What Are Fintech APIs? Understanding Their Role in Finance

What Are Fintech APIs? Understanding Their Role in Finance

Overview

Fintech APIs serve as essential software interfaces that facilitate seamless communication and data exchange between various financial systems. This capability enables services such as payment processing and account management. Notably, 95% of U.S. financial organizations utilize these APIs, underscoring their importance. The advantages of these APIs include enhanced operational efficiency and improved customer experience, as they provide real-time data access and foster innovative financial solutions.

Consider how these features can transform your organization’s financial operations. By leveraging fintech APIs, businesses can streamline processes and respond more swiftly to customer needs. The implications are significant: organizations that adopt these technologies can gain a competitive edge in the rapidly evolving financial landscape.

In summary, fintech APIs are not merely tools; they are catalysts for change in the financial sector. As the industry continues to evolve, understanding and utilizing these interfaces will be crucial for organizations aiming to thrive in a digital-first environment.

Introduction

Fintech APIs have emerged as pivotal tools in the financial landscape. They act as the connective tissue that binds various monetary systems and applications. By enabling seamless communication and data exchange, these interfaces empower developers to create innovative solutions that enhance user experiences and operational efficiency.

However, as organizations rush to adopt these technologies, they must navigate a complex web of challenges, including security risks and regulatory compliance. How can financial institutions harness the transformative power of fintech APIs while mitigating potential pitfalls?

