10 Ways Private Equity Data Enhances Investment Strategies

10 Ways Private Equity Data Enhances Investment Strategies

Introduction

The private equity landscape is experiencing a significant transformation, driven by the integration of advanced data analytics and innovative technologies. As firms seek to refine their investment strategies, the ability to access diverse datasets and leverage predictive insights has become increasingly vital. But how can private equity firms effectively utilize these data-driven tools to enhance decision-making and navigate the complexities of a rapidly changing market? This article delves into ten impactful ways that private equity data can enhance investment strategies, showcasing the potential for improved returns and more informed financial decisions.

Initial Data Offering: Streamline Access to Diverse Datasets for Investment Insights

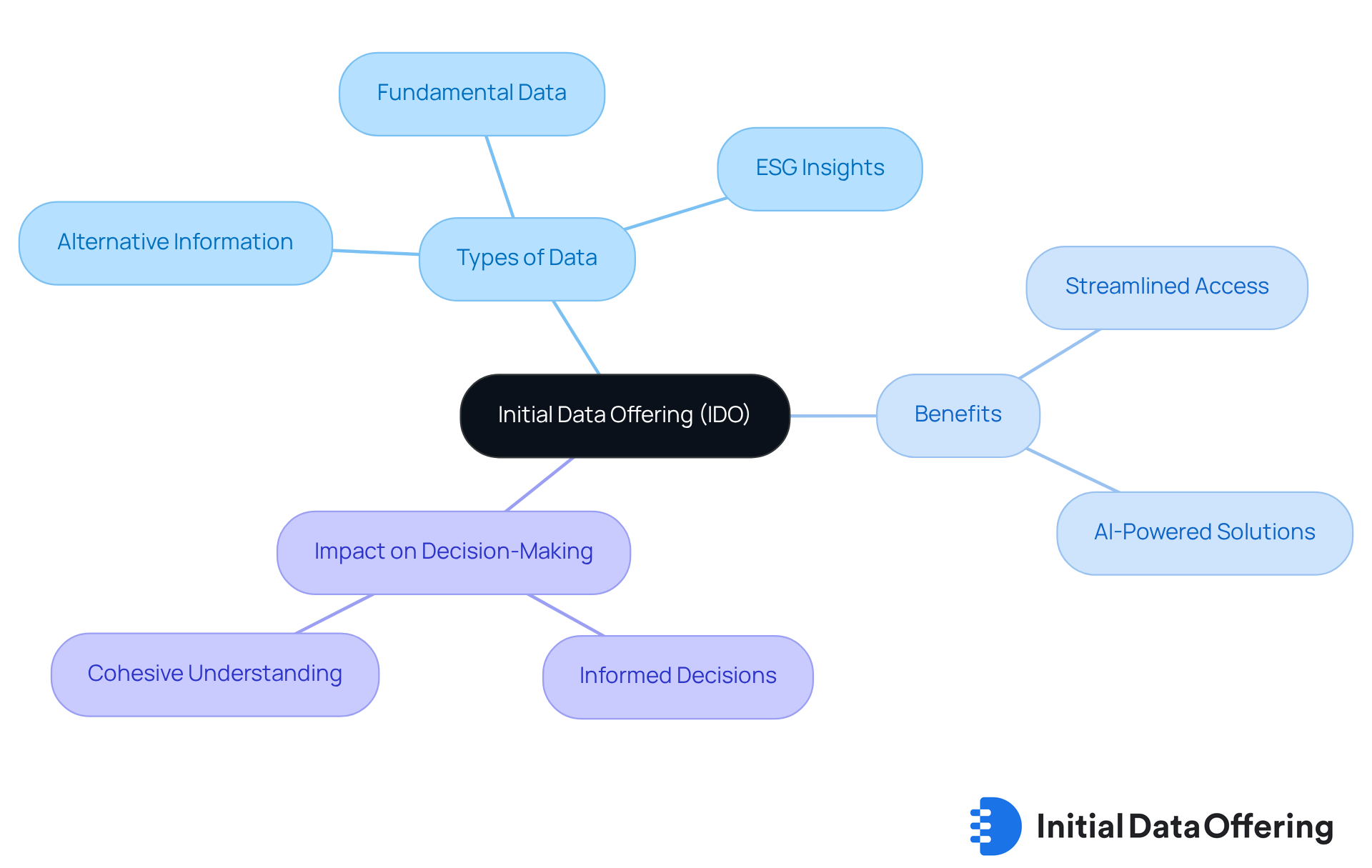

The Initial Data Offering (IDO) serves as a vital centralized hub for private equity firms by providing access to a diverse array of private equity data, including alternative information, fundamental data, and ESG insights. What makes IDO essential? This streamlined access allows investors to gain deeper insights into market dynamics, significantly improving their financial decision-making processes. In a landscape often characterized by fragmented information sources, IDO simplifies the identification and utilization of reliable private equity data, enabling companies to swiftly leverage insights crucial for refining their financial strategies.

Moreover, by incorporating AI-powered solutions, IDO enhances its offerings, facilitating more sophisticated analyses and insights that resonate with current market trends. Why is this important? The impact of centralized information hubs like IDO is substantial; they not only empower informed decision-making but also foster a more cohesive understanding of market trends and opportunities. By utilizing these datasets, investors can navigate the complexities of the market with greater confidence and clarity.

