9 Sources for Reliable Historical Intraday Data Access

9 Sources for Reliable Historical Intraday Data Access

Overview

The article outlines nine sources for reliable historical intraday data access, emphasizing their importance for traders and analysts in making informed decisions. Each source, including CME Group and Intrinio, offers distinct datasets and tools that significantly enhance market analysis and risk management strategies. By leveraging accurate historical data, traders can improve their decision-making processes in today's dynamic trading environment.

How might these datasets impact your trading strategies? Understanding their unique features and advantages can lead to better outcomes and more informed trading practices.

Introduction

In the realm of trading, the demand for accurate and timely historical intraday data is increasingly critical. As market dynamics shift and evolve, traders and analysts are turning to reliable sources that provide comprehensive datasets to inform their strategies. This article explores nine exceptional platforms that offer access to high-quality historical intraday data, empowering users to make informed decisions.

What challenges might traders face in navigating these resources? How can they leverage this data to enhance their trading performance? By addressing these questions, we can better understand the significant role that historical data plays in successful trading.

Initial Data Offering: Access High-Quality Historical Intraday Data

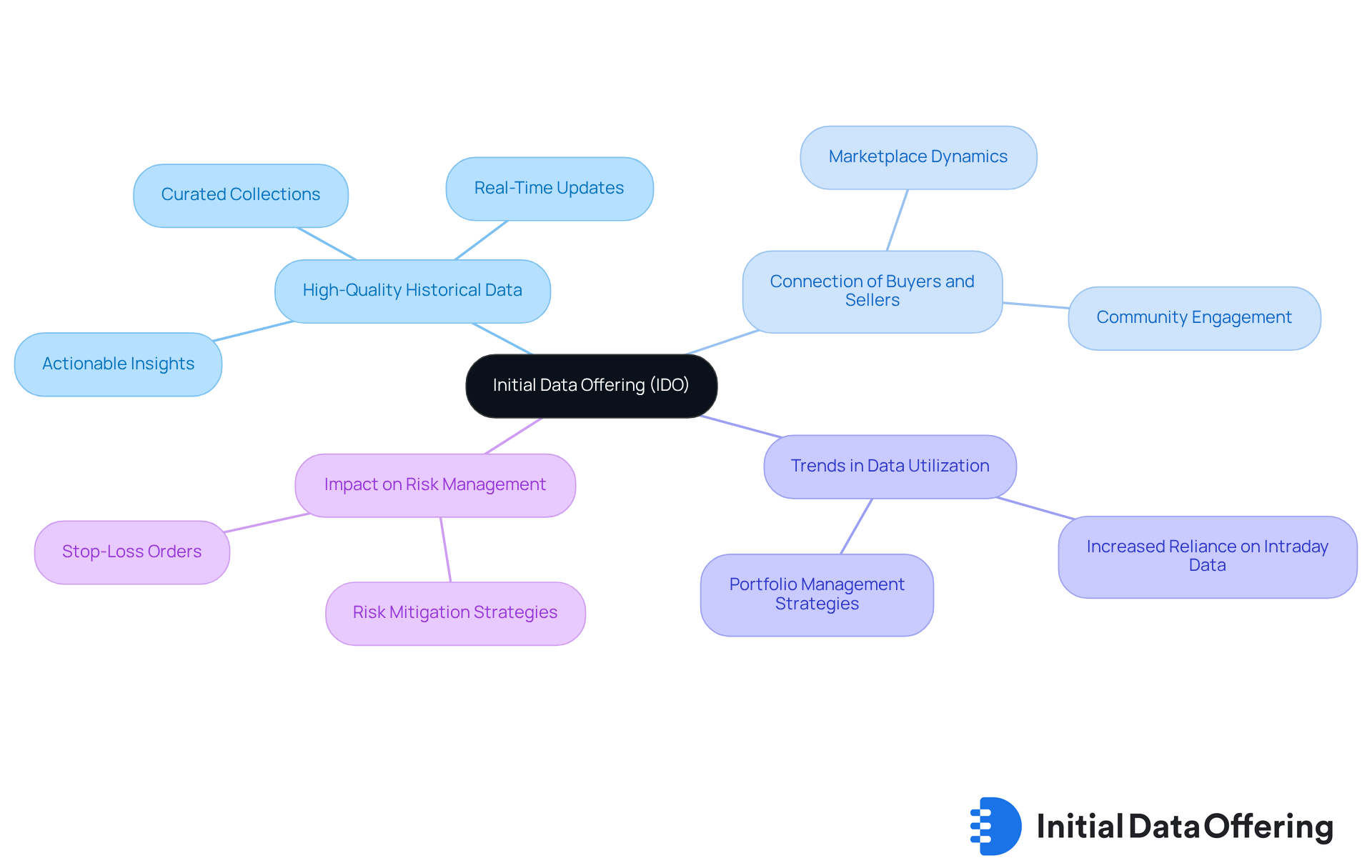

The Initial Data Offering (IDO) serves as a crucial platform for obtaining high-quality historical intraday data, addressing the increasing need for dependable information in today's fast-paced trading environment. By curating unique collections of information, IDO effectively connects buyers and