7 Essential Alternative Data Sources for Market Research Analysts

7 Essential Alternative Data Sources for Market Research Analysts

Overview

The article focuses on identifying essential alternative data sources that market research analysts can utilize to enhance their research capabilities. These datasets, such as social media sentiment, location data, and natural language processing, offer unique insights that are increasingly important in today's data-driven landscape.

Features:

- Social media sentiment analysis captures public opinion and trends in real-time, enabling analysts to gauge consumer attitudes.

- Location data provides context to consumer behavior, revealing where and when purchases occur.

- Natural language processing allows for the extraction of insights from unstructured text, helping analysts understand the nuances of consumer feedback.

Advantages:

- By leveraging these diverse data sets, analysts can gain a comprehensive view of market dynamics.

- The integration of varied data sources enhances the depth of analysis, allowing for more informed decision-making.

Benefits:

- Ultimately, utilizing alternative data sources equips market research analysts with a competitive advantage, enabling them to deliver richer insights and drive strategic initiatives.

How can you incorporate these datasets into your research to uncover new opportunities? By embracing these tools, you can significantly enhance your research capabilities and respond proactively to market changes.

Introduction

The landscape of market research is rapidly evolving, fueled by an increasing reliance on alternative data sources that offer unique insights beyond traditional metrics. This shift presents market research analysts with a wealth of opportunities to enhance their strategies and decision-making processes. As the demand for innovative and comprehensive data solutions grows, professionals must consider how to effectively navigate this expansive realm of alternative data.

How can they maximize their research capabilities and stay ahead of the competition? By understanding the features and advantages of these alternative data sources, analysts can unlock significant benefits that will inform their research and drive success.

Initial Data Offering: Access Diverse Alternative Data Sets for Market Insights

Initial Data Offering (IDO) serves as a crucial resource for market research professionals by providing a centralized platform for accessing a wide array of alternative data sources.

- Features include coverage of diverse areas such as finance, social media, and environmental studies. This broad scope allows researchers to recognize trends and insights that alternative data sources frequently overlook.

- Advantages arise from the daily listing of new datasets, enabling analysts to subscribe for premium access. This ensures they remain ahead of the curve with unique collections that enhance their research capabilities.

- Benefits are evident in the practical applications, as hedge fund managers utilize non-traditional information to assess investor sentiment and rapidly modify portfolios, showcasing how these datasets can be effectively employed in real-life scenarios.

The increasing demand for practical insights has resulted in notable growth in the sector of alternative data sources, projected to reach USD 22.9 billion by 2033. This trend underscores the importance for data evaluators to employ alternative data sources alongside varied datasets to enhance their decision-making methods. As emphasized by industry leaders, the efficient use of alternative data sources is essential for companies aiming to innovate and expand. By simplifying access to these valuable resources, IDO enables researchers to leverage extensive industry intelligence, ultimately promoting informed choices and strategic planning across various sectors.

Are you ready to unlock the potential of premium insights? Subscribe today to discover new datasets daily and enhance your research capabilities with Initial Data Offering.