Define Fintech APIs: Core Concepts and Functionality

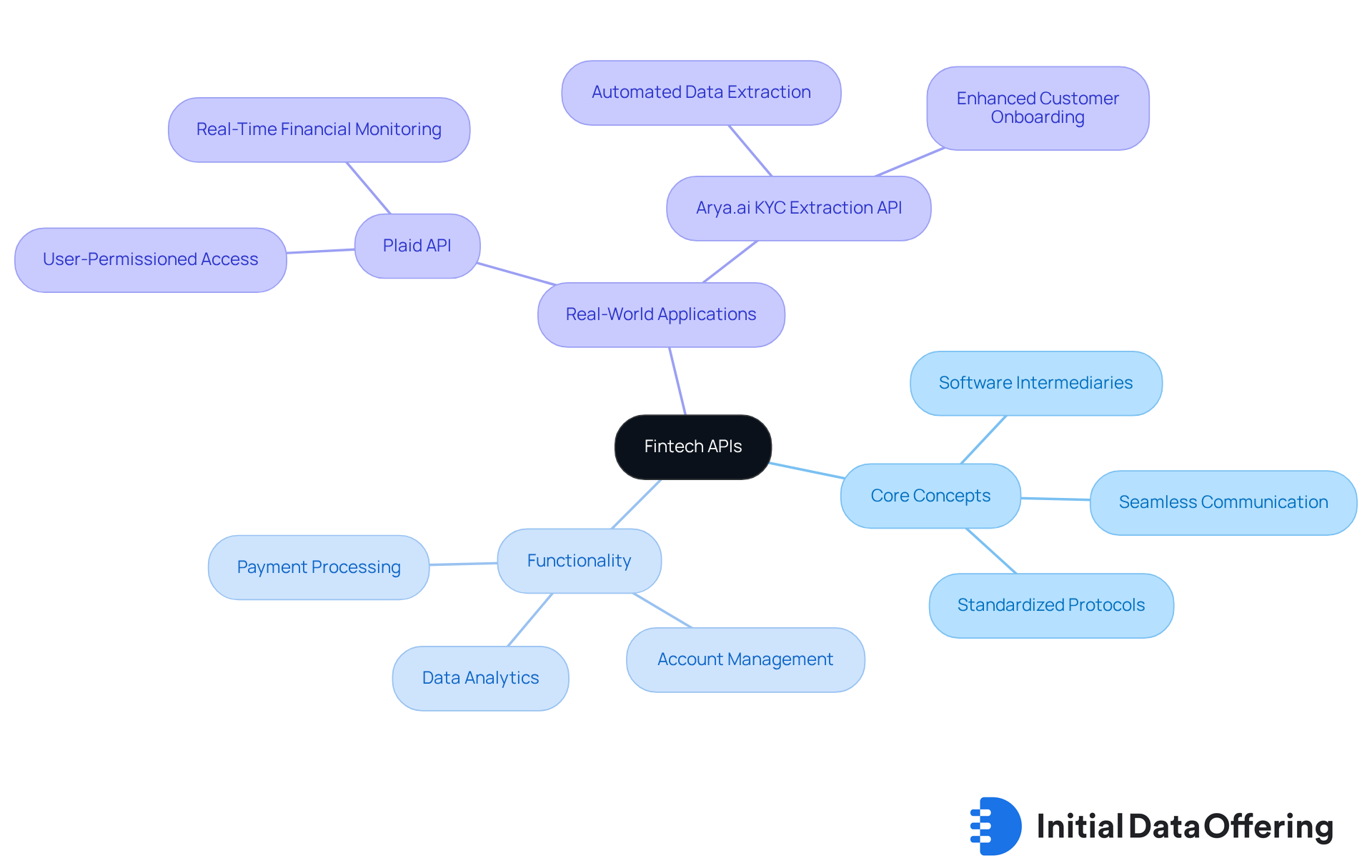

Fintech APIs, or financial technology interfaces, serve as essential software intermediaries that facilitate seamless communication and data exchange between various monetary systems and applications. By integrating diverse monetary services—such as payment processing, account management, and data analytics—these APIs empower developers to create applications that interact effectively with banking systems, payment gateways, and other financial services. Fintech APIs, with standardized protocols for data exchange, not only streamline operations but also significantly enhance user experiences across the sector.

In 2023, a remarkable 95% of monetary organizations in the U.S. actively utilized fintech APIs, highlighting their crucial role in modern finance. These interfaces enable real-time data access, allowing banks to provide services like instant loan approvals, which can reduce processing times by up to 40%. For instance, the Plaid API connects user bank accounts to financial applications, delivering standardized economic data that supports payment initiation and enhances transaction accuracy.

The real-world applications of fintech APIs demonstrate their transformative impact. For example, Flexport integrated Plaid to access user-permissioned bank account balances and transaction histories, enabling them to mitigate risk and streamline reporting for their clients. Similarly, Arya.ai's KYC Extraction API automates the extraction of structured data from identity documents, significantly enhancing customer onboarding processes.

As the financial landscape continues to evolve, the utilization of technology interfaces is expected to rise, driven by the demand for innovative solutions that boost operational efficiency and client satisfaction.

