10 Key Technology Trends in the Insurance Industry You Must Know

10 Key Technology Trends in the Insurance Industry You Must Know

Introduction

The insurance industry is experiencing a significant transformation as technology reshapes its landscape. Innovations such as artificial intelligence and cloud computing are not merely trends; they signify a fundamental shift in how insurers operate and interact with clients. This article delves into ten key technology trends that are redefining the insurance sector, emphasizing their features, advantages, and the benefits they offer for enhanced efficiency, improved customer experiences, and strategic decision-making.

As these advancements unfold, insurance professionals must consider: how can they leverage these technologies to navigate the complexities of a rapidly evolving market? By understanding these trends, insurers can position themselves to capitalize on new opportunities and address emerging challenges effectively.

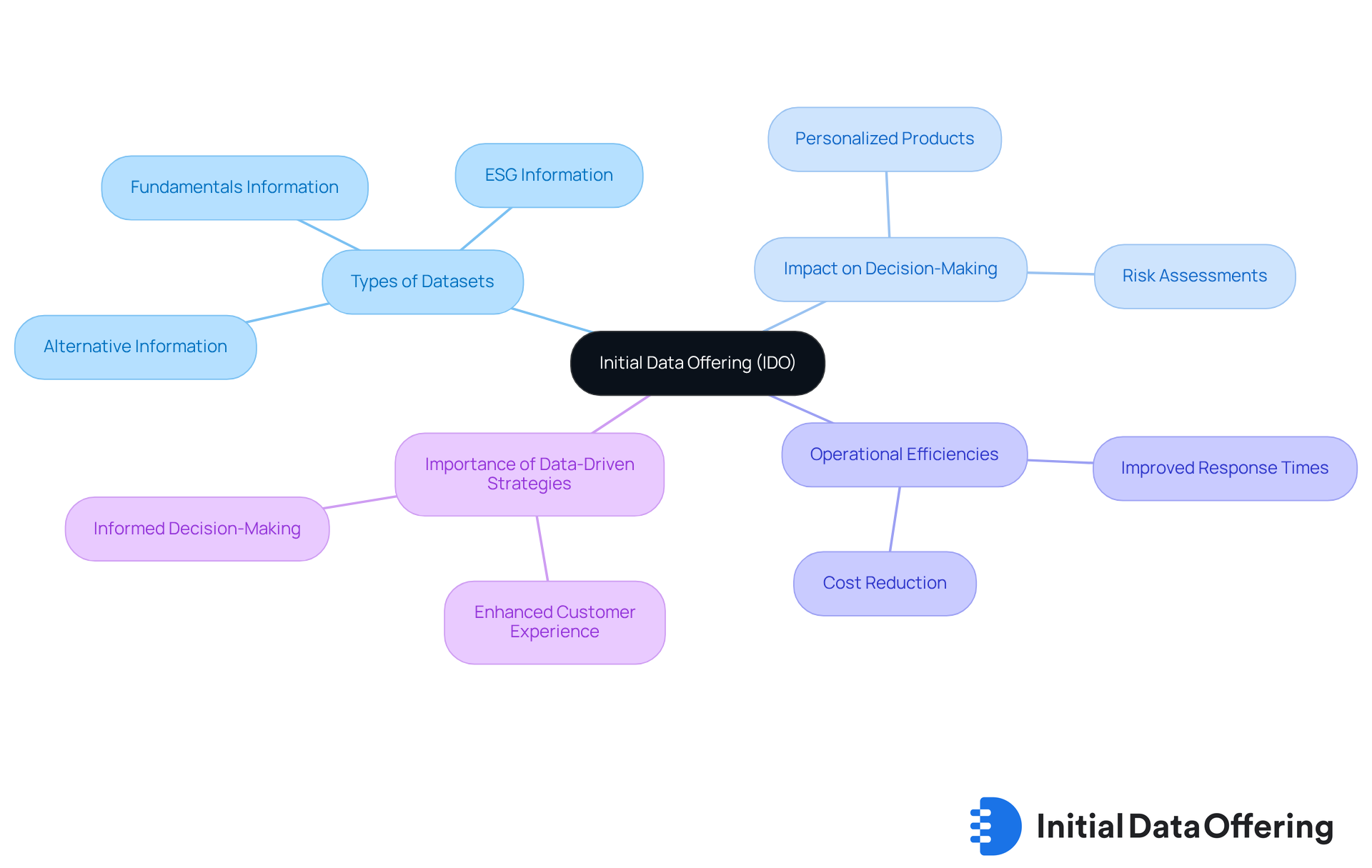

Initial Data Offering: Streamlining Data Access for Insurance Insights

Initial Data Offering (IDO) serves as a pivotal tool in transforming the insurance sector by simplifying the launch and discovery of datasets that are essential for informed decision-making.

- As a centralized hub for information exchange, IDO enhances accessibility to a diverse range of datasets, including alternative information, ESG information, and fundamentals information. This streamlined access empowers professionals to leverage the latest market trends and consumer behaviors, ultimately leading to improved outcomes in underwriting, claims processing, and risk assessment.

The impact of centralized data platforms on insurance decision-making is profound.

- Agencies that utilize these platforms can swiftly analyze technology trends in the insurance industry and customer preferences, enabling them to design personalized products that meet evolving market demands.

- For example, the integration of imagery and geospatial intelligence technologies allows insurers to conduct comprehensive risk assessments, enhancing their ability to price policies accurately and manage claims effectively.

Successful implementations of centralized information hubs have demonstrated significant operational efficiencies.

- By eliminating manual information retrieval processes, agencies can reduce costs and improve response times, which ultimately enhances customer service.

- Regular evaluations of information quality are essential to ensure accuracy and consistency, critical for generating reliable analytics and reports.

Citations from industry leaders underscore the significance of centralized information hubs for professionals in the sector.

- As specialists indicate, a data-driven strategy is vital for navigating the complexities of the coverage sector, especially in light of the technology trends in the insurance industry, enabling agencies to make informed choices based on a comprehensive perspective of their operations.

