10 Essential Tools for Private Equity Portfolio Analytics Success

10 Essential Tools for Private Equity Portfolio Analytics Success

Introduction

In the fast-paced realm of private equity, effectively harnessing data can significantly influence investment strategies. With a growing reliance on advanced analytics tools, investors now encounter a plethora of options designed to enhance portfolio performance and decision-making. This article explores ten essential tools that not only streamline data discovery and analysis but also tackle the critical challenges of risk management and performance monitoring. As firms work to navigate a competitive landscape, one question stands out: which tools will genuinely unlock the potential for success in private equity portfolio analytics?

These tools offer unique features that cater to the specific needs of investors. For instance, some tools provide real-time data visualization, allowing for immediate insights into portfolio performance. Others focus on predictive analytics, helping investors anticipate market trends and make informed decisions. By understanding the advantages these tools present, firms can better position themselves to capitalize on opportunities and mitigate risks.

Ultimately, the right tools can transform data into actionable insights, driving better investment outcomes. As you consider your own strategies, reflect on how these tools might enhance your approach to portfolio analytics.

Initial Data Offering: Streamline Your Data Discovery for Portfolio Analytics

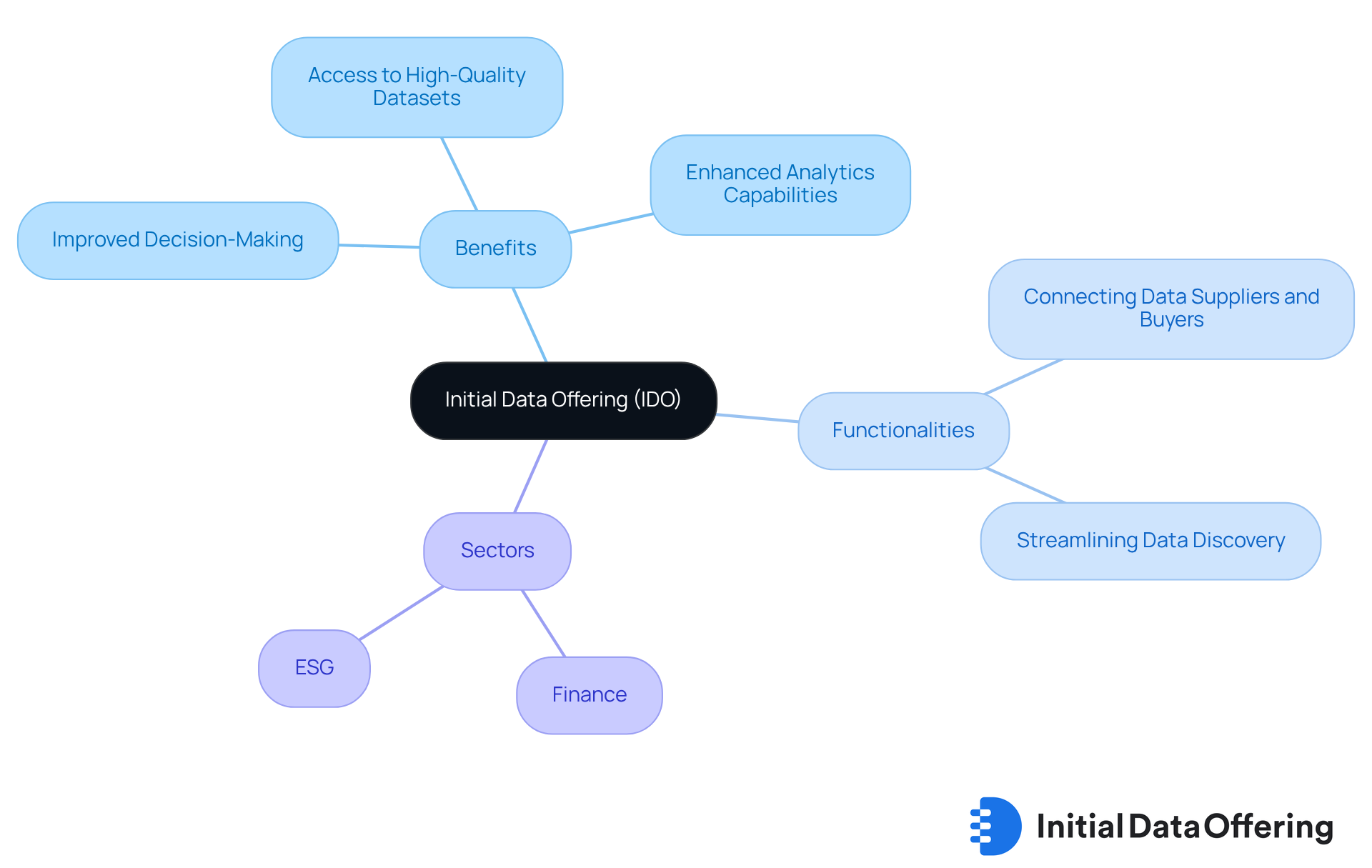

The Initial Data Offering (IDO) serves as a centralized platform that simplifies the process of discovering and introducing new datasets, which is crucial for investors aiming to make informed decisions. What if you could access high-quality datasets that significantly impact your financial outcomes? Industry leaders recognize that robust datasets enhance the accuracy of valuations and risk assessments. IDO curates a diverse array of unique datasets across sectors like finance and ESG, empowering portfolio managers to elevate their private equity portfolio analytics capabilities.