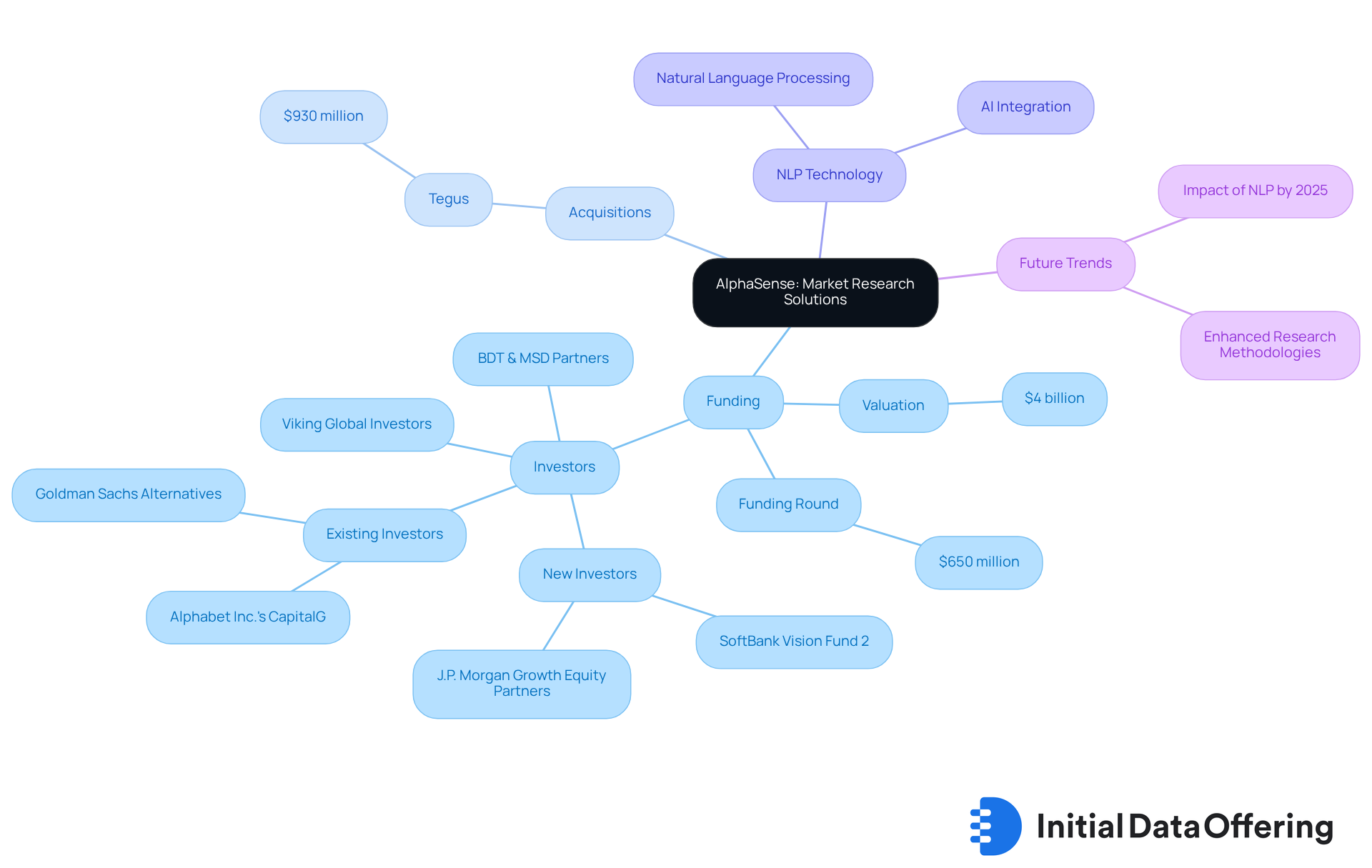

AlphaSense: Streamline Market Research with Alternative Data Solutions

AlphaSense provides a robust platform that merges conventional financial information with alternative sources, enabling research analysts to acquire deeper insights. Recently valued at $4 billion following a $650 million funding round co-led by Viking Global Investors and BDT & MSD Partners, AlphaSense is positioned as a leader in industry intelligence. This significant funding will facilitate its acquisition of provider Tegus for $930 million, further enhancing its capabilities in delivering extensive insights into the industry.

By utilizing natural language processing (NLP) techniques, AlphaSense allows users to search through vast amounts of data quickly, identifying relevant trends and sentiments that can inform investment strategies. As Jack Kokko observed, "AlphaSense is a prominent intelligence research platform that employs advanced artificial intelligence (AI) technology to offer businesses powerful insights from a vast array of private and public sources." This capability is essential for analysts striving to stay ahead in a competitive environment.

Current trends in NLP are transforming financial information analysis, enabling more nuanced interpretations of signals from the economy. By 2025, the influence of NLP on research is projected to be profound, facilitating the integration of conventional and diverse information for more comprehensive analysis. Merging these information types allows analysts to attain a broader perspective on economic dynamics, leading to informed decision-making. Expert insights indicate that incorporating NLP with alternative data sources not only enhances the precision of predictions but also streamlines the research process, making it more efficient. This evolution in research methodologies underscores the importance of platforms like AlphaSense in navigating the complexities of today's financial landscape.

SafeGraph: Leverage Location Data for Enhanced Market Analysis

SafeGraph provides top-quality location information that can significantly enhance analysis. By examining foot traffic patterns and consumer movement as alternative data sources, analysts can uncover valuable insights into industry trends, customer preferences, and competitive positioning. This information is crucial for businesses looking to refine their marketing strategies and increase customer engagement by identifying alternative data sources that reveal where their target audience spends their time.

For example, the recent surge in foot traffic to theaters and music venues—up 86.38% year-over-year—demonstrates a robust consumer demand for in-person experiences, which can inform targeted marketing efforts. Furthermore, the total foot traffic rose by 2.5% in April 2025, underscoring the importance of SafeGraph's information in understanding broader industry trends.

SafeGraph representatives emphasize that understanding foot traffic data enables organizations to make informed decisions, asserting that 'there is a chance to be the leader in providing location insights of the highest quality.' As industry research evolves in 2025, leveraging alternative data sources, such as foot traffic information, will be essential for professionals aiming to develop impactful marketing strategies and enhance overall business performance.

Moreover, as Geoffrey Moore points out, analytics is critical for making informed business choices, highlighting the significance of SafeGraph's insights in crafting effective marketing strategies.

Predikdata: Comprehensive Resources for Understanding Alternative Data Applications

Predikdata serves as a vital resource for market research professionals aiming to leverage the power of alternative data sources. One of its key features is the provision of numerous case studies and best practices, such as the 'Impact of Fintech on Non-traditional Information Demand.' This feature allows researchers to seamlessly integrate unconventional information into their methodologies. The advantage of this comprehensive approach lies in its ability to maximize insights derived from alternative data sources, empowering professionals to make informed decisions that drive strategic outcomes.

