7 Ways Alternative Data Enhances Investment Decisions

7 Ways Alternative Data Enhances Investment Decisions

Overview

The article explores how alternative data enhances investment decisions by providing deeper insights, improving risk evaluation, and optimizing portfolio performance. What if you could uncover hidden market dynamics? Utilizing alternative datasets allows investors to adapt their strategies in real-time, thereby gaining a competitive edge in the evolving financial landscape. This capability not only enhances decision-making but also offers a strategic advantage in navigating market complexities. By leveraging these datasets, investors can better understand market trends and respond proactively, ultimately leading to improved investment outcomes.

Introduction

The financial landscape is experiencing a seismic shift as alternative data emerges as a transformative element for investment strategies. Investors are now equipped with powerful insights derived from diverse datasets, which not only enhance traditional metrics but also uncover hidden market dynamics. However, amidst this wealth of information, how can firms effectively navigate the complexities of integrating alternative data into their decision-making processes? This article explores seven innovative ways that alternative data can elevate investment decisions, providing a clear roadmap for companies eager to harness its full potential.

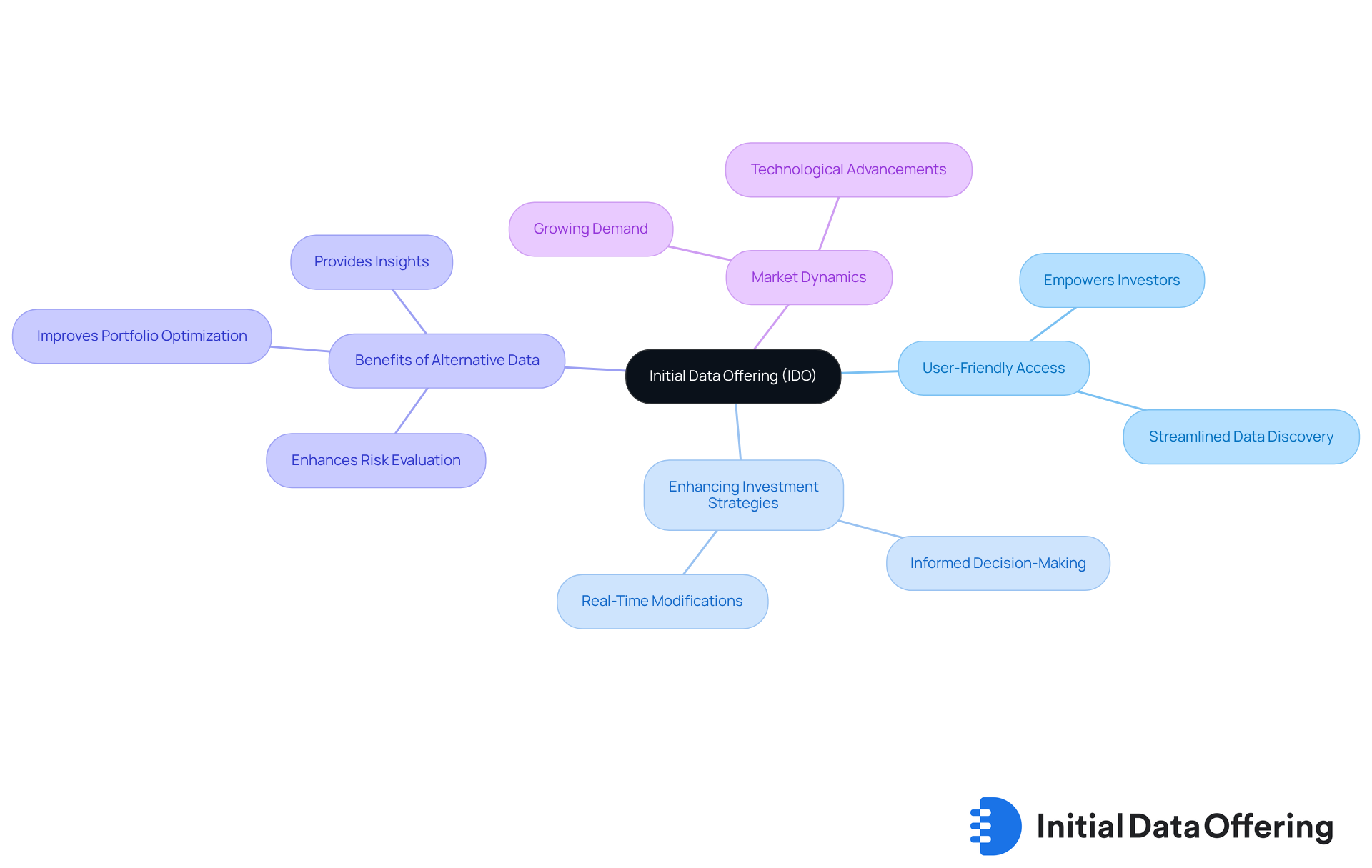

Initial Data Offering: Streamline Your Access to Alternative Data for Investment Decisions

The Initial Data Offering (IDO) serves as a pivotal centralized hub for accessing a diverse range of alternative datasets. This platform is designed to be user-friendly, empowering investors to discover and leverage alternative data for investment decisions that can significantly enhance their investment strategies. In a market where timely and pertinent information is crucial, streamlined access to alternative data for investment decisions is essential for informed decision-making and gaining competitive advantages.

Investment analysts emphasize that alternative data for investment decisions not only enhances conventional metrics but also uncovers concealed market dynamics. This allows investors to make more strategic decisions. With new datasets being listed daily, IDO ensures that users have access to the latest insights and trends, further enhancing their analytical capabilities.

Successful examples of centralized hubs like IDO illustrate how efficient information gathering can transform financial strategies. They enable real-time modifications based on market sentiment and trends. The advantages of utilizing diverse information, such as alternative data for investment decisions, are numerous:

- It enhances risk evaluation

- It improves portfolio optimization

- It provides insights that conventional sources may overlook

As the financial landscape evolves, platforms like IDO become essential for investors aiming to refine their strategies using alternative data for investment decisions and maintain a competitive edge. Consider subscribing to the Initial Data Offering for premium access to exclusive datasets and insights that can significantly influence your financial choices.

