10 Essential M&A Database Insights for Market Analysts

10 Essential M&A Database Insights for Market Analysts

Overview

The article "10 Essential M&A Database Insights for Market Analysts" emphasizes the significance of comprehensive M&A datasets in enhancing the analytical capabilities of market analysts. It highlights features such as:

- Transaction values

- Sector dynamics

- Regional conditions

These elements not only provide a robust data foundation but also empower analysts to make informed decisions and strategize effectively in the dynamic landscape of mergers and acquisitions.

How can these insights transform your approach to market analysis? By leveraging this data, analysts can navigate complexities and uncover opportunities that might otherwise remain hidden. Ultimately, the insights derived from the M&A database are crucial for strategic planning and informed decision-making.

Introduction

In the intricate world of mergers and acquisitions, access to accurate and comprehensive data is paramount for market analysts striving to make informed decisions. The evolving landscape of M&A demands a keen understanding of various datasets, such as transaction values and regional insights. These datasets enable analysts to uncover trends and forecast future movements, providing a significant advantage in navigating the complexities of the market.

However, as the market grows increasingly complex, how can analysts effectively leverage these insights to navigate uncertainties and seize emerging opportunities? This question underscores the importance of utilizing data strategically to enhance decision-making processes.

Initial Data Offering: Access Comprehensive M&A Datasets for Informed Analysis

The Initial Data Offering (IDO) is an essential resource for analysts, providing access to a diverse array of M&A datasets through the M&A database powered by SavvyIQ's AI-driven infrastructure, which includes the SavvyIQ Public & Private Company Entity Resolution Data. These datasets feature comprehensive details on past transactions, industry trends, and sector performance, which provide analysts with the necessary tools to perform thorough evaluations.

By leveraging IDO's AI-driven Recursive Data Engine, which continuously enhances and expands the dataset's quality, analysts can easily discover and utilize high-quality datasets. This capability significantly boosts their analytical prowess and supports informed decision-making utilizing the M&A database in processes.

How can these datasets transform your analytical approach? Consider the implications of such powerful tools in your work.

M&A Statistics: Understand Market Trends and Deal Activity

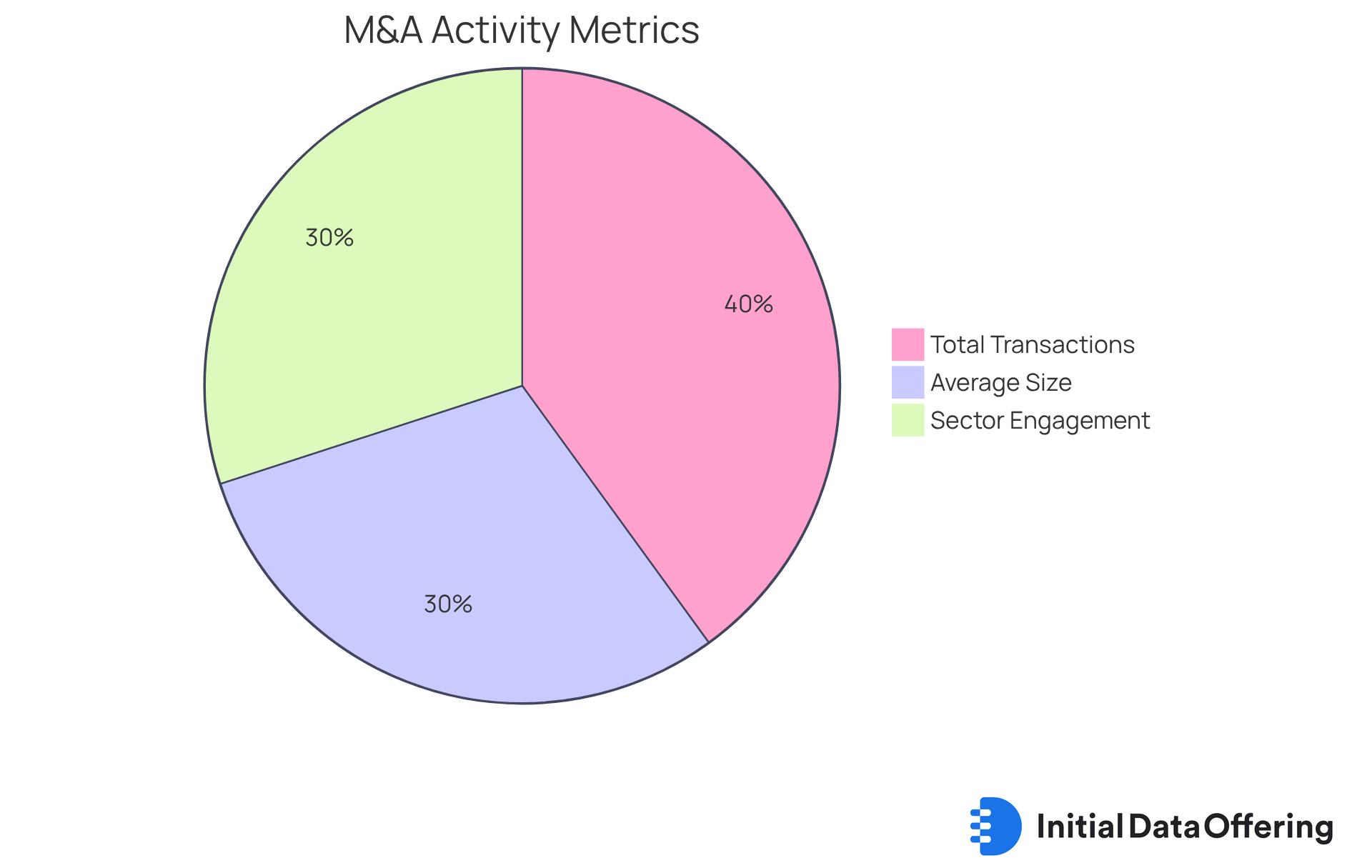

M&A statistics from the m&a database play a pivotal role in deciphering the mergers and acquisitions landscape. Analysts should focus on essential metrics such as:

- The total quantity of transactions

- Average transaction size

- Sector-specific engagement

to gain insights into market dynamics. For instance, in the first half of 2025, the Americas dominated global M&A transactions with an impressive $908 billion in value, indicating a substantial rise from $722 billion the prior year. This surge reflects a growing preference for domestic transactions amid geopolitical uncertainties, with 91% of capital remaining within the region.