For instance, the global non-traditional information sector is projected to reach USD 135.72 billion by 2030. This statistic underscores the importance of adopting a systematic approach to information integration. The benefit of effectively incorporating alternative data sources is twofold:

- It enhances research capabilities

- It equips researchers with unique insights that can distinguish their findings in a competitive landscape

By fostering a deep understanding of alternative information applications, Predikdata provides analysts with the tools necessary to navigate the complexities of modern research while addressing regulatory risks associated with the use of alternative information.

CFA Institute: Utilize NLP Techniques to Unlock Alternative Data Insights

The CFA Institute underscores the pivotal role of natural language processing (NLP) techniques in extracting valuable insights from alternative data sources. By leveraging NLP on unstructured data sources—such as news articles, social media posts, and financial reports—analysts can discern trends and sentiments that significantly impact financial fluctuations. This methodology not only enhances the understanding of economic dynamics but also empowers analysts to make more informed investment decisions.

In 2023, over 64% of investment professionals reported integrating alternative data sources into their workflows, signifying a growing dependence on these sophisticated analytical techniques, particularly NLP. Practical applications, such as sentiment analysis during crucial corporate events, demonstrate how NLP can provide early warnings of economic shifts. For instance, during the launch of Starbucks' rewards program, the surge in negative tweets could have alerted investors to potential financial repercussions prior to the release of quarterly results.

The CFA Institute actively promotes the adoption of NLP techniques, recognizing their capacity to revolutionize analysis and investment strategies in an increasingly data-driven landscape. As investment professionals consider the implications of these advanced tools, how might they leverage NLP to enhance their decision-making processes?

