What is a POS Transaction? Definition, Importance, and Types

What is a POS Transaction? Definition, Importance, and Types

Overview

A POS transaction represents a crucial process through which a customer completes a purchase by exchanging payment for goods or services. This exchange can occur through various payment methods, including cash, credit or debit cards, and mobile payments. The significance of POS transactions in modern commerce cannot be overstated. They enhance operational efficiency, accommodate consumer preferences for digital payments, and provide valuable sales data that informs business strategies.

How can businesses leverage this data to improve their operations and customer satisfaction? Understanding these aspects is essential for any professional looking to thrive in today's retail environment.

Introduction

A Point of Sale (POS) transaction represents a critical juncture where customers exchange payment for goods or services, whether in-store or online. As digital payment methods surge in popularity, understanding the nuances of POS transactions is essential for businesses aiming to enhance efficiency and customer satisfaction. The rapid evolution of payment technologies raises an important question: how can retailers navigate the complexities of integrating advanced POS systems while ensuring security and operational effectiveness? By exploring these challenges, businesses can identify strategies that not only streamline operations but also foster a more secure and satisfying customer experience.

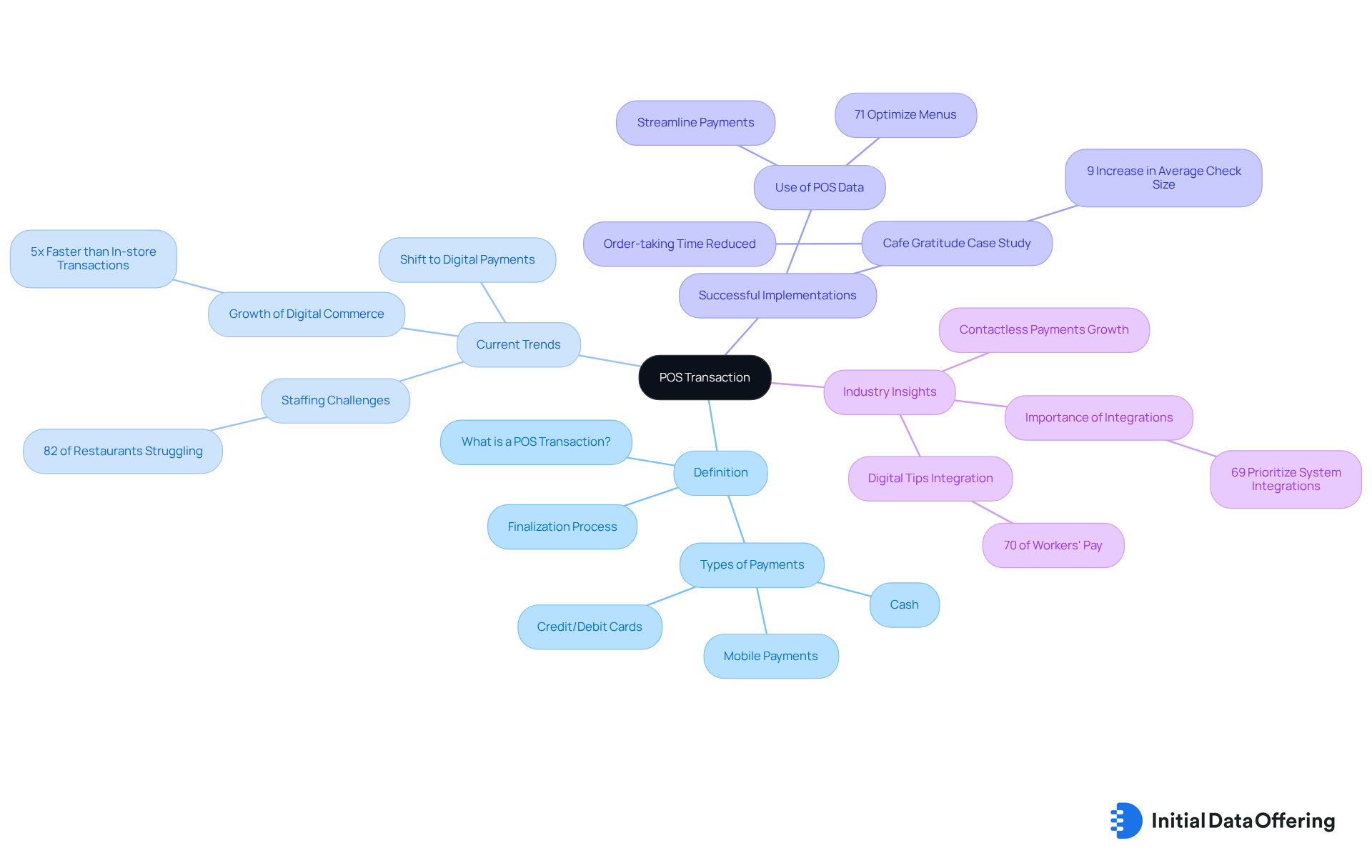

Define POS Transaction: A Comprehensive Overview

A POS transaction marks the moment when a customer completes a purchase, whether at a physical retail location or online, by exchanging payment for goods or services. This process typically involves a POS transaction system, incorporating both hardware—such as cash registers—and software that manages sales data. The POS transaction is finalized once the payment is processed, resulting in a receipt that confirms the sale's completion. POS transactions can take various forms, including cash, credit/debit cards, and mobile payments, making them essential to modern commerce.

