Comparative Analysis of Stock Market Data Feeds Providers

Comparative Analysis of Stock Market Data Feeds Providers

Overview

The article presents a comparative analysis of stock market data feed providers, emphasizing the various types available and the strengths and weaknesses inherent to each. Understanding the distinctions between real-time, delayed, and historical data feeds is crucial for traders.

How can these differences impact your trading strategies and investment goals? By selecting the most appropriate provider based on their specific needs, traders can optimize their decision-making process.

This analysis is supported by detailed evaluations of leading providers such as:

- Bloomberg

- Refinitiv

- Alpha Vantage

illustrating the practical implications of these choices.

Introduction

Stock market data feeds are essential in the trading landscape, offering vital information that enables investors to make timely decisions in a dynamic environment. As reliance on real-time data increases, it becomes crucial for traders to understand the various types of feeds—ranging from immediate updates to historical insights. This understanding can significantly enhance their strategies. However, as the market continues to evolve, how can investors effectively navigate the complexities of selecting the right provider from a multitude of options, each with its own strengths and weaknesses? This article presents a comparative analysis of leading stock market data feed providers, shedding light on their unique offerings and assisting traders in making informed choices in 2025.

Understanding Stock Market Data Feeds

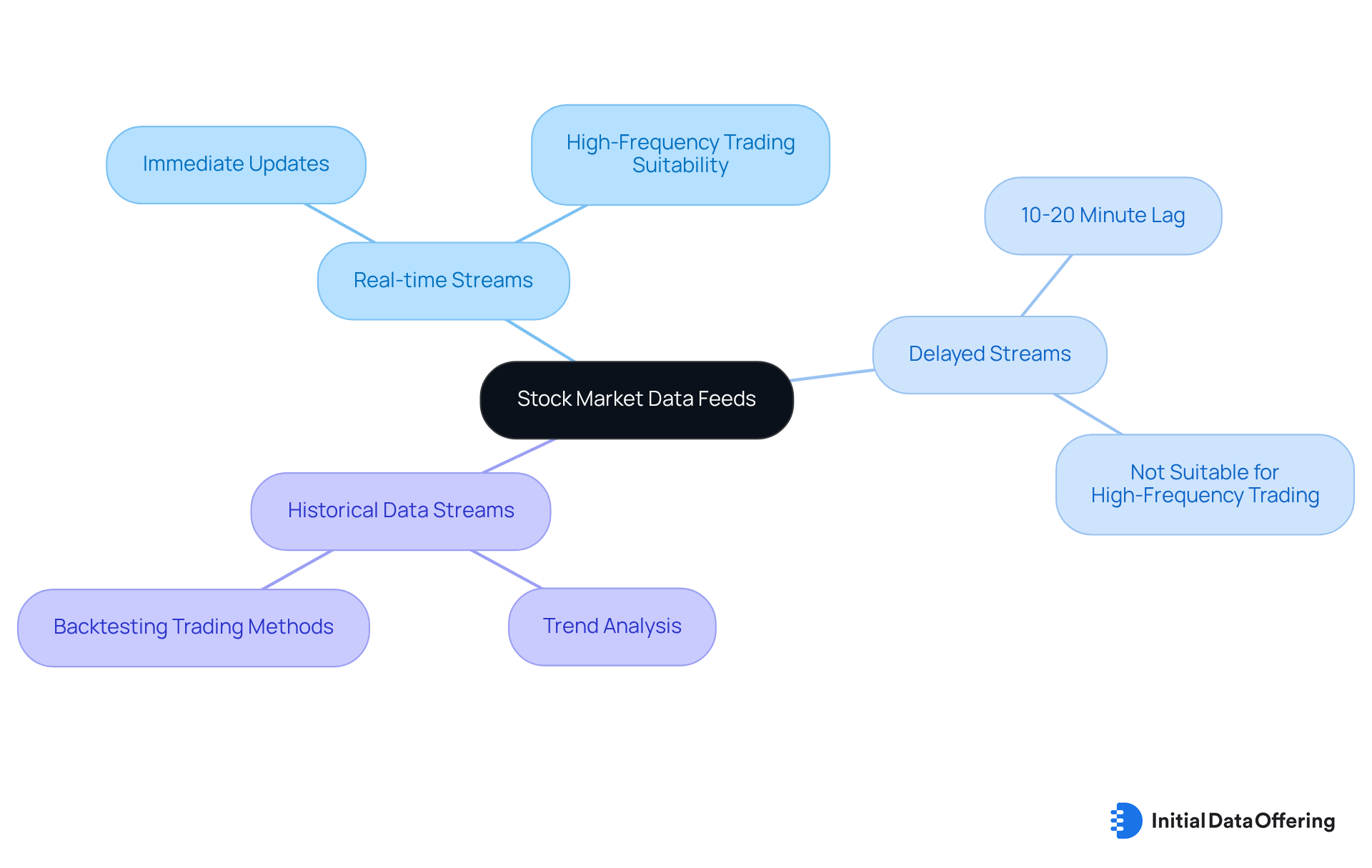

Stock market data feeds are essential sources of information, equipping traders and investors with real-time and historical details on stock prices, trading volumes, and other vital market metrics. These sources are crucial for making prompt and informed trading decisions. They can be categorized into three primary groups:

- Real-time streams

- Delayed streams

