4 Strategies for Effective EOD Historical Data Management

4 Strategies for Effective EOD Historical Data Management

Overview

The article presents four key strategies for the effective management of End-of-Day (EOD) historical data. These strategies include:

- Identifying reliable data sources

- Implementing efficient data collection methodologies

- Utilizing advanced analytical techniques

- Establishing continuous monitoring practices

Each strategy is not only a feature but also offers distinct advantages that enhance data accuracy and improve decision-making. Ultimately, these strategies lead to better financial analysis and risk management, providing significant benefits for professionals in the field.

By identifying reliable data sources, organizations can ensure the integrity of their data, which is crucial for accurate financial reporting. Efficient data collection methodologies streamline the process, saving time and resources while maintaining high-quality data. Advanced analytical techniques allow for deeper insights, enabling informed decisions that can positively impact financial outcomes. Continuous monitoring practices ensure that data remains relevant and accurate over time, adapting to changing market conditions.

How can these strategies be integrated into your current workflow? Consider the implications of adopting these practices in your organization. By employing these strategies, you can enhance your data management processes and ultimately achieve better financial results.

Introduction

Effective management of end-of-day (EOD) historical data is pivotal for financial analysts aiming to make informed decisions in a rapidly evolving market. By leveraging reliable sources, organizations can implement robust data collection methodologies and utilize advanced analytical techniques. These strategies significantly enhance data management.

However, with a vast landscape of data providers and the complexities involved in maintaining accuracy, firms face a critical question: how can they ensure they are not only gathering data effectively but also deriving actionable insights that drive profitability? This inquiry highlights the importance of strategic data management in achieving competitive advantage.

