10 Essential Insights on Reference Data for Market Analysts

10 Essential Insights on Reference Data for Market Analysts

Overview

The article titled "10 Essential Insights on Reference Data for Market Analysts" highlights the critical role of reference data in enhancing market analysis. Understanding and effectively managing reference data is essential for analysts, as it enables them to derive accurate insights and make informed decisions. This data supports the categorization and interpretation of various datasets, ultimately improving overall analytical quality.

What makes reference data so significant? Firstly, it provides a structured framework that allows analysts to organize and interpret information efficiently. This organization leads to enhanced accuracy in analysis, which is crucial for making strategic decisions. By leveraging reference data, analysts can identify trends and patterns that may otherwise go unnoticed.

In conclusion, the effective management of reference data not only elevates the quality of market analysis but also empowers analysts to make data-driven decisions with confidence. As the market continues to evolve, the ability to harness reference data will be a key differentiator for successful analysts.

Introduction

In a world where data drives decision-making, the significance of reference data for market analysts is paramount. As the landscape of information evolves, grasping the intricacies of reference data becomes essential for deriving actionable insights and making informed choices. What challenges do analysts encounter in this complex terrain? How can they leverage high-quality reference data to enhance their analytical capabilities? This article explores ten critical insights designed to empower market researchers to fully harness the potential of reference data, ensuring they maintain a competitive edge in their field.

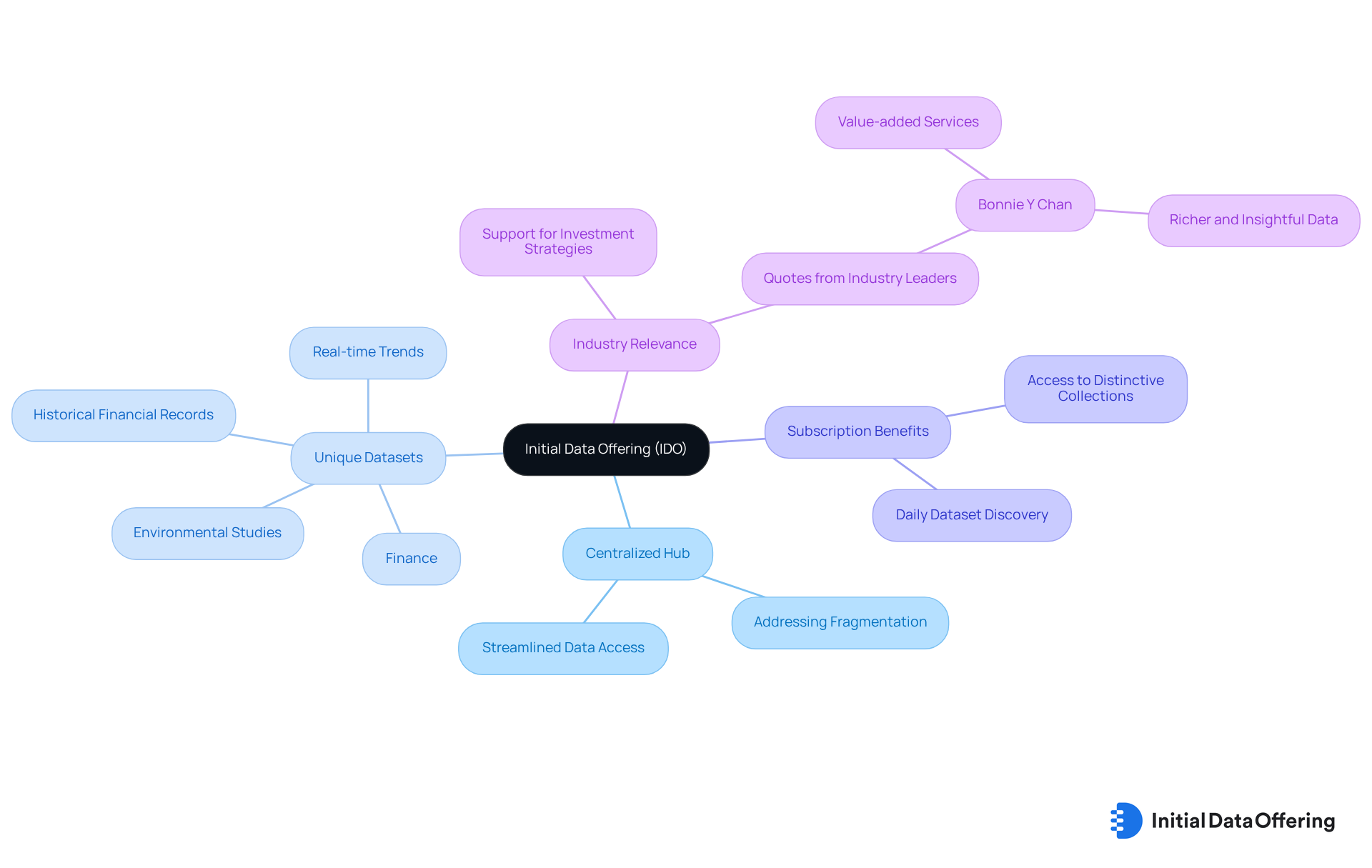

Initial Data Offering: Access High-Quality Reference Data for Analysis

The Initial Data Offering (IDO) serves as a centralized hub for market researchers in search of high-quality reference data. By curating unique datasets across various fields, including finance and environmental studies, IDO ensures that analysts have access to the most relevant and actionable insights. This platform streamlines the process of finding datasets while addressing the challenge of a fragmented marketplace, ultimately enhancing the quality of information available for analysis. As a result, IDO emerges as a vital asset for research professionals, empowering them to make informed decisions based on reliable information.

To further enrich their research, professionals can subscribe to the Initial Data Offering for premium access, which allows them to discover new datasets daily. This subscription provides insights into distinctive collections of information, such as real-time trends in commerce, historical financial records, and evaluations of environmental impacts. Such offerings ensure that users remain updated on the latest high-quality datasets available. The growing demand for high-quality reference data reflects a broader trend in the sector, where researchers increasingly rely on centralized information hubs to inform their evaluations. Industry leaders, including Bonnie Y Chan, emphasize the importance of these platforms in delivering comprehensive and insightful information that supports investment strategies. As the industry evolves, IDO is well-positioned to meet the rising demands of research professionals, fostering innovation and strategic planning across various sectors.