By closely analyzing these statistics, market analysts can identify emerging trends, evaluate the overall health of the m&a database, and make informed forecasts about future transaction activity. The current environment is marked by a shift towards quality, where high-quality companies draw greater interest, and control premiums in substantial transactions have stabilized around 30%. This trend highlights disciplined pricing strategies among transaction makers.

Furthermore, the quantity of M&A transactions in 2025 is anticipated to exhibit cautious optimism as firms leverage the m&a database to navigate uncertainties while pursuing transformative strategies. As Brian Levy, Global Transactions Industries Leader at PwC US, aptly noted, "The transactions environment is both frustrating and extraordinarily exciting." This sentiment underscores the necessity for analysts to leverage data-driven insights to align their strategies with market realities, ultimately driving better decision-making and outcomes. Additionally, Lucy Stapleton, Global Deals Leader at PwC UK, emphasizes the importance of steering with strategy in uncertain environments, reinforcing the need for a proactive approach in M&A analysis.

M&A Deal Values: Assess the Financial Impact of Transactions

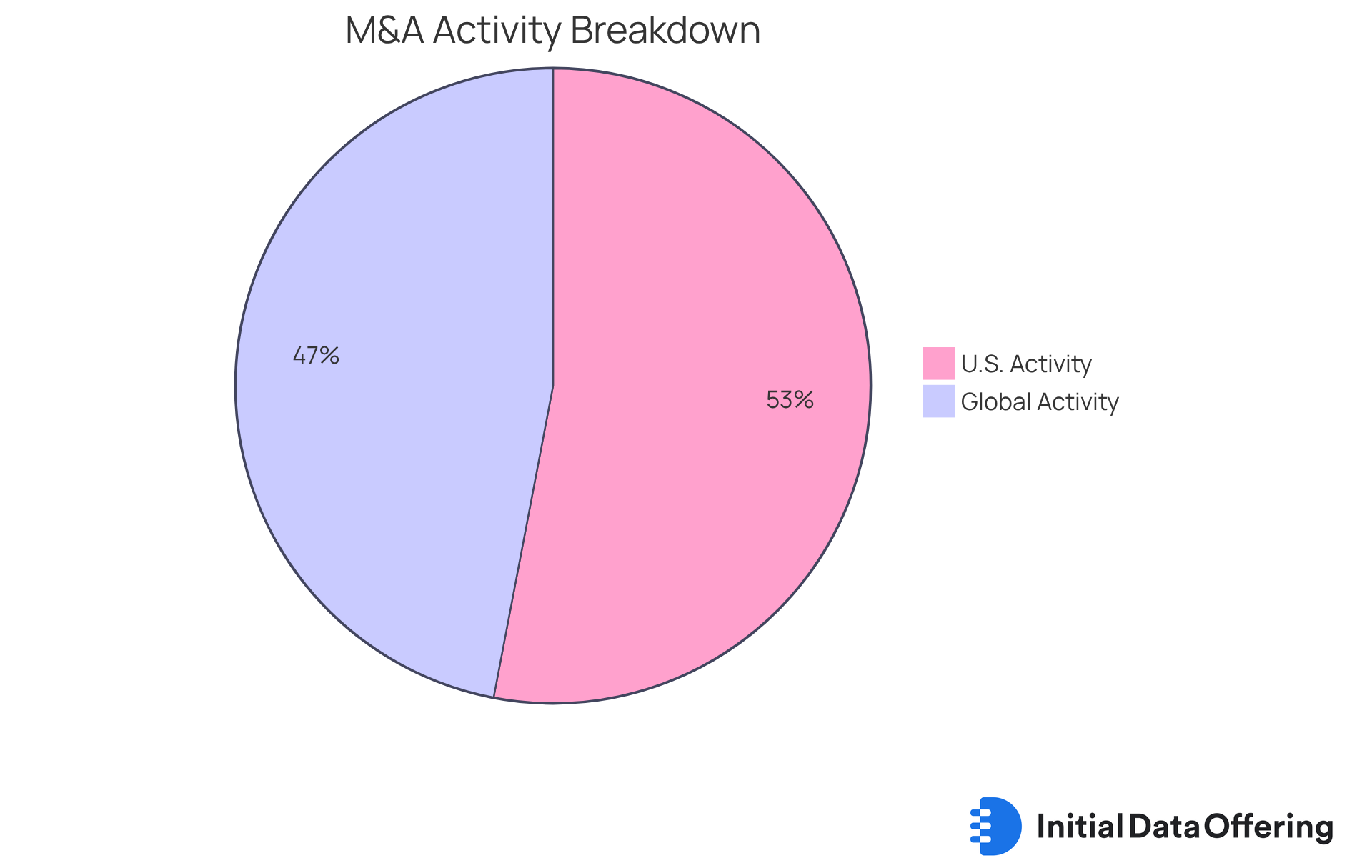

M&A agreement values provide essential insights into the financial impacts of transactions. Analysts must assess both the overall transaction value and the valuation multiples to fully understand the significance of each agreement. In Q2 2025, the U.S. accounted for $413 billion in total transaction value, representing 53% of global activity. Notably, 14 transactions exceeded $10 billion, contributing to a resurgence in M&A engagement. By comparing transaction values across various sectors and timeframes using the M&A database, analysts can discern trends in valuation and evaluate their potential influence on future M&A activities. This analysis is crucial for companies looking to strategically position themselves within the industry.

Furthermore, understanding the financial implications of M&A transactions necessitates a comprehensive examination of how these agreements affect company valuations and industry dynamics, which can be explored in the M&A database. Analysts should consider the implications of valuation multiples in their assessments, as these metrics provide valuable insights into market sentiment and investor expectations. As Brian Levy, a prominent figure in international transactions, emphasizes, this is a time for negotiators to be bold and innovative, navigating the complexities of the landscape to leverage new technologies and gain a competitive edge. Emma-Victoria Farr notes that the U.S. remains the largest venue for M&A, accounting for over half of global activity.

In conclusion, a comprehensive analysis using the M&A database for transaction values and valuation multiples is vital for businesses aiming to strategically navigate an evolving market landscape.