- Historical data streams

Live streams of stock market data feeds provide immediate updates, enabling investors to respond swiftly to changes in the financial landscape. In contrast, delayed data typically presents information with a time lag of 10 to 20 minutes, which may not be suitable for high-frequency trading strategies. Historical information streams, on the other hand, offer previous statistics that are critical for trend analysis and backtesting trading methods, enabling investors to refine their strategies based on past performance.

Recent trends indicate a growing reliance on immediate information, with approximately 70% of traders utilizing real-time sources to enhance their trading strategies. This shift underscores the vital role that timely information plays in navigating the complexities of the stock exchange. Notably, in the first quarter of 2025, 55% of Cboe's information sales originated from international clients, highlighting the global dependence on information feeds. Financial analysts emphasize that access to live stock market data feeds can significantly improve decision-making processes, empowering traders to capitalize on economic fluctuations as they occur. For instance, Alexandra Wilson-Elizondo noted that despite variability and execution risk, much of the negative news may be behind us, reinforcing the importance of timely information in current trading conditions.

Understanding these distinctions is essential for users to select the appropriate information stream that aligns with their trading objectives, ensuring they remain competitive in a constantly evolving market environment. Moreover, as of April 2025, the Cboe One Feed has achieved a quote quality within 1% of the National Best Bid and Offer (NBBO) at 99.84%, demonstrating the caliber of information streams available. However, traders should also recognize the challenges associated with real-time information streams, including their technical complexity and cost, which can influence their trading strategies.