Machine Learning Due Diligence: Enhance Decision-Making with Predictive Analytics

Machine learning algorithms offer powerful features for analyzing extensive datasets, enabling firms to uncover patterns and trends that significantly enhance due diligence processes. These algorithms provide a distinct advantage by utilizing predictive insights, enabling private equity data analysis for companies to assess potential opportunities with greater accuracy. By employing historical data to forecast future performance, firms can not only speed up the due diligence timeline but also gain deeper insights, leading to more informed financial decisions.

For instance, predictive analysis can quickly identify anomalies in financial statements or operational inefficiencies that traditional evaluations might miss. This capability results in a tangible benefit: firms that adopt these advanced techniques report a 30% reduction in forecasting errors compared to conventional spreadsheet-based methods. This improvement directly contributes to enhanced decision-making accuracy.

Moreover, consider the impact of AI on shareholder returns. Research indicates that 80% of acquirers using AI achieve superior returns, with revenue growth from AI-enabled combinations averaging 1.5 times higher than traditional deals. This statistic underscores the competitive advantage gained through data-driven strategies. As predictive analysis continues to evolve, its influence on capital decision-making in private equity data becomes increasingly significant, transforming the landscape towards more proactive and informed financial strategies.

How can your firm leverage these insights? By embracing predictive analysis, you can position yourself at the forefront of financial innovation, ensuring that your decision-making processes are not only efficient but also strategically sound.

Real-Time Risk Management: Utilize Data Analytics for Proactive Risk Mitigation

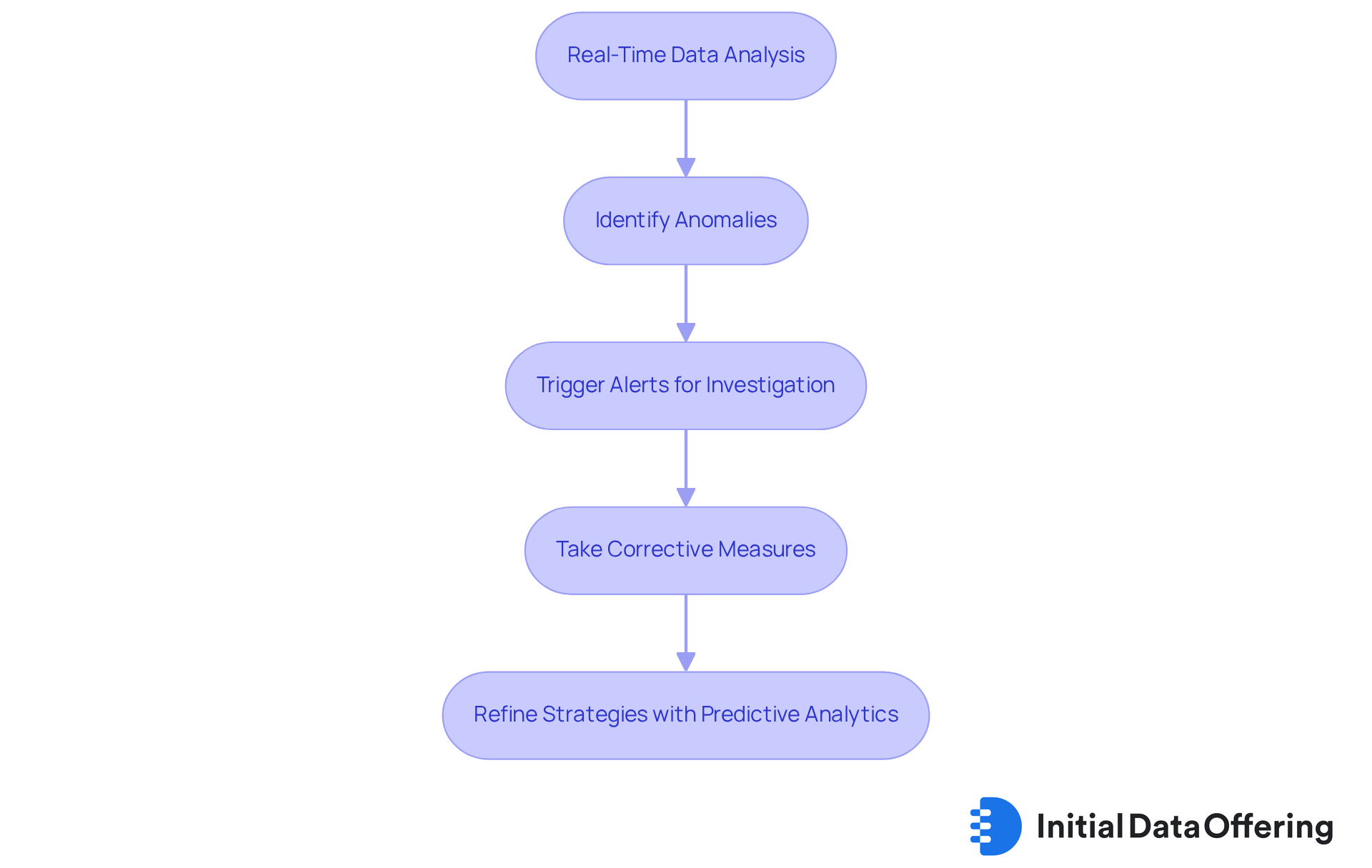

Real-time private equity data analysis serves as a powerful tool for private equity companies, enabling them to maintain continuous oversight of their investments. This feature facilitates proactive risk management, allowing firms to identify anomalies and potential risks as they emerge. Instead of merely reacting to issues after they occur, companies can take immediate action. For example, if a portfolio company faces an unexpected decline in sales, real-time analytics can trigger alerts that prompt swift investigation and corrective measures.