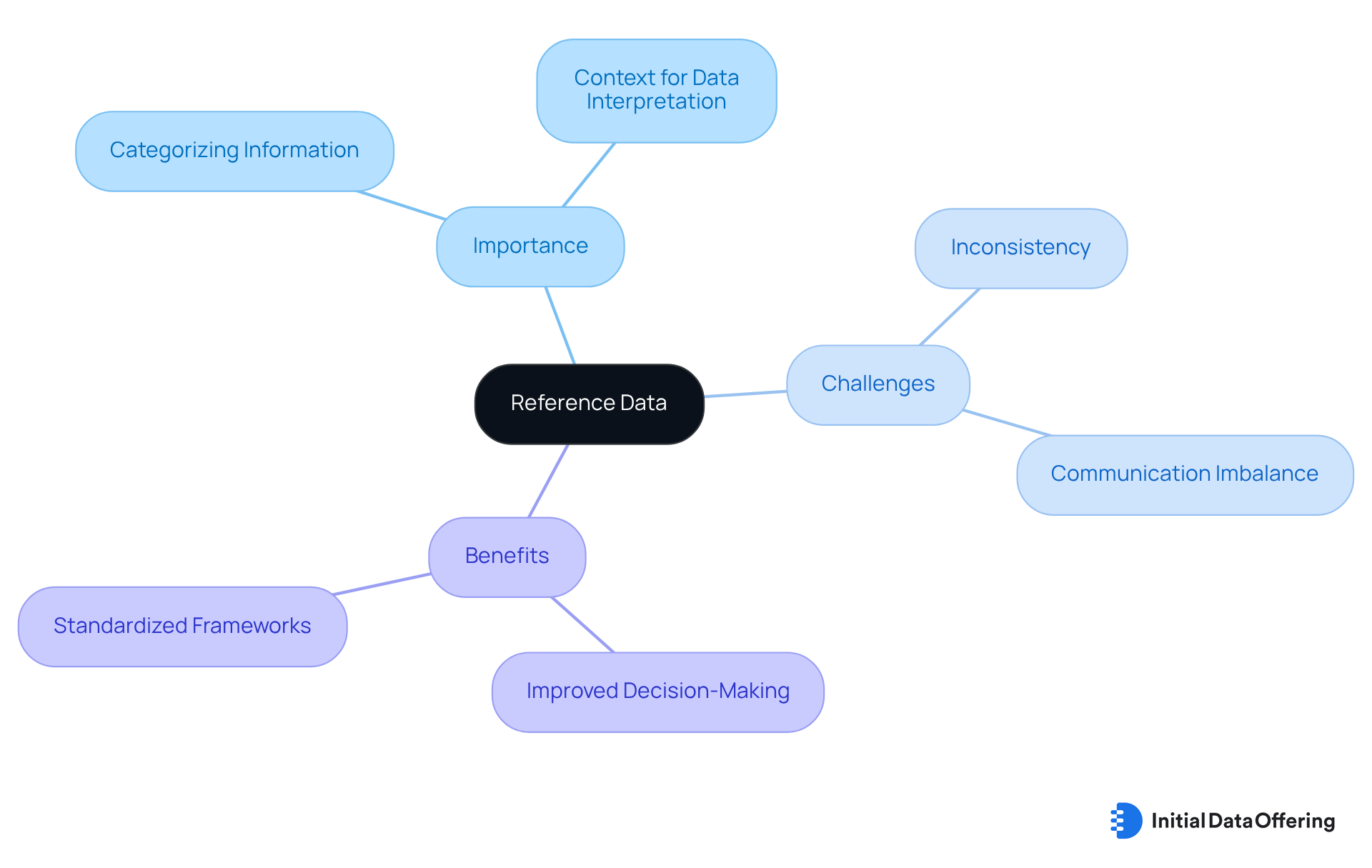

Definition of Reference Data: Key Concepts Every Analyst Must Understand

Reference data serves as the backbone for categorizing and defining various types, including features such as product codes, geographic locations, and customer classifications. For market evaluators, a thorough comprehension of this source information is essential; it provides the necessary context to accurately interpret transactional data. This foundational knowledge not only empowers analysts to derive meaningful insights from their datasets but also significantly enhances the overall quality of their analyses.

Statistics indicate that 20-50% of database tables contain related information that may become inconsistent across applications. This underscores the importance of maintaining precise related information for trustworthy analysis. As the financial services sector increasingly recognizes the significance of data, the role of Chief Data Officers (CDOs) is evolving to focus on standardizing source material, thereby improving operational effectiveness and reducing costs. A Chief Information Officer from a tier-one bank noted that when there is an imbalance in communication between the information organization and the business, it leads to challenges, highlighting the necessity for effective information management practices.

Efficient classification using source information can lead to improved decision-making and strategic planning. For instance, organizations that successfully establish standardized informational frameworks can mitigate the risks associated with fragmented management, which often results in high fixed costs and operational difficulties. By prioritizing the understanding and utilization of source information, industry evaluators can enhance their analytical capabilities and contribute to achieving better-informed business outcomes.