By connecting data suppliers with potential buyers, IDO addresses the fragmented nature of the data marketplace. This connection enables investment groups to swiftly uncover the insights necessary for strategic decision-making. Imagine having premium access to exclusive datasets that not only improve your analytics capabilities but also lead to better financial results. Subscribing to IDO offers these advantages, ultimately enhancing your investment strategies and outcomes.

Asset Metrix: Comprehensive Portfolio Analysis for Private Equity

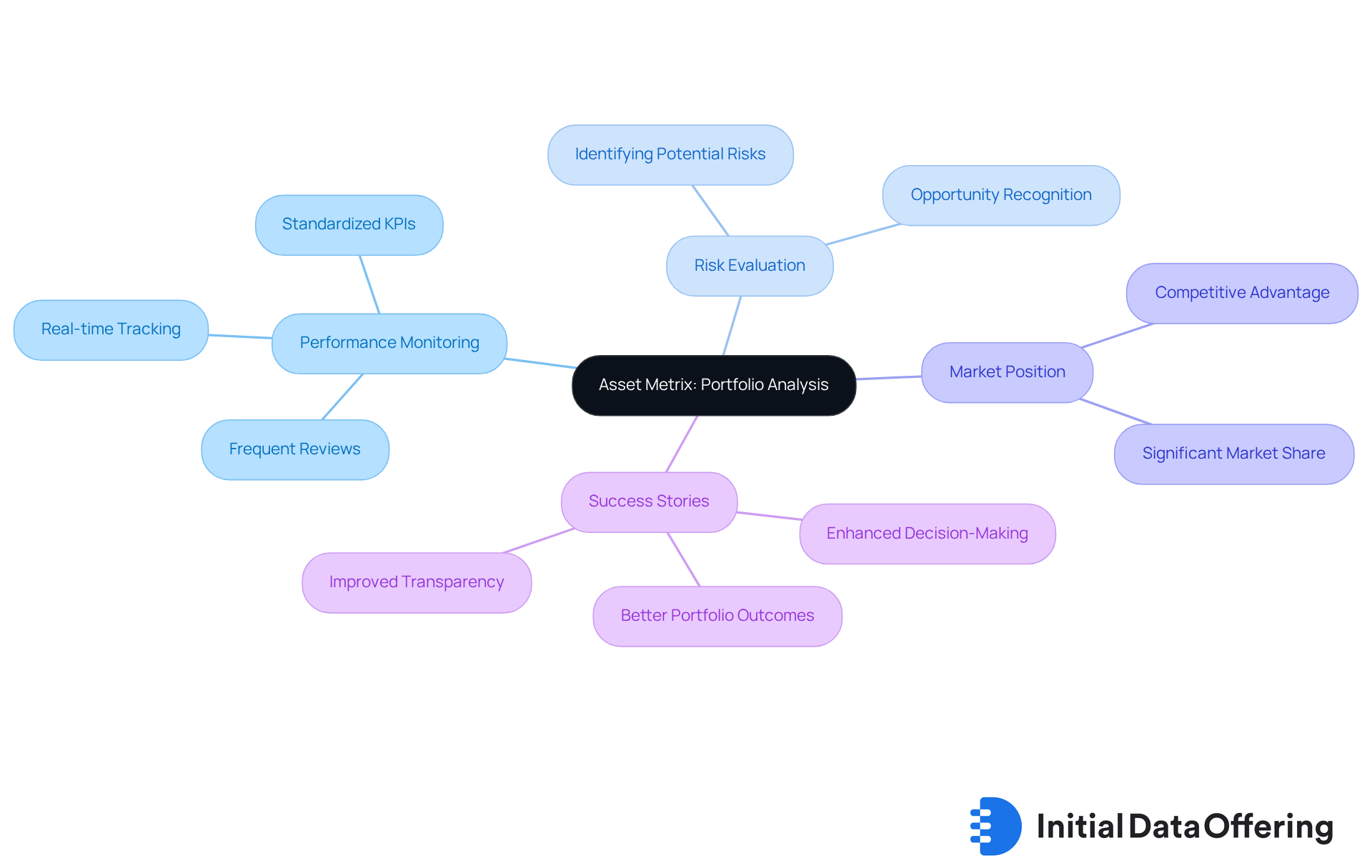

Asset Metrix provides a robust platform tailored for investment firms, featuring sophisticated performance monitoring and risk evaluation capabilities. This integration of diverse data sources offers a comprehensive view of private equity portfolio analytics, enabling managers to identify trends and make informed, data-driven decisions.

Why is efficient performance monitoring crucial? Analysts emphasize that it is vital for recognizing potential risks and opportunities. One analyst noted, "The capability to track performance metrics in real-time is essential for managing the intricacies of investment ventures."

With its latest updates, Asset Metrix has solidified its position in the market, boasting a significant share in investment analytics. Companies utilizing Asset Metrix have reported success stories that highlight improvements in portfolio management, showcasing enhanced transparency and strategic alignment. By leveraging these capabilities, financial organizations can not only refine their analytical processes but also improve their private equity portfolio analytics to achieve better outcomes.

In summary, Asset Metrix stands out as a powerful tool for investment firms. Its features, advantages, and benefits collectively enhance decision-making and risk management, ultimately leading to improved portfolio performance.