sellers, enabling users to extract actionable insights that inform strategic decision-making. This emphasis on quality and community engagement distinguishes IDO as a preferred resource for businesses and researchers across various sectors, including finance and environmental studies.

Recent trends indicate a notable shift towards the utilization of historical intraday data, as analysts and traders increasingly rely on this information to observe fluctuations and evaluate risks. For instance, portfolio managers employ intraday information to execute risk mitigation strategies, such as stop-loss orders, ensuring they can react swiftly to market fluctuations. How might this reliance on intraday data transform your approach to risk management?

Successful implementations of information marketplaces have demonstrated the transformative influence of accessible historical intraday data. By facilitating the exchange of valuable datasets, IDO empowers users to utilize information effectively, driving innovation and enhancing decision-making processes. Analysts emphasize that the role of marketplaces in improving accessibility cannot be overstated, as they provide essential resources that support informed analysis and strategic planning. What insights could you gain by leveraging these resources in your own work?

CME Group: Comprehensive Historical Data for Futures and Options

CME Group offers a robust collection of historical intraday data for futures and options, providing traders with essential insights for their analysis. Users can access a diverse range of datasets, including tick information and historical intraday data, which are crucial for developing effective strategies and understanding economic dynamics. With data dating back to 1973, CME Group distinguishes itself as a premier source for comprehensive market insights.