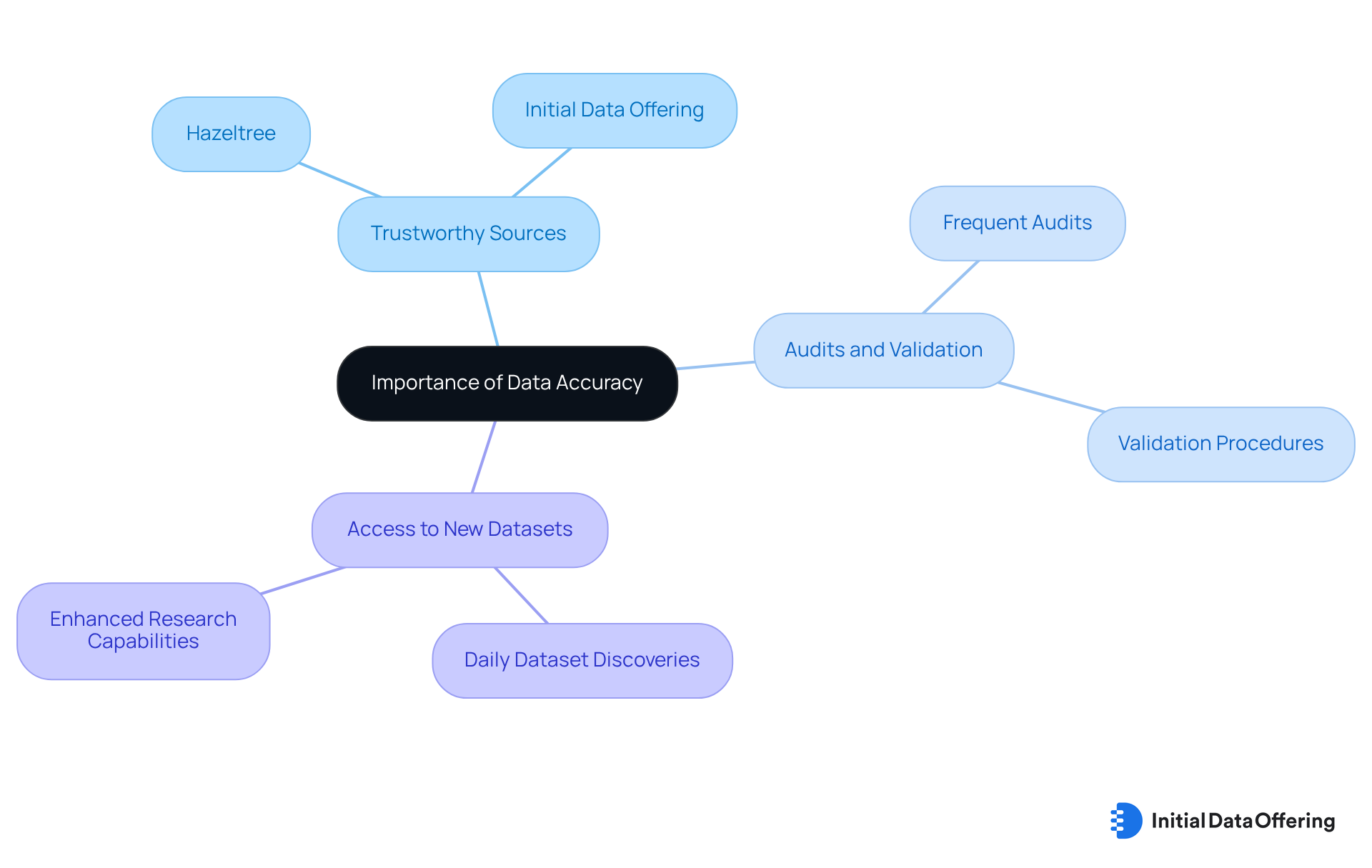

Importance of Data Accuracy: Ensuring Reliable Insights from Reference Data

Data accuracy is crucial for market researchers; even minor discrepancies can lead to significant misinterpretations of market trends. Analysts must ensure that the reference data they utilize is current and sourced from trustworthy providers like Hazeltree. Hazeltree offers comprehensive global insights on equity crowding and fund positions, featuring their Long and Short Equity Positioning Insights, which encompass 15,000 equities and provide historical information dating back to February 2017. This ensures that researchers have access to the most pertinent information available.

Frequent audits and validation procedures are essential in preserving information integrity. These practices ultimately result in more dependable insights and improved decision-making. Additionally, subscribing to platforms like Initial Data Offering allows analysts to discover new datasets daily. This enhances their research capabilities and keeps them informed of the latest market trends. How could access to these datasets transform your research? Subscribe now to gain premium access and stay updated.