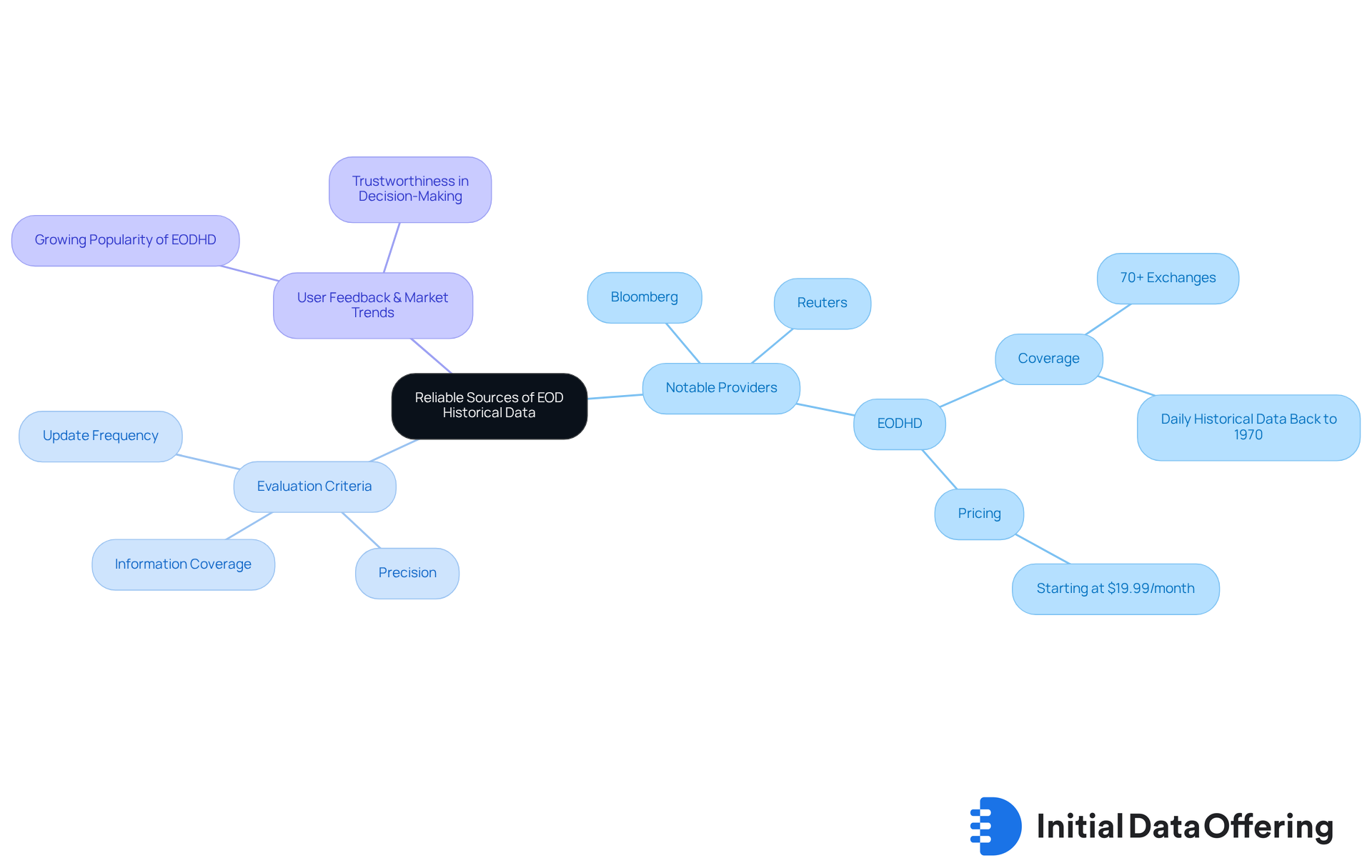

Identify Reliable Sources of EOD Historical Data

To effectively manage EOD historical data, identifying reputable sources is crucial. Established financial information providers such as Bloomberg, Reuters, and EODHD are notable for their comprehensive datasets, particularly their EOD historical data, and proven track records.

For instance, EODHD offers EOD historical data, providing daily historical information dating back to 1970 for most U.S. tickers and over 30 years of historical records, making it a dependable option for long-term analysis.

When assessing these references, consider factors such as:

- Information coverage

- Precision

- Update frequency

How can user feedback and industry suggestions further inform your perspective on a provider's trustworthiness? Financial analysts emphasize that a provider's reputation is foundational for informed decision-making and strategic planning.

Always prioritize sources that transparently reveal their information collection methodologies and provide clear pricing structures to avoid unexpected expenses.

In 2025, the market share of financial information providers reflects a competitive landscape, with companies like EODHD gaining traction due to their extensive offerings and user-friendly interfaces.