Capstone Partners: Enhance Your Private Equity Model with Data Analytics

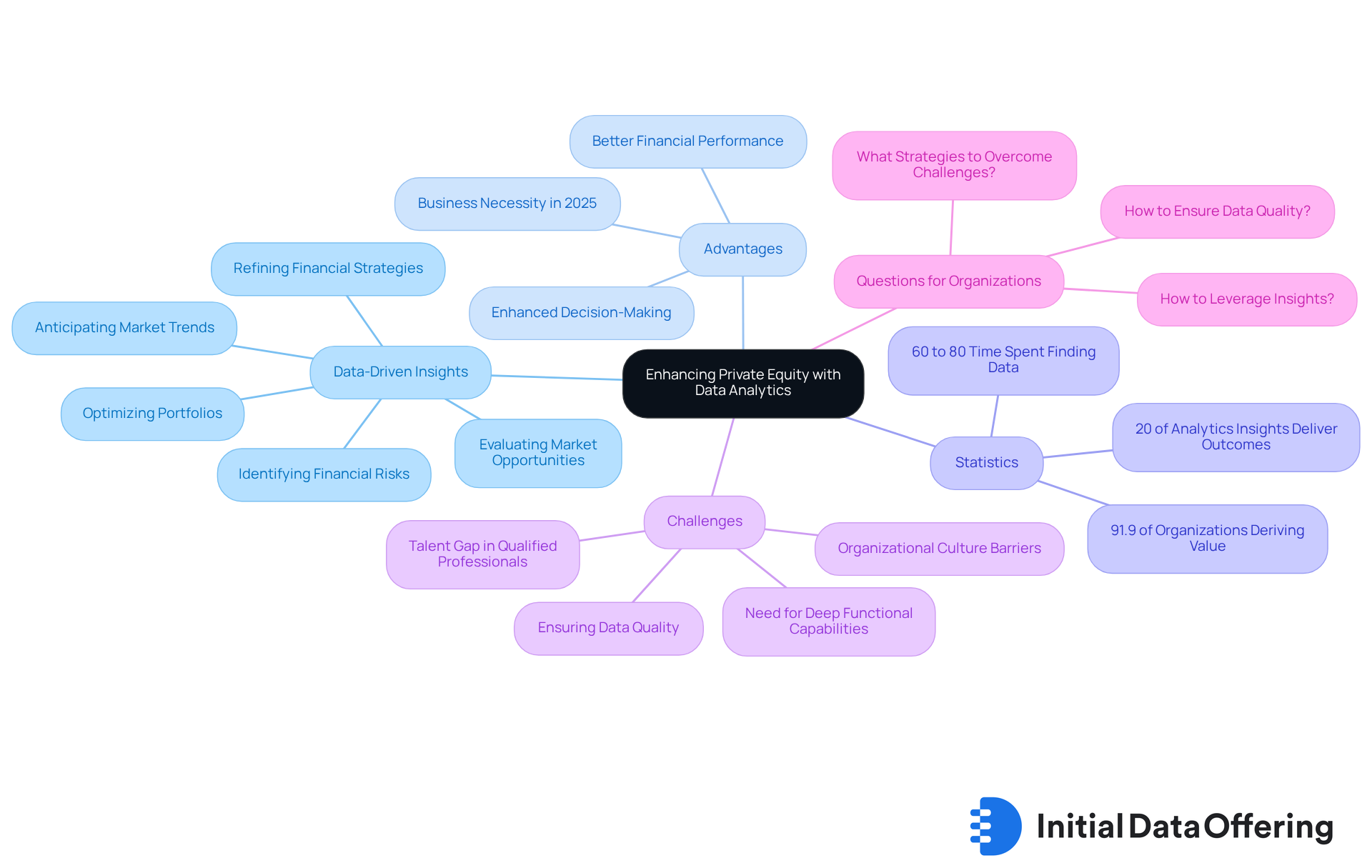

Capstone Partners specializes in enhancing private equity portfolio analytics using advanced data analytics. This service features data-driven insights that empower companies to refine their financial strategies, evaluate market opportunities, and optimize their portfolios. By utilizing predictive analytics, Capstone anticipates market trends and identifies potential financial risks.

The advantages of incorporating private equity portfolio analytics into operations are significant. Not only does it enhance decision-making, but it also promotes better financial performance. In fact, as data analytics has evolved from a desirable capability to a business necessity in 2025, statistics reveal that 91.9% of organizations have derived measurable value from their data and analytics expenditures.

However, companies must navigate challenges such as the need for deep functional capabilities and sector expertise. Ensuring data quality is also essential for effective analytics. How can your organization leverage these insights to improve its financial strategies? By addressing these challenges, private equity firms can leverage private equity portfolio analytics to position themselves for success in a data-driven landscape.