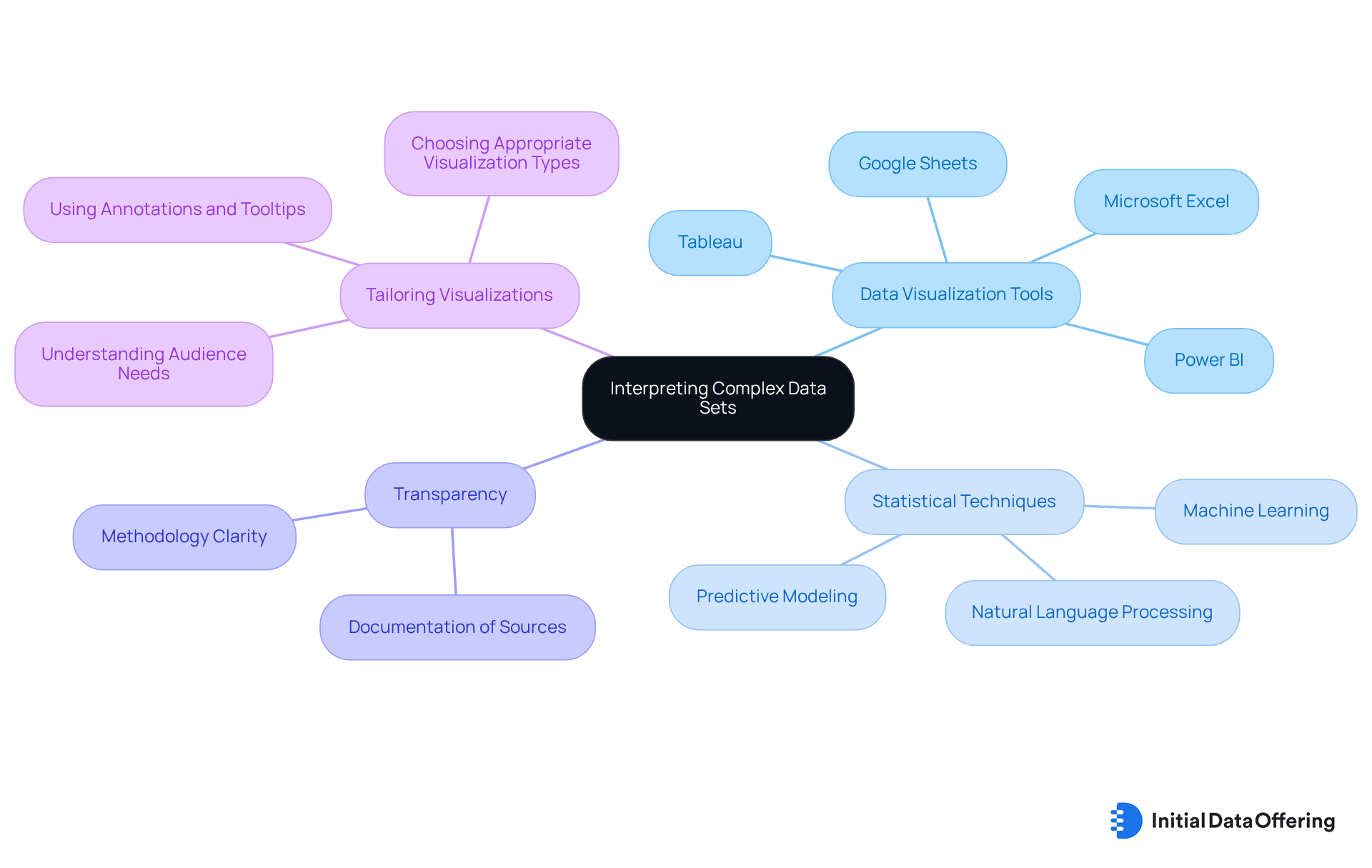

Interpreting Complex Data Sets: Strategies for Market Research Analysts

Interpreting complex datasets necessitates a structured methodology. Analysts should begin by dividing the information into manageable sections, focusing on key variables and their interconnections. This foundational step enables a clearer comprehension of the information landscape.

The use of data visualization tools is crucial; they transform intricate data into visual formats that effectively reveal patterns and trends. Research indicates that visual information can be processed 60,000 times faster than text, underscoring the importance of effective visualizations in market analysis.

Furthermore, incorporating statistical techniques enriches the depth of insights, allowing professionals to extract actionable recommendations from their findings. Tools such as Tableau and Power BI are particularly effective in this regard, facilitating the creation of compelling visual narratives that support informed decision-making. Basic tools like Microsoft Excel and Google Sheets are also commonly used for visualizations, providing analysts with a range of options.

Ensuring transparency about information sources and methodologies fosters trust with stakeholders, while clear documentation on collection and analysis aids the audience in understanding the context of the information. Finally, tailoring visualizations to meet the needs of different viewers is essential for effectively communicating insights.

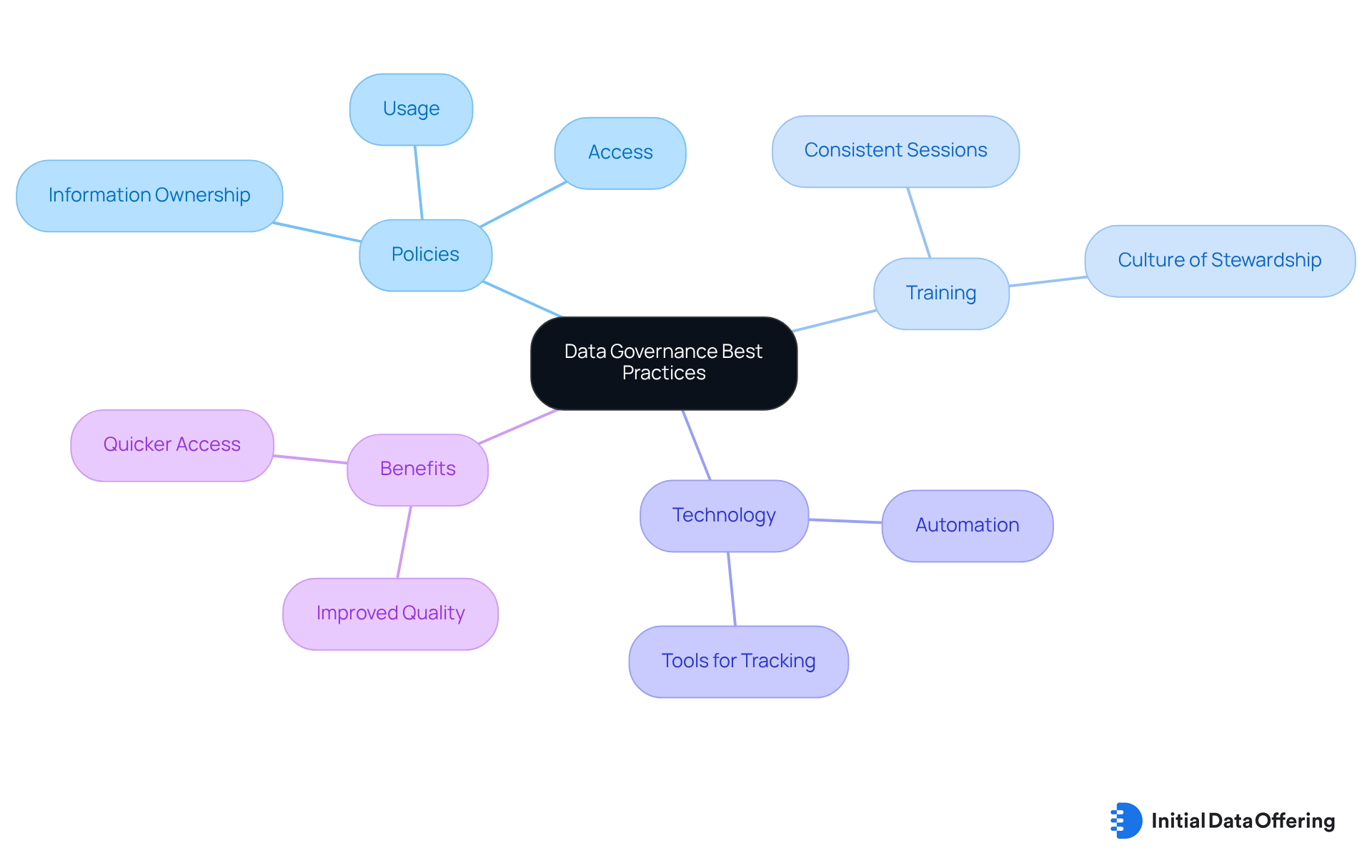

Data Governance: Best Practices for Managing Reference Data Effectively

Implementing strong governance practices is essential for the efficient management of reference data. Analysts must establish clear policies regarding information ownership, access, and usage to ensure accountability and compliance. Consistent training sessions are crucial to ensure all team members are aware of these policies, promoting a culture of information stewardship.