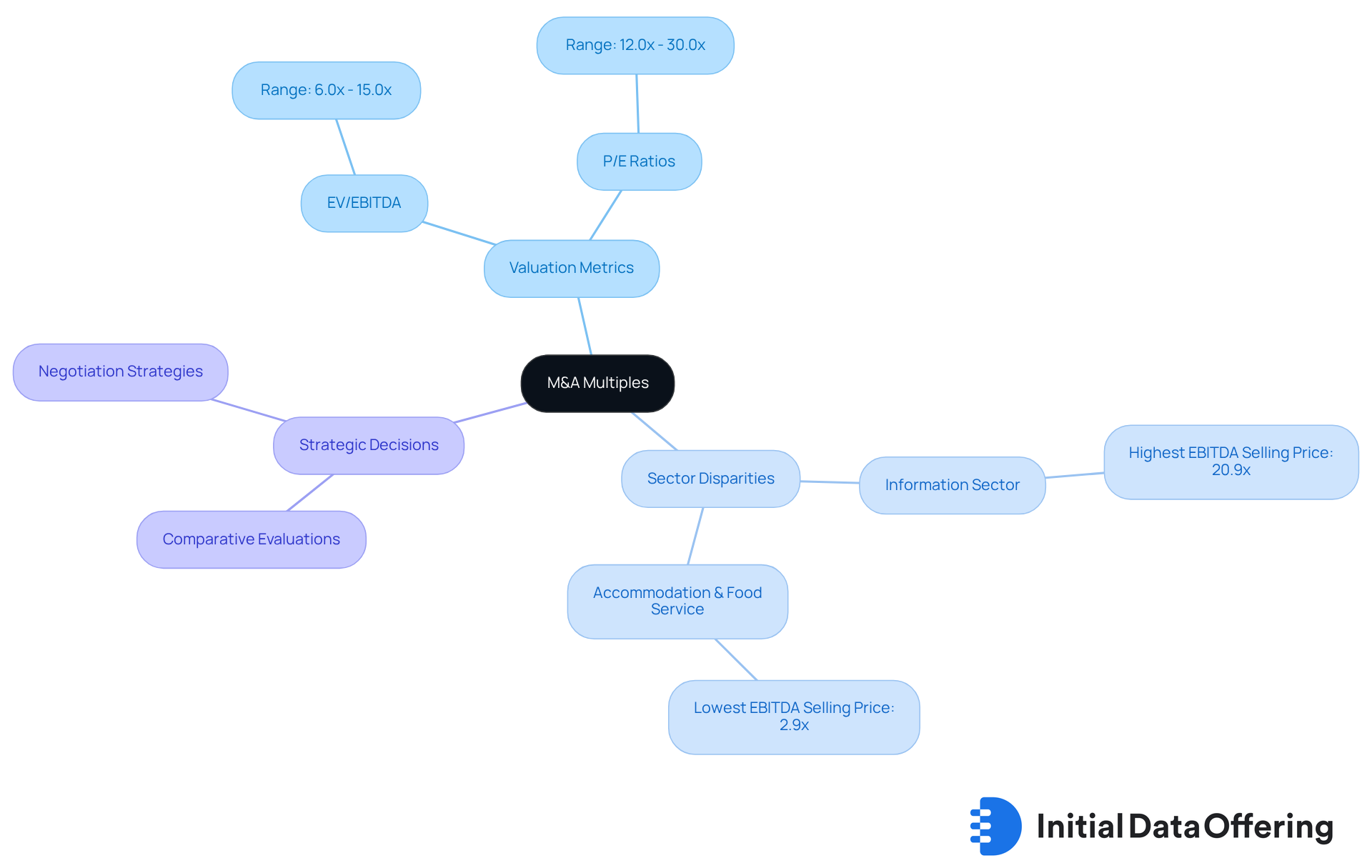

M&A Multiples: Evaluate Valuation Metrics for Strategic Decisions

M&A multiples, particularly those available in an M&A database such as EV/EBITDA and P/E ratios, are essential for assessing the relative worth of companies involved in transactions. In 2025, the median EV/EBITDA ratio fluctuated between 6.0x and 15.0x, whereas P/E multiples ranged from 12.0x to 30.0x, indicating notable sector disparities. Analysts are encouraged to conduct comparative evaluations of these multiples across similar transactions to determine if a target company is overvalued or undervalued. This method not only aids in making informed acquisition decisions but also strengthens negotiation strategies during M&A discussions.

For example, the information sector recently recorded the highest EBITDA selling price at 20.9x, while the accommodation and food service sector lagged behind with a low of 2.9x. Such differences highlight the importance of understanding sector-specific dynamics when assessing potential acquisitions. Moreover, although the number of agreements exceeding $1 billion increased by 19% in the first half of 2025, the M&A database indicates that global M&A volumes decreased by 9% during the same period, suggesting a complex environment for high-value transactions.

Experts emphasize the importance of these valuation metrics in aligning financial expectations with economic realities, particularly when utilizing the M&A database. Industry leaders, including Brian Levy, assert that the ability to accurately evaluate multiples can greatly impact the success of M&A efforts. Furthermore, Jennifer L. Kreischer points out that the rapidly evolving M&A landscape is reflected in the M&A database, shaped by changes in economic dynamics, valuation trends, and industry-specific factors. By leveraging these insights, analysts can navigate the complexities of the M&A landscape more effectively, ensuring their strategies are informed by current economic conditions and historical trends.

