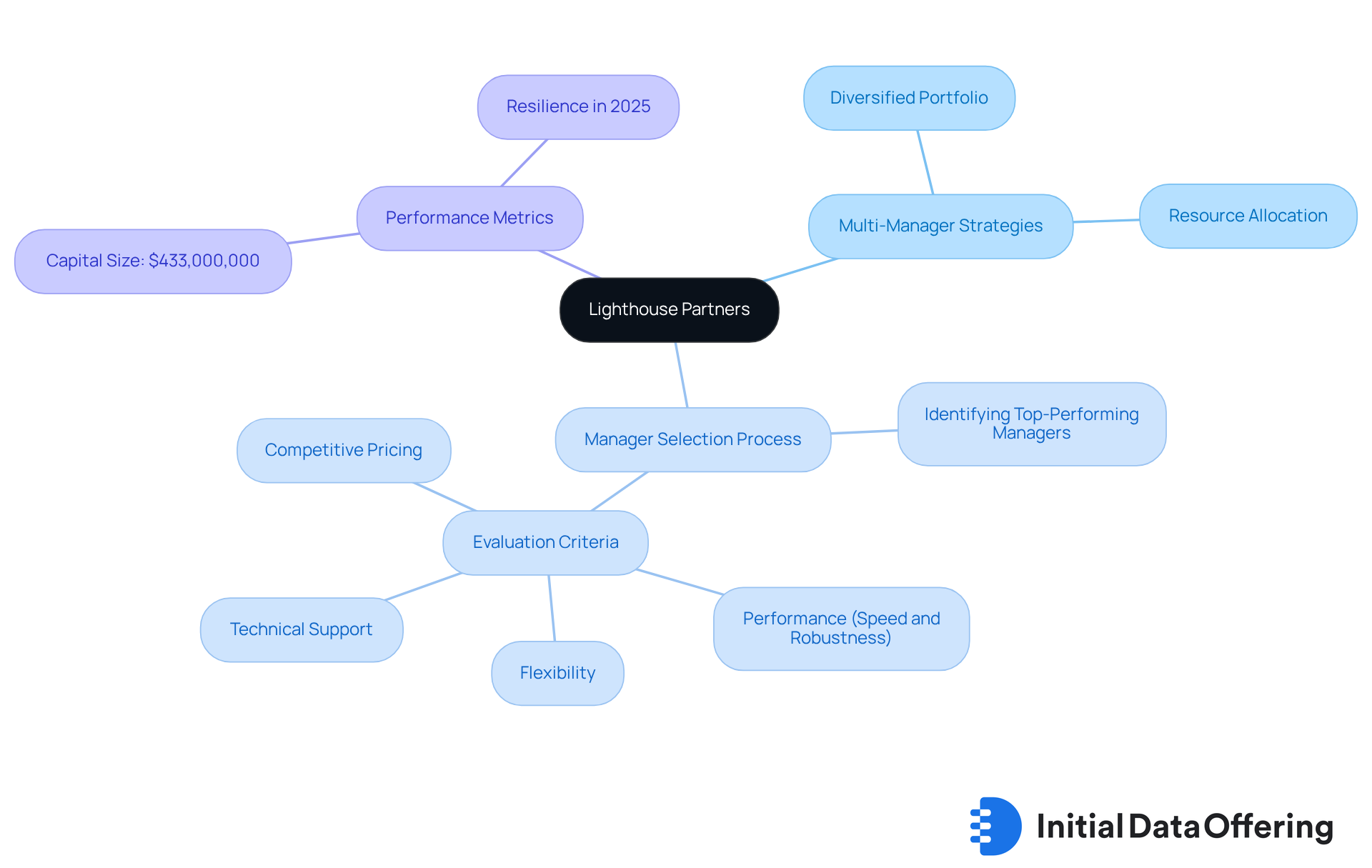

Lighthouse Partners: Multi-Manager Hedge Fund Strategies

Lighthouse Partners operates as a multi-manager investment vehicle, strategically allocating resources across various investment strategies. This firm is characterized by its meticulous selection process, which identifies top-performing managers, enabling investors to benefit from a well-diversified portfolio. In 2025, the performance of selected managers at Lighthouse Partners demonstrated considerable resilience, with a capital size of $433,000,000. This underscores the critical role that plays in achieving success in investment strategies.

Industry leaders consistently emphasize that a disciplined selection process is essential for attaining superior performance in investment vehicles. As Mathieu van Roon, Portfolio Manager at Robeco, noted, "After a lengthy and thorough selection procedure... we selected the Gurobi Optimizer based on performance (speed and robustness), flexibility... and the competitive price level." This statement reinforces Lighthouse's commitment to excellence in manager evaluation.