The advantages of this proactive strategy are significant. Not only does it reduce risks, but it also enhances the resilience of the asset portfolio. Financial analysts emphasize that methods driven by private equity data are essential for maintaining a competitive edge. They empower companies to adapt quickly to market fluctuations and safeguard their resources against unforeseen challenges.

Moreover, the incorporation of predictive analytics further strengthens risk management tactics. By anticipating potential downturns, companies can refine their strategies, ultimately boosting overall performance. How might your organization leverage real-time data analysis to enhance its investment strategies? By embracing these advanced tools, firms can not only navigate risks more effectively but also position themselves for sustained success in a dynamic market.

Data Transparency: Gain a Competitive Edge in Private Equity Investments

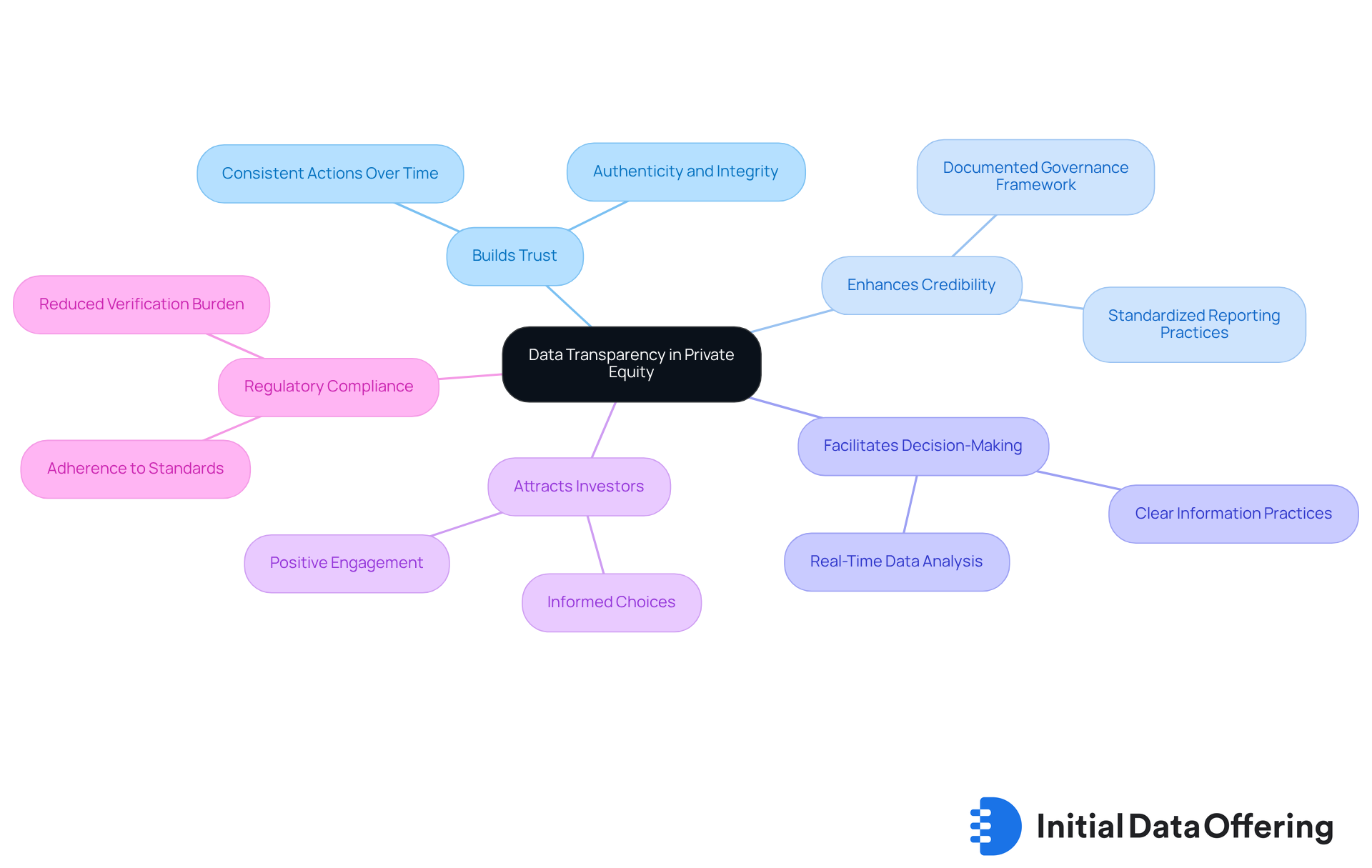

Private equity data transparency is increasingly recognized as a competitive advantage. What if you could build trust with your investors simply by sharing clear information? By offering transparent and accessible private equity data on investment performance, risks, and strategies, companies can establish a strong rapport with investors and stakeholders. This transparency not only enhances credibility but also facilitates better decision-making.

Companies that transparently share their private equity data and methodologies are more likely to attract investors who value accountability and informed choices. Consider this: when investors feel informed, they are more likely to engage positively with a firm. Furthermore, clear information practices can lead to enhanced adherence to regulatory standards, which further strengthens a company's reputation in the market.

In summary, embracing data transparency is not just about compliance; it's about fostering trust and making informed decisions that can lead to long-term success.