Types of Market Data Feeds and Their Applications

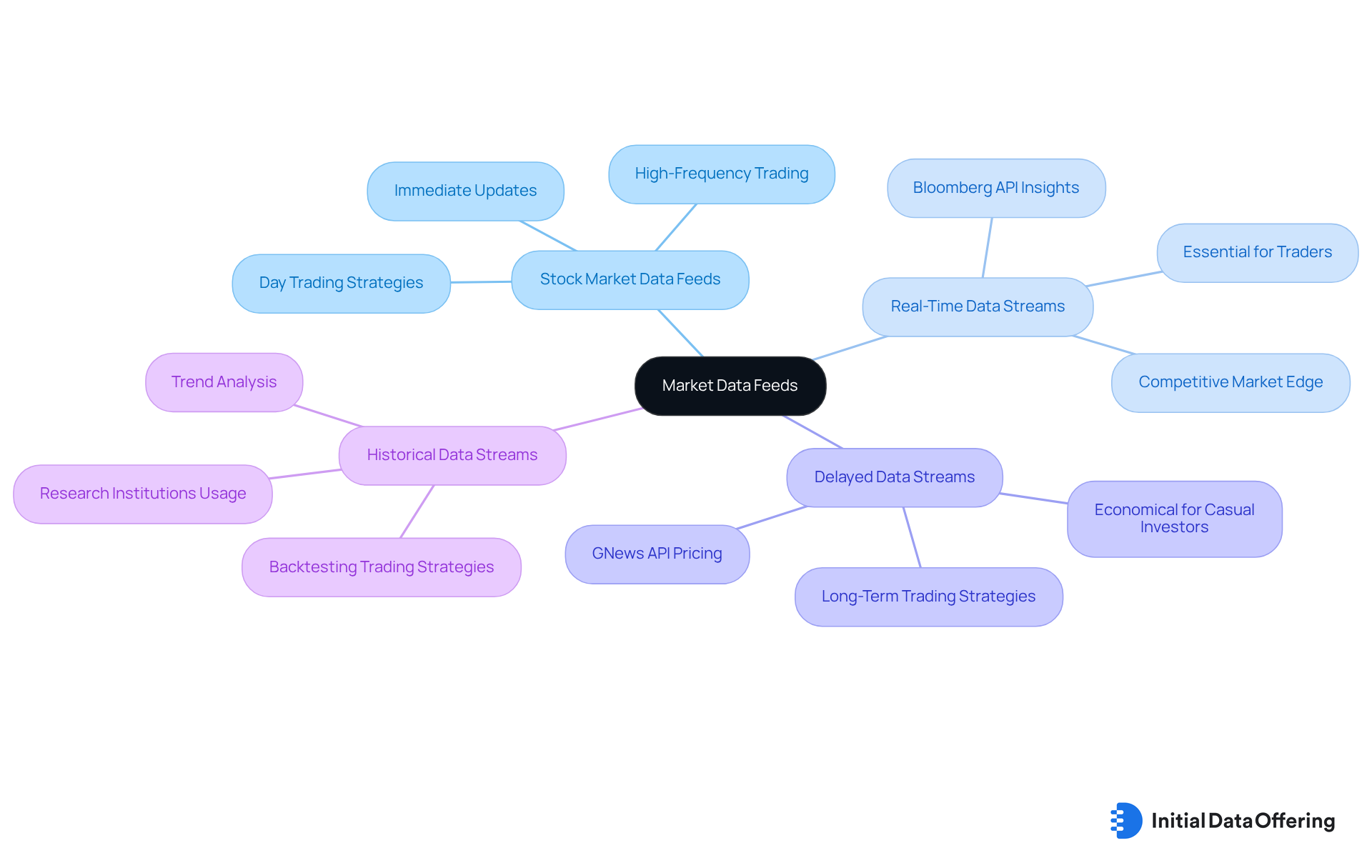

Market data streams can be broadly categorized into three primary types:

- Stock market data feeds

- Real-time data streams

- Delayed data streams

- Historical data streams

Stock market data feeds provide immediate updates on stock prices and trading volumes through real-time data streams, which are crucial for high-frequency trading and day trading strategies. According to the Bloomberg API, the stock market data feeds enable market participants to respond swiftly to fluctuations, thereby optimizing gains in dynamic settings. Brian Wallace emphasizes that access to real-time news information is now a necessity for traders seeking to stay ahead in the competitive market landscape.

Delayed information streams, which are typically refreshed every 10 to 20 minutes, serve as stock market data feeds for casual investors who do not require instant information. They are often more economical, offering valuable insights for longer-term trading strategies without the need for real-time updates. For instance, the GNews API provides economical pricing options that are suitable for startups, making delayed updates an attractive choice for those looking to manage expenses while still obtaining essential industry insights.

Stock market data feeds provide historical information, delivering previous trading data that is vital for backtesting trading strategies and conducting trend analysis. Investors can analyze historical performance to make informed predictions about future trends. Research institutions frequently utilize historical data to examine the impacts of market changes on global financial systems, enhancing their decision-making processes.

Each category of stock market data feeds serves distinct purposes, catering to various trading styles and investment strategies. By understanding the average costs associated with real-time versus delayed information sources, investors can select the most appropriate option based on their specific requirements and goals.