IDO enhances data accessibility for professionals in the field by providing a user-friendly platform that aggregates diverse datasets.

- This capability not only supports informed decision-making but also fosters a collaborative environment where data-driven insights can thrive, ultimately driving innovation and strategic planning across the industry.

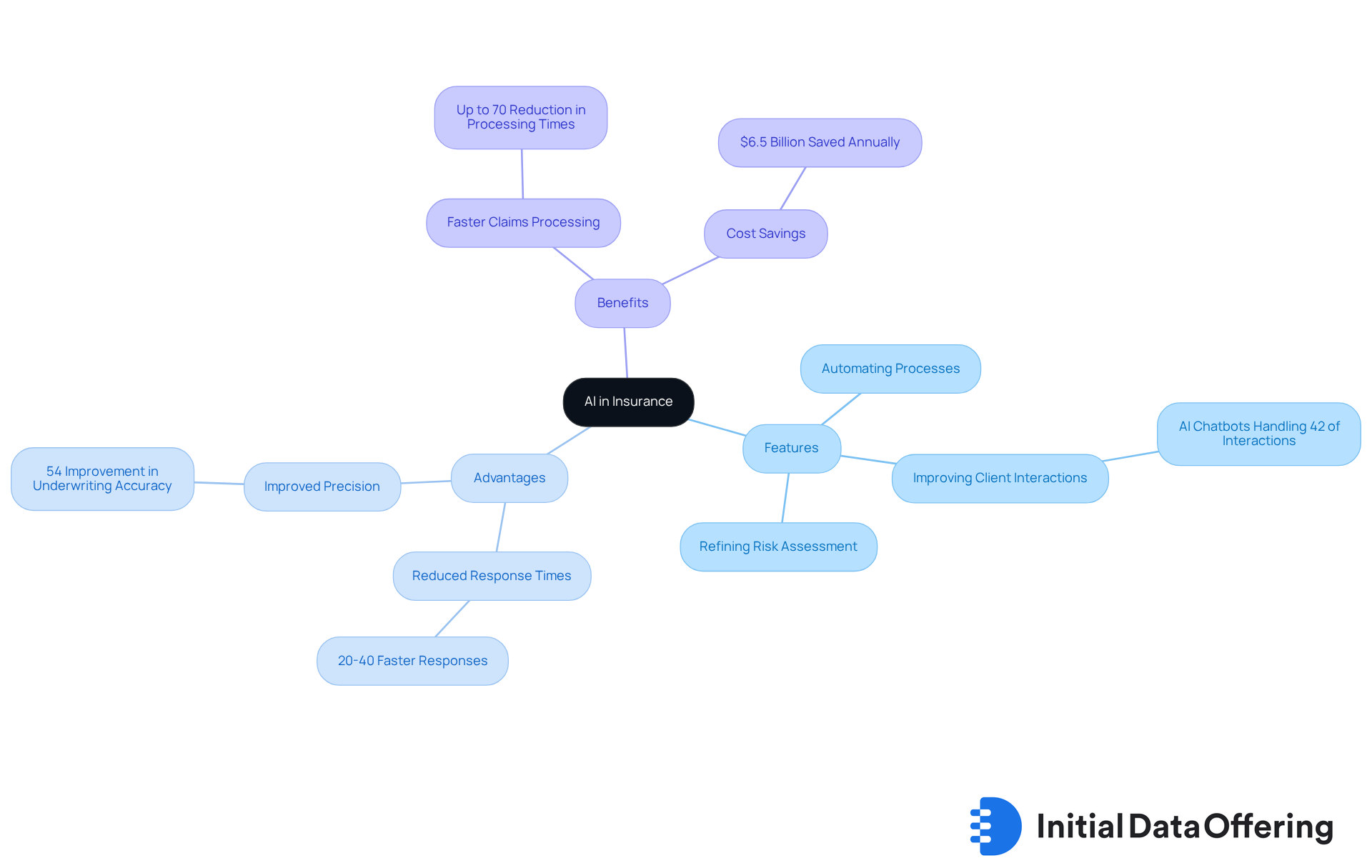

Artificial Intelligence: Transforming Operations and Customer Experience

Artificial Intelligence (AI) is fundamentally transforming the technology trends in the insurance industry. By automating processes, improving client interactions, and refining risk assessment, AI-driven tools are reshaping how insurers operate amid the technology trends in the insurance industry.

Features: AI tools enable insurance companies to rapidly examine large datasets. This capability leads to more accurate underwriting and personalized client experiences. For instance, AI chatbots and virtual assistants now handle 42% of customer service interactions.

Advantages: This automation significantly reduces response times by 20-40%, while also enhancing service quality. Moreover, the technology trends in the insurance industry, such as machine learning applications in underwriting, have improved precision by 54%. This allows companies to make data-driven decisions that bolster risk management.

Benefits: The integration of AI in claims processing has been revolutionary. Automation has cut processing times by up to 70%, saving insurers an estimated $6.5 billion annually. These advancements not only streamline operations but also significantly enhance the overall client experience.

As AI continues to evolve, it positions itself as a vital element in the technology trends in the insurance industry. Initiatives like the Zurich AI Lab exemplify how companies are actively pursuing AI integration to redefine business models and enhance customer experiences. How might these developments impact your approach to insurance? Consider the potential for AI to transform your operations and client interactions.