M&A Volumes: Analyze Trends to Predict Future Market Movements

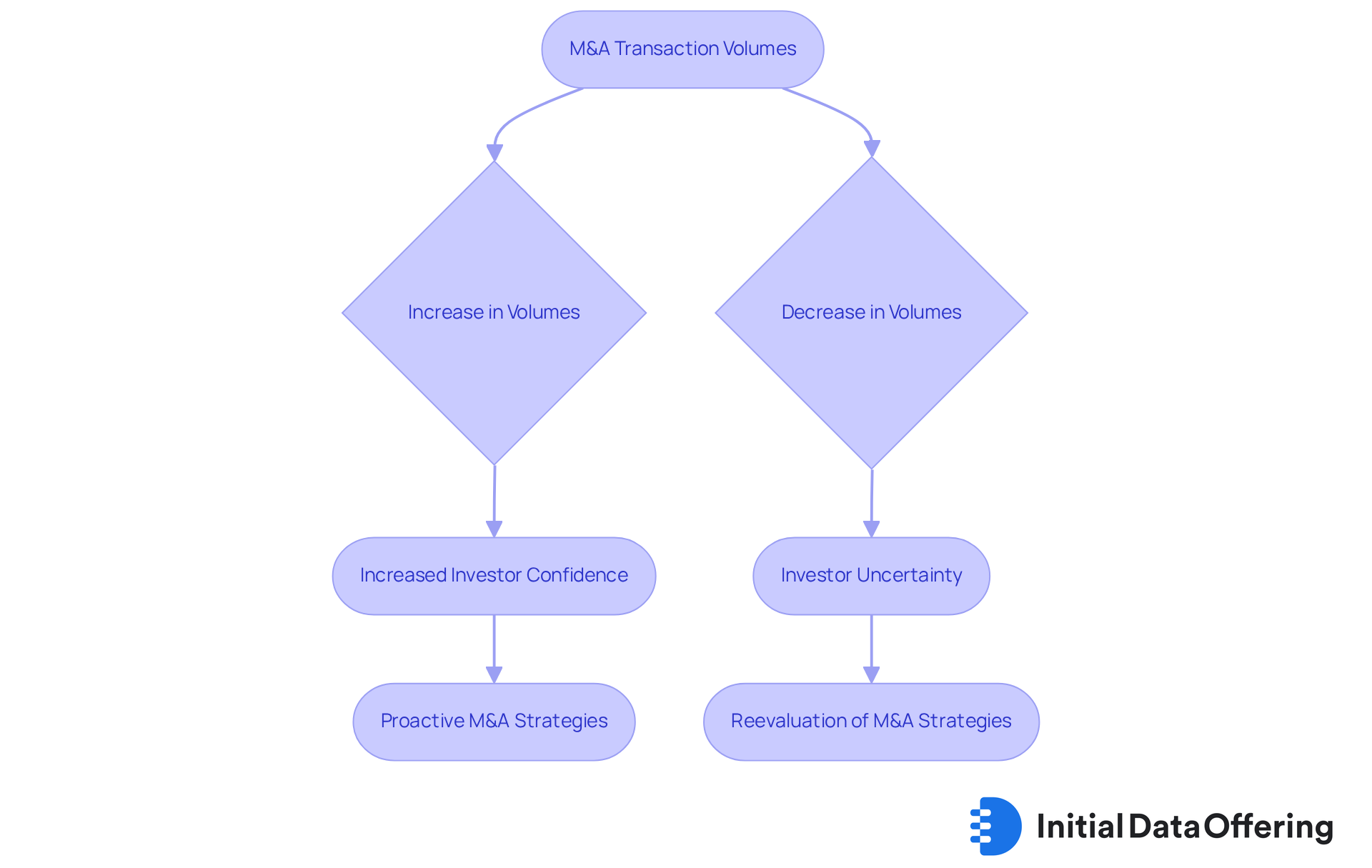

The m&a database tracks M&A volumes, representing the number of transactions occurring within a specific timeframe. Understanding the volumes in the m&a database is crucial as they reveal patterns that may indicate future financial movements.

For instance, a rise in transaction volumes often suggests increased confidence among investors, whereas a decline may reflect uncertainty within the sector. Recognizing these trends allows companies to proactively adjust their M&A strategies using the m&a database, which is essential for maintaining competitiveness in a dynamic business environment.

How can your organization leverage these insights to enhance its strategic positioning?