Time Savings: Automate Processes to Improve Operational Efficiency

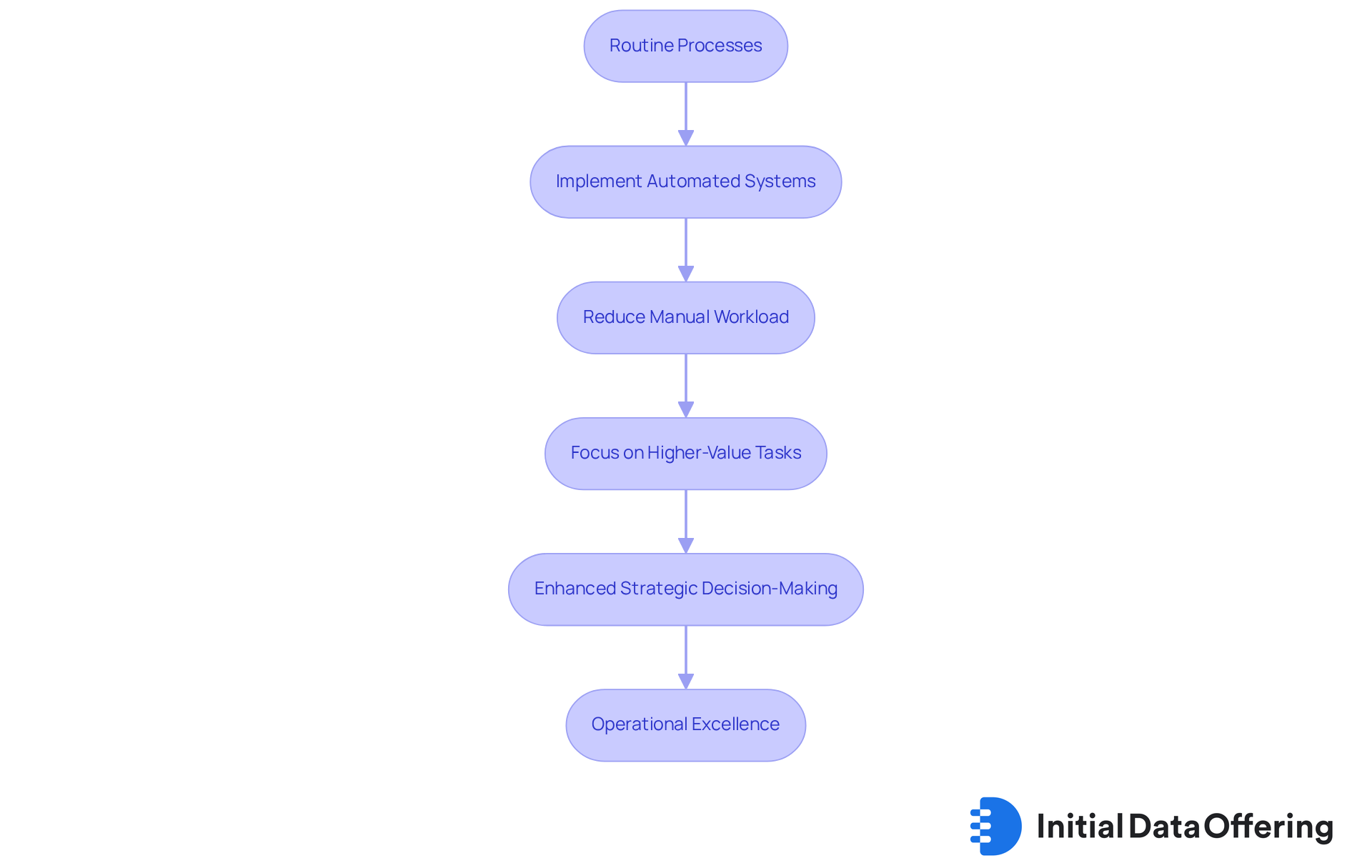

The automation of routine processes within private equity companies highlights a compelling feature: significant time savings and enhanced operational efficiency, supported by private equity data. By implementing automated systems for data collection, reporting, and analysis, organizations can reduce the manual workload on their teams. This shift allows employees to focus on higher-value tasks, such as strategic decision-making and relationship management.

Consider the due diligence process, for example. Automating this critical function can drastically cut down the time required to assess potential opportunities. As a result, companies can respond more swiftly to market chances, positioning themselves advantageously in a competitive landscape.

How might your organization benefit from such automation? By embracing these technologies, private equity firms can not only streamline operations but also enhance their strategic capabilities through private equity data. The implications are clear: automation is not just a trend; it’s a vital step toward operational excellence.