How can organizations effectively implement these practices? For instance, Tide, a UK-based digital bank, utilized Atlan Playbooks to automate the identification and tagging of personally identifiable information, transforming a 50-day manual process into mere hours. This case illustrates the advantages of leveraging technology in governance processes.

Furthermore, utilizing information management tools can significantly simplify governance, aiding in the tracking of lineage and compliance with industry standards by effectively managing reference data. Statistics indicate that organizations investing in information governance report improved quality of information and quicker access to pertinent information. Notably, 83% of those with advanced frameworks experience better outcomes, as emphasized by a study from LeBow College of Business.

This highlights the significance of a systematic method for information governance, which not only enhances information management but also enables analysts to make informed choices based on trustworthy source details.

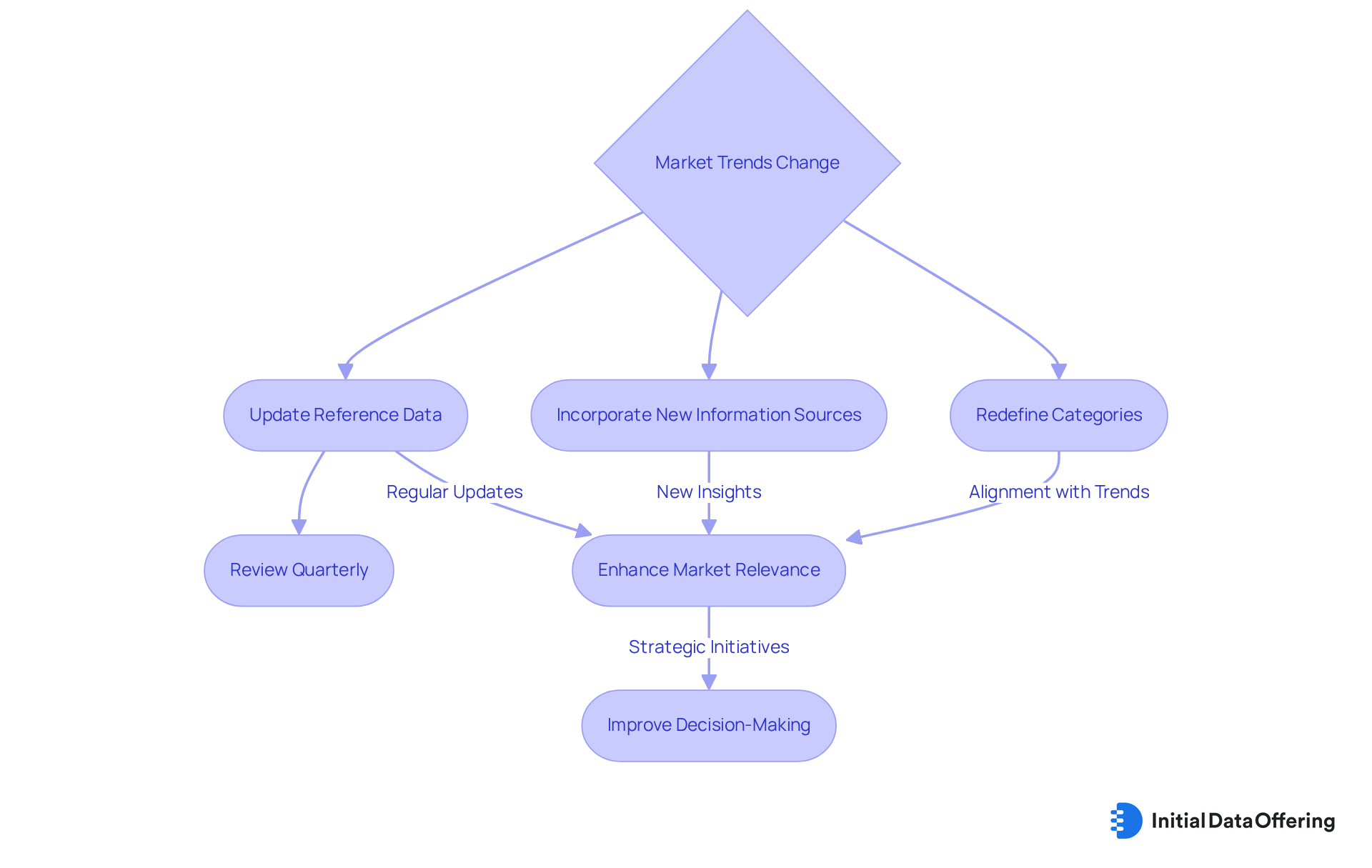

Adapting to Market Trends: The Dynamic Nature of Reference Data

Reference information is inherently dynamic, evolving alongside industry trends and consumer behaviors. Analysts must remain vigilant to these changes and adjust their reference data accordingly. This involves not only routine updates to reference data but also the incorporation of new information sources and the redefinition of categories to align with current economic conditions.

For example, companies that successfully update their datasets can significantly enhance their market relevance and decision-making capabilities. Statistics suggest that regular updates are crucial; numerous experts advocate reviewing source information at least quarterly to uphold its precision and relevance.

By proactively adapting to these shifts, professionals can ensure their insights remain pertinent and applicable, ultimately driving improved results in their strategic initiatives.