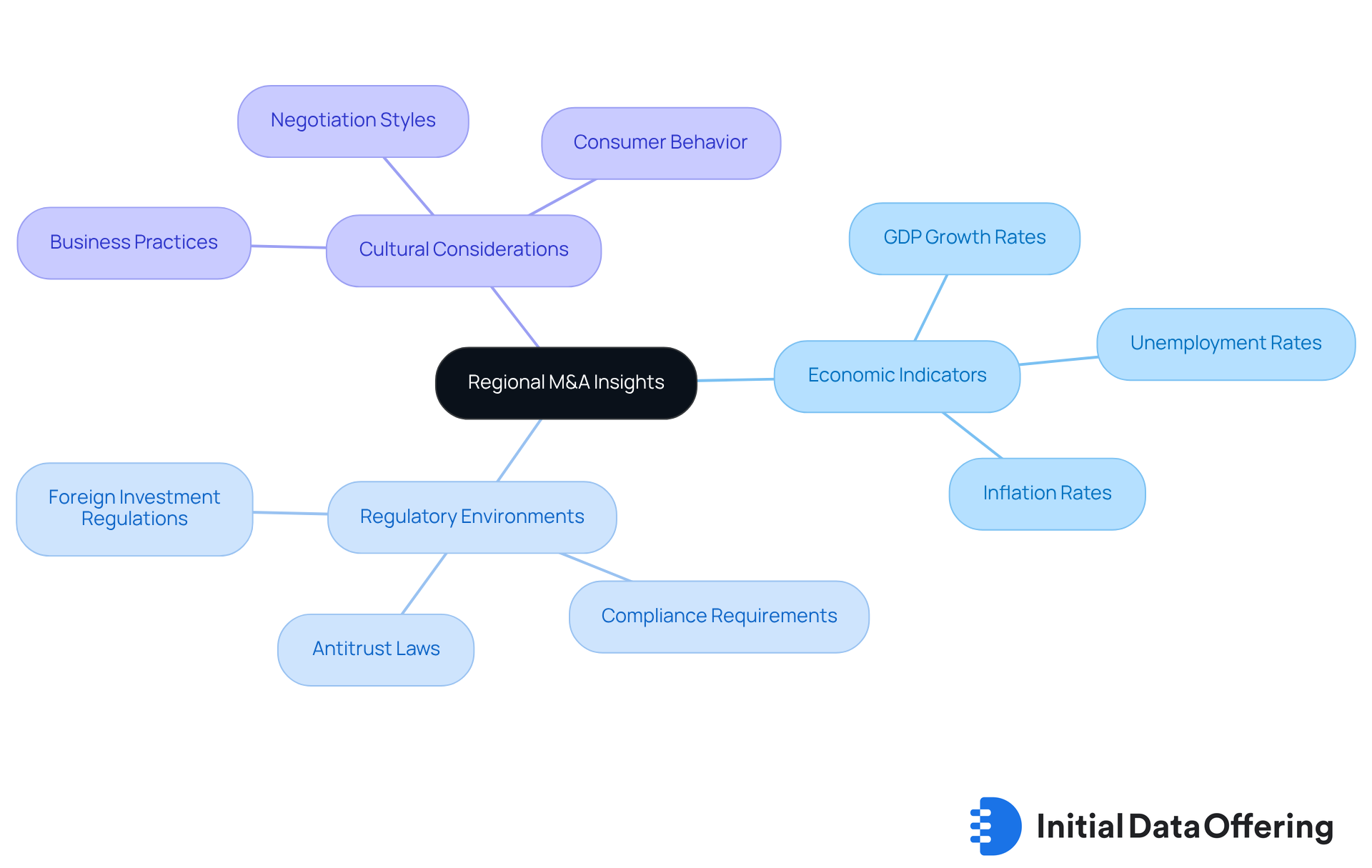

Regional M&A Insights: Navigate Local Market Conditions Effectively

Insights from the regional M&A database provide a comprehensive understanding of local conditions that significantly influence deal activity. Analysts must examine key factors such as:

- Economic indicators

- Regulatory environments

- Cultural considerations

These factors affect the M&A database and activities across different regions. By tailoring their strategies to these local conditions, companies can enhance their prospects for successful mergers and acquisitions, as indicated in their M&A database. This approach ensures alignment with regional economic dynamics, ultimately leading to more effective decision-making in the M&A database.

Mega Deals: Recognize Their Influence on Market Dynamics

Mega agreements, defined as activities exceeding $5 billion, significantly influence industry dynamics and set new valuation standards. In the first half of 2025, global transaction values rose from $1.3 trillion to $1.5 trillion, representing a 15% year-over-year increase, with major agreements being instrumental in this growth. Analysts must closely monitor these transactions, as they frequently lead to industry consolidation and diversification, impacting competitive environments across various sectors.

For example, the recent division of General Electric into three separate companies illustrates how strategic mega deals can foster innovation and generate new growth opportunities. This transformation is seen as a decade of value in motion, underscoring the importance of reconfiguration in today's landscape.

Industry leaders emphasize the significance of these substantial transactions. As one expert remarked, "A decade of value in motion, marked by reconfiguration and innovation, awaits." This perspective highlights the need for businesses to understand the motivations behind large transactions, which may include enhancing operational efficiency or adapting to shifting market demands.

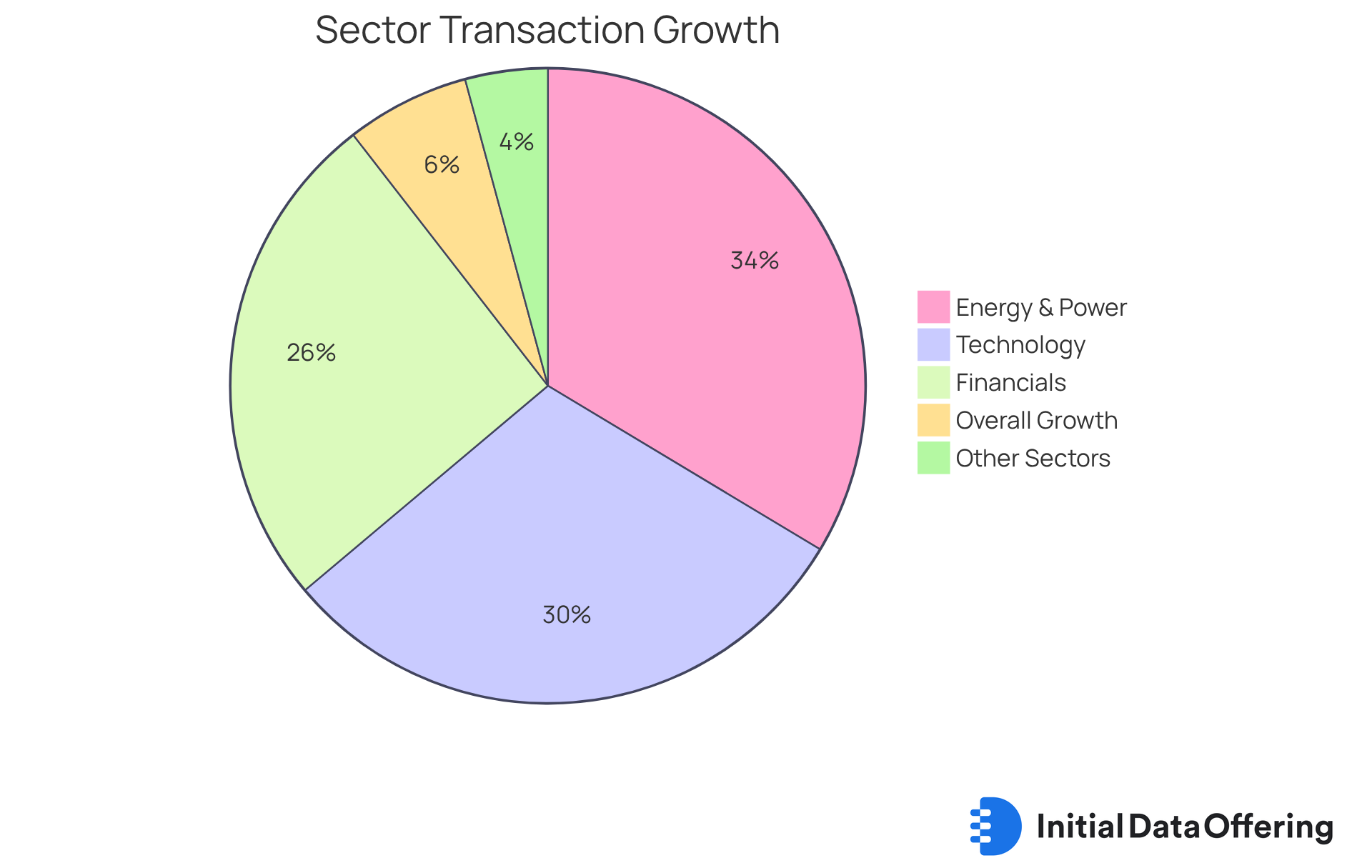

Moreover, the impact of large transactions goes beyond immediate financial metrics; they can reshape entire sectors. For instance, in Q1 2024, the Energy & Power sector experienced an 80% increase in transaction value, driven by changes in domestic energy policy, showcasing how large agreements can catalyze sector-wide transformations.