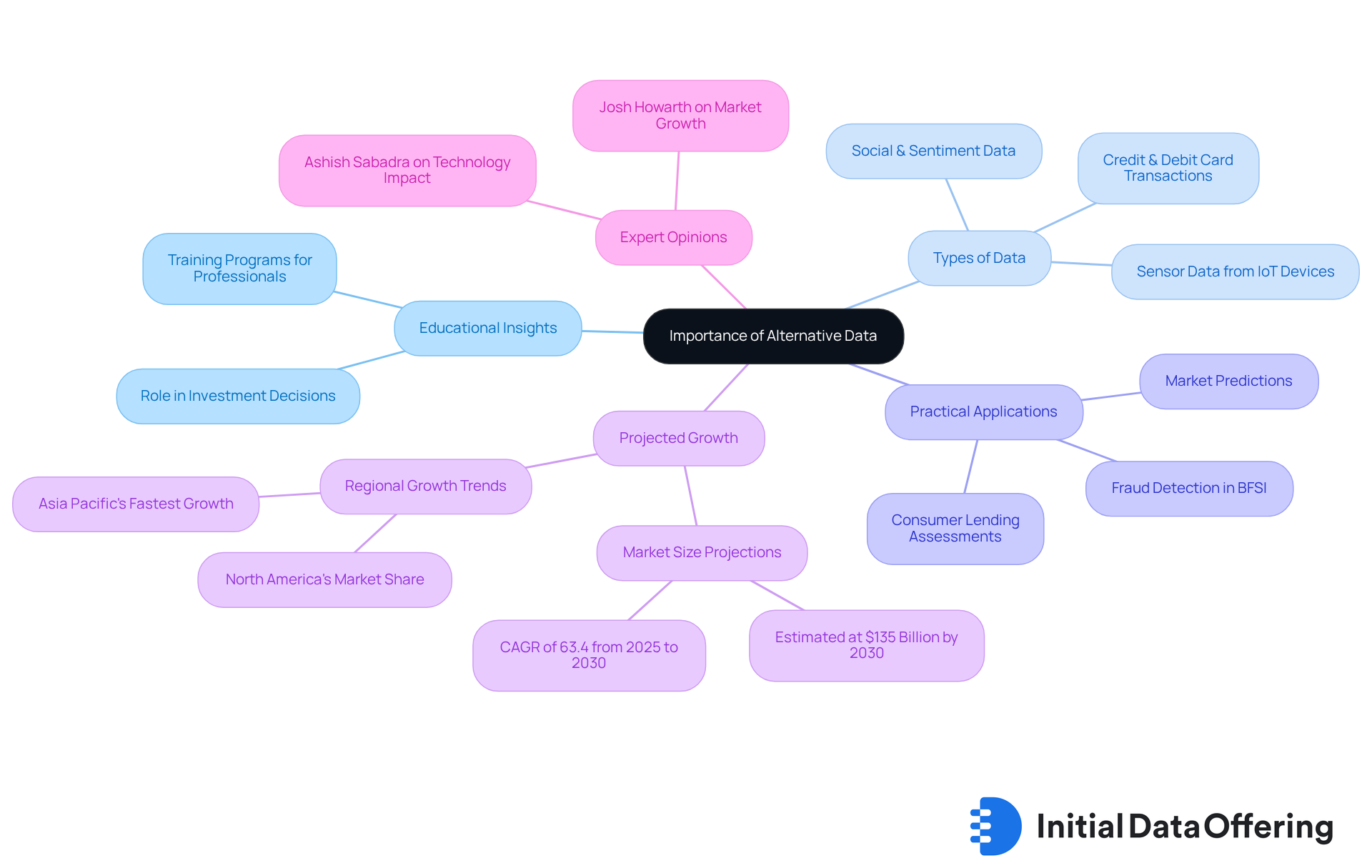

Investopedia: Educational Insights on the Importance of Alternative Data

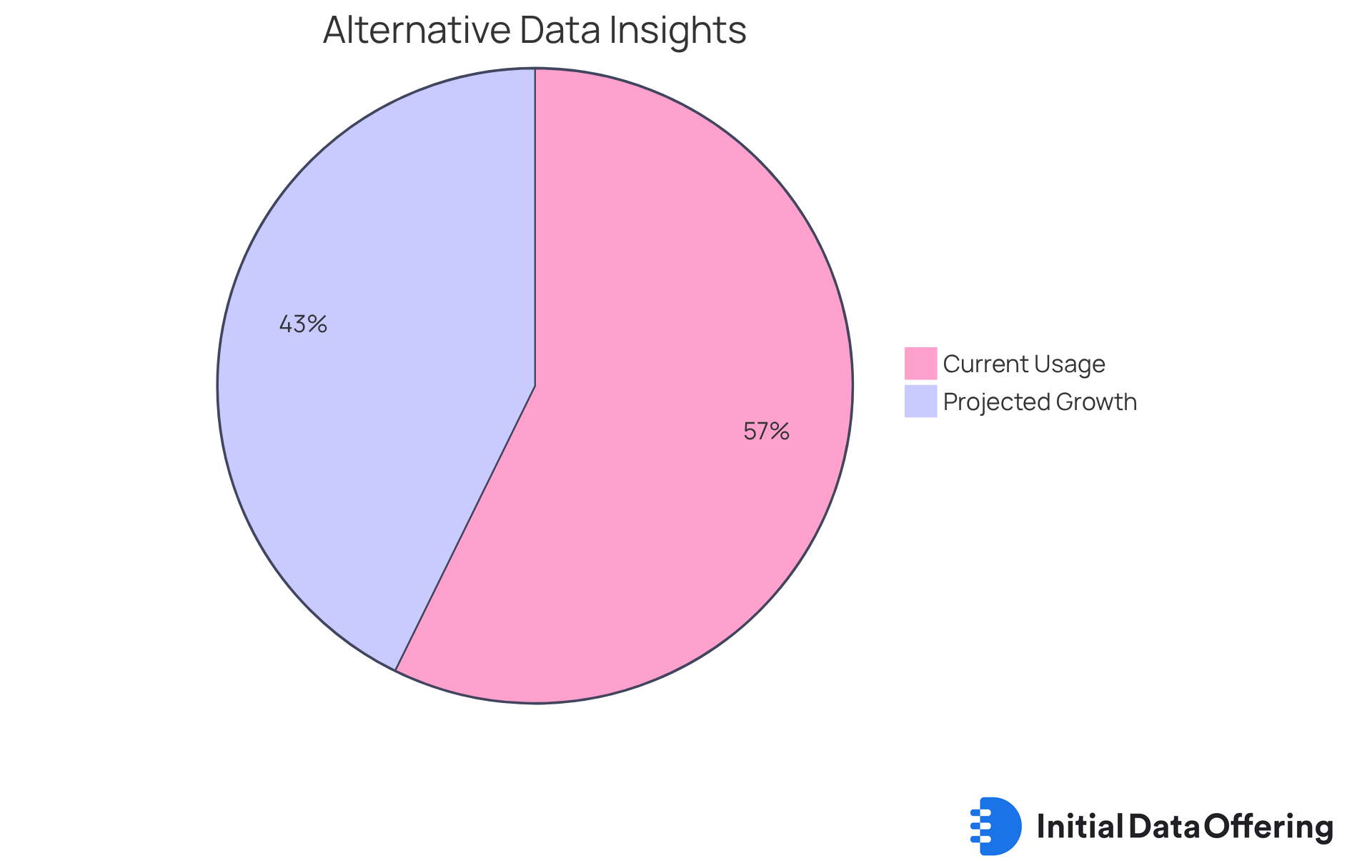

Investopedia serves as a vital resource for research professionals, offering comprehensive educational insights into the role of alternative data sources in making investment decisions. By detailing various types of supplementary information and their practical applications, Investopedia equips professionals with the essential knowledge necessary to effectively leverage these resources. This understanding is critical for researchers seeking to enhance their research capabilities and maintain a competitive edge in a rapidly changing landscape.