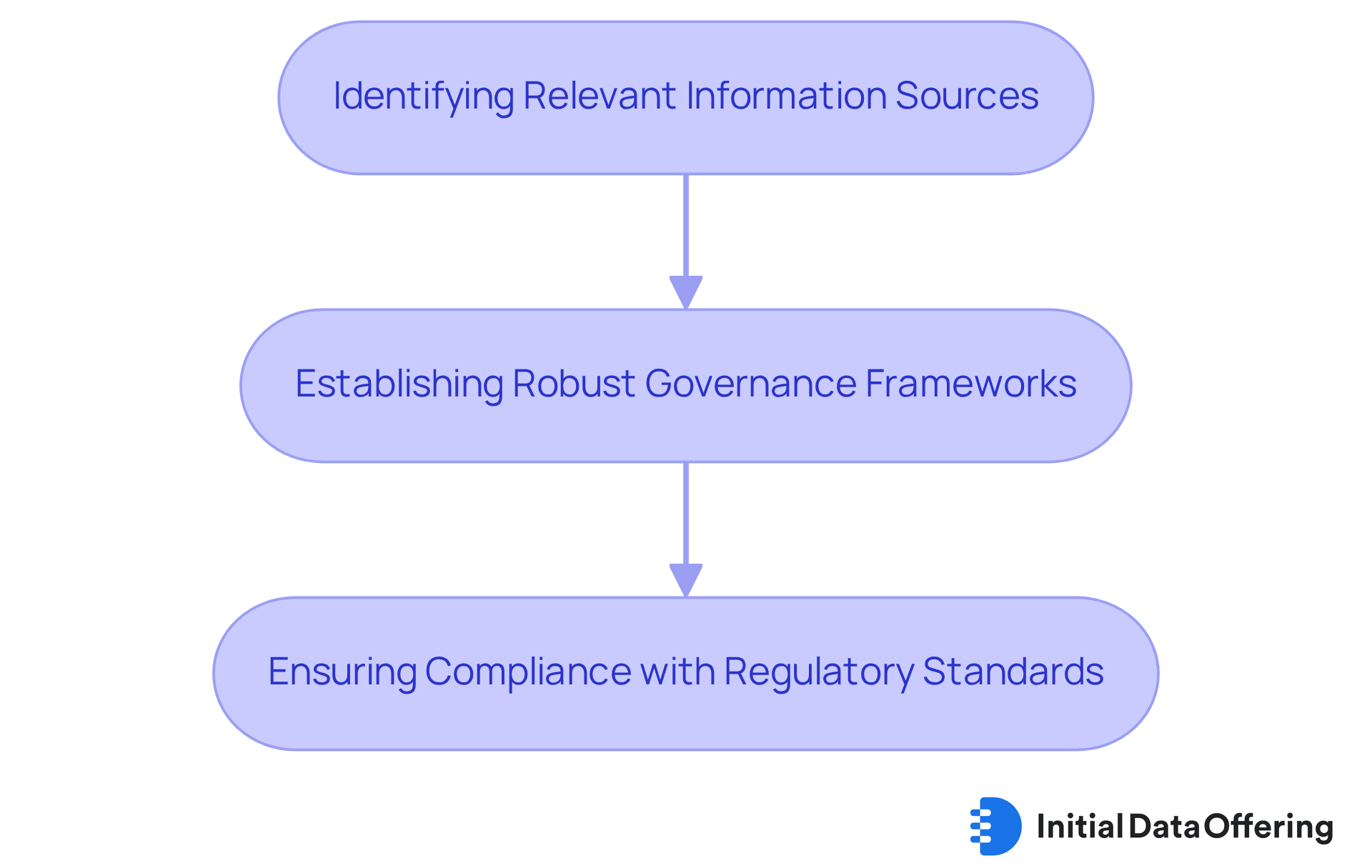

Deloitte: Comprehensive Roadmap for Integrating Alternative Data in Investment Strategies

Deloitte has created a comprehensive plan for financial companies looking to successfully integrate alternative data for investment decisions into their strategies. This roadmap outlines several key steps:

- Identifying relevant information sources

- Establishing robust governance frameworks

- Ensuring compliance with regulatory standards

By adhering to these guidelines, companies can substantially enhance their analytical capabilities, leading to more informed investment decisions through the use of alternative data for investment decisions and ultimately improving portfolio performance.

Notably, the global market for alternative information providers is projected to reach US$137 billion by 2029, growing at an impressive compound annual growth rate (CAGR) of 53%. This underscores the necessity for companies to adopt diverse information practices, including alternative data for investment decisions, to maintain competitiveness.

However, asset management firms encounter challenges such as procurement costs and the demand for technical expertise, complicating the integration process. Furthermore, fostering a culture of experimentation and collaboration between funding and information teams is essential for facilitating smoother integration and utilization of alternative information sources, ultimately resulting in improved funding outcomes.