Current trends indicate a significant shift towards digital payment methods, with digital commerce growing at a rate over five times faster than in-store POS transactions. As of 2022, 32% of restaurateurs focused on improving their technology for POS transactions to enhance operational efficiency and customer experience. This need for efficiency is underscored by the fact that 82% of restaurants faced difficulty hiring staff due to an industry-wide staffing shortage, prompting many to seek technological solutions. How can businesses leverage these trends to stay competitive?

Successful implementations, such as Cafe Gratitude's use of Toast, have demonstrated that the POS transaction efficiency can reduce order-taking times from 20 minutes to just 3 minutes per table, showcasing the gains possible with advanced POS technology. Moreover, 71% of restaurant owners utilize POS transaction data to enhance menus, simplify payments, and increase digital interaction, illustrating the broader influence of these tools on restaurant operations. What lessons can be learned from such case studies?

Industry leaders highlight the importance of integrating other tools with POS transaction technologies to enhance operations. For instance, 69% of restaurateurs consider system integrations a critical feature when selecting new software for POS transactions. As consumer tastes evolve, the ability to accommodate various payment options, such as mobile payments and digital gratuities, is becoming increasingly essential for companies aiming to improve customer satisfaction and streamline processes. Furthermore, as Visa observes, contactless payments are boosting card-present exchanges, further emphasizing the transition towards digital payment methods.