Databricks: Leverage Data Intelligence to Boost Portfolio Returns

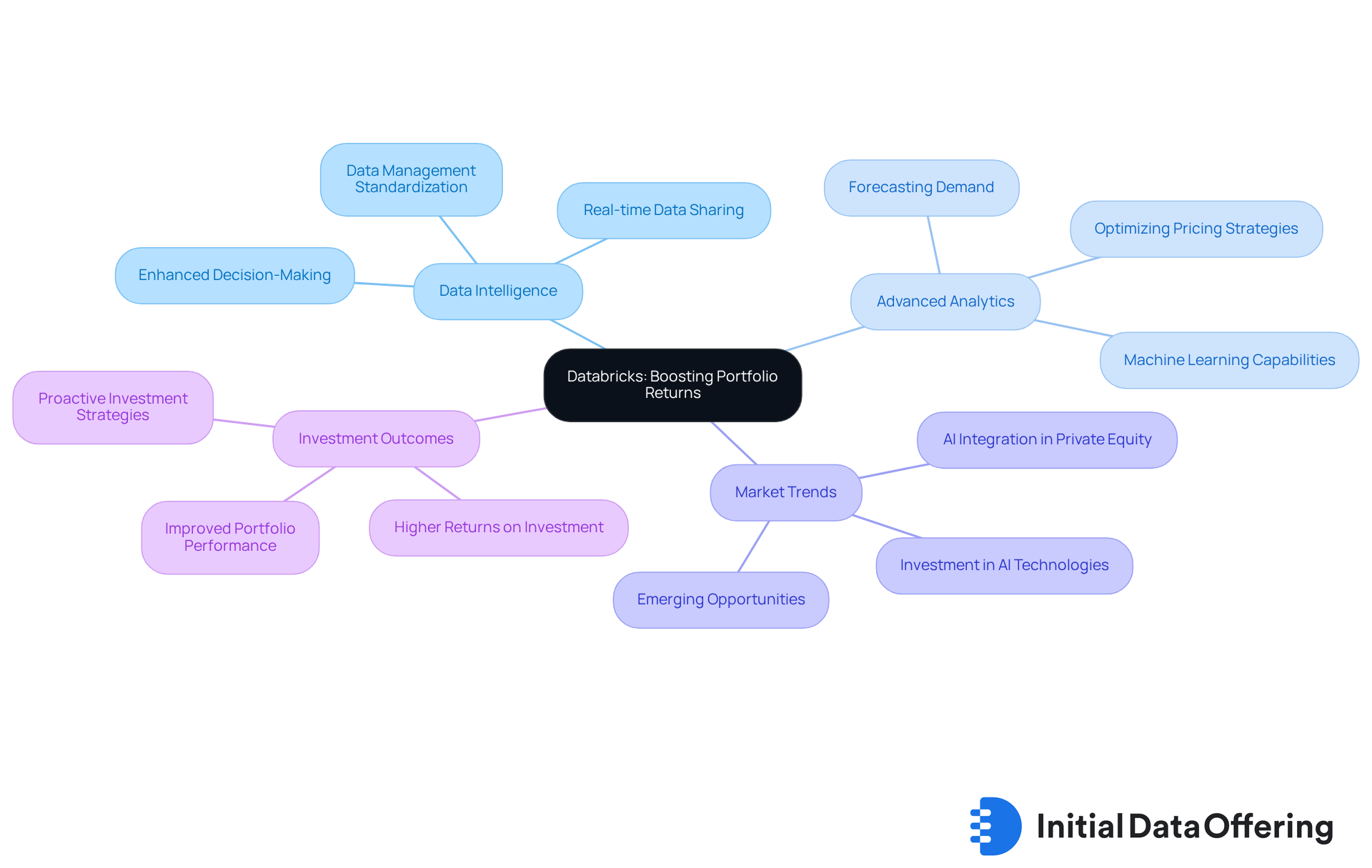

Databricks provides a powerful platform for private equity portfolio analytics, allowing firms to leverage data intelligence in their funding strategies. What if you could uncover hidden patterns in your portfolio data? With advanced analytics and machine learning capabilities, Databricks enables companies to make more informed decisions about capital allocation. This integration of various data sources allows for real-time private equity portfolio analytics and reporting, ultimately enhancing the overall performance of portfolios.

The advantages of using Databricks extend beyond just data analysis. By staying ahead of market trends, companies can significantly boost their returns on investment. Imagine having the ability to react swiftly to market changes, ensuring that your investment strategies are always aligned with current conditions. This capability not only improves decision-making but also fosters a proactive approach to managing investments.

In conclusion, utilizing Databricks can transform how private equity firms leverage private equity portfolio analytics in their funding strategies. By harnessing the power of data, companies can enhance their portfolio performance and achieve better investment outcomes. Are you ready to take your data-driven decision-making to the next level?

Growth Equity Interview Guide: Key Strategies for Effective Portfolio Management

The Growth Capital Interview Guide outlines essential tactics for effective portfolio management through private equity portfolio analytics that investment companies should adopt. Key features include thorough due diligence and continuous performance monitoring. These practices are crucial for informed decision-making and aligning investments with private equity portfolio analytics and market opportunities. For instance, private investment groups facilitated $410 billion in liquidity events across 30% of buyout portfolio companies in 2024-25. This statistic underscores the significance of careful oversight in achieving successful outcomes.

The advantages of continuous performance monitoring are evident as it enables private equity portfolio analytics, allowing businesses to track key performance indicators (KPIs) that reflect both financial and operational health. Metrics such as cash conversion cycles and employee retention rates offer valuable insights into private equity portfolio analytics, enabling timely strategy adjustments. A shorter cash conversion cycle, for example, signals improved liquidity and operational efficiency, while a longer cycle may indicate inefficiencies that require attention.

The guide also highlights the benefits of adaptability in response to market changes. Industry specialists note, "Private investment holding durations are at historic highs, increasing exit pressure," which emphasizes the need for companies to remain agile and responsive to evolving market conditions. By fostering a culture of proactive risk management and leveraging reliable data sources, investment firms can enhance their competitive edge and support sustainable growth through private equity portfolio analytics.