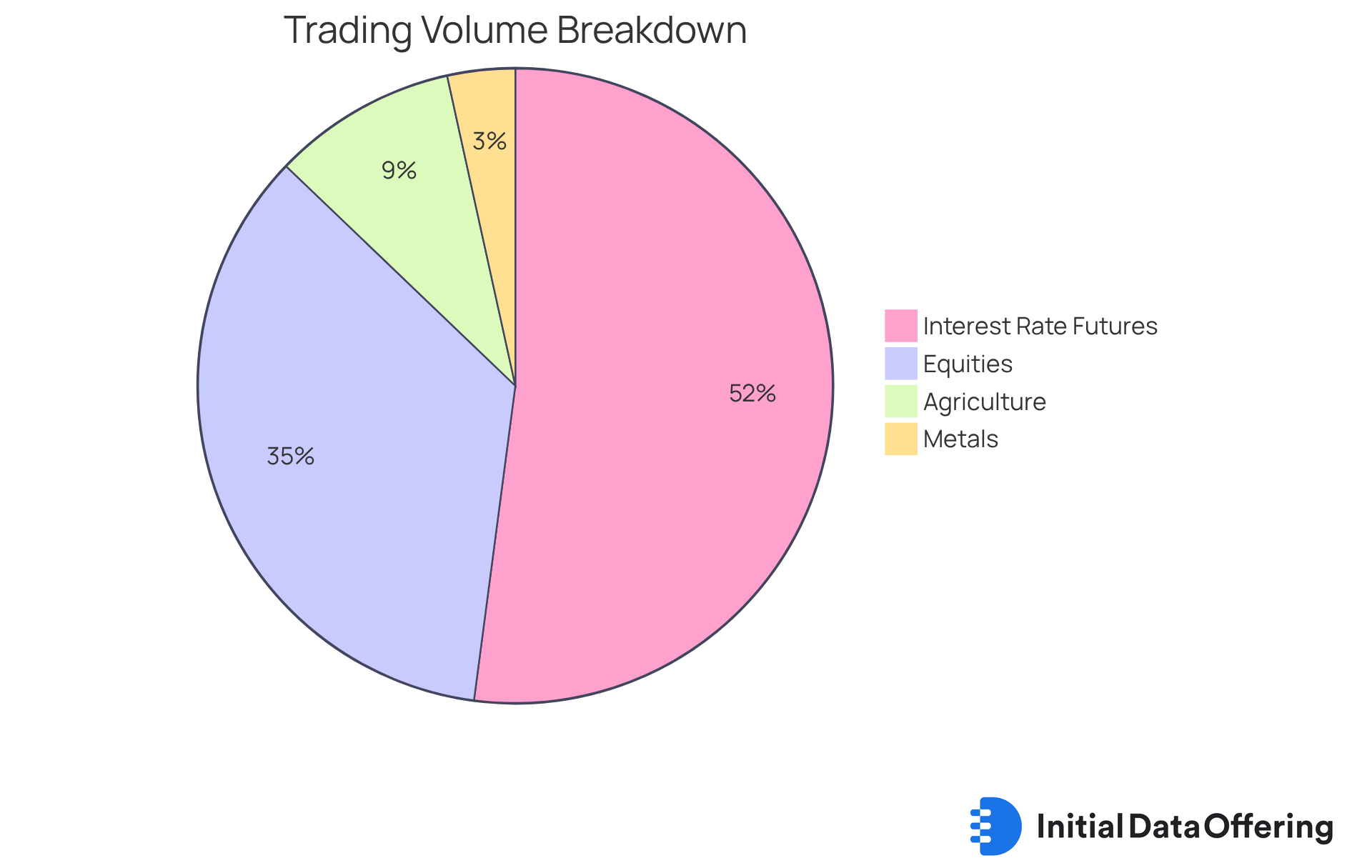

Recent statistics indicate that the total volume for interest rate futures and options reached 9,434,986, accompanied by an open interest change of +744,423. In contrast, equities futures and options totaled 6,279,713, reflecting an increase of +133,944 in open interest. These figures underscore the dynamic trading atmosphere supported by CME Group's information. Case studies illustrate how traders leverage this past data; for instance, on August 19, 2025, interest rate futures recorded a daily volume of 8,660,769, demonstrating a significant rise in open interest of +744,423. Furthermore, the agriculture sector noted a daily volume of 1,641,078 and an open interest of 10,422,407, while the metals sector reported a volume of 555,666 with an open interest increase of +7,213. Such insights empower traders to make informed choices based on historical intraday data and current trading conditions.

Moreover, CME Group's tools, such as the Dividend Futures Term Structure Tool, enable users to analyze anticipated dividend trends, enhancing their analytical capabilities. This tool assists in understanding how dividend expectations can shape trading strategies. By consistently updating their platform to reflect industry trends and trader feedback, CME Group ensures that users have access to the most current information, fostering a deeper understanding of trends and opportunities. Additionally, resources like expiration calendars and the Equity Total Cost Analysis Tool further support traders in their analysis, providing comprehensive insights into market dynamics.