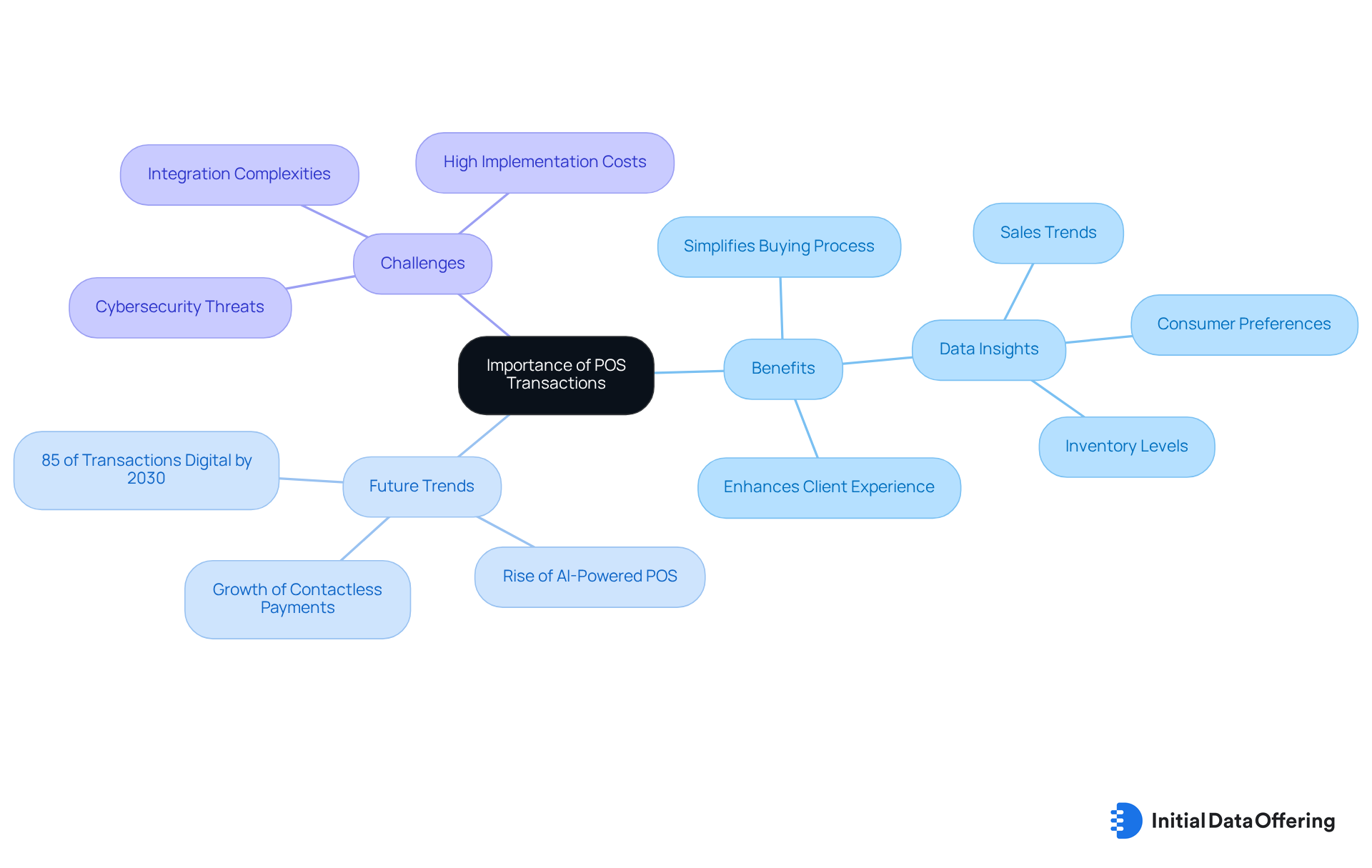

Contextualize the Importance of POS Transactions in Modern Commerce

In today's retail environment, Point of Sale (POS) operations are essential, serving as the primary means for finalizing sales. They simplify the buying process, allowing companies to handle dealings and inventory effectively. The rise of e-commerce has underscored the importance of POS systems, facilitating smooth online transactions alongside traditional in-store purchases. Additionally, POS transaction data generates valuable insights, enabling businesses to examine sales trends, consumer preferences, and inventory levels. This data-driven approach empowers retailers to make informed strategic choices, ultimately enhancing client experiences and driving sales growth.

As the retail sector evolves, the integration of advanced POS solutions becomes crucial for maintaining competitiveness and meeting consumer expectations. By 2030, experts predict that 85% of all retail exchanges will be digital, emphasizing the necessity for businesses to adopt innovative POS systems. Furthermore, POS transaction solutions extend beyond mere payment processing; they play a vital role in ensuring seamless transactions, improving customer experiences, and enhancing operational efficiency.

However, retailers face challenges such as cybersecurity threats and integration complexities when implementing these modern technologies. The integration of POS systems with loyalty programs and the incorporation of security features—such as encryption and tokenization—are essential for ensuring a secure and efficient process. Retailers must consider how these advanced solutions can be leveraged to not only protect their operations but also to create a more engaging and efficient shopping experience for their customers.

