4 Steps on How to Find Market Share Data Effectively

4 Steps on How to Find Market Share Data Effectively

Overview

To effectively find market share data, it is essential to utilize reliable sources.

- Industry reports

- Government databases

- Trade organizations

- Academic journals

- Market analysis firms

These sources not only provide comprehensive insights but also ensure accuracy, which is crucial for informed decision-making and strategic planning. By leveraging these datasets, companies can assess their competitive position within the industry more effectively.

How might these insights influence your strategic initiatives? Understanding the landscape through these reliable sources can lead to better positioning and enhanced decision-making.

Introduction

Understanding and leveraging market share data is critical for businesses aiming to navigate competitive landscapes and drive growth. This essential metric not only highlights a company's standing within its industry but also informs strategic decisions that can enhance profitability and market influence.

How can companies effectively sift through the plethora of information sources available to uncover actionable insights? Exploring reliable methodologies and addressing common pitfalls in market share research can empower organizations to make informed decisions and optimize their market position.

By focusing on market share data, businesses can better assess their competitive edge, identify growth opportunities, and ultimately improve their market influence.

Define Market Share Data and Its Importance

Information on how to find market share data indicates the proportion of a sector held by a particular firm, which is determined by dividing the firm's total sales by the sector's overall sales over a specified timeframe. This metric is essential for evaluating how to find market share data to assess a company's competitiveness and positioning within the industry, as it directly affects growth potential. Firms with a larger portion of the industry typically encounter greater profitability and improved influence, which highlights the importance of knowing how to find market share data for strategic planning and informed decision-making.