Intrinio: API for Real-Time and Historical Intraday Stock Data

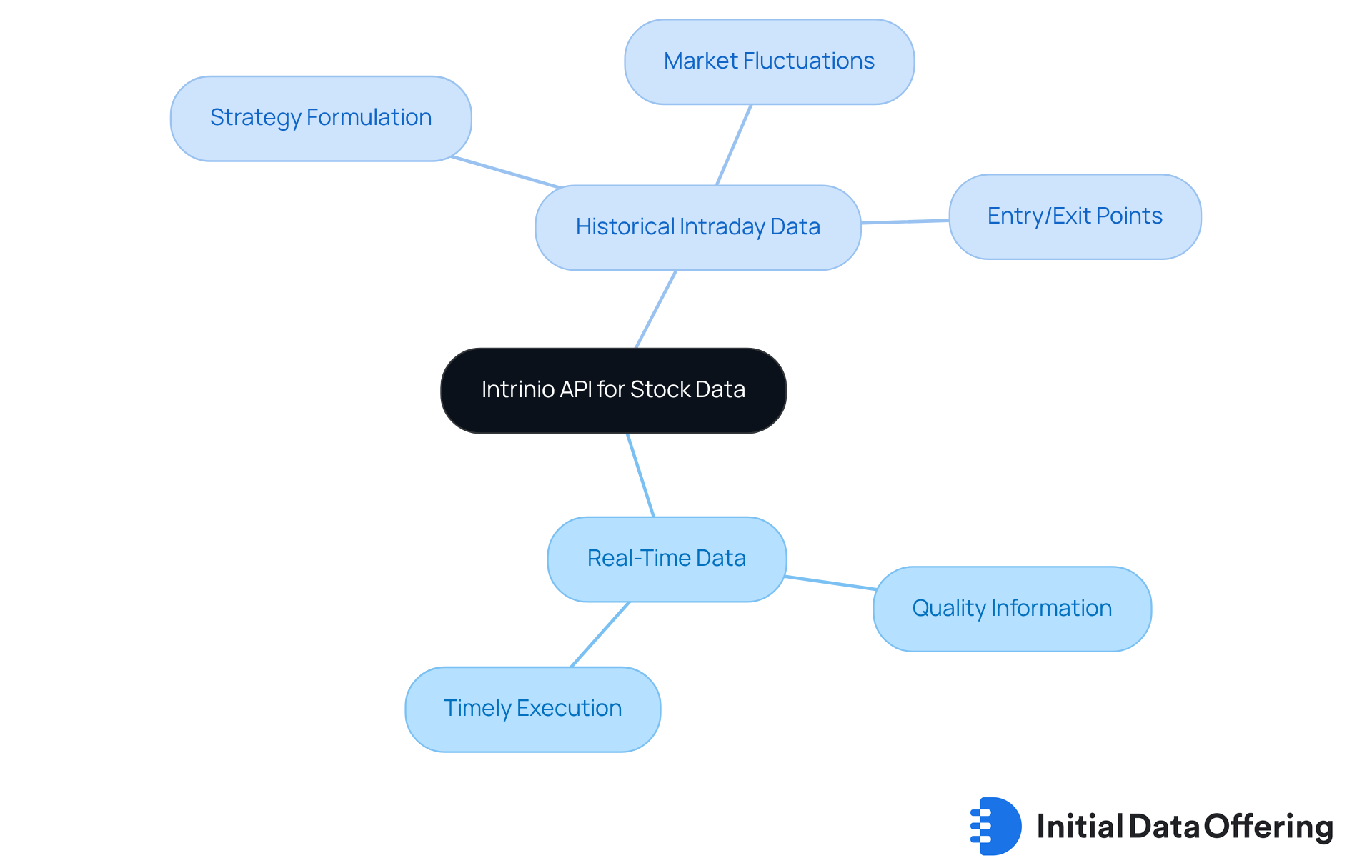

Intrinio offers a robust API that provides access to both real-time data and historical intraday data on stock information. This platform is particularly beneficial for developers and traders who aim to integrate financial data into their applications. With a focus on cost-effectiveness and user-friendliness, Intrinio enables users to tap into a wide range of data points, such as stock prices, trading volume, and historical trends, making it an indispensable tool for analysis and trading strategies.

Traders can leverage historical intraday data from Intrinio to formulate strategies that take advantage of market fluctuations. By examining past price movements and volume patterns, they can pinpoint potential entry and exit points, thereby enhancing their decision-making process. How can these insights transform your trading approach?

Furthermore, the significance of real-time information is paramount. As Jake Nulty, a technical writer, notes, "When you possess quality information, you can make quality, information-driven decisions." Access to timely financial data is crucial for executing trades efficiently and refining investment algorithms. Intrinio's commitment to delivering high-quality, real-time information empowers users to make informed choices, ultimately leading to improved investment outcomes. With its extensive information services, Intrinio stands out as a valuable asset for anyone looking to enhance their analysis and investment strategies.