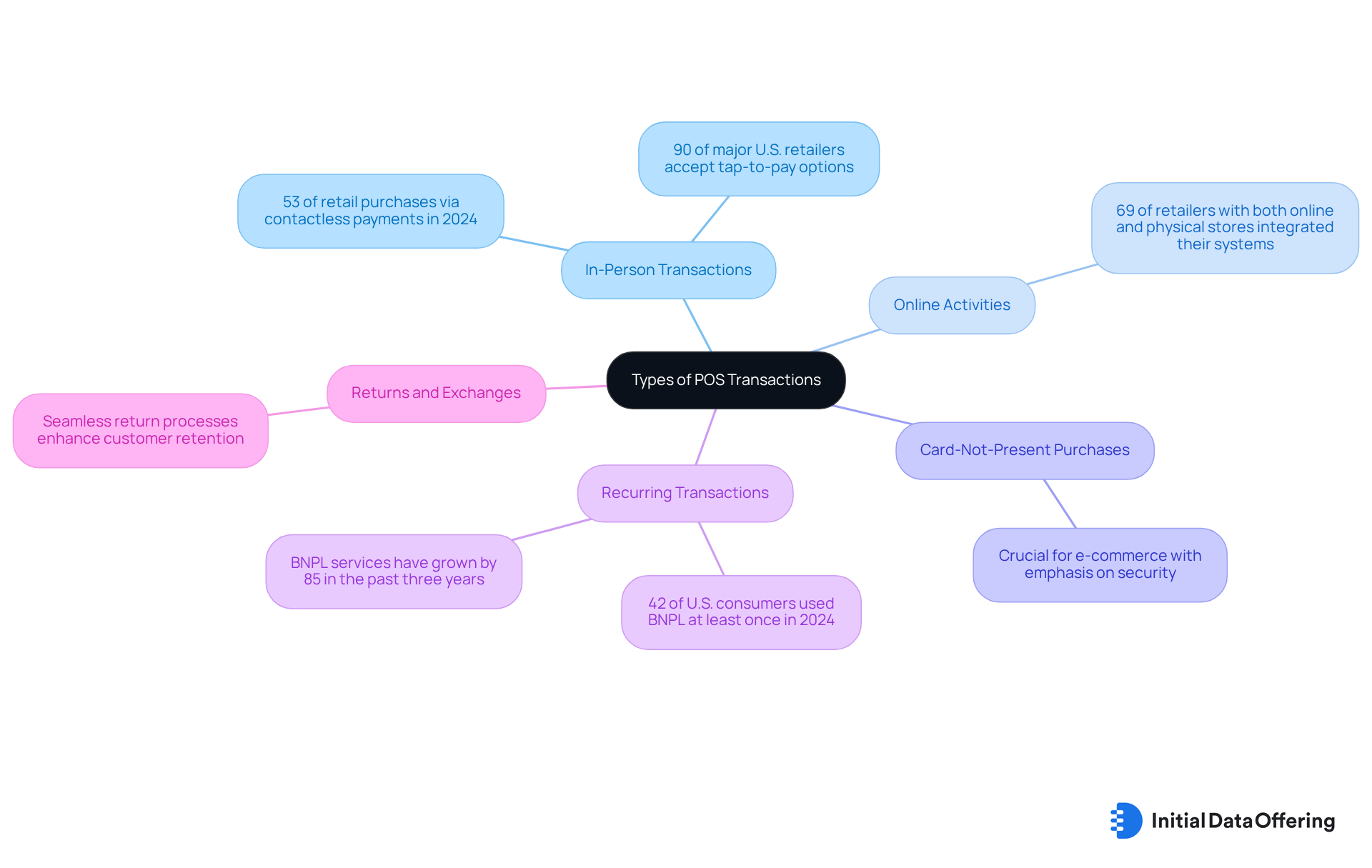

Explore Different Types of POS Transactions and Their Applications

POS transaction types can be categorized into several categories, each fulfilling specific roles in the retail landscape.

-

In-Person Transactions: These transactions occur when customers visit a physical store, utilizing cash, credit/debit cards, or mobile wallets for payment. With 53% of retail purchases conducted through contactless payments in 2024, up from 40% in 2022, the preference for quick, secure in-person exchanges is clear. Additionally, 90% of major U.S. retailers accept tap-to-pay options, further highlighting the growing popularity of this payment method. What does this mean for retailers? It emphasizes the need to adapt to consumer preferences for efficiency and security.

-

Online Activities: Carried out via e-commerce platforms, these actions enable individuals to buy goods without being physically present. As retailers progressively merge their systems with online platforms for POS transactions, 69% of those with both online and physical stores have embraced this strategy, improving convenience for shoppers. This integration not only enhances customer experience but also drives sales growth in a competitive market.

-

Card-Not-Present Purchases: Common in online sales, these purchases require individuals to input their card details without physically swiping or inserting the card. This method is crucial for e-commerce, where security measures are paramount to prevent fraud. Retailers must ensure robust security protocols to maintain consumer trust in this growing segment.

-

Recurring Transactions: Automated payments for subscriptions or services fall under this category, processed at regular intervals. The rise of Buy Now, Pay Later (BNPL) services, which saw 42% of U.S. consumers using them at least once in 2024 and has grown by 85% in the past three years, highlights the growing demand for flexible payment options. This trend reflects a shift in consumer behavior towards more manageable payment solutions.

-

Returns and Exchanges: These processes involve handling refunds or exchanges for previously acquired items, essential for sustaining client satisfaction and loyalty. A seamless return process can significantly enhance customer retention and brand loyalty.