Recognizing the ripple effects of these transactions is crucial for strategic planning. Notably, 51% of US companies are actively seeking agreements, indicating a sustained interest in the M&A database related to M&A activity. As the M&A environment continues to evolve, staying informed about significant transactions through an M&A database will empower analysts to make well-informed decisions and navigate the complexities of the industry effectively.

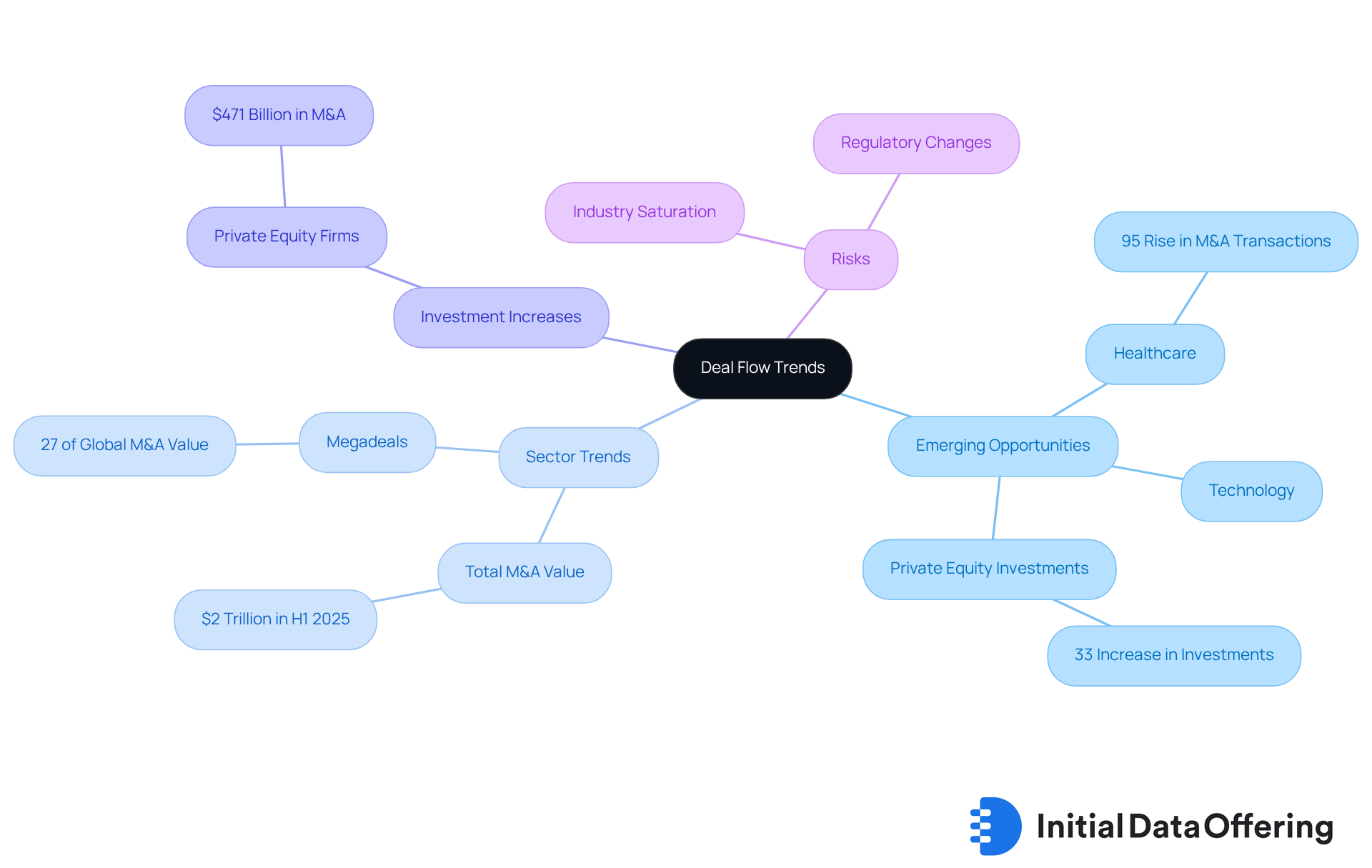

Deal Flow Trends: Identify Emerging Opportunities and Risks

Examining transaction flow trends is essential for comprehending the frequency and nature of activities within the M&A database. By closely monitoring these trends, analysts can pinpoint emerging opportunities in sectors witnessing increased investment, such as technology and healthcare, which have shown remarkable resilience and growth potential. For instance, the healthcare sector in EMEA experienced a staggering 95% rise in M&A transactions from the previous year, indicating a robust appetite for consolidation and innovation.

Additionally, the overall worth of international mergers and acquisitions exceeding $25 million increased by 22% to $2 trillion in the first half of 2025, demonstrating a vibrant economic environment. Significantly, M&A transactions could amount to approximately 4 percent of global capitalization, highlighting the importance of this activity in the wider economic context. However, analysts must also stay alert concerning potential risks, such as industry saturation and regulatory changes, which could affect deal viability. As highlighted by industry experts, navigating these uncertainties demands a nuanced understanding of economic dynamics and proactive scenario planning.

For example, private equity firms have increased their M&A investments by 33% to $471 billion, driven by a need for strategic exits and the availability of capital. This trend underscores the importance of identifying high-quality targets that align with long-term growth strategies. Furthermore, the count of megadeals (deals exceeding $10 billion) has increased, accounting for 27% of global M&A value, emphasizing a change in dynamics and the desire for larger deals despite geopolitical challenges. Dealmaking activity is particularly strong in the Americas, where net inflows reached $58 billion in cross-regional transactions, highlighting the region's attractiveness for international investors.

As Anu Aiyengar, Global Head of Advisory and M&A, stated, 'M&A and capital sectors have been remarkably resilient in the face of significant macroeconomic, geopolitical and policy volatility.' Consistent, profitable growth at scale has been rewarded with premium valuations driving companies to continue to pursue M&A. In this market, you need nuanced dealmaking with creativity, courage, and conviction.

In summary, a proactive approach to examining transaction flow trends not only aids in capitalizing on emerging opportunities but also in reducing risks linked to the evolving M&A database. By focusing on actionable insights and strategic planning, businesses can position themselves effectively to thrive in this competitive environment.