Furthermore, as Angie Henson points out, "Private investment KPIs are among the most valuable tools available to monitor the growth of portfolio companies as they progress toward operational excellence and predictable growth." This reinforces the critical role of KPIs in performance monitoring. Incorporating non-financial KPIs is equally important for assessing business health and long-term stability, providing a more comprehensive view of portfolio performance.

How can these insights be applied to your investment strategies? By understanding and implementing these tactics, firms can better navigate the complexities of portfolio management.

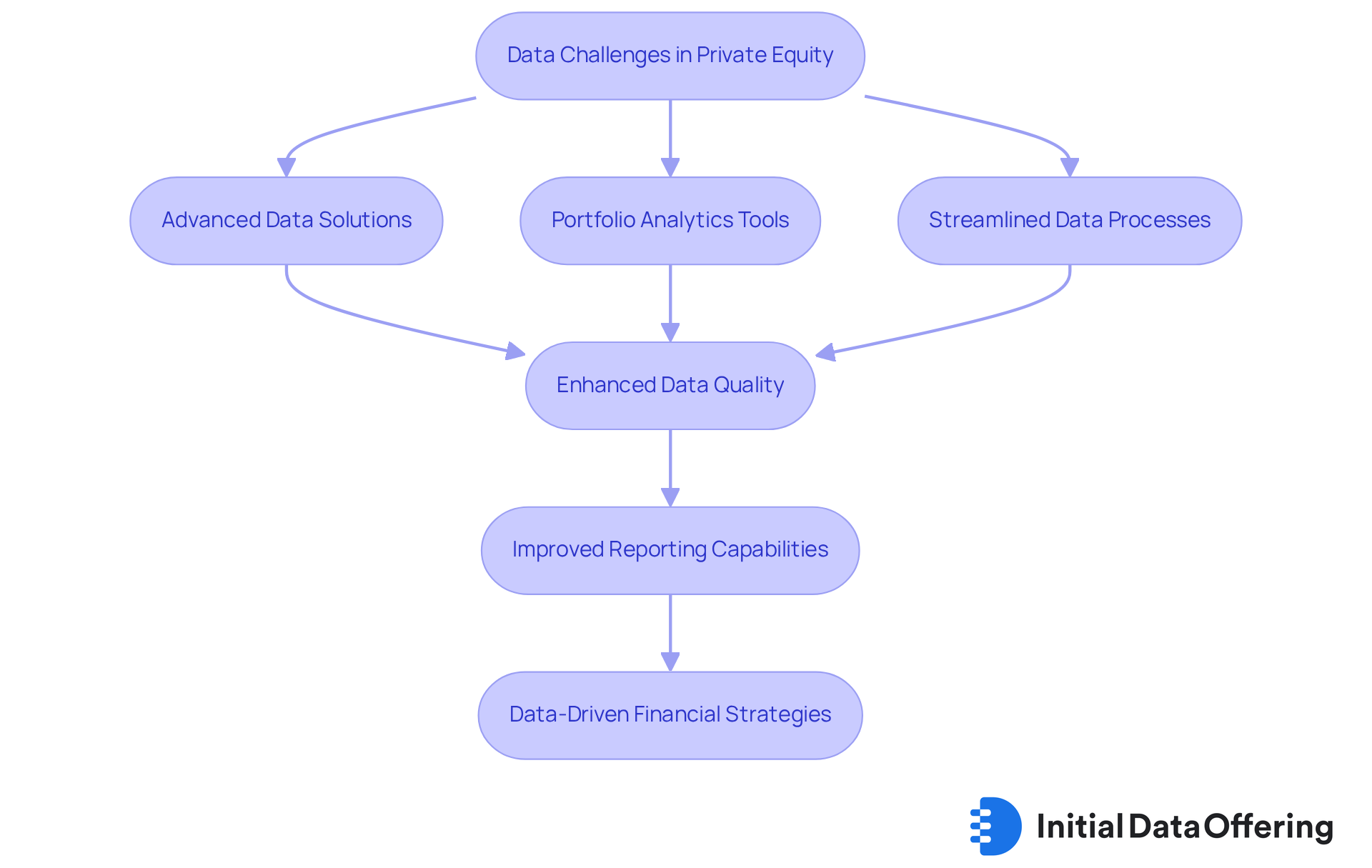

Spaulding Ridge: Overcome Data Challenges in Private Equity Portfolio Management

Spaulding Ridge excels in addressing the data quality challenges that often impede effective portfolio management in alternative investments. By deploying advanced data solutions and private equity portfolio analytics tools, the company equips private equity organizations with the means to streamline their data processes. This not only significantly enhances data quality but also improves reporting capabilities.

Why is this transformation crucial? Companies aiming to leverage data-driven insights for better financial strategies must prioritize data quality. For instance, organizations utilizing predictive algorithms have reported sales results up to ten times better than those relying on traditional methods. This stark contrast underscores the importance of robust data management.

With Spaulding Ridge's expertise, funding groups can adeptly navigate the complexities of data handling. This allows them to focus on achieving their financial goals with greater effectiveness and accuracy. Industry experts emphasize that high-quality data is fundamental to successful financial strategies, reinforcing Spaulding Ridge's pivotal role in fostering a data-centric approach within the sector.