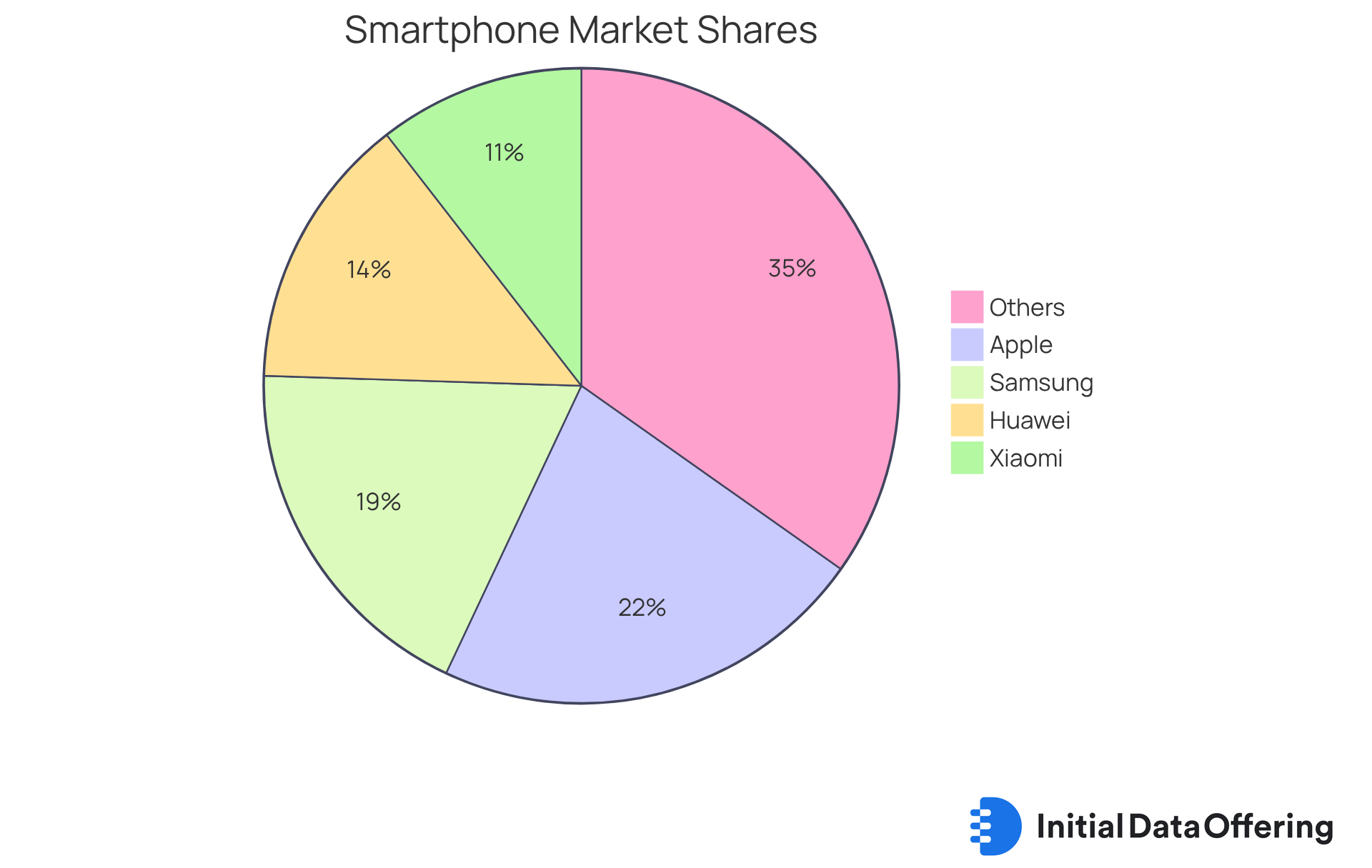

For instance, consider a company that produces $100 million in sales within a $200 million sector. This scenario results in a portion of 50%. Such a level of control over the industry signifies a strong competitive position and allows for better negotiation terms with suppliers, ultimately reducing costs and increasing profit margins. In 2025, firms such as Apple, which holds a 22.21% portion of the smartphone sector in China, exemplify how utilizing data on portions can lead to ongoing growth and profitability.

Furthermore, the portion of the business can also be determined using units sold, where the formula is:

- (total number of units sold by the company / total number of units sold in the sector) × 100.

Expert insights highlight the significance of observing changes in business presence, as these fluctuations can reveal a company's relative competitiveness. For instance, a company expanding its portion of the industry is likely boosting revenues quicker than its rivals—a pattern that investors monitor closely as an indicator of possible success. Therefore, comprehending and employing business information is crucial for companies striving to improve their operational efficiency and long-term sustainability.