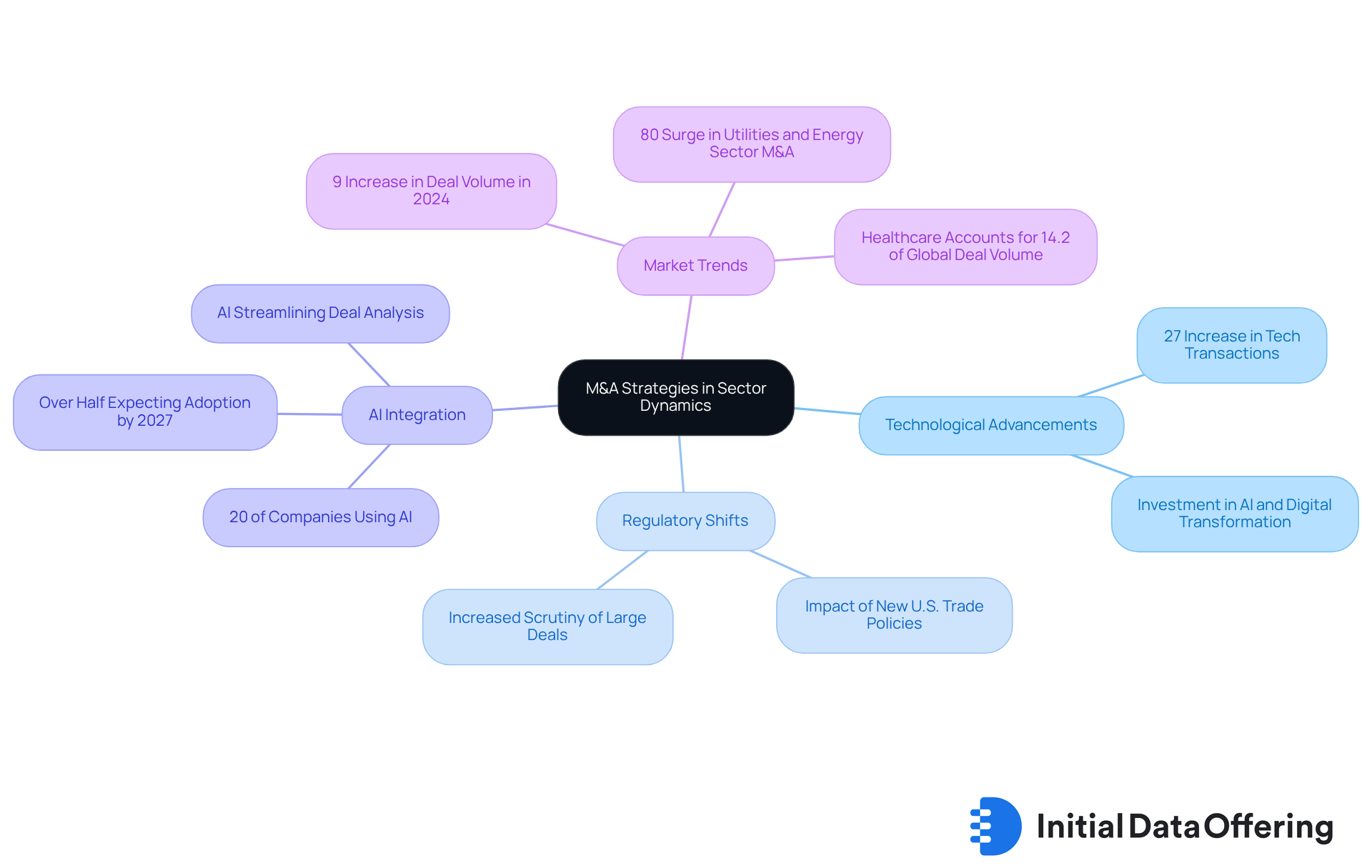

Sector Dynamics: Adapt M&A Strategies to Changing Market Conditions

Sector dynamics significantly influence M&A strategies, making it essential for analysts to closely monitor sector-specific trends, such as technological advancements and regulatory shifts, by utilizing an M&A database. A notable example is the technology sector, which recorded a remarkable 27% increase in transaction value in 2024. This statistic underscores the profound impact of innovation on M&A activity. Companies that adapt their strategies to these evolving dynamics can enhance their competitive positioning and effectively navigate market complexities.

As industry experts have observed, the integration of artificial intelligence in M&A processes, as tracked in the M&A database, is reshaping deal-making. Currently, nearly 20% of surveyed companies utilize generative AI, with over half expecting to adopt it by 2027. This technological shift streamlines deal analysis and creates new acquisition targets, particularly in software and AI.

Therefore, the ability to pivot and align M&A strategies with these sector dynamics is crucial for achieving successful outcomes in an increasingly competitive landscape.