Explore the Evolution of Fintech APIs in Modern Finance

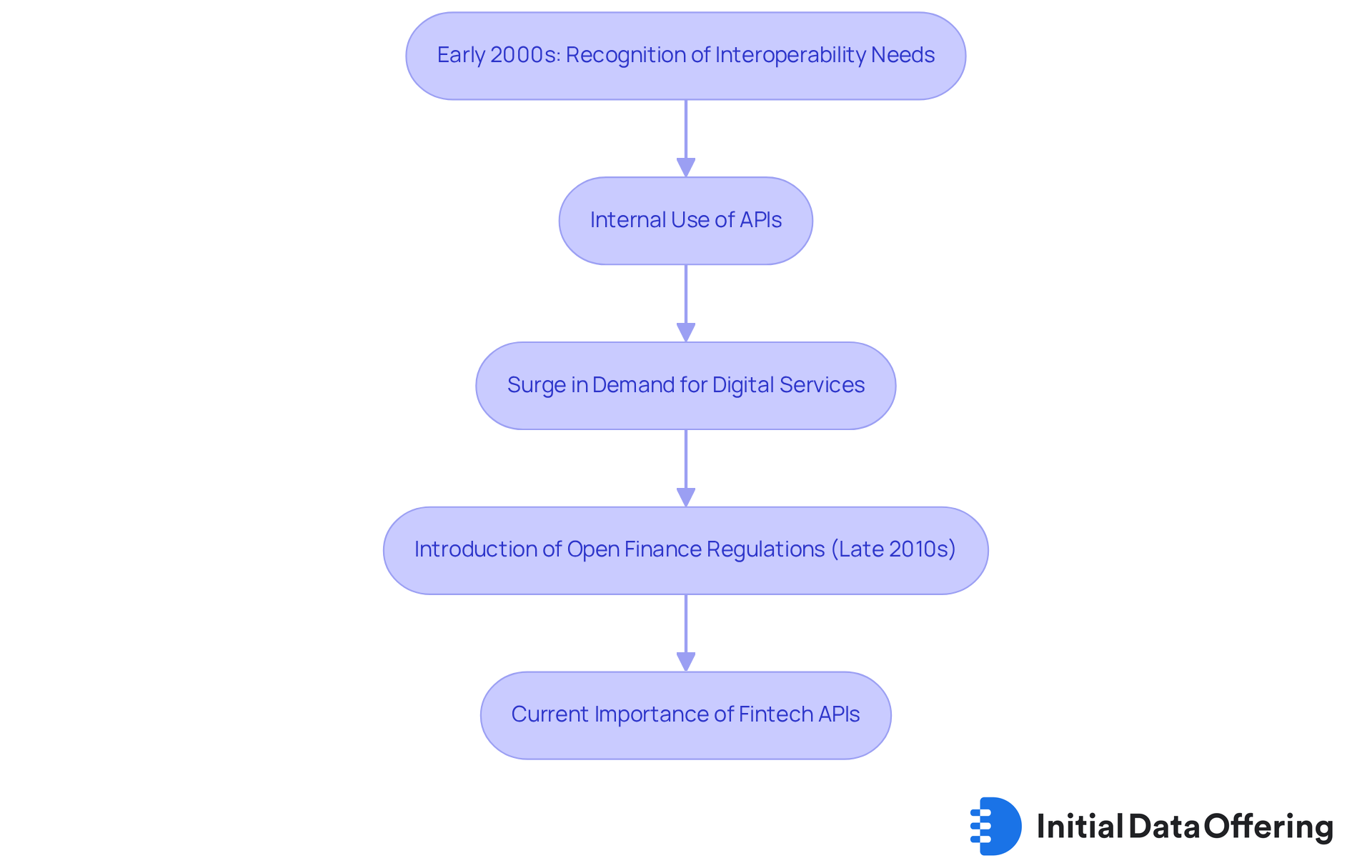

The evolution of fintech APIs started in the early 2000s when financial institutions acknowledged the necessity for interoperability among various systems. Initially, these APIs were used mainly for internal processes. However, as the demand for digital services surged, fintech APIs became essential for external integrations. The introduction of open finance regulations in the late 2010s accelerated the adoption of APIs, enabling external developers to securely access financial data.

Today, fintech APIs are essential to the economic ecosystem, enabling innovations such as embedded finance, which has experienced remarkable growth of 42%. This allows non-institutional platforms to deliver monetary services directly to users. In 2023, open financial transactions reached a record-high value of $500 billion globally, with 40% of consumers now using at least one open finance-enabled service, a significant increase from 28% in 2022.

As Michelle Henrich from HSBC states, 'Fintech APIs are increasingly at the heart of banking innovation, enabling financial institutions and fintechs to streamline complex processes and enhance customer experiences.' This underscores the vital role of application programming interfaces in modern finance.

How can your organization leverage these APIs to improve service delivery and customer engagement? The implications are clear: embracing fintech APIs not only enhances operational efficiency but also positions institutions to thrive in a rapidly evolving financial landscape.