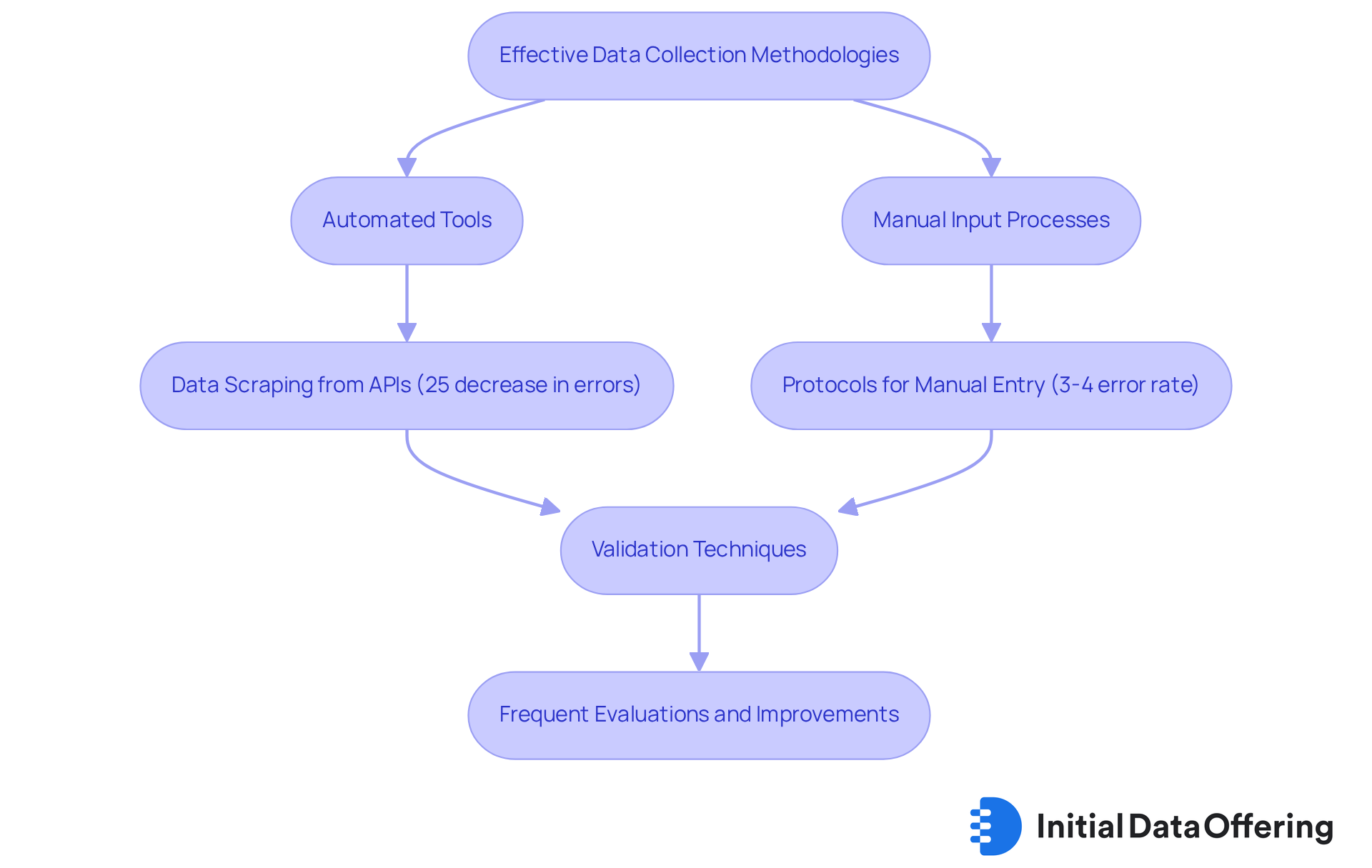

Implement Effective Data Collection Methodologies

To establish effective information collection methodologies, it is essential to blend automated information scraping tools with manual input processes. Automated tools excel at efficiently collecting eod historical data from APIs, such as those provided by EODHD. This ensures timely updates and minimizes the risk of human error. Organizations utilizing these automated information collection tools report a 25% decrease in errors, underscoring the effectiveness of automation in reducing inaccuracies.

In contrast, implementing clear protocols for manual information entry is crucial to minimize inaccuracies, as manual information capture can have error rates ranging from 3% to 4%. Utilizing validation techniques, such as cross-referencing information from various sources, can further improve the precision of the gathered information. For instance, firms such as Intrinio have effectively employed automated scraping tools to simplify their information collection processes.

Frequent evaluations and improvements of your information gathering techniques are essential. This adaptability ensures that your methods align with changing market circumstances and technological progress, guaranteeing that your information remains trustworthy and useful. How can your organization leverage these insights to enhance its information collection strategies?