Practical examples illustrate how researchers have successfully utilized diverse information to shape their strategies, underscoring the value of these insights in enabling informed decision-making. Notably, the sector of alternative data sources is projected to exceed $135 billion by 2030, highlighting the growing importance of these resources. As Ashish Sabadra emphasizes, 'technology and alternative data sources are reshaping the global investment landscape and potentially disrupting traditional practices.' This underscores the necessity for analysts to remain informed and adaptable in their approaches.

GetAura.ai: Transform Investment Strategies with Alternative Data Insights

GetAura.ai harnesses the potential of alternative data sources to revolutionize investment strategies by delivering critical insights into workforce analytics and market trends. By thoroughly analyzing diverse information sources, GetAura.ai empowers investors to pinpoint emerging opportunities and enhance their portfolios. This innovative approach is particularly vital for professionals seeking to refine their investment strategies and achieve superior outcomes.

The integration of workforce analytics has become increasingly significant, with 67% of investment professionals currently employing various information sources, marking a substantial rise from previous years. As firms adapt to the changing landscape, the capacity to interpret workforce dynamics—such as hiring freezes and employee sentiment—offers a competitive advantage. For example, top-quartile firms that sustained or increased hiring in strategic roles, especially in AI and analytics, have outperformed their counterparts.

Moreover, the sector of alternative data sources is projected to grow at a compound annual growth rate of nearly 50%, underscoring the need for researchers to leverage these insights. By utilizing platforms like GetAura.ai, research professionals can transform their decision-making processes, ensuring they remain at the forefront of a rapidly evolving investment landscape.