Each category of exchange, such as POS transactions, carries unique implications for businesses, influencing their sales management and customer interaction strategies. As the global market for POS transactions is projected to reach $181 billion by 2030, comprehending these payment types is essential for retailers striving to adjust to changing consumer preferences and technological progress. Moreover, retailers encounter difficulties like cybersecurity risks and elevated implementation expenses, which are vital for comprehending the effects of various types of exchanges.

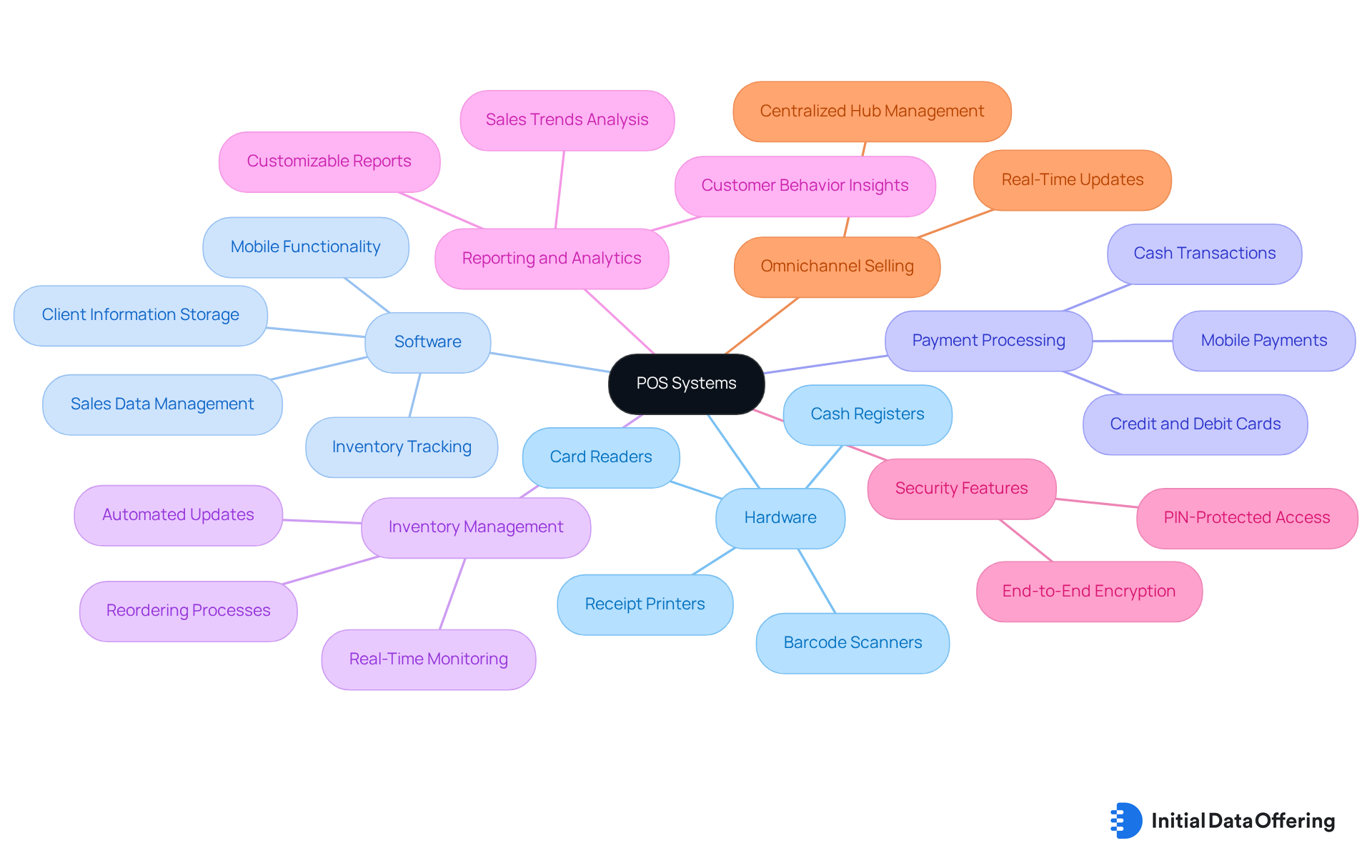

Identify Key Features and Components of POS Systems

A POS transaction system consists of several essential features and components that work together to streamline transactions and enhance operational efficiency.

-

Hardware: This includes cash registers, barcode scanners, receipt printers, and card readers, all vital for effective sales processing. Contemporary solutions for POS transactions frequently showcase intuitive interfaces designed to guarantee quick and hassle-free checkout experiences for both staff and patrons.