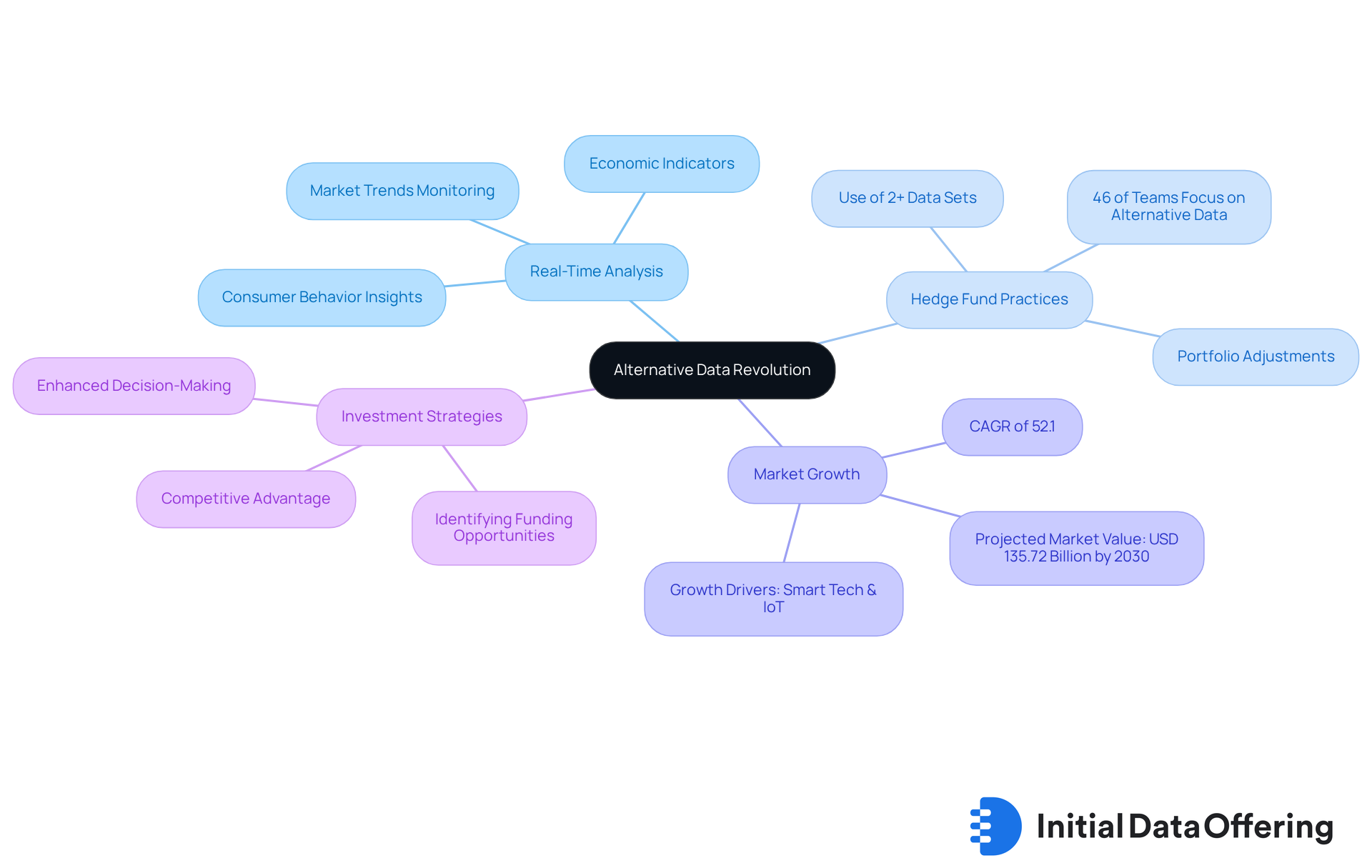

Alternative Data Revolution: Transforming Investment Research and Decision-Making

The rise of alternative data for investment decisions has fundamentally transformed financial research, providing insights that conventional sources often overlook. Investors can now harness real-time analysis of consumer behavior, market trends, and economic indicators as alternative data for investment decisions, significantly improving the speed and quality of their decision-making processes.

For instance, hedge funds are increasingly utilizing unconventional data to gauge market sentiment and swiftly adjust portfolios in response to market-moving events. Notably, 46% of hedge fund teams allocate 20% or more of their time to focus on non-traditional information, underscoring its growing importance in financial strategies. This transition not only enhances the quality of research but also uncovers funding opportunities that may have previously been overlooked.

As Doug Dannemiller, Senior Research Leader at Deloitte, states, "Integrating different information in the financial decision-making process may not be a plug-and-play situation," which highlights the complexities involved. Companies that utilize alternative data for investment decisions in their strategies are better positioned to capitalize on emerging trends and make informed financial decisions, ultimately strengthening their competitive advantage in a rapidly evolving market landscape.

Furthermore, the alternative information market is projected to reach USD 135.72 billion by 2030, emphasizing its significance in the financial arena.

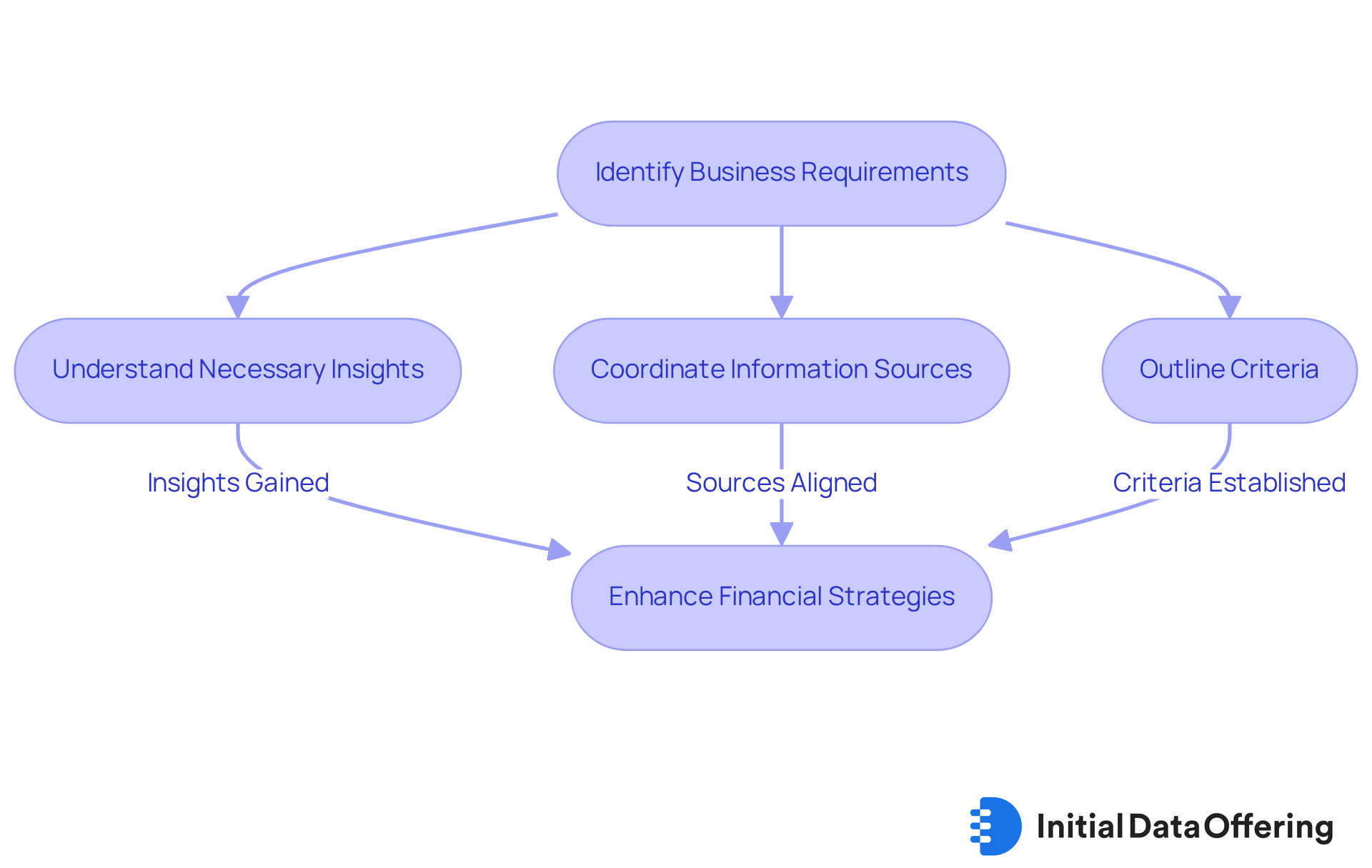

Identifying Business Requirements: Key to Effective Use of Alternative Data in Investments

To efficiently utilize various information sources, financial companies must first identify their specific business needs. This requires a comprehensive understanding of the insights necessary to inform financial decisions and the coordination of information sources accordingly. By clearly outlining these criteria, companies can ensure that the supplementary information they employ is not only relevant but also practical, ultimately enhancing their financial strategies.

