What Are Financial Research Associates and Why They Matter

What Are Financial Research Associates and Why They Matter

Overview

Financial research associates play a crucial role in the investment sector. They are responsible for collecting and analyzing financial data, assessing risks, and providing insights that inform strategic decision-making. As technology advances, particularly with the introduction of AI, their importance continues to grow. This enhancement in analytical capabilities enables organizations to navigate complex economic environments more effectively.

Why are financial research associates becoming increasingly vital? Their ability to adapt to technological advancements not only improves their analytical skills but also positions organizations to make informed decisions in a rapidly changing market. By leveraging AI, these professionals can analyze vast datasets, uncover trends, and provide actionable insights that drive strategic initiatives.

In conclusion, the evolving landscape of finance underscores the significance of financial research associates. Their expertise, coupled with advanced technology, empowers organizations to remain competitive and responsive to market dynamics. As we move forward, the integration of AI within this field will likely continue to shape the future of investment strategies.

Introduction

Financial research associates play a pivotal role in the investment landscape, delivering essential insights that influence strategic financial decisions. As the demand for data-driven analysis intensifies, these professionals are tasked not only with gathering and interpreting complex information but also with leveraging advanced technologies such as AI to bolster their analytical capabilities.

This evolution raises a critical question: how can financial research associates adapt to the increasing sophistication of their roles while ensuring their contributions remain impactful in a rapidly changing economic environment?

By embracing these advancements, they can enhance their effectiveness and relevance in the industry.