Identify Different Types of Fintech APIs and Their Applications

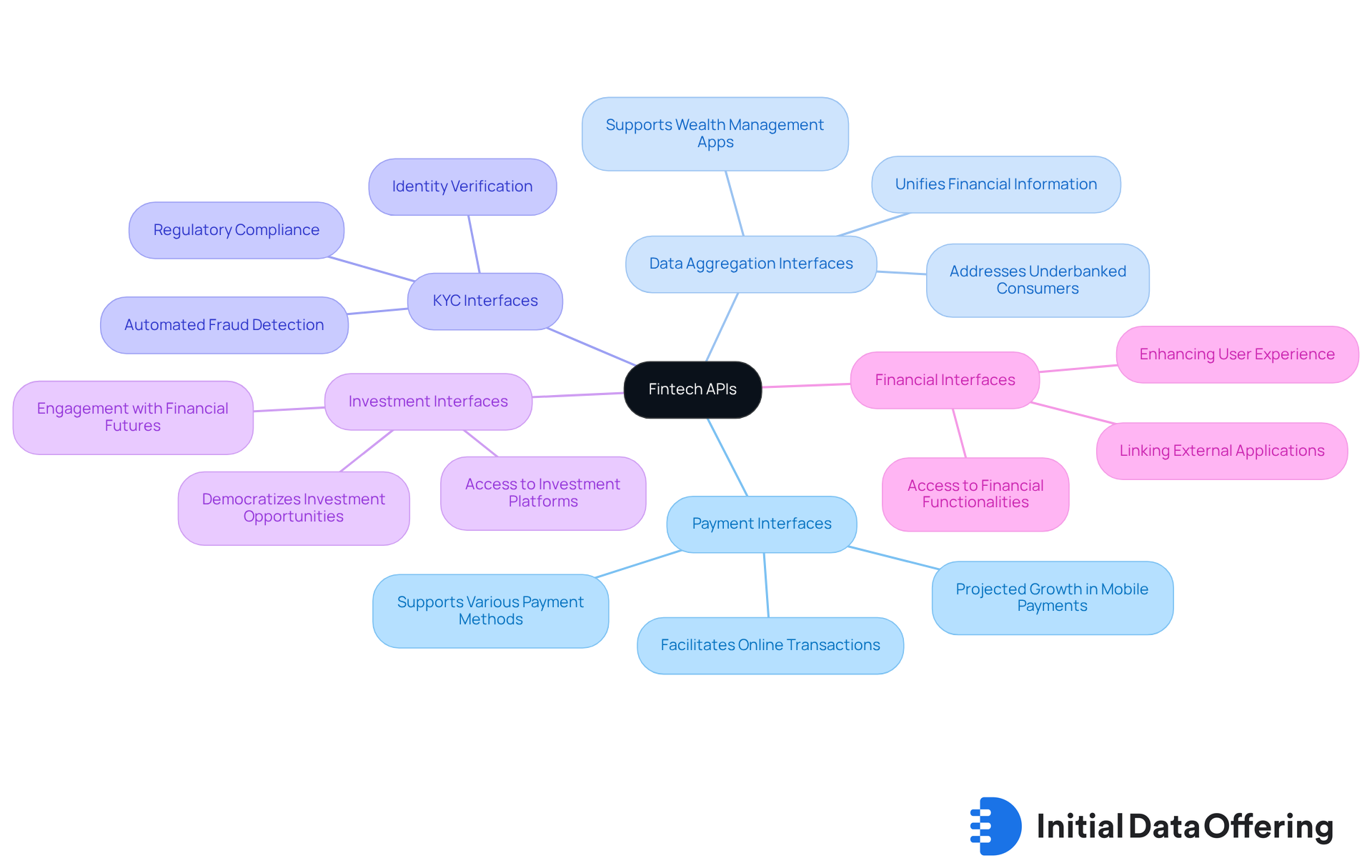

Fintech APIs can be categorized into several types, each serving distinct purposes:

-

Payment interfaces: These interfaces are essential for facilitating online transactions and payment processing, enabling businesses to accept payments through various methods, including credit cards and digital wallets. Within five years, half of today’s smartphone users will be utilizing their devices and mobile wallets as their favored method for payments. This trend highlights the growing dependence on payment interfaces in the economic landscape. The global banking market for fintech APIs is projected to grow at a compound annual growth rate (CAGR) of 23.4% from 2021 to 2028, underscoring the significance of these interfaces.

-

Data Aggregation Interfaces: These interfaces gather and unify monetary information from various sources, offering users a complete perspective of their economic status. For instance, Yodlee's API connects to over 16,000 global data sources, enabling wealth management apps to provide consolidated portfolio views. This capability is particularly significant given that there are around 60 million underbanked consumers in the country, emphasizing the necessity for accessible monetary services.

-

KYC (Know Your Customer) interfaces: KYC interfaces are essential for monetary institutions to confirm the identity of their clients, ensuring adherence to regulatory requirements. Arya.ai's ID Verification API, for example, automates identity validation using government records and AI document recognition. This streamlines the onboarding process and enhances security, while also supporting automated fraud detection and AML compliance. Such capabilities illustrate the importance of KYC interfaces in safeguarding financial transactions.

-

Investment interfaces: These interfaces allow users to access investment platforms, enabling trading and portfolio management. They play a vital role in democratizing access to investment opportunities, particularly for retail investors. How might these interfaces change the way individuals engage with their financial futures?

-

Financial interfaces: Financial interfaces allow external applications to link with financial systems, enabling services such as account administration and transaction history access. This connectivity enhances user experiences by providing seamless access to financial functionalities.

Each type of interface, including fintech APIs, plays a vital role in enhancing the functionality and accessibility of financial services, with payment interfaces leading the charge in transforming online transaction processing and improving consumer experiences. As Michal Maliarov observes, comprehending these application programming interfaces is not solely about technical expertise; it's about acknowledging the transformative potential they offer in establishing a connected and innovative banking ecosystem. However, challenges such as compliance and regulatory obstacles must also be tackled to fully utilize the potential of financial technology interfaces.

Analyze the Benefits and Challenges of Implementing Fintech APIs

The advantages offered by implementing fintech APIs can significantly impact organizations.