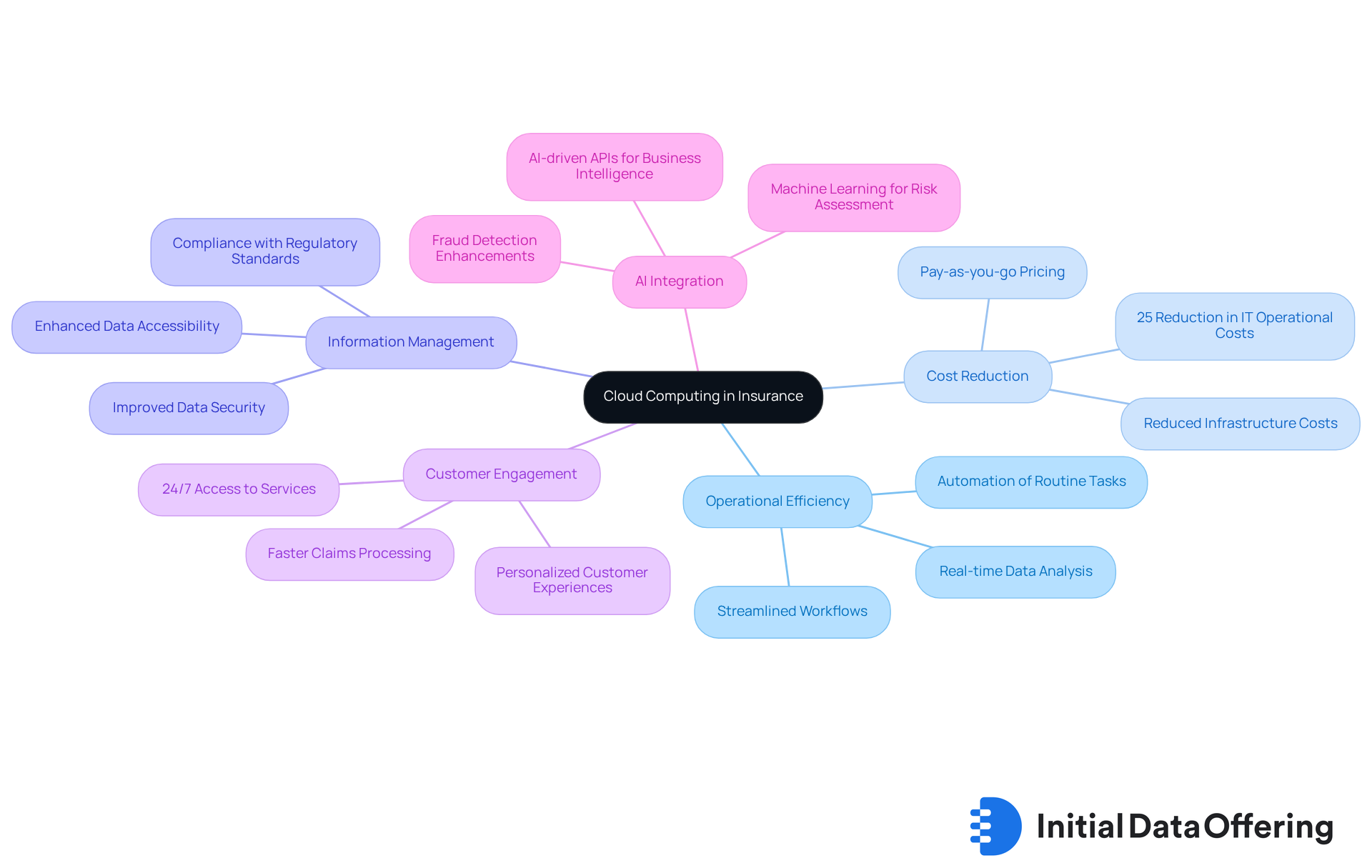

Cloud Computing: Enabling Scalable Solutions for Insurance Providers

Cloud computing is one of the technology trends in the insurance industry, offering scalable solutions that significantly enhance operational efficiency and information management. By transitioning to cloud-based systems, these companies can reduce infrastructure costs, improve information accessibility, and ensure compliance with regulatory standards. This technology facilitates real-time data analysis and fosters collaboration among teams, enabling providers to swiftly adapt to market changes and evolving client needs.

Insurers leveraging cloud solutions can automate routine tasks, streamline workflows, and elevate customer service. This ultimately leads to higher satisfaction and retention rates. Notably, the integration of AI-driven APIs, such as those from SavvyIQ, empowers insurance providers to harness advanced entity resolution and business intelligence. This further enhances their operational capabilities and decision-making processes.

How can your organization benefit from these advancements? Consider the potential for improved efficiency and customer engagement through cloud computing. By embracing these technologies, insurance companies can not only keep pace with technology trends in the insurance industry but also position themselves for future growth.