For instance, a recent study revealed that 67% of financial consultants for hedge funds and private equity firms now utilize non-traditional information, a significant increase from 31% in 2022. This shift underscores the growing recognition of the value of non-traditional information in refining financial strategies.

Moreover, financial companies that prioritize the alignment of their information sources with business requirements are better positioned to capitalize on emerging trends and insights. The successful integration of supplementary information can lead to improved predictive accuracy, enabling companies to make timely financial decisions based on current consumer behavior and market dynamics.

As noted by industry experts, the ability to merge non-traditional information with conventional sources enhances the overall decision-making process. This alignment not only supports financial strategies but also fosters a data-driven culture within organizations, which is crucial for achieving business objectives.

In summary, the importance of aligning alternative information sources with financial strategies cannot be overstated. Companies that effectively manage this alignment are likely to gain a competitive edge in the rapidly evolving financial landscape.

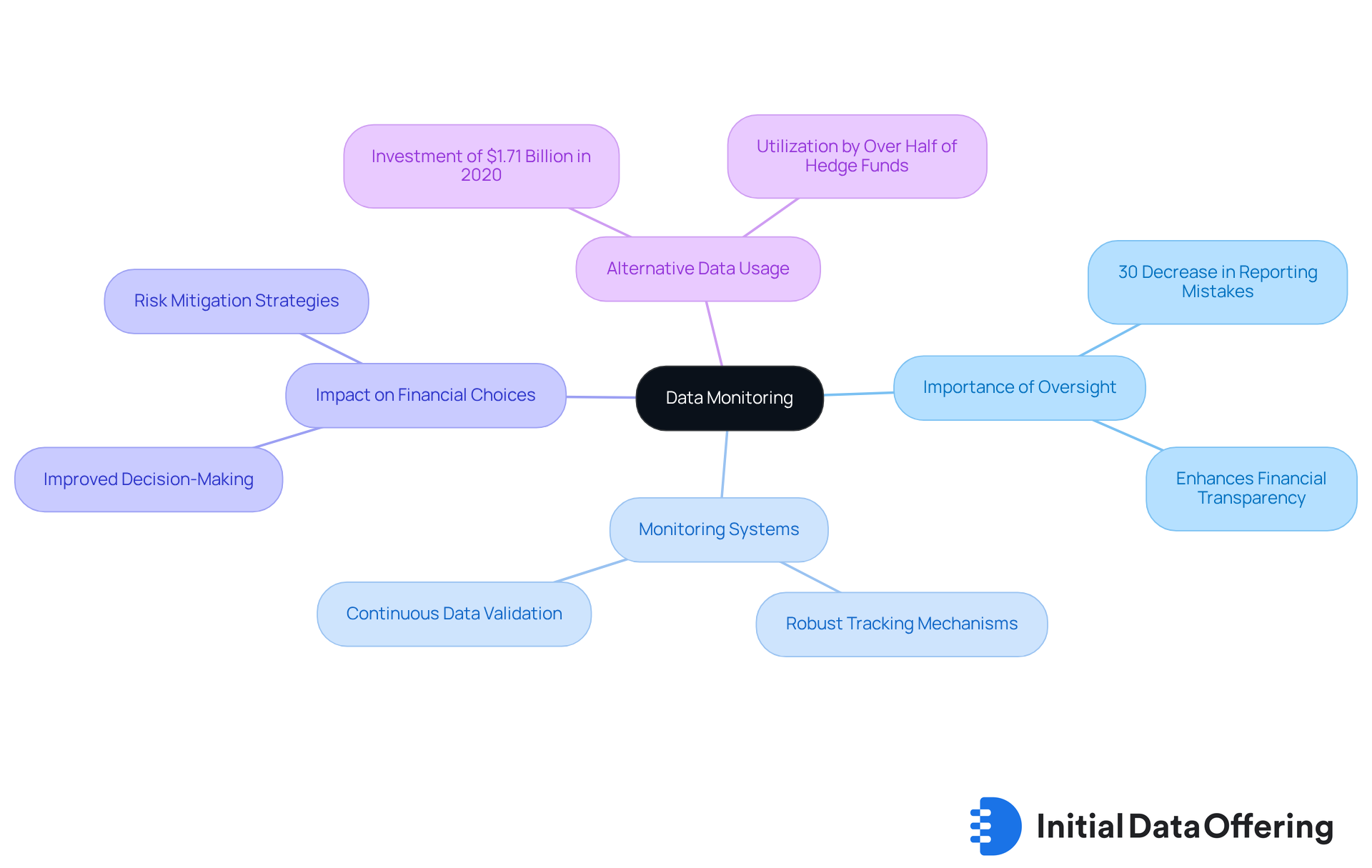

Data Monitoring: Ensuring Accuracy and Efficacy in Investment Decisions

Ongoing oversight of information is essential for preserving the precision and efficacy of financial choices. By establishing robust monitoring systems, financial firms can systematically track the performance of alternative data for investment decisions. This allows for timely adjustments to their strategies, reducing risks associated with inaccuracies and significantly improving the dependability of financial analyses. For instance, organizations that prioritize information accuracy in their financial processes typically experience a 30% decrease in reporting mistakes, underscoring the critical role of careful monitoring.

Moreover, more than half of hedge funds have adopted various types of information, such as the extensive long and short equity positioning insights provided by Initial Data Offering, to inform their financial strategies. This proprietary dataset captures long and short positions across equities and swaps worldwide, sourced from over 600 funds representing $700 billion in GMV. In 2020, buy-side companies globally allocated $1.71 billion on alternative data for investment decisions, highlighting its significance in shaping financial strategies. As the investment landscape continues to evolve, incorporating ongoing monitoring systems will be crucial for companies aiming to utilize alternative data for investment decisions effectively and achieve improved investment results.

Boosting Data Science Capabilities: Enhancing Market Research with Alternative Data

Investment companies can significantly enhance their market research capabilities by investing in analytical science training for their teams. This training focuses on effectively examining diverse information and utilizing advanced analytical tools, which are essential in today's information-driven landscape. By fostering an environment that prioritizes data-driven insights, companies can gain deeper understanding from various datasets. This, in turn, leads to more informed financial decisions and improved competitive positioning in the market.