Risk Management Strategies: Essential Insights for Private Equity Portfolios

Implementing strong risk management strategies is crucial for private equity portfolio analytics to safeguard their assets. Key strategies include:

- Conducting thorough due diligence

- Diversifying portfolios

- Continuously monitoring market conditions

These strategies not only help in identifying potential risks but also in developing effective mitigation plans. By proactively addressing these risks, companies can enhance their resilience against market volatility, which could face a drawdown of 40% to 50% during the next major market correction.

Utilizing data analytics to evaluate risk exposure is another vital feature of effective risk management. This approach enables companies to make informed choices that align with their risk appetite and financial goals. A comprehensive business continuity plan is also essential for minimizing losses during unforeseen crises. As noted by Peter L. Bernstein, the essence of risk management lies in maximizing control over outcomes while minimizing uncertainties. This comprehensive method not only improves the safety of assets but also allows companies to seize opportunities during market difficulties.

Moreover, the vital elements of consumer data privacy and cybersecurity cannot be overlooked. How prepared is your company to handle these challenges? By incorporating private equity portfolio analytics into their risk management strategies, private equity firms can not only safeguard their assets but also position themselves advantageously in a competitive landscape.

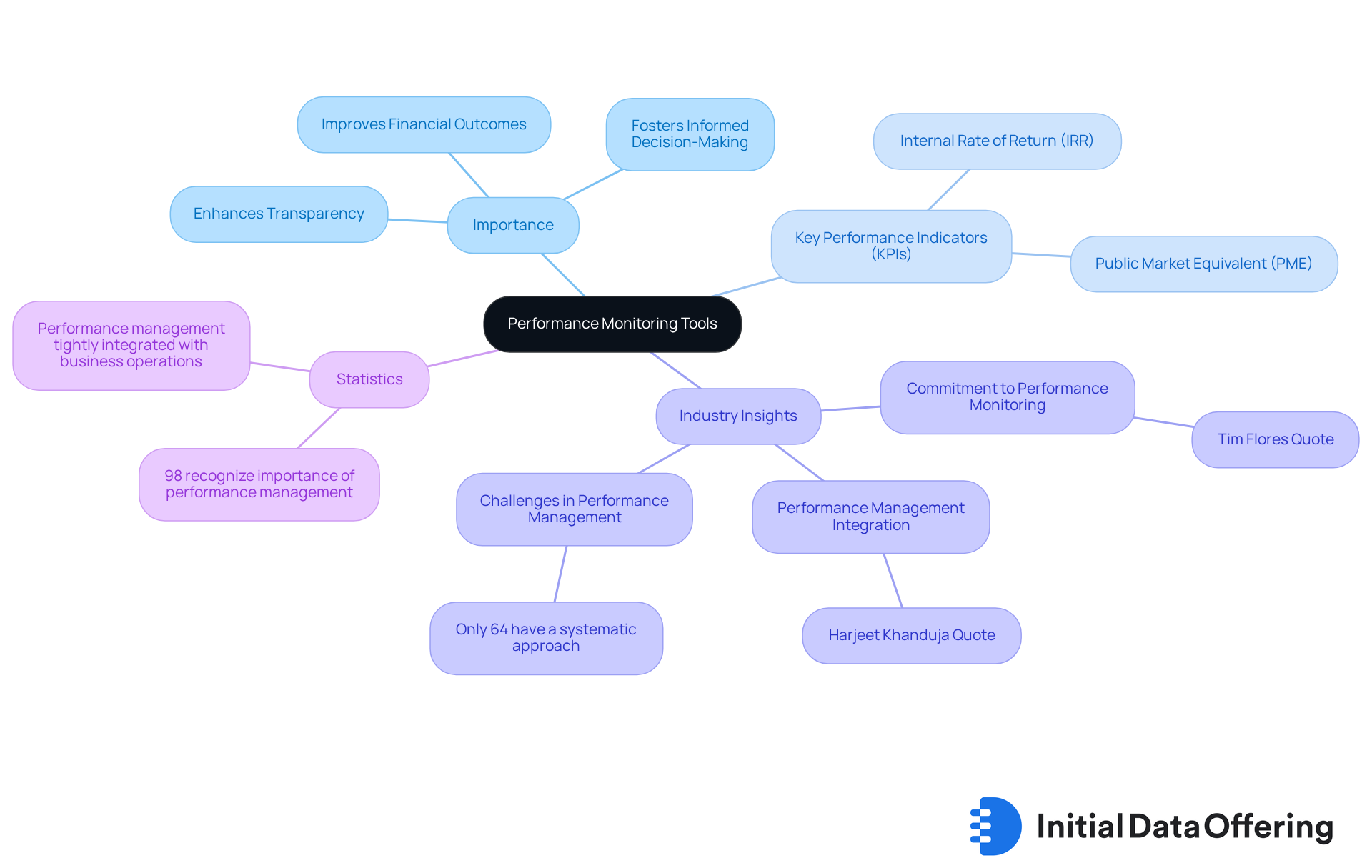

Performance Monitoring Tools: Measure Success in Private Equity Portfolios

Performance monitoring tools are vital for private equity firms looking to utilize private equity portfolio analytics to evaluate their portfolio success. These tools enable the tracking of key performance indicators (KPIs), which helps companies assess their performance over time. By utilizing advanced analytics and comprehensive reporting capabilities, firms can identify trends, evaluate the impact of market fluctuations, and make informed, data-driven adjustments to their strategies.