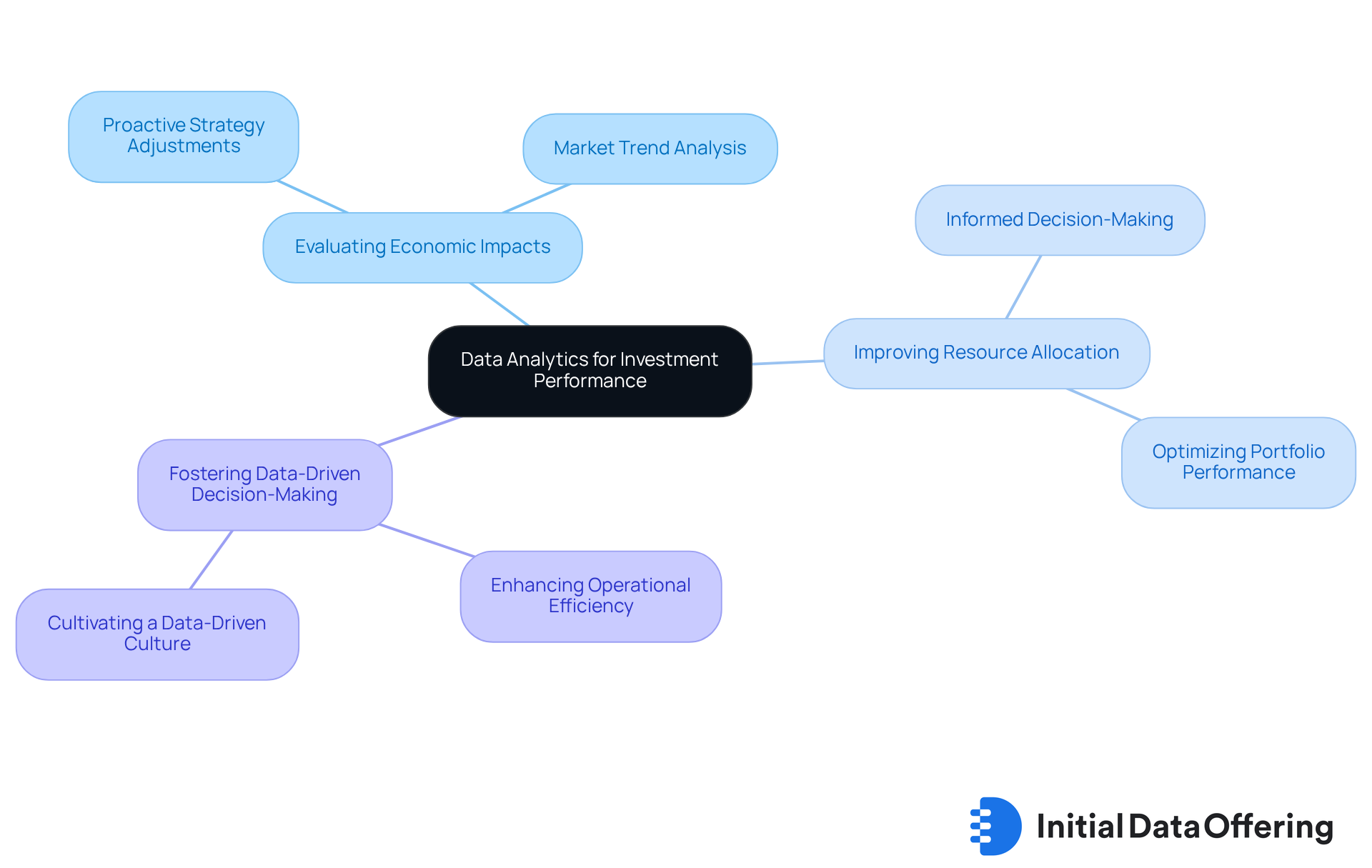

Higher Returns: Leverage Data Analytics for Enhanced Investment Performance

Data analysis is essential for generating higher returns in ventures involving private equity data. By examining market trends, consumer habits, and financial results, companies can uncover profitable opportunities and enhance their portfolios.

What are the advantages of sophisticated analysis? It enables firms to evaluate the potential impacts of economic changes on their assets, allowing them to adjust their strategies proactively. This foresight can be a game-changer in a volatile market.

Moreover, leveraging data to assess the performance of portfolio companies leads to more informed decisions regarding resource allocation and growth strategies. This approach not only improves overall investment effectiveness but also fosters a culture of data-driven decision-making.

In conclusion, the effective use of data analysis in private equity not only enhances returns but also equips companies with the insights needed to navigate complex market dynamics.