Identify Reliable Sources for Market Share Data

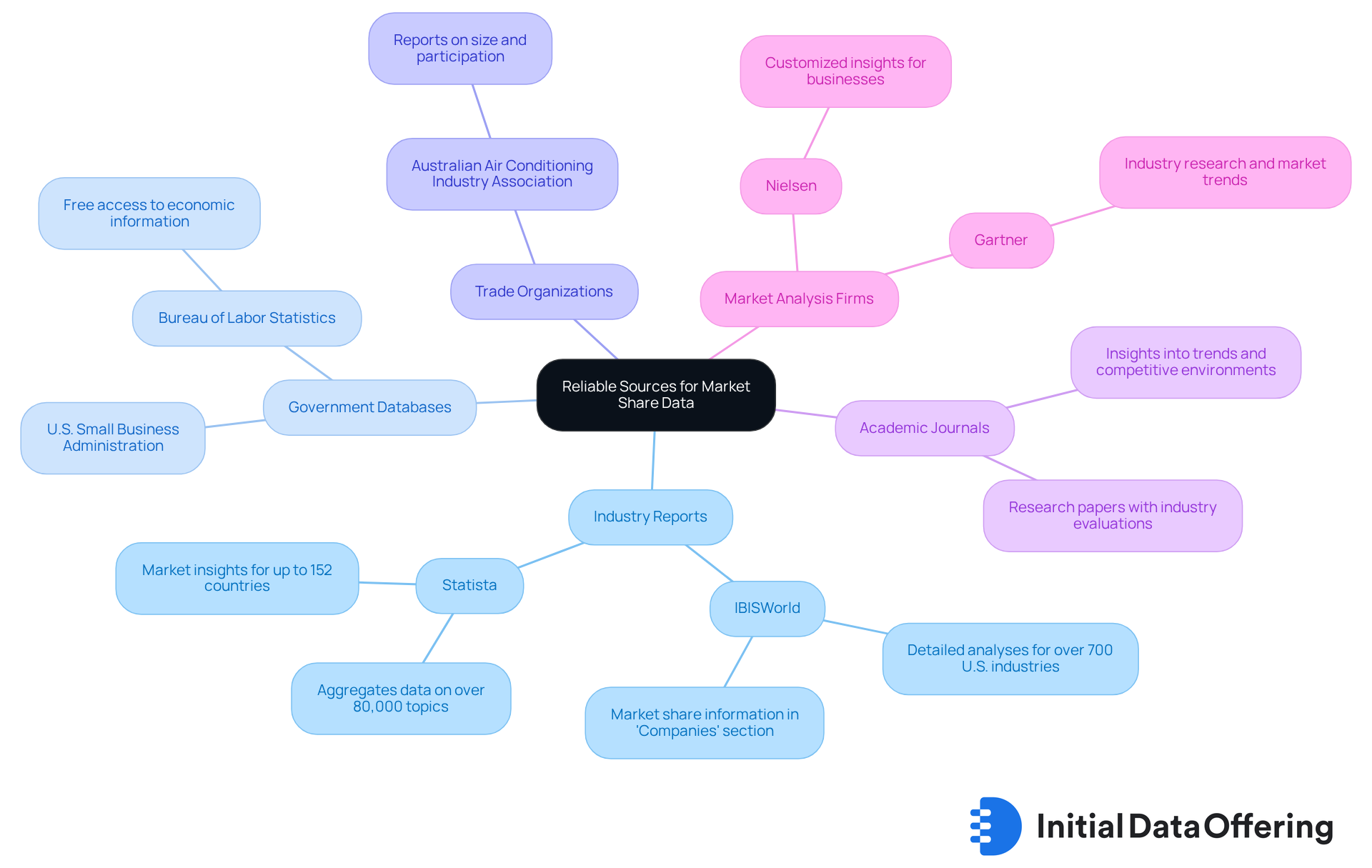

To effectively find reliable market share data, consider leveraging the following sources:

-

Industry Reports: Industry reports from entities such as IBISWorld and Statista provide invaluable insights. IBISWorld offers detailed analyses for over 700 U.S. industries classified by NAICS, while Statista compiles information on more than 80,000 subjects from over 18,000 sources. These resources deliver comprehensive share statistics and analyses, ensuring a wide perspective on market dynamics. By utilizing these reports, you gain access to a wealth of data that can inform you on how to find market share data for strategic decisions.

-

Government Databases: Free access to valuable economic information is available on websites such as the U.S. Small Business Administration and the Bureau of Labor Statistics. These databases are recognized for their precision, with government statistics frequently serving as a standard for understanding how to find market share data in economic analysis. This reliability renders them vital for trustworthy information gathering, allowing businesses to base their decisions on accurate data.

-

Trade Organizations: Numerous sectors possess specialized associations that release informative reports on size and participation. For instance, the Australian Air Conditioning Industry Association provides essential information that can guide strategic choices within the sector. Engaging with these organizations can yield insights on how to find market share data that are tailored to specific industry needs.

-

Academic Journals: Research papers often include comprehensive evaluations of industry statistics and methodologies. These publications provide thorough insights that enhance comprehension of trends and competitive environments. By exploring academic literature, you can uncover valuable analyses that inform your understanding of how to find market share data and market dynamics.

-

Market Analysis Firms: Companies like Nielsen and Gartner focus on industry research, offering customized insights and information that assist businesses in navigating their specific environments effectively. Statista's extensive aggregation capabilities further enhance the value of these firms. Leveraging their expertise can empower your organization to make informed decisions by understanding how to find market share data based on market trends.

By utilizing these diverse sources, you can ensure that the information you gather is both precise and pertinent. This ultimately supports informed decision-making, equipping you with the necessary data to thrive in a competitive landscape.