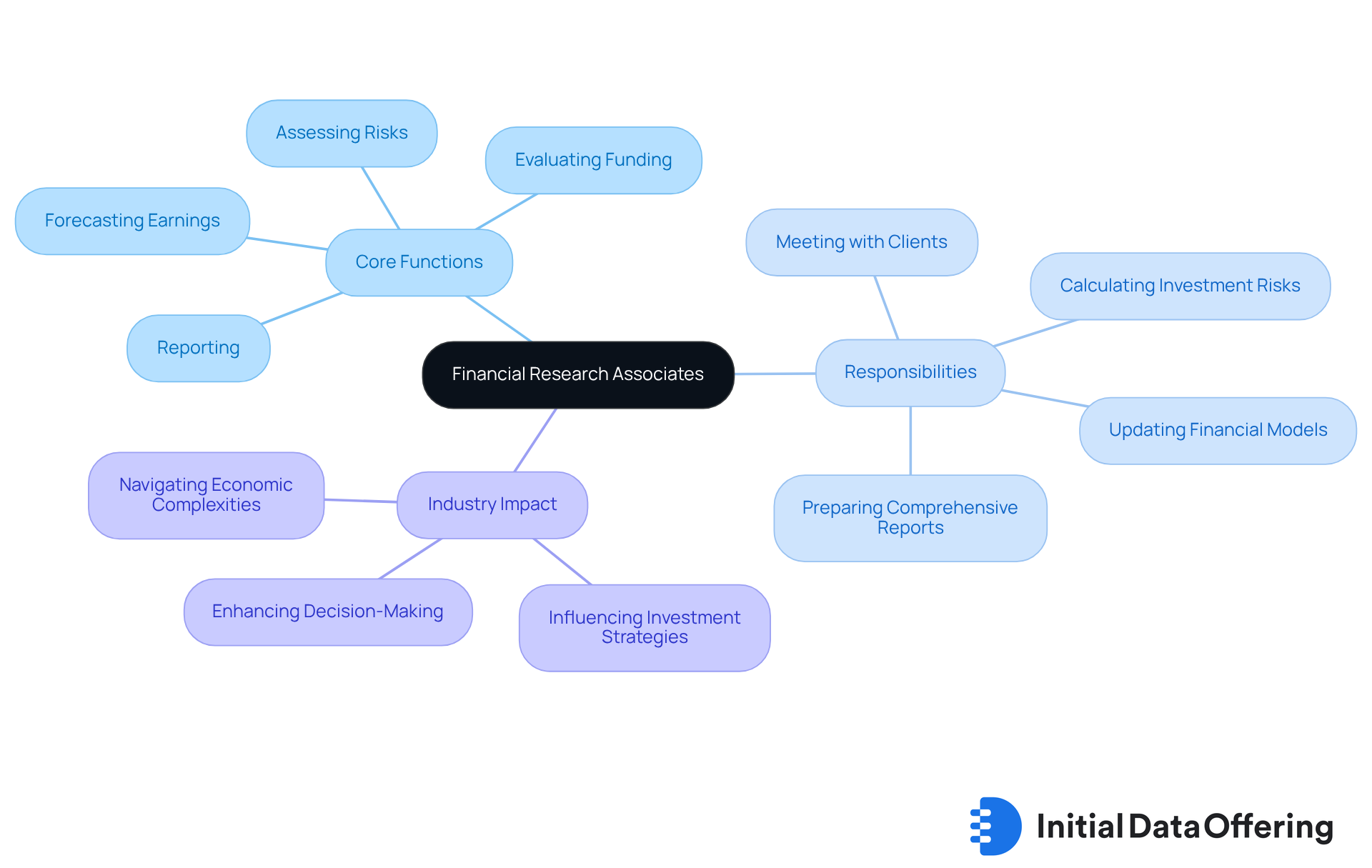

Define Financial Research Associates and Their Core Functions

Financial research associates play a vital role in the investment landscape, delivering essential support to investment analysts and portfolio managers. Their primary responsibilities encompass collecting and examining monetary information, market trends, and economic conditions from diverse sources. By 2025, these professionals are expected to increasingly leverage AI-driven insights to enhance their investigative capabilities, facilitating quicker and more precise decision-making.

Key responsibilities include:

- Preparing comprehensive reports that distill complex information into actionable intelligence.

- Evaluating potential funding opportunities.

- Assessing risks.

- Forecasting earnings, which directly influences funding recommendations.

This process is critical for monetary organizations aiming to refine asset management and strategic planning.

Case studies underscore the significant impact of monetary analysts on asset-related decision-making. In one instance, an organization that employed robust analytical methods witnessed a marked improvement in asset performance, attributing this success to the thorough evaluations provided by its analysis team. Furthermore, financial research associates emphasize the importance of these roles in navigating the complexities of today’s economic environments, with many industry leaders advocating for enhanced training and technology integration to bolster their effectiveness.

As the advisory sector continues to evolve, the demand for skilled analysts is projected to rise, reflecting their crucial role in shaping investment strategies and fostering informed decision-making across the industry.