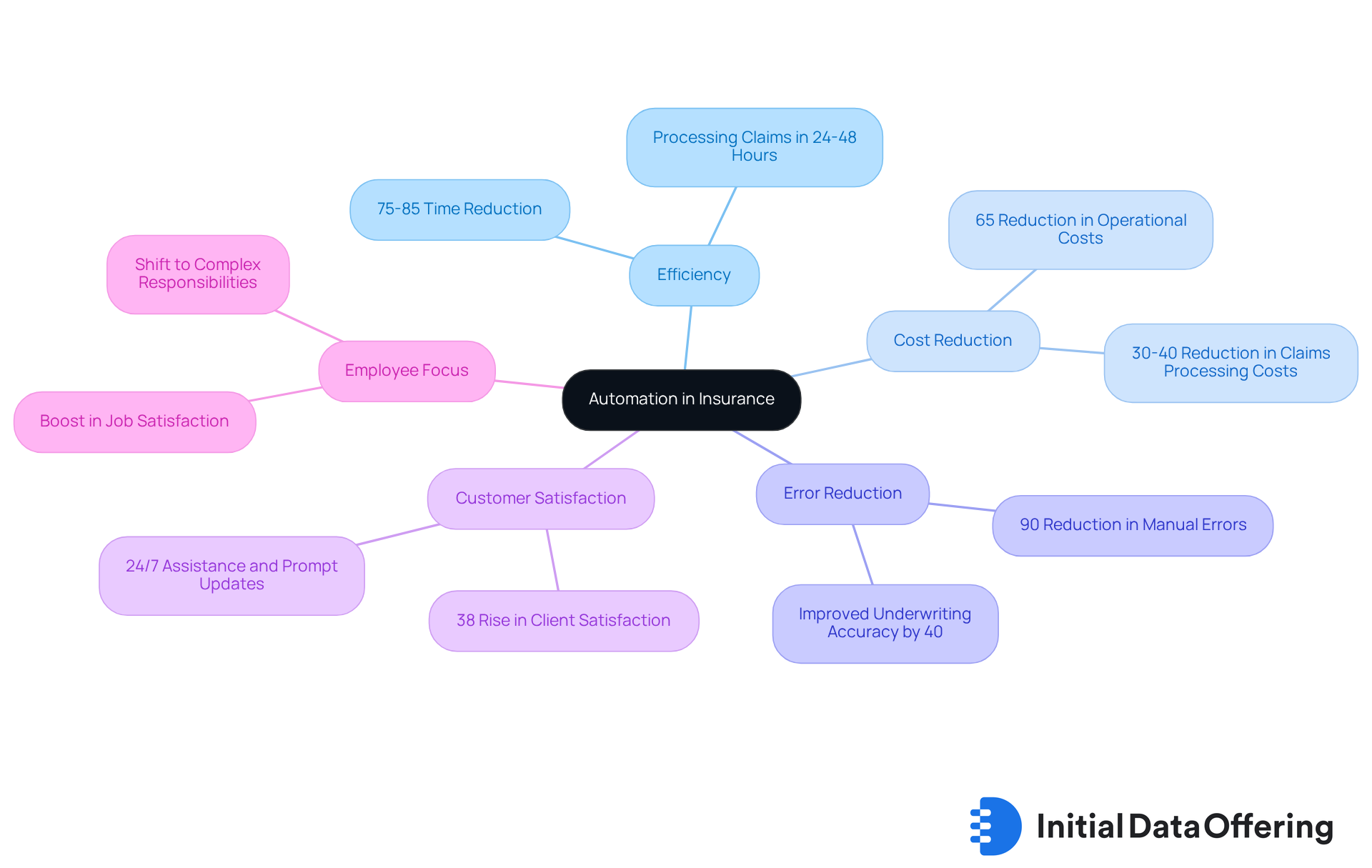

Automation: Enhancing Efficiency and Operational Excellence

Automation technologies are transforming the insurance landscape by streamlining repetitive tasks such as claims processing and policy management. One notable feature is the adoption of robotic process automation (RPA), which enables insurers to reduce processing times from 7-10 days to just 24-48 hours. This results in a remarkable 75-85% reduction in time spent on these tasks. The advantage of this significant decrease is not only enhanced operational efficiency but also a reduction in manual errors by up to 90%. This leads to improved accuracy and reliability in data management, which is crucial for insurers.

With RPA, employees can shift their focus from mundane tasks to more complex responsibilities that require human judgment. This shift ultimately boosts job satisfaction and productivity. Insurers that implement workflow automation report an average of 65% reduction in total operational costs. This allows them to allocate resources more strategically, enhancing their overall business performance.

Furthermore, the incorporation of RPA in claims processing has led to a 38% rise in client satisfaction. Users benefit from prompt updates and 24/7 assistance, which are essential in today’s fast-paced environment. Companies like Geico and State Farm have successfully integrated AI-powered chatbots alongside RPA, enhancing customer interactions and ensuring that routine inquiries are handled efficiently. As Brian Carey, VP of Insurance Solutions Engineering, aptly states, "Automation is no longer a future trend; it is a present-day necessity for insurers looking to remain agile and competitive."

As the sector continues to embrace automation, the focus on enhancing claims processing and policy management through RPA will remain a key aspect of the technology trends in the insurance industry. This ongoing evolution drives innovation and operational excellence across the field, prompting insurers to consider how these advancements can be leveraged in their own operations.