TickData: Research-Quality Historical Market Data Solutions

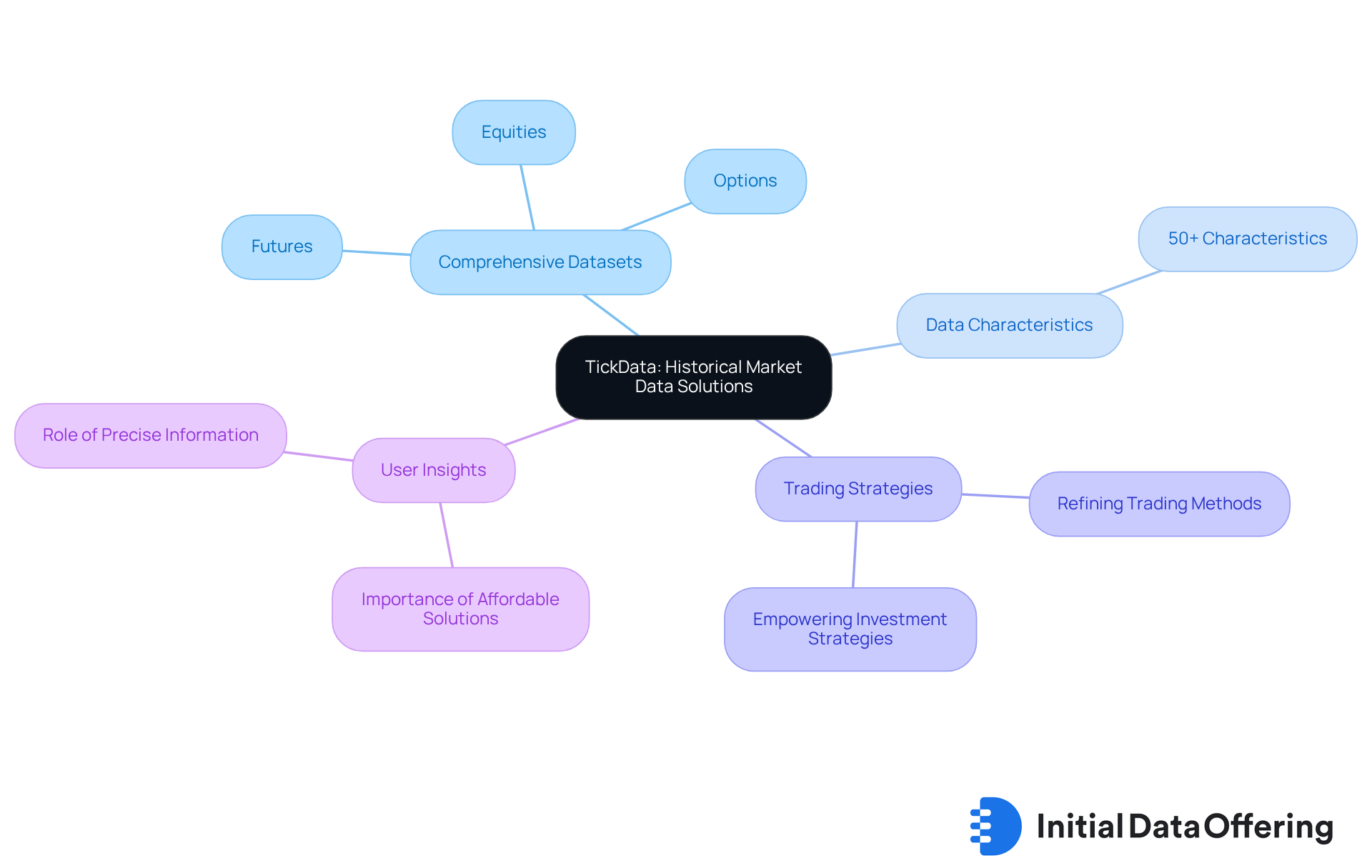

TickData specializes in providing research-quality solutions for historical intraday data that are tailored to the needs of analysts and researchers. Their offerings feature comprehensive datasets that encompass equities, options, and futures, ensuring users have access to accurate and reliable information. The advantage of having more than 50 characteristics available for each tool emphasizes TickData's commitment to information integrity and usability, empowering users to conduct thorough analyses and develop robust investment strategies.

Analysts frequently leverage TickData's services to refine their trading methods, underscoring the critical role that precise information plays in crafting effective trading strategies. As highlighted by Databento, 'Most of our individual users utilize Databento US Equities Mini due to its low cost,' which illustrates the importance of affordable information solutions.

By providing dependable historical intraday data, TickData supports informed decision-making and enhances the overall quality of research.