Analyze and Interpret Market Share Data Effectively

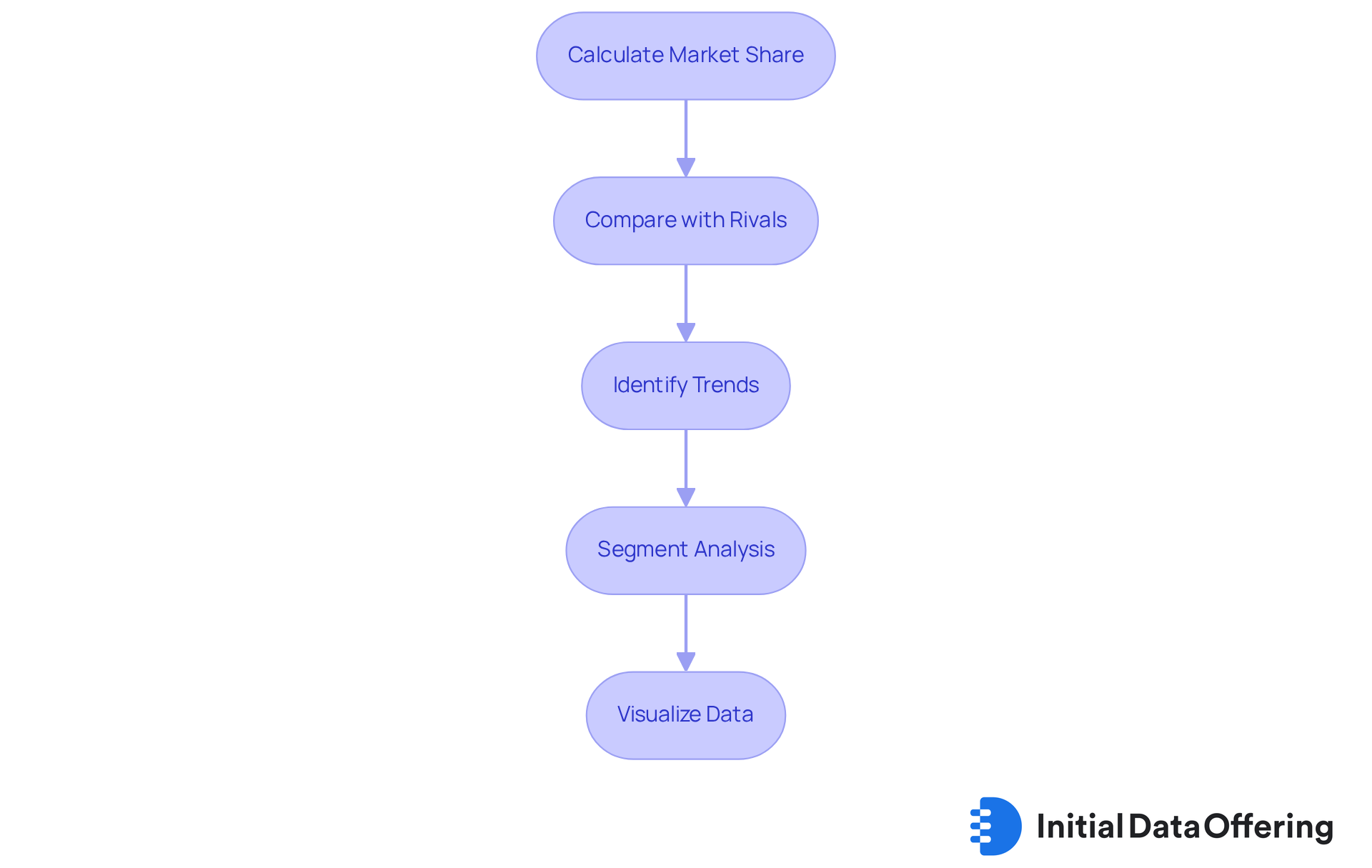

To effectively analyze and interpret market share data, it is essential to follow these steps:

-

Calculate Market Share: Utilize the formula: Market Share = (Company Sales / Total Industry Sales) x 100. This calculation illustrates how to find market share data by revealing the percentage of the industry your company commands, providing a foundational metric for analysis. Understanding this figure is crucial, as it sets the stage for subsequent evaluations.

-

Compare with Rivals: Evaluate your position against key competitors. This comparative analysis can reveal strengths and weaknesses in your positioning within the industry, allowing for strategic adjustments. How does your company stack up against others? This insight can guide your strategic planning.

-

Identify Trends: Examine trends over time to determine whether your market share is on the rise or decline. Understanding how to find market share data is crucial for evaluating the effectiveness of your strategies and making informed decisions. Are you adapting effectively to market changes?