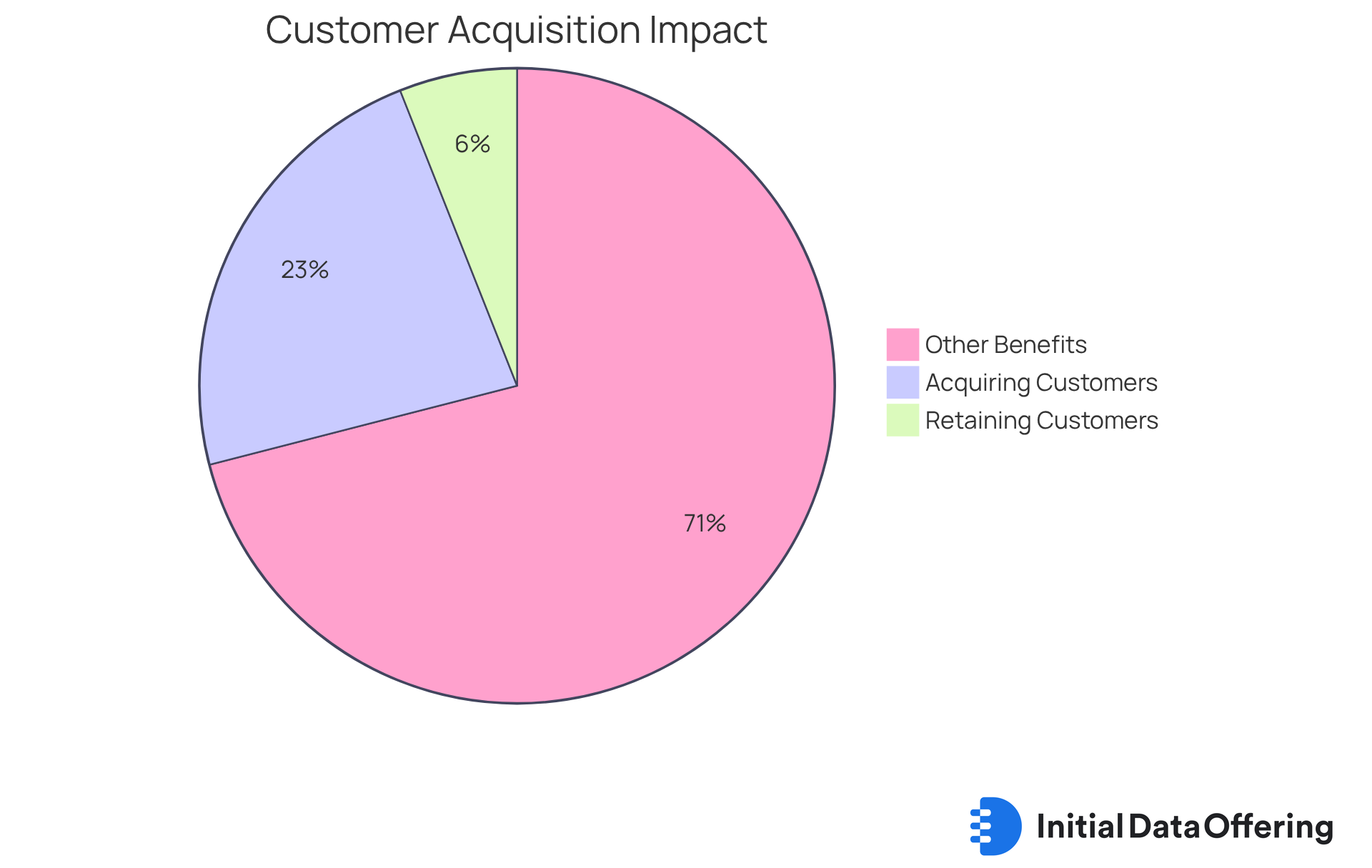

Industry leaders emphasize that organizations with strong information capabilities are:

- 23 times more likely to acquire customers

- Six times more likely to retain them

Furthermore, as 85% of asset managers anticipate an increase in their non-traditional budget allocations, the demand for skilled individuals who can navigate and analyze this information becomes increasingly critical. Additionally, 60% of organizations believe that large-scale information and analytics capabilities are becoming more important, underscoring the necessity of science training in financial decision-making.

Numerous financial companies have successfully prepared their teams in analytics, enabling them to leverage alternative data for investment decisions to enhance their decision-making. This commitment to improving analytical skills not only allows companies to assess diverse information effectively but also positions them for success in an increasingly competitive financial environment.

How might your organization benefit from such training? The evidence is clear: investing in analytical capabilities can lead to substantial competitive advantages.