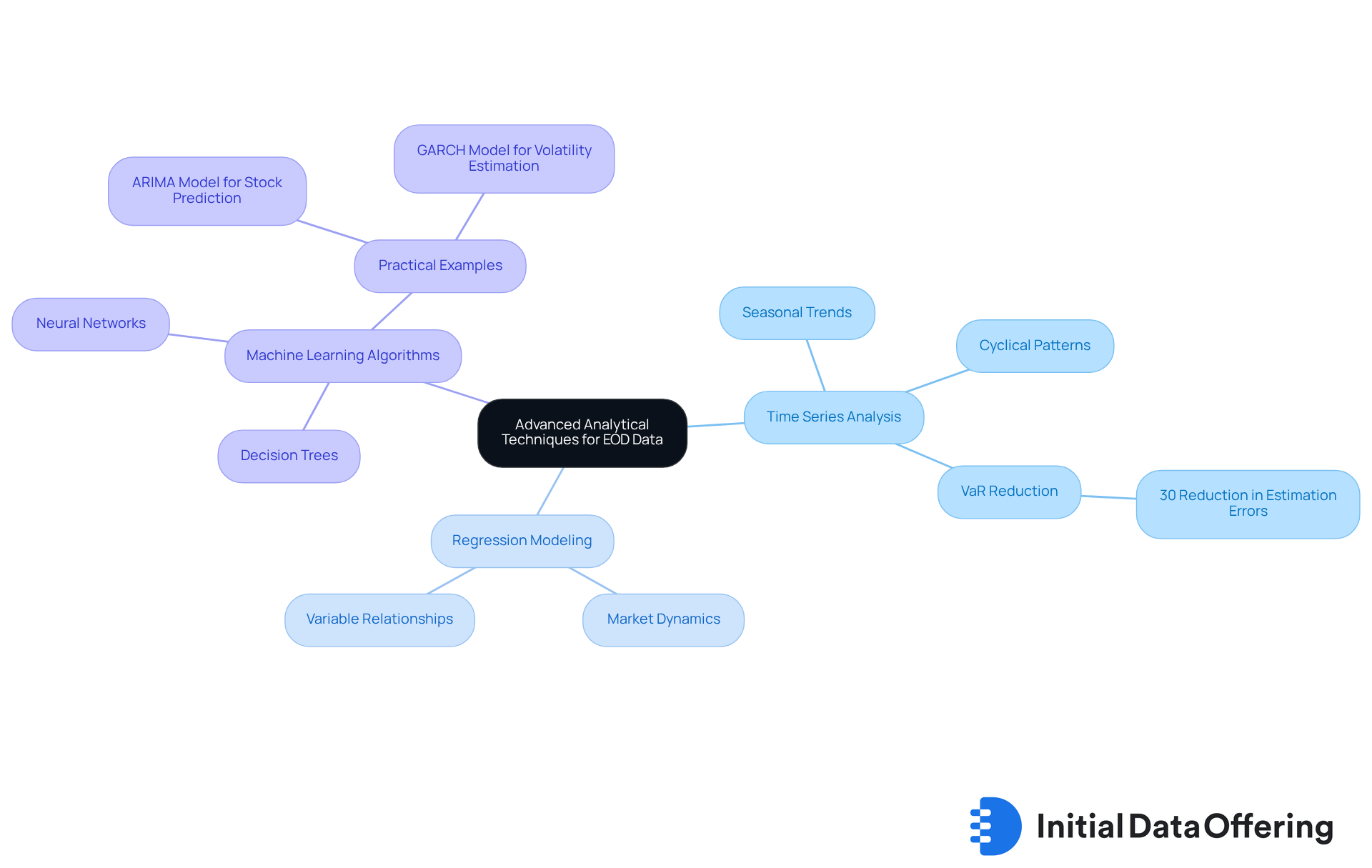

Utilize Advanced Analytical Techniques for EOD Data

To derive actionable insights from eod historical data, employing advanced analytical techniques is crucial. Techniques such as time series analysis, regression modeling, and machine learning algorithms are particularly effective. Time series analysis uncovers seasonal trends and cyclical patterns, enabling analysts to forecast future movements based on historical performance. For example, organizations that implement specialized techniques to address non-stationarity in financial data can reduce their Value-at-Risk (VaR) estimation errors by up to 30%. This significantly enhances capital allocation efficiency.

Regression modeling further enriches this analysis by evaluating relationships between various variables, such as stock prices and economic indicators. This provides a deeper understanding of market dynamics. As highlighted by Sarah Lee, organizations employing robust time series analytics frameworks surpass their peers by an average of 15-20% in forecasting precision. This directly influences profitability and risk management capabilities.