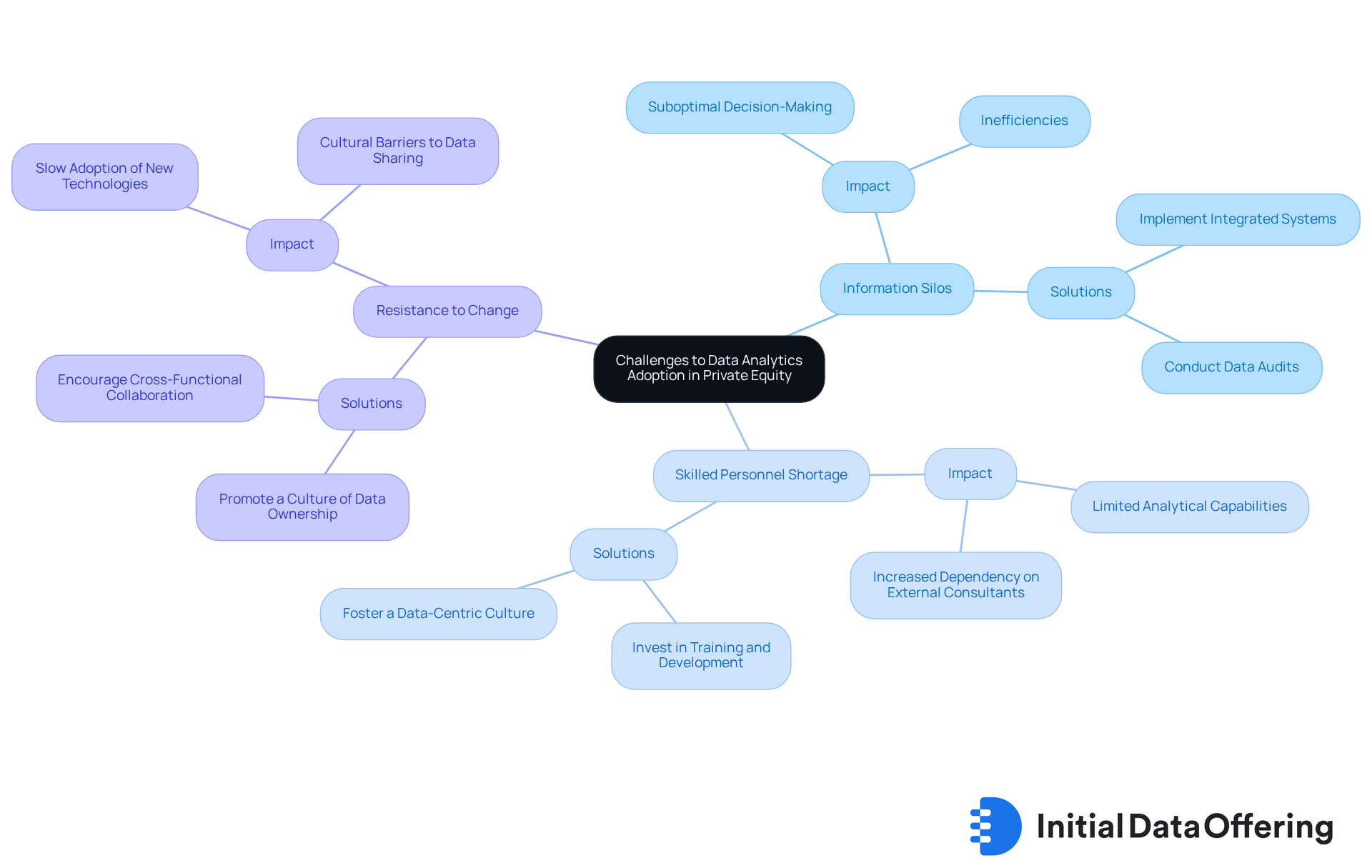

Common Challenges: Overcoming Barriers to Data Analytics Adoption in Private Equity

Private equity data is increasingly helping companies recognize the transformative potential of analytical insights. However, many face significant challenges in adopting these insights effectively. Key challenges include:

- Persistent information silos

- A shortage of skilled personnel

- Organizational resistance to change

For instance, over 80% of information leaders report that silos hinder business transformation, leading to inefficiencies and suboptimal decision-making.

To tackle these challenges, companies must prioritize investment in training and development. This investment fosters a culture that embraces data-driven decision-making. Implementing integrated information management systems is crucial for dismantling silos and enhancing collaboration across teams. Consider a case study of a private equity-owned food manufacturing business: by leveraging analytics, the firm identified vendor payment discrepancies, recovering $850,000 in working capital within just one hour. This example not only highlights the immediate financial advantages of effective information management but also underscores the importance of a cohesive approach to information strategy.

Industry leaders emphasize that establishing a culture where 'everyone owns the information' is vital for overcoming obstacles to an information-driven environment. By addressing these challenges head-on, private equity companies can unlock the full potential of information analysis. Ultimately, this leads to improved investment strategies and fosters exceptional performance. How can your organization begin to embrace these insights for better decision-making?

Future Trends: Explore the Evolving Landscape of Data Analytics in Private Equity

The landscape of private equity data analysis is rapidly transforming, driven by technological advancements and shifting market dynamics. A significant trend is the increasing adoption of artificial intelligence (AI) and machine learning for predictive analytics. These technologies enable firms to make data-driven decisions with greater accuracy. In 2024, 78% of organizations reported utilizing AI, a notable rise from 55% the prior year. This highlights AI's growing significance in funding strategies. Furthermore, U.S. private AI funding reached $109.1 billion in 2024, reflecting a substantial financial commitment to these technologies in the sector.

The rise of alternative information sources is also changing how companies evaluate market conditions and identify investment opportunities. This shift is supported by an increased emphasis on information governance and adherence. Companies recognize the importance of maintaining robust structures to manage information efficiently. As noted by Brownloop, "The role of analytics across the entire private equity lifecycle has been transformational."

As private equity firms navigate these trends, the use of private equity data in investing in advanced technologies and methodologies becomes essential for maximizing the potential of information. The integration of AI-driven insights enhances operational efficiency and empowers companies to uncover untapped value while proactively managing risks. This ultimately drives superior investment outcomes. However, companies must also address the challenges posed by dispersed information, which can hinder effective decision-making and limit the benefits of AI integration.

How can your organization leverage these insights to improve decision-making processes? By embracing AI and alternative information sources, firms can position themselves to capitalize on emerging opportunities in the market.