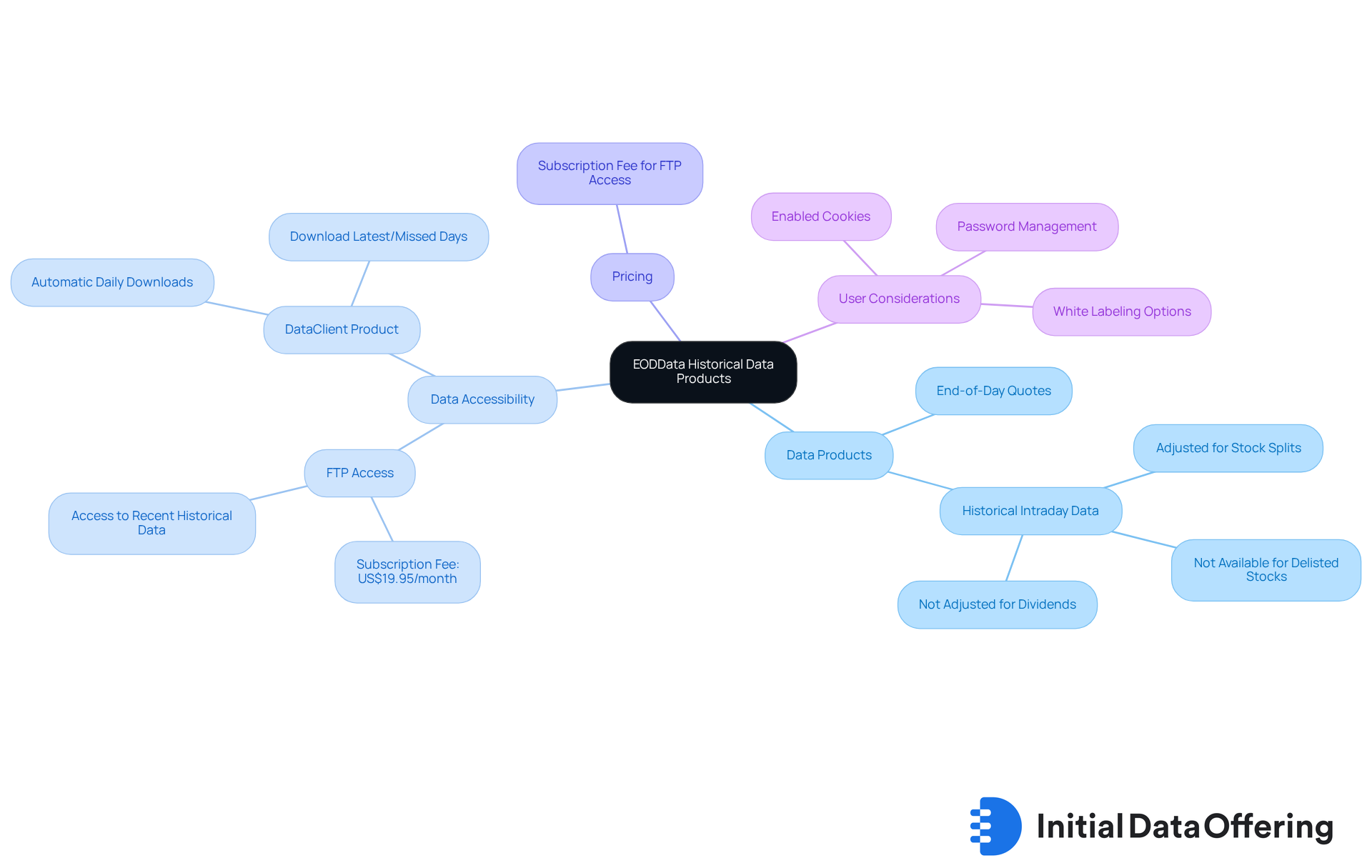

EODData: Diverse Historical Data Products for Market Analysis

EODData presents a comprehensive array of past information products, including end-of-day quotes and historical intraday data, which are essential for thorough analysis. This platform allows users to seamlessly download data across various asset classes, providing a flexible solution for both traders and analysts. With access to up to 30 years of historical intraday data, EODData empowers users to make informed trading decisions grounded in detailed market insights. Notably, archival file records are adjusted for stock splits, ensuring accuracy and reliability for users. However, it is crucial to recognize that EODData does not supply historical intraday data for stocks that have been delisted from the exchange, which limits the breadth of available information for analysis.

The DataClient product significantly enhances efficiency by enabling users to download only the most recent or missed days of data, thereby streamlining the data retrieval process. Furthermore, users can access end-of-day files via FTP for a subscription fee of US$19.95 per month. Analysts emphasize the significance of end-of-day quotes, as they reflect the final consensus among market participants, thereby influencing trading strategies. Real-world examples showcase the practical effectiveness of EODData, with traders utilizing the platform to analyze market trends and make data-driven decisions. To maximize the website's functionality, users should ensure that cookies are enabled.

Portara: Tailored Historical Intraday Futures Data Solutions

Portara specializes in offering customized solutions for traders and portfolio managers that provide historical intraday data for futures. The company offers access to extensive datasets, including minute-by-minute and tick information, which features historical intraday data with 1-minute records for S&P 500 futures since 1987. This comprehensive historical intraday data allows users to conduct thorough analysis and backtesting of their investment strategies, which is crucial for informed decision-making.

The emphasis on high-quality information is essential, as it allows traders to make choices based on accurate insights from historical intraday data. Portfolio managers have noted that historical intraday data is vital for understanding trading dynamics, facilitating prompt modifications to strategies. As George Soros highlights, it is not merely about being right or wrong; it is about how much money is made when right and how much is lost when wrong.

With Portara's commitment to quality and accuracy, traders can leverage these insights to enhance their performance. By navigating the complexities of the market effectively, they can improve their strategies and achieve better outcomes. This focus on data-driven decision-making underscores the importance of having reliable information at one's fingertips.