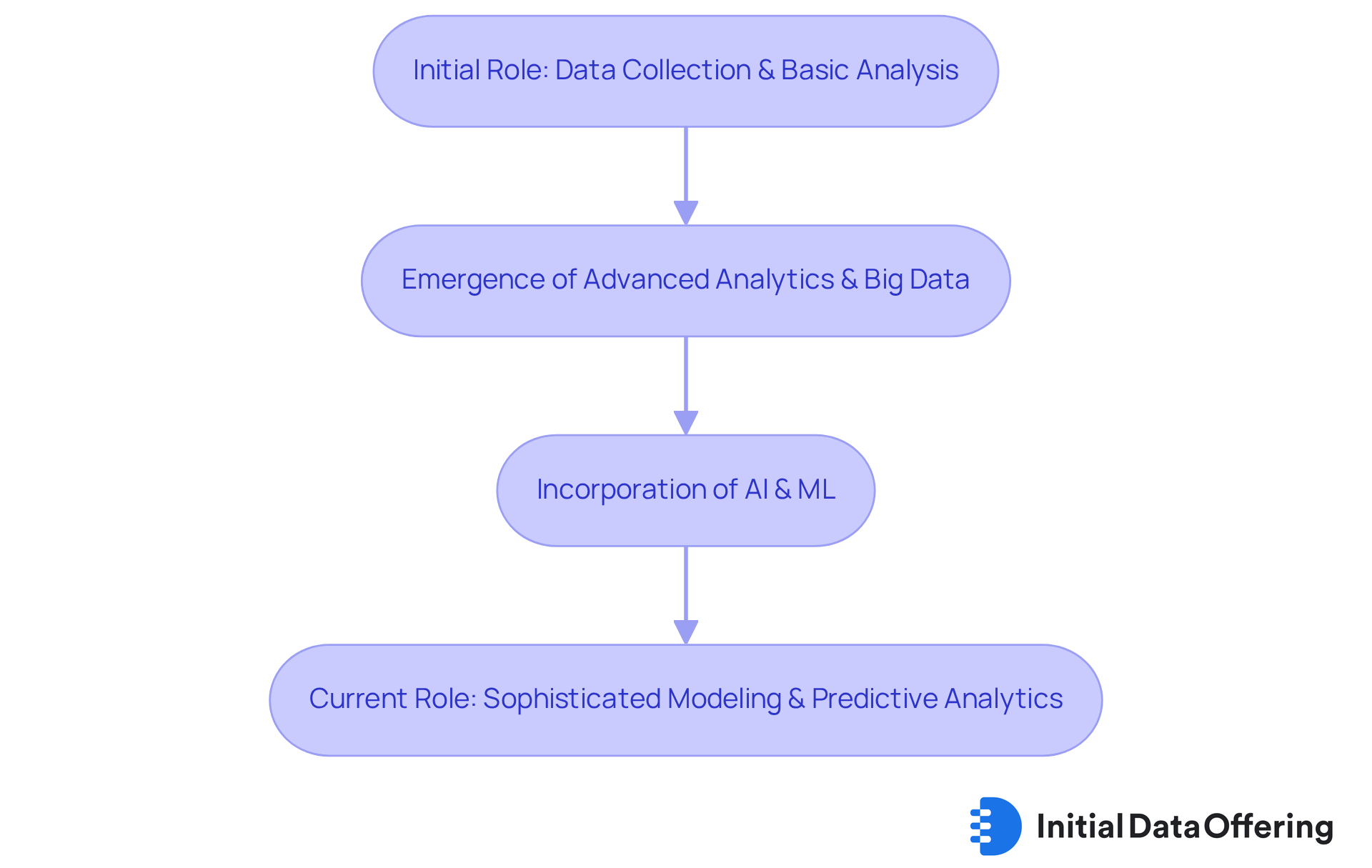

Trace the Evolution of Financial Research Associates in the Industry

The position of monetary analysis associates has undergone a significant transformation over the last few decades. Initially, their responsibilities centered on data collection and basic analysis. However, with the emergence of advanced analytics and big data, their scope has broadened considerably, now encompassing sophisticated modeling and predictive analytics. The incorporation of artificial intelligence (AI) and machine learning (ML) into economic practices has further empowered research associates, enabling them to provide deeper insights and more accurate forecasts. This evolution underscores the growing dependence on data to guide investment strategies and monetary planning.

Statistics indicate that:

- 60% of small enterprises in the U.S. employ economic models for budgeting.

- An impressive 93% of worldwide C-level leaders rely on monetary modeling for strategic decision-making.

The typical economic model today is three times more intricate than those constructed a decade ago, highlighting the increasing sophistication in monetary analysis.

Furthermore, the implementation of advanced analytics tools is projected to propel the financial analytics sector to achieve USD 600.46 billion by 2032. This projection emphasizes the essential role that technology plays in shaping the future of financial analysis. How can organizations leverage these advancements to enhance their financial strategies? The continuous evolution of these tools presents a unique opportunity for professionals to refine their approaches and adapt to the changing landscape.