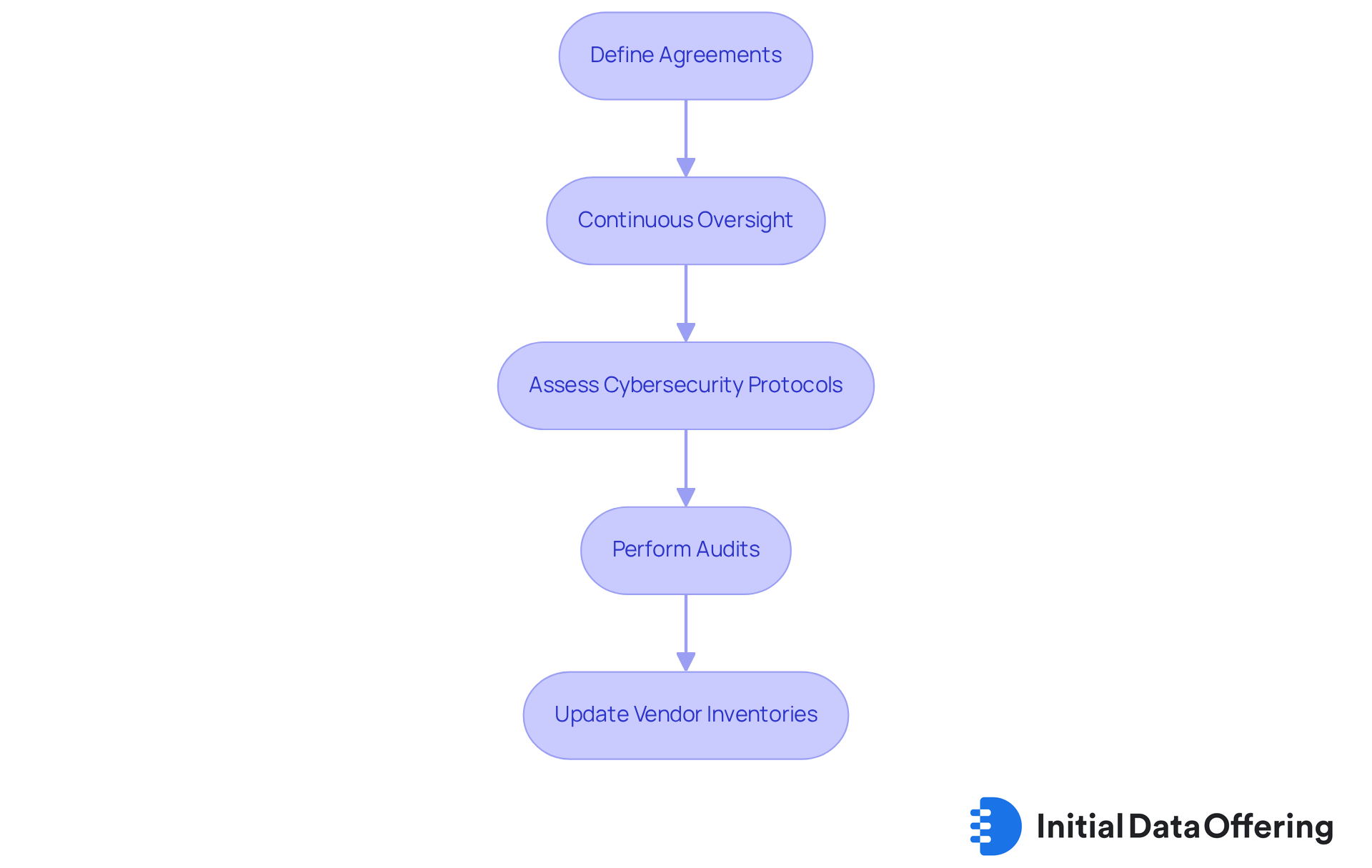

Vendor Risk Management: Safeguarding Your Investment in Alternative Data

Strong vendor risk management is essential for safeguarding investments by utilizing alternative data for investment decisions. Investment companies must conduct thorough due diligence to assess the trustworthiness of their information suppliers and ensure adherence to regulatory standards. This process involves:

- Creating clearly defined agreements that specify information sharing and retention policies.

- Executing continuous oversight of vendor performance.

By actively evaluating vendors' cybersecurity protocols and operational dependability, companies can greatly minimize risks related to sourcing information.

For example, organizations ought to frequently assess vendor inventories and perform audits to ensure that vendors comply with security protocols and uphold the integrity of the information provided. Compliance specialists stress that a systematic method for vendor selection and ongoing oversight is crucial for protecting sensitive information and improving financial strategies.

Have you considered how your organization manages vendor relationships? According to recent findings, 60% of companies lack a complete list of all third parties with whom they share sensitive information, underscoring the importance of thorough vendor assessments.

Ultimately, effective due diligence not only enhances the trustworthiness of information providers but also strengthens the overall financial structure, empowering companies to make informed choices based on alternative data for investment decisions. To further improve vendor risk management, companies should create a routine for reviewing and updating vendor inventories, ensuring that they stay informed of any changes in vendor performance or compliance status.

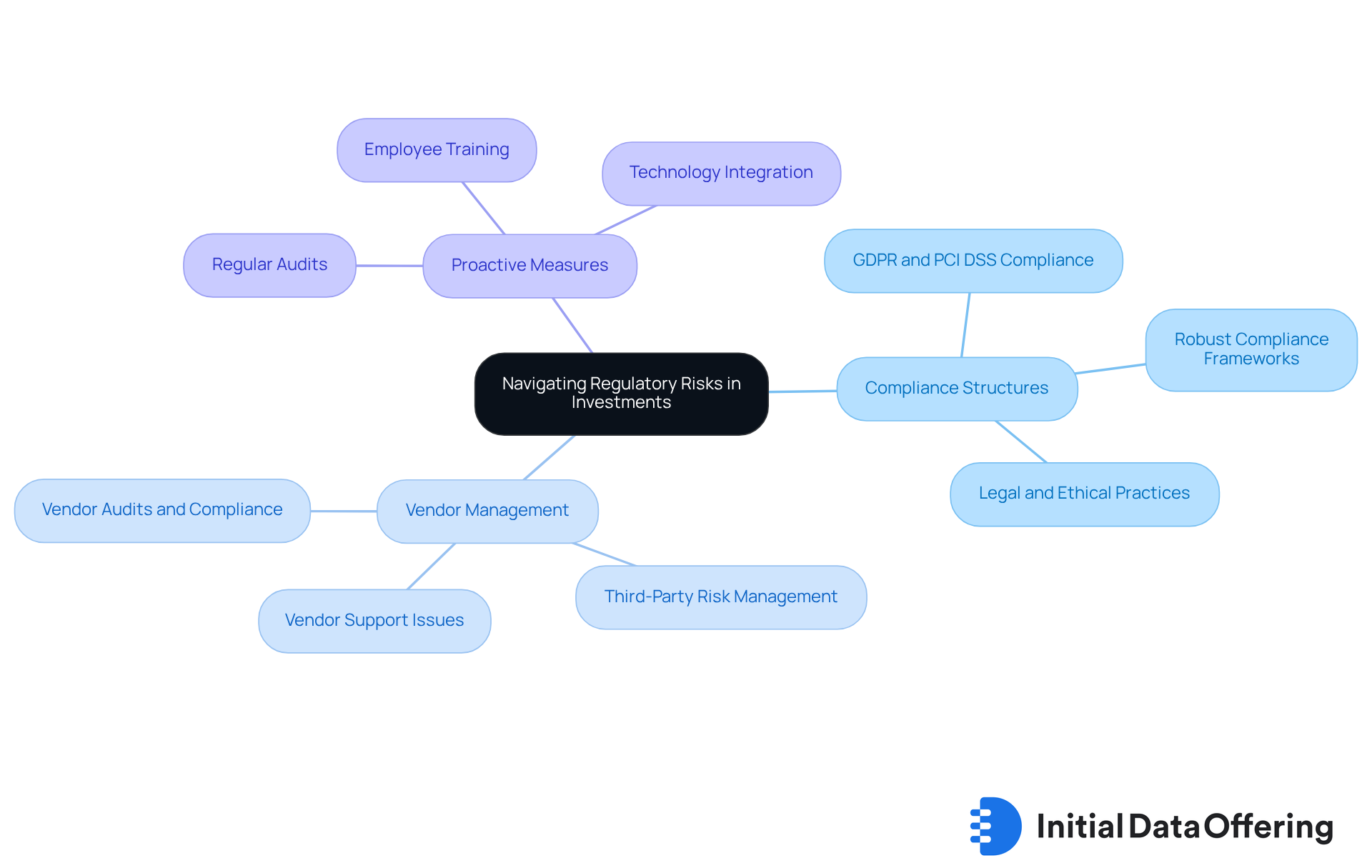

Navigating Regulatory Risks: Compliance in the Use of Alternative Data for Investments

As alternative data for investment decisions becomes increasingly essential to financial strategies, companies face a complex regulatory environment that necessitates careful maneuvering. Establishing robust compliance structures is critical for addressing the unique challenges associated with alternative information, ensuring that financial practices are both ethical and legally compliant. For instance, investment companies are adopting frameworks that adhere to regulations such as GDPR and PCI DSS, which govern protection and privacy. Legal experts highlight that these frameworks not only mitigate risks but also enhance operational transparency, thereby fostering trust among stakeholders. A legal specialist noted, "Investment companies must ensure their compliance frameworks are not only sturdy but also flexible to the changing regulatory environment to uphold stakeholder trust."