Consequently, investors can engage confidently with a portfolio that is both diverse and strategically aligned with market opportunities.

Morgan Stanley Alternative Investment Partners: Research-Driven Hedge Fund Selection

Morgan Stanley Alternative Investment Partners stands out due to its research-driven investment selection, which is anchored in comprehensive market analysis. This approach allows the firm to pinpoint top-performing opportunities, giving it a competitive edge. In 2025, it is anticipated that companies employing stringent research techniques will outperform their competitors significantly, with forecasts predicting an average annual growth of 11% in the investment sector. This statistic underscores the importance of in achieving superior results.

The company's thorough due diligence process is not merely a procedural formality; it plays a critical role in identifying high-quality investment strategies while simultaneously mitigating investment-related risks. Financial analysts emphasize that rigorous due diligence is essential for navigating the complexities of various investment vehicles. This ensures that clients are not only well-informed but also adequately equipped for success in their investment endeavors.

Recent investigations into wealth management practices further highlight Morgan Stanley's unwavering commitment to research and analysis. This dedication enhances the firm's ability to deliver exceptional value to clients, particularly in a hedge fund list that is becoming increasingly competitive. How can investors leverage this commitment to optimize their investment strategies? By understanding the significance of research-driven approaches, clients can make informed decisions that align with their financial goals.

Conclusion

The exploration of hedge funds in this article highlights the dynamic landscape of investment strategies and the pivotal role that data and innovation play in shaping financial success. Each hedge fund discussed, from Citadel's adaptive trading to Bridgewater's systematic decision-making, underscores the importance of a tailored approach to investment that can effectively respond to market fluctuations and opportunities.

Key insights reveal that the integration of technology, whether through algorithmic trading at Renaissance Technologies or data-driven strategies at Two Sigma, is increasingly vital for achieving superior returns. This reliance on advanced technology not only enhances performance but also positions these firms to capitalize on emerging market trends. Furthermore, the emphasis on risk management and capital preservation by firms like Ruffer Investment Co. demonstrates a growing recognition of the need for stability amidst market volatility.

As the hedge fund sector continues to evolve, these varied strategies illustrate the importance of adaptability, rigorous research, and innovative thinking. Investors must ask themselves: how can they leverage these insights to refine their own strategies? Ultimately, the hedge funds to watch in 2025 are not merely about their past performance; they embody a forward-thinking approach that prioritizes data accessibility, strategic risk management, and active engagement in corporate governance.

Investors are encouraged to consider these insights as they navigate their own investment journeys, leveraging the lessons learned from leading hedge funds to enhance their portfolios. The ongoing evolution of the hedge fund industry signifies a landscape ripe with opportunity for those willing to embrace change and innovation.

Frequently Asked Questions

What is the Initial Data Offering (IDO)?

The Initial Data Offering (IDO) is a platform that provides access to unique investment datasets, streamlining the process of discovering high-quality information essential for informed investment decisions.

How does the IDO benefit investors?

The IDO centralizes various datasets, allowing users to explore performance metrics, investment strategies, and market trends, which are crucial for navigating the investment landscape and making strategic decisions.

What is the significance of investment vehicle data?

Investment vehicle data plays a pivotal role in shaping investment choices and strategies, and the market for this data is projected to experience substantial growth by 2025.

What makes Citadel a leading hedge fund?

Citadel is renowned for its innovative trading strategies, robust risk management practices, and its ability to adapt to changing market conditions, which sets it apart as a leader in the hedge fund space.

What are Citadel's key strategies for risk management?

Citadel emphasizes resilience and adaptability in its risk management practices, utilizing both traditional methods and innovative strategies to anticipate market shifts and capitalize on emerging opportunities.

What investment philosophy does Bridgewater Associates follow?

Bridgewater Associates, founded by Ray Dalio, follows a pioneering investment philosophy that emphasizes radical transparency and systematic decision-making to navigate complex financial landscapes effectively.

What is Bridgewater's flagship investment strategy?

Bridgewater's flagship investment, Pure Alpha, is designed to generate returns through a diversified portfolio that balances risk across various asset classes, mitigating potential losses while enhancing growth potential.

How does AQR Capital Management approach investments?

AQR Capital Management employs quantitative investment approaches using advanced mathematical models and data analysis to inform its investment decisions across diverse asset classes.

What are some notable achievements of AQR Capital Management?

AQR manages approximately $500 million in portable alpha strategies and has achieved a year-to-date return of 10.6% with its flagship Apex Strategy, as well as around 15% with its Equity Market Neutral Fund.

What is the importance of data analysis at AQR?

Data analysis is crucial at AQR for guiding informed investment choices, reinforcing the organization's commitment to rational investing in a complex market landscape.