-

Segment Analysis: Disaggregate the information by segments such as geography or product line. This segmentation offers deeper insights into specific areas of strength and weakness, enabling targeted strategies. What segments show promise, and where might you need to improve?

-

Visualize Data: Employ charts and graphs to present your findings visually. Effective data visualization simplifies communication with stakeholders and supports strategic decision-making. How can visual tools enhance your data's impact?

In 2025, sectors are observing diverse growth rates, with some areas encountering considerable increases in their portion. For example, the grocery industry has experienced a shift towards discount retailers, with Tesco and Sainsbury's having a combined presence of 43.4% as of July 2025. Businesses that effectively analyze trends in their sectors, like those utilizing detailed industry reports, are more equipped to adjust and succeed in competitive environments. As Alex Chriss, President and CEO of PayPal, observed, "Comprehending industry dynamics is essential for fostering sustainable growth." By following these steps, you can convert raw information into practical insights that promote business expansion.

Troubleshoot Common Issues in Market Share Data Research

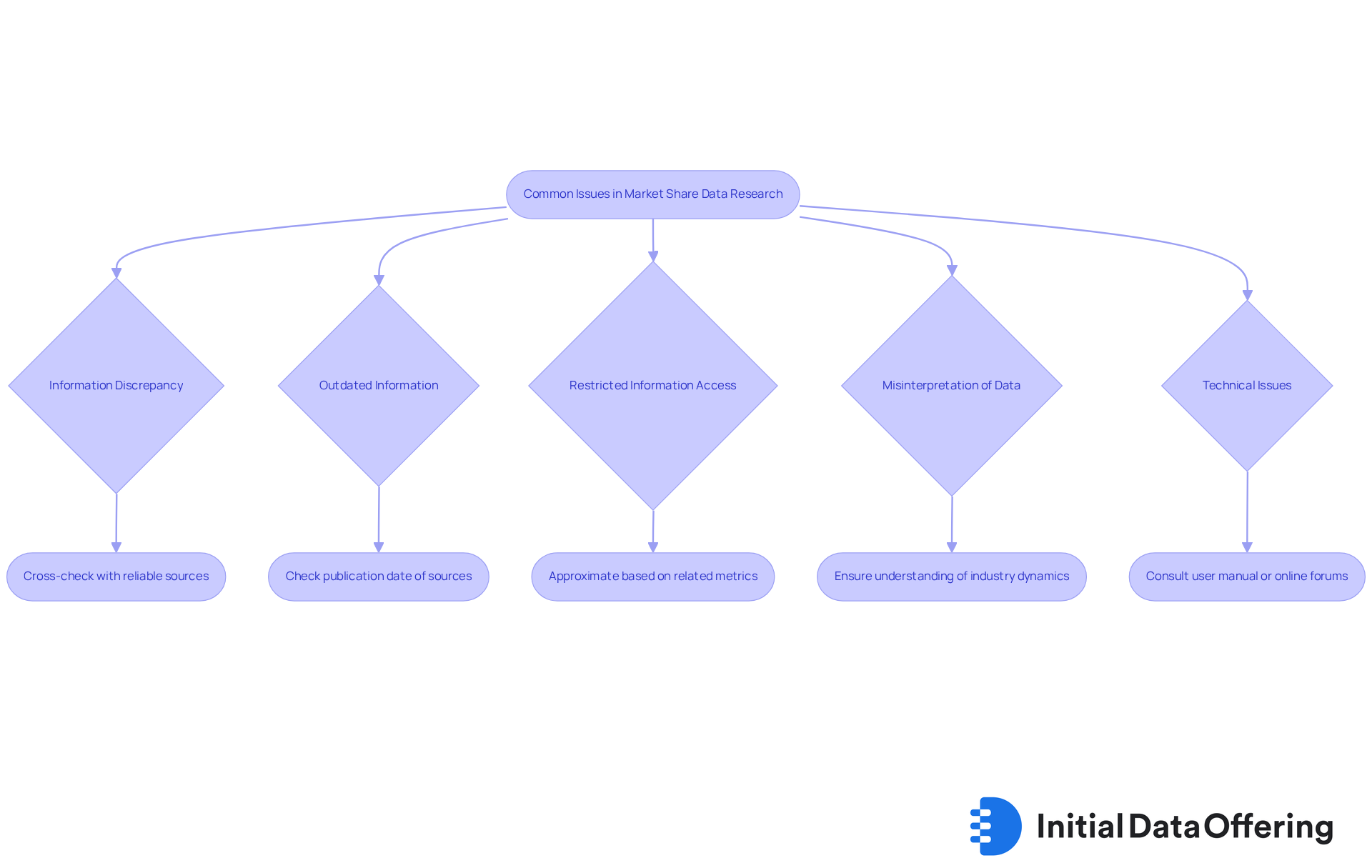

When conducting research on how to find market share data, several common issues may arise. Understanding these challenges is crucial for effective analysis. Here’s how to troubleshoot them:

-

Information Discrepancy: Discovering inconsistencies in information from various sources can be troubling. To ensure precision, cross-check with additional reliable sources. This approach not only verifies the data but also enhances the credibility of your findings.

-

Outdated Information: The relevance of your data hinges on its timeliness. Market conditions can shift rapidly; therefore, always check the publication date of your sources. Utilizing current information allows for more accurate insights into market trends.

-

Restricted Information Access: If certain share statistics are inaccessible, consider approximating them based on related metrics, such as sales figures or industry reports. This method can provide a reasonable estimate and keep your analysis grounded in relevant data.

-

Misinterpretation of Data: When interpreting data, context is essential. Be cautious and ensure you fully comprehend the industry dynamics before drawing conclusions. This understanding can prevent errors and lead to more informed decisions.

-

Technical Issues: Utilizing software tools for analysis can sometimes lead to technical problems. In such cases, consulting the user manual or seeking assistance from online forums can be beneficial. Addressing these issues promptly ensures your research remains on track.

By being aware of these common issues and knowing how to find market share data, you can significantly enhance the reliability and effectiveness of your research.

Conclusion