Investment companies must also stay updated on evolving privacy regulations, which can significantly impact their operations. A recent survey indicated that 39% of businesses cite vendor support issues as a primary reason for enhancing their security frameworks, underscoring the necessity for comprehensive vendor management strategies. This is particularly crucial given that organizations with high non-compliance face an average breach expense of $5.05 million, illustrating the financial ramifications of regulatory failures. As a result, companies are increasingly implementing frameworks that incorporate thorough vendor management protocols to ensure adherence across all information sources.

To effectively navigate these complexities, financial organizations are adopting proactive measures, including:

- Regular audits

- Employee training on compliance protocols

By fostering a culture of adherence and leveraging technology to streamline processes, companies can enhance their ability to manage regulatory risks associated with the use of alternative data for investment decisions. As the landscape continues to evolve, remaining informed and adaptable will be vital for ensuring compliance and achieving strategic financial objectives.

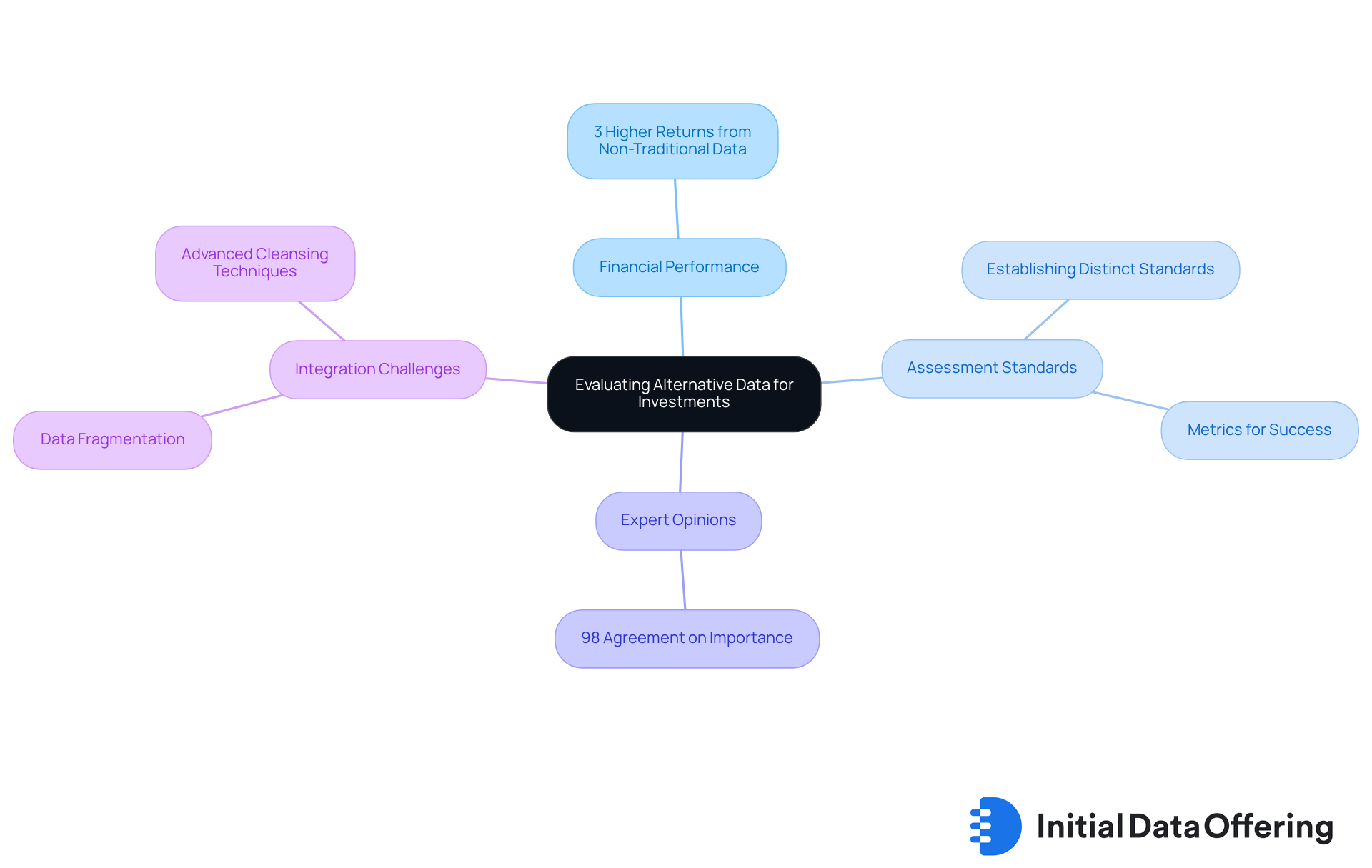

Evaluating Return Potential: Maximizing Investment Insights from Alternative Data

To fully harness the advantages of diverse information sources, financial companies must implement a systematic strategy to evaluate alternative data for investment decisions. This necessitates a thorough examination of how various datasets, particularly alternative data for investment decisions, influence financial performance, alongside the identification of key metrics that signify success.

Establishing distinct assessment standards is crucial; it enables companies to ensure that their investments in different information, such as alternative data for investment decisions, yield practical insights that enhance overall portfolio performance. For instance, a 2024 study by J.P. Morgan revealed that hedge funds utilizing non-traditional information achieved annual returns that are 3% higher than those relying solely on conventional sources.

Furthermore, 98% of finance experts agree or strongly agree that the use of alternative data for investment decisions is increasingly vital for uncovering innovative ideas to improve alpha. However, companies face challenges in integrating non-traditional information, such as data fragmentation and the need for advanced cleansing techniques.

By focusing on these metrics and acknowledging these challenges, companies can effectively evaluate the success of non-traditional information integration and refine their investment strategies accordingly.