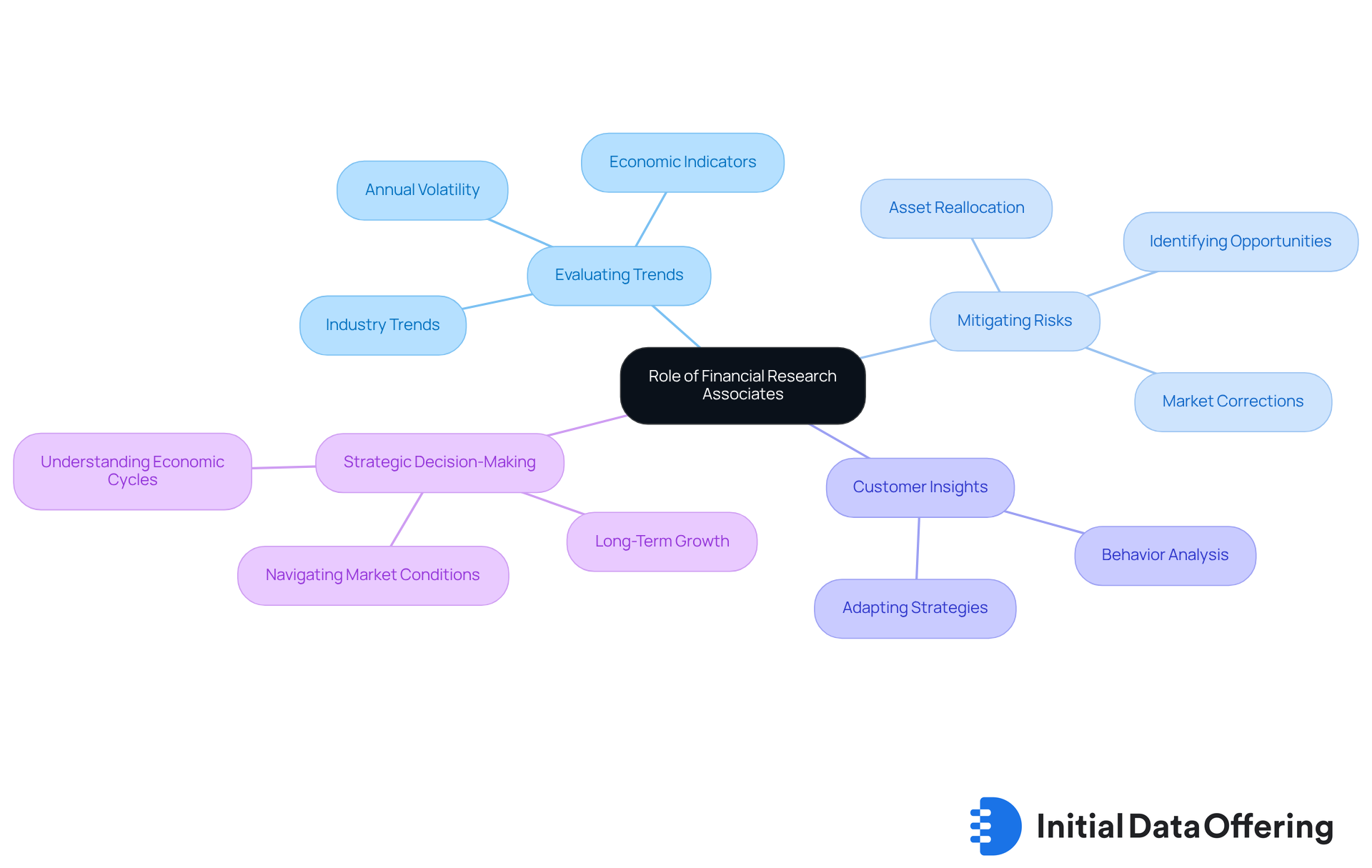

Examine the Importance of Financial Research Associates in Financial Decision-Making

Financial analysis associates play a crucial role in the decision-making process within finance. Their ability to evaluate industry trends and economic indicators empowers financial firms to identify opportunities and mitigate risks. For example, during periods of volatility in the financial sector—occurring approximately once a year with an average decline of 10%—their research aids portfolio managers in reallocating assets to safeguard investments.