Understanding how to find market share data is crucial for any business aiming to enhance its competitive edge and make informed strategic decisions. By grasping the significance of market share, companies can effectively assess their position within the industry and identify growth opportunities. The insights provided in this guide lay out the essential steps and reliable sources necessary for gathering and analyzing this critical data.

The article outlines a comprehensive approach to locating and interpreting market share data. It emphasizes the importance of utilizing diverse resources such as:

- industry reports

- government databases

- trade organizations

- academic journals

- market analysis firms

Analyzing trends, comparing performance with competitors, and employing effective data visualization techniques are necessary to better understand market dynamics. Additionally, troubleshooting common research issues ensures the credibility and accuracy of the gathered information.

Ultimately, mastering the art of finding and analyzing market share data empowers businesses to navigate competitive landscapes and fosters sustainable growth. By leveraging the strategies and insights discussed, organizations can position themselves for success and make data-driven decisions that enhance their market presence. Embracing these practices will undoubtedly lead to improved operational efficiency and long-term viability in an ever-evolving market.

Frequently Asked Questions

What is market share data?

Market share data refers to the proportion of a sector held by a particular firm, calculated by dividing the firm's total sales by the sector's overall sales over a specified timeframe.

Why is market share data important?

Market share data is essential for evaluating a company's competitiveness and positioning within the industry, as it directly affects growth potential, profitability, and strategic planning.

How can market share be calculated?

Market share can be calculated using the formula: (total sales of the company / total sales of the sector) × 100, or by using units sold with the formula: (total number of units sold by the company / total number of units sold in the sector) × 100.

Can you provide an example of market share calculation?

For instance, if a company produces $100 million in sales within a $200 million sector, its market share would be 50%, indicating a strong competitive position.

How does market share impact a company's negotiation power?

Firms with a larger market share typically have better negotiation terms with suppliers, which can lead to reduced costs and increased profit margins.

What does a change in market share indicate?

Changes in market share can reveal a company's relative competitiveness; for example, if a company is increasing its market share, it may be boosting revenues faster than its rivals, which is closely monitored by investors.

Why should companies track their market share?

Companies should track their market share to improve operational efficiency, assess competitive positioning, and ensure long-term sustainability in their industry.