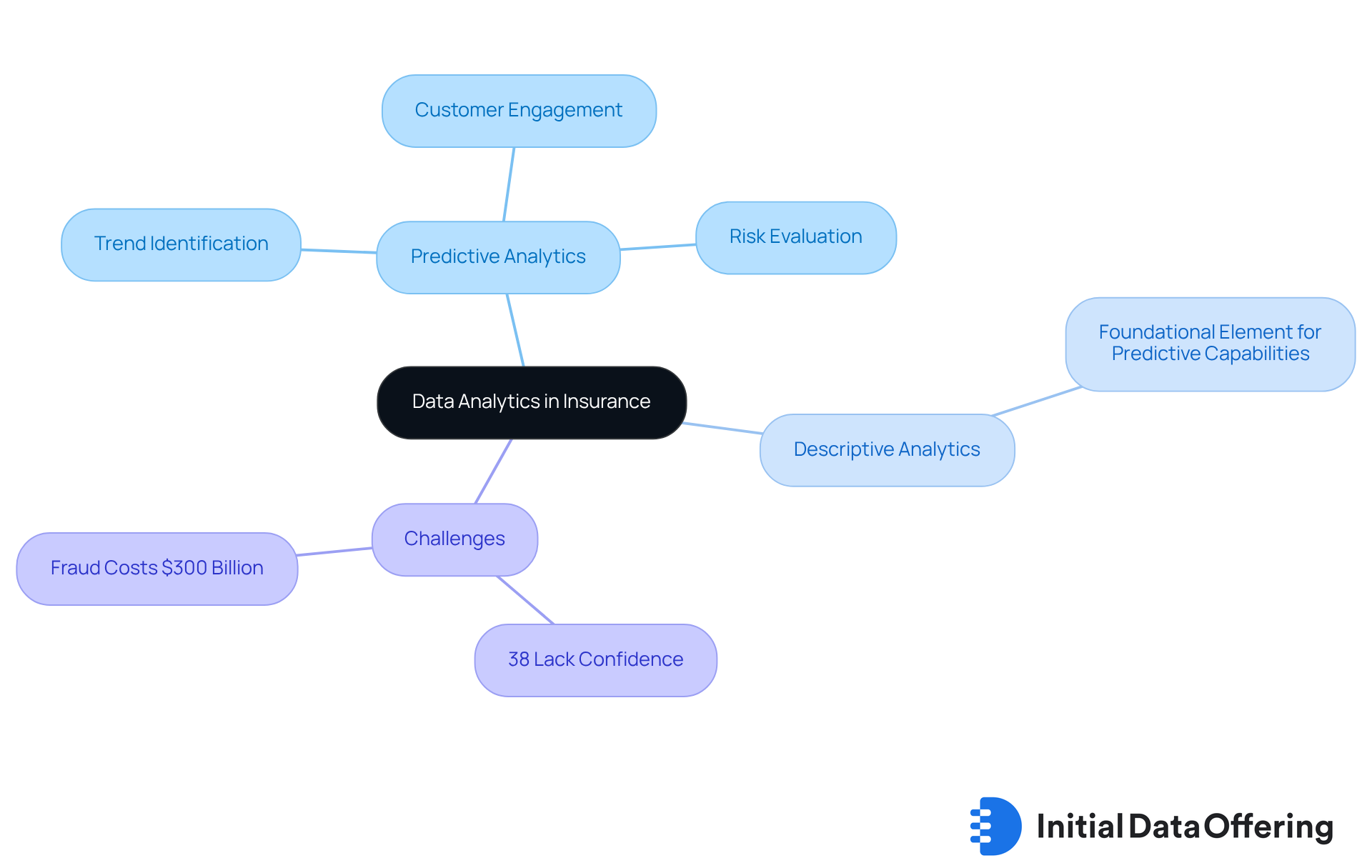

Data Analytics: Leveraging Insights for Strategic Decision-Making

Data analytics is transforming the insurance sector by allowing companies to extract actionable insights from vast datasets. Predictive analytics stands out as a crucial feature, enabling the identification of trends and risk evaluation. This capability allows companies to customize products that align with client needs, enhancing underwriting accuracy and fostering improved customer engagement. The benefits are clear: better engagement leads to superior business outcomes.

For example, the integration of advanced analytics tools, such as those in the Equisoft/amplify suite, significantly reduces the risk of fraud, which costs the industry over $300 billion annually. Case studies further illustrate that insurers leveraging predictive analytics can personalize experiences and retain valuable clients by accurately assessing individual profiles based on driving habits and claims history. How might your organization benefit from such tailored approaches?

However, a survey reveals that 38% of industry leaders lack confidence in their organization's comprehensive, real-time view of risks, revenue, and costs. This highlights ongoing challenges in the sector. As the industry continues to adopt technology trends in the insurance industry, the ability to make informed choices based on real-time information will be essential for maintaining a competitive edge.

Descriptive analytics serves as a foundational element for these predictive capabilities, further enhancing the strategic decision-making process. By understanding the features and advantages of these analytics, companies can better navigate the complexities of the insurance landscape.