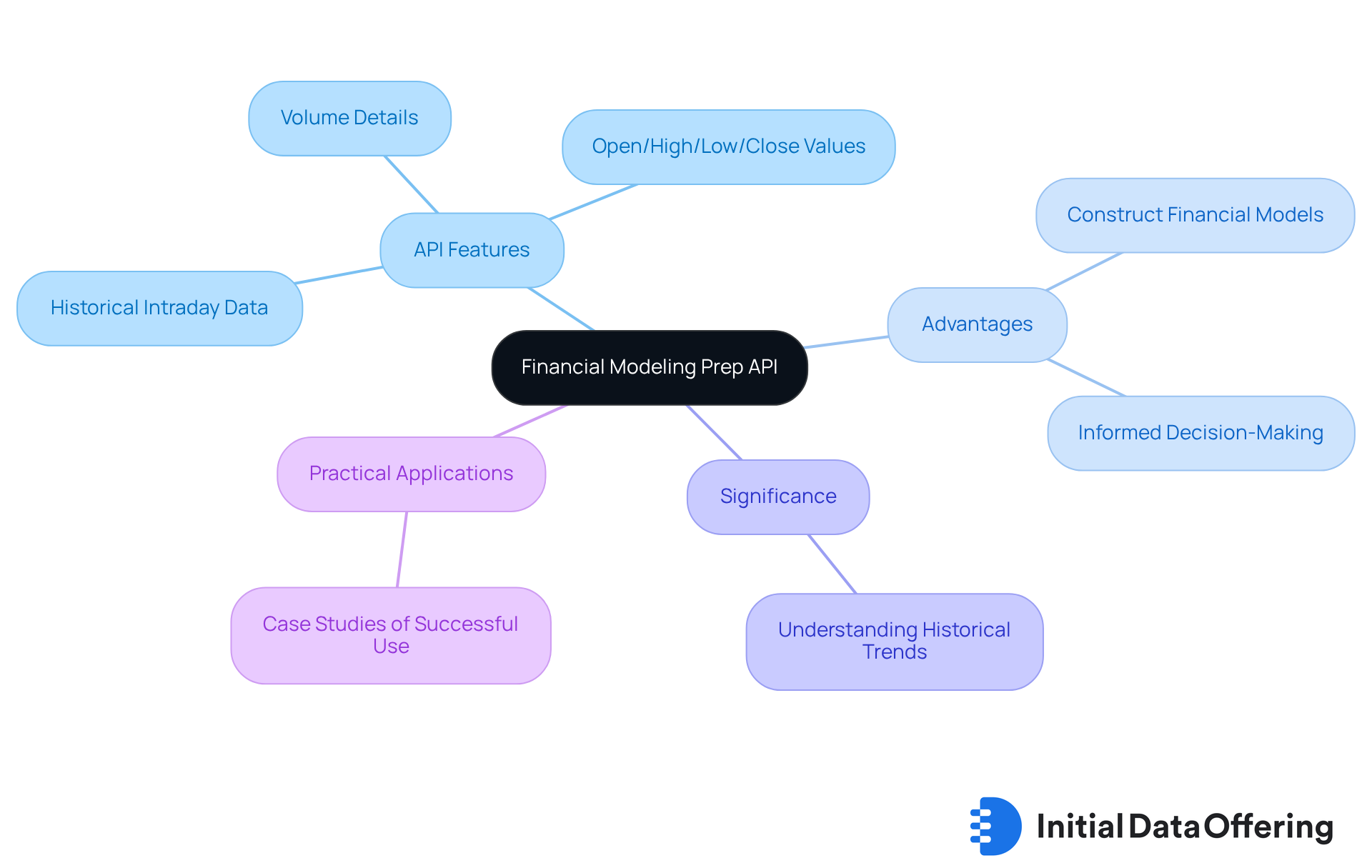

Financial Modeling Prep: API for Historical Stock Data Access

Financial Modeling Prep offers a powerful API that facilitates seamless access to historical intraday data, making it an indispensable tool for developers and analysts alike. This API provides users with comprehensive past price information, including open, high, low, and close values, as well as volume details. The advantages of this API are clear: it is crucial for constructing financial models and performing in-depth economic analysis, enabling users to leverage historical intraday data for informed decision-making.

Why is access to past prices so vital? Analysts emphasize that understanding historical trends is essential for making strategic investment decisions. This underscores the API's significance in the financial modeling landscape. As Warren Buffett famously stated, 'The stock exchange is intended to shift wealth from the Active to the Patient,' highlighting the importance of grasping past information to make educated investment choices.

Moreover, case studies demonstrate how analysts have successfully utilized Financial Modeling Prep data to create robust financial models that adapt to evolving economic conditions. This practical application showcases the API's versatility. With the increasing trend towards utilizing APIs for historical intraday data, analysts are better equipped to navigate the complexities of financial modeling and investment strategies. How might you integrate this API into your own financial analysis practices?