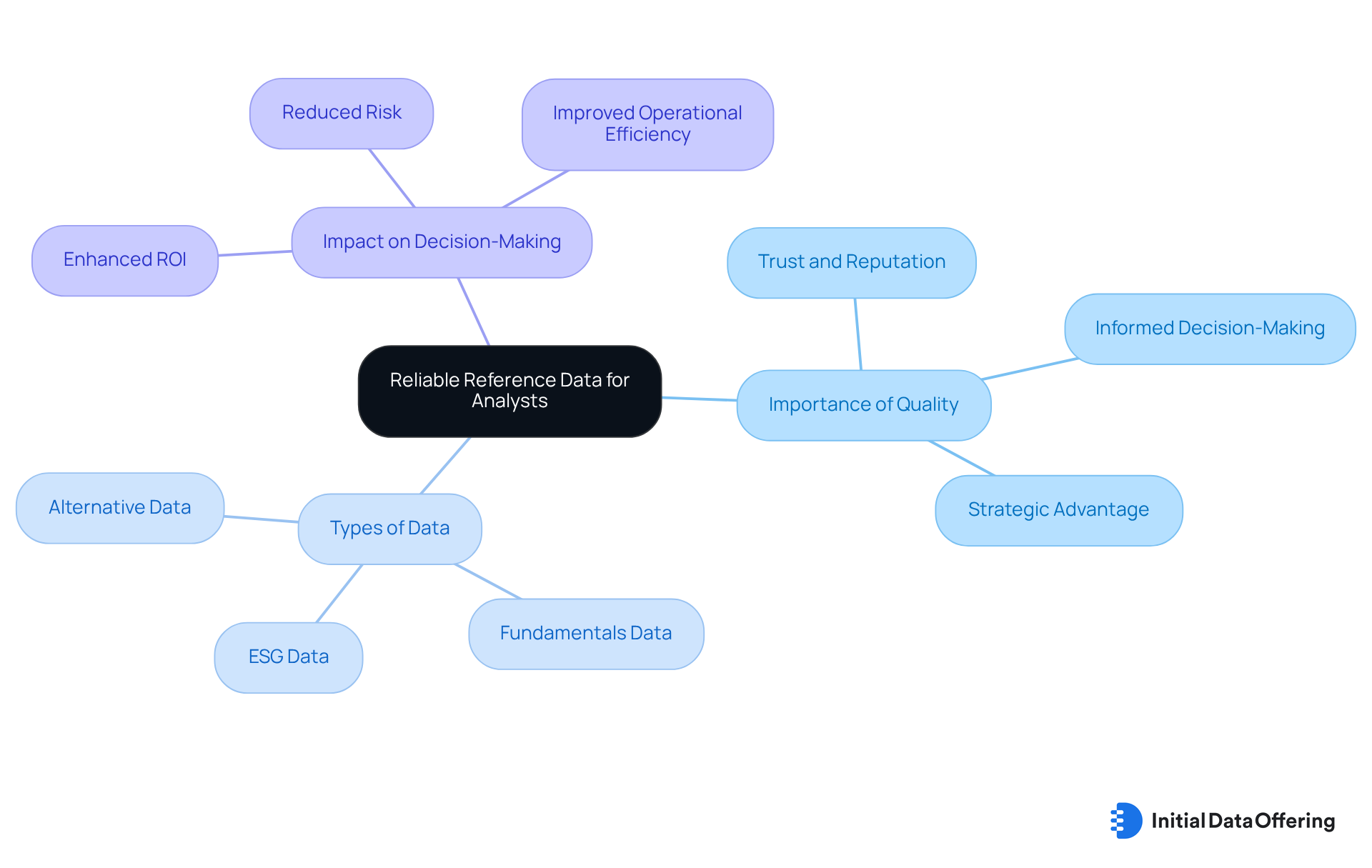

Sources of Reference Data: Identifying Reliable Providers for Analysts

For market analysts, obtaining trustworthy reference data is paramount. Prioritizing providers with a proven dedication to information quality and transparency is essential. This involves a comprehensive assessment of their information gathering methods and the frequency of updates to their collections. High information reliability, as noted by industry experts, is crucial for maintaining a company's reputation and ensuring precise reference data insights.

Engaging with platforms like IDO broadens access to a diverse array of high-quality datasets, including:

- Alternative Data

- Fundamentals Data

- ESG Data

This not only enhances the toolkit for informed decision-making but also underscores the importance of quality and transparency in data sourcing. Successful collaborations with trustworthy information suppliers can illustrate the standards that analysts should pursue, ultimately leading to improved results in research.

How can these datasets apply to your work? By leveraging high-quality information, analysts can make more informed decisions that positively impact their organizations. The integration of reliable reference data sources is not just a best practice; it is a strategic advantage in today’s competitive landscape.