Comparative Analysis of Top Stock Market Data Feed Providers

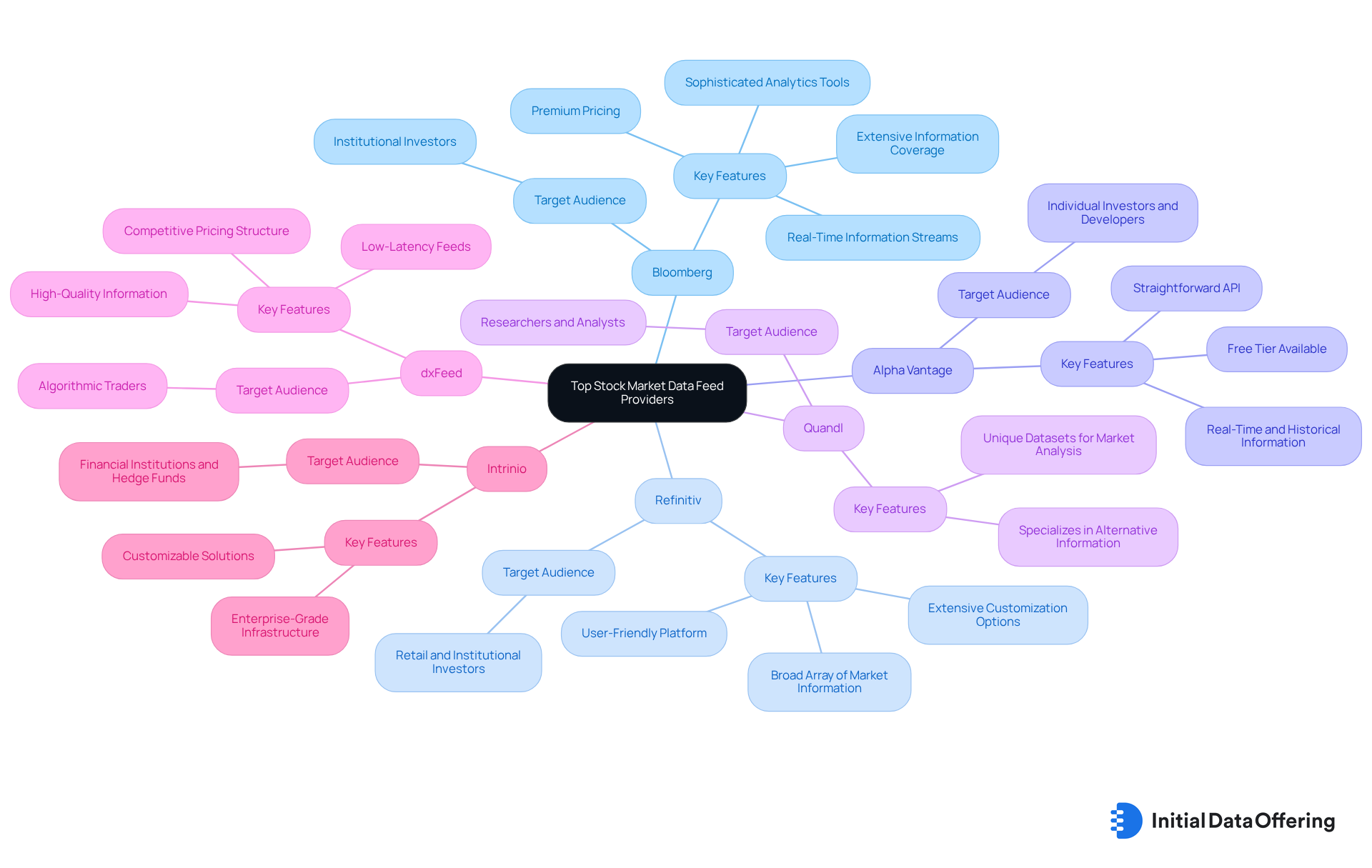

In 2025, several stock exchange information suppliers distinguish themselves by offering unique stock market data feeds and capabilities. This comparative analysis highlights some of the top providers:

-

Bloomberg: Known for its extensive information coverage and sophisticated analytics tools, Bloomberg delivers real-time information streams, historical records, and a robust API for integration. The premium price tag associated with Bloomberg makes it particularly suitable for institutional investors, who benefit from its comprehensive resources.

-

Refinitiv (previously Thomson Reuters): Provides a broad array of market information, which includes stock market data feeds, both real-time and historical. Its user-friendly platform and extensive customization options appeal to both retail and institutional investors, enhancing their trading experience through stock market data feeds.

-

Alpha Vantage: This provider is recognized for its free tier, which offers real-time and historical information through a straightforward API. Ideal for individual investors and developers seeking cost-effective solutions, Alpha Vantage significantly impacts individual traders by providing accessible information without high subscription costs.

-

Quandl: Specializing in alternative information, Quandl offers unique datasets that can enhance market analysis. Its focus on specialized information serves as a valuable resource for researchers and analysts looking to gain deeper insights into market trends.

-

dxFeed: Acknowledged for its high-quality information and low-latency feeds, dxFeed is a strong contender for algorithmic traders who require speed and precision. Its competitive pricing structure broadens its accessibility, catering to a wider audience.

-

Intrinio: Offering customizable solutions for institutional compliance needs, Intrinio serves financial institutions and hedge funds. This makes it a strong option for those requiring high-quality stock market data feeds that are tailored to their specific requirements.

The trend of democratization in financial information is reshaping the market landscape, making sophisticated analysis accessible to previously underserved populations. As noted, "This transition toward democratized financial information has accelerated dramatically in 2025," which underscores the increasing availability of information streams for individual traders and smaller companies.

Each provider has its strengths and weaknesses, making it essential for users to evaluate their specific requirements before selecting a source. Pricing models vary significantly, with Intrinio starting at US$2,500 per month, while Alpha Vantage remains an affordable choice for those seeking reliable information without the burden of high subscription costs.