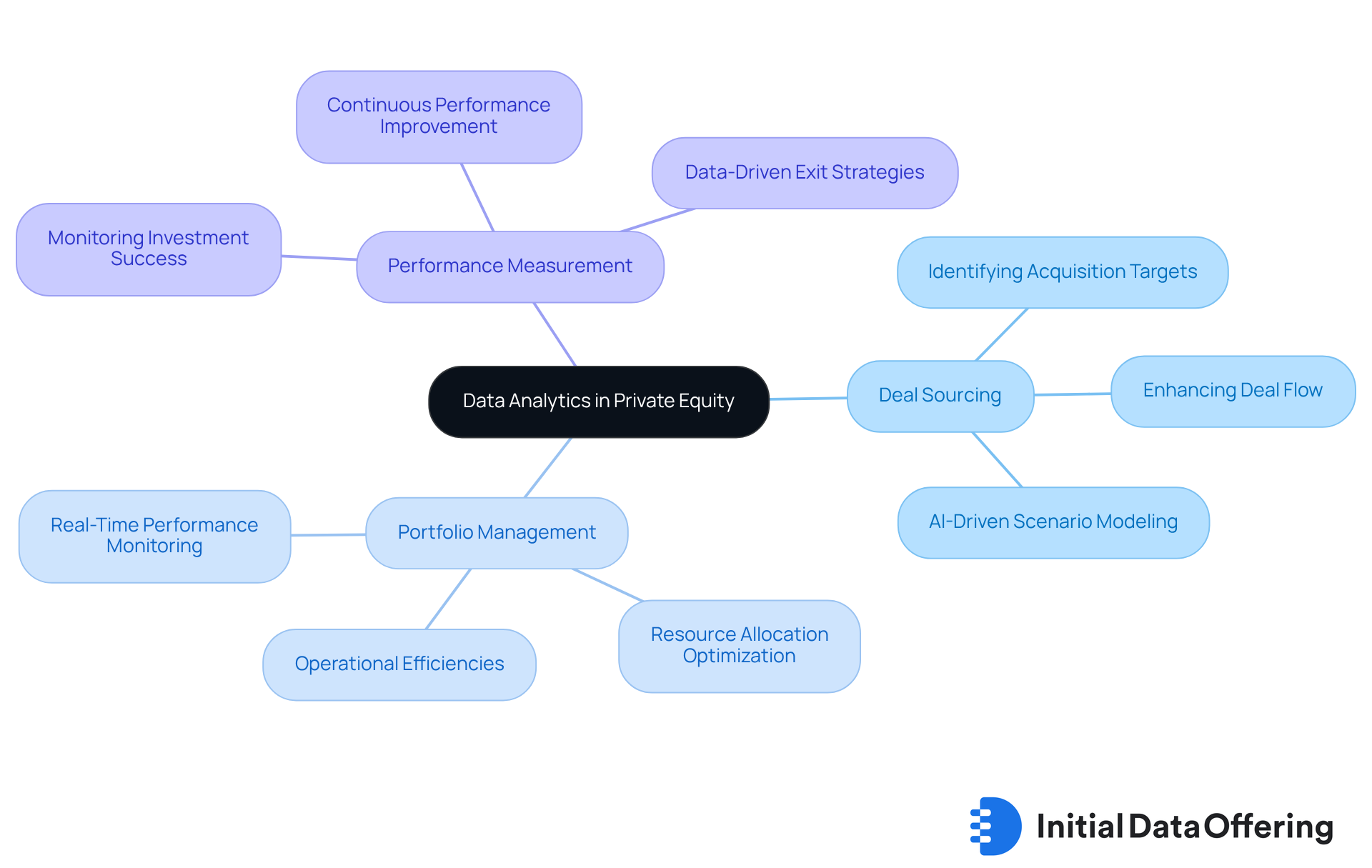

Key Use Cases: Practical Applications of Data Analytics in Private Equity

Private equity data analysis plays a crucial role in the industry, offering several practical applications such as deal sourcing, portfolio management, and performance measurement. What if you could identify potential acquisition targets with precision? By examining market trends and competitor performance, companies can leverage data analysis to pinpoint these opportunities effectively.

In terms of portfolio management, analytics provide valuable insights into operational efficiencies and financial health. This empowers companies to make informed, data-driven decisions regarding resource allocation. Imagine the impact of optimizing your resources based on solid data!

Moreover, performance measurement tools enable firms to monitor the success of their investments over time. This ongoing assessment facilitates continuous improvement in strategies, ensuring that companies remain competitive and responsive to market changes. How can your organization benefit from such insights? By integrating private equity data analysis into their operations, firms can enhance their decision-making processes and drive better outcomes.