-

Software: The POS software manages sales data, tracks inventory, and stores client information, providing valuable insights into business operations. Many platforms now offer mobile functionalities for POS transaction, enabling sales processing anywhere inside the store and at events.

-

Payment Processing: This component allows businesses to accept various payment methods, including credit and debit cards, mobile payments, cash, and pos transactions, ensuring flexibility for users.

-

Inventory Management: Numerous contemporary POS solutions include inventory management tools that facilitate real-time monitoring of stock levels, essential for minimizing waste and avoiding stockouts. For instance, MyPOS Connect automates inventory updates and reordering processes, significantly enhancing inventory accuracy.

-

Reporting and Analytics: Robust reporting features enable businesses to analyze sales trends, customer behavior, and overall performance. With over 200 customizable reports available, businesses can make informed decisions that drive strategic planning and marketing efforts. Moreover, these frameworks frequently offer customizable dashboards and automated report generation to improve usability.

-

Security Features: Safety is crucial in POS solutions, with features like PIN-protected access and end-to-end encryption safeguarding sensitive information and ensuring secure exchanges.

-

Omnichannel Selling: Contemporary POS solutions facilitate omnichannel selling, enabling businesses to oversee transactions across various platforms from a centralized hub, ensuring real-time updates on inventory and client data.

These components collectively form a powerful system that not only improves transaction efficiency through pos transaction but also elevates customer service, ultimately contributing to a business's success in a competitive market.

Conclusion

A POS transaction represents a pivotal moment in the retail landscape, encapsulating the exchange of payment for goods or services, whether conducted in-store or online. Understanding the intricacies of POS transactions is essential for businesses aiming to thrive in a rapidly evolving marketplace. As the shift towards digital payment methods accelerates, the importance of efficient POS systems becomes increasingly evident, enabling companies to meet consumer demands and enhance their overall operational efficiency.

Key insights from this exploration reveal the diverse types of POS transactions, including:

- In-person

- Online

- Card-not-present

- Recurring purchases

- Returns

Each category plays a distinct role in shaping customer experiences and influencing sales strategies. The integration of advanced POS systems not only streamlines payment processing but also equips businesses with valuable data analytics, facilitating informed decisions that drive growth and improve customer satisfaction.

In light of these developments, businesses are encouraged to embrace innovative POS solutions that cater to the evolving preferences of consumers. By prioritizing security, integrating technology, and adapting to market trends, retailers can position themselves for success in a competitive environment. Ultimately, the effective implementation of POS transactions transcends mere sales facilitation; it is about creating a seamless and engaging shopping experience that fosters customer loyalty and drives long-term business success.

Frequently Asked Questions

What is a POS transaction?

A POS transaction marks the moment when a customer completes a purchase by exchanging payment for goods or services, either at a physical retail location or online.

What components are involved in a POS transaction?

A POS transaction typically involves a POS transaction system that includes both hardware, such as cash registers, and software that manages sales data.

How is a POS transaction finalized?

A POS transaction is finalized once the payment is processed, resulting in a receipt that confirms the completion of the sale.

What forms can POS transactions take?

POS transactions can take various forms, including cash, credit/debit cards, and mobile payments.

What trends are currently affecting POS transactions?

There is a significant shift towards digital payment methods, with digital commerce growing at a rate over five times faster than in-store POS transactions.

How are restaurants adapting to trends in POS transactions?

As of 2022, 32% of restaurateurs focused on improving their technology for POS transactions to enhance operational efficiency and customer experience, partly due to staffing shortages in the industry.

Can you provide an example of successful POS transaction implementation?

Cafe Gratitude's use of Toast has shown that POS transaction efficiency can reduce order-taking times from 20 minutes to just 3 minutes per table.

How do restaurant owners utilize POS transaction data?

71% of restaurant owners use POS transaction data to enhance menus, simplify payments, and increase digital interaction.

What do industry leaders say about integrating tools with POS technologies?

Industry leaders highlight that 69% of restaurateurs consider system integrations a critical feature when selecting new software for POS transactions.

Why is accommodating various payment options important for businesses?

As consumer tastes evolve, accommodating various payment options, such as mobile payments and digital gratuities, is essential for improving customer satisfaction and streamlining processes.

What impact do contactless payments have on POS transactions?

Contactless payments are boosting card-present exchanges, emphasizing the transition towards digital payment methods, as noted by Visa.