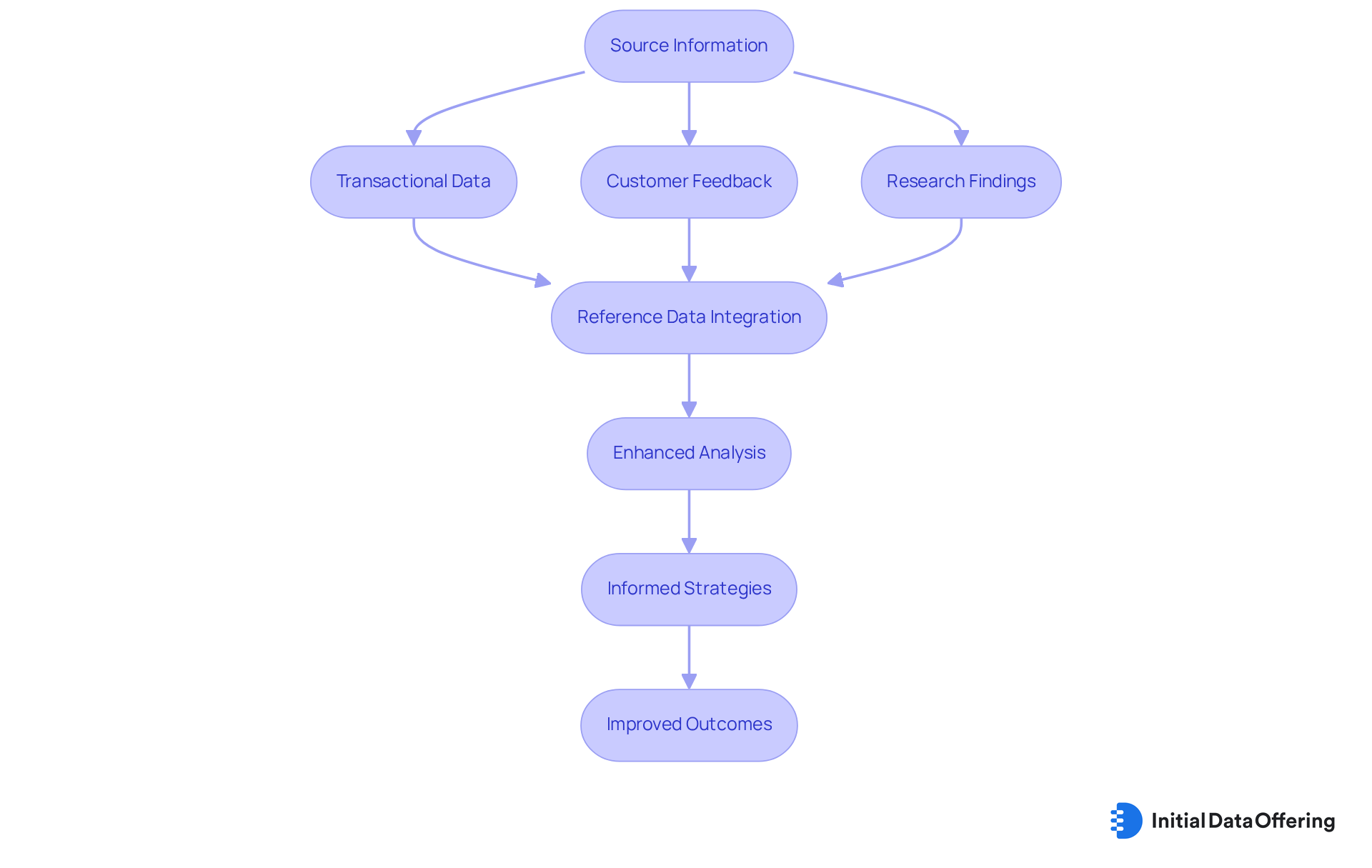

Data Integration: Combining Reference Data with Other Sources for Enhanced Analysis

Combining source information with other information collections is vital for enhancing the analysis of the sector. Analysts should proactively seek opportunities to merge transactional details, customer feedback, and research findings with reference data. This comprehensive approach not only provides a deeper understanding of market dynamics but also reveals insights that may remain concealed when information is examined in isolation. A study by McKinsey found that organizations utilizing AI in information integration can achieve an average enhancement of 20% in quality, significantly impacting decision-making processes.

Employing advanced information integration tools simplifies this merging process, facilitating a seamless flow of information and improved analytical capabilities. As the growth of IoT introduces challenges in information integration, experts must leverage these tools to effectively combine various datasets, resulting in more informed strategies and enhanced outcomes in their industry evaluations. Michael Curry, President of the Data Modernization Business Unit at Rocket Software, noted, "AI-driven integration solutions are particularly effective in managing complex, unstructured information sources, including social media feeds, sensor inputs, and customer interactions." This underscores the importance of efficiently incorporating source information as reference data, which will be a crucial factor for successful market evaluators.