Why is efficient performance tracking important? It not only enhances transparency but also fosters informed decision-making, leading to improved financial outcomes. For example, standardized KPIs like Internal Rate of Return (IRR) and Public Market Equivalent (PME) create a common framework for performance evaluation, allowing general partners (GPs) to effectively compare company performance. Notably, while IRR is a commonly used metric in investment funds, it is rarely applied to public market indices, underscoring its unique significance in this context.

Industry leaders stress that a robust performance management system is essential for aligning business operations with strategic objectives. As Tim Flores aptly stated, "A total commitment is paramount to reaching the ultimate in performance." This commitment to thorough performance monitoring is crucial for asset management companies using private equity portfolio analytics to navigate the complexities of financial landscapes and achieve exceptional results.

Statistics indicate that 98% of businesses recognize the importance of performance management, yet only 64% have a systematic approach to it. This gap highlights the pressing need for effective performance monitoring tools in the industry. How can your organization leverage these insights to enhance its performance management strategy?

Benchmarking Practices: Evaluate Your Private Equity Portfolio Performance

Benchmarking practices are crucial for investment companies that want to evaluate their portfolio performance against industry standards. By aligning their allocations with relevant benchmarks, like the Russell 3000, firms can gain valuable insights into their relative performance and identify areas for improvement. A survey of over 100 public pension schemes revealed that approximately 80% utilize public stock indices to assess their alternative investment returns. This statistic underscores the prevalence of benchmarking in the sector.

Effective benchmarking requires the careful selection of metrics that accurately reflect financial objectives. For instance, the annualized 10-year return average for alternative equity benchmarks is nearly double that of public indices. This illustrates the potential for enhanced performance when appropriate benchmarks are employed. Financial analysts emphasize that the choice of benchmarks significantly influences financial strategies, providing a framework for accountability and informed decision-making. As Luis O’Shea pointed out, 'Benchmarking and indexes are important tools for investors navigating private equity portfolio analytics within a significant but relatively opaque investment ecosystem.'

Moreover, companies should routinely evaluate performance data to ensure alignment with their strategic goals. This ongoing process not only boosts accountability but also allows firms to optimize their portfolios for better returns. As the landscape of alternative investment evolves, mastering benchmarking practices will be essential for companies aiming to navigate this complex and competitive environment.

How can your organization leverage benchmarking to enhance its investment strategies? By understanding and implementing effective benchmarking practices, firms can position themselves for success in an increasingly competitive market.