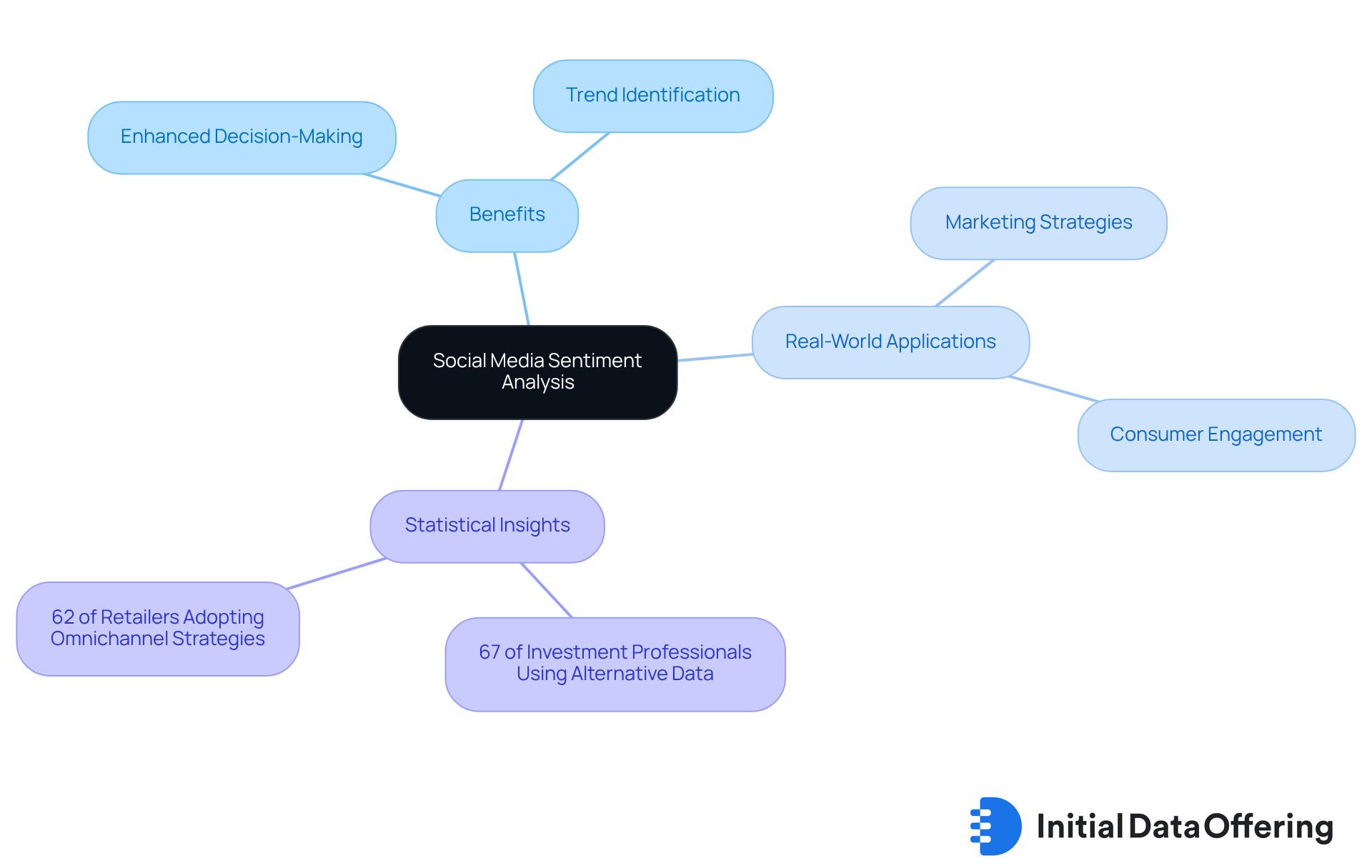

Builtin.com: Explore Various Types of Alternative Data for Market Research

Social media sentiment evaluation has emerged as a crucial alternative data source for research professionals, offering insights that traditional information often overlooks. By analyzing consumer sentiments shared on platforms like Twitter, Facebook, and Instagram, experts can gauge public opinions and emotional responses regarding brands, products, and industry trends. This analysis not only enriches industry insights but also enables professionals to swiftly identify emerging trends and shifts in consumer behavior.

The real-world applications of social media sentiment analysis are extensive. For instance, businesses can leverage this information to refine marketing strategies, enhance customer engagement, and even predict stock market fluctuations based on public sentiments towards specific companies or sectors. The ability to monitor sentiment changes empowers businesses to proactively address consumer needs and preferences, ultimately leading to improved decision-making.

Furthermore, integrating sentiment evaluation into research methodologies allows specialists to diversify their information sources, resulting in more comprehensive and nuanced insights. As consumer behavior continues to evolve, the importance of social media sentiment analysis in research becomes increasingly significant, positioning it as an indispensable tool for analysts striving to remain competitive. A 2024 survey indicates that 67% of investment professionals are utilizing alternative data sources, which highlights the growing dependence on such insights. Additionally, the Harvard Business Review notes that 62% of retailers worldwide are implementing omnichannel strategies, emphasizing the necessity of understanding consumer sentiment in a multi-faceted environment. Case studies, such as those involving hedge funds employing sentiment analysis to gauge overall market sentiment, further demonstrate the practical applications and effectiveness of this approach.

Research.Aimultiple.com: Practical Use Cases for Alternative Data in Market Research