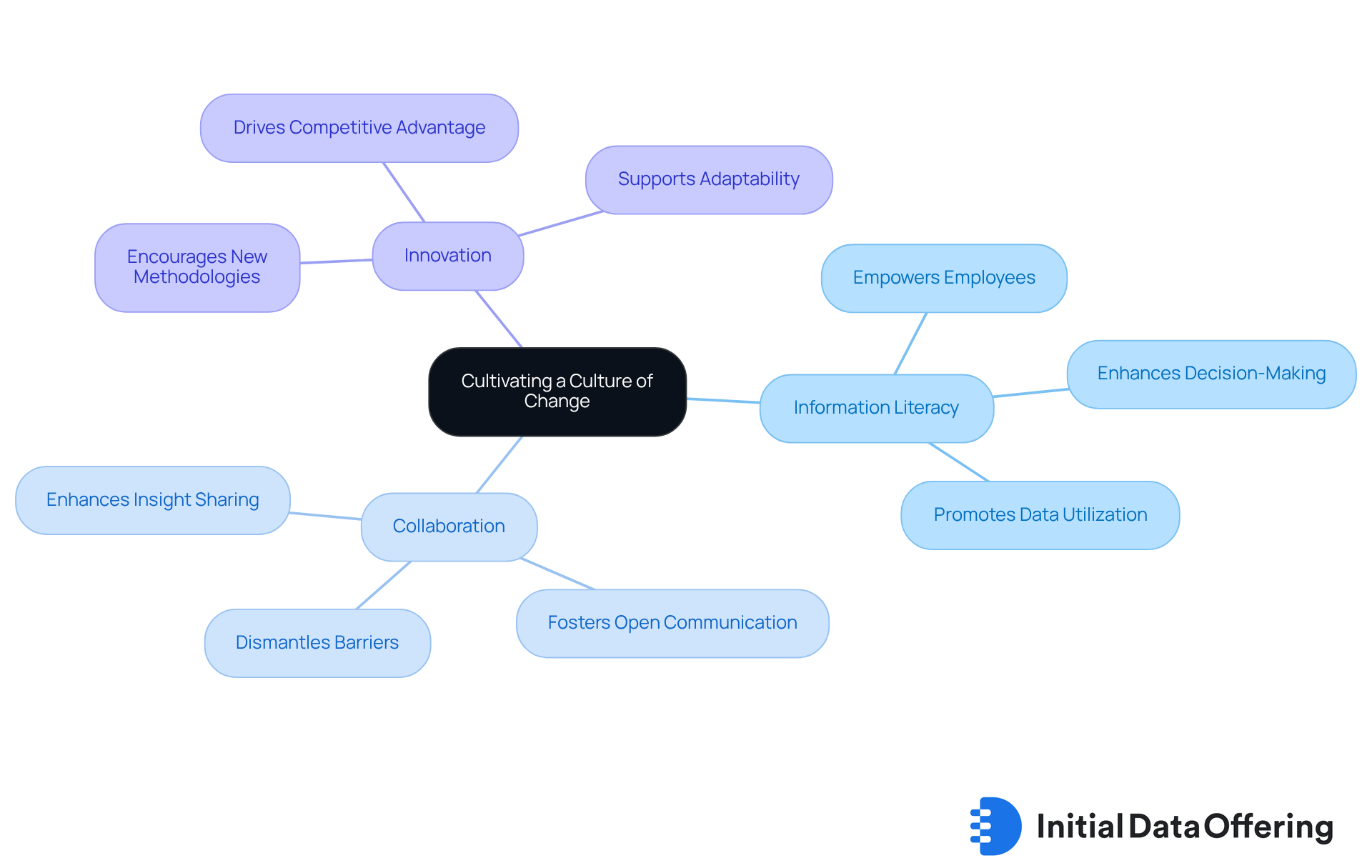

Cultivating a Culture of Change: Embracing Alternative Data in Investment Firms

Investment companies must actively foster a culture of change to realize the full potential of alternative information. This commitment to innovation encourages organizations to explore new data-driven methodologies and insights. Information literacy is crucial; it empowers all employees, not just those in IT or analytics, to comprehend and effectively utilize information in their decision-making processes. As Luke Komiskey states, "Information is the new gold and the key to improved decision-making," which underscores the importance of information literacy initiatives. Companies that prioritize these initiatives have seen significant enhancements in their financial strategies, as knowledgeable teams leverage alternative information to gain competitive advantages.

Collaboration across departments is equally vital. By dismantling barriers and promoting open communication, companies can ensure that insights derived from alternative information are shared and utilized effectively. David Gilbert emphasizes that fostering a culture centered on innovative research and communication is essential for navigating the complexities of contemporary financial environments. Furthermore, organizations with robust data-driven cultures are twice as likely to exceed their business goals compared to those that do not. Companies that embrace data literacy and innovation are better positioned to adapt to market changes and enhance their investment decision-making capabilities by utilizing alternative data for investment decisions. This comprehensive approach not only drives improved outcomes but also positions firms as leaders in the insights economy.

Conclusion

The exploration of alternative data reveals its transformative potential in enhancing investment decisions. By leveraging diverse datasets, investors can gain deeper insights that transcend traditional metrics, leading to more informed and strategic financial choices. Platforms like the Initial Data Offering (IDO) exemplify how streamlined access to alternative data empowers investors to stay ahead in a competitive landscape.

Key arguments throughout the article underscore the necessity of integrating alternative data into investment strategies. The features of alternative data include improved risk evaluation and portfolio optimization, which are significant advantages. These benefits facilitate navigating regulatory challenges and fostering a data-driven culture, ultimately refining financial strategies and achieving superior investment outcomes.

Embracing alternative data is not merely a trend; it is a critical strategy for investment firms aiming to thrive in a rapidly evolving market. Organizations must prioritize the integration of alternative data, invest in data science capabilities, and cultivate a culture of innovation to fully harness its advantages. By doing so, they position themselves as leaders in the insights economy, ready to capitalize on emerging opportunities and drive long-term success.

Frequently Asked Questions

What is the Initial Data Offering (IDO)?

The Initial Data Offering (IDO) is a centralized hub designed for accessing a diverse range of alternative datasets, empowering investors to discover and leverage alternative data for informed investment decisions.

How does alternative data enhance investment strategies?

Alternative data enhances investment strategies by improving risk evaluation, optimizing portfolios, and providing insights that conventional sources may overlook, thereby uncovering concealed market dynamics.

What are the benefits of using platforms like IDO for investment decisions?

Platforms like IDO provide streamlined access to the latest insights and trends, allowing for real-time modifications based on market sentiment and improving analytical capabilities.

What roadmap has Deloitte created for integrating alternative data into investment strategies?

Deloitte's roadmap includes identifying relevant information sources, establishing robust governance frameworks, and ensuring compliance with regulatory standards to enhance analytical capabilities and improve portfolio performance.

What challenges do asset management firms face when integrating alternative data?

Asset management firms encounter challenges such as procurement costs and the need for technical expertise, which complicate the integration process.

How has alternative data transformed financial research and decision-making?

Alternative data has transformed financial research by providing real-time analysis of consumer behavior, market trends, and economic indicators, significantly improving the speed and quality of decision-making processes.

What percentage of hedge fund teams focus on non-traditional information?

Approximately 46% of hedge fund teams allocate 20% or more of their time to focus on non-traditional information, highlighting its growing importance in financial strategies.

What is the projected growth of the alternative information market?

The global market for alternative information providers is projected to reach USD 137 billion by 2029, with a compound annual growth rate (CAGR) of 53%, emphasizing the necessity for companies to adopt diverse information practices.