Additionally, their insights into customer behavior and industry dynamics enable companies to adapt their strategies to meet evolving demands. As Warren Buffett noted, economic downturns can present opportunities to acquire shares of quality companies at advantageous prices.

By providing a comprehensive view of the financial landscape, financial research associates enable organizations to make strategic decisions that promote growth and profitability. Understanding economic cycles is vital, as highlighted in the case study 'Markets Fluctuate: Stay the Course,' which underscores the importance of remaining invested during downturns. This holistic perspective allows organizations to effectively navigate complex market conditions.

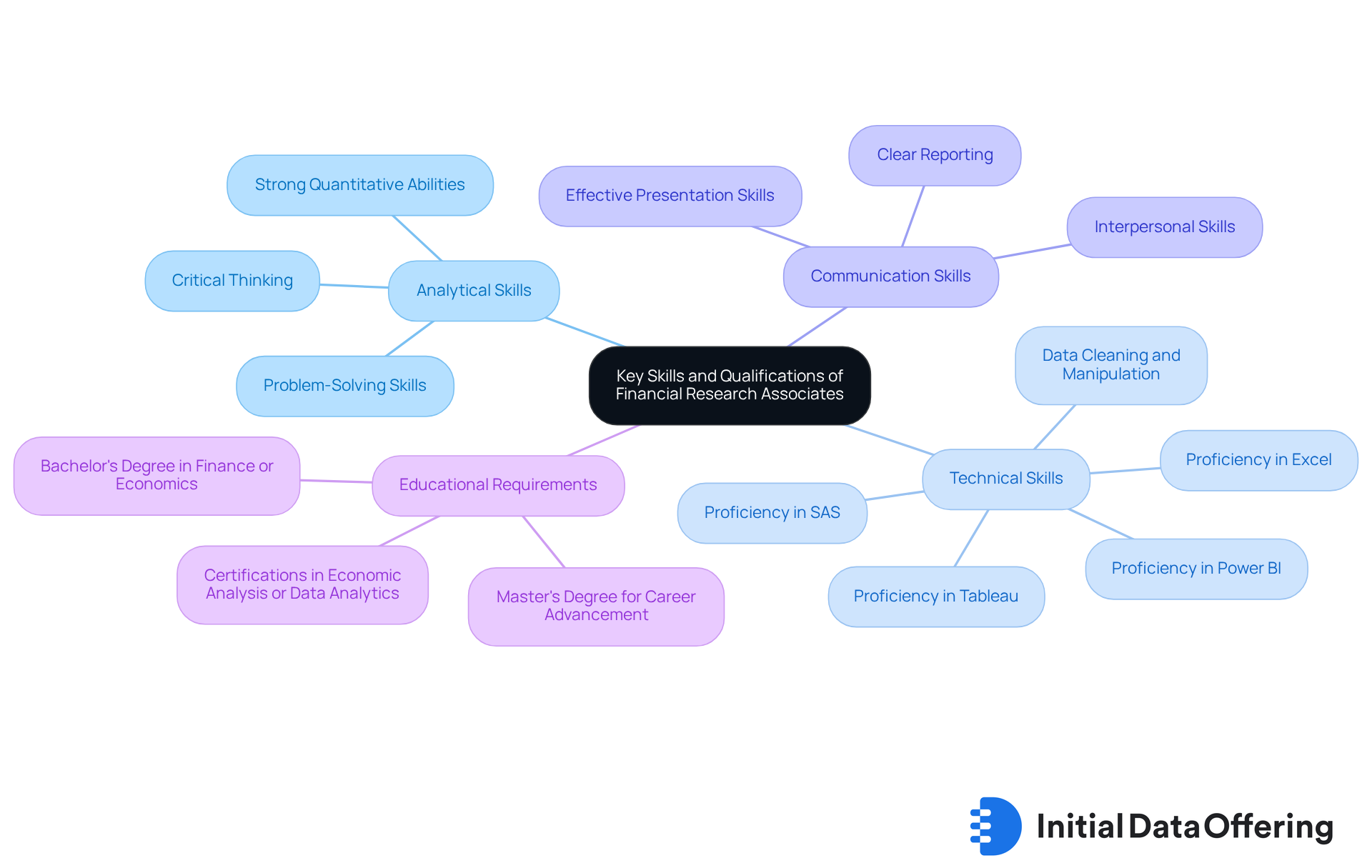

Identify Key Skills and Qualifications of Successful Financial Research Associates

Successful financial research associates embody a unique combination of analytical, technical, and communication skills. They typically hold a degree in finance, economics, or a related field, which serves as a foundational requirement. Proficiency in data analysis tools and software, such as Excel, SAS, Tableau, and Power BI, is crucial for interpreting complex datasets effectively. Strong quantitative abilities allow them to analyze monetary data and derive actionable insights. Effective communication skills are vital for presenting findings clearly to stakeholders. As Andrew D. White emphasizes, 'in this business, words aren’t just words. They’re your most powerful asset.' A profound comprehension of economic systems and investment principles further enhances their capability to provide informed suggestions.

Continuous professional development is vital for career advancement in this field. Pursuing certifications in economic analysis or data analytics not only sharpens expertise but also enhances marketability. Statistics indicate that professionals with advanced degrees or certifications tend to have better job prospects and higher earning potential. For example, a bachelor’s degree can assist in starting as an entry-level analyst, while a master’s degree greatly improves job market opportunities and career growth. Training programs designed for financial research associates typically emphasize enhancing analytical skills, mastering financial modeling, and improving communication techniques. This ensures they remain competitive in a rapidly evolving industry.

Conclusion

Financial research associates are integral to the financial sector, serving as the backbone of informed investment strategies and decision-making processes. Their evolving role, driven by advancements in technology and analytics, underscores their importance in navigating complex economic landscapes. As the demand for skilled professionals in this field continues to grow, understanding their contributions becomes essential for anyone involved in finance.