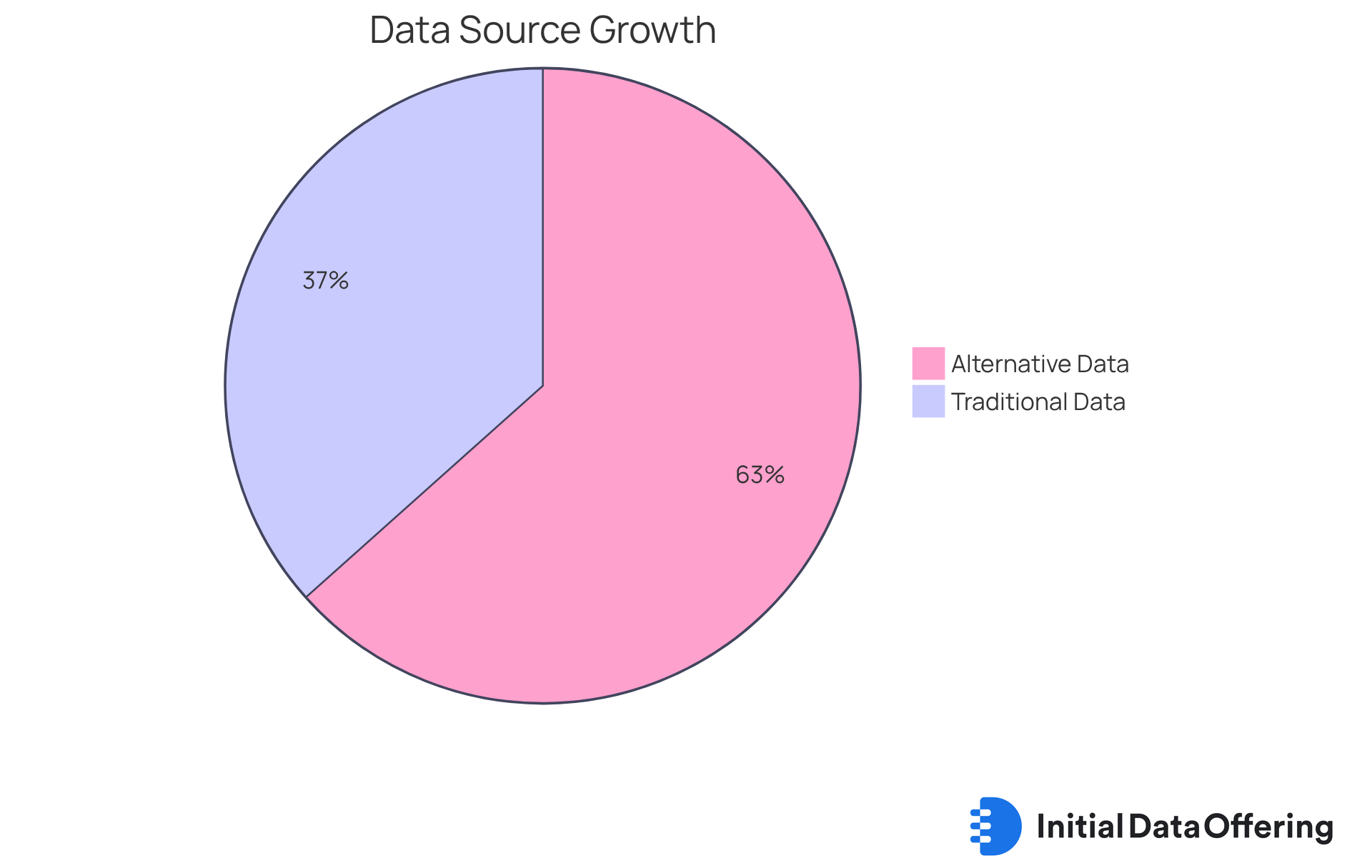

Research.Aimultiple.com provides a wealth of practical applications for diverse information in research, equipping professionals with actionable insights essential for successful execution. By analyzing various case studies across multiple sectors, researchers can discover effective methods to seamlessly integrate alternative data sources into their research processes. This integration not only enhances analytical capabilities but also significantly improves decision-making processes through the use of alternative data sources.

For instance, the substitute information sector is projected to grow at a compound annual growth rate of 63.4% from 2025 to 2030, underscoring its increasing importance in the field. Furthermore, real-time insights drawn from alternative data sources, such as social media sentiment and consumer transaction details, deliver a near-instantaneous perspective on economic dynamics. This allows experts to make informed choices based on current trends rather than relying solely on traditional financial data.

As the landscape of market research evolves, leveraging alternative data sources becomes imperative for analysts aiming to remain competitive.

DefiSolutions: Alternative Data for Enhanced Credit Decisioning in Market Analysis