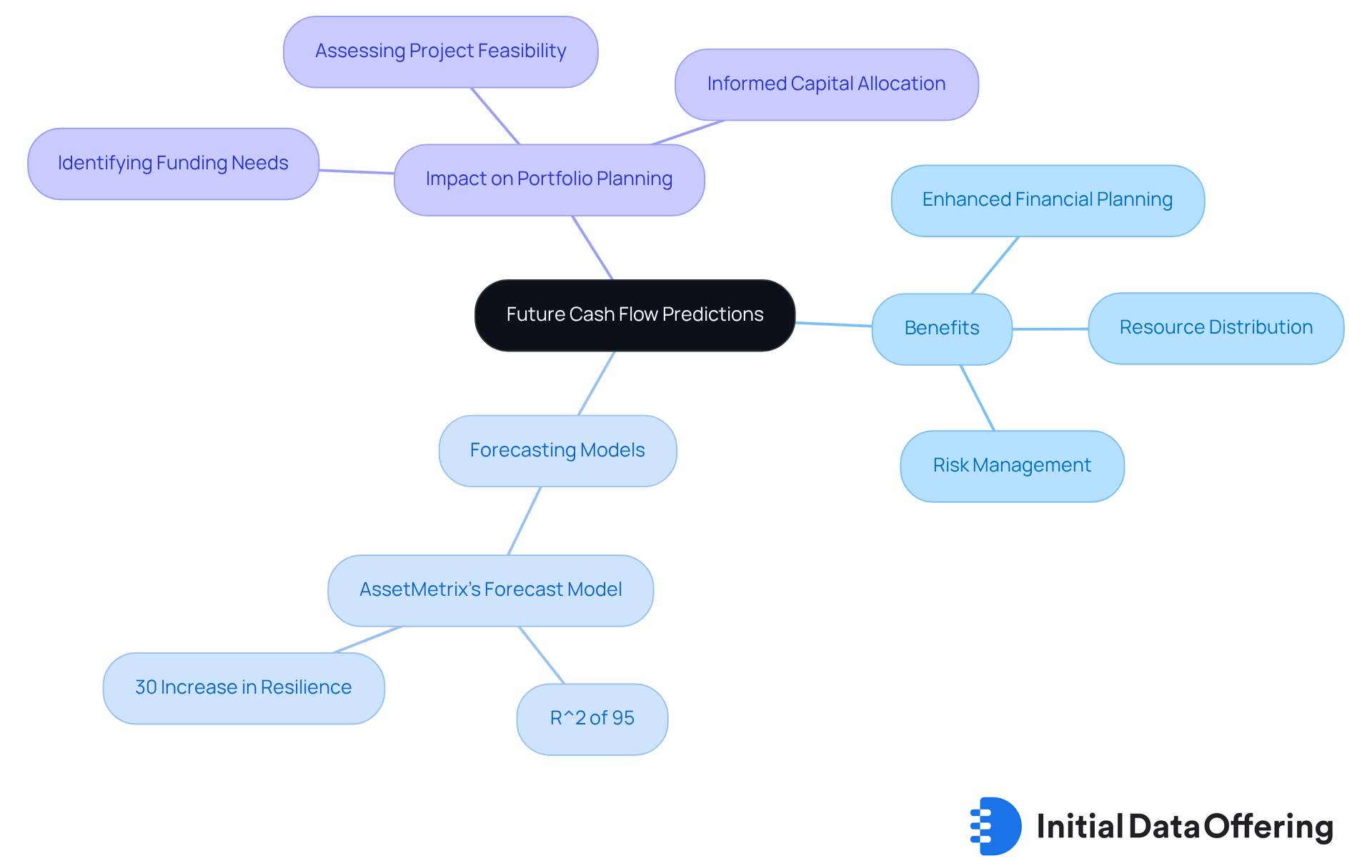

Future Cash Flow Predictions: Enhance Your Private Equity Portfolio Planning

Future cash flow predictions are pivotal in refining private equity portfolio analytics. What if you could accurately forecast your financial future? By utilizing advanced forecasting models, companies can precisely assess future cash flows from their assets. This capability aids in enhanced financial planning and resource distribution.

These accurate cash flow forecasts enable companies to recognize potential funding needs, assess project feasibility, and make informed choices about capital allocation. The proactive approach to cash flow management is crucial for sustaining growth and maximizing returns in the competitive landscape of private equity portfolio analytics. As analytics specialists highlight, effective forecasting models not only improve financial planning but also offer a strategic edge in managing market volatility.

For instance, AssetMetrix’s Forecast Model, an enhanced version of previous methodologies, has demonstrated a high predictive accuracy, achieving an R^2 of 95% for medium-term horizons. This underscores its reliability in guiding investment decisions. Furthermore, companies utilizing advanced cash flow forecasting techniques report a 30% increase in resilience during financial fluctuations. This statistic highlights the importance of these models in maintaining operational stability and driving value creation.

Additionally, cash flow forecasting plays a critical role in identifying high-risk periods. This allows firms to take proactive measures to mitigate potential financial disruptions. Moreover, private equity portfolio analytics linked to these models can reduce forecasting errors by up to 30% compared to traditional methods. This further emphasizes the advantages of sophisticated forecasting within private equity portfolio analytics.

Conclusion

The landscape of private equity portfolio analytics is evolving, driven by advanced tools and strategies that enhance decision-making and performance. Each essential tool, from the Initial Data Offering to sophisticated performance monitoring systems, plays a vital role in empowering investment firms to leverage data effectively. By adopting these innovative solutions, organizations can streamline their data processes and gain valuable insights that lead to informed investment strategies and improved financial outcomes.

Key insights underscore the importance of:

- Data quality

- Real-time analytics

- Robust risk management practices

Utilizing platforms like Asset Metrix and Databricks enables firms to:

- Track performance metrics

- Anticipate market trends

- Make proactive adjustments to their portfolios

Furthermore, integrating predictive analytics and future cash flow predictions provides a strategic advantage, allowing firms to navigate market volatility with confidence.

In an increasingly competitive environment, embracing these essential tools for private equity portfolio analytics is not just beneficial; it is imperative for success. Firms that prioritize data-driven decision-making and continuous performance evaluation will position themselves to thrive in the dynamic world of private equity. The time to act is now-implement these strategies and tools to unlock the full potential of your portfolio analytics and secure a prosperous future.

Frequently Asked Questions

What is the Initial Data Offering (IDO) and its purpose?

The Initial Data Offering (IDO) is a centralized platform that simplifies the discovery and introduction of new datasets, helping investors access high-quality datasets that significantly impact financial outcomes.

How does IDO benefit portfolio managers?

IDO curates a diverse array of unique datasets across sectors like finance and ESG, enabling portfolio managers to enhance their private equity portfolio analytics capabilities and make informed decisions.

What problem does IDO address in the data marketplace?

IDO connects data suppliers with potential buyers, addressing the fragmented nature of the data marketplace and allowing investment groups to quickly uncover insights necessary for strategic decision-making.

What is Asset Metrix and what does it offer?

Asset Metrix is a robust platform tailored for investment firms that provides sophisticated performance monitoring and risk evaluation capabilities, offering a comprehensive view of private equity portfolio analytics.

Why is performance monitoring important in investment?

Efficient performance monitoring is crucial for recognizing potential risks and opportunities, allowing analysts to track performance metrics in real-time, which is essential for managing complex investment ventures.

What improvements have companies reported from using Asset Metrix?

Companies utilizing Asset Metrix have reported success stories highlighting improvements in portfolio management, enhanced transparency, and better strategic alignment.

How does Capstone Partners enhance private equity portfolio analytics?

Capstone Partners specializes in advanced data analytics to provide data-driven insights that help companies refine financial strategies, evaluate market opportunities, and optimize portfolios.

What are the benefits of incorporating private equity portfolio analytics?

Incorporating private equity portfolio analytics enhances decision-making, promotes better financial performance, and is increasingly seen as a business necessity for organizations.

What challenges do companies face when implementing data analytics in private equity?

Companies face challenges such as the need for deep functional capabilities, sector expertise, and ensuring data quality for effective analytics.

How can organizations leverage insights from data analytics to improve financial strategies?

By addressing challenges related to data quality and expertise, private equity firms can leverage data analytics to enhance their financial strategies and position themselves for success in a data-driven landscape.