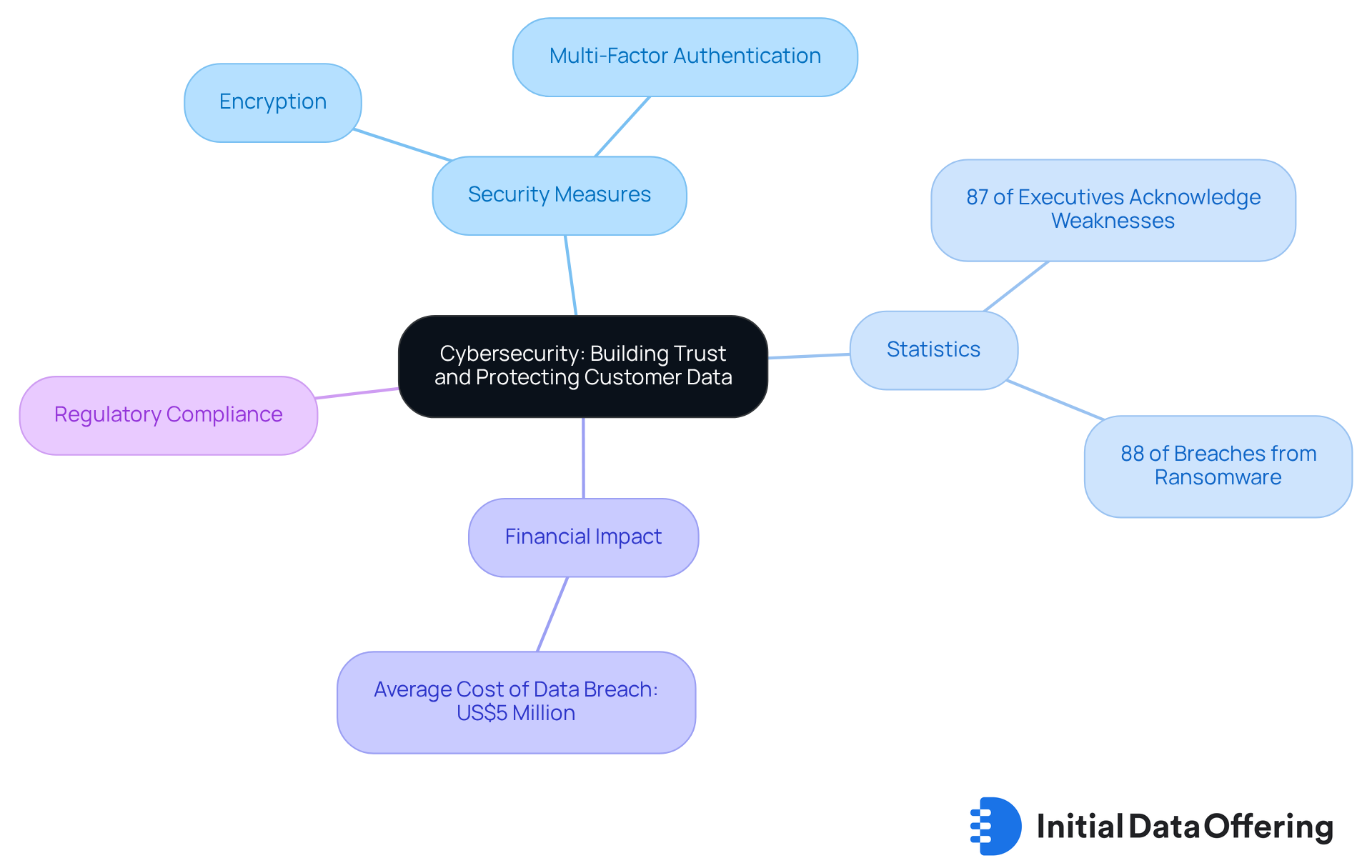

Cybersecurity: Building Trust and Protecting Customer Data

As cyber threats grow increasingly sophisticated, insurance firms must prioritize robust cybersecurity protocols to safeguard sensitive client information. Implementing advanced security measures, such as encryption and multi-factor authentication, is crucial for mitigating the risks associated with information breaches. A strong cybersecurity framework not only protects client data but also enhances trust among stakeholders. In fact, 87% of C-level executives acknowledge weaknesses in their organizations' protective measures.

Moreover, with ransomware accounting for 88% of breaches in small and medium-sized enterprises, the urgency for effective cybersecurity cannot be overstated. Compliance with evolving regulatory standards is vital for maintaining a reputable market presence. For example, Allianz Commercial has highlighted the significance of cyber insurance in fostering resilience amid rapid technological advancements, emphasizing that effective cybersecurity strategies can greatly enhance customer confidence.

Additionally, the average global cost of a data breach reached nearly US$5 million in 2024, underscoring the financial ramifications of insufficient security. By proactively addressing these challenges, providers can create a secure environment that not only reassures clients but also strengthens their competitive position in the market. How can your organization enhance its cybersecurity measures to protect against these growing threats?

Internet of Things: Revolutionizing Risk Assessment and Management

The Internet of Things (IoT) is transforming risk assessment and management in accordance with the technology trends in the insurance industry. Connected devices serve as a key feature, enabling insurers to gather real-time data on consumer behavior and environmental conditions. This capability offers significant advantages, such as:

- More accurate risk assessments

- The ability to implement proactive risk management strategies

As a result, insurers can expect decreased claims and improved client satisfaction.

How can this data-driven approach reshape your understanding of risk? By leveraging IoT, insurers not only enhance their operational efficiency but also align with technology trends in the insurance industry to foster stronger relationships with clients. The implications are clear: adopting technology trends in the insurance industry can lead to a more resilient and responsive insurance model.

In summary, the integration of IoT into insurance practices showcases the technology trends in the insurance industry, as it not only streamlines processes but also provides a competitive edge in a rapidly evolving market.