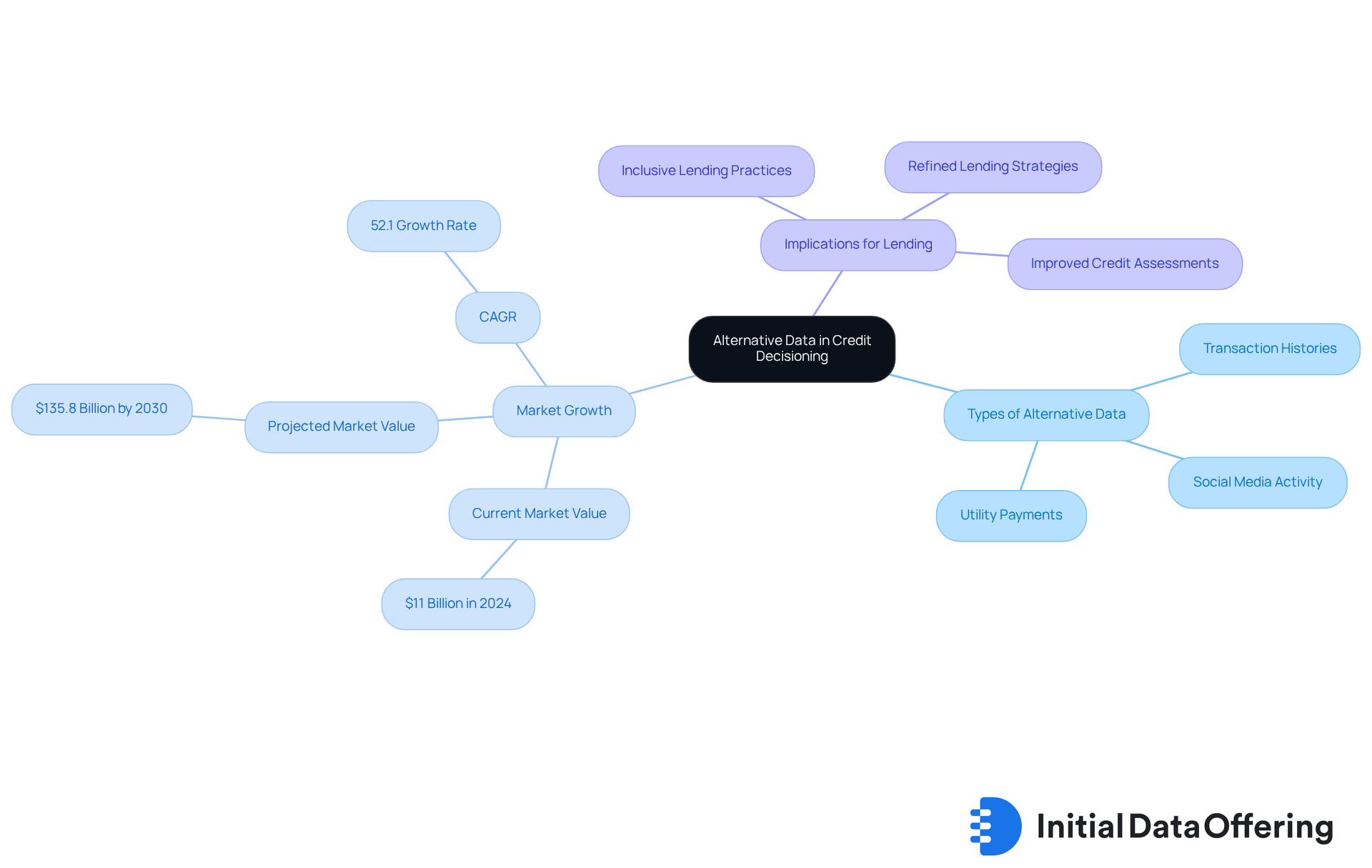

DefiSolutions highlights the transformative effect of alternative data sources on the credit decision-making processes. By incorporating alternative data sources like transaction histories, social media activity, and utility payments, analysts can develop a more nuanced understanding of creditworthiness. This integration enhances the precision of credit assessments and empowers financial institutions to make more informed lending decisions. Consequently, lenders can refine their strategies, resulting in improved outcomes in the analysis of the economy.

The alternative information market is projected to expand significantly, from $11 billion in 2024 to an estimated $135.8 billion by 2030, demonstrating a notable CAGR of 52.1% over the next six years. This growth underscores the increasing significance of alternative data sources in influencing credit evaluations. For instance, alternative credit unions leverage real-time financial activity to evaluate applicants lacking traditional credit histories, leading to faster approvals and more inclusive lending practices. How can your organization adapt to this shift towards utilizing varied information sets?

This evolution in credit assessment is crucial, especially considering that the Consumer Financial Protection Bureau estimates that 26 million Americans are credit invisible. As W. Edwards Deming aptly stated, 'Without information, you're just another person with an opinion.' Analysts are encouraged to explore specific alternative data sources and platforms to improve their credit assessment strategies. What alternative data could you incorporate to improve your lending decisions?

Conclusion

The exploration of alternative data sources has become essential for market research analysts striving to gain a competitive edge in an increasingly data-driven landscape. By leveraging diverse datasets, professionals can uncover insights that traditional data often overlooks, thereby enhancing their decision-making processes and strategic planning.

Throughout the article, various platforms such as Initial Data Offering, AlphaSense, and SafeGraph have been highlighted for their unique contributions to the field. These platforms provide daily updates on alternative datasets and employ advanced natural language processing techniques that streamline research. Such resources empower analysts to integrate unconventional information into their methodologies. Furthermore, the growing significance of social media sentiment analysis and location data illustrates the diverse applications of alternative data in understanding consumer behavior and market dynamics.

As the market for alternative data is projected to experience significant growth, it is imperative for analysts to embrace these innovative resources. By doing so, they can transform their research capabilities, make informed investment decisions, and ultimately drive success in their respective fields. The future of market research lies in the effective utilization of alternative data, urging professionals to remain adaptable and proactive in their approaches.

Frequently Asked Questions

What is the Initial Data Offering (IDO)?

The Initial Data Offering (IDO) is a centralized platform that provides market research professionals with access to a wide array of alternative data sources, covering areas such as finance, social media, and environmental studies.

What are the advantages of using IDO?

IDO offers daily listings of new datasets, allowing analysts to subscribe for premium access to unique collections that enhance their research capabilities and help them stay ahead of trends.

How do hedge fund managers utilize alternative data from IDO?

Hedge fund managers use non-traditional information from alternative data to assess investor sentiment and quickly adjust their portfolios, demonstrating practical applications of these datasets.

What is the projected growth of the alternative data sector?

The alternative data sector is projected to reach USD 22.9 billion by 2033, highlighting the increasing demand for practical insights.

What role does AlphaSense play in market research?

AlphaSense merges conventional financial information with alternative sources, enabling research analysts to gain deeper insights and stay competitive in the market.

How does AlphaSense utilize natural language processing (NLP)?

AlphaSense uses NLP techniques to allow users to quickly search vast amounts of data, identifying relevant trends and sentiments that inform investment strategies.

What recent developments have occurred with AlphaSense?

AlphaSense was recently valued at $4 billion following a $650 million funding round and plans to acquire provider Tegus for $930 million to enhance its industry intelligence capabilities.

How is SafeGraph important for market analysis?

SafeGraph provides high-quality location data that helps analysts examine foot traffic patterns and consumer movement, revealing insights into industry trends and customer preferences.

What recent trends have SafeGraph's location data revealed?

SafeGraph reported an 86.38% year-over-year increase in foot traffic to theaters and music venues, indicating strong consumer demand for in-person experiences.

Why is foot traffic data significant for businesses?

Understanding foot traffic data allows businesses to refine their marketing strategies and increase customer engagement by identifying where their target audience spends time.