-

Increased Efficiency: APIs automate data exchange, which greatly reduces the need for manual intervention and the potential for errors. This streamlining of processes can lead to faster transaction times and improved operational workflows.

-

Enhanced Customer Experience: By integrating various services, application programming interfaces facilitate seamless user experiences, such as instant payments and real-time account access—features that are increasingly demanded by consumers.

-

Cost Reduction: Organizations can achieve substantial savings by minimizing the need for extensive in-house infrastructure. For example, companies that have integrated application programming interfaces report operational cost reductions of up to 30%, allowing them to allocate resources more effectively. Additionally, it costs five times more to acquire a new customer than to retain an existing one, emphasizing the importance of customer retention in the context of cost savings.

Despite these benefits, organizations encounter several challenges that must be addressed.

-

Security Risks: APIs can be vulnerable to cyberattacks if not adequately secured. A significant 37% of security issues arise from vulnerabilities such as misconfigurations and broken object-level authorization, highlighting the necessity for robust security measures. As Jason Soroko from Sectigo points out, modern security requires access control that extends beyond traditional perimeter-based strategies.

-

Regulatory Compliance: The financial sector is heavily regulated, making it daunting for organizations deploying application programming interfaces to navigate this complex landscape. Compliance with standards such as GDPR and PSD2 is essential for maintaining customer trust and avoiding penalties.

-

Integration Complexity: Ensuring compatibility between different systems can pose technical challenges. Organizations often require skilled developers and adequate resources to effectively address these integration issues. Notably, 22% of organizations struggle with personnel shortages in API security, underscoring the difficulties in finding the necessary talent for successful API implementation.

Understanding these factors is crucial for organizations aiming to effectively leverage fintech APIs. While they can drive innovation, careful planning and execution are essential to maximize their potential.

Conclusion

Fintech APIs are revolutionizing the financial landscape by serving as vital links that facilitate communication between various financial systems and applications. These APIs streamline operations, enhance user experiences, and integrate diverse services, positioning themselves as essential tools for modern financial institutions. As the demand for innovative solutions continues to rise, understanding and leveraging these APIs becomes crucial for organizations aiming to thrive in an increasingly interconnected economic environment.

Throughout this article, we explored key insights into the functionality and evolution of fintech APIs. Their role in enabling real-time data access, automating processes, and applications in payment processing, data aggregation, and KYC compliance illustrates how these APIs are reshaping the delivery of financial services. Statistics highlight their widespread adoption, with a significant portion of financial organizations actively utilizing these interfaces to improve operational efficiency and customer engagement.

The implications of embracing fintech APIs extend beyond mere operational improvements. They signify a transformative shift in how financial services are accessed and delivered, emphasizing the importance of innovation in the financial sector. Organizations must navigate the challenges of security, regulatory compliance, and integration complexity to fully harness the potential of these technologies. By prioritizing the implementation of fintech APIs, institutions can enhance their service delivery and position themselves as leaders in a rapidly evolving financial landscape.

Frequently Asked Questions

What are fintech APIs?

Fintech APIs, or financial technology interfaces, are software intermediaries that facilitate seamless communication and data exchange between various monetary systems and applications.

What functionalities do fintech APIs provide?

Fintech APIs integrate diverse monetary services such as payment processing, account management, and data analytics, allowing developers to create applications that effectively interact with banking systems and financial services.

How do fintech APIs enhance user experiences?

By using standardized protocols for data exchange, fintech APIs streamline operations and significantly enhance user experiences across the financial sector.

What percentage of monetary organizations in the U.S. utilized fintech APIs in 2023?

In 2023, 95% of monetary organizations in the U.S. actively utilized fintech APIs.

How do fintech APIs improve service delivery in banking?

Fintech APIs enable real-time data access, allowing banks to provide services like instant loan approvals, which can reduce processing times by up to 40%.

Can you give an example of a fintech API and its application?

The Plaid API connects user bank accounts to financial applications, delivering standardized economic data that supports payment initiation and enhances transaction accuracy.

What is a real-world application of fintech APIs?

Flexport integrated the Plaid API to access user-permissioned bank account balances and transaction histories, helping to mitigate risk and streamline reporting for clients.

How do fintech APIs impact customer onboarding?

Arya.ai's KYC Extraction API automates the extraction of structured data from identity documents, significantly enhancing customer onboarding processes.

What is the future outlook for fintech APIs?

The utilization of fintech APIs is expected to rise as the financial landscape evolves, driven by the demand for innovative solutions that boost operational efficiency and client satisfaction.