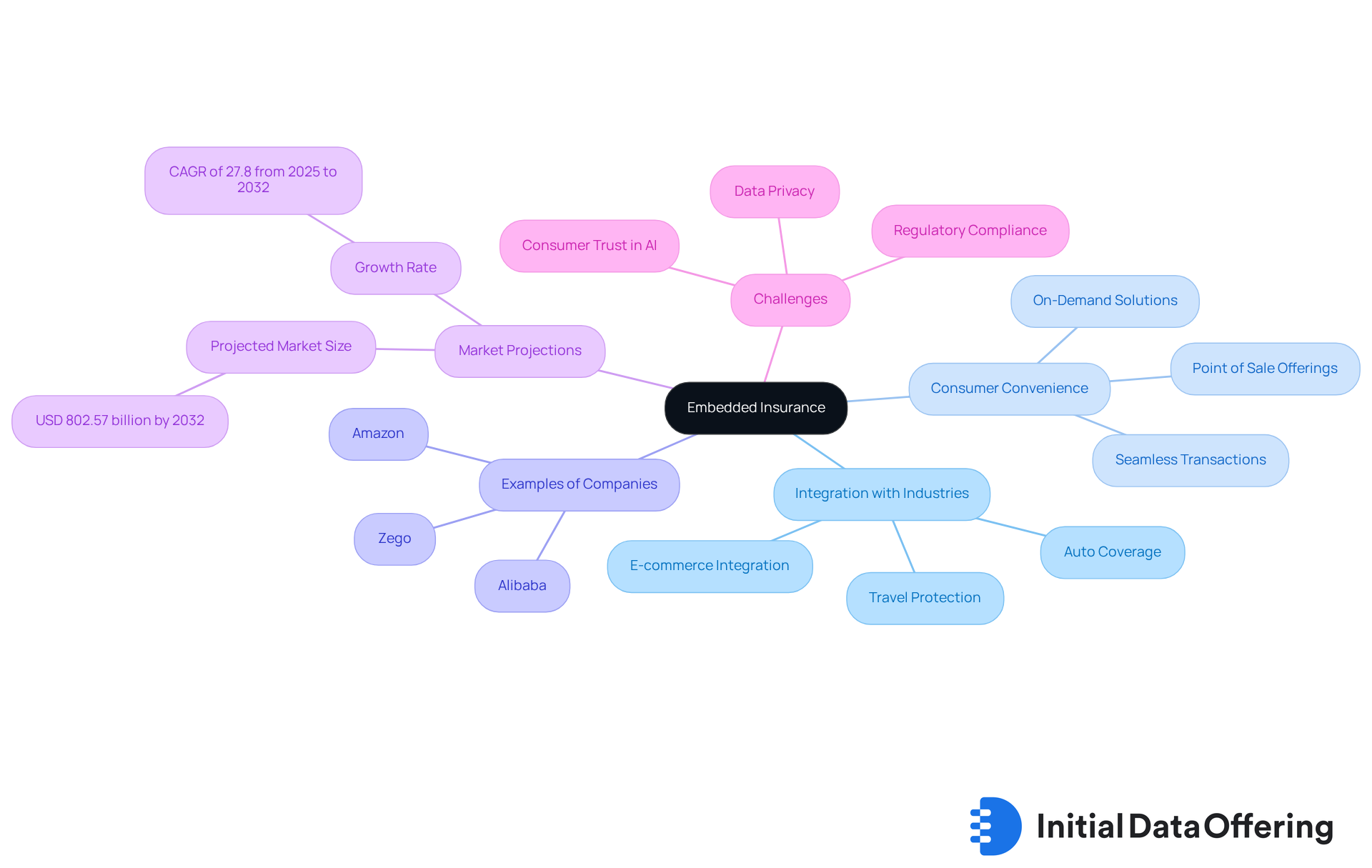

Embedded Insurance: Transforming Distribution Channels

Embedded coverage is rapidly transforming distribution channels by seamlessly integrating protection products into everyday transactions. This model allows insurers to collaborate with various industries, providing coverage options directly at the point of sale, which significantly enhances customer convenience. For example, travel protection can be offered during flight reservations, while auto coverage is available when purchasing a vehicle. Such integrations not only align with consumer purchasing behaviors but also increase the likelihood of policy acquisitions. A survey revealed that 31.6% of participants identified embedded coverage as the leading distribution model for future growth in personal lines.

Moreover, this innovative approach creates new revenue streams for insurers, enabling them to reach clients who may not actively seek coverage. Companies like Alibaba and Amazon have successfully embedded protection products into their offerings by integrating coverage options directly into their e-commerce platforms, making purchases easier for consumers. With the embedded coverage market projected to reach USD 802.57 billion by 2032, the demand for seamless digital experiences continues to rise. As consumers increasingly expect smooth transactions, the embedded protection model positions providers to meet these expectations effectively. This shift reflects the technology trends in the insurance industry, transforming how coverage is distributed and utilized in the digital age, while also addressing challenges such as data privacy and regulatory compliance.

Climate Risk Management: Adapting to Environmental Challenges

As climate change poses significant challenges, effective climate risk management has become essential for insurance companies. Insurers must develop comprehensive strategies to assess and mitigate climate-related risks, such as natural disasters and extreme weather events. By integrating climate risk evaluations into their underwriting processes, companies can enhance their ability to protect portfolios and ensure long-term sustainability. This proactive approach not only secures financial interests but also meets the increasing demand for accountability in addressing environmental, social, and governance (ESG) factors.

For instance, the Principles for Sustainable Insurance (PSI), endorsed by leading companies in the sector, underscore the necessity of evaluating climate-related risks to foster resilience within the industry. Recent statistics reveal that average insured losses have surged by 5.9% annually from 1994 to 2023, significantly outpacing the 2.7% growth of global GDP. This trend highlights the urgency of addressing these risks. As insurance providers adapt to these evolving challenges, they not only protect their operations but also contribute to broader initiatives aimed at building sustainable communities and economies.

Tobias Grimm, chief climate scientist at Munich Re, emphasizes that "it's all about the question of price," pointing to the critical role of risk-adequate premiums in climate risk management. How can your organization leverage this information to enhance its own risk management strategies? By understanding the implications of these statistics and trends, insurance companies can better position themselves to navigate the complexities of climate risk and contribute to a more sustainable future.