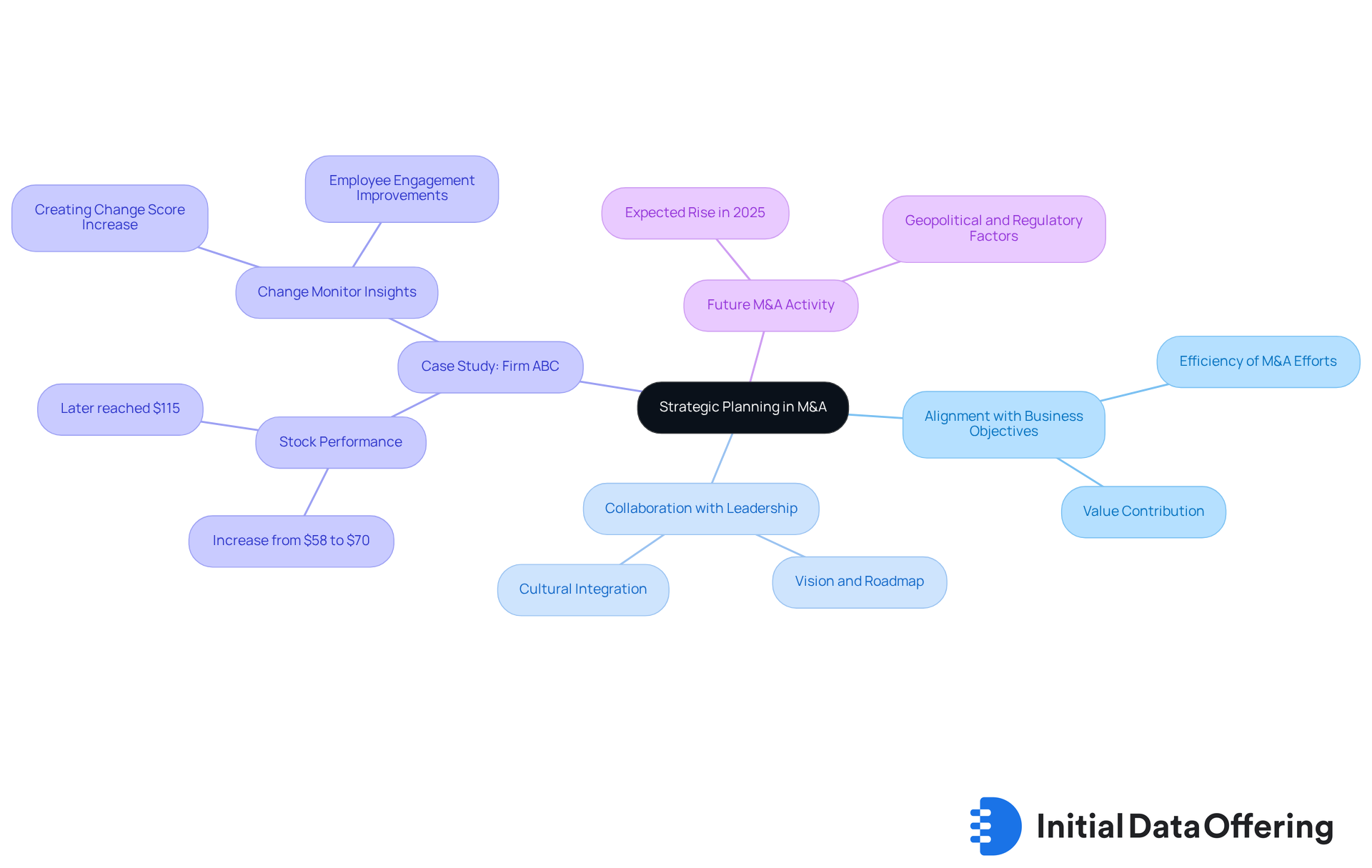

Strategic Planning: Align M&A Insights with Business Objectives

Strategic planning is essential for the effective integration of insights from the M&A database into business objectives. Analysts must work closely with leadership teams to ensure that the M&A strategies reflected in the M&A database are aligned with the company's long-term goals. This alignment not only enhances the efficiency of M&A efforts but also ensures that the M&A database contributes significant value to the organization's overall success.

For instance, consider Firm ABC, whose stock price increased from $58 to $115 shortly after their merger. This case exemplifies the positive impact of aligning M&A strategies with business objectives. By cultivating a culture of collaboration between analysts and decision-makers, as highlighted by a Firm ABC executive who emphasized the importance of communicating their Vision and Roadmap, businesses can utilize M&A insights to foster innovation and sustainable growth.

Ultimately, this approach transforms M&A from a mere transactional activity into a strategic advantage, especially considering the insights from the M&A database regarding the expected rise in M&A activity in 2025.

Conclusion

The insights derived from M&A databases are indispensable for market analysts seeking to navigate the complexities of mergers and acquisitions. By leveraging comprehensive datasets, analysts can gain a nuanced understanding of market trends, deal activity, and valuation metrics. These elements are crucial for informed decision-making in an ever-evolving landscape.

Key arguments highlight the significance of data offerings such as the Initial Data Offering, which provides access to high-quality M&A datasets. Analyzing M&A statistics, deal values, and sector dynamics enables analysts to identify emerging opportunities and risks. Additionally, understanding regional insights helps tailor strategies to local market conditions. Moreover, the impact of mega deals and transaction flow trends underscores the need for strategic planning that aligns with business objectives.

In light of these insights, it is vital for organizations to embrace a proactive approach to M&A analysis. By utilizing the M&A database effectively, businesses can enhance their strategic positioning and capitalize on growth opportunities while mitigating potential risks. The future of M&A is not just about transactions; it’s about leveraging data-driven insights to foster innovation and sustainable growth in an increasingly competitive environment.

Frequently Asked Questions

What is the Initial Data Offering (IDO)?

The Initial Data Offering (IDO) is a resource that provides analysts with access to a diverse range of M&A datasets through the M&A database powered by SavvyIQ's AI-driven infrastructure. It includes comprehensive details on past transactions, industry trends, and sector performance.

How does the IDO enhance analytical capabilities?

The IDO leverages an AI-driven Recursive Data Engine that continuously improves the dataset's quality, allowing analysts to discover and utilize high-quality datasets easily. This enhances their analytical abilities and supports informed decision-making.

What key metrics should analysts focus on when reviewing M&A statistics?

Analysts should focus on the total number of transactions, average transaction size, and sector-specific engagement to gain insights into market dynamics.

What notable trend was observed in M&A transactions in the first half of 2025?

The Americas dominated global M&A transactions with a total value of $908 billion, a significant increase from $722 billion the previous year, reflecting a preference for domestic transactions amid geopolitical uncertainties.

What does the current M&A environment indicate about transaction quality and pricing strategies?

The current environment shows a shift towards quality, with high-quality companies attracting more interest. Control premiums in substantial transactions have stabilized around 30%, indicating disciplined pricing strategies among transaction makers.

What is the anticipated outlook for M&A transactions in 2025?

The quantity of M&A transactions in 2025 is expected to show cautious optimism, as firms use the M&A database to navigate uncertainties while pursuing transformative strategies.

What financial insights can be gained from assessing M&A deal values?

Analysts can gain insights into the financial impacts of transactions by assessing overall transaction values and valuation multiples, which help understand company valuations and industry dynamics.

How much of the global M&A activity did the U.S. account for in Q2 2025?

In Q2 2025, the U.S. accounted for $413 billion in total transaction value, representing 53% of global M&A activity.

Why is a comprehensive analysis of M&A transaction values important for businesses?

A comprehensive analysis using the M&A database for transaction values and valuation multiples is crucial for businesses to strategically position themselves within an evolving market landscape.