Moreover, machine learning algorithms, including decision trees and neural networks, can be utilized to forecast future price changes with greater precision. A notable case is a financial analyst at XYZ Investment Firm, who successfully used the ARIMA model to predict stock movements over a six-month period, leading to profitable investment decisions. Utilizing Python libraries such as Pandas and Scikit-learn facilitates the effective application of these techniques, simplifying information handling and analysis for improved decision-making.

However, analysts must remain vigilant regarding common pitfalls, such as information quality issues and model selection challenges, which can impact forecast accuracy. By addressing these challenges and leveraging advanced analytical techniques, analysts can significantly enhance their decision-making processes and drive better outcomes.

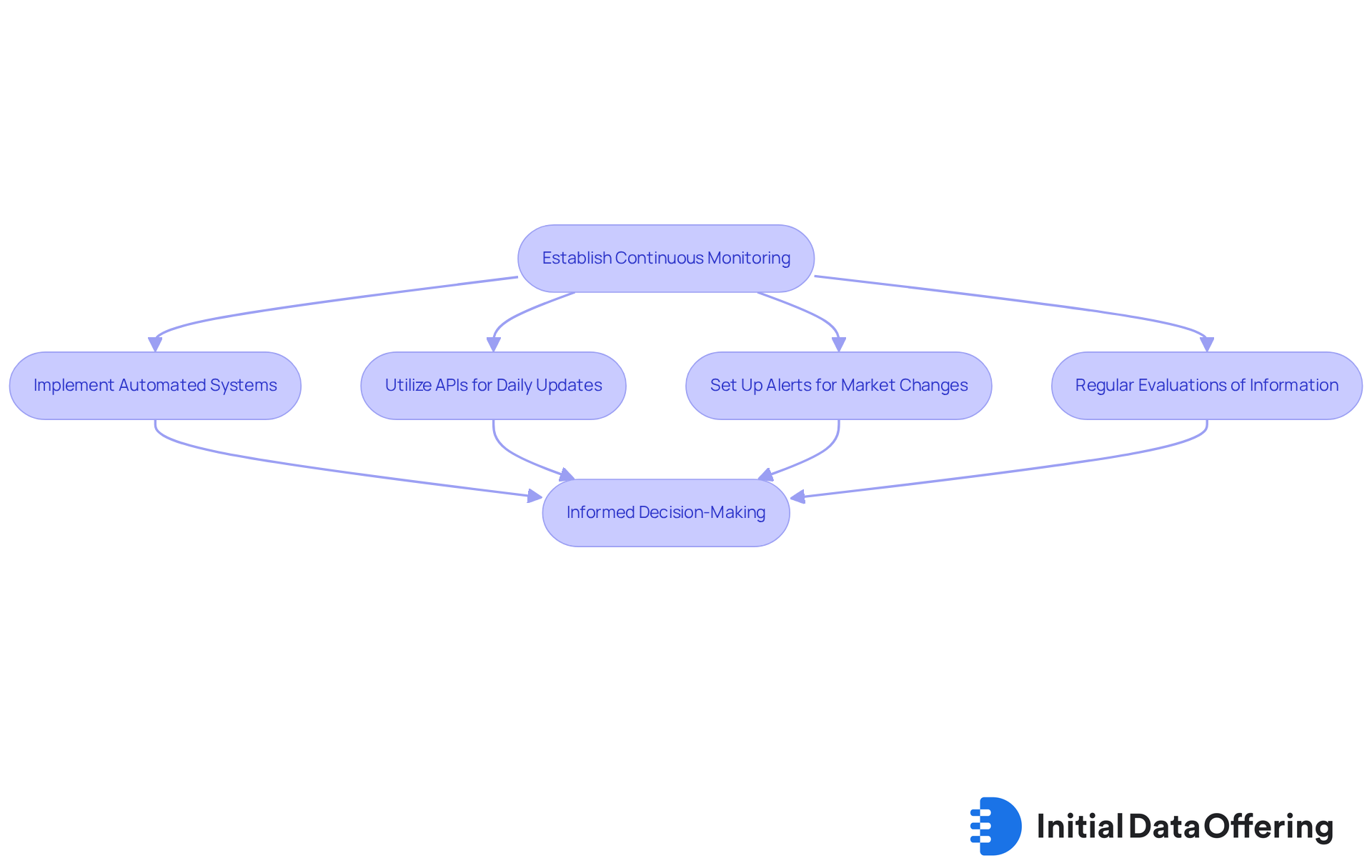

Establish Continuous Monitoring and Data Update Practices

To ensure effective management of EOD historical data, it is essential to establish continuous monitoring and update practices. Implementing automated systems that consistently retrieve the latest EOD historical data from selected sources is a key feature of this approach. The advantage of utilizing APIs for daily updates is that your datasets remain current and relevant, which ultimately benefits decision-making processes. Additionally, setting up alerts to notify you of significant market changes or anomalies enables swift analysis and response, ensuring you can act promptly.

Regular evaluations of your information are crucial to uncover discrepancies or outdated details. Tools like Tableau and Power BI serve as valuable assets in visualizing trends and identifying areas that require urgent attention. This visualization capability not only enhances understanding but also enables proactive decision-making. Financial analysts emphasize that timely updates of EOD historical data are vital for maintaining accuracy and reliability in market assessments.

How can these practices drive informed strategic decisions in your organization? By prioritizing these updates, you position yourself to make decisions based on the most accurate and relevant information available.

Conclusion

Effective management of EOD historical data is crucial for organizations aiming to make informed financial decisions. By emphasizing reliable sources, adopting robust data collection methodologies, leveraging advanced analytical techniques, and establishing continuous monitoring practices, organizations can significantly enhance their data management processes and improve overall decision-making.

Key strategies include:

- Identifying reputable data providers such as Bloomberg and EODHD, which deliver comprehensive datasets and transparent pricing.

- The integration of automated tools alongside manual processes can markedly reduce errors in data collection.

- Advanced analytical techniques, including time series analysis and machine learning, can yield more accurate forecasts and insights.

- Continuous monitoring ensures that data remains current and relevant, enabling organizations to respond swiftly to market changes.

In conclusion, prioritizing effective EOD historical data management not only enhances accuracy and reliability but also empowers organizations to make strategic decisions based on the most pertinent information. By adopting these best practices, organizations can position themselves for success in a competitive financial landscape. Embracing these strategies ultimately leads to improved risk management and profitability, underscoring the vital role of diligent data management in today’s dynamic market environment.

Frequently Asked Questions

Why is it important to identify reliable sources of EOD historical data?

Identifying reliable sources of EOD historical data is crucial for effectively managing and analyzing financial information, as it ensures the accuracy and comprehensiveness of the data used for decision-making.

Which financial information providers are considered reputable for EOD historical data?

Established financial information providers such as Bloomberg, Reuters, and EODHD are notable for their comprehensive datasets and proven track records in providing EOD historical data.

What specific historical data does EODHD offer?

EODHD offers daily historical information dating back to 1970 for most U.S. tickers and over 30 years of historical records, making it a dependable option for long-term analysis.

What factors should be considered when assessing data providers?

When assessing data providers, consider factors such as information coverage, precision, and update frequency.

How can user feedback and industry suggestions influence the choice of a data provider?

User feedback and industry suggestions can provide insights into a provider's trustworthiness and reputation, which are foundational for informed decision-making and strategic planning.

What should be prioritized when choosing a data provider?

Always prioritize sources that transparently reveal their information collection methodologies and provide clear pricing structures to avoid unexpected expenses.

How is the market for financial information providers expected to change by 2025?

By 2025, the market share of financial information providers reflects a competitive landscape, with companies like EODHD gaining traction due to their extensive offerings and user-friendly interfaces.