Key responsibilities of financial research associates encompass:

- Data analysis

- Risk assessment

- The preparation of actionable reports

Their ability to adapt to new technologies, such as AI and machine learning, enhances their effectiveness in delivering insights that influence funding opportunities and strategic planning. This evolution reflects the increasing complexity of financial models and the necessity for precise forecasting in today’s market.

The significance of financial research associates cannot be overstated. Their expertise aids in mitigating risks and identifying opportunities, empowering organizations to make strategic decisions that promote growth and resilience. As the financial landscape continues to evolve, investing in the development of these professionals will be crucial for fostering innovation and ensuring sustainable success in the industry.

Frequently Asked Questions

What are financial research associates?

Financial research associates are professionals who provide essential support to investment analysts and portfolio managers by collecting and analyzing monetary information, market trends, and economic conditions from various sources.

What are the core functions of financial research associates?

Their core functions include preparing comprehensive reports, evaluating funding opportunities, assessing risks, and forecasting earnings, which influence funding recommendations.

How will the role of financial research associates evolve by 2025?

By 2025, financial research associates are expected to increasingly utilize AI-driven insights to enhance their investigative capabilities, leading to quicker and more precise decision-making.

Why are the evaluations provided by financial research associates important?

Their evaluations are critical for monetary organizations as they help refine asset management and strategic planning, ultimately impacting asset-related decision-making.

Can you provide an example of the impact of financial research associates?

One case study showed that an organization using robust analytical methods experienced a significant improvement in asset performance, attributing this success to the thorough evaluations from its analysis team.

What is the future outlook for financial research associates in the advisory sector?

The demand for skilled financial research associates is projected to rise as the advisory sector continues to evolve, reflecting their crucial role in shaping investment strategies and fostering informed decision-making.