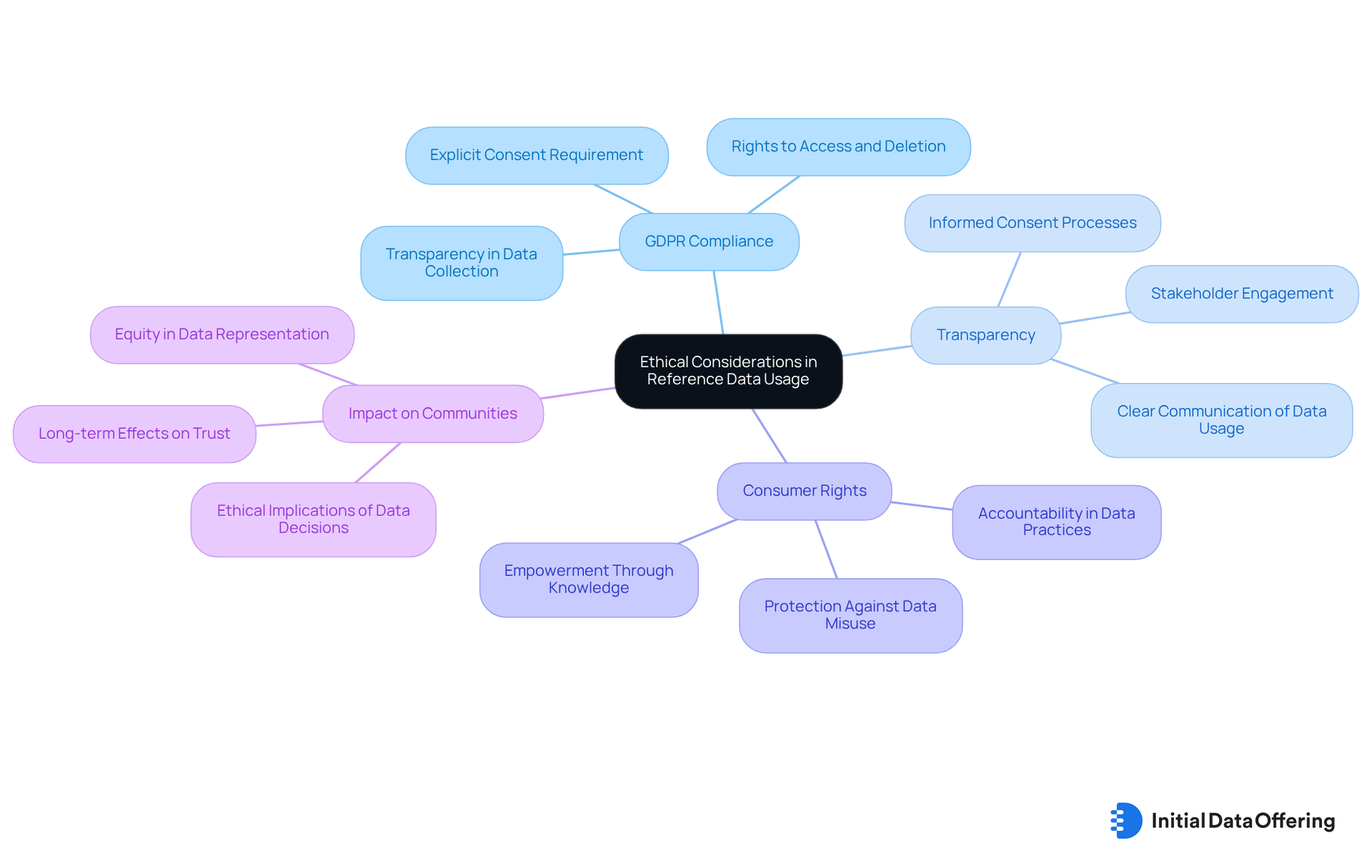

Ethical Considerations: Navigating the Use of Reference Data Responsibly

Market analysts face significant ethical obligations when utilizing reference data, particularly concerning regulations such as the General Data Protection Regulation (GDPR). The requirement to obtain clear consent from individuals before collecting their information is a fundamental feature of GDPR compliance, promoting transparency in data usage. This adherence not only fosters trust among stakeholders but also enhances the credibility of analysts' findings.

Furthermore, it is crucial to consider the broader implications of information-driven decisions on individuals and communities. The use of reference data in ethical information practices safeguards consumer rights and encourages responsible practices within the industry. By prioritizing these ethical considerations, researchers can effectively navigate the complexities of information gathering and utilization, ultimately contributing to a more reliable information landscape.

How can analysts ensure they are meeting these ethical standards in their work? By reflecting on these practices, professionals can better understand their role in promoting ethical data usage.

Future Trends in Reference Data: Preparing for the Next Generation of Data Insights

As the information landscape evolves, market analysts must adjust to emerging trends in reference data. The integration of artificial intelligence (AI) is transforming information analysis, with financial firms increasingly investing in AI technologies to improve decision-making and lower operational expenses. Currently, 25% of companies are utilizing AI for information management, with another 30% planning to incorporate these technologies soon. This shift not only improves efficiency but also enables organizations to derive actionable insights from complex datasets.

Organizations such as JPMorgan Chase have effectively employed large-scale analytics to enhance credit risk evaluations, showcasing how alternative information sources can boost loan underwriting precision and reduce default rates. Similarly, PricewaterhouseCoopers (PwC) has embraced sophisticated visualization tools to enhance client insights, resulting in improved strategic decision-making and higher profitability.

Furthermore, the focus on information ethics and privacy is becoming increasingly crucial as organizations navigate the complexities of information governance. Analysts must remain vigilant regarding ethical information use, particularly as concerns about compliance and security intensify. By adopting these trends and utilizing AI-driven insights, professionals can position themselves to seize new opportunities and achieve improved results for their organizations.

In this rapidly changing environment, staying informed about the latest advancements in AI and data analysis is essential. As highlighted by industry leaders, the financial sector is entering a phase defined by technological progress that will significantly influence how experts forecast and handle market shifts. By proactively adapting to these changes, analysts can enhance their analytical capabilities and contribute to their organizations' success.

Conclusion

Market analysts stand to gain significantly from a comprehensive understanding of reference data, which serves as the cornerstone for effective analysis and informed decision-making. The insights provided throughout this article highlight the critical role that high-quality reference data plays in shaping market evaluations. This ensures that analysts can navigate complex datasets with confidence and precision.

Key discussions have centered around:

- The importance of data accuracy

- The dynamic nature of reference data

- The necessity of effective data governance practices

Analysts are encouraged to leverage platforms like the Initial Data Offering to access reliable datasets. They should also prioritize ethical considerations and transparency in their data usage. By integrating various sources of reference data and employing advanced analytical tools, professionals can enhance their insights and adapt to the ever-changing market landscape.

Looking ahead, it is essential for analysts to remain proactive in adopting emerging trends, such as the integration of artificial intelligence and innovative data management techniques. Embracing these advancements will not only improve analytical capabilities but also position organizations to thrive in a competitive environment. By prioritizing high-quality reference data and ethical practices, market analysts can ensure they are equipped to make impactful decisions that drive success in their respective fields.

Frequently Asked Questions

What is the Initial Data Offering (IDO)?

The Initial Data Offering (IDO) is a centralized hub designed for market researchers to access high-quality reference data across various fields, including finance and environmental studies. It curates unique datasets to streamline the process of finding relevant and actionable insights.

How does IDO enhance the quality of information for analysts?

IDO addresses the challenge of a fragmented marketplace by providing a centralized platform where analysts can easily find high-quality datasets, ultimately enhancing the quality of information available for their analyses.

What are the benefits of subscribing to the Initial Data Offering?

Subscribing to IDO provides premium access that allows users to discover new datasets daily, including real-time trends in commerce, historical financial records, and evaluations of environmental impacts, keeping them updated on the latest high-quality datasets.

Why is reference data important for market evaluators?

Reference data is crucial as it categorizes and defines various types, such as product codes and geographic locations. It provides the necessary context for accurately interpreting transactional data, enabling analysts to derive meaningful insights and enhance the overall quality of their analyses.

What challenges do inconsistencies in reference data present?

Statistics indicate that 20-50% of database tables may contain related information that becomes inconsistent across applications. This inconsistency can lead to unreliable analyses, highlighting the importance of maintaining precise related information.

How is the role of Chief Data Officers (CDOs) evolving in the financial services sector?

The role of CDOs is evolving to focus on standardizing source material to improve operational effectiveness and reduce costs, reflecting the growing recognition of data's significance in the financial services sector.

What practices are essential for ensuring data accuracy?

Frequent audits and validation procedures are essential for preserving information integrity, resulting in more dependable insights and improved decision-making for market researchers.

How can access to high-quality datasets transform research?

Access to high-quality datasets can significantly enhance research capabilities by providing the most pertinent information available, allowing analysts to stay informed of the latest market trends and make better-informed decisions.