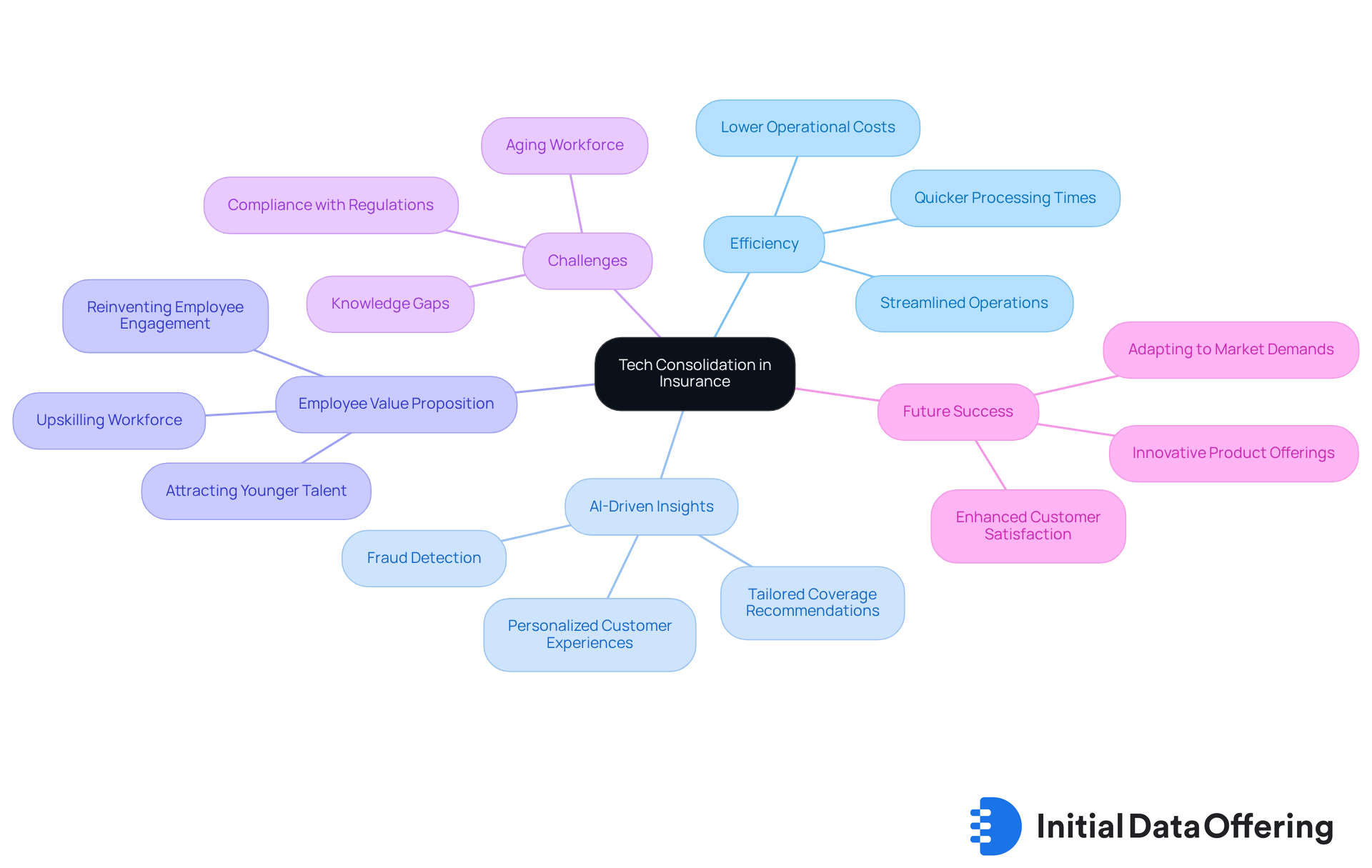

Tech Consolidation: Streamlining Operations for Better Service Delivery

Tech consolidation stands as a pivotal strategy for insurance companies, especially given the technology trends in the insurance industry, emphasizing the integration of diverse technological systems and platforms to streamline operations. This approach not only enhances efficiency but also improves data management and client service. By refining their technology framework to align with technology trends in the insurance industry, companies can lower operational costs and respond swiftly to market demands and evolving client needs.

As David Soto notes, 'AI-driven insights customize user experiences by analyzing behaviors, streamlining claims, and tailoring coverage recommendations.' This highlights a significant feature of tech consolidation: the ability to leverage AI for personalized service. Companies like Cigna exemplify this trend by linking frontline compensation to client experience metrics, which reinforces a culture of service excellence. This strategy is part of a broader movement, with 90% of insurance executives recognizing the urgency of reinventing the employee value proposition to boost customer engagement, especially considering the technology trends in the insurance industry.

Moreover, integrating technology systems in response to technology trends in the insurance industry allows providers to automate labor-intensive tasks, resulting in quicker processing times and improved service delivery. The benefits of these integrated systems are profound, as they empower insurers to enhance operational capabilities while adapting to technology trends in the insurance industry and fostering a more responsive and customer-centric approach. However, the industry faces challenges, such as an aging workforce and the pressing need for upskilling, which are crucial for understanding the broader context of technology integration.

How can your organization leverage these insights to improve efficiency and client satisfaction? By embracing tech consolidation, insurance companies can not only streamline their operations but also align themselves with technology trends in the insurance industry for future success in a rapidly changing market.

Conclusion

The insurance industry is experiencing a notable transformation, driven by key technology trends that are reshaping operations, customer experiences, and risk management strategies. Innovations such as Initial Data Offerings, Artificial Intelligence, and Cloud Computing are not just enhancing operational efficiencies; they are also improving the ability of insurance providers to meet evolving customer needs.

Throughout this article, we’ve explored various trends, including:

- The role of automation in streamlining processes

- The importance of data analytics for strategic decision-making

- The critical need for robust cybersecurity measures to protect sensitive information

Furthermore, the integration of the Internet of Things and the rise of embedded insurance are revolutionizing product distribution and risk assessment, ultimately leading to better customer engagement and satisfaction.

As the insurance landscape continues to evolve, it’s essential for organizations to remain agile and responsive to these technological advancements. By leveraging these trends, insurance companies can enhance their competitive edge, foster resilience against emerging challenges, and better serve their clients in an increasingly complex market. The time to adapt and innovate is now. Embracing these technology trends not only positions insurers for success but also contributes to a more sustainable and customer-centric industry.

Frequently Asked Questions

What is the Initial Data Offering (IDO) and its role in the insurance sector?

The Initial Data Offering (IDO) is a centralized hub that simplifies the launch and discovery of essential datasets for informed decision-making in the insurance sector. It enhances accessibility to various datasets, empowering professionals to leverage market trends and consumer behaviors for improved underwriting, claims processing, and risk assessment.

How does IDO impact decision-making in insurance?

IDO allows agencies to quickly analyze technology trends and customer preferences, enabling the design of personalized products that meet market demands. It facilitates comprehensive risk assessments through the integration of technologies like imagery and geospatial intelligence, improving policy pricing and claims management.

What operational efficiencies can be gained from using centralized information hubs?

Centralized information hubs eliminate manual information retrieval processes, which reduces costs and improves response times, ultimately enhancing customer service. Regular evaluations of information quality are crucial for maintaining accuracy and consistency in analytics and reports.

What is the significance of a data-driven strategy in the insurance sector?

A data-driven strategy is vital for navigating the complexities of the coverage sector. It allows agencies to make informed decisions based on a comprehensive understanding of their operations, particularly in light of ongoing technology trends in the insurance industry.

How is Artificial Intelligence (AI) transforming the insurance industry?

AI is transforming the insurance industry by automating processes, improving client interactions, and refining risk assessment. AI tools enable rapid examination of large datasets, leading to more accurate underwriting and personalized client experiences.

What are the advantages of using AI in insurance operations?

AI automation reduces response times by 20-40% and enhances service quality. Machine learning applications in underwriting have improved precision by 54%, allowing for better risk management and data-driven decision-making.

What benefits does AI bring to claims processing?

The integration of AI in claims processing has significantly reduced processing times by up to 70%, saving insurers an estimated $6.5 billion annually, while also enhancing the overall client experience.

How does cloud computing benefit insurance providers?

Cloud computing offers scalable solutions that enhance operational efficiency and information management. It reduces infrastructure costs, improves information accessibility, and facilitates real-time data analysis, allowing insurers to adapt quickly to market changes and client needs.

What role do AI-driven APIs play in insurance?

AI-driven APIs, such as those from SavvyIQ, enable insurance providers to utilize advanced entity resolution and business intelligence, enhancing their operational capabilities and decision-making processes.

How can insurance companies position themselves for future growth?

By embracing advancements in technologies like AI and cloud computing, insurance companies can improve efficiency and customer engagement, keeping pace with industry trends and positioning themselves for future growth.