Evaluating the Strengths and Weaknesses of Each Provider

When evaluating stock market data feeds providers, it is essential to consider their strengths and weaknesses to make informed decisions.

-

Bloomberg offers comprehensive data coverage, advanced analytics, and a strong reputation in the industry. However, its high cost—approximately $2,000 per user per month—may not be feasible for smaller investors. The extensive features can benefit those who require in-depth analysis and reliable data.

-

Refinitiv stands out with its user-friendly interface, extensive customization options, and a wide range of data offerings. Yet, its pricing can be complex, varying significantly based on the services selected, averaging about $113,000 annually. This flexibility may appeal to larger firms seeking tailored solutions.

-

Alpha Vantage provides a free tier, an easy-to-use API, and is particularly good for individual traders. Nonetheless, its limited information coverage compared to premium providers may not meet the needs of institutional investors. This makes it a suitable choice for those starting out or with less demanding requirements.

-

Quandl features unique datasets, especially in alternative data, alongside strong analytical tools. Some datasets may require additional fees, and the platform can be less intuitive for new users. This could be a consideration for those looking for specialized data but unsure about navigating the platform.

-

dxFeed delivers low-latency feeds, high-quality data, and competitive pricing. However, its less recognized brand compared to larger providers may affect trust for some users. This could be a deciding factor for those prioritizing reliability and established reputation.

By carefully weighing these factors, traders and investors can choose the most suitable stock market data feeds provider that aligns with their trading strategies and investment goals. Additionally, incorporating user feedback and expert insights can further inform decision-making in this area.

Conclusion

Stock market data feeds are essential components of the trading landscape, providing critical information that enables traders and investors to make timely decisions. Understanding the differences between real-time, delayed, and historical data streams is vital for selecting the appropriate type of information that aligns with individual trading strategies and objectives. The increasing reliance on real-time data underscores the growing necessity for immediate access to market metrics, particularly in a fast-paced financial environment.

This article explores the various types of market data feeds and their applications, highlighting how each category caters to different trading needs.

- Real-time data is crucial for high-frequency trading, offering the advantage of immediate insights.

- Delayed streams serve casual investors who seek cost-effective solutions, while

- Historical data feeds facilitate trend analysis and backtesting, allowing investors to refine their strategies based on past performance.

Furthermore, a comparative analysis of leading providers such as Bloomberg, Refinitiv, and Alpha Vantage reveals their unique strengths and weaknesses, guiding users in making informed choices based on their specific requirements.

In conclusion, the importance of stock market data feeds is paramount in today’s trading environment. As the market evolves, traders and investors must prioritize access to high-quality information streams to maintain a competitive edge. By carefully evaluating the offerings of different providers and understanding their distinct features, users can enhance their trading strategies and capitalize on market opportunities. Embracing the right data feed is not merely a tactical decision; it is a strategic necessity that can lead to greater success in the dynamic world of finance.

Frequently Asked Questions

What are stock market data feeds?

Stock market data feeds are essential sources of information that provide traders and investors with real-time and historical details on stock prices, trading volumes, and other vital market metrics.

What are the main types of stock market data feeds?

Stock market data feeds can be categorized into three primary groups: real-time streams, delayed streams, and historical data streams.

What is the difference between real-time and delayed data streams?

Real-time streams provide immediate updates, allowing investors to respond swiftly to market changes, while delayed streams present information with a time lag of 10 to 20 minutes, which may not be suitable for high-frequency trading strategies.

How are historical data streams used in trading?

Historical data streams offer previous statistics that are critical for trend analysis and backtesting trading methods, enabling investors to refine their strategies based on past performance.

What recent trends have been observed regarding the use of stock market data feeds?

Recent trends indicate a growing reliance on immediate information, with approximately 70% of traders utilizing real-time sources to enhance their trading strategies.

What percentage of Cboe's information sales came from international clients in early 2025?

In the first quarter of 2025, 55% of Cboe's information sales originated from international clients, highlighting the global dependence on information feeds.

How does access to live stock market data feeds impact decision-making?

Access to live stock market data feeds can significantly improve decision-making processes, empowering traders to capitalize on economic fluctuations as they occur.

What is the significance of the Cboe One Feed's quote quality?

As of April 2025, the Cboe One Feed achieved a quote quality within 1% of the National Best Bid and Offer (NBBO) at 99.84%, demonstrating the caliber of information streams available.

What challenges are associated with real-time information streams?

Challenges associated with real-time information streams include their technical complexity and cost, which can influence traders' strategies.