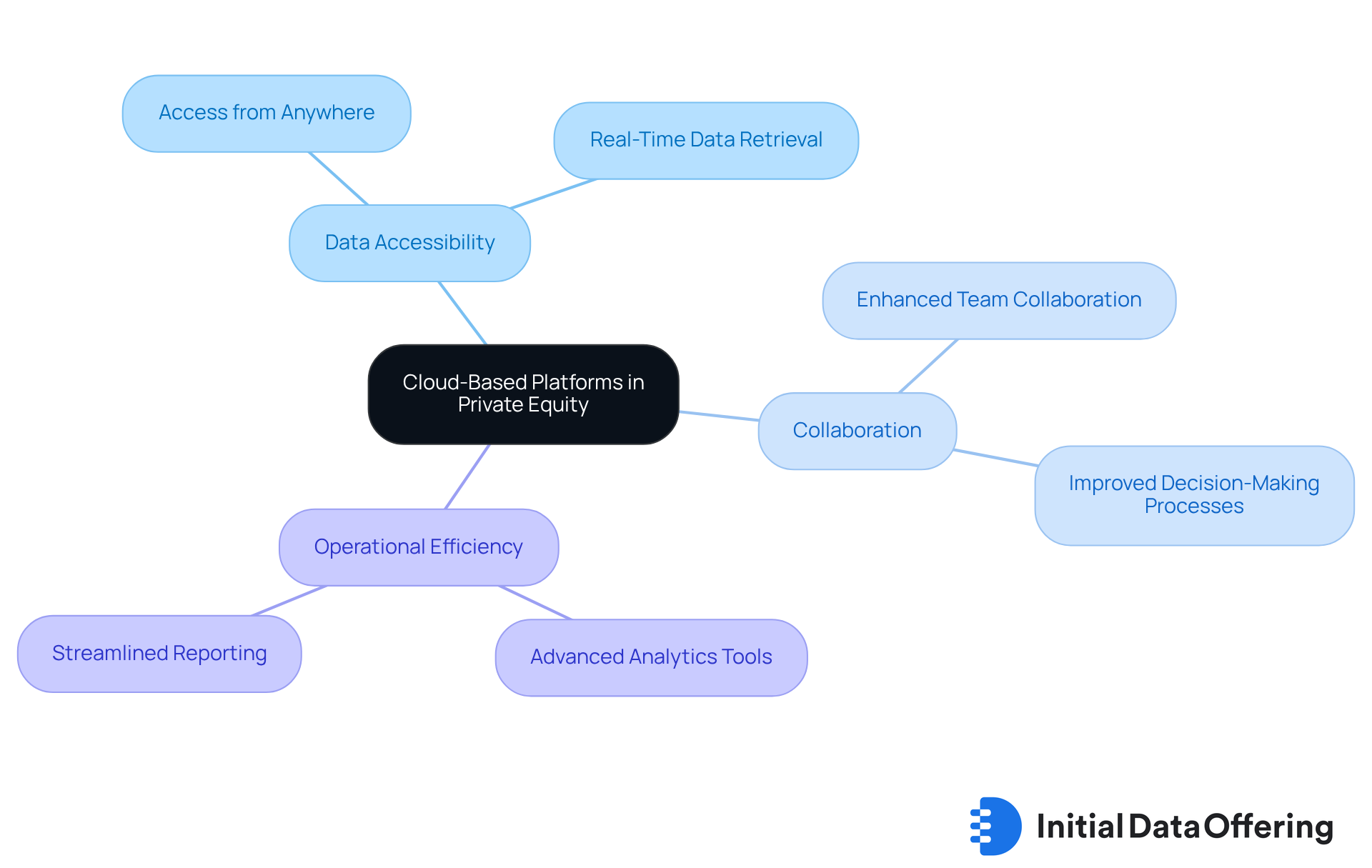

Cloud-Based Platforms: Enhance Data Accessibility and Collaboration in Private Equity

Cloud-based platforms are revolutionizing how private equity data is managed and analyzed by companies. These platforms enhance information accessibility, allowing team members to retrieve essential details from anywhere at any time. This flexibility not only fosters collaboration among investment teams but also enables them to work together more effectively on projects and decision-making processes.

Moreover, cloud platforms often come equipped with advanced analytics tools that streamline the analysis and reporting of private equity data. This capability significantly enhances operational efficiency, allowing firms to make informed decisions quickly. As private equity firms continue to embrace digital transformation, the benefits of cloud-based solutions become increasingly clear. They are not just tools; they are pivotal to the success of these firms in a competitive landscape.

How can your firm leverage cloud technology to improve collaboration and efficiency? Consider the potential of these platforms to transform your operations and drive success.

Conclusion

The integration of private equity data analytics is reshaping investment strategies, providing firms with essential tools to make informed decisions in a complex financial landscape. By harnessing diverse datasets, predictive analytics, and advanced technologies, private equity firms can navigate market dynamics with enhanced confidence and agility. This evolution highlights the critical role that data plays in driving superior investment outcomes and fostering a culture of data-driven decision-making.

Key insights have emerged throughout this discussion, emphasizing the importance of streamlined data access through platforms like the Initial Data Offering. The transformative power of machine learning in due diligence cannot be overlooked, nor can the necessity of real-time risk management. Furthermore, the focus on data transparency and automation illustrates how these elements contribute to operational efficiency and competitive advantage. By overcoming common challenges in data adoption, private equity firms can unlock significant value and improve their investment performance.

As the private equity landscape continues to evolve, embracing these data-driven strategies is essential for long-term success. Firms should explore innovative technologies and methodologies to remain at the forefront of industry advancements. By prioritizing data analytics, private equity companies can enhance their decision-making processes and position themselves for sustained growth and resilience in an ever-changing market.

How can your firm leverage these insights to improve its investment strategies?

Frequently Asked Questions

What is the Initial Data Offering (IDO) and its purpose?

The IDO is a centralized hub for private equity firms that provides access to a diverse range of private equity data, including alternative information, fundamental data, and ESG insights. Its purpose is to streamline access to reliable data, improving financial decision-making processes for investors.

How does IDO enhance financial decision-making?

By providing streamlined access to diverse datasets, IDO allows investors to gain deeper insights into market dynamics, which significantly enhances their ability to make informed financial decisions.

What role does AI play in the IDO?

AI-powered solutions incorporated into the IDO enhance its offerings by facilitating sophisticated analyses and insights that align with current market trends, empowering informed decision-making.

How does machine learning improve due diligence processes?

Machine learning algorithms analyze extensive datasets to uncover patterns and trends, enabling firms to assess potential opportunities with greater accuracy and speed, thus enhancing the due diligence process.

What is the benefit of using predictive analytics in financial decision-making?

Predictive analytics allows firms to utilize historical data to forecast future performance, leading to a 30% reduction in forecasting errors compared to traditional methods and resulting in more informed financial decisions.

What impact does AI have on shareholder returns in private equity?

Research shows that 80% of acquirers using AI achieve superior returns, with revenue growth from AI-enabled transactions averaging 1.5 times higher than traditional deals.

How does real-time data analysis assist in risk management for private equity companies?

Real-time data analysis allows firms to maintain continuous oversight of their investments, enabling proactive risk management by identifying anomalies and potential risks as they arise.

What are the advantages of a proactive risk management strategy?

A proactive strategy reduces risks and enhances the resilience of the asset portfolio, allowing companies to adapt quickly to market fluctuations and safeguard their resources against unforeseen challenges.

How can organizations leverage real-time data analysis to improve investment strategies?

By embracing advanced tools for real-time data analysis, firms can navigate risks more effectively and position themselves for sustained success in a dynamic market.