SIX Group: High-Quality Tick Data for Market Analysis

SIX Group provides premium tick information, a crucial feature for comprehensive analysis and transactions. Their extensive datasets encompass various exchange platforms, offering users access to complex financial information. This advantage is essential for making informed investment choices, as it underscores the importance of precise and dependable historical intraday data.

As a result, traders can develop effective strategies grounded in thorough insights into the industry. For instance, traders utilizing SIX Group information have reported improved performance by integrating accurate tick information into their models. This integration leads to more precise predictions and timely responses to economic fluctuations.

Ultimately, this dedication to information integrity not only supports individual trading strategies but also contributes to broader analytical trends, underscoring the significance of historical intraday data in today's fast-paced trading environment.

How can you leverage this data to enhance your trading approach?

QuantStart: Resources for Downloading Historical Intraday Data

QuantStart provides a comprehensive suite of resources specifically designed for traders and analysts seeking historical intraday data. This platform guides users through various information sources while equipping them with tools to enhance their market analysis. Notably, intraday data is available in 1-minute increments for nearly a decade, providing traders with an extensive array of details to refine their strategies. By leveraging QuantStart's resources, traders can significantly improve their approaches by utilizing precise historical intraday data to identify trends and optimize their methodologies effectively.

As Jean Baker, Project Director at Barchart.com, Inc., emphasizes, "Efficient access to data is crucial for market analysis, as it allows traders to make informed decisions based on reliable information." However, it is essential for traders to remain vigilant regarding potential biases in backtesting, including:

- Look-ahead bias

- Survivorship bias

These biases may affect the validity of their strategies. Furthermore, accounting for realistic transaction costs and selecting a robust backtesting platform are vital components for achieving successful trading outcomes. How can you ensure that your backtesting methods are sound and free from biases? Consider these factors to enhance your trading effectiveness.

Conclusion

Accessing reliable historical intraday data is essential for traders and analysts aiming to enhance their decision-making processes. This article highlights various platforms that provide high-quality data, emphasizing the critical role that accurate and timely information plays in developing effective trading strategies. By leveraging these resources, users can gain valuable insights that significantly improve their market analysis and risk management.

Key sources such as:

- Initial Data Offering

- CME Group

- Intrinio

- TickData

- EODData

- Portara

- Financial Modeling Prep

- SIX Group

- QuantStart

each offer unique advantages tailored to different trading needs. These platforms provide comprehensive datasets, APIs, and customizable solutions, empowering users to navigate the complexities of the market with confidence. Understanding historical trends and making data-driven decisions is crucial for successful trading outcomes, as these elements cannot be overstated.

Ultimately, the landscape of historical intraday data access is rich with opportunities for those willing to explore these platforms. By recognizing the value of high-quality data, traders can refine their strategies, mitigate risks, and enhance their performance in a competitive trading environment. Embracing these insights will not only lead to better decision-making but also foster a deeper understanding of market dynamics, paving the way for sustained success in trading endeavors.

Frequently Asked Questions

What is the Initial Data Offering (IDO)?

The Initial Data Offering (IDO) is a platform that provides access to high-quality historical intraday data, connecting buyers and sellers to extract actionable insights for strategic decision-making.

Why is historical intraday data important for traders and analysts?

Historical intraday data is crucial for observing market fluctuations and evaluating risks, allowing portfolio managers and traders to execute strategies like stop-loss orders to react quickly to market changes.

How does IDO facilitate the exchange of historical intraday data?

IDO empowers users by curating unique collections of information, enabling effective utilization of data and driving innovation in decision-making processes.

What type of historical data does CME Group offer?

CME Group provides a robust collection of historical intraday data for futures and options, including tick information, which is essential for traders' analysis and strategy development.

What significant historical data does CME Group have?

CME Group has historical data dating back to 1973, offering insights into trading dynamics and enabling traders to make informed decisions based on past market conditions.

What tools does CME Group provide to enhance trading analysis?

CME Group offers tools such as the Dividend Futures Term Structure Tool, expiration calendars, and the Equity Total Cost Analysis Tool to help traders analyze market trends and make informed choices.

How does Intrinio support traders and developers?

Intrinio provides a robust API for accessing real-time and historical intraday stock data, making it beneficial for developers and traders looking to integrate financial data into their applications.

What advantages do traders gain from using Intrinio's historical intraday data?

Traders can analyze past price movements and volume patterns to identify potential entry and exit points, enhancing their decision-making and trading strategies.

Why is real-time information important in trading?

Real-time information is crucial for executing trades efficiently and refining investment algorithms, leading to better investment outcomes.

What commitment does Intrinio have regarding data quality?

Intrinio is committed to delivering high-quality, real-time information, empowering users to make informed decisions and improve their investment strategies.